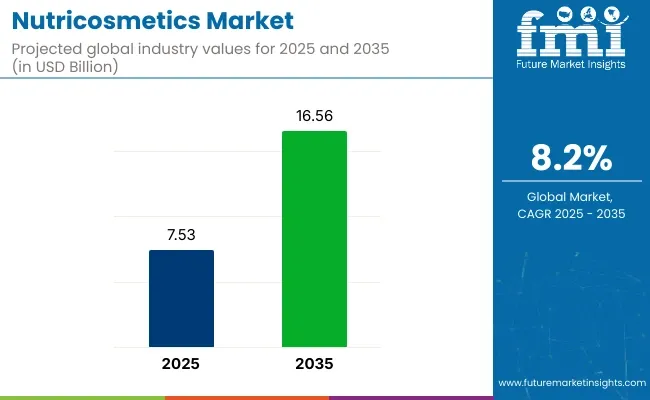

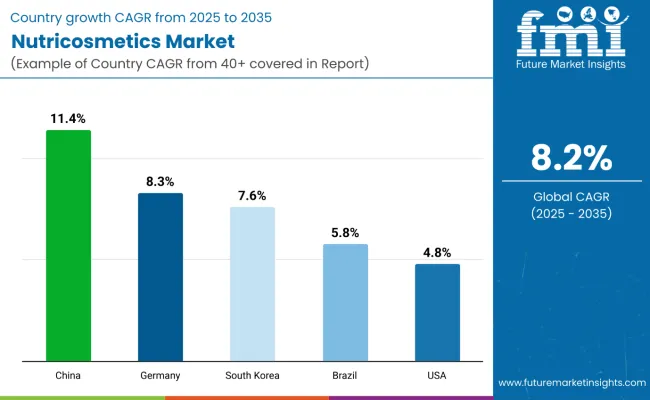

The nutricosmetics market is projected to grow from USD 7.5 billion in 2025 to USD 16.6 billion by 2035, expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. The market is gaining momentum as consumers increasingly seek holistic beauty solutions that support the health of their skin, hair, and nails from within.

| Metric | Value |

|---|---|

| Nutricosmetics Market Size (2025E) | USD 7.5 billion |

| Nutricosmetics Industry Value (2035F) | USD 16.6 billion |

| Nutricosmetics Market CAGR (2025 to 2035) | 8.20% |

Nutricosmetics, which include dietary supplements and functional foods fortified with bioactive ingredients like collagen peptides, vitamins, carotenoids, and polyphenols, are being widely adopted for their anti-aging, hydration, and UV protection benefits. This growing convergence of nutrition and cosmetics is driven by lifestyle trends that favor wellness, preventive care, and non-invasive alternatives to topical and surgical beauty treatments.

Innovation and product diversification are fueling growth in this space. Manufacturers are developing personalized formulations tailored to gender, age, skin type, and lifestyle factors, often using botanical extracts, probiotics, and marine-sourced ingredients. The rise of e-commerce, influencer marketing, and beauty-from-within campaigns has further propelled awareness and accessibility of nutricosmetic products.

Additionally, increasing clinical evidence supporting the efficacy of ingredients such as hyaluronic acid, biotin, and astaxanthin is reinforcing consumer trust and expanding usage beyond traditional beauty-conscious demographics to include men and aging populations. Leading players are also launching gummies, drinkable shots, and functional powders to improve convenience and consumer engagement.

Regulatory frameworks across regions are evolving to ensure product safety, transparency in labeling, and the accuracy of efficacy claims. In the United States, nutricosmetics fall under dietary supplement regulations governed by the FDA, while in the European Union, EFSA plays a key role in evaluating health claims.

In Asia, countries like Japan and South Korea have well-established functional food regulations, making them high-growth markets for nutricosmetic innovation. As consumer preferences shift toward clean-label, plant-based, and scientifically validated beauty supplements, the global nutricosmetics market is poised to expand significantly, driven by cross-sector collaborations between nutrition, skincare, and pharmaceutical companies.

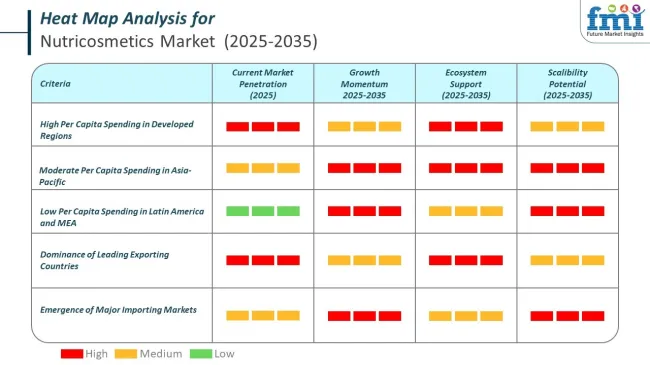

Per capita spending in the nutricosmetics market reflects clear regional contrasts, driven by lifestyle trends, income distribution, and consumer awareness of beauty-from-within solutions. Developed economies allocate higher individual budgets due to widespread acceptance of premium wellness products and advanced retail networks.

The nutricosmetics market operates within a dynamic global trade network where leading manufacturers and suppliers cater to growing demand for beauty-from-within solutions. Export and import flows are heavily influenced by regional production capabilities, raw material availability, and consumer-driven trends toward functional beauty products.

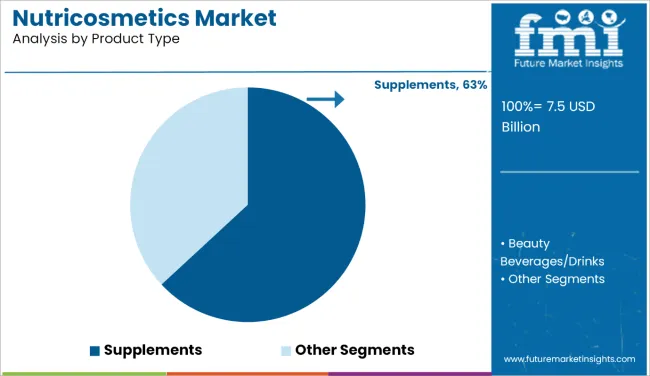

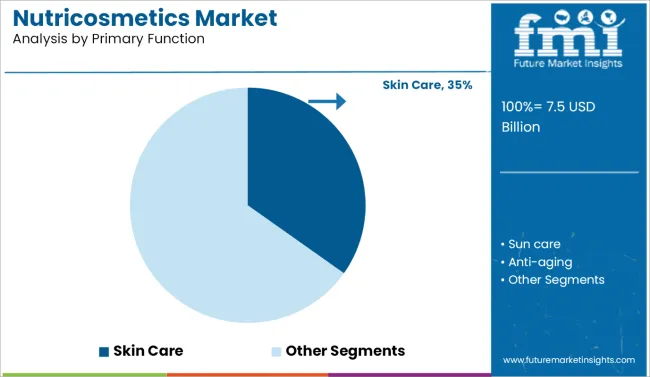

The nutricosmetics market is segmented based on product type, primary function, price range, distribution channel, and region. By product type, the market is divided into supplements, including tablets, capsules, powder, and liquid, as well as beauty beverages or drinks. In terms of primary function, the market encompasses skin care, sun care, anti-aging, radiance and glow, anti-acne or pimple care, hair and nail care, weight management, and multi-functional products that offer combined benefits, such as skin and hair care.

Based on price range, the market is categorized into economy, mid-range, and premium segments. By distribution channel, nutricosmetics are available through hypermarkets or supermarkets, convenience stores, specialty stores, direct selling, departmental stores, e-commerce platforms, and other retail formats (pharmacy chains, beauty salons, wellness stores, and MLM channels). Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, the Middle East and Africa.

Supplements are projected to account for 63% of the overall product share in the nutricosmetics market by 2025. Tablets and capsules remain the most widely adopted formats due to standardized dosing, portability, and shelf stability. Tablets are preferred for multi-functional benefits, while capsules, especially soft gels, are gaining favor for improved bioavailability.

Powders are increasingly integrated into daily wellness routines through smoothies and meal replacements, while liquid supplements are growing in relevance for quick absorption and personalized dosing. The expanding nutraceuticals landscape and the rising adoption of preventive skincare through ingestibles continue to reinforce supplement growth.

Beauty beverages or drinks, on the other hand, are steadily capturing consumer interest. These include ready-to-drink collagen shots, antioxidant tonics, and functional beverages that blend hydration with skin health benefits. Their appeal lies in convenience, natural ingredient positioning, and brand-driven innovation that resonates strongly with wellness-conscious millennials and Gen Z consumers.

Beauty beverages are gaining momentum as brands invest in R&D to formulate multifunctional drinks enriched with collagen, hyaluronic acid, and vitamins. Their portability and appeal as part of daily wellness rituals are encouraging greater trial and repeat purchases. As consumer preferences shift toward holistic beauty routines, beverages are poised to emerge as a key innovation frontier in nutricosmetics. The beauty beverages/drinks segment accounts for 63% share.

| Product Type | Share (2025) |

|---|---|

| Supplements | 63% |

Skin care is expected to lead the nutricosmetics market by primary function, accounting for 35% share in 2025. This dominance is driven by the growing preference for ingestible solutions that address hydration, elasticity, pigmentation, and overall dermal health. Collagen peptides, ceramides, antioxidants, and vitamins are the most commonly included actives, addressing internal factors that influence skin aging.

Consumers across age groups are embracing nutricosmetics as a preventive and restorative solution, supporting the transition from topical products to holistic beauty routines. With growing awareness around environmental stressors and lifestyle-related skin issues, the demand for skin-targeted products continues to rise.

Multi-functional products that offer combined benefits for skin, hair, and nails are quickly gaining traction in the market. These blends are designed for modern consumers seeking efficiency and all-in-one wellness solutions, incorporating botanicals, bioactives, and adaptogens.

They are also increasingly tailored to hormonal balance, sleep, and immunity support. As wellness merges with beauty, personalized formulations targeting multiple outcomes are gaining traction across both mass and premium channels. With skin care retaining its leadership and multi-functional offerings expanding rapidly, nutricosmetics are set to redefine internal beauty during the forecast period. The hair & nail care segment accounts for a 21% share.

| Primary Function | Share (2025) |

|---|---|

| Skin Care | 35% |

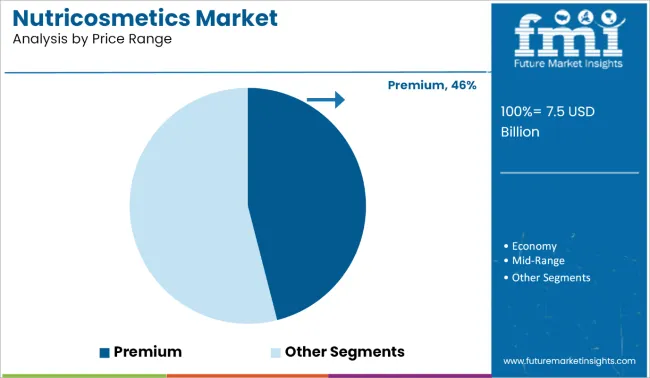

The premium segment is expected to register the fastest CAGR of 7.4% from 2025 to 2035 in the nutricosmetics market. This segment holds a 46% share. This growth is being driven by rising consumer willingness to invest in high-efficacy beauty-from-within products that use clinically backed ingredients, clean-label formulations, and sustainable packaging.

Premium nutricosmetics often incorporate patented bioactives, such as hydrolyzed collagen, phytoceramides, and probiotics, which are marketed for visible results in skin hydration, elasticity, and radiance. Affluent and urban consumers are particularly responsive to premium positioning that emphasizes transparency, ethical sourcing, and dermatologist-formulated blends.

The mid-range segment remains highly competitive, serving a broad demographic that values both affordability and performance. Brands in this segment often balance functional benefits with flavor, dosage flexibility, and influencer-driven branding to attract younger audiences. Many direct-to-consumer brands begin in the mid-range before expanding into premium lines based on consumer loyalty.

The economy segment remains relevant in emerging markets, where price sensitivity influences purchasing behavior. While growth is slower, this category benefits from increasing awareness, entry-level beauty regimes, and greater retail penetration. As personalized nutrition, anti-aging, and clean beauty trends advance, the premium price tier is projected to lead market momentum by setting new standards for innovation, quality, and perceived value. The mid-range segment accounts for 23% share.

| By Price Range | Share (2025) |

|---|---|

| Premium | 46% |

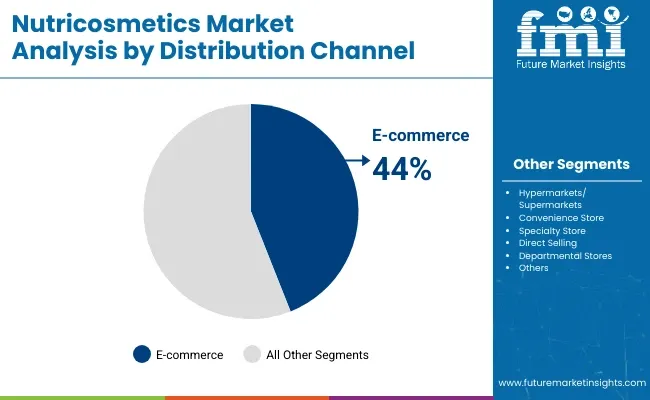

E-commerce is projected to grow at the fastest CAGR of 7.5% from 2025 to 2035, emerging as the primary distribution channel for nutricosmetics. This segment holds 445 shares. Online platforms offer unmatched convenience, ingredient transparency, and access to global brands, catering to digitally native and health-conscious consumers.

Direct-to-consumer (DTC) brands are innovating with subscription services, AI-based personalization, and influencer-driven campaigns. These factors help brands build strong community engagement and loyalty while offering flexible pricing and customized bundles. Online reviews, user-generated content, and educational content further reinforce consumer trust in nutricosmetic products sold via e-commerce.

Hypermarkets and supermarkets remain essential for impulse and routine purchases. The hypermarkets/supermarkets segment registers 20% share. These formats provide visibility for mainstream supplement brands, functional drinks, and introductory nutricosmetic SKUs. Shelf placement, in-store promotions, and cross-merchandising with beauty categories support higher conversion at the retail level. Specialty retailers, salons, and pharmacy chains also play a role in premium positioning and education-driven sales.

As hybrid shopping behaviors evolve, many consumers explore products in-store but complete purchases online. E-commerce’s growth trajectory will continue to influence product development, sampling, and marketing strategies in the nutricosmetics space.

| Distribution Channel | Share (2025) |

|---|---|

| E-commerce | 44% |

The global nutricosmetics market steadily advanced at a CAGR of 6.6% from 2020 to 2024, as people approached the topic with increased attention to the cooperation of nutrition and cosmetics. This period was marked by increased demand for skincare products, including nutritional supplements that benefit the skin, containing vitamins, minerals, and antioxidants.

There was an increased occurrence of trends in the markets for wellness and personalized health, with customers looking for scientifically proven remedies for beauty and aging.

From 2025 to 2035, there will be further development, although the scenario will be different. Over the years, the level of demand is expected to remain high due to continued research on new formulas, the promotion of the total body care concept, and the development of new nutritional knowledge.

Nevertheless, the market will be under pressure to address increased competitive rivalry, legal requirements, and changes in customer needs that influence growth rates. Future determinants of sales will involve innovative technologies applicable to nutricosmetics ingredients, customized nutrition, and general healthy living.

Consumer inclination towards “natural” alternatives to skin health and beauty has become quite obvious over the past few years! it coincides with the eco-friendly and organic beauty brands. Consumers are increasingly opting for natural alternatives over synthetic formulations. Leading cosmetics brands are foraying into the production of herbal compositions, eliminating any toxic or chemical interventions within the product composition.

Nutricosmetics ingredients are often naturally obtained, making them appealing to this type of consumer, especially within the channels of distribution. Novel herbal ingredients are being incorporated into a range of natural skin and hair applications for cosmetic as well as therapeutic benefits.

Customers are turning out to be progressively accepting that applying product to the skin isn't as productive as ingesting nutrients from inside enhancements coordinated explicitly for the hair, skin, and nails to improve and maintain beauty from the inside out.

Consumer education regarding the health benefits associated with balanced nutrition and supplementation is increasing, simultaneously encouraging natural and non-invasive protocols to combat accelerated aging, premature hairline receding, and other skin-related issues.

There is a growing awareness among consumers regarding the significance of a multi-factorial approach to skin's wellbeing, longevity, and beauty. Customers have started to shun chemical formulations and treatments for oral enhancements.

The promotion of explicit nutritional benefits for health and skin has proven to be more effective than presenting beauty-enhancing claims for nutricosmetics. A balanced diet, a strict fitness routine, and oral enhancements all contribute to achieving the best outcomes for overall beauty, which is driving the global nutricosmetics market.

It has been observed that there is a growing market for microbiome skincare products, also known as nutricosmetics, due to the increasing demand for organic and natural products, as well as the positive results shown by probiotics in the food and beverage sector. It is, therefore, creating vast opportunities within the cosmetics and personal care industry as consumers are progressively increasing their understanding of the benefits of using microbial-targeted products.

The market for nutricosmetics is poised for strong global growth, driven by a growing and consistent demand for nutrition-cosmetic products. Currently, in the United States, the FDA is evaluating scientific evidence to determine the safety and efficacy of probiotics and post-biotics, again emphasizing the viability of these ingredients in skincare.

Leaders such as DSM are at the cutting edge of technological advances, experimenting with specific strains of probiotics and skin health. For instance, Pentavitin, a skin bioactive accepted in the US market, works on the Staphylococcus epidermidis bacteria of the scalp microbiome to help nourish the skin and alleviate dryness.

Moreover, there is DSM’s Syn-Up, which is available only in the USA, and it is a peptide-based ingredient that works with the skin microbiome to address issues related to dry skin and skin redness.

In the future, as the nutricosmetics industry continues to flourish, microbiome-friendly ingredients for skincare products will remain one of the most important factors to be explored through research. Firms that can explore and dominate the use of probiotics and other bioactive compounds to improve skin health are set to reap huge benefits in terms of market reach and customer interest.

There are several factors that have led to the increased market demand of the nutricosmetics market. Aging population is one of the main factors that help to drive change. Therefore, people with a desire for youthful-looking skin and the ability to enhance their quality of life often turn to wrinkle cream.

This demographic alone spends billions of dollars every year on goods and services targeting fine wrinkles and other signs of aging; hence, it can be considered a huge market for nutricosmetics.

Besides, the role of an aging population and the modern approach to beauty, with the “beauty from within” message, implies a more profound understanding of the link between nutrition, health, and beauty. This awareness has made consumers diversify and change their ways of thinking in the sense that they now realize that the foods they take have direct effects on generating their skin and hair complexion and general outlook.

It is estimated that the Italian market for nutricosmetics products will have a CAGR of 7.3% by the end of 2035 in Europe. Italian consumers prefer skincare products that contain active ingredients and natural components, a trend expected to continue. Another highly sought-after feature is the ease of use and absorption of the product.

Italian cosmetics are renowned worldwide for their innovative formulas and exceptional manufacturing service characteristics, which have enabled the Italian cosmetics sector to establish itself in both established and emerging markets. These factors help Italy in making a prominent market for nutricosmetics products in Europe.

In the South Asia Region, India has been the dominant market for nutricosmetics, with an estimated CAGR value for the Indian market by the end of 2035 of 16.1%. Few professional make-up lines in India can cater to the diverse variety of salons and professional make-up artists.

In addition to increasing competition within the beauty business in India, the rapid growth of the sector has attracted numerous international brands to the country with these factors are making India a prominent market and driving business for nutricosmetics products in India.

In North America, the US nutricosmetics market is expected to hold the largest market share by the end of 2024 and grow at a CAGR of 5.4% from 2025 to 2035.

A changing lifestyle, driven by rising income, is making it possible for consumers to opt for healthier alternatives for themselves and the environment, which were previously considered inaccessible. These factors are driving the market towards significant growth in the region and making the USA a prominent market for cosmetic products.

Leading players operating globally in the market are focusing on expansion, development, and new product launches in order to expand their business globally.

For instance

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 7.5 billion |

| Projected Market Size (2035) | USD 16.6 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value and million units for volume |

| By Product Type | Supplements (Tablets, Capsules, Powder, Liquid), Beauty Beverages/Drinks |

| By Primary Function | Skin Care, Sun Care, Anti-aging, Radiance & Glow, Anti-acne/Pimple, Hair & Nail Care, Weight Management, Multi-functional (combined benefits such as skin & hair) |

| By Price Range | Economy, Mid-Range, and Premium |

| By Distribution Channel | Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Direct Selling, Departmental Stores, E-Commerce, Other Retail Formats (Pharmacy Chains, Beauty Salons, Wellness Stores, MLM Channels) |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | Pfizer Inc., Herbalife Nutrition Ltd, Amway Corporation, Phyto Botanical Power, Viviscal Limited, Everest NeoCell LLC, Amazing Nutrition, 21st Century HealthCare Inc., Nature's Bounty, Nutrawise Health & Beauty Corporation, PureLogical International, Ivy Bears, Vitabiotics Ltd., MartiDerm, Shiseido Co. Ltd., H&H Group, Origo Cosmecuticals Pvt. Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global nutricosmetics market is expected to reach USD 16.56 billion by 2035, rising from USD 7.53 billion in 2024, and growing at a CAGR of 8.2% during the forecast period.

Supplements are projected to lead with a 63.1% market share in 2025, with tablets, capsules, powders, and liquids offering convenient, standardized, and effective solutions for skin, hair, and nail health.

Skin care is expected to account for 34.8% of the market in 2025, driven by the rising demand for anti-aging, hydration, and elasticity-enhancing ingestible products featuring collagen, ceramides, and antioxidants.

E-commerce is projected to grow at a CAGR of 7.5% from 2025 to 2035, as digital-first consumers increasingly turn to online platforms for direct-to-consumer brands, personalized offerings, and global access.

Key players include Pfizer Inc., Herbalife Nutrition Ltd., Shiseido Co. Ltd., Amway Corporation, Viviscal Limited, Vitabiotics Ltd., MartiDerm, and Nature’s Bounty each offering science-backed, beauty-from-within formulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Nutricosmetics Manufacturers

UK Nutricosmetics Market Growth – Demand, Trends & Forecast 2025-2035

GCC Nutricosmetics Market Outlook - Size, Growth & Trends 2025-2035

USA Nutricosmetics Market Trends – Size, Share & Growth 2025-2035

Japan Nutricosmetics Market Report – Trends, Demand & Outlook 2025-2035

Germany Nutricosmetics Market Insights – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA