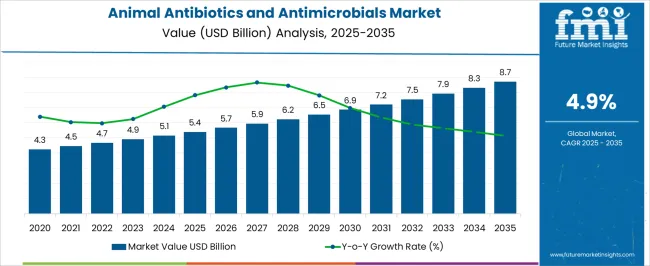

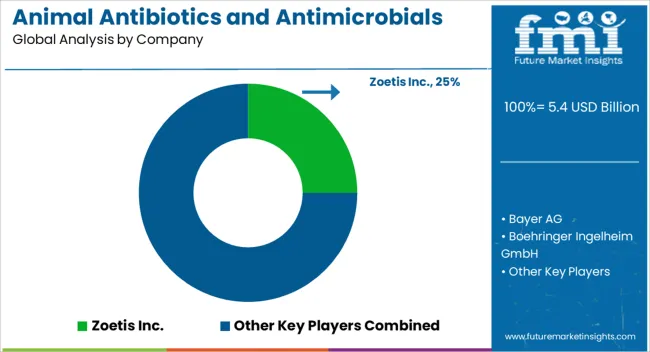

The Animal Antibiotics and Antimicrobials Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Animal Antibiotics and Antimicrobials Market Estimated Value in (2025 E) | USD 5.4 billion |

| Animal Antibiotics and Antimicrobials Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Animal Antibiotics and Antimicrobials market is experiencing steady growth driven by the increasing need to prevent and treat infectious diseases in livestock and other animal populations. Rising awareness about animal health and the economic impact of disease outbreaks in food-producing and companion animals has reinforced the adoption of antimicrobial solutions.

In addition, regulatory emphasis on maintaining animal welfare standards, along with improving veterinary healthcare infrastructure, is supporting the market expansion. The demand for effective antibiotics and antimicrobials is further influenced by the growth of intensive livestock farming, which necessitates proactive disease management practices.

As emerging regions expand their animal husbandry operations, the use of antibiotics and antimicrobials for both therapeutic and preventive purposes is expected to continue rising Ongoing research in veterinary pharmaceuticals and innovations in delivery methods are also facilitating more efficient and targeted treatment regimens, thereby enhancing the market’s growth potential over the coming years.

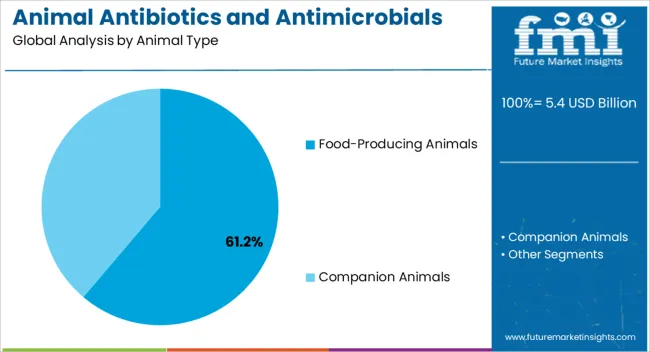

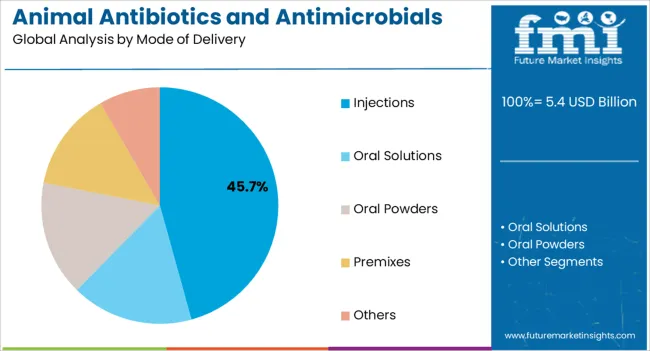

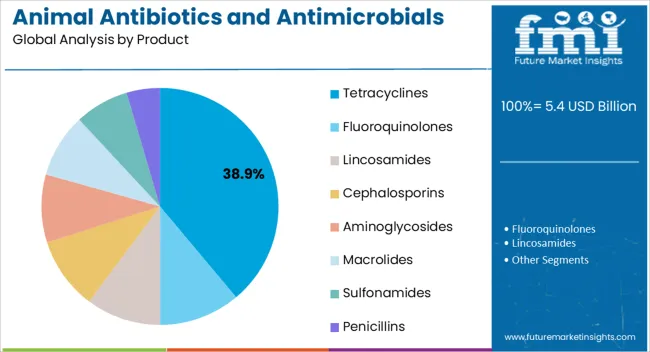

The animal antibiotics and antimicrobials market is segmented by animal type, mode of delivery, product, and geographic regions. By animal type, animal antibiotics and antimicrobials market is divided into Food-Producing Animals and Companion Animals. In terms of mode of delivery, animal antibiotics and antimicrobials market is classified into Injections, Oral Solutions, Oral Powders, Premixes, and Others. Based on product, animal antibiotics and antimicrobials market is segmented into Tetracyclines, Fluoroquinolones, Lincosamides, Cephalosporins, Aminoglycosides, Macrolides, Sulfonamides, and Penicillins. Regionally, the animal antibiotics and antimicrobials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Food-Producing Animals segment is projected to hold 61.20% of the Animal Antibiotics and Antimicrobials market revenue in 2025, making it the leading animal type segment. This dominance is being driven by the extensive scale of poultry, swine, and cattle operations, where the risk of infectious disease outbreaks is significant and economic stakes are high.

The growth of this segment has been facilitated by preventive medication practices that reduce morbidity and mortality rates while improving overall productivity. Veterinary intervention through antibiotics and antimicrobials is considered essential to maintain herd health and ensure food safety standards.

Additionally, the segment benefits from structured veterinary programs, routine vaccination, and increased monitoring of disease prevalence As global demand for animal protein continues to rise, the Food-Producing Animals segment is anticipated to sustain its leading position due to consistent investment in disease prevention, herd management, and regulatory compliance, which collectively drive widespread adoption of antibiotics and antimicrobial solutions.

The Injections segment is expected to account for 45.70% of the Animal Antibiotics and Antimicrobials market revenue in 2025, emerging as the primary mode of delivery. This leadership is being attributed to the precision, rapid bioavailability, and effectiveness of injectable formulations in treating systemic infections.

Injectable antibiotics allow veterinary professionals to deliver accurate doses directly into the bloodstream or muscle, ensuring faster therapeutic effects compared to oral administration. This method is especially preferred in intensive farming environments, where rapid control of disease outbreaks is critical to prevent widespread losses.

The segment’s growth has also been supported by the increasing prevalence of injectable formulations for both preventive and therapeutic applications, combined with veterinary training programs emphasizing correct dosage and administration techniques With rising adoption of integrated animal health programs and a focus on minimizing disease-related production losses, the injections segment is expected to maintain strong growth, reflecting its reliability and efficiency in improving animal health outcomes.

The Tetracyclines product segment is projected to hold 38.90% of the Animal Antibiotics and Antimicrobials market revenue in 2025, making it the leading product category. This prominence is being driven by the broad-spectrum activity of tetracyclines against multiple bacterial pathogens commonly affecting both food-producing and companion animals.

Their effectiveness in preventing and treating respiratory, gastrointestinal, and systemic infections has facilitated widespread adoption in veterinary practice. Additionally, tetracyclines are valued for their cost-efficiency and ease of integration into existing herd health management programs.

The segment’s growth has been further reinforced by improvements in formulation stability, including enhanced solubility and bioavailability, which enable flexible delivery methods such as oral and injectable applications Continued emphasis on disease prevention in intensive animal farming, combined with rising veterinary awareness and structured treatment protocols, is expected to sustain the leadership of tetracyclines within the market while supporting overall adoption of antibiotics and antimicrobial solutions.

Growing usage of various meats in Western diet together with increasing adoption of the Western eating habits throughout the globe is expected to stimulate demand supply for animal antibiotics and antimicrobials market.

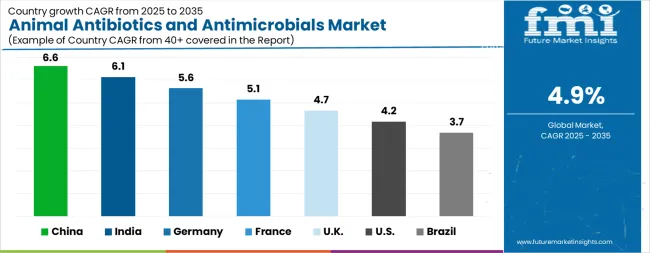

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The Animal Antibiotics and Antimicrobials Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.6%, followed by India at 6.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global Animal Antibiotics and Antimicrobials Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.6%. The USA Animal Antibiotics and Antimicrobials Market is estimated to be valued at USD 1.9 billion in 2025 and is anticipated to reach a valuation of USD 2.8 billion by 2035. Sales are projected to rise at a CAGR of 4.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 259.3 million and USD 137.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Animal Type | Food-Producing Animals and Companion Animals |

| Mode of Delivery | Injections, Oral Solutions, Oral Powders, Premixes, and Others |

| Product | Tetracyclines, Fluoroquinolones, Lincosamides, Cephalosporins, Aminoglycosides, Macrolides, Sulfonamides, and Penicillins |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis Inc., Bayer AG, Boehringer Ingelheim GmbH, Ceva Santé Animale, Dechra Pharmaceuticals PLC, Eli Lilly and Company, Merck & Co., Inc., and Elanco Animal Health |

The global animal antibiotics and antimicrobials market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the animal antibiotics and antimicrobials market is projected to reach USD 8.7 billion by 2035.

The animal antibiotics and antimicrobials market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in animal antibiotics and antimicrobials market are food-producing animals and companion animals.

In terms of mode of delivery, injections segment to command 45.7% share in the animal antibiotics and antimicrobials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA