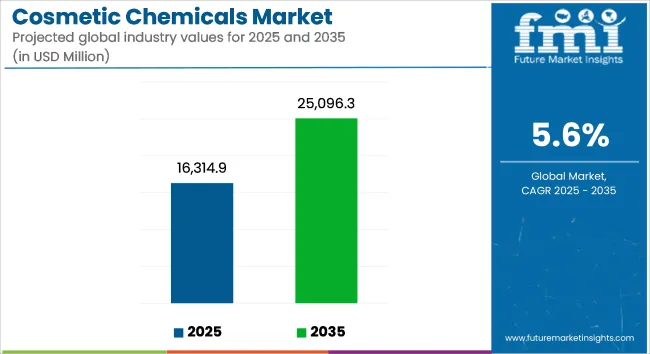

The global cosmetic chemicals market is projected to grow from USD 16,314.9 Million in 2025 to USD 25,096.3 Million by 2035, progressing at a CAGR of 5.6% during the forecast period. This growth is primarily fueled by evolving consumer lifestyles, rising demand for multifunctional and clean-label personal care products, and the increasing penetration of cosmetics across emerging economies. Regulatory scrutiny and eco-conscious consumerism are driving the adoption of biodegradable, plant-based, and skin-friendly chemical formulations.

The ongoing shift toward dermatology-driven, science-backed skincare is further propelling demand for specialty actives, peptides, ceramides, and botanical extracts. Growing awareness of aging, pigmentation, and pollution-induced skin damage is influencing the formulation trends in both mass-market and premium cosmetics. Additionally, male grooming, hybrid cosmetics, and the surge of online beauty platforms are reshaping product development and regional demand dynamics.

The demand for sustainable, non-toxic, and high-efficacy cosmetic chemicals is growing as consumers become increasingly ingredient-conscious and environmentally aware. Formulation transparency, clean beauty labels, and hypoallergenic claims are driving purchasing behavior, especially among Gen Z and millennial consumers. The Asia-Pacific region, led by China, South Korea, and India, is witnessing an uptick in domestic cosmetic manufacturing, supported by rising disposable incomes and the localization of beauty trends.

The industry is also witnessing increased demand for multifunctional ingredients that combine emulsification, sensory enhancement, and therapeutic activity. As skinimalism (minimal skincare), vegan cosmetics, and functional beauty gain traction, cosmetic chemicals are expected to play a vital role in driving product performance and regulatory alignment.

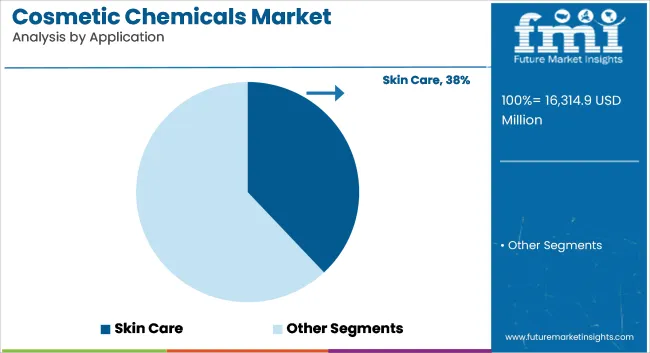

The skin care segment is forecast to account for around 38% of global cosmetic chemical demand in 2025, with a CAGR of 6.8% projected through 2035. This segment’s growth is driven by expanding consumer focus on anti-aging, hydration, barrier repair, and pigmentation correction. The increasing popularity of products such as serums, moisturizers, masks, and sunscreens has intensified the need for functional chemicals like hyaluronic acid, retinoids, niacinamide, peptides, and ceramides.

Multifunctional actives that offer antioxidant, anti-inflammatory, and UV-protective properties are being incorporated in both dermatological and luxury skin care. North America and Europe are investing in biomimetic and plant-based chemical alternatives that provide long-term efficacy without irritation. Asia-Pacific, particularly South Korea and Japan, is at the forefront of innovation in fermentation-based actives and delivery systems like liposomes and microspheres.

Consumer preference for minimal-ingredient formulations and hybrid products (cosmetics with skin care benefits) is further elevating demand for emulsifiers, rheology modifiers, and penetration enhancers. The rise of sensitive skin care, baby skin solutions, and dermocosmetics is also reinforcing this trend.

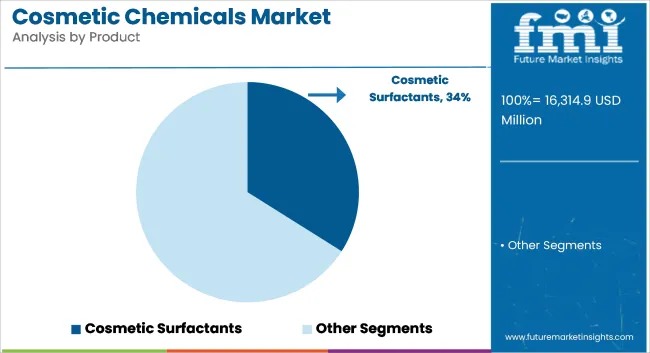

The cosmetic surfactants segment is projected to dominate the cosmetic chemicals market in 2025, accounting for about 34% of total consumption and growing at a CAGR of 6.4% through 2035. These ingredients are critical in products such as facial cleansers, body washes, shampoos, and makeup removers, where they act as cleansing agents, emulsifiers, and foaming boosters. The demand for surfactants is being reshaped by rising consumer awareness around skin sensitivity, leading to a growing preference for sulfate-free, non-irritating, and eco-certified alternatives.

Formulators are increasingly turning to naturally derived surfactants such as alkyl polyglucosides (APGs), amino acid-based surfactants, and sugar-derived esters that provide a gentler cleansing experience while maintaining efficacy. In particular, personal care brands across North America and Europe are phasing out traditional sulfate compounds like SLS and SLES, replacing them with bio-based, dermatologically tested alternatives to meet consumer demand for transparency and safety.

The Asia-Pacific region, home to large-scale shampoo and skincare production hubs, is also witnessing rising adoption of mild surfactants as local consumers prioritize sensitive skin and daily-use hygiene routines. Meanwhile, global leaders such as Solvay, BASF, and Dow are accelerating R&D and capacity expansion for sulfate-free surfactant technologies, targeting premium, baby care, and sensitive-skin product lines. As the clean beauty and green chemistry movement gains momentum, cosmetic surfactants will remain foundational to both functional performance and regulatory compliance in next-generation cosmetic formulations.

Regulatory Compliance and Safety Concerns

Like chemical manufacturers that supply cosmetic ingredients, cosmetic chemical manufacturers must manage a complicated global regulatory framework affecting safety standards, ingredient bans and disclosure requirements. Regions like the EU have prohibited or banned over 1,000 ingredients, forcing companies to search for alternatives that follow the rules.

And growing concerns about allergens, endocrine disrupting chemicals and micro plastics are putting pressure on companies to trace the safety and environmental impact of raw materials. It is challenging technically and financially to develop effective products that can satisfy these rules.

Surge in Demand for Natural and Sustainable Ingredients

The transition to green cosmetics and clean beauty formulations is also a sector with significant growth opportunities. Information from many sources has made consumers side with products that do not contain parabens, sulphates, silicones, and synthetic fragrances, increasing the demand for things like plant-derived emulsifiers, botanical extracts, bioactive, and biodegradable preservatives.

This pressure to produce biodegradable products has been exacerbated with the increase in vegan, cruelty-free and carbon-neutral beauty brands. Those that invest in green chemistry, biotechnology, and circular sourcing models should see significant traction in both developed and emerging markets.

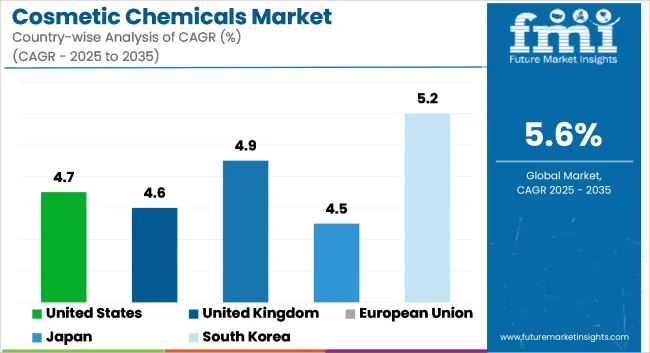

The United States cosmetic chemicals market is expected to witness a CAGR of 4.7% during the tenure of 2025 to 2035. This segment is witnessing growth in this region due to the increasing consumer awareness about the ingredients in formulation, the increasing of clean beauty trends; and innovation of the formulations of anti-aging and multifunctional products.

As the rules and needs of consumers are pushing manufacturers to turn more bio-based and sustainable, domestic manufacturers are investing in providing chemical ingredients that meet such demands. The adoption of advanced cosmetic chemicals across product lines (skincare, haircare, and colour cosmetics) is also attributed to the strong cosmetics manufacturing base and the presence of major personal care brands in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK cosmetic chemicals market is expected to grow at a CAGR of 4.6% during the forecast period. Local cosmetic brands have been adapting their strategic approach to ingredient sourcing, with a firm shift towards vegan, cruelty free and dermatologically tested products. According to the trend, natural and green preservative, emollients, and surfactants is on the rise. They also add that, especially post-Brexit, the UK’s regulatory adaptations in chemical imports and safety standards are impacting both aspects and growing reliance on localized innovation and sustainable sourcing.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

The cosmetic chemicals market in the broader European Union is expected to shape up with a CAGR of 4.9% during 2025 to 2035. With strict EU regulation on cosmetic products and emphasis of consumer safety, manufacturers are aiming towards REACH compliant nontoxic chemical substitutes.

These active and functional ingredients are highly demanded in industries such as organic cosmetics and cosmeceutical products which will boost the absolute volume demand for specialty cosmetic ingredients in developed regions such as Germany and France. The growing trend of male grooming and such age-based formulations are also contributing to the demand across the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

The cosmetic chemicals market in Japan is projected to register a CAGR of 4.5% during the forecast period. The demand for new chemical ingredients that enhance skin health and provide natural look are magnified in this country whose culture is very keen on skin-care and minimalism. Japanese cosmetic manufacturers are especially interested in hybrid skincare-makeup formulations and innovative functional ingredients from traditional herbal sources and biotechnology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korea cosmetic chemicals market aspires to grow at a CAGR of 5.2% over the tenure of 2025 to 2035. The country remains a top investor in high-efficacy chemical ingredients, such as peptides, ceramides and botanical actives, as a global leader in beauty innovation.

The growing domestic production and export of cosmetic chemical ingredients is driven by rising K-beauty product demand in global markets. Fi India has a host of government-supported R&D for biotechnological and nanotechnological developments that contribute to formulations in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The cosmetic chemicals market is moderately fragmented with intense innovation-focused competition. Leading manufacturers are differentiating themselves through green chemistry innovations, biotech-based ingredients, and circular economy integration. Companies are emphasizing sustainable sourcing, biodegradable formulations, and certified natural/organic claims to align with consumer expectations and regulatory mandates.

Strategic mergers, joint ventures, and acquisitions are being executed to access novel ingredient platforms, R&D capabilities, and regional markets. BASF, Croda, and Clariant have expanded their portfolios with plant-derived and fermentation-based actives, while Dow and Ashland are pioneering sensory-optimized polymers and bio-based solubilizers.

Recent Developments

The overall market size for the Cosmetic Chemicals Market was USD 16,314.9 Million in 2025.

The Cosmetic Chemicals Market is expected to reach USD 25,096.3 Million in 2035.

The demand is driven by increasing consumer spending on personal care, growing preference for multifunctional and anti-aging products, rising demand for organic and sustainable ingredients, and advancements in cosmetic formulations and active compounds.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Cosmetic surfactants segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Cosmetic Chemicals Market Growth – Trends & Forecast 2025-2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA