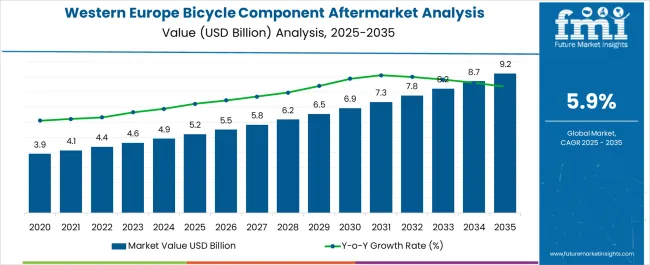

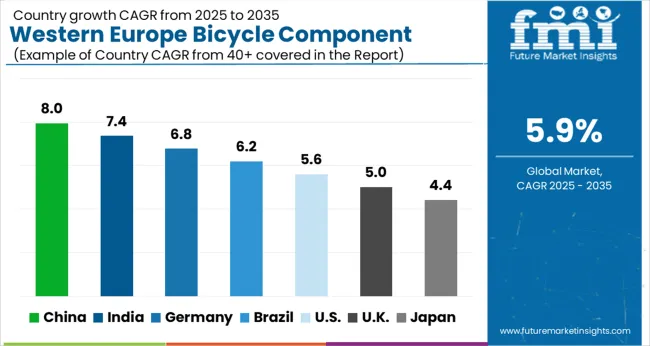

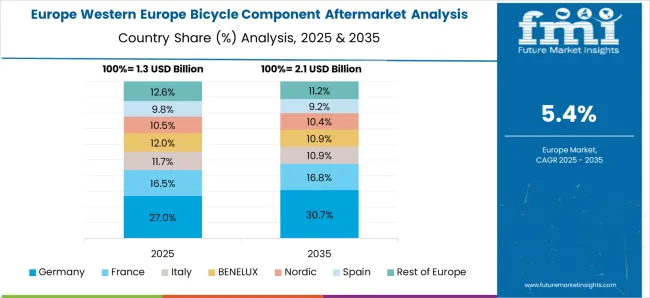

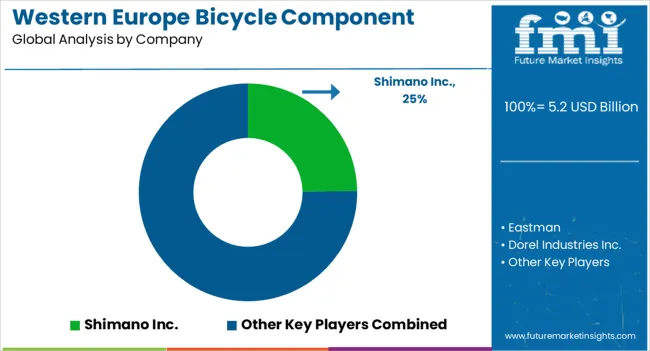

The Western Europe Bicycle Component Aftermarket Analysis is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Western Europe Bicycle Component Aftermarket Analysis Estimated Value in (2025 E) | USD 5.2 billion |

| Western Europe Bicycle Component Aftermarket Analysis Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The Western Europe bicycle component aftermarket is experiencing steady growth. Rising cycling adoption driven by environmental awareness, health consciousness, and urban mobility initiatives is supporting demand for replacement and upgraded components.

Current market dynamics are characterized by a mature retail network, technological advancements in component design, and increasing consumer preference for high-performance and durable parts. The future outlook is shaped by the expansion of specialty retail channels, growth in e-commerce penetration, and rising popularity of performance-oriented bicycles, which are driving replacement cycles and aftermarket consumption.

Growth rationale is anchored on the continued need for maintenance and upgrading of bicycles across urban and recreational users, the availability of diverse component options catering to different performance segments, and the presence of established supply chains that ensure consistent product availability These factors collectively support sustained revenue growth, enhanced consumer engagement, and deeper penetration of specialty components within the Western Europe market.

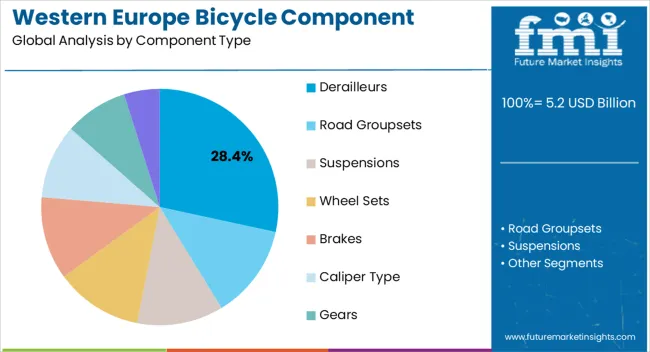

The derailleurs segment, representing 28.40% of the component type category, has been leading due to its critical role in gear shifting performance and rider experience. Adoption has been driven by the need for reliable, high-quality components that ensure smooth operation across varying terrain conditions.

Technological enhancements, such as lightweight materials and precision engineering, have reinforced consumer preference. The segment has benefited from strong brand recognition and consistent aftermarket availability.

Reliability, durability, and ease of installation have contributed to sustained market confidence Continued focus on innovation, performance optimization, and integration with advanced drivetrain systems is expected to maintain the segment’s leading share and support ongoing growth within the bicycle component aftermarket.

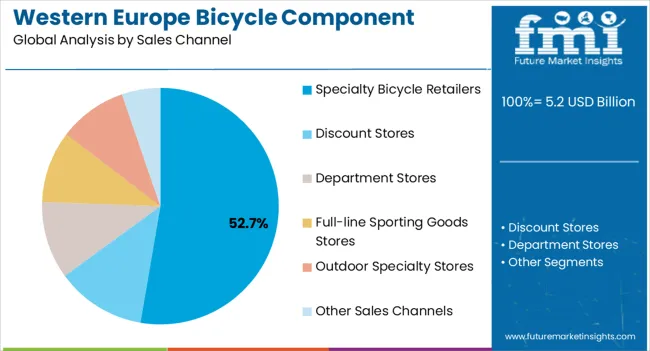

The specialty bicycle retailers segment, holding 52.70% of the sales channel category, has emerged as the dominant channel due to its expertise in product selection, personalized service, and access to high-performance components. Adoption has been reinforced by the ability to provide expert guidance, installation services, and post-purchase support.

The segment benefits from established customer loyalty and targeted marketing strategies. Availability of diverse brands and product ranges enhances consumer choice and satisfaction.

Strategic collaborations with component manufacturers have strengthened distribution efficiency and inventory management Continued emphasis on service quality, brand curation, and customer experience is expected to sustain the segment’s market share and reinforce its central role in the aftermarket ecosystem.

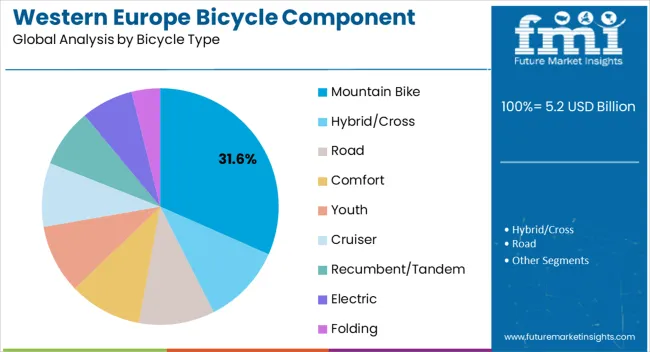

The mountain bike segment, accounting for 31.60% of the bicycle type category, has maintained a leading position due to increasing popularity of off-road cycling and recreational adventure sports. Adoption is driven by the demand for durable, high-performance bicycles capable of handling diverse terrains.

Segment growth has been supported by product innovations, enhanced component quality, and improved safety features. Consumers’ preference for rugged bicycles and consistent replacement cycles has reinforced market stability.

Engagement with specialty retailers and targeted marketing campaigns has strengthened brand visibility and sales penetration Ongoing technological upgrades, including advanced suspension systems and precision drivetrain integration, are expected to sustain the segment’s market share and continue to drive aftermarket demand in Western Europe.

The bicycle component aftermarket in Italy is projected to experience growth with a CAGR of 6.3% through 2035, indicating a thriving market. Meanwhile, despite exhibiting a slightly lower CAGR of 5.8%, Germany still signifies a steady and promising trajectory in the aftermarket sector. Both countries showcase positive trends, reflecting a buoyant landscape for bicycle component sales and adoption.

| Countries | CAGR through 2035 |

|---|---|

| Italy | 6.3% |

| Germany | 5.8% |

The bicycle component aftermarket in Italy is on an upward trajectory, forecasting a CAGR of 6.3% through 2035. This impressive growth signifies a flourishing industrial landscape driven by heightened consumer demand for aftermarket upgrades and components.

The favorable environment sets the stage for manufacturers and retailers to thrive, presenting ample opportunities for innovation and expansion of the dynamic bicycle component sector in Italy.

Germany bicycle component aftermarket demonstrates a promising outlook, boasting a noteworthy CAGR of 5.8% through 2035. While slightly below Italy growth rate, Germany market maintains resilience and steady progression.

Fueled by a robust cycling culture and a preference for high-quality, innovative components, Germany emerges as a pivotal player in the European aftermarket landscape. The projected growth underscores sustained consumer interest, offering a conducive market for businesses to explore and capitalize on emerging opportunities within the flourishing German bicycle component sector.Top of Form

In 2025, the bicycle component aftermarket is especially lucrative for road groupsets, constituting a substantial industrial share of 58.6%. By sales channel, departmental stores play a significant role, capturing a notable share of 37.5%, indicating diverse consumer channels within the bicycle component sector.

This distribution underscores the industrial focus on specialized components for road cycling and the accessibility of components through departmental retail outlets, contributing to a dynamic and varied aftermarket landscape.

| Category | Industrial Share in 2025 |

|---|---|

| Road Groupsets | 58.6% |

| Departmental Store | 37.5% |

In the landscape of the bicycle component aftermarket in 2025, road groupsets emerged as the dominant category, commanding a substantial industrial share of 58.6%.

This high percentage underscores a pronounced preference among consumers for specialized components tailored to road cycling, reflecting a strong market demand for performance-driven and technologically advanced groupsets.

The departmental store category claims a noteworthy share of 37.5%, highlighting the significance of diverse retail channels within the bicycle component sector. The accessibility of components through departmental stores signifies a broad consumer reach, indicating a robust retail presence for bicycle components beyond specialized outlets.

This diversified approach to distribution contributes to the overall resilience and accessibility of the bicycle component aftermarket, catering to a wide range of consumer preferences and purchasing behaviors.

| Attribute | Details |

|---|---|

| Estimated Size in 2025 | USD 5.2 billion |

| Projected Size in 2035 | USD 9.2 billion |

| Anticipated CAGR between 2025 to 2035 | 5.9% CAGR |

| Demand Forecast for the Bicycle Component Aftermarket in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing the Bicycle Component Aftermarket in Western Europe, Insights on Global Players and their Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Provinces Analyzed |

The United Kingdom, Germany, France, The Netherlands, Spain, Italy, Rest of Western Europe |

| Key Companies Profiled |

Eastman; Dorel Industries Inc.; Accell Group N.V.; Shimano Inc.; SRAM LLC; Hero Cycles Limited; Campagnolo S.R.L.; Merida Industry Co. Ltd.; Specialized Bicycle Components; Rohloff AG |

The global Western Europe bicycle component aftermarket analysis is estimated to be valued at USD 5.2 billion in 2025.

The market size for the Western Europe bicycle component aftermarket analysis is projected to reach USD 9.3 billion by 2035.

The Western Europe bicycle component aftermarket analysis is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in Western Europe bicycle component aftermarket analysis are derailleurs, road groupsets, suspensions, wheel sets, brakes, _hydraulic, _mechanical, caliper type, gears and others (bottom brackets etc.).

In terms of sales channel, specialty bicycle retailers segment to command 52.7% share in the Western Europe bicycle component aftermarket analysis in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Bicycle Component Aftermarket Insights by Component Type, Sales Channel, Bicycle Type, and Region: 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA