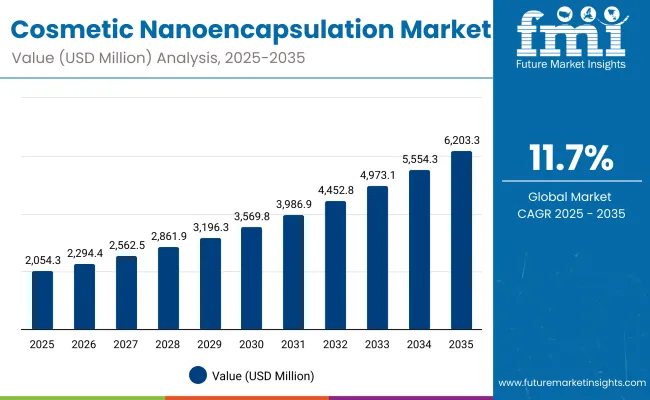

The Global Cosmetic Nanoencapsulation Market is expected to record a valuation of USD 2,054.3 million in 2025 and USD 6,203.3 million in 2035, with an increase of USD 4,149.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 11.7% and a nearly 2X increase in market size.

| Metric | Value |

|---|---|

| Global Cosmetic Nanoencapsulation Market Estimated Value in (2025E) | USD 2,054.3 million |

| Global Cosmetic Nanoencapsulation Market Forecast Value in (2035F) | USD 6,203.3 million |

| Forecast CAGR (2025 to 2035) | 11.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,054.3 million to USD 3,569.8 million, adding USD 1,515.5 million, which accounts for 36.5% of the total decade growth. This phase records steady adoption in anti-aging skincare, suncare, and dermocosmetic formulations, driven by the need for stable delivery of retinoids, vitamins, and UV filters. Lipid nanoparticles dominate this period as they cater to over 30% of encapsulation needs, offering enhanced bioavailability and controlled release.

The second half from 2030 to 2035 contributes USD 2,633.5 million, equal to 63.5% of total growth, as the market jumps from USD 3,569.8 million to USD 6,203.3 million. This acceleration is powered by widespread deployment of nanoemulsions in haircare and color cosmetics, peptide-loaded polymeric nanocapsules, and AI-assisted product personalization in smart beauty platforms. UV filters and brightening agents capture a larger share above 40% by the end of the decade. Regulatory-driven EU-compliant innovations and APAC-first launches add recurring momentum, increasing the skincare share beyond 55% in total value.

From 2020 to 2024, the Global Cosmetic Nanoencapsulation Market grew from USD 1,240 million to USD 1,900 million, driven by skincare-centric adoption. During this period, the competitive landscape was dominated by specialty ingredient manufacturers controlling nearly 60% of revenue, with leaders such as Lipotec (Lubrizol), Evonik, and Croda focusing on lipid and polymer-based encapsulation platforms for anti-aging and sun protection applications.

Competitive differentiation relied on stability, penetration efficiency, and cost-effectiveness, while regulatory-compliant solutions were often positioned as a premium offering rather than a mainstream adoption path. Service-based product development had minimal traction, contributing less than 10% of the total market value.

Demand for cosmetic nanoencapsulation will expand to USD 2,054.3 million in 2025, and the revenue mix will shift as polymeric nanocapsules and nanoemulsions grow to over 50% share. Traditional lipid-based leaders face rising competition from digital-first and biotech-driven players offering AI-personalized skincare delivery, cloud-enabled formulation design, and subscription-based nano-beauty platforms.

Major encapsulation vendors are pivoting to hybrid models, integrating peptide/growth factor delivery systems and multifunctional encapsulation to retain relevance. Emerging entrants specializing in retinoid stability, UV filter micro-carriers, and APAC-first brightening solutions are gaining share. The competitive advantage is moving away from traditional lipid nanoparticle innovation alone to ecosystem partnerships, personalization scalability, and regulatory credibility across geographies.

Advances in nano-carrier systems have improved stability, penetration, and controlled release, allowing for more efficient delivery of actives across skincare, suncare, and haircare categories. Lipid nanoparticles have gained popularity due to their biocompatibility, skin safety, and ability to encapsulate sensitive molecules like retinoids and vitamins. The rise of UV filter encapsulation has contributed to superior sun protection, reduced irritation, and longer-lasting formulations. Industries such as dermocosmetics, cosmeceuticals, and premium beauty are driving demand for nanoencapsulation that can integrate seamlessly into existing skincare routines.

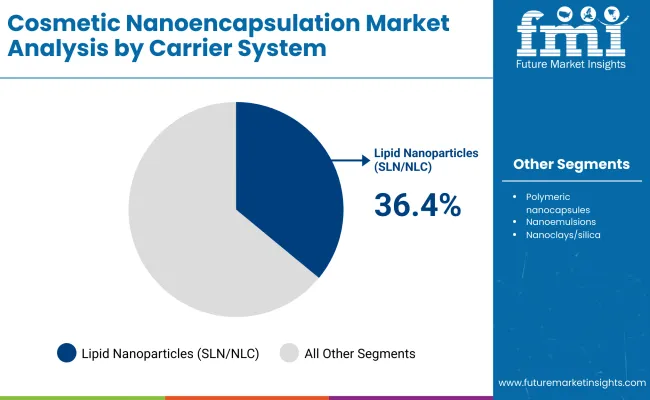

Expansion of anti-aging serums, brightening essences, and multifunctional lotions has fueled market growth. Innovations in polymeric nanocapsules and nanoemulsions are expected to open new application areas such as color cosmetics and advanced sprays/mists. Segment growth is expected to be led by lipid nanoparticles in carrier systems, UV filters in active class, and skincare in applications due to their precision and adaptability across global consumer needs.

The market is segmented by carrier system, active class, application, product format, regulatory positioning, and geography. Carrier systems include lipid nanoparticles (SLN/NLC), polymeric nanocapsules, nanoemulsions, and nanoclays/silica, highlighting the core encapsulation platforms driving adoption. Active classes cover retinoids, vitamins (C/E), UV filters, peptides & growth factors, and whitening/brightening agents to meet functional requirements. Applications include skincare, suncare, haircare, and color cosmetics. Product formats encompass serums, creams & lotions, essences/ampoules, and sprays/mists. Regulatory positioning is segmented as Global (EU-compliant), APAC-first, and USA-first. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Carrier System Segment | Market Value Share, 2025 |

|---|---|

| Lipid Nanoparticles (SLN/NLC) | 36.4% |

| Others | 63.6% |

The lipid nanoparticles segment is projected to contribute 36.4% of the Global Cosmetic Nanoencapsulation Market revenue in 2025, maintaining its lead as the dominant carrier system. This is driven by ongoing demand for biocompatible, safe, and stable nano-delivery in skincare and suncare. Lipid-based carriers are prioritized by brands seeking to improve retinoid stability, vitamin absorption, and UV filter dispersion across global formulations.

The segment’s growth is also supported by scalable manufacturing technologies and strong EU regulatory acceptance. As polymeric and hybrid systems become more integrated, lipid nanoparticles continue to retain their position as the backbone of cosmetic nanoencapsulation platforms.

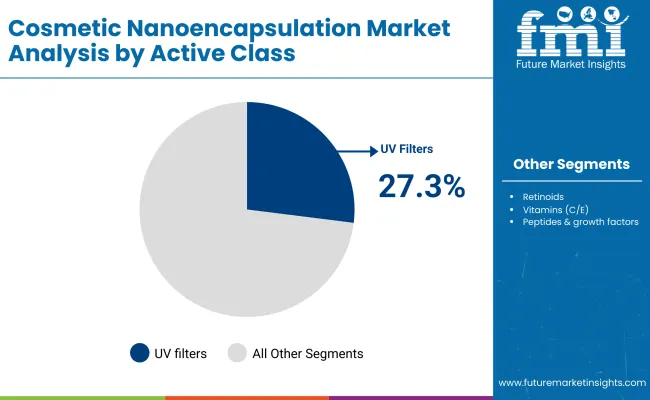

| Active Class Segment | Market Value Share, 2025 |

|---|---|

| UV filters | 27.3% |

| Others | 72.7% |

In 2025, UV filters account for 27.3% of the Global Cosmetic Nanoencapsulation Market, valued at USD 560.26 million, highlighting their central role in the fast-growing suncare and multifunctional skincare categories. Encapsulation improves UV filter stability, reduces irritation, and enhances long-lasting protection, making it a preferred technology in both premium and mass-market suncare formulations. Increasing consumer awareness of photoaging, coupled with stricter global sun protection regulations, ensures that UV filter encapsulation will continue to expand in importance.

The “Others” category dominates with 72.7% share, equal to USD 1,494.04 million, covering retinoids, vitamins, peptides, growth factors, and brightening agents. Demand is strongest in anti-aging serums and brightening essences, where encapsulation enhances penetration and protects unstable actives such as vitamin C and retinol. With dermocosmetic and cosmeceutical products gaining popularity worldwide, encapsulated multifunctional actives are expected to sustain their dominance. This balance between UV filters and broader active classes indicates a dual growth path one driven by regulatory-led suncare, and the other by performance-led anti-aging and skin brightening innovations.

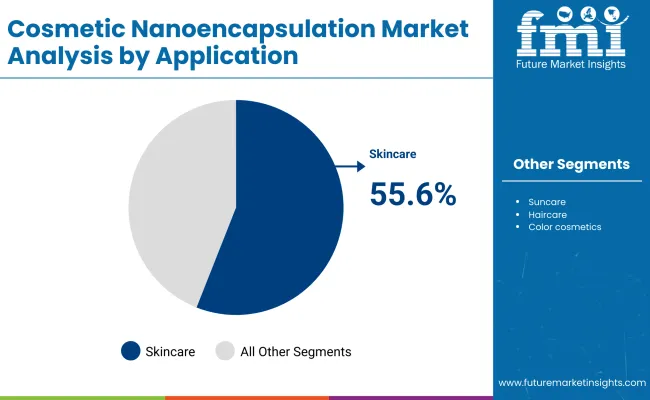

| Application Segment | Market Value Share, 2025 |

|---|---|

| Skincare | 55.6% |

| Others | 44.4% |

The skincare segment is forecasted to hold 55.6% of the market share in 2025, led by its application in anti-aging, brightening, and dermocosmetic solutions. These formulations are favored for their efficacy, safety, and premium positioning, making them ideal for mass-market and luxury beauty brands alike.

Its broad product presence across serums, lotions, and essences has facilitated widespread adoption in both Western dermocosmetics and APAC beauty regimens. The segment’s growth is bolstered by encapsulation technologies that improve retinoid tolerance, vitamin stability, and long-lasting UV protection. As consumers increasingly demand visible efficacy and dermatological validation, skincare is expected to continue its dominance in the Global Cosmetic Nanoencapsulation Market.

Rising Demand for High-Performance and Stable Cosmetic Formulations

One of the strongest drivers for the Global Cosmetic Nanoencapsulation Market is the growing consumer expectation for high-performance skincare and suncare products. Nanoencapsulation allows actives such as retinoids, vitamin C, peptides, and UV filters to be delivered with higher stability, improved penetration, and controlled release. Traditional formulations often face degradation (e.g., vitamin C oxidizing quickly, retinoids losing potency), which reduces efficacy. Encapsulation technology addresses these limitations by protecting actives from environmental stressors like light, oxygen, and pH fluctuations. This results in longer shelf life and more consistent results, which resonate strongly with both dermocosmetic and luxury beauty consumers. Global brands are actively reformulating hero products with nanoencapsulation, turning it into a key differentiator for anti-aging serums, brightening lotions, and multifunctional suncare.

Regulatory Push and Expansion into APAC Beauty Markets

The regulatory environment, particularly in Europe and East Asia, is another major growth catalyst. EU-compliant nanoencapsulation is increasingly seen as a safety and innovation benchmark, compelling global players to align their R&D and product launches with stricter standards. At the same time, APAC-first innovations in K-beauty and J-beauty are fueling demand for encapsulated actives, especially whitening/brightening agents and lightweight essences/ampoules. These markets are adopting encapsulation faster than Western peers due to consumer openness to science-backed, ingredient-driven claims. With India and China recording CAGRs of 19.6% and 17.4% respectively, regulatory positioning and early APAC adoption are creating a powerful pull factor, making encapsulation technologies indispensable for global rollouts.

High Cost of Encapsulation Technology and Limited Scale-Up Efficiency

Despite its advantages, nanoencapsulation remains a cost-intensive process, which restrains mass-market adoption. Technologies like lipid nanoparticles (SLN/NLC) and polymeric nanocapsules require specialized equipment, precise particle size control, and stringent safety validation, which increase manufacturing costs. For many mid-tier brands, the added cost per unit reduces competitiveness, particularly in price-sensitive markets like Latin America or South Asia. Moreover, scale-up efficiency is limited moving from lab-scale encapsulation to industrial-scale production without compromising stability is a complex challenge. This cost barrier means adoption remains skewed toward premium and luxury segments, slowing down penetration into wider beauty categories.

Regulatory Ambiguity and Consumer Perception of “Nanotechnology”

Another restraint is the ambiguity in regulatory approvals and consumer perception of nanotechnology. While the EU has established strict guidelines for nanomaterials in cosmetics, many regions still lack harmonized frameworks. This creates uncertainty for multinational companies, delaying launches or increasing compliance costs. On the consumer side, the word “nano” sometimes raises safety concerns due to associations with nanoparticles in food or environmental toxicity. Negative media coverage or lack of transparent labeling can lead to hesitation, particularly among clean beauty and natural product consumers. Addressing these perceptions with clear education, safety data, and compliance certifications is critical but remains a barrier in market expansion.

Shift Toward Personalization and Smart Beauty Platforms

A defining trend is the integration of nanoencapsulation with AI-driven personalization and smart beauty delivery systems. Encapsulated actives are increasingly used in customized serums, boosters, and ampoules, tailored to skin diagnostics and real-time consumer feedback. Brands are combining encapsulation with digital skin analysis apps, IoT-enabled dispensers, and subscription models, where nano-loaded formulations are adjusted to consumer needs over time. This convergence of biotech, AI, and cosmetic delivery systems is shifting the competitive advantage from product-level innovation to ecosystem-level differentiation, especially among digitally native premium skincare brands.

Expansion of Encapsulation Beyond Skincare into Haircare and Color Cosmetics

While skincare currently accounts for 55.6% of the market, the trend is moving toward wider application in haircare and color cosmetics. In haircare, encapsulated actives such as keratin peptides and vitamins are being developed to enhance scalp absorption and improve hair strength. In color cosmetics, nanoemulsions and silica-based carriers are enabling longer-lasting pigments, lightweight textures, and multifunctional hybrids like makeup with built-in SPF or anti-pollution protection. This broadening of application segments not only diversifies revenue streams but also enhances consumer acceptance by embedding encapsulation benefits into everyday beauty rituals.

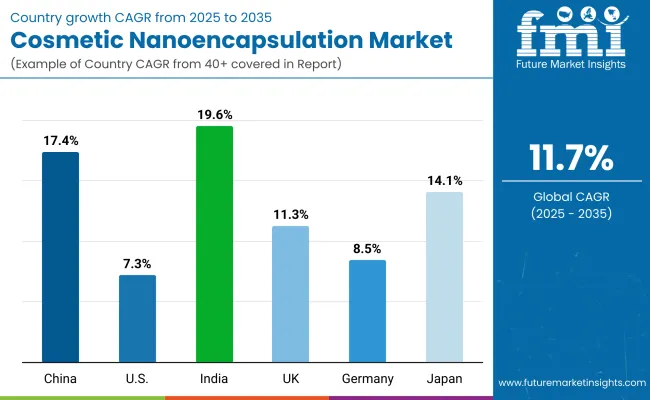

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.4% |

| USA | 7.3% |

| India | 19.6% |

| UK | 11.3% |

| Germany | 8.5% |

| Japan | 14.1% |

Between 2025 and 2035, the Global Cosmetic Nanoencapsulation Market is expected to see its fastest growth in India (19.6% CAGR) and China (17.4% CAGR), reflecting the strong pull of APAC beauty markets. India’s rapid expansion is tied to rising middle-class demand, increasing adoption of premium skincare, and local manufacturing investments in cosmeceutical actives. China, on the other hand, benefits from its massive consumer base, strong whitening/brightening culture, and heavy innovation pipelines in K-beauty and C-beauty product formats. Japan also stands out with a 14.1% CAGR, supported by its early adoption of encapsulated actives in anti-aging and sun protection categories, aligning with its aging population’s skincare needs.

In contrast, mature Western markets display moderate but steady growth. The USA (7.3% CAGR) continues to expand due to demand for clinical skincare and dermocosmetics, although its share is gradually declining as APAC rises. Germany (8.5% CAGR) and the UK (11.3% CAGR) remain strong within Europe, with Germany benefiting from regulatory compliance strength and dermocosmetic leadership, while the UK grows faster due to its dynamic beauty retail ecosystem and consumer openness to innovative ingredients. Overall, the geographic outlook highlights APAC as the growth engine of cosmetic nanoencapsulation, with Europe and the USA providing a stable but slower-growing revenue base.

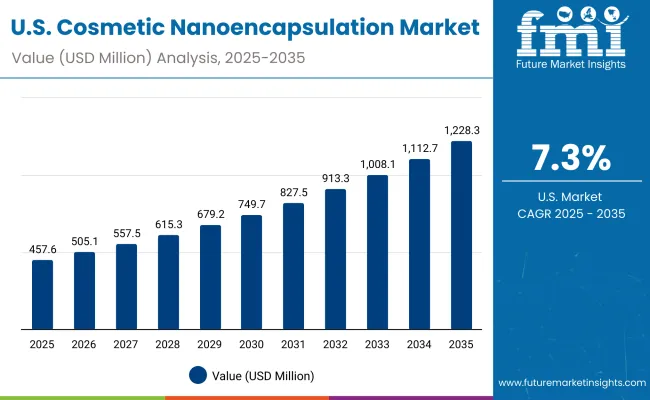

| Year | USA Cosmetic Nanoencapsulation Market (USD Million) |

|---|---|

| 2025 | 457.6 |

| 2026 | 505.1 |

| 2027 | 557.5 |

| 2028 | 615.4 |

| 2029 | 679.2 |

| 2030 | 749.7 |

| 2031 | 827.5 |

| 2032 | 913.4 |

| 2033 | 1008.2 |

| 2034 | 1112.8 |

| 2035 | 1228.3 |

The Cosmetic Nanoencapsulation Market in the United States is projected to grow at a CAGR of 7.3%, supported by strong demand for advanced skincare and dermocosmetic formulations. Growth is being led by encapsulated retinoids, vitamins, and UV filters incorporated into premium anti-aging serums and OTC cosmeceuticals. Dermatology-focused brands are investing heavily in encapsulated delivery systems to reduce irritation and improve efficacy, while suncare adoption is increasing due to the need for stable UV filters. The market is also seeing adoption in haircare, with encapsulated peptides and growth factors entering scalp health solutions. Regulatory alignment with FDA and rising consumer interest in clinically backed claims are fueling sustained growth.

The Cosmetic Nanoencapsulation Market in the United Kingdom is expected to grow at a CAGR of 11.3%, supported by applications in luxury skincare, hybrid color cosmetics, and dermocosmetic-led retail innovation. Premium brands are accelerating usage of encapsulated vitamins and peptides to improve claims around skin renewal, brightening, and hydration. Retail chains and online platforms are pushing EU-compliant nanoencapsulation as part of their “science-based beauty” product lines. Institutions and consumer groups have encouraged transparent labeling of nano-formulations, which is increasing consumer trust. The combination of EU regulatory standards, a dynamic retail ecosystem, and strong positioning in luxury skincare continues to fuel adoption.

India is witnessing rapid growth in the Cosmetic Nanoencapsulation Market, which is forecast to expand at a CAGR of 19.6% through 2035, the highest globally. Growth is being driven by the fast adoption of encapsulated brightening agents, UV filters, and vitamins in mass-premium skincare and suncare products. Local and multinational players are expanding their encapsulation capabilities to cater to tier-2 and tier-3 cities, where awareness of dermatology-backed products is rising. Educational and vocational institutions are also beginning to explore encapsulation as part of cosmetic science programs, adding to domestic R&D capabilities. Public interest in skin-brightening, anti-pollution, and protective formulations is expected to accelerate expansion.

The Cosmetic Nanoencapsulation Market in China is expected to grow at a CAGR of 17.4%, among the highest across leading economies. This momentum is fueled by demand for whitening/brightening agents, peptide-based anti-aging, and UV filter encapsulation, especially within C-beauty and K-beauty influenced formats. Domestic brands are innovating rapidly with encapsulated serums, essences, and sprays, while international players are entering with premium dermocosmetic formulations. Municipal and regional consumer campaigns on sun protection and skin health are also expanding the suncare base. Competitive innovation by local ingredient firms is lowering costs, making encapsulation more accessible to mid-tier and online-first brands.

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.3% |

| China | 11.4% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 7.7% |

| India | 4.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.3% |

| Japan | 8.0% |

| Germany | 12.8% |

| UK | 6.9% |

| India | 5.6% |

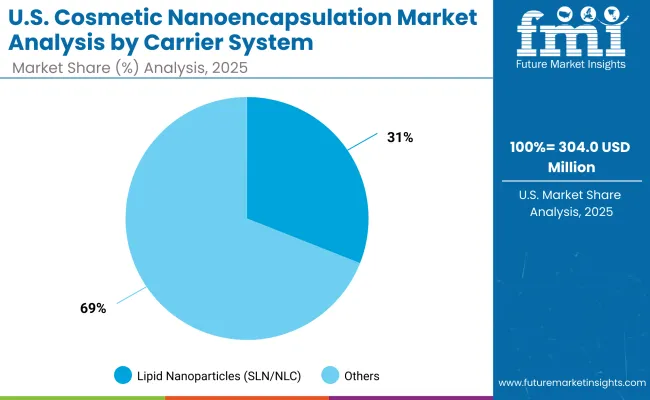

| Carrier System Segment | Market Value Share, 2025 |

|---|---|

| Lipid Nanoparticles (SLN/NLC) | 30.7% |

| Others | 63.6% |

The Cosmetic Nanoencapsulation Market in the United States is valued at USD 304.02 million in 2025, with lipid nanoparticles leading at 30.7% due to their safety, biocompatibility, and proven track record in dermocosmetics. These carriers are particularly important for encapsulating retinoids, peptides, and vitamins, which dominate the USA premium skincare segment. Their use reduces irritation, improves penetration, and ensures controlled release, aligning with consumer demand for dermatology-backed and OTC-approved products.

The strong base of clinical skincare, anti-aging serums, and suncare products is fueling lipid nanoparticle adoption. Other carriers, particularly nanoemulsions, are gaining relevance in lightweight mists and hybrid color cosmetics, but lipid-based systems remain the backbone for anti-aging and UV filter applications. As USA regulations prioritize safety and efficacy, encapsulated actives are expected to expand into mass-market OTC channels over the next decade.

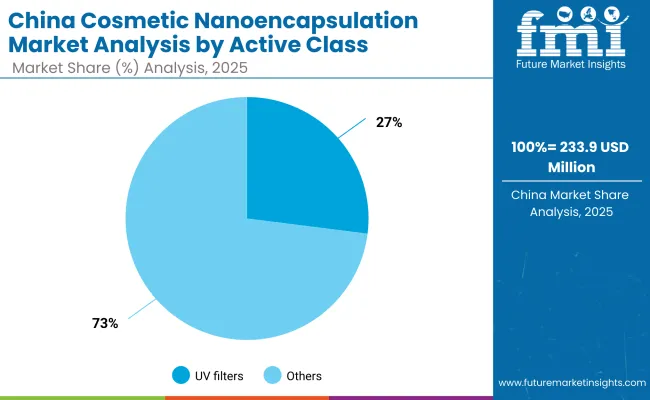

| Active Class Segment | Market Value Share, 2025 |

|---|---|

| UV filters | 27.3% |

| Others | 72.7% |

The Cosmetic Nanoencapsulation Market in China is valued at USD 233.9 million in 2025, with UV filters leading at 27.5% as suncare becomes a central part of consumer routines. Rising concerns around skin health, photoaging, and regulatory campaigns on sun protection are making encapsulated UV filters indispensable. These systems enhance stability, extend efficacy, and reduce irritation, which resonate strongly with local consumers.

At the same time, whitening and brightening agents encapsulated in nanoemulsions and nanocapsules are highly sought after in China’s beauty culture. Serums and essences dominate the format landscape, while sprays and hybrid formulations are seeing faster uptake. Competitive innovation by local firms is pushing down production costs, enabling encapsulated actives to enter mid-tier and online-first C-beauty brands.

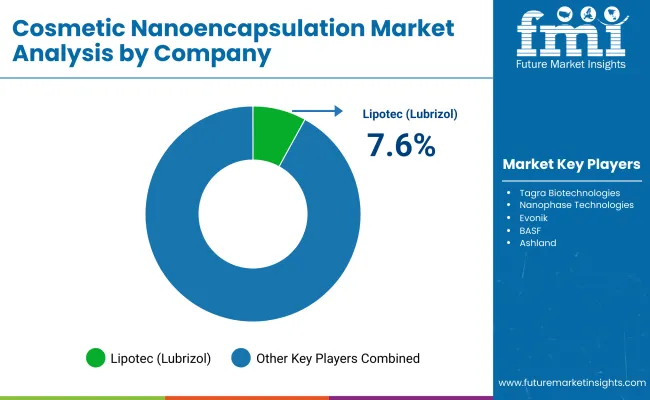

| Company | Global Value Share 2025 |

|---|---|

| Lipotec (Lubrizol) | 7.6% |

| Others | 92.4% |

The Cosmetic Nanoencapsulation Market is moderately fragmented, with global ingredient leaders, mid-sized innovators, and niche-focused specialists competing across skincare, suncare, and color cosmetics. Global technology leaders such as Lipotec (Lubrizol), Evonik, BASF, and Croda hold significant market share, driven by advanced lipid and polymeric encapsulation platforms, clinical validation, and strong partnerships with multinational beauty brands. Their strategies emphasize regulatory-compliant actives, AI-assisted formulation design, and multifunctional delivery systems that extend into dermocosmetics and OTC categories.

Established mid-sized players, including Tagra Biotechnologies, Gattefossé, Seppic, and Lucas Meyer Cosmetics, cater to the rising demand for portable encapsulation formats such as nanoemulsions, ampoules, and sprays. These companies are accelerating adoption through ingredient–format innovation, making them highly relevant for APAC-driven launches in skincare and hybrid cosmetics.

Specialized providers such as Nanophase Technologies and Ashland focus on UV filter encapsulation, mineral-based systems, and application-specific nano-delivery for suncare and color cosmetics. Their strength lies in customization and alignment with regional consumer demands rather than global dominance.Competitive differentiation is shifting away from raw encapsulation technology toward ecosystem integration that includes personalized beauty platforms, regulatory credibility, and subscription-based models tied to skincare personalization and dermocosmetic diagnostics.

Key Developments in Global Cosmetic NanoencapsulationMarket

| Item | Value |

|---|---|

| Quantitative Units | USD 2,054.3 million |

| Carrier System | Lipid nanoparticles (SLN/NLC), Polymeric nanocapsules, Nanoemulsions, Nanoclays /silica |

| Active Class | Retinoids, Vitamins (C/E), UV filters, Peptides & growth factors, Whitening/brightening agents |

| Application | Skincare, Suncare, Haircare, Color cosmetics |

| Product Format | Serums, Creams & lotions, Essences/ampoules, Sprays/mists |

| End-use Industry | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lipotec (Lubrizol), Tagra Biotechnologies, Nanophase Technologies, Evonik, BASF, Ashland, Croda, Seppic, Gattefossé, Lucas Meyer Cosmetics |

| Additional Attributes | Dollar sales by carrier system, active class, application, and geography; adoption trends in skincare, suncare, and hybrid formats; rising demand for serums, ampoules, and multifunctional creams; sector-specific growth in dermocosmetics and premium beauty; regulatory-driven product positioning across EU, APAC, and USA; integration of nano -delivery systems into AI-personalized beauty; regional trends influenced by sun protection awareness, anti-aging demand, and brightening culture; innovations in lipid nanoparticles, nanoemulsions, and polymeric nanocapsules . |

The Global Cosmetic Nanoencapsulation Market is estimated to be valued at USD 2,054.3 million in 2025.

The market size for the Global Cosmetic Nanoencapsulation Market is projected to reach USD 6,203.3 million by 2035.

The Global Cosmetic Nanoencapsulation Market is expected to grow at a CAGR of 11.7% between 2025 and 2035.

The key product formats in the Global Cosmetic Nanoencapsulation Market are serums, creams & lotions, essences/ampoules, and sprays/mists.

In terms of application, skincare is set to command 55.6% share of the Global Cosmetic Nanoencapsulation Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA