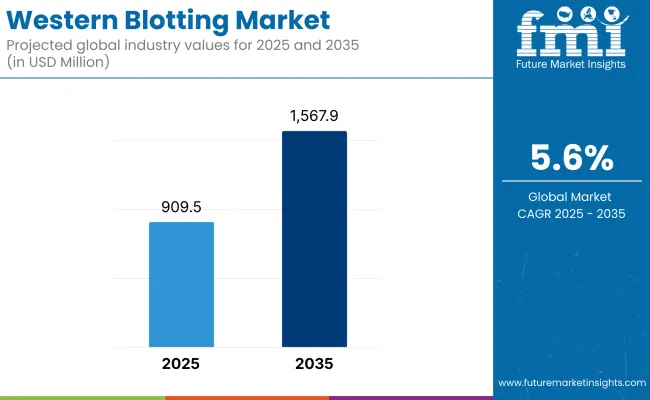

The global Western Blotting Market is estimated to be valued at USD 909.5 million in 2025 and is projected to reach USD 1,567.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. This growth is driven by the increasing prevalence of chronic diseases, such as HIV and Lyme disease, which necessitate reliable protein detection methods for diagnosis .

The technique's specificity and sensitivity make it indispensable in medical diagnostics and research applications. Additionally, substantial investments in R&D by pharmaceutical and biotechnology companies are fostering advancements in Western Blotting technologies, further propelling market expansion.

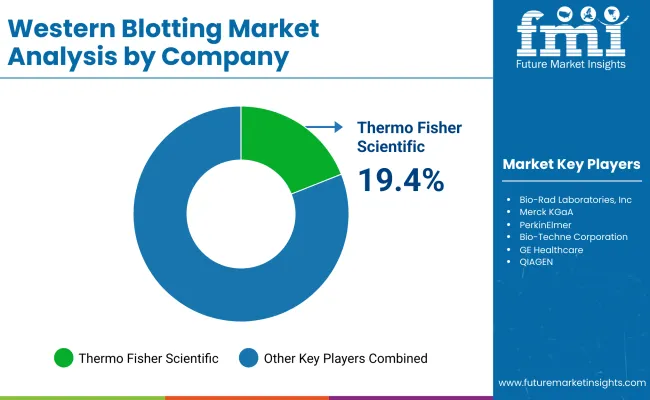

Prominent players in the market include Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, and F. Hoffmann-La Roche Ltd., each actively pursuing product innovation and strategic collaborations to strengthen market positioning. Notably, in 2024, Bio-Techne Corporation announced the launch of the Leo™ System, a next-generation Simple Western™ instrument offering enhanced throughput, flexibility, and automation compared to conventional blotting platforms.

“The upcoming introduction of the Leo System reaffirms Bio-Techne's commitment to advancing protein analysis technology. The ability to perform Western analysis at this scale is truly game-changing and will allow the adoption of Leo as a quantitative immunoassay platform in all stages of drug development and commercialization,” stated Will Geist, President of Protein Sciences. These product advancements are critical for improving data reproducibility, reducing human error, and accelerating protein quantification workflows across academic and commercial settings.

North America leads the Western Blotting market, buoyed by its advanced precision diagnostics ecosystem, especially in fields such as oncology and neurodegenerative disease research. The region’s widespread adoption of multi-omics platforms in large hospital systems and integrated research networks ensures Western blotting remains a cornerstone for protein validation.

In Europe, market growth is being propelled by the expansion of GLP-certified contract research organizations (CROs) in countries like Germany, France, and the Netherlands, particularly for pharmacokinetic and immunogenicity testing in early-phase drug trials.

The harmonization of bioanalytical method validation protocols across the EU under EMA guidance has fostered adoption of standardized, automated blotting technologies. Meanwhile, the growth of biosimilar development and requirements for post-market surveillance have made protein characterization via Western blotting an essential regulatory and research tool in the region.

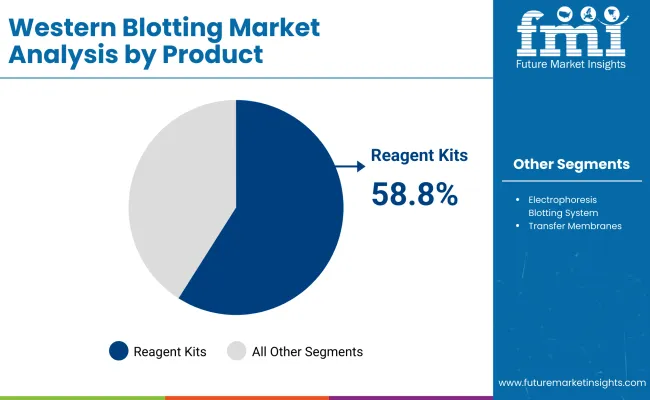

Reagent Kits are projected to dominate the Western blotting market in 2025, capturing approximately 58.8% of total revenue share. Their widespread adoption is driven by demand for standardized, ready-to-use reagents that enhance reproducibility and reduce manual preparation in both clinical and research workflows.

These kits are highly favored across diagnostic laboratories, academic institutions, and biopharma R&D centers due to their consistent performance in protein quantification and transfer efficiency. As applications expand into high-sensitivity detection and multiplex assays, specialized reagent kits designed for low-abundance proteins are gaining traction.

Their compatibility with automated Western blot platforms and GLP-compliant labs further supports growth. Additionally, their use in pharmacokinetic assessments, biomarker discovery, and infectious disease research underscores their scalability and practicality for protein analysis across diverse research settings.

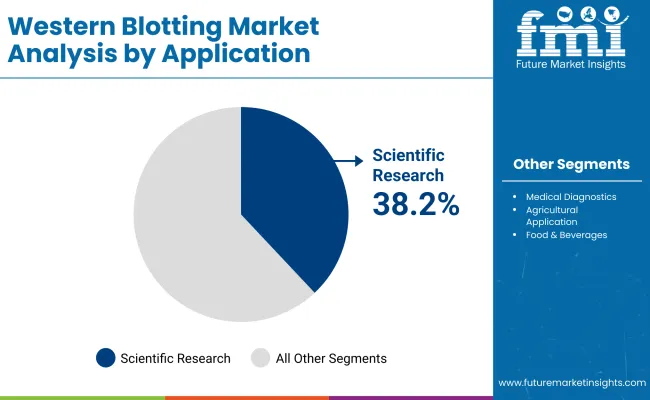

In 2025, The Scientific Research segment remains the primary application area for Western blotting, accounting for 38.2% of the market’s total revenue. This leadership stems from the technique’s foundational role in biological research, particularly in the study of protein expression, post-translational modifications, and cell signaling pathways.

It continues to serve as a critical validation tool for omics-driven investigations, including those in oncology, immunology, neurobiology, and metabolic disease research. Growing investments by public and private entities in biomarker discovery and therapeutic target validation have heightened demand for reproducible and sensitive blotting assays.

Additionally, the increasing emphasis on personalized medicine and rare disease characterization has reinforced the technique’s use in profiling molecular anomalies. As multi-disciplinary translational research gains momentum globally, Western blotting is expected to maintain its central role, driving continued expansion in this segment.

Challenges

Time-consuming and Labor-Intensive Nature of the Technique

The time-consuming and labor-intensive nature of the method is imposing barrier in the market. Traditional Western blot assays involve several manual steps like gel electrophoresis, protein transfer, antibody incubation, and imaging, thus leading to long processing times and higher potential for human error.

Aside from it the biggest barrier is the cost of instruments, reagents, and antibodies. Although automated Western blotting platforms are more effective, they are expensive to buy initially, which discourages their use in small labs and developing economies.

Further, threat from substitute protein detection techniques such as enzyme-linked immunosorbent assays (ELISA), mass spectrometry, and protein microarrays poses risk to market expansion. These are more likely to provide faster and more quantitative findings, thereby proving to be suitable alternatives in high-throughput testing for research and diagnostic purposes.

Despite these challenges, the increasing demand for proteomics research, advancements in automation, and chemiluminescence and fluorescence detection technology are expected to drive Western blotting procedures and fuel market growth.

Opportunities

Growing Interest in Proteomics and Biomarker Research Growing Opportunities for the Western Blotting Industry

Heightened proteomics and biomarker discovery activities are expected to open up tremendous growth opportunities for the Western blotting market. With the growing face of personalized medicine, Western blotting, being a vital technique in protein expression analysis, sees application in cancer research, neurological disease research, and drug development.

With newer technological advancements of automated Western blotting systems, other avenues are being opened up. Automated systems save time, minimize human error and variability, and are therefore considered a cost-effective protein detection approach. The recent developments of highly sensitive detection approaches, namely near-infrared fluorescence and chemiluminescence imaging, have begun contributing enormously to the accuracy of Western blotting.

As further developments ensue in digital imaging, machine learning for protein analysis, and lab automation, it will change the landscape of Western blotting to improved protein research and diagnostics in terms of efficiency and accuracy.

From 2020 to 2024, the market for western blotting sales has increased steadily mainly because of growth in applications in proteomics, disease diagnosis, and drug discovery. Growing research on infectious diseases, cancer, and neurodegenerative diseases led to demand for western blotting methods in research and clinical labs.

Advances in automation, for example, automated blotting systems, and more sensitive detection methods increased sensitivity and throughput. Nevertheless, difficulties involving long protocols, the costliness of reagents, and accessibility of substitute methods for protein analysis hindered the expansion of markets.

Looking ahead to 2025 to 2035, the market will be characterized by automation, AI-based image analysis, and new-generation blotting methods that maximize reproducibility while cutting processing times. Regulatory authorities will hone guidelines for clinical use, maintaining pace with the increasing role of western blotting in precision medicine.

The need for eco-friendly, low-waste reagents and more sustainable lab practice will increase, pushing innovations in green membrane materials and digital blotting technology. Furthermore, supply chain resiliency will be enhanced through localized production and diversification of vital reagent vendors.

The United States Western blotting market is following a strong growth pace, fueled by growing use in biomedical research, clinical diagnostics, and pharmaceutical drug development. Western blotting is a gold-standard method of analyzing protein in research labs, especially for the identification of biomarkers for neurological diseases, cancer, and infections.

The increasing prevalence of chronic diseases, including HIV/AIDS and Lyme disease, requires precise diagnostic methods, further increasing the demand for Western blot assays. Moreover, the development of automated and high-throughput blotting technologies has enhanced efficiency and reproducibility, rendering the method more convenient for researchers.

Market Growth Factors

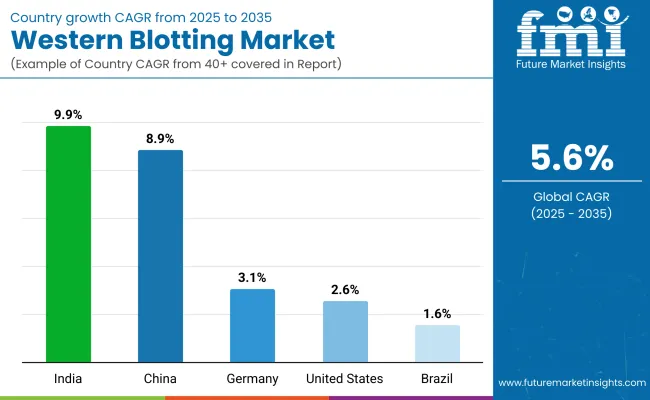

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

Germany's Western blotting market is growing consistently owing to a solid emphasis on biomedical research, biotechnology advancements, and government-funded healthcare programs. Germany boasts some of the best-developed life sciences industries in Europe, featuring established research institutes like the Max Planck Society and the German Cancer Research Center making active use of Western blotting for proteomic research.

The need for high-quality protein detection methods is growing, especially in the neurodegenerative disease area like Alzheimer's and Parkinson's. Furthermore, tight regulatory environments ensure the application of high-quality reagents and imaging systems, driving steady market growth.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.1% |

India's market for Western blotting is seeing considerable growth as a result of the rising incidence of infectious diseases, expanding interest in diagnostic research, and growing investments in the life sciences. The high incidence of tuberculosis, HIV, and autoimmune diseases requires trusted protein detection tools, keeping demand for Western blotting in clinical labs going. Moreover, the Indian government is also supporting biotech research actively through programs like 'Make in India' as well as investment in research centers like the National Institute of Immunology.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.9% |

China's Western blotting market is growing considerably with increasing government investment in biotechnology and the creation of growing research capabilities in universities and pharmaceutical companies. Precision medicine and targeted therapy have become increasingly important in the country, thereby necessitating higher demand for proteomics research and biomarker analysis in which Western blotting plays a critical role.

The development of infectious diseases, e.g., tuberculosis and hepatitis, has also stimulated the application of Western blot-based diagnostics. The reagents of Western blotting and imaging tools are also increasing in availability at research laboratories and hospitals through indigenous manufacturers who are making them less expensive.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.9% |

The sales for Western blotting products across Brazil is growing, owing to increased healthcare spending, growing biomedical research, and an expanding burden of chronic conditions. The country is seeing growing use of Western blotting to diagnose infectious conditions such as Zika virus and HIV/AIDS and cancer research. An increasing number of research centers and pharmaceutical companies in Latin America are also driving protein detection product demand.

Furthermore, collaborations with European and North American biotechnology firms are propelling the application of sophisticated blotting techniques. Economic uncertainty, disparities in access to healthcare, and reliance on foreign reagents and equipment are, however, impeding market growth.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.6% |

The Western blotting market is growing steadily with the surging incidence of infectious diseases, growing proteomics research demand, and development in molecular biology methods. Major market players are concentrating on automation, improved detection technology, and broadening their product portfolios to consolidate market positions. The market is highly competitive with established biotechnology companies and new players investing in new-generation Western blotting solutions.

Bio-Rad Laboratories, Inc. (14.6%)

Bio-Rad Laboratories uses its solid foothold in North America and Europe to build its Western blotting offerings around precision imaging and chemiluminescence detection. The firm spends money on automation to help automate workflow inefficiencies in academic and biopharmaceutical research laboratories. Building on personalized medicine, Bio-Rad deepens partnerships with CROs and biotech companies developing targeted therapies.

Thermo Fisher Scientific (19.4%)

Thermo Fisher Scientific leads the Western blotting market through combining blotting systems with electrophoresis and imaging offerings. In the USA, it addresses large pharma businesses and research centers through bundled offerings, providing value-for-money workflows. Growth in China and India comes through investing in local manufacturing and academic partnerships, minimizing reliance on imports. It leverages FDA and EMA validation necessities through marketing high-sensitivity reagents and antibodies for clinical research.

Merck KGaA (9.7%)

Merck KGaA expands its Western blotting business strategically through improved reagent quality and increased detection sensitivity for translational research. It reinforces European leadership by tapping into Germany's biotech cluster and collaborating with research institutes on R&D partnerships. In China and Japan, Merck focuses on localized manufacturing and GMP-qualified reagents to address stringent regulatory requirements. It also takes advantage of EU funding programs for proteomics and biomarker research.

PerkinElmer (8.2%)

PerkinElmer addresses high-growth areas such as precision medicine and drug discovery, offering Western blotting solutions specifically to pharma and CROs. PerkinElmer expands its presence in North America and Europe with strategic acquisitions centered on multiplexing and high-throughput detection. In India and Southeast Asia, PerkinElmer collaborates with government-sponsored biotech clusters to spur adoption in academic research. Its innovation strategy features AI-based blot imaging and automation to reduce variability in proteomics workflows.

Various other pharmaceutical and medical device companies contribute significantly to the western blotting market through a variety of drug formulations and surgical interventions. Notable players include:

As demand for Western blotting continues to grow, companies are prioritizing automation, enhanced detection technologies, and strategic collaborations to maintain their competitive edge and improve research outcomes.

Electrophoresis Blotting Systems, Reagent Kits and Transfer Membranes

Scientific Research, Medical Diagnostics, Agricultural Application, Food & Beverages and Other Applications

Diagnostic Laboratories, Research Institutions, Pharmaceutical & Biotechnology Companies

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for western blotting market was USD 909.5 million in 2025.

The western blotting market is expected to reach USD 1,567.9 million in 2035.

Rising prevalence of infectious diseases, cancer, and autoimmune disorders has significantly increased the demand for Western blot assays in clinical diagnostics.

The top key players that drives the development of Western Blotting Market are Thermo Fisher, scientific, Inc., Bio-Rad Laboratories, Merck KGaA, GE Healthcare and F. Hoffmann-La Roche Ltd

Reagent kits by product is western blotting market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA