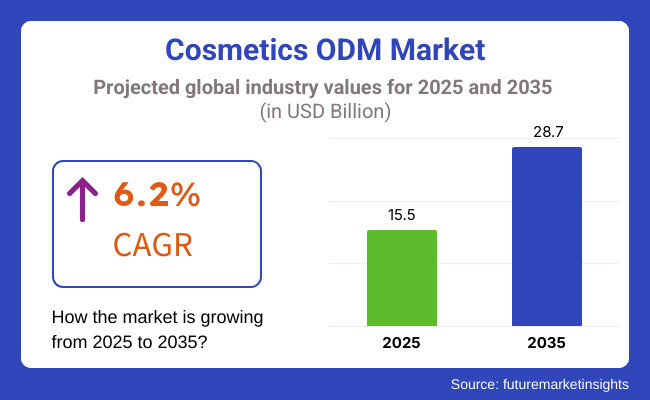

The global cosmetics ODM market is valued at USD 15.5 billion in 2025 and is poised to register USD 28.7 billion by 2035, which shows a CAGR of 6.2%.

The market is being driven by rising demand for personalized, innovative, and sustainable cosmetic products across skincare, color cosmetics, personal care, and wellness segments. As beauty brands increasingly turn to ODM (Original Design Manufacturing) partners to accelerate time-to-market and optimize production costs, ODMs offer comprehensive services including formulation, packaging design, and manufacturing.

Demand is particularly strong in clean beauty and functional cosmetics, where consumers seek products with natural ingredients, ethical sourcing, and wellness benefits. Additionally, the growth of e-commerce and direct-to-consumer channels is enabling more brands to launch private-label cosmetics, further fueling ODM market expansion.

Technological advancements are playing a critical role in enhancing the competitiveness of the market. Manufacturers are adopting green chemistry practices, leveraging biotechnological actives, and investing in sustainable packaging innovations to meet evolving consumer expectations and regulatory standards. AI-driven formulation tools and rapid prototyping techniques are enabling faster and more precise product development, allowing brands to respond quickly to market trends.

The demand for personalized cosmetics is also rising, with ODM firms offering solutions that cater to diverse skin tones, individual preferences, and regional beauty trends. These innovations are helping ODM players expand their role from contract manufacturers to strategic innovation partners for global beauty brands.

Government regulations are shaping the cosmetics ODM market landscape as global standards for product safety, sustainability, and transparency continue to evolve. In the European Union, the Cosmetics Regulation (EC) No. 1223/2009 mandates strict ingredient safety, labeling, and product claims requirements.

In the United States, the Modernization of Cosmetics Regulation Act of 2022 (MoCRA) enhances FDA oversight, introducing new requirements for product registration, adverse event reporting, and GMP compliance.

Asia Pacific markets, including China, are strengthening regulatory frameworks around ingredient disclosure and safety testing. These regulatory trends are driving ODM firms to prioritize clean formulations, robust quality systems, and ethical sourcing practices.

The market is segmented based on product type, formulation type, sales channel, and region. By product type, the market is divided into skincare, haircare, makeup, and others (fragrances, personal hygiene products, oral care products, men's grooming products).

In terms of formulation type, it is segmented into creams & lotions, gels, powders, sprays, and others (serums, sticks, balms, emulsions). Based on sales channel, the market is categorized into supermarkets/hypermarkets, specialty stores, online, departmental stores, and others (convenience stores, pharmacies/drug stores, beauty salons/spas, direct sales). Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The skincare segment holds a dominant 46% market share in 2025, driving the bulk of demand in the cosmetics ODM market. Rising consumer focus on wellness, anti-aging, and preventive skin health fuels demand for innovative skincare solutions. ODM partners increasingly develop customized formulations for facial creams, serums, sunscreens, and eye care products to address evolving consumer preferences.

The rapid expansion of the dermocosmetic segment, clean beauty, and plant-based ingredients further amplifies opportunities in skincare. ODM providers are also leveraging advanced delivery technologies, such as encapsulation and nanotechnology, to enhance product efficacy and differentiation.

Haircare remains a key growth category as demand for scalp treatments, anti-hair falls solutions, and hair repair products gains traction. Makeup products such as foundations, lipsticks, and eyeliners witness steady demand, particularly in trend-driven markets and among Gen Z consumers.

Other products, including fragrances, personal hygiene, oral care, and men’s grooming items, represent emerging opportunities for ODM players, especially in lifestyle-driven brands. Skincare will continue to lead as global consumers prioritize holistic beauty and wellness. Growing demand from niche brands, indie players, and e-commerce channels reinforces skincare’s central role in ODM-driven innovation.

| Product Type | Market Share (2025) |

|---|---|

| Skincare | 46% |

The creams & lotions segment captures a leading 38% share in 2025, maintaining its position as the most versatile and demanded formulation type in the cosmetics ODM market. The format’s broad applicability across skincare, haircare, body care, and sun protection products drives sustained growth. Brands seek ODM partners capable of developing sophisticated emulsions with superior sensory profiles, stability, and ingredient compatibility.

Demand is further supported by consumer preferences for products with multifunctional claims, such as moisturization, anti-aging, SPF protection, and skin brightening. Natural and vegan formulations, along with innovations in sustainable packaging for creams & lotions, are also shaping market trends.

Gels, particularly water-based and oil-free formats, are gaining popularity in both skincare and haircare applications, especially in Asian markets. Powder formulations continue to find favor in cosmetics and sun care, with demand for clean, preservative-free alternatives. Sprays offer convenience for body care, hair styling, and fragrance products.

Other formats including serums, sticks, balms, and emulsions are witnessing innovation-led growth as brands seek unique delivery systems. As consumers continue to favor easy-to-use, high-performance products, creams & lotions will remain integral to ODM development pipelines.

| Formulation Type | Market Share (2025) |

|---|---|

| Creams & Lotions | 38% |

The online sales channel segment is projected to grow at the highest CAGR of 12.8% from 2025 to 2035, fueled by the global shift toward e-commerce and direct-to-consumer beauty brands. Digital-native and indie beauty brands increasingly rely on ODM partners to deliver fast, agile product development aligned with social media-driven trends.

Online platforms offer unmatched flexibility in launching limited editions, niche formulations, and influencer collaborations. ODM providers with strong e-commerce packaging expertise and supply chain agility are well-positioned to serve this dynamic channel.

Supermarkets and hypermarkets maintain broad reach for mass-market and affordable beauty products, especially in emerging economies. Specialty stores remain a vital retail channel for premium and prestige cosmetics, fostering in-store brand experiences. Departmental stores continue to play a role in driving sales for established luxury brands.

Other channels including convenience stores, pharmacies, salons/spas, and direct sales offer important touchpoints for impulse purchases, professional-grade products, and high-trust categories such as skincare and personal care. As consumer buying behavior increasingly favors online discovery and convenience, the online segment is expected to remain the fastest-growing and most disruptive force in cosmetics ODM market dynamics.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Online | 12.8% |

One of the crucial challenges in the cosmetics ODM request is navigating the complex and evolving nonsupervisory geography across different regions. Each country has distinct compliance conditions regarding constituents, safety testing, and labelling, making it challenging for ODMs to ensure global standardization.

Failure to misbehave with regulations can lead to recalls, forfeitures, or reputational damage. Also, maintaining harmonious quality assurance while spanning up products is a pivotal concern. ODMs must invest in rigorous testing protocols, force chain translucency, and third-party instruments to meet safety and efficacy norms while maintaining competitive pricing.

The adding demand for clean beauty and sustainable results presents significant openings for ODMs. Consumers are laboriously seeking products formulated without dangerous chemicals, parabens, or synthetic complements, pushing brands to unite with ODMs specializing in natural and organic phrasings.

Likewise, the rise of refillable packaging, biodegradable accouterments, and arid beauty products is creating new avenues for ODM invention. Companies that invest in eco-conscious product development and sustainable manufacturing practices will gain a competitive advantage in the evolving cosmetics geography

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 34.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 15.80 |

| Country | South Korea |

|---|---|

| Population (millions) | 51.7 |

| Estimated Per Capita Spending (USD) | 19.30 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 18.70 |

| Country | France |

|---|---|

| Population (millions) | 65.8 |

| Estimated Per Capita Spending (USD) | 21.10 |

The USA cosmetics ODM request thrives on private- marker beauty brands and indie ornamental companies seeking turnkey manufacturing results. High per capita spending is fuelled by demand for clean beauty, sustainable phrasings, and nonsupervisory compliance. Crucial ODM players similar as KDC/ One and Interco’s support decoration and mass- request brands.

China’s booming beauty assiduity has propelled its ODM sector, with domestic manufacturers feeding to global and original brands. Rising demand for K- beauty and J-beauty-inspired products influences ODM enterprises. Online channels similar as Alibaba and Tmall drive direct-to-consumer brands, fueling request expansion.

South Korea’s ODM request benefits from the country’s strong ornamental R&D, invention in skincare, and advanced expression ways. Leading ODM enterprises, similar to Cosmax and Kolmar Korea, set trends in K- beauty and attract transnational collaborations.

Japan's ODM request is characterized by a focus on high-quality, dermatologically tested, and technologically advanced cosmetics. Japanese manufacturers feed to luxury brands and niche skincare requests, maintaining strong import demand.

France, a global hub for luxury beauty, sees robust ODM activity led by renowned contract manufacturers. The market emphasizes organic and natural formulations, with increasing interest in sustainability and ethical sourcing.

The private-label cosmetics ODM market is experiencing strong growth, fuelled by growing demand for independent-label beauty brands, growing innovation in clean and sustainable products, and the growing reach of indie cosmetics companies. According to a survey of 250 owners of beauty brands, product developers, and industry experts, these are the trends that are fueling the market.

Skincare leads the ODM segment with 63% of the players concentrating on creating serums, moisturizers, and anti-aging products because of popularity and profitability with consumers. Concurrently, 29% of the players mention colour cosmetics as an area of growth, since new makeup trends create new product opportunities in terms of development, especially in the foundation, lipsticks, and combination skin care-makeup products.

Sustainability and clean beauty continue to lead product invention, with 58 of companies looking for ODM mates with organic, vegan, or atrocity-free products to meet consumer demand. Also, 41 prioritize biodegradable packaging and refillable products, which suggest a shift towards green branding and sustainable force.

Customization and speed-to-market are the major market drivers, with 53% of beauty companies using ODM services that enable customized formulas, proprietary ingredients, and variable production quantities to customize their products. Speed-to-market matters, with 46% of the interviewees preferring ODMs enabling product development in six months or less to be able to capitalize on rapidly changing beauty trends.

Asian ODM players dominate the market, with 67% of the participants naming South Korea and Japan as their favourite production bases, banking on their lead in innovative formulations, K-beauty trends, and advanced skincare advancements. European ODMs command 21% of brands, especially for luxury and dermatology-inspired cosmetics, and emphasize high-quality ingredients and compliance with regulations.

Direct-to-consumer and e-commerce brands drive demand for ODM, with 72% of the respondents concurring that online beauty startup companies and influencer-based brands are driving ODM buyers who want low production costs but do not own any in-house factories. As much as 28% of conventional beauty businesses utilize ODM collaborations on exclusive product lines or market entry.

While beauty companies focus on speed, sustainability, and high-performance products, the ODM producers need to keep pace by focusing more on R&D capabilities, flexible production models, and green innovation adoption to stay competitive in the new cosmetics market.

The USA cosmetics ODM( Original Design Manufacturer) request is witnessing strong growth, driven by adding demand for private-marker beauty products, rising consumer preference for clean beauty phrasings, and advancements in ornamental manufacturing technologies. Major players include KDC/ One, Kolmar USA, and Intercos Group.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The UK cosmetics ODM request is expanding due to the rise of substantiated beauty products, adding relinquishment of atrocity-free and vegan phrasings, and the presence of established beauty manufacturing capitals. Leading ODM companies include Orean Personal Care, HCP Packaging, and Swallowfield.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

Germany’s cosmetics ODM request is growing, with a strong focus on dermatologically tested, sustainable, and technologically advanced beauty results. Crucial players include Beiersdorf, Schwan Cosmetics, and Bomo Trendline.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s cosmetics ODM request is witnessing rapid-fire growth, fueled by adding demand for Ayurvedic and herbal beauty products, rising interest in budget-friendly private-marker cosmetics, and expanding domestic manufacturing capabilities. Major players include Vedic Cosmeceuticals, Bo International, and Cosmetify India.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.0% |

China’s cosmetics ODM request is expanding significantly, driven by adding demand for K- beauty and J-beauty inspired phrasings, rising exports of Chinese-cultivated cosmetics, and strong investments in innovative ornamental exploration and development. Crucial players include Cosmax, Kolmar Korea, and Biohyalux.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.5% |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 15.5 billion |

| Projected Market Size (2035) | USD 28.7 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Product Type | Skincare, Haircare, Makeup, Others |

| By Formulation Type | Creams & Lotions, Gels, Powders, Sprays, Others |

| By Sales Channel | Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, Others |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, MEA |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Cosmax, Intercos S.P.A, Nako Cosmetic, Kolmar Korea, Nihon Kolmar, Nox Bellow Cosmetics, Picaso Cosmetic Laboratory, Global Cosmetics, Allure Labs LLC, COSMOBEAUTY Co., Ltd |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

The cosmetics ODM industry is projected to witness a CAGR of 6.2% between 2025 and 2035, driven by rising demand for private-label beauty products, clean formulations, and sustainable packaging innovations.

The cosmetics ODM industry stood at USD 15.5 billion in 2025, supported by strong demand from indie beauty brands, clean beauty trends, and advances in AI-driven cosmetic formulation.

The cosmetics ODM industry is anticipated to reach USD 28.7 billion by the end of 2035, as beauty brands increasingly rely on ODM partners for innovative product development and faster time-to-market.

Asia Pacific is expected to record the highest CAGR of 8.1% between 2025 and 2035, driven by strong demand in South Korea, Japan, China, and the growing influence of K-beauty and J-beauty trends.

Key players operating in the cosmetics ODM industry include Cosmax, Intercos Group, Kolmar Korea, Toyo Beauty, Nox Bellow Cosmetics, and BioTruly, all of whom are investing in AI-driven innovation, sustainable formulations, and advanced manufacturing technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Nature Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Nature Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Packaging Format, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Packaging Format, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Packaging Format, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Nature Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Packaging Format, 2023 to 2033

Figure 119: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Nature Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Packaging Format, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Nature Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Nature Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Nature Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Nature Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Nature Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Nature Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Packaging Format, 2023 to 2033

Figure 179: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Korea Cosmetics ODM Market Analysis – Size, Share & Trends 2025 to 2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Colour Cosmetics Market Insights – Growth & Forecast 2024-2034

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Natural Cosmetics Market - Size, Share, and Forecast 2025-2035

UK Nutricosmetics Market Growth – Demand, Trends & Forecast 2025-2035

Organic Cosmetics Market Insights – Growth & Forecast 2024-2034

GCC Nutricosmetics Market Outlook - Size, Growth & Trends 2025-2035

USA Nutricosmetics Market Trends – Size, Share & Growth 2025-2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Waterless Cosmetics Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA