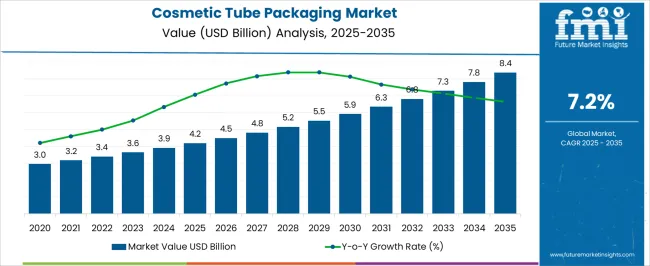

The cosmetic tube packaging market, valued at USD 4.2 billion in 2025 and projected to reach USD 8.4 billion by 2035 with a CAGR of 7.2%, is significantly shaped by regulatory frameworks governing packaging materials, safety, and environmental compliance. Regulatory impact is seen in two major dimensions, material safety and sustainability. Stringent regulations by agencies such as the FDA in the United States and EFSA in Europe enforce guidelines on permissible material usage to avoid contamination risks in cosmetic formulations.

This ensures that polymer resins, laminates, and coatings meet safety standards before market entry. Environmental regulations also influence cost structures and innovation. The EU directives on single-use plastics and extended producer responsibility frameworks are accelerating the shift toward recyclable and bio-based materials, forcing companies to redesign tubes for compliance. Such mandates elevate initial manufacturing costs but encourage long-term market differentiation through eco-friendly solutions.

In Asia-Pacific, evolving regulations are creating inconsistencies in compliance across regions, which may slow adoption in emerging economies. The steady growth from USD 4.2 to 8.4 billion reflects how the industry is balancing regulatory constraints with innovation, especially in areas such as biodegradable plastics, post-consumer recycled content, and reduced carbon footprint designs. By 2035, regulatory harmonization is expected to drive broader acceptance of sustainable cosmetic tube packaging worldwide.

| Metric | Value |

|---|---|

| Cosmetic Tube Packaging Market Estimated Value in (2025 E) | USD 4.2 billion |

| Cosmetic Tube Packaging Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The cosmetic tube packaging market is considered a vital segment across the beauty and personal care industries. It accounts for around 7.4% of personal care packaging, driven by increasing demand for skincare and haircare products. In the broader beauty and cosmetics packaging domain, it holds about a 5.6% share, supported by the popularity of squeezable and lightweight solutions. Within the plastic packaging industry, a 2.9% share is observed due to high reliance on laminated and mono-material tubes. Flexible packaging contributes 3.8%, given the functional adaptability of cosmetic tubes. Premium packaging represents 2.2%, reflecting growing demand for aesthetically designed and branded tubes. Recent industry trends highlight the rapid adoption of eco-friendly materials and innovation in design features.

Developments include recyclable mono-layer tubes, bio-based resins, and post-consumer recycled plastics used in tube production. Groundbreaking trends include airless dispensing systems that prevent contamination, digital printing for brand personalization, and smart labeling solutions with traceability features. Key players are investing in research collaborations to create lightweight barrier tubes and shifting production toward circular economy models. Strategies have focused on enhancing sustainability, ensuring premium appearance, and improving functionality, allowing cosmetic tube packaging to strengthen its role in both mass market and luxury segments.

Increasing consumer preference for convenient, portable, and hygienic packaging formats is enhancing the adoption of tube-based solutions across various cosmetic categories. The ability of tube packaging to maintain product integrity, minimize waste, and offer customizable designs has strengthened its presence in both premium and mass-market segments.

Manufacturers are focusing on sustainable materials, advanced printing technologies, and functional dispensing features to align with evolving consumer expectations. The integration of recyclable and bio-based materials is further driving brand differentiation and compliance with environmental regulations.

Expanding e-commerce penetration and heightened focus on product safety during transportation are also contributing to growth. With the cosmetic industry emphasizing brand aesthetics and functional convenience, tube packaging is positioned to remain a preferred choice, fostering continuous innovation and adoption across multiple product lines.

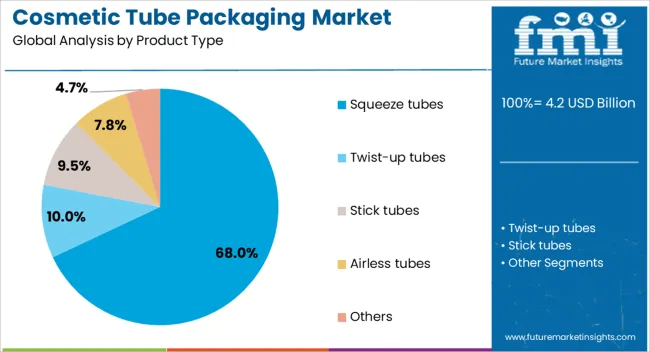

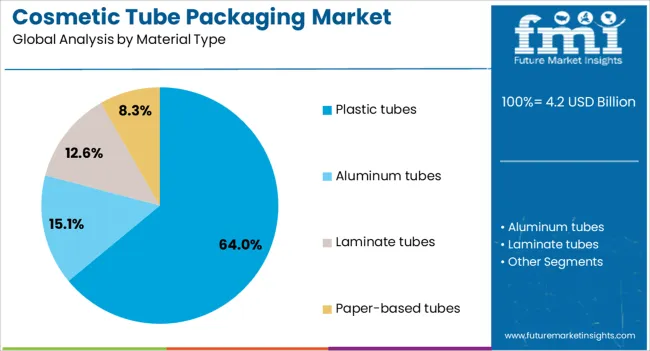

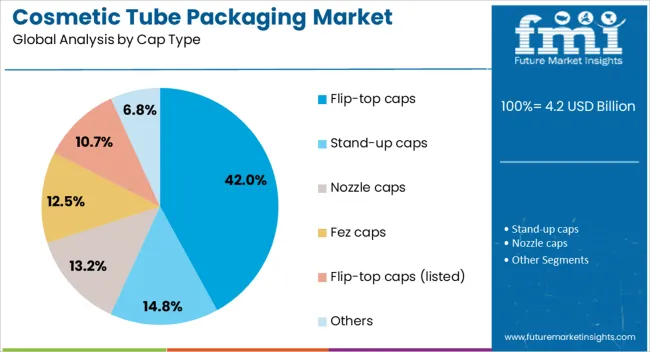

The cosmetic tube packaging market is segmented by product type, material type, cap type, capacity, application, and geographic regions. By product type, cosmetic tube packaging market is divided into Squeeze tubes, Twist-up tubes, Stick tubes, Airless tubes, and Others. In terms of material type, cosmetic tube packaging market is classified into Plastic tubes, Aluminum tubes, Laminate tubes, and Paper-based tubes. Based on cap type, cosmetic tube packaging market is segmented into Flip-top caps, Stand-up caps, Nozzle caps, Fez caps, Flip-top caps (listed), and Others.

By capacity, the cosmetic tube packaging market is segmented into 51 ml to 100 ml, up to 50 ml, 101 ml to 150 ml, and above 150 ml. By application, cosmetic tube packaging market is segmented into Skincare, Haircare, Makeup, and Others. Regionally, the cosmetic tube packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The squeeze tubes segment is projected to hold 68% of the market revenue share in 2025, making it the dominant product type. This leadership position has been driven by their flexibility, ease of dispensing, and suitability for a wide range of cosmetic formulations, including creams, gels, and lotions. The ability to control product flow, combined with minimal product wastage, has increased consumer preference for squeeze tubes.

Their lightweight nature and portability have also enhanced their adoption in travel-friendly cosmetic products. Manufacturers have leveraged this format to offer diverse sizes and innovative shapes that support brand differentiation while maintaining cost efficiency in production.

Additionally, squeeze tubes are compatible with various closure types, enhancing convenience and product protection. The segment has further benefited from advancements in decoration and printing techniques, enabling visually appealing designs that strengthen brand visibility in competitive retail environments.

The plastic tubes segment is expected to account for 64% of the market revenue share in 2025, securing its position as the leading material type. The versatility, durability, and cost-effectiveness of plastic-based packaging solutions have supported this dominance. Plastic tubes offer excellent barrier properties to protect formulations from external contaminants, ensuring longer shelf life and product safety.

The ease of molding plastic into various shapes and sizes has enabled brands to create distinctive packaging that enhances consumer appeal. Lightweight construction has reduced transportation costs, while compatibility with advanced printing and labeling technologies has supported creative brand presentation.

Increasing use of recyclable and post-consumer recycled plastics is also aligning the segment with sustainability objectives, driving further adoption. Plastic tubes are particularly valued for their resilience in handling and storage, making them a reliable choice for both mass-market and premium cosmetic products.

The flip-top caps segment is anticipated to command 42% of the market revenue share in 2025, emerging as the leading cap type. Growth in this segment has been reinforced by consumer demand for easy-to-use, one-handed operation in cosmetic product dispensing. Flip-top caps offer convenience, secure closure, and controlled dispensing, reducing the risk of spills and product contamination.

Their reusability and functional design have made them a preferred choice in daily-use cosmetics such as lotions, shampoos, and facial cleansers. Brands have increasingly adopted flip-top caps to enhance user experience while maintaining product integrity. The caps’ compatibility with various tube sizes and materials has further widened their application scope.

Advances in closure design, including tamper-evident features and eco-friendly materials, have strengthened the segment’s position. The balance between practicality, aesthetic appeal, and functional performance has ensured that flip-top caps remain the preferred choice for many cosmetic packaging applications.

Cosmetic tube packaging has been adopted widely across skincare, haircare, personal hygiene, and color cosmetics where ease of dispensing, protection of formulations, and branding flexibility are vital. Tubes in laminated, plastic, aluminum, and bio based materials have been engineered for functional and aesthetic appeal. Advanced printing and decoration technologies have supported strong shelf presence and consumer engagement. The market has been guided by requirements for barrier protection, sustainability, portability, and customization in premium and mass cosmetic ranges.

Cosmetic products such as creams, gels, lotions, and pastes often contain active ingredients sensitive to air, moisture, and light. Tube packaging has been applied to provide effective barrier protection using multilayer laminates, aluminum foils, or high density polymers. Airless tubes have been introduced to preserve sensitive formulations and improve dosing precision. The reclosable and hygienic nature of tubes has reinforced preference in personal care routines. Tamper evident closures, precision applicator tips, and soft touch materials have been incorporated to enhance usability. Protection against contamination and wastage has been a key driver in shaping tube packaging as a preferred solution across diverse cosmetic categories.

Tubes have offered strong opportunities for brand differentiation due to wide options in shapes, finishes, and decoration. Techniques such as offset printing, hot stamping, digital printing, and embossing have allowed premium visuals. Matte, glossy, metallic, and textured finishes have been applied to support positioning strategies. Flexible geometry including oval and super flat tubes has expanded display opportunities and consumer appeal. Transparent windows and gradient coloring have been introduced to showcase formulations. This versatility has allowed both luxury and mass market brands to align packaging design with consumer identity. The importance of first impression and tactile experience in cosmetics retail has reinforced tube packaging as a key marketing tool.

Rising emphasis on recyclable and ecofriendly solutions has influenced significant changes in cosmetic tube packaging. Mono material polyethylene and polypropylene tubes have been developed to improve recyclability within established waste streams. Recycled resins and bio based plastics have been adopted to reduce carbon footprint. Lightweighting strategies have been applied without compromising strength or barrier performance. Paper based laminated tubes have emerged as alternatives to conventional plastics, with some incorporating biodegradable layers. Investments in sustainable printing inks and reduced solvent decoration processes have also grown. These sustainability efforts have been supported by brand commitments to circular economy goals, making environmental considerations a decisive factor in material selection and innovation.

The expansion of online cosmetic sales has placed new emphasis on packaging durability, leak prevention, and protective secondary layers. Tubes have been designed to withstand shipping and handling while maintaining premium appearance. Airless and pump integrated tubes have gained traction in prestige cosmetic categories, offering controlled dispensing and elevated user experience. Travel size and sample tubes have become significant due to e-commerce promotion strategies. Refill systems and modular packaging formats have been introduced to combine sustainability with convenience. Premiumization trends have driven demand for innovative tube formats that combine luxury aesthetics with functional features. These shifts have reinforced tube packaging as a vital element of consumer engagement in both physical retail and digital sales channels.

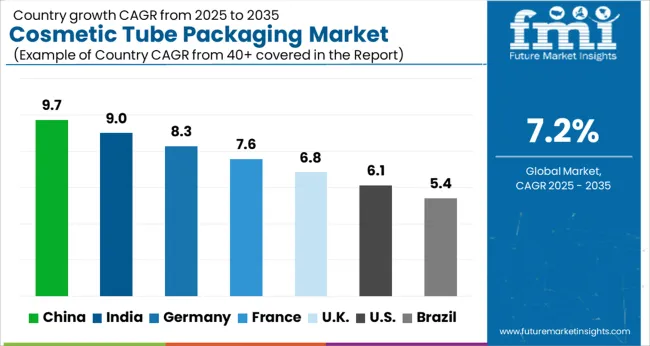

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

China recorded the strongest development in the cosmetic tube packaging market with a forecast growth rate of 9.7%, driven by rising demand for skincare and personal care products across domestic and export markets. India followed with 9.0%, supported by a growing beauty industry and increasing adoption of ecofriendly and flexible packaging formats. Germany stood at 8.3%, benefiting from advanced manufacturing capabilities and a strong presence of premium cosmetic brands. The United Kingdom registered 6.8%, where innovation in sustainable and recyclable packaging designs contributed to steady progress. The United States reported 6.1%, supported by ongoing advancements in material science and consistent consumer demand for premium cosmetic packaging solutions. Collectively, these countries represent a critical share of global adoption and innovation in cosmetic tube packaging. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 9.7% in the market, supported by rising demand for skincare, haircare, and personal grooming products. The domestic beauty sector is highly dynamic, encouraging packaging manufacturers to introduce innovative solutions that emphasize product safety, convenience, and premium appeal. Lightweight tubes with advanced barrier properties are increasingly used to protect formulations against contamination and external factors. The influence of online retail is also shaping packaging preferences, as brands seek visually appealing designs for digital platforms. With the growing presence of global and local cosmetic companies, China is expected to continue leading the market in terms of scale and innovation.

India is recording a CAGR of 9.0% in the market, largely driven by its growing personal care and beauty industries. Increasing consumer awareness of hygiene and quality packaging is encouraging the adoption of advanced tube formats that offer convenience and durability. Local manufacturers are responding with cost-effective yet innovative designs that cater to mass-market and premium segments. The influence of social media and digital retail platforms is driving stronger demand for attractive, travel-friendly cosmetic packaging. As global beauty brands expand their presence in India, the need for differentiated and sustainable packaging formats is becoming more prominent, creating new opportunities for domestic producers.

Germany is progressing at a CAGR of 8.3% in the market, supported by high consumer expectations for quality, safety, and sustainability. The country’s beauty industry is characterized by strong demand for organic and dermatologically tested products, which in turn drives packaging requirements for protective and eco-friendly tubes. Manufacturers are innovating with recyclable and bio-based materials while maintaining strict regulatory compliance. The growing premiumization trend in skincare and haircare is fueling interest in sleek, functional packaging formats. Germany continues to be a hub for advanced packaging technologies, setting a strong precedent for sustainable and high-quality cosmetic tube production in Europe.

The United Kingdom is witnessing a CAGR of 6.8% in the market, with rising demand from skincare, grooming, and organic beauty segments. Packaging companies are focusing on lightweight, recyclable tube designs that combine convenience with sustainability. The growing popularity of online beauty retail platforms is boosting demand for packaging that enhances brand visibility and consumer engagement. Collaborations between cosmetic brands and packaging firms are fostering innovation in print finishes, closures, and user-friendly applicators. With consumer preference shifting toward authenticity and eco-friendly solutions, the UK market is expected to maintain steady growth in the coming years.

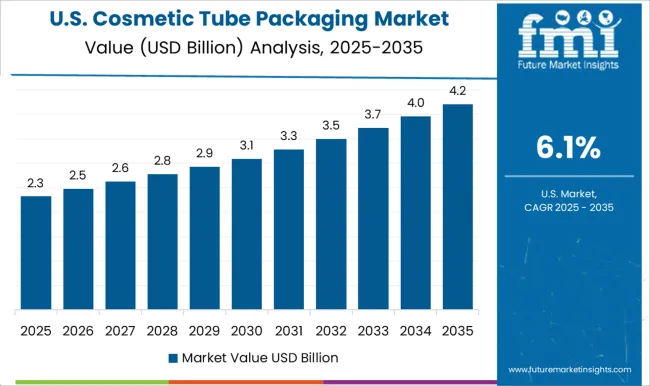

The United States is expanding at a CAGR of 6.1% in the market, supported by the strong presence of global and domestic beauty brands. Packaging innovation is centered on delivering premium appeal, ease of use, and enhanced protective qualities for sensitive formulations. The rise of clean beauty and wellness-focused cosmetics is encouraging companies to adopt recyclable and renewable packaging solutions. E-commerce growth is further influencing demand for durable yet visually appealing designs that resonate with digital shoppers. With regulatory standards shaping packaging practices and consumers placing high value on sustainability, the US market is positioned for consistent long-term development.

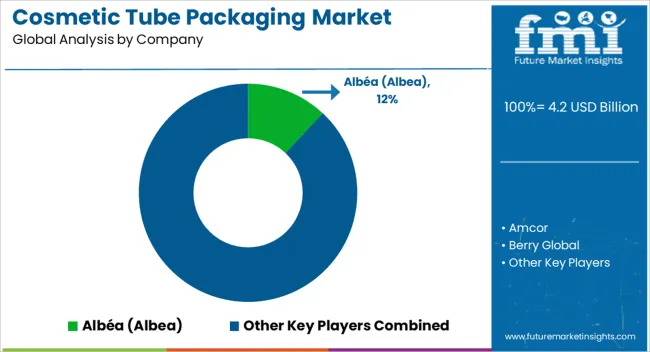

The market is shaped by a mix of multinational packaging giants and specialized players offering advanced tube solutions tailored for skincare, haircare, and personal grooming brands. Albéa has positioned itself as a leading innovator with a strong focus on eco-designed tubes, integrating recycled plastics and lightweight materials for global cosmetic companies. Amcor contributes with its expertise in sustainable flexible packaging, introducing recyclable and barrier-protected tube formats that extend shelf life and align with evolving consumer preferences for premium beauty packaging. Berry Global is another major participant, supplying high-volume production capabilities with innovations in extrusion and laminate tube technologies that address both mass-market and luxury cosmetic needs.

Hoffmann Neopak brings a more specialized approach, emphasizing premium metal and hybrid tube designs that appeal to luxury cosmetics and niche beauty brands seeking differentiation. EPL, formerly Essel Propack, holds a strong global presence with advanced laminate tubes that offer high barrier properties and printing flexibility, enabling strong branding opportunities for multinational cosmetic firms. Alongside these leaders, several regional and niche participants continue to support localized cosmetic manufacturers with customized, cost-effective, and innovative tube solutions, ensuring that competition in this segment remains dynamic and innovation-driven.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Product Type | Squeeze tubes, Twist-up tubes, Stick tubes, Airless tubes, and Others |

| Material Type | Plastic tubes, Aluminum tubes, Laminate tubes, and Paper-based tubes |

| Cap Type | Flip-top caps, Stand-up caps, Nozzle caps, Fez caps, Flip-top caps (listed), and Others |

| Capacity | 51 ml to 100 ml, Up to 50 ml, 101 ml to 150 ml, and Above 150 ml |

| Application | Skincare, Haircare, Makeup, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Albéa (Albea), Amcor, Berry Global, Hoffmann Neopak, EPL / Essel Propack, and Others |

| Additional Attributes | Dollar sales by tube type and material, demand dynamics across skincare, haircare, and personal care sectors, regional trends in cosmetic packaging adoption, innovation in lightweight design, dispensing systems, and eco-friendly materials, environmental impact of plastic waste and recycling, and emerging use cases in sustainable packaging and premium beauty products. |

The global cosmetic tube packaging market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the cosmetic tube packaging market is projected to reach USD 8.4 billion by 2035.

The cosmetic tube packaging market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in cosmetic tube packaging market are squeeze tubes, twist-up tubes, stick tubes, airless tubes and others.

In terms of material type, plastic tubes segment to command 64.0% share in the cosmetic tube packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Cosmetic Oil Market Growth - Size, Demand & Forecast 2025 to 2035

Cosmetic Vials Market Trends - Size & Growth 2025 to 2035

Cosmetic Peptide Manufacturing Market Analysis by Product, Application, End Product, End User, and Region through 2035

Market Leaders & Share in the Cosmetic Dropper Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA