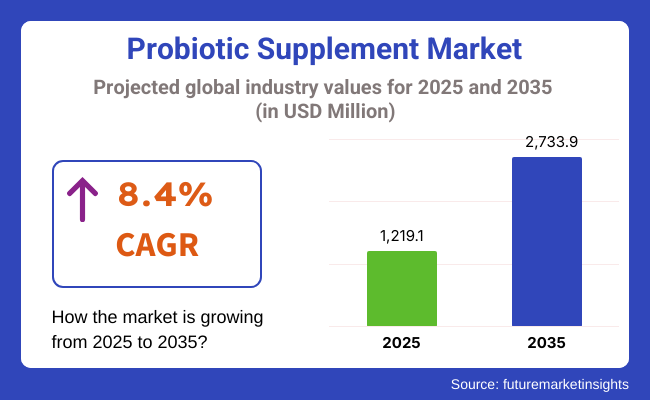

In 2025, the value of the Probiotic Supplement Industry Analysis in Western Europe is predicted to reach almost USD 1,219.1 million and have a projected value of approximately USD 2,733.9 million during the forecast period, with an 8.4% CAGR from 2025 to 2035. The strong cultural preference for preventive health care, the growing interest in digestive health and an aging but increasingly health-conscious populace that prefers wellness solutions drive growth in this segment increasingly.

Western Europe is home to one of the most mature industries globally, with high consumer awareness about the benefits of probiotics for digestive health, immunity, and even mental well-being. They have evolved from niche products to essentials for the mainstream, where consumers demand transparency, scientifically backed formulations and clean labels. The well-established healthcare infrastructure of this region, along with the very high attention toward wellness, creates an environment conducive to sales growth.

During the forecast period, there has been a massive trend toward personalized health solutions, with microbiome testing services and AI-enabled health applications gaining ground to enable the consumer to customize their supplements. This is accompanied by the further mounting of scientific studies that connect gut microbiota to all aspects of health. The increased awareness of the health advantages of specific strains has led several companies to invest in clinical trials and collaborations with European health institutes to validate the efficacy of probiotics further.

As consumers become more aware, they demand not just efficacious products but also those that are free from allergens, gluten, and other irritants. More such offerings have availed themselves, most of them being vegan all the way to gluten- and allergen-free probiotic goods, thus diversifying dietary fads and broadening the market appeal.

Rising multi-symptom formulations increase sales growth, along with the increased popularity of psychobiotics (probiotics designed to affect mental health) and the concept of synbiotics (a combination of probiotics and prebiotics). Innovation in retailing, harmonization of regulations, and development of next-generation probiotics will continue to create and strengthen the industry. Personalized probiotics that meet individual microbiome profiles will be a top contributor to future growth. The increasing popularity of supplements supporting both mental and digestive health further boosts the industry.

By bacteria type, the probiotic supplement industry in Western Europe will mainly be led by Lactobacillus, garnering a 38.4% share, while Streptococcus comes second with 33.5%.

The leading type of bacteria, Lactobacillus, offers a wide spectrum of advantages such as digestive health, immune support, and general wellness. The most popular strains in the region include L. rhamnosus GG, L. acidophilus, and L. plantarum. Major European companies with good dairy intake, such as Danone, which has its Activia and Dan Active brands, employ Lactobacillus strains for digestive and immune health benefits.

Nestlé Health Science, through the Pro Nourish line, includes L. rhamnosus in specific formulas directed toward gut health and the overall improvement of digestion among persons with sensitive stomachs. Moreover, Chr. Hansen, a leading biotech firm, supplies antibiotic strains such as Lactobacillus to a number of supplement brands focusing solely on gut health and digestive comfort. Bio Gaia, a Swedish company engaged in the manufacture of probiotics based on L. reuteri, excels in these products for the betterment of gastrointestinal function and enhancement of immunity.

Streptococcus, especially S. thermophilus, contributes to a big revenue share since it improves lactose digestion and acts in alliance with other probiotic strains. For instance, Morinaga uses S. thermophilus in its probiotic drinks, which are widely consumed in Europe for their digestive health benefits.

Another major player in the European dairy industry is Arla Foods, which uses S. thermophilus in its probiotic dairy products, promoting healthy guts as well as wellness in general. In addition, an international leader in nutrition, DSM, also provides probiotic strains like S. thermophilus to several supplement companies focusing on digestive comfort and immunity.

In 2025, the form of probiotic supplements in Western Europe will be dominated by tablets, with an industry share of 27.2% compared to that of capsules, which is 25.8%.

Tablets are the most preferred since they provide great convenience and accuracy in dose and are also a good method for the incorporation of probiotics in nutritional products. ProNourish probiotic tablets sold by Nestlé Health Science are a combination of probiotics and nutrients for digestive health. A series of probiotic tablets identified by L. reuteri from the Swedish science provider BioGaia target the gastrointestinal area and immunity.

Epsilon Ltd. is a company based in the United Kingdom that manufactures probiotic tablets specifically targeting the health of women, with L. acidophilus probiotics, which help to balance gut flora. Pharmalex is one of the European companies that provides probiotic tablets specifically for children. It contains strains such as L. casei to enhance digestion comfort. Such compactness in tablet form makes it very suitable for busy consumers who want a simple supplement.

Capsules also form an extensive share of the industry, such as those for tablets, in terms of convenience and dosing accuracy. Danone developed an Activia Probiotic Capsule that contains L. rhamnosus to promote digestive health, which is ideal for customers who prefer a more convenient way of taking probiotics than yogurt.

Yakult capsules, under the name Yakult Plus, use L. casei Shirota to promote health and immunity in the gut. Probiotic-bacterial capsules with proprietary strains such as L. plantarum are marketed by Probi AB, a Swedish company, for benefits to digestion and immunity. Optibac Probiotics specializes in Bifidobacterium lactis probiotic capsules for digestive balance and gut flora support.

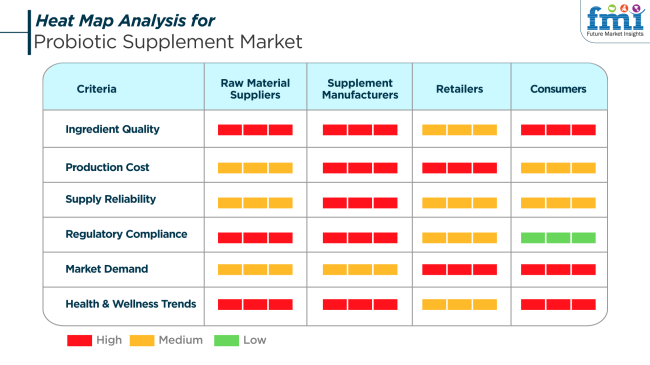

The growing interest of consumers in gut health and overall wellness primarily propels the demand for probiotic supplements in Western Europe. This is the reason why raw material suppliers and supplement manufacturers place much emphasis on ingredient quality, compliance with regulations, and production standards to meet the high expectations of consumers while navigating through the strict regulatory landscape in the region.

Raw material suppliers have been focusing much on obtaining high-quality strains of probiotics and prebiotics, thereby meeting the increasing demand for both efficacy and safety. Compliance with regulations is very critical since European markets have stringent laws regarding supplement formulations and health claims.

Manufacturers of supplements face skyrocketing production costs, especially when using high-end probiotic strains and ensuring their effective performance. Also, they treasure the ingredient quality and compliance with regulations (red) as they get along with the increased demand for scientifically substantiated health supplements. Retailers show a high demand as consumers require probiotic products to be easily accessible. Retailers also consider price and availability, responding to the increasing business volume of probiotics generated through both online and outside-the-store sales.

Among consumers, probiotics are regarded as necessary for maintaining health, given that awareness grows around the gut-brain connection and immunity. One important priority rating about ingredient quality, health benefits, and wellness trends is the very high demand for goods that promise digestive health, immune boosts, and skin improvements. Even if the end users may not find regulatory compliance important, it is still important for manufacturers and suppliers to make sure that any claims made are right and compliant with European standards.

From 2020 to 2024, Western Europe registered significant growth driven by increased health awareness, especially towards gut and immune health. The pandemic drove interest in daily wellness habits, and consumers turned to probiotic products as protective health habits. Capsules, powders, and probiotic drinks became very popular due to their convenience and ease of use.

Online selling played a major role in driving the growth, with consumers choosing quick and easy at-home wellness products. Brands focused on offering clean-label, allergen-free, and plant-based options in an attempt to appeal to more discerning buyers. Label approval issues and industry oversaturation for health claims are challenges for brands.

During the forecast period 2025 to 2035, the industry is expected to be moving towards customization and function-type probiotics, mental well-being, skin health, and weight loss. Probiotic gummies and food infusions will become mainstream. AI-driven customization will allow consumers to choose supplements according to their microbiome profile.

Sustainability in sourcing and packaging will become a key differentiator. Firms will have to navigate changing EU rules while using technology and consumer insights to establish trust and long-term relationships in this emerging yet dynamic market.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Immune and gut health | Broader focus: mood, skin, metabolism |

| Capsules, powders, drinks | Gummies, functional foods, customized formats |

| Rapid e-commerce expansion | Omnichannel dominance with digital personalization |

| Clean-label and vegan development | AI-driven personalization, microbiome-matched products |

| Regulatory attention to health claims | Striking a balance between personalization vs. complexity of regulation |

| A growing concern among consumers | At the center of branding: eco-packaging, sustainable sourcing |

The growing demand for probiotic supplements in Western Europe is attributed to increasing awareness of gut health, immune health, and general probiotic benefits. The consumer base within the area has become more and more health-conscious, with a rising preference for natural and holistic health solutions, thereby providing a surge in the sales of probiotic supplements. Consumers are looking for opportunities to gain probiotic formulations with benefits beyond digestive health; immune support, skin health, and mental well-being are emerging in popularity.

Market trends show a shift toward more personalized and functional probiotic styles. Consumers are now largely moving toward probiotics beyond simple digestive supplements to seek specific strains that can target specially defined health concerns. There is an increased appeal for multi-strain probiotics for even broader health benefits.

Organic and plant-based options are also surging in popularity, powered by the increase in vegan/vegetarian tendencies in Western Europe. This demand is stronger in Germany, with the UK and France closely following suit, where consumers have become increasingly apprehensive towards animal-based products and plant-derived alternatives.

eCommerce is one of the other major driving factors, with online retail channels providing a conveniently accessible avenue for consumers to purchase a plethora of supplement products. The COVID-19 pandemic has only acted as an enabler, with consumers now purchasing health-and-wellness products online in great numbers.

It is also apparent from consumer sentiment that products that are premium and scientifically backed are trending, with consumers actively deciding to opt for supplements that come with clinical validity, as well as transparency around ingredient sourcing and efficacy.

Another factor behind the rising prevalence of probiotics in Western Europe is the aging population, with older adults tending to suffer from digestive and immune system-related problems. In this sense, probiotics that target age-related disorders further widen the consumer base through marketing mechanisms.

On the distribution end, pharmacies and health stores remain the key players. In contrast, online platforms and direct-to-consumer channels are now favorably gaining notoriety due to convenience and the capability of reaching a larger audience. Retailers are also more inclined toward offering probiotic products in all aspects of capsules, powders, drinks, and functional foods.

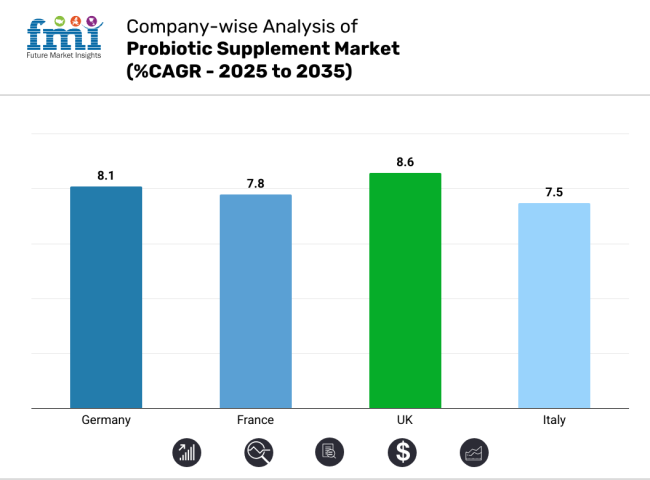

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| Germany | 8.1% |

| France | 7.8% |

| UK | 8.6% |

| Italy | 7.5% |

Germany will expand at an 8.1% CAGR during the study period. Heading the Western Europe region as a user of probiotic supplements is Germany because of its penetration of health science, consumer health education and product credibility needs. The industry favors high-quality formulas containing well-labeled strains, clinical study endorsement and sustainably available ingredients.

In 2024, there is an especially growing demand for probiotics targeting conditions such as gastrointestinal disorders, immune modulation, and mood modulation via the gut-brain axis. German consumers are detail-conscious and prefer supplements that communicate efficacy and strain-specific effects on their labels. The channel structure is also distinct, and pharmacies and online health stores have command over sales due to their focus on science-based advice.

Slow-release, non-refrigerated, and dual-capsule probiotic formulations are gaining traction as a result of convenience and bioavailability. Synbiotics and microbiome recovery following the use of antibiotics are becoming popular with aging demographics. Sustainability is a key to brand preference.

France will grow at 7.8% CAGR over the study period. Probiotics in France enjoy robust historical roots in fermented food culture and pharmaceutical-grade health products. The shift to encapsulated supplements accelerates health-conscious and urban consumers, who expect digestive comfort, immunity and wellness benefits to suit individual requirements.

French consumers appreciate formulation convenience, clean labels, and strain-specific performance supported by medical or nutritional guidance. Pharmacies continue to be trusted access points for product authenticity and customized guidance.

The industry experiences a boom in female-specific probiotic products, particularly those supporting hormonal equilibrium, urinary health, and vaginal microbiota. Trends in beauty-from-within are also driving demand for probiotics supporting skin radiance and gut synergy.

Adding microbiome testing kits and personalized probiotic regimens is becoming more mainstream among tech-conscious consumers who prefer tailored wellness programs. French brands are shifting towards packaging minimalism, eco-responsibility, and purity storytelling to attract their discerning customer base. As a scientifically organized nation, France provides a growing and highly quality-focused industry.

The UK will grow at 8.6% CAGR during the study period. The UK is one of the most rapidly increasing probiotic supplement industries in Western Europe, with features of tech-enabled wellness trends and rapidly growing interest in gut health. Younger age segments are fueling a trend towards daily supplementation as part of exercise, beauty and mental health routines. Multi-strain probiotics, high-potency blends, and gut-brain products are driving product innovation.

Demand is also shifting into specialized categories like travel health, athlete recovery, and cognitive performance. The digital realm commands UK sales of probiotics in 2024 through subscription schemes, microbiome profiling companies, and well-being apps, delivering added layers of personalization. UK consumer expectations hinge on transparency, clear benefits, and environmentally friendly packaging for leading brands to drive towards transparency, cruelty-free production, and allergen-free lines.

Learning material based on influencer promotion and well-being dictates purchases, especially among city workers. Plant-based, gluten-free, and sugar-free is now a mass expectation. The digital health infrastructure in the UK and progressive consumer culture are setting up the conditions for highly scalable and responsive industry growth.

Italy is projected to grow at a 7.5% CAGR during the research period. Italy boasts strong consumer dedication to digestive health and a probiotic-rich food culture. Old consumption of traditional yogurt and fermented foods remains the rule.

Yet, the new consumer is embracing targeted supplements for digestive wellness, reducing bloating, and achieving balance after medical procedures. In 2024, pharmacies will remain the initial purchasing channel, driven by high confidence in expert opinions and pharmaceutical excellence. Probiotic trends in Italy are following its move toward natural remedies and adoption of the Mediterranean way of life.

Symbiotic formulas, plant extract formulas, and postbiotic formulas are becoming increasingly popular for their presumed holistic advantages. Parental demand is propelling pediatric probiotics and pregnancy-safe formulas. An aging population, in turn, is accepting supplements for long-term digestive health and immunity enhancement. Italian nutraceutical tradition, sustainability, and soft formulas are the keys to success in marketing, which brands should highlight. With a taste for subtle, well-integrated solutions that favor healthy living habits, Italy remains a stable but increasingly modernizing region.

Probiotic supplement markets in Western Europe are already well-matured, but they continue to evolve along with specialization and premiumization trends. Bio-Kult remains a name to reckon with and adds to its already strong portfolio with multi-strain probiotic formulations, targeting health conditions like IBS as well as immune health.

Optibac Probiotics has further consolidated its dominance through massive investments in consumer education and evidence-backed promotional support on women's and children's probiotics. Symprove offers something unique through a water-based probiotic delivery system, garnering clinical endorsement and much customer goodwill across both the UK and Germany.

Due to this, ProVen Probiotics' enhanced business, especially via pharmacies and other healthcare channels, is benefiting from the increasing appeal of probiotics targeting both children and obstetric patients. At the same time, major names like Sanofi and Jarrow Formulas have made major strides in the Western European region by modifying products according to the region's strict EFSA (European Food Safety Authority) requirements.

NOVA Probiotics and Lifeway Foods are increasingly targeting vegan and lactose-intolerant segments while focusing on high-potency formulations appealing to sports nutrition and senior demographics. Total Nutrition and Pharma Care Laboratories focus on high-potency formulations that appeal to sports nutrition and also senior demographics.

Market Share Analysis by Company

Key Success Factors Driving the Probiotic Supplement Industry in Western Europe

Bio-Kult holds the leading position in the Western European probiotic supplement market, with an estimated 18-22% share. Its focus on scientifically supported, multi-strain formulations, particularly for digestive and immune support, has cemented its status as a trusted brand across pharmacies and specialist retailers. Optibac Probiotics follows closely with a 15-18% share, leveraging strong consumer trust built through transparent clinical research and specific product ranges for different life stages and health conditions.

Symprove commands around 10-13% of the industry due to its unique live, water-based probiotic system that enhances bacterial survival through the stomach. ProVen Probiotics has captured approximately 8-11% share by targeting niche segments such as maternal and child health, reinforced through collaborations with healthcare professionals. Sanofi, with a 7-10% share, capitalizes on its global pharmaceutical expertise and robust regulatory capabilities, offering probiotics that meet EFSA’s stringent requirements.

The Western European region is characterized by a strong emphasis on clinically validated efficacy, transparent labeling, and targeted health outcome trends that top companies have seamlessly integrated into their strategies for growth and differentiation.

The segmentation is into Bifid bacterium, Lactobacillus, and Streptococcus.

The segmentation is into Tablets, Capsules, Liquid, Powder Premixes, Gummies/chewables, Lozenges, and Liquid & Gels.

The segmentation is into Immunity & Digestive Health, Urogenital Health, Vaginal Health, Urinary Tract Infections, Pregnancy, and Weight Management.

The segmentation is into Hypermarkets/Supermarkets, Specialty Stores, E-Commerce, and Pharmacy Stores.

The segmentation is into Women, Seniors, and Kids.

The report covers the UK, Germany, Italy, France, Spain, and the Rest of Western Europe.

The industry is expected to reach USD 1,219.1 million in 2025.

The industry is projected to grow to USD 2,733.9 million by 2035.

Key players include Bio-Kult, Optibac Probiotics, Symprove, ProVen Probiotics, Sanofi, Jarrow Formulas, NOVA Probiotics, Lifeway Foods, Total Nutrition, Inc., and PharmaCare Laboratories.

The UK, with a CAGR of 8.6%, is among the fastest-growing countries for probiotic supplements.

Lactobacillus strains are currently the most widely used in probiotic supplements.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 21: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: UK Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 23: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: UK Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 32: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 33: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 34: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 35: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Germany Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 41: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 43: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 44: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 45: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 47: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Italy Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 51: France Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 52: France Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 53: France Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: France Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 55: France Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 56: France Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 57: France Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 58: France Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 59: France Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: France Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 61: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 62: Spain Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 63: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 64: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 65: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 67: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 68: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 69: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 71: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 72: Spain Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 73: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 74: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 75: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 77: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 78: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 79: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 81: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 82: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 38: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 42: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 44: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 48: UK Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 50: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 52: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 56: UK Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 57: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 60: UK Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 61: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 62: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 63: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 64: UK Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 65: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 66: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 67: UK Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 68: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 69: UK Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 70: UK Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: UK Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 72: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 75: Germany Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 76: Germany Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 79: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 81: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 83: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 85: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 89: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 92: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 93: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 94: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 95: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 96: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 97: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 98: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 99: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 100: Germany Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 101: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Germany Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 104: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 105: Germany Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 106: Germany Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 107: Germany Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 108: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Italy Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 110: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 113: Italy Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 114: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 116: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 117: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 120: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 121: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 122: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 123: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 124: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 125: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 128: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 129: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 130: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 131: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 132: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 133: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 134: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 135: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 136: Italy Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 137: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 138: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 139: Italy Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 140: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 141: Italy Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 142: Italy Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: Italy Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 144: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 151: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 152: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 153: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 154: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 155: France Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 156: France Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 157: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 158: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 159: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 161: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: France Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 164: France Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 165: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 166: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 167: France Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 168: France Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 169: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: France Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 172: France Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 173: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 174: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 175: France Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 176: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 177: France Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 178: France Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 179: France Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 180: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Spain Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 182: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 183: Spain Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 184: Spain Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: Spain Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 186: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 187: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 188: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 189: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 190: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 191: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 192: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 193: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 194: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 195: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 196: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 197: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 200: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 201: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 202: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 203: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 204: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 205: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 206: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 207: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 208: Spain Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 209: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 210: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 211: Spain Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 212: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 213: Spain Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 214: Spain Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 215: Spain Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 216: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 217: Rest of Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 218: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 219: Rest of Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 220: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 221: Rest of Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 222: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 223: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 224: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 225: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 226: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 227: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 228: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 229: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 230: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 231: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 232: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 233: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 234: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 235: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 236: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 237: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 238: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 239: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 240: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 241: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 242: Rest of Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 243: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 244: Rest of Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 245: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 246: Rest of Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

The thermal printing Market in Western Europe is segmented by printer type, printing technology, industry and country from 2025 to 2035.

Western Europe Smart Space Market Growth – Trends & Forecast 2025 to 2035

Western Europe On-Shelf Availability Solution Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA