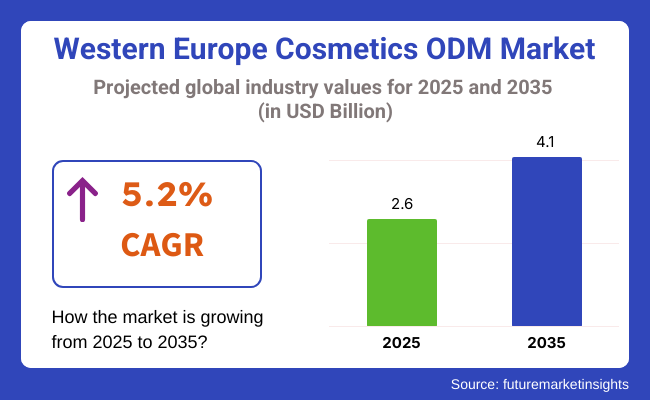

The Western Europe cosmetics ODM market is poised to register a valuation of USD 2.6 billion in 2025. The industry is slated to grow at 5.2% CAGR from 2025 to 2035, witnessing USD 4.1 billion by 2035.

The expansion of the market is fueled by a number of important drivers. One of the most significant of these is the growing consumer demand for innovative and high-quality cosmetics. With consumers learning more and more about ingredients and formulation, there is mounting demand for products that are natural, organic, and sustainable.

The ODM model, which enables firms to rapidly launch tailored products to market, is perfectly positioned to satisfy these consumer needs. Through the use of ODM manufacturers' knowledge, brands can launch new formulations, packaging, and product lines without large investments in research and development, saving time and money.

Additionally, the move by consumers towards personalized beauty products is driving growth in the cosmetics ODM market. Consumers are looking for products that are customized to their own needs, whether for a particular skin issue or a desire for cruelty-free, vegan, or environmentally friendly products. ODM suppliers, with their flexibility to provide bespoke solutions, can fulfill these requirements, allowing brands to respond to niche markets and new trends.

Moreover, the growth of e-commerce and online platforms has provided more convenience to customers in terms of accessing numerous products, thus elevating the regional demand for cosmetic products overall.

Another force is the increase in the number of international and regional beauty companies looking to diversify their product offerings while lowering production costs. As the market becomes more competitive, brands want to simplify their supply chains and stay in competition, so they consider ODM.

With the emphasis on sustainability rising as a top concern for consumers, players in the cosmetic ODM industry are also going green, which again fuels growth in the market as consumers identify with their values and the products they consume.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 2.6 billion |

| Industry Value (2035F) | USD 4.1 billion |

| CAGR (2025 to 2035) | 5.2% |

In the Western Europe cosmetics industry, trends in various end-use segments are influenced by changing consumer attitudes, with increasing emphasis on sustainability and personalization. In skin care, there is a strong trend towards clean and natural beauty products, led by consumer consciousness of harmful ingredients. Products that are organic, paraben-free and artificial fragrance-free, and plant-based are becoming increasingly popular.

Moreover, specific treatments, like anti-aging and pollution-beating skincare, are on an upward trend. In color cosmetics, inclusivity is also one of the dominant trends, where brands are making their products more inclusive by broadening their color ranges to match a broader skin tone spectrum.

Multifunctional products, which offer skincare and makeup, are also more in demand as people seek convenience. Ethical considerations, including vegan, cruelty-free, and green beauty, are also shaping product purchase decisions for skincare as well as color cosmetics.

Western European fragrance is also seeing a transition towards niche and personalized perfumes due to consumers searching for individualized scents that reflect their own identities.

There is also increased demand for environmentally friendly packaging and ingredients. In the hair care market, individualized products offering solutions for specific hair concerns and types, such as scalp health and hair growth, are also gaining popularity.

Between 2020 and 2024, the Western Europe cosmetics market saw tremendous changes owing to evolving consumer habits, innovation, and increased emphasis on sustainability. Demand for clean beauty cosmetics skyrocketed as consumers grew wiser about what they put into their cosmetics, resulting in the desire for natural, organic, and green formulas.

Brands countered by broadening their ranges with cruelty-free, vegan, and eco-friendly products. Digitalization also revolutionized the industry, with online shopping capturing a majority of sales, driven by convenience and variety. Social media, especially beauty influencers and online tutorials, significantly influenced consumer decisions, driving the trend toward individualized beauty solutions.

In addition, the COVID-19 pandemic boosted demand for skincare products as consumers prioritized self-care and well-being during lockdowns, while the makeup category experienced a short-term slump as people worked from home.

In the years ahead to 2025 to 2035, the cosmetics market is likely to continue to evolve with more focus on personalization, technology integration, and sustainability. AI-powered, data-driven, personalized beauty solutions will enable consumers to customize products to individual needs and wants.

Consumers will increasingly turn to science-formulated, functional cosmetics, including anti-aging, skin repair, and wellness-enhancing products. In addition, sustainability will remain a key theme, with a focus on circular beauty models, biodegradable packaging, and sustainable sourcing of ingredients.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 Industry Shifts | 2025 to 2035 Future Trends |

|---|---|

| Demand for natural, organic, and environmentally friendly beauty products increased as consumers became more aware of toxic ingredients and environmental consequences. | Personalization and AI will propel the industry, with brands leveraging data analysis to provide personalized beauty products based on individual preference and requirement. |

| COVID-19 spurred demand for skincare, with consumers prioritizing self-care during lockdown, but makeup demand was suppressed by work-from-home arrangements. | Sustainability will be the theme, with the adoption of circular beauty paradigms, biodegradable packs, and responsible sourcing practices, all with the end goal of creating less environmental footprint. |

| E-commerce expanded faster, with the power of social media and beauty influencers driving shopping behavior , making online shopping the channel of choice. | Clean ingredients and biotechnology will drive the market, with emphasis on science-driven formulations offering the transparency and consumer validation required to satisfy demands for clean, effective beauty. |

| Inclusivity rose to the foreground, with make-up companies now reaching out and offering products with a broader mix of skin tone and type representations, mirroring the diversity needed by consumers. | Virtual try-outs and augmented reality (AR) technologies will come to dominate consumer shopping experiences and enable digital trying before buying. |

The Western Europe Cosmetics ODM (Original Design Manufacturer) industry is exposed to a number of risks that have the potential to affect growth and stability. Among the major risks is regulatory compliance. The cosmetics sector in Western Europe is greatly regulated, and there are rigid regulations on formulations, labeling, and safety.

These regulations, especially in the EU with guidelines like the EU Cosmetics Regulation (EC) No. 1223/2009, mandate companies to make sure that their products are up to high standards of safety and environmental protection.

Any non-compliance with these regulations can result in expensive recalls, legal issues, and damage to the brand, posing a substantial risk for companies in the ODM business. Further, with changing regulations, especially on the fronts of sustainability and environmental footprint, being a head above the regulatory curve demands ongoing research and development investments.

Another significant risk is the volatility of raw material prices. Ingredient sourcing for cosmetics production is volatile, and it could be subject to the vagaries of supply chain disruptions from around the world, shift in demand for organic or natural ingredients, and geopolitical risks. Over the past few years, there has been a growing need for sustainable, organic, and ethically sourced materials.

Although this is in line with consumer tastes, it tends to be more expensive and comes with supply chain risks. ODM businesses that are not efficient in handling these fluctuations can experience margin squeezes or production delays, which can impact their capacity to deliver to market demand on time.

The market for skincare products like creams, lotions, facial cleansers, sunscreens, face packs, and masks has been expanding strongly as consumers are becoming more aware of skin care and anti-aging. ODM firms are key players in these categories since most skincare companies look for economical solutions to mass produce without compromising on quality.

The trend towards customization, with the demand for products that address specific skin types and issues, contributes to the development of the ODM market in this segment as well.

Further, there is a growing requirement for natural and organic ingredients in skincare, and thus ODM companies are responding by modifying their formulations accordingly. Brands usually depend on ODMs to bring their experience, formulation science, and adaptability in order to meet these consumer needs effectively.

Hair care items such as shampoos, conditioners, hair dyes, tonics, and styling products are also extensively manufactured via ODM models. The popularity of these products has increased in tandem with the growth of wellness and self-care trends, with consumers becoming more and more concerned about the health of their hair and scalp. Similar to skincare, hair care demands high levels of specialization in ingredients, packaging, and formulations, which ODMs are well-equipped to deliver.

In the Western European cosmetics ODM market, tubes and bottles are the most common packaging forms. These packaging forms are favored for a broad variety of products because they are practical, versatile, and popular among consumers.

Bottles are widely employed for skincare and hair care applications like shampoos, conditioners, lotions, face cleansers, and sunscreens due to the ease of usage, visibility, and effectiveness they offer in supporting product integrity and shelf life.

Bottles with pumps and dispensers are conducive to controlled dispensing, ensuring ease and cleanliness of use, which is vital for consumers' concerns. Also, bottles can be produced using different materials, such as glass and plastic, with the advantage of design flexibility and sustainability, which is increasingly becoming an issue in the beauty sector.

Tubes are also a favorite packaging format, especially for products such as creams, gels, sunscreens, and facial masks. They are preferred due to their convenience, ease of use, and accurate application of the product, making them perfect for consumers seeking convenience in their beauty regimen. Additionally, tubes are inexpensive, light, and come in different sizes, making them perfect for both premium and mass-market products.

The Western Europe cosmetics ODM market is growing strongly, with rising demand for innovative, personalized beauty products that meet consumer demands for sustainability, clean-label products, and high-performance formulations. Intercos Group, Viaderm Limited, and Kolmar Korea are leading the charge, providing leading-edge research and development in the beauty industry, with a focus on clean beauty, organic products, and natural ingredients.

These businesses are taking advantage of the emerging trends like green products and plant-based products. They provide a diverse array of ODM solutions ranging from customized formulations for hair care, skin care, and makeup products to guarantee that the manufacturers are able to keep up with the increasing demand for customized quality beauty products.

With consumer trends favoring environmentally sustainable and ethically sourced goods, these firms are also adopting greener packaging options and more eco-friendly production techniques as part of their portfolio, aligning them even further with the region's sustainability targets.

Other firms such as Oracle OEM, Herrco Ltd, and BioTruly Group offer specialized ODM services, targeting distinctive formulations, packaging, and innovative cosmetic technologies. Their knowledge of personal care products, such as body care, facial care, and hair care products, enables brands to diversify their product lines while ensuring high standards of safety and efficacy.

With growing competition, firms such as Sabel Ltd, Francia Beauty, and Nowcos Co. Ltd. are servicing niche markets with customized, small-batch products that enable cosmetic brands to stand out in the market. That focus on innovation, combined with consumer-driven demand for product that expresses individual identity and values, is driving cosmetics ODM market growth.

Hence, the future phase of the industry will witness heightened investment in R&D, digitalization, and sustainable business practices to address the constantly changing needs of beauty-aware European consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Intercos Group | 17-20% |

| Oracle OEM | 13-16% |

| Viaderm Limited | 11-14% |

| Herrco Ltd | 9-12% |

| BioTruly Group | 6-9% |

| ANC Corporation | 5-7% |

| Kolmar Korea | 4-6% |

| Francia Beauty | 3-5% |

| Nowcos Co. Ltd. | 2-4% |

| Sabel Ltd | 2-4% |

| Other Niche Players | 10-12% |

Key Company Insights

Intercos Group is still the market leader, with a market share of 17-20%, which is renowned for its robust R&D capabilities and wide range of products in skincare, makeup, and fragrance.

The company is at the forefront of clean beauty solutions and green practices. Viaderm Limited and Kolmar Korea are closely behind, with substantial shares of 11-14% and 4-6%, respectively. Both companies focus on skincare and personal care ingredients with a preference for high-performance actives and clean formulation.

Herrco Ltd and Bio Truly Group deliver custom cosmetic solutions to small-volume and niche markets with innovative, made-to-measure products meeting the increased call for bespoke beauty products.

As the demand for one-of-a-kind, customized beauty products keeps growing, these firms are setting themselves up for long-term success by making investments in sustainable methods, technological innovation, and innovative research.

On the basis of product type, the industry is classified into skin care, hair care, makeup, body care, and others.

In terms of nature type, the market is divided into natural/organic and synthetic.

Based on packaging format, the market is divided into bottles, compact cases, droppers, folding cartons, jars, pouches, pumps and dispensers, roll-on, roll-on sticks, sachets, sticks, andtubes.

Based on end use, the industry is classified into prestige brands, private brands, mass brands, and indie brands.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 2.6 billion in 2025.

The market is projected to witness USD 4.1 billion by 2035.

The industry is slated to capture 5.2% CAGR during the study period.

Bottles are widely preferred.

Leading companies include Intercos Group, Oracle OEM, Viaderm Limited, Herrco Ltd, BioTruly Group, ANC Corporation, Kolmar Korea, Francia Beauty, Nowcos Co. Ltd., and Sabel Ltd.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: UK Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 16: UK Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 18: UK Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 20: UK Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Germany Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 26: Germany Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 28: Germany Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Germany Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Italy Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 36: Italy Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 38: Italy Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Italy Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: France Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 46: France Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 48: France Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: France Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 54: Spain Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 56: Spain Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 58: Spain Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 60: Spain Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 62: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 64: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 66: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 68: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 41: UK Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 45: UK Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 49: UK Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 53: UK Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 56: UK Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 57: UK Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 58: UK Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 59: UK Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 71: Germany Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 75: Germany Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 79: Germany Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 83: Germany Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 89: Germany Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Italy Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 105: Italy Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 109: Italy Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 113: Italy Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 119: Italy Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 131: France Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 135: France Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 139: France Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 143: France Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 146: France Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 147: France Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 148: France Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 149: France Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 161: Spain Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 165: Spain Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 169: Spain Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 173: Spain Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 179: Spain Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 186: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 190: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 194: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 198: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Natural Cosmetics Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA