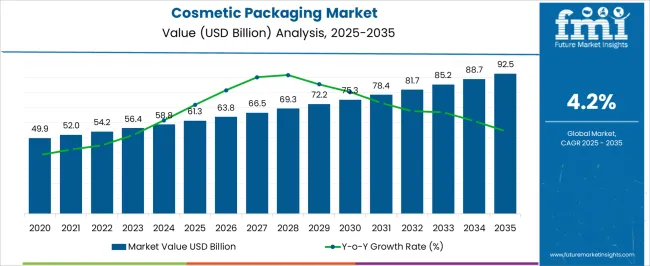

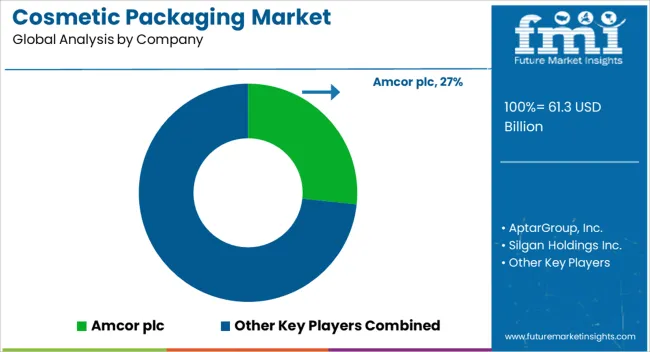

The cosmetic packaging market is estimated to be valued at USD 61.3 billion in 2025 and is projected to reach USD 92.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The global cosmetic packaging market is projected to reach 92.5 USD billion by 2035 from an estimated 61.3 USD billion in 2025, growing at a CAGR of 4.2%. Analysis of the market growth curve indicates a steady upward trajectory with moderate acceleration across the 2025–2035 period. Annual increments show a gradual expansion, moving from 61.3 USD billion in 2025 to 92.5 USD billion in 2035, suggesting consistent investment and demand in packaging innovations catering to personal care and beauty sectors. Early years of the forecast period demonstrate incremental gains, highlighting cautious but stable market adoption of sustainable and premium packaging solutions.

Mid-period trends between 2029 and 2032 depict slightly faster growth, driven by rising consumer preference for aesthetic appeal, customization, and functional packaging that preserves product integrity. By the latter part of the decade, demand is expected to strengthen further due to heightened brand differentiation efforts, increasing e-commerce penetration, and evolving regulatory requirements that emphasize product safety and packaging transparency. The curve, while linear in its general shape, shows minor inflections associated with seasonal demand fluctuations, new product launches, and regional adoption disparities. Overall, the market exhibits a steady growth profile rather than abrupt spikes, reflecting the gradual adaptation of innovative materials, refillable formats, and smart packaging technologies in response to changing consumer behavior and industry standards.

| Metric | Value |

|---|---|

| Cosmetic Packaging Market Estimated Value in (2025 E) | USD 61.3 billion |

| Cosmetic Packaging Market Forecast Value in (2035 F) | USD 92.5 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The cosmetic packaging market holds a diverse share across various end-use segments, reflecting the growth of personal care and beauty industries worldwide. Skincare products dominate with a 35% share, as increasing consumer focus on anti-aging, moisturization, and premium skincare formulations drives demand for sophisticated packaging solutions that ensure product efficacy and visual appeal. The makeup and color cosmetics segment contributes 25%, propelled by rising trends in innovative, travel-friendly, and refillable packaging formats for foundations, lipsticks, eyeshadows, and mascaras. Haircare products account for 20%, where shampoos, conditioners, and styling products rely on bottles, pumps, and tubes that combine functionality with aesthetic appeal.

Fragrance and perfumes represent a 12% share, with demand for luxurious, designer packaging that enhances brand perception and shelf impact. Finally, personal hygiene and toiletries, including soaps, deodorants, and oral care products, hold an 8% share, as convenience-driven and sustainable-inspired packaging gains traction among consumers. Collectively, skincare, makeup, and haircare segments constitute 80% of the market, emphasizing that beauty and self-care products remain the primary drivers of growth, while fragrances and toiletries present emerging opportunities for packaging innovation, premiumization, and differentiation in both mature and developing markets globally.

The cosmetic packaging market is witnessing significant growth, driven by rising consumer demand for personal care and beauty products across developed and emerging economies. Increasing consumer focus on product quality, convenience, and sustainability is shaping packaging preferences, encouraging the adoption of innovative and versatile packaging solutions. The market is being further supported by rapid growth in skincare, haircare, and color cosmetics sectors, which require functional and visually appealing packaging to differentiate products in a competitive environment.

Advancements in packaging technology, including lightweight materials, protective coatings, and recyclable components, are enhancing product safety and shelf life. Rising e-commerce penetration and evolving retail channels are increasing demand for secure and transport-friendly packaging.

Growing awareness of sustainability and environmental regulations is motivating manufacturers to adopt recyclable and biodegradable materials As brands increasingly prioritize aesthetics, safety, and consumer experience, the market is expected to witness continuous expansion, with packaging solutions evolving to support both functionality and branding in line with global cosmetic trends.

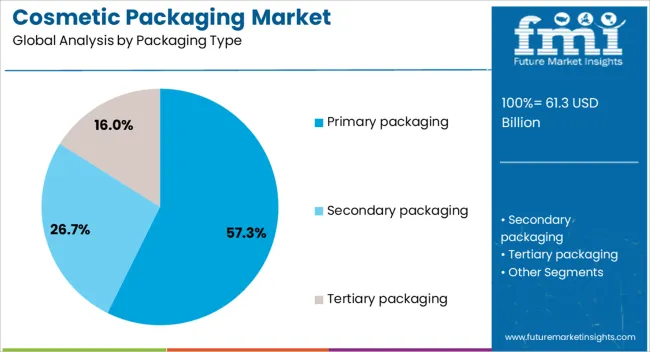

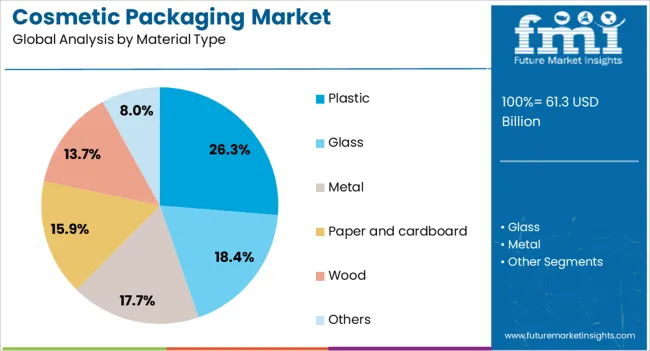

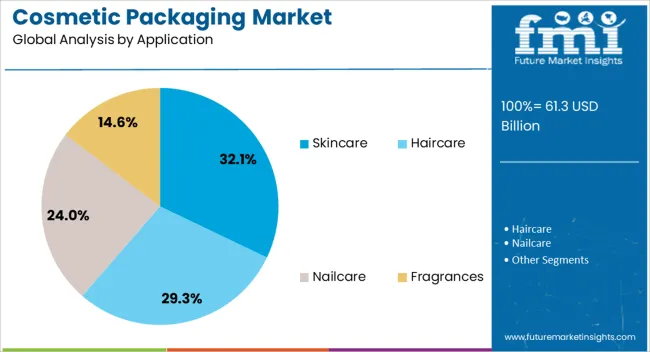

The cosmetic packaging market is segmented by packaging type, material type, application, end use, and geographic regions. By packaging type, cosmetic packaging market is divided into primary packaging, secondary packaging, and tertiary packaging. In terms of material type, cosmetic packaging market is classified into plastic, glass, metal, paper and cardboard, wood, and others. Based on application, cosmetic packaging market is segmented into skincare, haircare, nailcare, and fragrances. By end use, cosmetic packaging market is segmented into mass market brands and luxury brands. Regionally, the cosmetic packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The primary packaging segment is projected to hold 57.3% of the cosmetic packaging market revenue share in 2025, establishing it as the leading packaging type. Its dominance is being driven by the critical role it plays in protecting the product, maintaining its quality, and delivering a premium consumer experience.

Primary packaging is being preferred due to its ability to directly house and preserve the cosmetic product while enabling convenient usage and precise dispensing. The segment benefits from extensive adoption across skincare, haircare, and color cosmetics, where functional and attractive containers enhance brand visibility and consumer engagement.

Technological advancements, such as airtight closures, pumps, and innovative bottle designs, are improving shelf life and usability, while cost-effective manufacturing and scalable production processes are supporting market penetration Increasing investments in product design and customization have further strengthened its position, as brands continue to differentiate offerings through innovative primary packaging solutions, ensuring high consumer satisfaction and loyalty.

The plastic material type segment is expected to account for 26.3% of the cosmetic packaging market revenue share in 2025, positioning it as a leading material category. This leadership is being reinforced by plastic’s lightweight nature, durability, and versatility, which make it suitable for a wide range of cosmetic applications. Plastic packaging enables innovative designs, color customization, and functional enhancements such as pumps, droppers, and airtight closures.

Its ability to provide protection against contamination, moisture, and light ensures product integrity over extended shelf life. The segment is further supported by cost efficiency, scalability, and ease of processing, which allows manufacturers to meet growing demand across skincare, haircare, and personal care products.

While sustainability concerns are prompting the adoption of recyclable and biodegradable plastics, ongoing innovation in eco-friendly plastic alternatives is maintaining the segment’s relevance As consumer expectations for visually appealing, functional, and safe packaging continue to rise, plastic materials are expected to retain a significant share in the cosmetic packaging market.

The skincare application segment is anticipated to represent 32.1% of the cosmetic packaging market revenue share in 2025, making it the leading application area. This growth is being driven by the rising demand for facial care, moisturizers, serums, and anti-aging products, which require high-quality, protective, and convenient packaging solutions. Skincare products often involve sensitive formulations, making packaging that preserves stability and prevents contamination critical.

The segment benefits from innovations in dispensers, airless bottles, and tubes, which enhance usability, maintain product efficacy, and improve consumer experience. Growing consumer awareness regarding self-care, personal wellness, and premium beauty routines is further stimulating demand for visually appealing and functional packaging. E-commerce growth and direct-to-consumer sales are reinforcing the need for secure and transport-friendly packaging.

The adoption of eco-conscious packaging solutions in skincare is also influencing purchasing decisions, highlighting sustainability alongside performance These factors collectively ensure that skincare remains the leading application driving cosmetic packaging market growth.

The cosmetic packaging market is being shaped by multiple interlinked factors. Rising consumer demand for premium, visually attractive packaging drives innovation in materials and designs. Regulatory compliance and safety standards are critical for product protection and brand trust, influencing packaging choices across regions. Environmental consciousness encourages adoption of recyclable, reusable, and eco-friendly materials, while e-commerce expansion creates the need for durable, tamper-evident, and transport-optimized packaging solutions.

The global cosmetic packaging market is experiencing a steady rise due to growing consumer preference for premium and aesthetically appealing packaging. Consumers increasingly consider packaging as a reflection of product quality, influencing purchase decisions significantly. Lightweight and durable materials such as glass, aluminum, and high-grade plastics are gaining traction for their functional and visual appeal. Multi-functional packaging designs, including airless pumps, reusable jars, and travel-friendly formats, are driving adoption. Market growth is supported by a surge in mid-to-high-end personal care product launches, especially in skincare and color cosmetics. Brand differentiation through packaging aesthetics is becoming a key competitive lever, particularly in e-commerce and luxury retail channels.

Regulatory frameworks governing cosmetic packaging are shaping market dynamics considerably. Compliance with food-grade, chemical-safe, and recyclable material standards is mandatory in most regions. Authorities enforce strict labeling, ingredient transparency, and tamper-evident measures to ensure consumer safety. Manufacturers are increasingly adopting compliant solutions to reduce liability risks and enhance brand trust. The rise in awareness regarding product contamination and allergens has prompted brands to use sealed and hygienic packaging. Regulatory pressure is driving the adoption of innovative closure systems, anti-leakage designs, and protective coatings. Packaging choices are now guided not only by visual appeal but also by adherence to global standards, ensuring durability, functionality, and safety across multiple product formats.

Consumer preference for eco-conscious packaging has created a strong demand for refillable, recyclable, and reusable materials. Brands are exploring alternatives like post-consumer recycled plastics, glass jars, aluminum tubes, and biodegradable materials to minimize environmental impact. Refill stations and modular packaging concepts are becoming popular in key markets, allowing repeated usage and waste reduction. Retailers emphasize product display and sustainability claims to attract environmentally aware buyers. This shift affects packaging design strategies, requiring innovations in material selection, structure, and aesthetics without compromising safety or durability. Regions with strict environmental regulations are witnessing higher adoption rates, creating opportunities for converters and packaging suppliers to offer compliant, visually attractive solutions that meet consumer expectations.

The rise of online cosmetic sales and direct-to-consumer models has reshaped packaging demands. Lightweight, durable, and secure designs are required to withstand shipping, handling, and returns. Tamper-evident, leak-proof, and protective packaging has become essential to maintain product integrity during transit. Customizable packaging that enhances unboxing experiences drives brand loyalty and repeat purchases. E-commerce platforms favor compact and stackable formats that optimize storage and shipping costs. Additionally, digital printing technologies allow limited-edition designs, personalization, and brand storytelling, supporting marketing strategies. Packaging suppliers are increasingly collaborating with brands to create functional yet visually appealing solutions suitable for global e-commerce distribution.

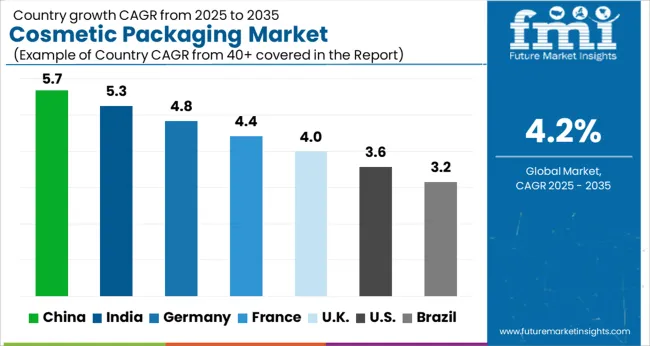

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| U.K. | 4.0% |

| U.S. | 3.6% |

| Brazil | 3.2% |

The global cosmetic packaging market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads expansion at 5.7%, followed by India at 5.3%, Germany at 4.8%, the U.K. at 4.0%, and the U.S. at 3.6%. Growth is driven by rising demand for premium and functional packaging, increasing cosmetic product launches, and evolving consumer preferences for aesthetics, convenience, and product safety. China and India dominate manufacturing and adoption due to large-scale production capacities and growing domestic demand, while Germany, the U.K., and the U.S. focus on innovative design, sustainable material alternatives, and high-end packaging solutions. The analysis covers over 40 countries, with the leading markets detailed below.

The cosmetic packaging market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035, with the market benefiting from a rising demand for premium and customized cosmetic products. Domestic and international brands are increasingly introducing high-end packaging formats including airless pumps, glass jars, and recyclable tubes to enhance brand perception and consumer appeal. Growth in e-commerce and direct-to-consumer channels is driving demand for visually appealing, durable, and transport-friendly packaging. Advanced manufacturing technologies, such as injection molding and thermoforming, support large-scale production while maintaining aesthetic quality. Consumer preferences are shifting toward multifunctional, lightweight, and refillable formats, contributing to broader adoption.

The cosmetic packaging market in India is expected to expand at a CAGR of 5.3% between 2025 and 2035, driven by growing beauty awareness, rising disposable income, and increased cosmetic product consumption. Both international and domestic cosmetic brands are adopting innovative packaging solutions such as airless containers, eco-friendly tubes, and lightweight bottles to meet consumer expectations. Demand from tier-2 and tier-3 cities is rising as regional brands expand distribution and e-commerce platforms facilitate wider accessibility. Packaging manufacturers are also enhancing printing, labeling, and finishing techniques to provide visually attractive designs that influence purchasing decisions. Refillable and modular packaging systems are gaining traction among urban and semi-urban consumers.

Germany’s cosmetic packaging market is anticipated to grow at a CAGR of 4.8% from 2025 to 2035, largely driven by premium skincare and luxury cosmetic product demand. Consumers increasingly prefer innovative packaging solutions that combine convenience, aesthetics, and quality preservation. Manufacturers are investing in sustainable material alternatives, modular designs, and refillable systems, meeting stringent regulations and environmentally conscious consumer expectations. E-commerce growth is influencing packaging designs, requiring durable, tamper-proof, and shipping-friendly formats. High-quality finishing, digital printing, and product personalization are differentiating packaging in a competitive market. Partnerships between local converters and cosmetic brands are fostering innovation and efficiency.

The UK cosmetic packaging market is projected to register a CAGR of 4.0% from 2025 to 2035, driven by an emphasis on visually compelling, travel-friendly, and convenient packaging. Rising consumer awareness regarding product quality, hygiene, and preservation is encouraging the adoption of airless pumps, jars, and protective secondary packaging. E-commerce sales and subscription-based cosmetic models are shaping packaging innovations that optimize durability, shipping, and unboxing experience. Manufacturers are leveraging lightweight plastics, high-grade glass, and composite materials to maintain brand aesthetics while minimizing logistics costs. Market growth is also fueled by collaborations between cosmetic brands and specialized packaging converters, ensuring efficient, creative, and regulatory-compliant solutions.

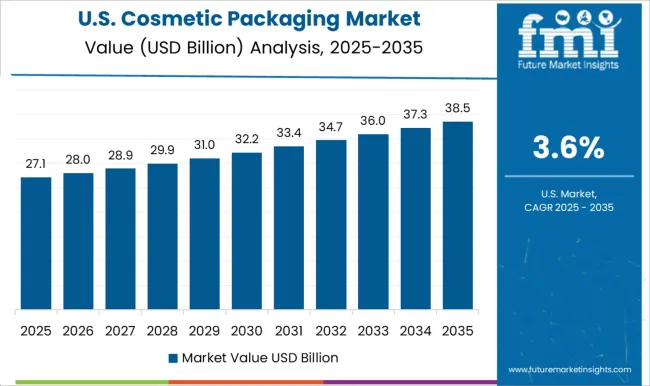

The U.S. cosmetic packaging market is estimated to grow at a CAGR of 3.6% from 2025 to 2035, shaped by increasing demand for premium skincare, functional cosmetics, and convenience-oriented packaging formats. Consumer preference for travel-ready, modular, and refillable containers is shaping design trends. Packaging manufacturers are adopting advanced printing, labeling, and finishing technologies to enhance aesthetic appeal, brand differentiation, and consumer engagement. E-commerce and omni-channel retail are driving packaging durability, shipping efficiency, and product protection standards. Innovation in lightweight, hybrid, and multifunctional packaging solutions supports brand competitiveness while meeting evolving regulatory and environmental standards.

Competition in the cosmetic packaging market is shaped by material innovation, design flexibility, and brand customization. Amcor plc, AptarGroup, Inc., and Silgan Holdings Inc. lead through multi-format packaging solutions, offering bottles, jars, tubes, and closures with advanced barrier properties and aesthetic finishes. Gerresheimer AG, Berry Global Group, Inc., and other major players compete in glass, plastic, and hybrid packaging for premium and mass-market cosmetics, emphasizing lightweight designs, functional dispensing, and high-end surface treatments. Product differentiation is achieved through specialty coatings, anti-tamper closures, and ergonomic design tailored for brand identity and consumer convenience.

Mid-tier competitors, including regional converters and niche manufacturers, offer quick-turnaround, customizable formats for boutique and emerging cosmetic brands. They focus on rapid prototyping, modular filling compatibility, and innovative secondary packaging, enabling small-to-medium enterprises to access sophisticated solutions without high capital investment. Strategies across market leaders emphasize global reach, material sustainability alternatives, and comprehensive service programs including design consultancy, filling line compatibility, and supply chain integration.

Automation and digital mock-ups for brand testing, along with anti-counterfeit features and smart packaging integration, are leveraged as critical differentiators. Customer support and lifecycle services, such as refills, recycling guidance, and regulatory compliance assistance, further strengthen market positioning. Companies aim to combine functional performance with visual appeal, ensuring packaging enhances product safety, shelf impact, and brand perception, reflecting a market highly focused on versatility, innovation, and operational reliability.

| Items | Values |

|---|---|

| Quantitative Units | USD 61.3 billion |

| Packaging Type | Primary packaging, Secondary packaging, and Tertiary packaging |

| Material Type | Plastic, Glass, Metal, Paper and cardboard, Wood, and Others |

| Application | Skincare, Haircare, Nailcare, and Fragrances |

| End Use | Mass market brands and Luxury brands |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc, AptarGroup, Inc., Silgan Holdings Inc., Gerresheimer AG, and Berry Global Group, Inc. |

| Additional Attributes | Dollar sales by material and format, market share by region and segment, growth trends, consumer preferences, regulatory requirements, emerging product formats, and competitive positioning. |

The global cosmetic packaging market is estimated to be valued at USD 61.3 billion in 2025.

The market size for the cosmetic packaging market is projected to reach USD 92.5 billion by 2035.

The cosmetic packaging market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in cosmetic packaging market are primary packaging, jars, tubes, bottles, pumps and dispensers, and others.

In terms of material type, plastic segment to command 26.3% share in the cosmetic packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Eye Cosmetic Packaging Providers

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Single Portion Cosmetic Packaging Companies

Anti-counterfeit Cosmetic Packaging Market Growth - Demand & Forecast 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA