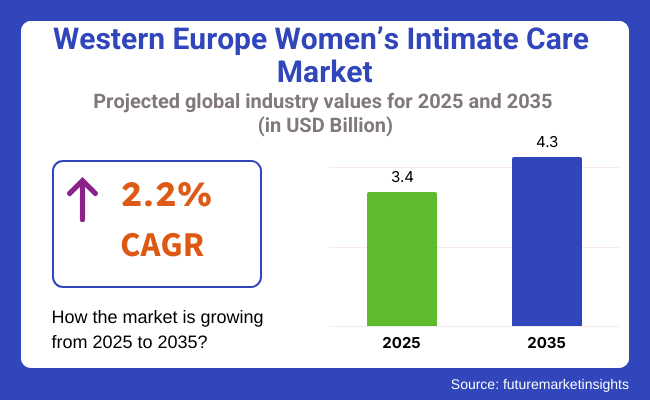

The Western Europe women’s intimate care market is poised to register a valuation of USD 3.4 billion in 2025. The industry is slated to grow at 2.2% CAGR from 2025 to 2035, witnessing USD 4.3 billion by 2035.

The market is on a steady growth path, primarily fueled by growing awareness about women's hygiene, a transition to wellness-oriented lifestyles, and changing social attitudes towards intimate well-being. Women in Western Europe are increasingly taking charge of their overall health, and intimate care is no longer considered a taboo topic but a natural part of daily personal hygiene routines.

This cultural transformation has paved the way for increased education and acceptance, leading more women to look for specialized products that address their specific needs-be it pH-balanced cleansers, organic wipes, or calming creams for sensitive skin.

The increasing power of social media and wellness influencers has also contributed to making discussions about intimate hygiene more mainstream, particularly among younger consumers. Educational information on vaginal health, skin care in the intimate zones, and changes associated with hormones is more prevalent than ever, giving women more informed choices.

This has triggered increased experimentation across new product categories and a drive for high-performance products that are gentle, safe, and supported by science. Clean beauty continues to penetrate intimate care with consumers looking for products that have no parabens, sulfates, fragrances, and strong chemicals.

Sustainability is another driver behind market growth. European consumers are renowned for their sustainability focus and, as a result, increasingly choosing biodegradable wipes, reusable period products, and brands with green packaging credentials. Moreover, demographic change-e.g., an increasing age cohort and rising menopause awareness-are broadening the target base, leading to the creation of intimate care products specifically formulated for older women.

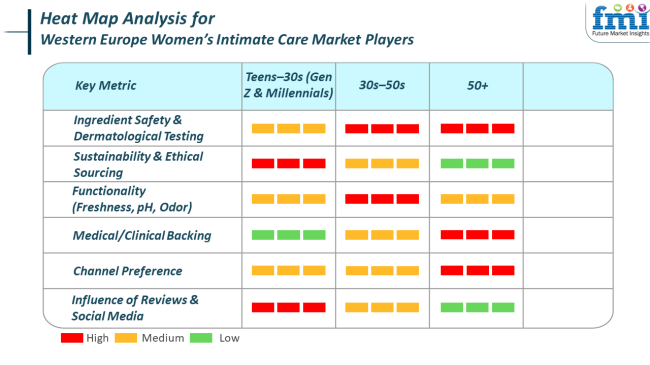

The market is changing dynamically with trends oriented around personalization, transparency, and wellness-led solutions. Demanding products like inner intimate wipes, foams, and gels with up-to-date, contemporary branding and uncluttered ingredient declarations, younger shoppers at 18-30 years are leading this change.

Influenced more by social media, this category is looking for products that work well but are also in consonance with life values like cruelty-free, sustainability, and veganism. In contrast, females in the age bracket of 30-50 prioritize functionality as well as protection, seeking physician-endorsed products that serve sensitivity, care after pregnancy, and hormonal change. Amongst women aged above 50 years, menopausal requirements of dryness comfort and skin smoothness are influencing the growth of niche products with a focus on discretion and clinically validated formulations.

Buying decisions amongst these segments are influenced by varied expectations and buying experiences. On-shelf at health stores and pharmacies, reliance, clinical endorsement, and company reputation are primary influencers, but online consumers prefer extensive product details, testimonials, and anonymity.

No matter the age, sustainability is becoming an across-the-board priority-recyclable packaging, biodegradable materials, and ethical sourcing are all considered more positively. Consumers today demand transparency, safe ingredients, and solutions that fit seamlessly into their wellness regimens, pointing to a market not only expanding but also growing more deliberate and consumer-centric.

Between 2020 and 2024, the women's intimate care market in Western Europe underwent a significant shift, driven by greater sensitivity around female hygiene and the growing value placed on self-care. In these years, the marketplace drifted away from plain hygiene products and towards more specialized, health-focused products.

The pandemic years were key to speeding up information on individual health, hygiene, and immunity-creating a push for women to look for mild, clinically proven, and pH-balanced products. Intimate washes, wipes, and natural remedies saw a surge in demand as consumers became increasingly discerning, opting for clean-label, fragrance-free, and dermatologically tested options.

Brands also started catering to various needs, like postpartum, menstrual ease, and skin sensitivities, creating a more expansive and inclusive product environment. Online platforms also gained popularity as a trusted distribution channel, providing privacy, access to reviews, and direct-to-consumer subscription.

Forward to 2025 to 2035, the market will become increasingly personalized, technology-driven, and environmentally friendly. Emerging trends will center around the convergence of intimate care within the larger wellness system-merging skincare, hormonal equilibrium, and even wearable technology.

Technologies such as microbiome-compatible products, menopause-oriented care, and hormone-balancing topical products will reframe consumer demand. Sustainability will move from trend to foundational norm, with packaging disclosure, carbon-neutral manufacturing, and refill-friendly formats becoming industry standards.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| During this time, consumers valued intimate basic hygiene with a strong focus on pH-balanced, dermatologist-tested, and fragrance-free products, particularly because of increased health consciousness as a result of the pandemic. | Intimate care will become a category of wellness in its own right, adding hormone support, microbiome harmony, and every day comfort to a preemptive health regimen. |

| Increased demand for natural ingredients, organic certifications, and "free-from" labeling, based on greater skin sensitivity and safety awareness. | Shoppers will look for sophisticated, clinically supported formulas, with a greater interest in biotechnological actives and treatments linked to life stages. |

| The market experienced a notable surge in online sales because of convenience and the growth of DTC (direct-to-consumer) brands with subscriptions and bundles. | Usage of apps, diagnostics, and AI tools will become mainstream, enabling brands to prescribe customized intimate care routines based on user information and health indicators. |

| Discussions about intimate health started to unravel, but product categories mostly remained within classic hygiene and cleansing products. | The market will branch into menopause, postpartum healing, and emotional health, with solutions customized to various stages in a woman's life. |

The Western Europe women's intimate care market, though expanding steadily, is subject to a number of inherent risks that may affect its future direction. Regulatory scrutiny and compliance are one of the most important risks. The EU has strict regulations over personal care and cosmetic products, especially in the areas of ingredient safety, labeling, and claims.

Any inconsistency or ambiguity in these fields can lead to product recalls, legal action, or brand reputation loss. This risk is increased for newer, smaller brands that might not have the resources to deal with complicated compliance procedures or invest in comprehensive product testing and documentation.

Another challenge is consumer trust and misinformation. As the market grows and more niche and indie players enter the arena, there's a greater likelihood of unverified health statements or products that fail dermatological requirements. Also, intimate care continues to be a delicate category; any error in messaging or advertising can lead to public backlash or cultural resistance, particularly in diversified European markets where intimate wellness attitudes are very diverse.

Intimate washes tend to be positioned as gentle, gynecologist-endorsed, and chemical-free, which makes them extremely appealing to consumers who care about safe, routine care. Demand is particularly high among younger and middle-aged women who are increasingly aware of vaginal health and prefer specialized products to regular soaps or body washes.

Panty liners also witness good sales because they are seen as convenient, discreet, and necessary for day-to-day discharge, light incontinence, or menstrual spotting. These liners are often bought in bulk form, hence common in most women's personal grooming routines. Intimate wipes form another rapidly increasing category because of their convenience and portability.

They are convenient for on-the-go hygiene during travel, working days, or menstruation. More and more consumers prefer biodegradable, fragrance-free wipes in line with the strong environmental awareness of the region and desire for skin-friendly products.

In Western Europe, the 26-40 years age group is the primary consumer segment for women's intimate care products. This group is generally made up of women who are in their reproductive age, post-childbearing, or juggling active careers and family life-factors that tend to heighten the demand for expert and regular personal care routines.

Women in these age groups are typically more health-aware, brand-conscious, and financially able to spend on superior or wellness-driven intimate care solutions. They will also tend to actively look for products that benefit vaginal health, hormonal balance, and comfort in various stages of life like menstruation, pregnancy, or postpartum.

This cohort frequently generates interest in a variety of goods and services such as intimate cleansers, wipes, panty liners, and moisturizers, the larger notion of overall hygiene and self-care. They are likely to prioritize ingredient clarification, dermatologist endorsements, and environmentally friendly formulation, and most likely to do so across online and offline sources.

Moreover, women within this group are digitally savvy and proactively access health content on the internet and are, therefore, very receptive to educationally driven promotions, influencer promotion, and well-being initiatives that normalize personal care.

Western Europe women's intimate care market is experiencing a dynamic shift, fueled by growing consumer awareness, heightened emphasis on personal hygiene, and expanding demand for natural, pH-balanced, and sustainable intimate care products. Consumers are demanding intimate care solutions that are both healthy and environmentally responsible, prompting companies to invest in cleaner, dermatologically-tested, and recyclable products.

Industry leaders Procter & Gamble, Johnson & Johnson, and Hindustan Unilever Limited are capturing the market with robust portfolios and recognized brands, while new entrants like WooWoo, SANFE.IN, and Joylux Inc. are focusing on niche markets with innovative, inclusive, and purpose-driven products.

These companies are using trends like vegan ingredients, personalized wellness, and emerging technology like smart pelvic health devices to outcompete. With Western Europe embracing a wider definition of well-being, the close care segment is transforming to address not only hygiene requirements, but also overall well-being and life harmony, challenging brands to innovate yet remain committed to values of safety, sustainability, and uniqueness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble (P&G) | 12-15% |

| Johnson & Johnson | 8-10% |

| Hindustan Unilever Limited (HUL) | 6-8% |

| Femfresh (by P&G) | 4-6% |

| Bodyform (by P&G) | 3-5% |

| WooWoo | 2-4% |

| Redcliffe Hygiene Private Limited | 2-4% |

| SANFE.IN | 1-3% |

| Joylux Inc. | 1-3% |

| QUEEN V | 1-2% |

| Other Niche Players | 10-15% |

Key Company Insights

Procter & Gamble (P&G)

Procter & Gamble (P&G) is a leading player in Western Europe women's intimate care, with high brand awareness through brands such as Always and Tampax. P&G has taken a leading position in terms of sustainability and product innovation, reflecting consumer trends for more environmentally friendly and health-oriented products.

Johnson & Johnson

Johnson & Johnson commands a solid market share with its established feminine care brands like Carefree and o.b. Reputed for its emphasis on safety and effectiveness, the company has been a trusted name in personal care for years.

Hindustan Unilever Limited (HUL)

Hindustan Unilever Limited (HUL) has expanded its footprint in the region with a strategic acquisition of VWash, a top feminine hygiene brand. This action supports HUL's move to capitalize on increasing demand for intimate hygiene products in Western Europe.

Femfresh, a P&G-owned brand, has carved out a niche in the market with its range of pH-balanced intimate washes and wipes. The brand appeals to consumers seeking gentle yet effective hygiene solutions that maintain the body’s natural balance.

Bodyform, also part of P&G, is famous for its sanitary pads and pantyliners that are all about comfort, protection, and reliability. Brand marketing also propagates body positivity and female empowerment and appeals to younger audiences.

WooWoo

WooWoo is a newer, colorful brand with a focus on clean-label and organic intimate care brands. It aligns perfectly with environmentally friendly consumers and presents an inclusive brand identity that overcomes traditional taboos surrounding feminine hygiene.

Redcliffe Hygiene Private Limited

Redcliffe Hygiene Private Limited is spreading its wings globally by providing a broad portfolio of feminine care solutions, ranging from pantyliners to intimate washes. Its focus on affordable hygiene is making it a trusted substitute in value-driven segments.

SANFE.IN

SANFE.IN offers a cutting-edge approach to the market with eco-friendly products such as menstrual cups, intimate wipes, and washes that are dermatologically tested and made for contemporary lifestyles. SANFE.IN is also a champion of women's health education and empowerment.

Joylux Inc.

Joylux Inc. is revolutionizing intimate wellness through medical-grade technology for pelvic health, postpartum healing, and menopause care. The technology-driven focus of the company sets it apart from mainstream hygiene product companies.

QUEEN V

QUEEN V is targeting the new generation of consumers seeking cruelty-free, vegan, and entertaining intimate care. In a straight-talking and unapologetic tone, it seeks to normalize discussions related to vaginal wellness and enable personal care routines.

In terms of product, the industry is classified into intimate washes, liners, oils, masks, moisturizers & creams, hair removal, gels, foams, exfoliates, mousses, mists, and sprays.

By age group, the market is divided into 12-19 years, 20-25 years, 26-40 years, 41-50 years, and 51 and above.

In terms of user, the industry is bifurcated into women without children and women with children.

With respect to sales channel, the market is divided into online sales and offline sales.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 3.4 billion in 2025.

The market is projected to witness USD 4.3 billion by 2035.

The industry is slated to capture 2.2% CAGR during the study period.

Intimate washes are widely sold.

Leading companies include Femfresh, Bodyform, WooWoo, Redcliffe Hygiene Private Limited, SANFE.IN, Joylux Inc., Hindustan Unilever Limited, Procter & Gamble, Johnson & Johnson, and QUEEN V.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 14: UK Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 16: UK Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 18: UK Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: UK Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany Industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 24: Germany Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 26: Germany Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 28: Germany Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Germany Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy Industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: Italy Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 36: Italy Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 38: Italy Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Italy Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France Industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: France Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 46: France Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 48: France Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: France Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain Industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 54: Spain Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 56: Spain Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 58: Spain Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Spain Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 62: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 64: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 66: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 68: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK Industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 41: UK Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 45: UK Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 49: UK Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: UK Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: UK Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 57: UK Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 58: UK Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 59: UK Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany Industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 71: Germany Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 75: Germany Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 79: Germany Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Germany Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 88: Germany Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy Industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 101: Italy Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 105: Italy Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 109: Italy Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Italy Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 118: Italy Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France Industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 131: France Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 135: France Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 139: France Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: France Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: France Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 147: France Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 148: France Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 149: France Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain Industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 161: Spain Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 165: Spain Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 169: Spain Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: Spain Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 178: Spain Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 186: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 190: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 194: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 198: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA