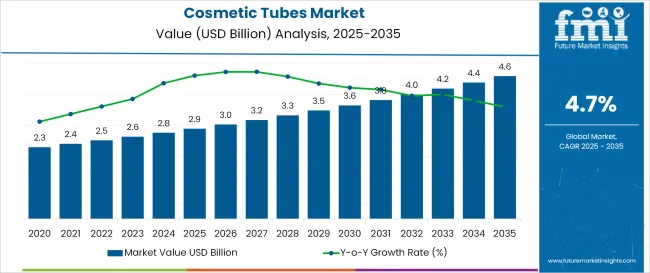

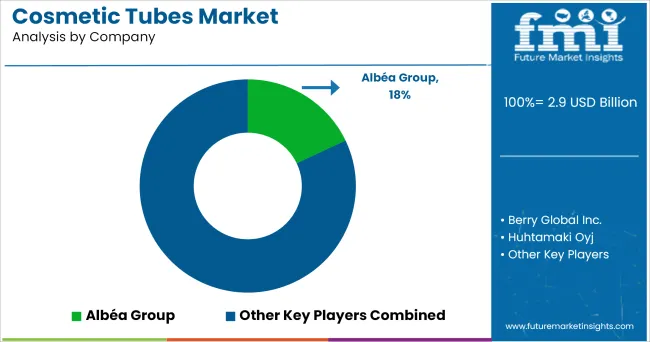

The Cosmetic Tubes Market is estimated at USD 2.9 billion in 2025 and is projected to reach USD 4.6 billion by 2035, reflecting a CAGR of 4.7% between 2025 and 2035. The parent market, Cosmetic Packaging, is valued at USD 35.8 billion in 2025, placing tubes at a 8.1% share of total packaging demand by value.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.9 Billion |

| Projected Market Size in 2035 | USD 4.6 Billion |

| CAGR (2025 to 2035) | 4.7% |

Demand for cosmetic tubes continues to rise with growing consumption of skincare and personal grooming products, particularly in portable and single-use formats. Urban millennials and Gen Z consumers favor compact packaging for moisturizers, cleansers, and creams, prompting manufacturers to standardize tubes across retail and e-commerce SKUs. The surge in on-the-go routines and travel-sized formats in Asia and North America has expanded baseline volume uptake across mid-tier brands and private labels.

However, high material volatility, especially in plastics and laminates, continues to exert pressure on packaging converters. Regulatory shifts around single-use plastic bans in the EU, Canada, and select Asian economies have added compliance costs and limited flexibility in raw material sourcing. Moreover, recycling challenges for multi-layered tubes constrain circular economy targets, slowing down adoption among sustainability-first brands despite consumer demand.

Opportunities emerge from innovations in mono-material tube designs and biodegradable options using PLA and sugarcane-derived materials. These solutions are gaining traction among premium skincare and dermo-cosmetic brands, particularly in France, Japan, and South Korea. Airless tube variants are also seeing wider uptake in formulations with actives, as brands seek to preserve shelf life and minimize contamination risk.

One clear trend is the tiered shift toward customization and high-decoration tubes across prestige brands, with digital printing and metallic foils increasingly replacing label-based SKUs. While mass-market brands prioritize function and cost, niche and indie players are investing in tactile finishes and proprietary dispensing closures-reshaping the unit economics of tube manufacturing across both contract and in-house setups.

The global cosmetic tubes market is analyzed by key investment segments as follows: by Capacity Type; Below 50 ml; 50-100 ml; 100-150 ml; 150 to 200 ml; Above 200 ml; by Material Type; Plastic; Aluminum; Laminated; by Application; Skin Care; Hair Care; Make-Up; Others; and by Region; North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa.

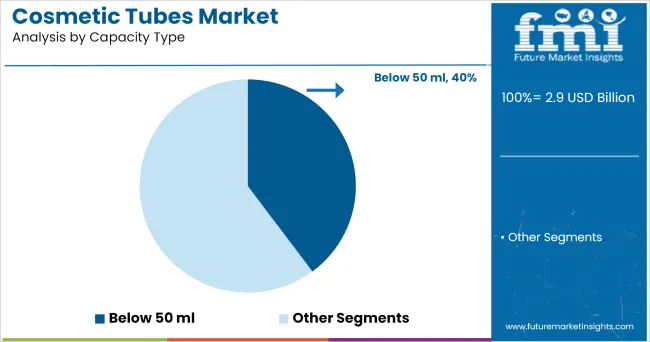

Below 50 ml tubes hold a dominant 40% share in 2025, supported by their widespread use in sample packaging, travel-size formats, and premium skincare serums. Brands favor this size for trial conversion and compactness in retail sets, particularly in facial care. Growth is sustained by consumer demand for convenience, portability, and product hygiene.

Rising adoption of minimalist skincare routines limits product volume usage, while the push for multi-SKU beauty kits expands demand for small-capacity packaging across both mass and luxury tiers. However, recyclability remains constrained due to small formats being excluded from some municipal collection streams.

Mono-material redesigns in this size bracket-especially PP-based tubes-are driving cost savings and end-of-life recovery rates, making them more appealing to eco-conscious brands. These formats are increasingly used in influencer gifting, dermocosmetic samples, and K-beauty lines focused on efficacy over volume.

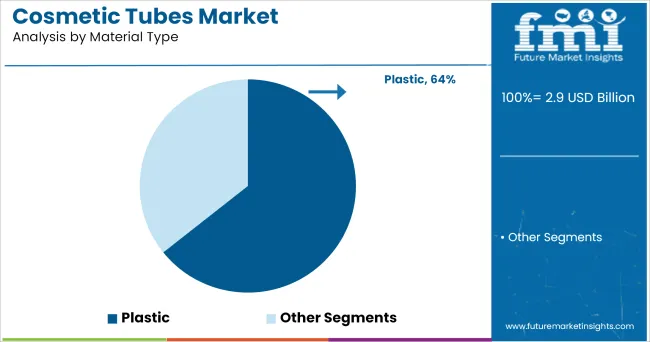

Plastic dominates the cosmetic tubes market with a 64% share in 2025, owing to its low cost, moldability, and compatibility with a wide range of formulations. HDPE and LDPE variants remain the default materials for skin and hair care applications, especially in mass and masstige segments. Flexible production scalability also supports short-run customization and multi-shade cosmetic SKUs.

However, mounting scrutiny over plastic waste and evolving Extended Producer Responsibility (EPR) norms in the EU and Asia are compelling brands to explore alternatives. Laminated and aluminum variants gain share slowly, though pricing and compatibility constraints persist.

The shift toward recyclable mono-material plastics, including PP-only and PE-based tubes, is accelerating. Brands pursuing sustainability claims without disrupting existing lines are opting for these plug-and-play substitutes, leading to a 2x increase in mono-material SKUs between 2022 and 2025.

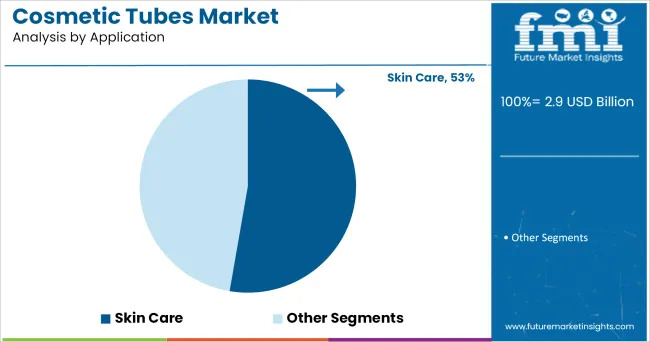

Skin care applications account for 53% of the cosmetic tubes market in 2025, led by moisturizers, sunscreens, cleansers, and acne treatments. The format offers controlled dispensing, portability, and hygiene, essential for active ingredient-based formulations in both daily care and dermo-cosmetic routines.

Demand is propelled by the rising adoption of structured skin regimens, especially across urban consumers in Asia and North America. However, market saturation in basic moisturizers and price sensitivity in emerging economies limit volume expansion for standard SKUs.

Ingredient-forward brands are leveraging airless tubes to improve shelf-life and product efficacy, particularly in retinol and vitamin C-based products. These tubes allow oxygen protection and minimize contact exposure, enabling cleaner-label claims and justifying price premiums.

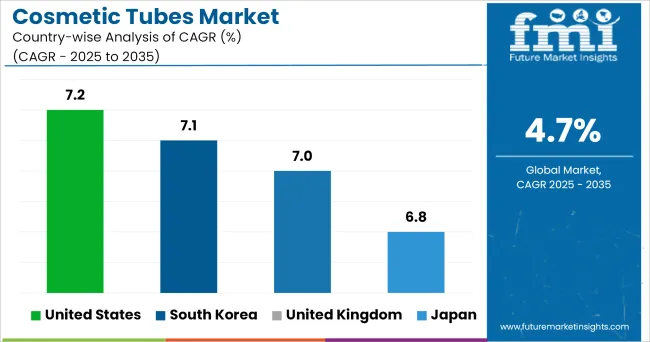

Across the top-performing economies, the cosmetic tubes market is evolving beyond basic packaging into a tool for product experience and differentiation. In the United States, the strategic shift toward DTC and clean beauty has increased demand for mono-material and airless tubes that align with efficacy and recycling claims. South Korea’s dominance stems from its role as a global incubator of format innovation-its brands aggressively prototype travel-sized and multi-step regimen tubes that are quickly replicated in ASEAN and Western markets.

The UK market reflects consolidation among private-label and prestige skincare players, with squeezable tubes preferred for mid-tier dermocosmetics. Japan’s ageing demographic and clinical skincare preferences fuel demand for functional tubes with barrier protection, minimal design, and hygienic dispensing. These markets signal a strategic pivot toward smaller capacities, digitally printed tubes, and packaging-integrated storytelling-each reinforcing brand value while navigating material regulations and consumer scrutiny.

In the USA, the cosmetic tubes market is being reshaped by the rise of DTC-first beauty brands and dermatologist-led formulations. Tubes have become the default for high-active skincare, especially in formats that emphasize hygiene and portability-traits essential for retinol, niacinamide, and SPF products. Airless and soft-touch laminate tubes are gaining traction as brands prioritize perceived safety and shelf-life extension.

Regulatory momentum around recyclability is pushing even mass-market players to shift from multi-layer formats to mono-material alternatives. While traditional brands still dominate volume, indie and wellness-aligned entrants are influencing aesthetic, closure, and sizing norms, particularly in facial care and under-eye treatments.

South Korea’s cosmetic tubes market is driven by its role as a global trendsetter in packaging miniaturization and functional aesthetics. The country’s beauty brands-especially in K-beauty-are deploying tubes not just for practicality but as a core part of storytelling, often pairing multi-step regimens with color-coded, travel-sized tubes.

Refillable and dual-chamber tubes are emerging in anti-aging and brightening lines, targeting consumers who demand precision dosing. While PET and laminated tubes still dominate, there's rapid uptake of bio-based materials in SKUs aimed at export markets. Regulatory soft nudges favor local sourcing and recyclability, prompting converters to invest in localized mono-material lines.

In the UK, the cosmetic tubes market reflects a dual-track evolution: cost-conscious private labels expanding in volume, while prestige and ethical brands redefine tube design with sustainability front and center. Post-Brexit compliance complexity has prompted local sourcing of tube materials and simplified construction to ease recyclability across EU and UK systems.

Functional simplicity-especially in single-layer PP and PE tubes-has gained preference among brands targeting natural or dermatological positioning. Meanwhile, refillable tubes and click-on applicators are being piloted in high-street chains and boutique lines, supported by rising consumer preference for waste reduction and minimalism.

Japan’s cosmetic tubes market is shaped by precision, aesthetics, and aging-skin functionality. Local consumers prioritize controlled application, tactile feedback, and discreet packaging-making soft-squeeze tubes with narrow tips or metal roller-ball heads highly favored in eye creams and spot treatments.

With a strong domestic base in skin-calming and anti-aging formulas, Japanese brands tend to invest in tubes that preserve product integrity, often opting for multi-layered barrier formats despite recyclability trade-offs. Regulatory preferences for minimal labeling and subdued design are influencing a rise in UV-blocking and matte-finish laminates. Innovation centers around ergonomic dispensing and compact, refillable formats that suit an aging, space-conscious consumer base.

The players in the cosmetic tubes market are focusing on mono-material innovation, airless dispensing, and advanced printing to align with evolving regulatory norms and brand aesthetics. Tier 1 companies such as Albéa Group, Huhtamaki, and Berry Global are expanding their recyclable tube portfolios and investing in digital printing capabilities for personalization at scale. These firms maintain global supply partnerships with premium and mass-market brands, leveraging vertically integrated operations and early compliance with EU plastic mandates.

Tier 2 players-including companies like Essel Propack (now EPL Limited), Viva Group, and Tubopress-are targeting mid-market brands with cost-effective laminated and extruded tubes. Their agility in short-run orders and regional customization helps address fast-moving skincare lines, particularly in South Asia and Eastern Europe. Many are shifting toward localized production to offset logistics volatility and meet traceability requirements.

Startups and niche converters are emerging with disruptive propositions-such as refillable applicator tubes, biodegradable formats, and bio-based resins for green-certified cosmetics. While volumes remain small, these players are attracting partnerships with clean beauty and DTC brands seeking novel packaging identities. As EPR laws tighten and consumers demand both function and ethics, players that combine design flexibility with recyclability are poised to outperform laggards focused solely on cost.

| Metric | Details |

|---|---|

| Market Size 2025 | USD 2.9 Billion |

| Market Size 2035 | USD 4.6 Billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Units | USD Billion (Revenue-based) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Analyzed | United States, South Korea, United Kingdom, Japan |

| Segments Covered | By Capacity Type, By Material Type, By Application |

| Capacity Type | Below 50 ml; 50-100 ml; 100-150 ml; 150 to 200 ml; Above 200 ml |

| Material Type | Plastic; Aluminum; Laminated |

| Application | Skin Care; Hair Care; Make-Up; Others |

| Key Players | Albéa Group, Berry Global Inc., Huhtamaki Oyj, EPL Limited, Viva Group, CCL Industries, Montebello Packaging, Tubopress, CTL Packaging, Linhardt GmbH & Co. KG |

The cosmetic tubes market is estimated at USD 2.9 billion in 2025.

The cosmetic tubes market is projected to grow at a CAGR of 4.7% between 2025 and 2035.

Skin care leads the cosmetic tubes market with a 53% share in 2025.

Key players in the cosmetic tubes market include Albéa Group, Berry Global, and Huhtamaki Oyj.

The United States shows the highest growth in the cosmetic tubes market with a 7.2% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Cosmetic Tubes Product Providers

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA