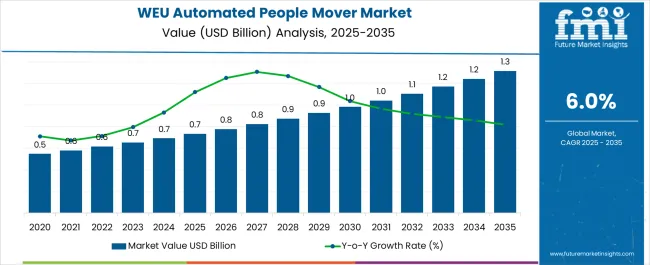

The Western Europe Automated People Mover Industry is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Western Europe Automated People Mover Industry Estimated Value in (2025 E) | USD 0.7 billion |

| Western Europe Automated People Mover Industry Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Western Europe automated people mover industry is expanding steadily due to growing urbanization, rising demand for sustainable mobility, and increasing investments in advanced public transportation infrastructure. Current industry dynamics are defined by the adoption of automated systems to improve passenger flow efficiency, reduce traffic congestion, and support environmentally friendly transport solutions.

Technological progress in automation, energy efficiency, and digital monitoring systems has further strengthened market acceptance. The future outlook is being shaped by large-scale infrastructure development projects, policy-driven emphasis on reducing carbon emissions, and the modernization of urban transit frameworks.

Growth rationale is reinforced by the ability of automated people movers to deliver cost-efficient, reliable, and safe mobility solutions that align with long-term sustainability goals Ongoing collaboration between system manufacturers, government agencies, and urban planners is expected to ensure widespread adoption, with demand projected to rise across both urban transit and specialized commercial applications.

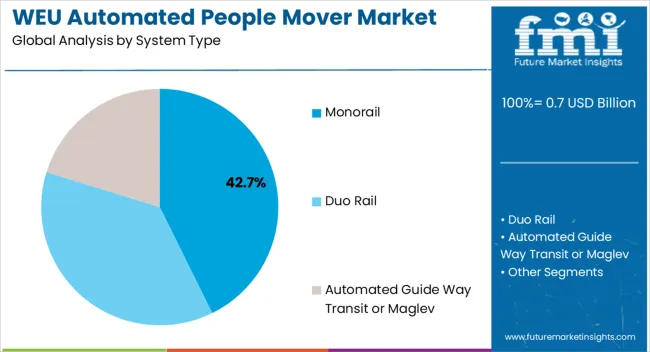

The monorail segment, holding 42.70% of the system type category, has emerged as the dominant configuration owing to its suitability for dense urban environments and relatively lower land-use requirements. The segment’s growth has been supported by technological improvements in automated control, structural durability, and energy efficiency, which have enhanced operational reliability.

Monorails are being increasingly deployed in metropolitan areas to alleviate congestion and provide seamless connectivity to existing transport hubs. Market share has been reinforced by government-backed infrastructure programs and public-private partnerships that prioritize sustainable and space-efficient solutions.

The integration of smart monitoring systems has enabled predictive maintenance and optimized performance, further elevating adoption Over the forecast horizon, the segment is expected to retain its leadership position, supported by continuous advancements in design and construction techniques that reduce lifecycle costs and improve passenger capacity.

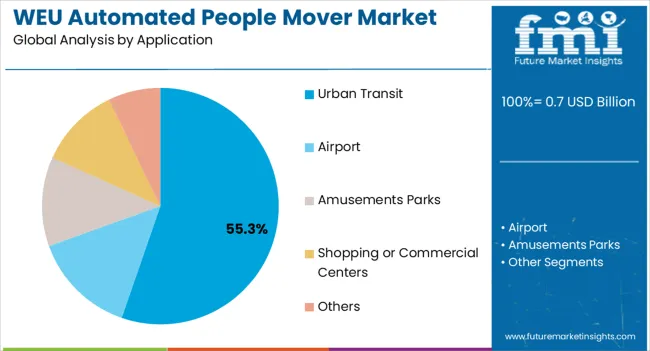

The urban transit segment, representing 55.30% of the application category, has maintained dominance as cities across Western Europe prioritize efficient, automated mobility solutions for growing populations. Its leadership has been driven by increasing demand for reduced road congestion, improved air quality, and enhanced connectivity across metropolitan areas.

The segment’s growth has been strengthened by integration with multimodal transit systems, ensuring last-mile connectivity and optimized passenger flow. Urban transit projects have benefited from strong regulatory support and significant government investments in green transportation infrastructure.

The segment has also been reinforced by technological innovation in autonomous driving systems, communication-based train control, and energy-efficient propulsion technologies Looking ahead, ongoing urban development and the push for carbon-neutral mobility are expected to drive sustained demand, ensuring that automated people movers continue to play a central role in shaping the future of Western Europe’s transit landscape.

Duo rail is the dominant force, projected to claim an impressive 81.5% industry share in the Western Europe automated people mover industry in 2025. The duo rail system excels in urban transit scenarios and is renowned for its unparalleled precision and efficiency.

| System Type | Duo Rail |

|---|---|

| Industry Share in 2025 | 81.5% |

Its dual-track design ensures enhanced stability, reliability, and streamlined operations. Embracing cutting-edge technology and modular adaptability, duo rail provides a versatile solution for varying infrastructural needs, solidifying its supremacy.

As Western Europe seeks advanced transit solutions, the exceptional performance of duo rail cements its status as the system of choice, shaping the future of urban mobility.

With a projected formidable 62.6% industry share in 2025, the airport application segment emerges as the powerhouse in the Western Europe automated people mover industry. Tailored to optimize passenger flow, reduce transit times, and enhance the overall airport experience, these systems are pivotal in large-scale terminals.

| Application | Airports |

|---|---|

| Industry Share in 2025 | 62.6% |

With a focus on efficiency and passenger comfort, automated people mover elevates the air travel journey, positioning airports as the primary adopters. As the Western Europe aviation sector thrives, the dominance of automated people mover within airport infrastructures continues to reshape the landscape of seamless tech-driven travel experiences.

| Regions Profiled | CAGR from 2025 to 2035 |

|---|---|

| France | 7.9% |

| Germany | 7.5% |

France's automated people mover industry rides a wave of evolution with a robust 7.9% CAGR through 2035, unveiling transformative trends. A surge in urban mobility projects witnesses’ automated people mover seamlessly integrated into France's cityscapes, connecting communities and reducing congestion.

The evolution of smart stations emerges, leveraging advanced technologies to optimize passenger experiences, from intelligent ticketing to real-time information dissemination. Its commitment to sustainability manifests in eco-friendly automated people mover, aligning with its green initiatives and promoting environmentally conscious transit solutions.

The rise of intermodal transit hubs signifies a trend where automated people mover seamlessly connects with various modes of transportation, fostering efficient and interconnected transit networks. A digital revolution unfolds, leveraging data analytics and IoT to enhance operational efficiency, predictive maintenance, and overall service quality, marking a new era in France's automated people mover landscape.

The Germany automated people mover industry, projecting a 7.5% CAGR through 2035, unveils a landscape ripe with opportunities. Germany's bustling airports present a significant opportunity for automated people mover, especially as airports expand to accommodate growing passenger traffic.

Integration into smart city projects marks a strategic opportunity, with automated people mover becoming integral components of its urban infrastructure. Developing interconnected transportation hubs provides fertile ground for automated people mover, enhancing seamless connectivity within its transit networks.

Opportunities arise to enhance tourist experiences as automated people mover offer efficient and novel ways to explore Germany's iconic attractions, fostering tourism-driven opportunities. With Germany's commitment to technological innovation, there is an opportunity for investment in research and development, pushing the boundaries of automated people mover capabilities and efficiency.

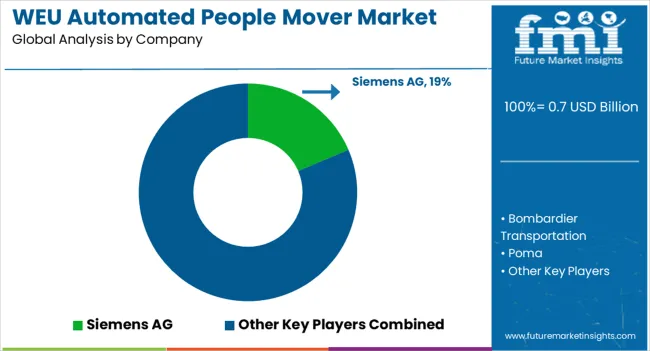

A dynamic competitive landscape unfolds in the Western Europe automated people mover industry. Industry leaders like Siemens spearhead innovation, offering advanced and customizable solutions. Local players, such as Poma and Doppelmayr, contribute region-specific expertise. Collaboration and strategic partnerships thrive, with companies like Hitachi joining forces for seamless integration. As urbanization and transit needs evolve, key players continually invest in research, development, and sustainable practices, ensuring a competitive edge. This amalgamation of global giants and niche specialists shapes a landscape where innovation, efficiency, and adaptability are the cornerstones of success.

Product Portfolio:

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.7 billion |

| Projected Industry Size by 2035 | USD 1.3 billion |

| Attributed CAGR between 2025 and 2035 | 6.0% |

| Historical Analysis of Demand for Automated People Mover in Western Europe Countries | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Report Coverage | Industry size, industry trends, analysis of key factors influencing Automated People Mover in Western Europe insights on global players and their industry strategy in Western Europe ecosystem analysis of local and regional Western Europe providers. |

| Key Countries Analyzed while Studying Opportunities for Automated People Mover in Western Europe | Germany, Italy, France, Spain, United Kingdom, BENELUX, Rest of Western Europe |

| Key Companies Profiled in the Industry Analysis of Automated People Mover in Western Europe | Siemens AG; Bombardier Transportation; Poma; Thales Group; Alstom SA; Ansaldo STS |

The global Western Europe automated people mover industry is estimated to be valued at USD 0.7 billion in 2025.

The market size for the Western Europe automated people mover industry is projected to reach USD 1.3 billion by 2035.

The Western Europe automated people mover industry is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in Western Europe automated people mover industry are monorail, duo rail and automated guide way transit or maglev.

In terms of application, urban transit segment to command 55.3% share in the Western Europe automated people mover industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Fabric Stain Remover Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Building Automation System Market by System, Application and Region - Forecast for 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA