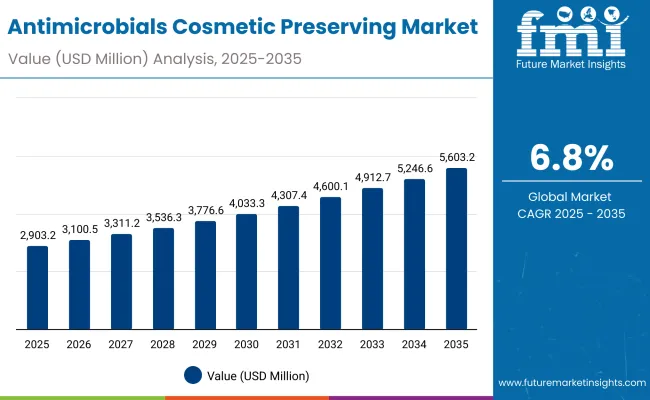

A valuation of USD 2,903.2 million in 2025 has been projected for the Antimicrobials Market (Cosmetic Preserving & Hygiene Actives), which is expected to rise to USD 5,603.2 million by 2035. This reflects an overall addition of USD 2,700.0 million, representing a 6.8% CAGR and a near doubling of market size over the ten-year horizon. The trajectory demonstrates how preservation actives are being embedded as a critical element of formulation strategies within the global personal care and hygiene industry.

Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) Key Takeaways

| Metric | Value |

|---|---|

| Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) Estimated Value in (2025E) | USD 2,903.2 million |

| Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) Forecast Value in (2035F) | USD 5,603.2 million |

| Forecast CAGR (2025 to 2035) | 6.80% |

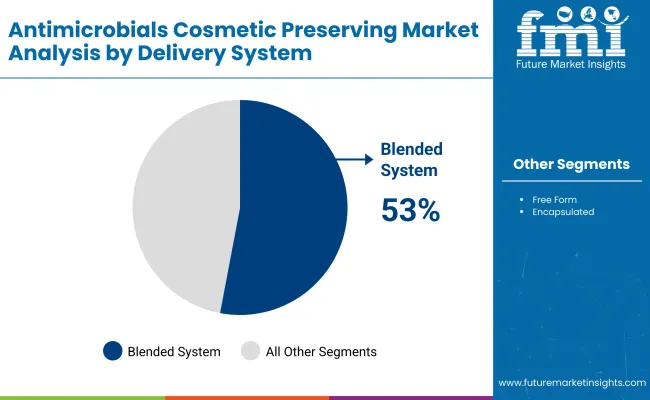

During the first half of the decade, the market is anticipated to expand from USD 2,903.2 million in 2025 to USD 4,033.3 million in 2030, generating USD 1,130.1 million in incremental value, equal to over 41% of the total decade growth. This steady expansion will be driven by increasing incorporation of antimicrobial blends in mass and masstige personal care categories, with blended delivery systems forecast to dominate at 53.0% share in 2025 due to their compatibility and broad-spectrum efficacy.

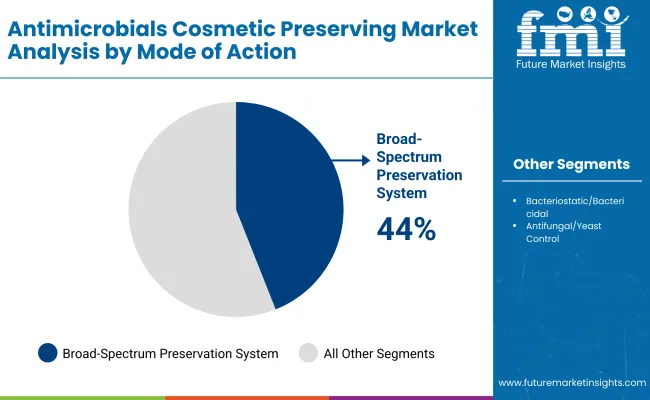

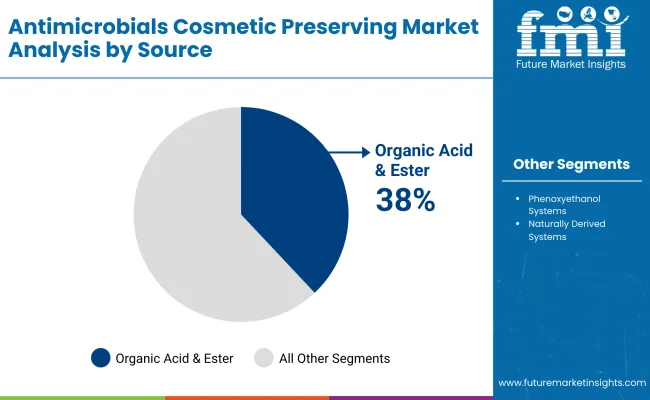

From 2030 to 2035, the market is projected to accelerate, rising from USD 4,033.3 million to USD 5,603.2 million, contributing nearly 59% of the decade’s growth. Stronger demand is expected from dermocosmetic and premium segments, where assurance of safety and consumer transparency will push suppliers to provide high-purity and natural-aligned actives. Broad-spectrum preservation systems are expected to remain the leading mode of action with 44.0% share in 2025, while organic acids and esters will strengthen as preferred sources due to regulatory alignment and clean-label appeal.

From 2020 to 2024, incremental adoption of advanced preservative systems was observed, largely influenced by regulatory compliance and rising consumer awareness of product safety. By 2025, market demand is projected to stand at USD 2,903.2 million, with blended systems and natural-aligned sources expected to dominate procurement preferences.

Looking forward, the revenue pool is forecast to expand to USD 5,603.2 million by 2035, supported by double-digit growth in China and India. Competitive advantage is expected to transition from cost-driven commodity preservatives to value-added solutions offering multifunctionality, clean-label compliance, and proven stability in complex formulations. Suppliers are projected to shift toward hybrid portfolios, combining broad-spectrum efficacy with naturally derived claims to align with both regulatory expectations and brand differentiation strategies.

As the market matures, procurement decisions are anticipated to be influenced less by ingredient cost and more by dossier strength, sustainability proof, and speed of technical service. Market leaders are expected to defend share through R&D investments, regulatory foresight, and targeted regional expansions, while emerging players with innovation-led actives are projected to gain traction in Asia-Pacific.

Growth in the Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is being driven by increasing regulatory scrutiny, heightened consumer awareness of product safety, and the need for longer shelf life in personal care formulations. Rising demand for multifunctional preservation systems is being observed as brand owners pursue clean-label positioning and ingredient transparency. Adoption of organic acids, esters, and naturally aligned systems is being accelerated by sustainability mandates and shifting consumer preferences toward natural formulations. Blended delivery systems are being favored for their compatibility, broad-spectrum efficacy, and cost-in-use advantages. Expanding applications in leave-on skincare, haircare, and hygiene wipes are further reinforcing demand, particularly in fast-growing economies across Asia-Pacific. The premiumization of dermocosmetic and professional care categories is expected to amplify reliance on high-purity, science-backed actives. With innovations in multifunctional boosters and encapsulated formats anticipated, the market is projected to evolve rapidly, positioning antimicrobial ingredients as indispensable raw materials for next-generation formulations.

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) has been segmented on the basis of mode of action, source, and delivery system to capture the core dynamics shaping demand. Each of these segments is projected to influence procurement strategies differently, reflecting evolving formulation needs and regulatory priorities. Broad-spectrum preservation systems are being prioritized for comprehensive microbial protection, while organic acids and esters are gaining traction as naturally aligned sources. Blended delivery systems are emerging as the preferred approach, ensuring cost-in-use advantages and compatibility across diverse formulations. Together, these segments define how suppliers and formulators are expected to align innovation pipelines and raw material strategies over the forecast horizon.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Broad-spectrum preservation systems | 44% |

| Others | 56.0% |

Broad-spectrum preservation systems are expected to maintain dominance in 2025 with a 44.0% market share, supported by their ability to ensure comprehensive microbial protection across a wide variety of cosmetic and hygiene formulations. Their reliability in extending shelf life and safeguarding against contamination is being increasingly valued by formulators under tightening regulatory standards. Others, including specialized bacteriostatic and yeast-control systems, will collectively account for 56.0% share, reflecting the diversification of antimicrobial strategies. Rising demand for multifunctional booster systems is projected to complement broad-spectrum use, especially in premium and dermocosmetic categories. The segment’s growth is anticipated to be reinforced by the shift toward multifunctionality and clean-label preservation, ensuring continued relevance throughout the forecast horizon.

| Source | Market Value Share, 2025 |

|---|---|

| Organic acids & esters | 38% |

| Others | 62.0% |

Organic acids and esters are anticipated to secure 38.0% of the market in 2025, translating into USD 1103.22 million. Their adoption is being accelerated by clean-label positioning and compatibility with natural and sustainable formulation requirements. Increasing consumer preference for naturally aligned preservatives is expected to further strengthen their role, especially in premium skincare and haircare applications. Other sources, which collectively account for 62.0% share, will remain relevant due to scalability, performance efficiency, and affordability across mass-market formulations. Regulatory alignment and toxicology support will continue to shape procurement decisions, with suppliers expected to strengthen dossiers for global compliance. Overall, organic acids and esters are projected to rise steadily as brand owners align portfolios with consumer-driven transparency and sustainability narratives.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Blended systems | 53% |

| Others | 47.0% |

Blended systems are projected to dominate the delivery system segment in 2025 with a 53.0% share, amounting to USD 1538.70 million. Their effectiveness in combining broad-spectrum protection with formulation flexibility is being recognized as critical by manufacturers seeking robust solutions at optimized treat rates. Cost-in-use advantages and the ability to achieve synergistic effects are further strengthening adoption. Others, accounting for 47.0% of the market, will continue to serve applications requiring high versatility but are unlikely to surpass blended formats. Increasing preference for blended systems is expected as global formulators prioritize efficacy, safety, and scalability. This segment is anticipated to play a central role in shaping antimicrobial ingredient strategies, ensuring stability across a diverse range of cosmetic and hygiene applications.

Growing compliance requirements and evolving consumer transparency expectations are reshaping how cosmetic and hygiene preservatives are sourced, evaluated, and deployed, creating both opportunities and limitations for ingredient manufacturers and formulators as the market moves toward stricter global standards and sustainability mandates.

Intensification of Regulatory Alignment as a Value Lever

Stricter preservative regulations across regions are no longer being perceived only as hurdles but as value levers that are reshaping supply chains. Formulators are being compelled to prioritize ingredients supported by robust toxicology dossiers, global regulatory harmonization, and validated safety data. As enforcement mechanisms tighten, ingredient portfolios with established global clearance are expected to capture procurement preference. Suppliers who proactively demonstrate alignment with evolving EU and Asian frameworks are anticipated to be elevated as strategic partners, enabling brands to accelerate international launches without reformulation risks. The shift toward compliance-led differentiation is projected to redefine competitive positioning in the decade ahead.

Multifunctionality Embedded into Procurement Criteria

Preservatives are increasingly being evaluated not just for microbial efficacy but for multifunctional attributes such as moisturization support, pH stability, and compatibility with active-rich formulations. This evolution is transforming procurement criteria, as multifunctionality reduces the need for multiple additives and aligns with clean-label demands. By embedding additional functional benefits, antimicrobial systems are being reframed as enablers of formulation simplification and cost efficiency. This repositioning is expected to push multifunctional systems from niche to mainstream adoption, particularly within premium skincare and professional dermocosmetic applications where consumer scrutiny is highest. Suppliers offering credible performance evidence are expected to define the next wave of leadership.

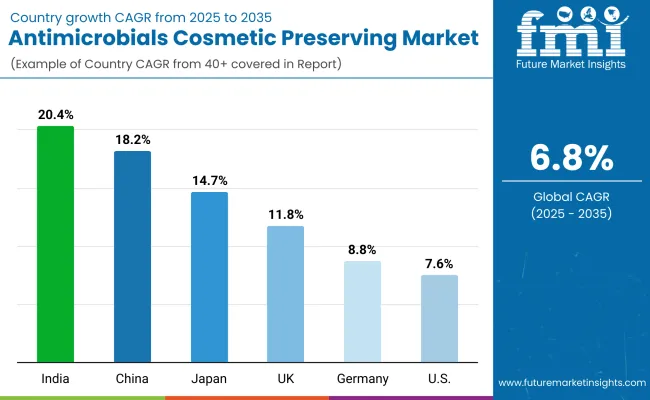

| Country | CAGR |

|---|---|

| China | 18.2% |

| USA | 7.6% |

| India | 20.4% |

| UK | 11.8% |

| Germany | 8.8% |

| Japan | 14.7% |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is projected to expand unevenly across countries, with adoption patterns shaped by regulatory frameworks, consumer awareness, and formulation strategies. Asia-Pacific is expected to be the most dynamic growth arena, anchored by India at a projected 20.4% CAGR and China at 18.2% CAGR through 2035. India’s trajectory is anticipated to be driven by rapid expansion of domestic personal care brands and increasing adoption of antimicrobial blends tailored for affordability and mass-market positioning. China’s acceleration is projected to reflect rising premiumization in skincare, a tightening regulatory environment, and preference for multifunctional preservation systems aligned with clean-label expectations.

Japan, advancing at 14.7% CAGR, is expected to benefit from high consumer scrutiny of product safety and innovation-led adoption of dermocosmetic solutions. Europe maintains a resilient profile, led by the UK at 11.8% CAGR and Germany at 8.8% CAGR, as compliance-driven procurement and sustainability reporting remain pivotal. Broader Europe is projected at 10.9% CAGR, supported by established personal care ecosystems adapting to stricter preservative evaluations. The USA demonstrates maturity, advancing at 7.6% CAGR, where incremental growth is expected from dermocosmetic and premium segments, while broader adoption is shaped by complex regulatory compliance and established market saturation.

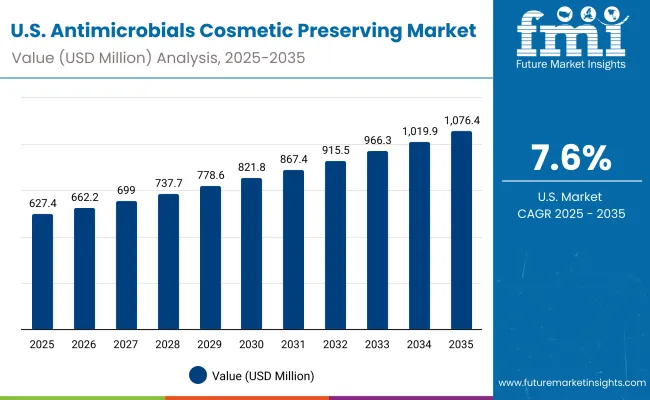

| Year | USA Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) (USD Million) |

|---|---|

| 2025 | 627.48 |

| 2026 | 662.28 |

| 2027 | 699.01 |

| 2028 | 737.77 |

| 2029 | 778.69 |

| 2030 | 821.87 |

| 2031 | 867.45 |

| 2032 | 915.56 |

| 2033 | 966.33 |

| 2034 | 1019.92 |

| 2035 | 1076.48 |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in the United States is projected to grow at a CAGR of 7.6% from 2025 to 2035, supported by regulatory-driven adoption and consumer-led demand for safer formulations. Market expansion is being influenced by broad-spectrum solutions that ensure compliance, coupled with blended delivery systems offering cost-in-use benefits. Rising preference for high-purity actives is anticipated within dermocosmetic and premium categories, while mass-market personal care continues to anchor steady consumption.

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in the UK is projected to grow at a CAGR of 11.8% from 2025 to 2035. Growth is expected to be shaped by retailer-driven “free-from” lists, post-Brexit regulatory pragmatism, and brand repositioning toward evidence-backed preservation. Blended systems are anticipated to be favored for cost-in-use efficiency and documentation depth, while organic acids and esters are expected to gain traction in premium skincare. Procurement is likely to reward suppliers offering rapid challenge-test support and compatibility matrices with sensitive-skin actives. Private-label personal care is expected to scale antimicrobial adoption as retailers push stricter quality gates.

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in India is projected to expand at a CAGR of 20.4% through 2035. Expansion is expected to be propelled by rapid scaling of domestic personal care brands, localization of dossiers, and cost-optimized blend strategies for humidity-prone climates. Mass and masstige categories are anticipated to dominate volumes, while dermocosmetic lines are expected to introduce higher-purity organics and encapsulated options. Distributor-led technical service is likely to accelerate qualification cycles for regional manufacturers. Documentation aligned to BIS expectations and export markets is projected to determine national account wins.

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in Germany is projected to grow at a CAGR of 8.8% through 2035. Expansion is expected to be guided by stringent product stewardship, life-cycle evidence requests, and disciplined supplier audits. Engineering-driven formulators are anticipated to prefer blended systems with robust toxicology packages and consistent performance in stress testing. Sustainability proof points renewable carbon content, LCA snapshots, and recyclability compliance-are likely to be embedded in RFP scoring. Premium dermocosmetic and pharmacy channels are expected to pull high-purity organics validated for sensitive-skin claims.

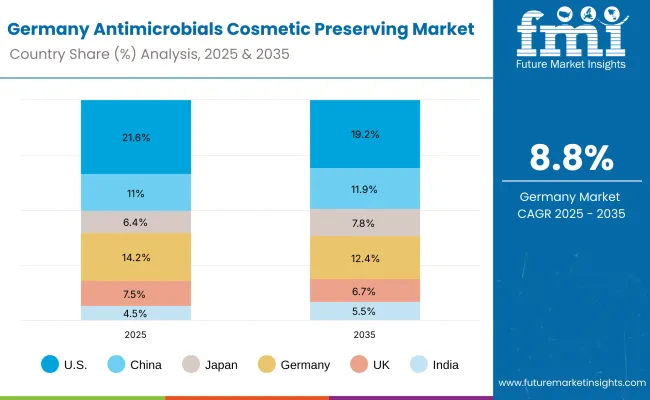

| Country | 2025 |

|---|---|

| USA | 21.6% |

| China | 11.0% |

| Japan | 6.4% |

| Germany | 14.2% |

| UK | 7.5% |

| India | 4.5% |

| Country | 2035 |

|---|---|

| USA | 19.2% |

| China | 11.9% |

| Japan | 7.8% |

| Germany | 12.4% |

| UK | 6.7% |

| India | 5.5% |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in Germany is projected to grow at a CAGR of 8.8% through 2035. Expansion is expected to be guided by stringent product stewardship, life-cycle evidence requests, and disciplined supplier audits. Engineering-driven formulators are anticipated to prefer blended systems with robust toxicology packages and consistent performance in stress testing. Sustainability proof points renewable carbon content, LCA snapshots, and recyclability compliance are likely to be embedded in RFP scoring. Premium dermocosmetic and pharmacy channels are expected to pull high-purity organics validated for sensitive-skin claims.

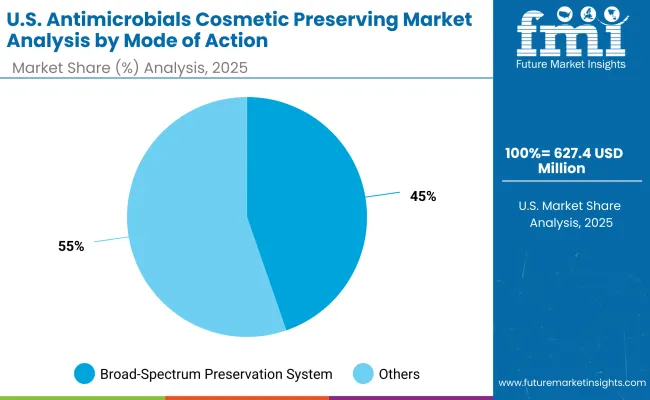

| USA By Mode of Action | Market Value Share, 2025 |

|---|---|

| Broad-spectrum preservation systems | 44.7% |

| Others | 55.3% |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in the United States is projected at USD 627.48 million in 2025. Broad-spectrum preservation systems contribute 44.7%, while others hold 55.3%, highlighting a stronger orientation toward diversified antimicrobial strategies. The preference for broad-spectrum solutions is being shaped by compliance-led requirements and the demand for reliable microbial coverage in mass personal care and hygiene products. In contrast, the dominance of the “others” category reflects the ongoing shift toward specialized and multifunctional systems that deliver targeted efficacy and address formulation complexity.

Multifunctionality is expected to become a central procurement criterion, with actives being selected for both preservation and added formulation benefits such as pH stability and compatibility with sensitive-skin products. Supplier differentiation is likely to hinge on regulatory alignment, dossier depth, and challenge-test support. As dermocosmetic and premium formulations expand, reliance on advanced preservation systems is anticipated to strengthen further, driving incremental demand for innovative solutions.

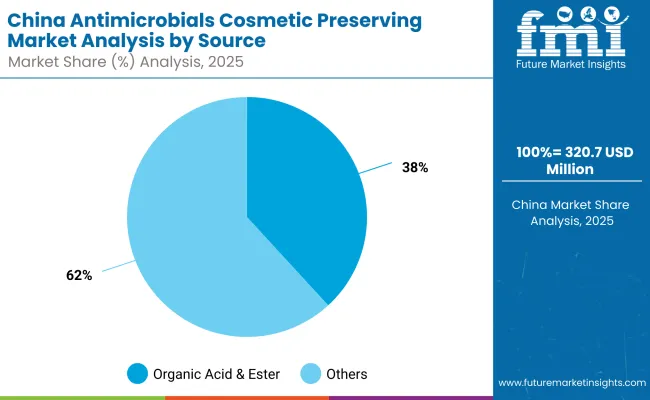

| China By Source | Market Value Share, 2025 |

|---|---|

| Organic acids & esters | 38.2% |

| Others | 61.8% |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) in China is projected to be defined by rapid adoption of diverse antimicrobial sources, with the market by source valued at USD 320.71 million in 2025. Organic acids and esters are estimated to contribute 38.2% of this total, equal to USD 122.51 million, reflecting strong alignment with clean-label positioning and consumer preference for naturally oriented ingredients. Others, holding 61.8% share at USD 198.20 million, will dominate overall demand, showcasing the widespread reliance on multifunctional synthetic and blended actives that meet large-scale production needs.

Procurement decisions are expected to be shaped by the dual emphasis on safety assurance and premiumization, particularly in skincare and hygiene categories. Local regulatory frameworks are anticipated to reinforce demand for dossiers demonstrating stability and compatibility in active-rich formulations. Multinational and domestic players are likely to seek suppliers offering NMPA-aligned documentation and bilingual technical support to accelerate approvals.

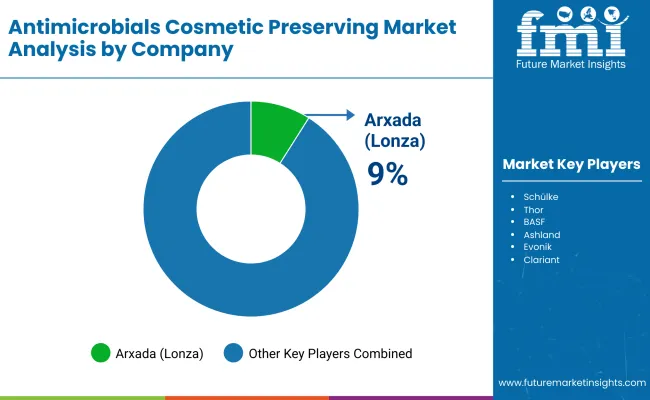

| Company | Global Value Share 2025 |

|---|---|

| Arxada (Lonza) | 9% |

| Others | 91.0% |

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is moderately fragmented, with global leaders, regional suppliers, and niche-focused specialists competing for share across diverse formulation needs. Arxada (Lonza) is positioned as the most influential global leader, holding an estimated 9% share in 2025, while the remaining 91% is distributed among a wide pool of competitors. This fragmentation highlights the absence of a single dominant supplier and underscores how technical capabilities, regulatory alignment, and service support shape procurement outcomes.

Global players such as Arxada, BASF, Evonik, Clariant, Symrise, Ashland, Schülke, Inolex, and Thor are expected to define the upper tier of competition, leveraging broad portfolios, toxicology dossiers, and global regulatory clearances to secure multinational accounts. Their strategies are increasingly focused on multifunctional actives, natural-aligned formulations, and challenge-test backed solutions to align with clean-label and safety-driven trends.

Mid-sized innovators and regional suppliers are anticipated to gain relevance through competitive pricing, localized toll manufacturing, and region-specific documentation support. Niche specialists are likely to remain essential for dermocosmetic and premium markets, where bespoke formulations, encapsulated formats, and sustainability validation are prioritized.

Competitive differentiation is projected to move away from volume supply toward value-added ecosystems, including technical guidance, regulatory support, and evidence-backed performance claims. This shift is expected to accelerate partnerships between ingredient suppliers and brand owners, positioning innovation and compliance as the ultimate drivers of leadership.

Key Developments in Antimicrobials Market (Cosmetic Preserving & Hygiene Actives)

| Item | Value |

|---|---|

| Quantitative Units | USD 2,903.2 million (2025); USD 5,603.2 million (2035); CAGR 2025 to 2035: 6.8% |

| Mode of Action | Broad-spectrum preservation systems; Others (bacteriostatic/bactericidal, antifungal/yeast control, multifunctional boosters) |

| Source | Organic acids & esters; Others (quats & biguanides, phenoxyethanol systems, naturally derived systems) |

| Delivery System | Blended systems; Free form; Encapsulated |

| Physical Form | Liquid concentrate; Powder; Dispersion |

| Application | Leave-on skincare; Rinse-off cleansing; Haircare; Wet wipes & hygiene |

| End-use Industry | Mass & masstige personal care; Dermocosmetic; Professional/premium |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | Arxada (Lonza); BASF; Evonik; Clariant; Symrise; Ashland; Thor; Schülke; Inolex; Kathon portfolio holders |

| Selected 2025 Benchmarks | Broad-spectrum systems: 44.0% share (USD 1,277.41 million); Organic acids & esters: 38.0% share (USD 1,103.22 million); Blended systems: 53.0% share (USD 1,538.70 million) |

| Additional Attributes | Dollar sales by mode of action, source, and delivery system; clean-label and dossier-driven procurement trends; shift toward multifunctional, blend-based systems; PET/CHT evidence requirements; sustainability and renewable-carbon disclosures; regional qualification needs (e.g., NMPA, BIS); service differentiation via regulatory support and in-country applications labs |

The global Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is estimated to be valued at USD 2,903.2 million in 2025.

The market size for the Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is projected to reach USD 5,603.2 million by 2035.

The Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) is expected to grow at a CAGR of 6.8% between 2025 and 2035.

The key product types in the Antimicrobials Market (Cosmetic Preserving & Hygiene Actives) include broad-spectrum preservation systems, bacteriostatic/bactericidal actives, antifungal and yeast-control solutions, and multifunctional booster systems.

In terms of delivery system, blended systems are expected to command the largest share in 2025 with 53.0%, reflecting their efficiency, compatibility, and broad-spectrum efficacy across cosmetic and hygiene formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Oil Market Growth - Size, Demand & Forecast 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Competitive Overview of Cosmetic Jars Market Share

Global Cosmetic CDMO Market Analysis – Size, Share & Forecast 2024-2034

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Vials Market Trends - Size & Growth 2025 to 2035

Market Share Insights of Cosmetic Tubes Product Providers

Cosmetic Lasers Market

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Cosmetic Dropper Industry

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA