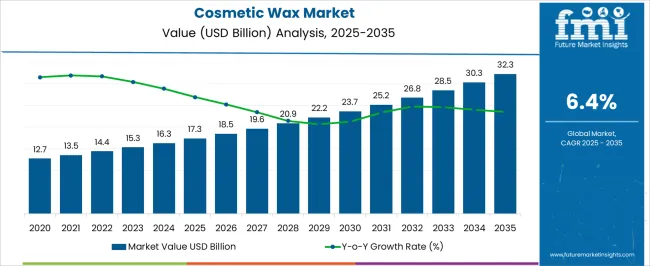

The Cosmetic Wax Market is estimated to be valued at USD 17.3 billion in 2025 and is projected to reach USD 32.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. Over the next decade, the market will experience steady expansion, driven by increased demand for high-quality cosmetic products across skincare, haircare, and personal care segments. From 2025 to 2030, the market will grow from USD 17.3 billion to USD 23.7 billion, adding USD 6.4 billion in value. This period will witness growth rates of 6–7%, driven by the rising consumer preference for natural and organic cosmetic formulations, alongside the continuous innovation of wax-based products in cosmetics.

From 2030 to 2035, the growth rate will maintain momentum, with the market reaching USD 32.3 billion by the end of the forecast period. This five-year period is expected to contribute an additional USD 8.6 billion, fueled by the increasing use of cosmetic wax in luxury and premium beauty products. Growth will also be influenced by consumer trends toward clean beauty and sustainability, with waxes derived from natural sources becoming more prevalent in formulation. Over the full 10-year span, the cosmetic wax market will see a cumulative increase of USD 15 billion.

Product development environments present intricate coordination challenges between formulation chemists operating under different regional compliance requirements and marketing teams pursuing global brand consistency. Technical teams specify wax formulations optimized for texture, spreadability, and wear properties while regulatory affairs departments must navigate divergent ingredient approval lists across major markets. European operations require compliance with over 1,600 banned substances while North American facilities face less restrictive frameworks, creating formulation complexity where global product lines require multiple variants to achieve regulatory compliance across all target markets.

Manufacturing operations reveal fundamental tensions between cost optimization objectives and regulatory compliance requirements that vary significantly by geographic region. Production planning departments prefer standardized formulations that maximize economies of scale while quality assurance teams establish testing protocols addressing different safety standards across international markets. Procurement strategies become complicated where approved wax suppliers in one region may not meet certification requirements for other markets, creating supply chain complexity that traditional vendor management systems struggle to accommodate effectively.

Color cosmetics applications introduce additional complexity layers where wax performance characteristics must balance aesthetic properties with regulatory safety margins. Lipstick formulations require waxes providing optimal color payoff and comfortable wear while meeting lead content restrictions that differ between markets. Eye makeup products demand wax systems compatible with sensitive skin zones yet capable of achieving long-wearing performance that consumers expect from premium products. These requirements create formulation challenges where technical performance conflicts with regulatory constraints, particularly when natural wax alternatives may not provide equivalent functional benefits.

| Metric | Value |

|---|---|

| Cosmetic Wax Market Estimated Value in (2025 E) | USD 17.3 billion |

| Cosmetic Wax Market Forecast Value in (2035 F) | USD 32.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The cosmetic wax market is experiencing steady expansion due to the rising consumer demand for high-performance ingredients in skincare, haircare, and decorative cosmetics. As clean beauty and eco-conscious formulations gain momentum, cosmetic waxes have emerged as essential ingredients for achieving product stability, texture, and moisture retention. Advances in cosmetic science and dermatologically approved formulations are accelerating the adoption of multifunctional waxes that enhance application feel while meeting natural and regulatory benchmarks.

The integration of cosmetic waxes into sunscreens, lip balms, and facial creams has been reinforced by a growing preference for ingredients that offer both functional and aesthetic benefits. Manufacturers are increasingly focusing on supply chain transparency and product traceability, especially for waxes derived from plant-based or organic sources.

In emerging markets, rising disposable income and heightened beauty consciousness are further propelling demand Looking ahead, innovations in bio-based waxes and synthetic-natural hybrids are expected to support new product development, ensuring continued growth across various cosmetic segments globally.

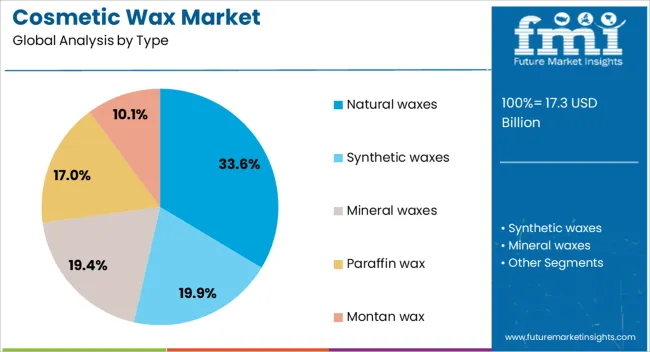

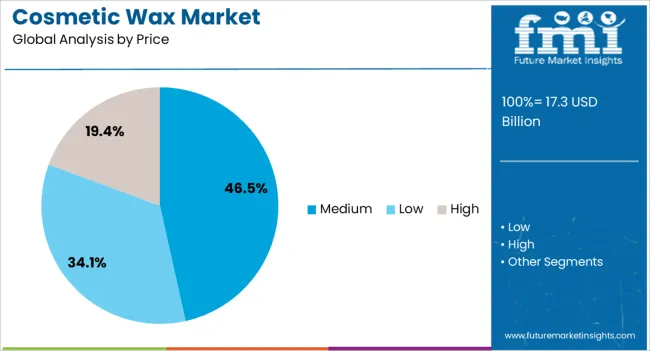

The cosmetic wax market is segmented by type, price, form, and geographic regions. By type, cosmetic wax market is divided into Natural waxes, Synthetic waxes, Mineral waxes, Paraffin wax, Montan wax, and Others (ceresin wax, ozokerite wax, etc.). In terms of price, cosmetic wax market is classified into Medium, Low, and High.

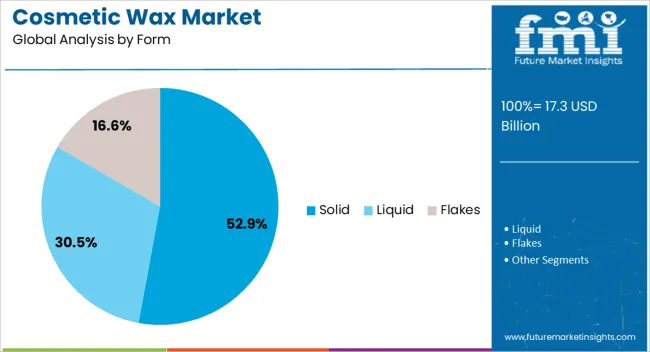

Based on form, cosmetic wax market is segmented into Solid, Liquid, and Flakes. Regionally, the cosmetic wax industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural waxes are expected to account for 33.6% of the total revenue share in the cosmetic wax market in 2025, making it the leading type segment. Growth in this category is being driven by increasing consumer inclination toward clean-label beauty products and plant-based alternatives. Demand for beeswax, carnauba, and candelilla waxes has risen sharply due to their favorable skin compatibility and biodegradability.

Formulators have increasingly preferred natural waxes for their emollient properties and their ability to provide consistent structure to cosmetic products such as lipsticks, balms, and creams. The segment’s prominence is further reinforced by evolving regulatory guidelines that encourage reduced use of petroleum-based derivatives.

With premium brands promoting ethical sourcing and sustainable production, natural waxes have gained wider adoption across both mass and prestige product lines Technological improvements in extraction and purification processes have also enhanced their applicability in sensitive formulations, allowing natural waxes to remain central to the development of environmentally conscious cosmetic solutions.

The medium price segment is anticipated to contribute 46.5% of the total revenue share in the cosmetic wax market in 2025. The segment’s strength lies in its ability to balance performance and affordability, making it an attractive choice for a broad consumer base. Medium-priced waxes are widely adopted by mid-tier personal care brands that aim to offer quality without compromising cost efficiency.

The availability of a wide variety of waxes with consistent texture, stability, and functional properties within this pricing range has facilitated their integration into daily-use cosmetic products. The segment's continued growth is supported by expanding middle-class populations and increasing beauty spending in emerging economies.

Manufacturers have optimized production processes to maintain quality standards while controlling pricing, thereby ensuring competitiveness across global markets. With rising consumer demand for value-driven skincare and haircare products, the medium price category is expected to remain a pivotal segment in supporting volume-driven growth across the cosmetic industry.

Solid form cosmetic waxes are projected to hold 52.9% of the overall revenue share in the market in 2025, emerging as the dominant form segment. The segment’s leadership is being driven by its widespread application across various product formats, including lipsticks, solid perfumes, balms, and deodorant sticks. Solid waxes offer superior moldability, ease of incorporation, and stability in both hot and cold processing environments, making them ideal for large-scale manufacturing.

Their ability to provide consistent texture and structural integrity has been a major factor in maintaining formulation quality across different climatic conditions. The segment has also benefited from increased consumer interest in solid beauty products due to their portability and eco-friendly packaging options.

Moreover, the stability and extended shelf life offered by solid waxes have made them suitable for waterless formulations and emerging formats in zero-waste beauty. As solid cosmetics continue to grow in popularity, the demand for solid waxes is expected to maintain a strong upward trajectory in the coming years.

The cosmetic wax industry is set to grow significantly, driven by the increasing preference for natural and organic beauty products, alongside rising demand for premium cosmetics. With consumers becoming more conscious of eco-friendly and skin-safe ingredients, natural waxes like beeswax, carnauba, and candelilla are seeing an uptick in popularity. The expanding presence of 5G, premium beauty products, and growth in e-commerce are all contributing to the market's continuous expansion. As the beauty industry focuses on efficient and effective formulations, the cosmetic wax market is projected to experience steady growth.

The cosmetic wax market is experiencing strong growth due to the increasing consumer preference for natural and organic beauty products. As awareness of clean-label ingredients rises, natural waxes such as beeswax, carnauba, and candelilla are becoming increasingly popular for their eco-friendly and skin-safe properties. Consumers are becoming more conscious of the ingredients in their beauty products, seeking items free from harmful chemicals and toxins. This has led to a surge in demand for natural waxes that can offer both aesthetic and functional benefits in cosmetics. The premium cosmetics sector is also contributing to the market's expansion, driven by rising disposable incomes and evolving beauty standards. Additionally, technological advancements in cosmetic formulations are improving the performance and stability of wax-based products, resulting in longer-lasting and more effective solutions. The growth of online retail platforms further boosts accessibility, driving the overall demand for cosmetic wax-based products.

Several challenges are emerging in the cosmetic wax market that may hinder its development. Fluctuations in raw material prices, particularly for natural waxes, are a major concern, as they can disrupt pricing structures and affect profitability for manufacturers. The cost of sourcing natural ingredients such as beeswax and carnauba is often subject to supply chain variances, creating financial unpredictability. Stricter regulations on synthetic waxes and other cosmetic ingredients are also limiting formulation flexibility, making it difficult for manufacturers to offer a wide range of products. Limited availability of certain natural waxes can cause supply chain bottlenecks, leading to production delays and reduced product availability. Furthermore, educating consumers about the benefits of natural waxes remains a challenge, as many customers are still unfamiliar with these ingredients compared to traditional wax alternatives, slowing market penetration and growth.

The cosmetic wax sector offers several exciting opportunities for innovation and market expansion. With increasing demand for products that are environmentally friendly and less harmful to the skin, manufacturers are looking to develop biodegradable and naturally derived waxes. This shift caters to the growing preference for clean, sustainable products that align with consumer values. There is also an opportunity to create customized wax formulations designed to meet specific consumer needs, particularly for products like lip balms, mascaras, and moisturizers, which require particular textures and performance characteristics. Emerging markets, especially in developing regions with rising beauty awareness and disposable incomes, represent untapped opportunities for growth. Companies can capitalize on this by expanding their presence in these regions. Collaborating with established beauty brands or launching co-branded products also presents significant growth prospects, as this can provide access to a broader consumer base and further drive innovation in wax-based cosmetics.

One of the most notable trends is the rising demand for natural and non-toxic beauty products. Consumers are increasingly prioritizing clean, natural ingredients in their cosmetics, driving the continued growth of the natural wax segment. As consumers seek more personalized beauty solutions, customization in cosmetic formulations is also gaining traction, with brands offering products tailored to individual needs. This shift is creating opportunities for the development of specialized wax-based products. Technological advancements in product development are also enhancing the performance and appeal of wax-based cosmetics. These innovations are improving the texture, sensory qualities, and overall effectiveness of waxes in a variety of beauty products. Additionally, manufacturers are adopting new production techniques to keep up with consumer demand for products that reflect their preferences for high-quality, sustainable, and ethically produced goods, ensuring the market's continued evolution.

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global cosmetic wax market is projected to grow at a CAGR of 6.4% from 2025 to 2035. Among the key markets, China leads with a growth rate of 8.6%, followed by India at 8.0%, and Germany at 7.4%. The United Kingdom and the United States record more moderate growth rates at 6.1% and 5.4%, respectively. This growth is fueled by increasing consumer demand for natural, sustainable, and high-quality beauty products, with emerging markets like China and India experiencing faster growth due to expanding middle-class populations and a rise in beauty consciousness. In contrast, developed markets like the USA and UK show steady demand, driven by established personal care industries and a growing focus on eco-friendly formulations. The analysis includes over 40+ countries, with the leading markets detailed below.

The cosmetic wax market in China is projected to grow at a CAGR of 8.6% from 2025 to 2035. The country’s growing cosmetics industry, supported by rising disposable incomes and increasing consumer demand for personal care products, is driving the demand for cosmetic wax. China’s expanding manufacturing sector and the increasing adoption of innovative formulations in cosmetics further contribute to this growth. The country’s focus on product diversification and new cosmetic innovations is expected to fuel the growth of the cosmetic wax market.

Demand for cosmetic wax in India is projected to grow at a strong rate, with a CAGR of 8.0% from 2025 to 2035. The increasing demand for skincare and personal care products, coupled with a growing interest in natural and organic beauty solutions, is driving the market’s growth. India’s expanding middle class and rising awareness about grooming and self-care are further fueling the demand for cosmetic wax. As Indian consumers embrace international beauty trends, the market for cosmetic wax continues to expand, offering new growth opportunities.

Sale of cosmetic wax in Germany is projected to grow at a CAGR of 7.4% from 2025 to 2035. Germany’s established cosmetics and personal care sector, coupled with the growing interest in sustainable and high-quality cosmetic products, is driving demand for cosmetic wax. The country’s focus on clean beauty and eco-friendly formulations is further accelerating the demand for natural cosmetic waxes. As Germany continues to innovate in the beauty and skincare industries, the adoption of cosmetic waxes in new formulations will see further growth.

The United Kingdom’s cosmetic wax market is projected to grow at a CAGR of 6.1% from 2025 to 2035. The UK’s demand for cosmetic wax is driven by the rising popularity of natural and organic skincare products. As consumers in the UK increasingly prioritize sustainable and ethically sourced products, the cosmetic wax market is set to expand. The demand for premium personal care items and grooming products in the UK continues to drive the need for innovative wax formulations.

The USA cosmetic wax market is projected to grow at a CAGR of 5.4% from 2025 to 2035. The country’s strong consumer preference for natural ingredients in beauty products is driving the demand for cosmetic wax. The increasing adoption of personal care products made with organic and sustainable materials is expected to further drive growth in the market. As the USA continues to be a leader in beauty and skincare innovation, the demand for cosmetic wax in both new and traditional formulations is expected to rise.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.3 Billion |

| Type | Natural waxes, Synthetic waxes, Mineral waxes, Paraffin wax, Montan wax, and Others (ceresin wax, ozokerite wax, etc.) |

| Price | Medium, Low, and High |

| Form | Solid, Liquid, and Flakes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Body Wax Brazil, Depileve, GiGi, Dow Inc., Cirepil, Rica Group, Italwax, Starpil Wax, Xanitalia, CALWAX, Koster Keunen, FILOBCO, Perron Rigot, LCM Company Ltd., Tuel Skincare |

| Additional Attributes | Dollar sales by product type (soft wax, hard wax, strip wax) and end-use segments (salons, spas, home use). Demand dynamics are driven by the increasing popularity of hair removal treatments, growing beauty consciousness, and the shift toward natural, skin-friendly formulations. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by an expanding beauty industry and rising consumer interest in effective hair removal products. |

The global cosmetic wax market is estimated to be valued at USD 17.3 billion in 2025.

The market size for the cosmetic wax market is projected to reach USD 32.3 billion by 2035.

The cosmetic wax market is expected to grow at a 6.4% CAGR between 2025 and 2035.

In terms of price, medium segment to command 46.5% share in the cosmetic wax market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beeswax for Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Waxed Paper Market Size and Share Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Waxing Base Paper Market Size and Share Forecast Outlook 2025 to 2035

Wax Injector Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA