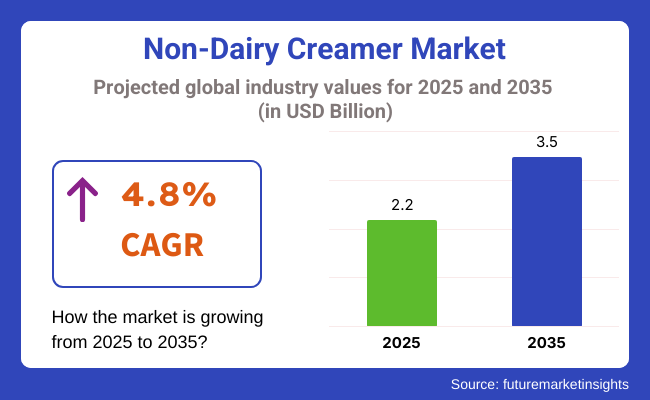

The Western Europe Non-Dairy Creamer Market will be worth USD 2.2 billion in 2025. According to FMI's report, the market will grow at a CAGR of 4.8% and reach USD 3.5 billion by 2035. Increasing cases of lactose intolerance and a high consumer transition towards plant-based and low-calorie products are key drivers driving the adoption of non-dairy creamers in Western Europe.

The industry is witnessing dynamic momentum, with Western European consumers gradually moving towards flexitarian and vegan diets, driving demand for plant-based creamers from almond, soy, coconut, and oats.

Demand is also driven by rising instances of lactose intolerance and green issues related to dairy production. Companies are competitively innovating with cleaner label ingredients, fortified nutritional content and organic labeling to gain market share.

Growth in ready-to-use and shelf-stable creamers is consistent with active lifestyles and use on the go, particularly among urban professionals. Single-serve packaging technologies are also suitable for use in supporting portability and portion control, facilitating uptake in household and food service markets.

Distribution channels within Western Europe are changing, and online stores, specialist vegan shops, and high-end supermarket shelves are becoming points of sale. Growing digital penetration and targeted online campaign marketing are expanding consumer reach and increasing brand visibility throughout the region.

Over the forecasting period, the market will experience robust growth propelled by sustained R&D expenditure and co-opetition among food-tech companies, retailers and plant-based ingredient companies.

Support from the regulatory framework and friendly labeling legislation in the EU are also driving product innovation and streamlining market entry for new players.

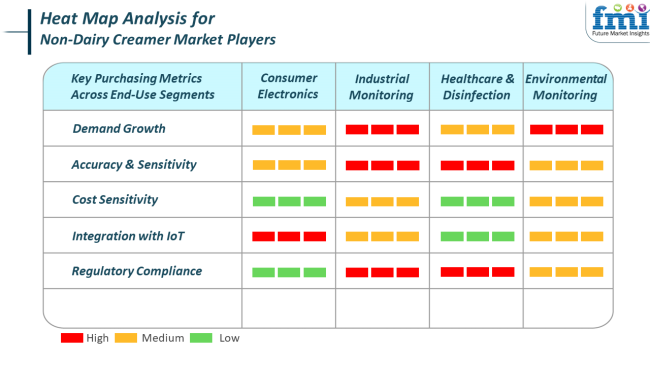

Consumer preferences differ greatly by use, but the underlying demand drivers are similar. The growth metric of demand indicates a broad consumer trend toward plant-based eating. In segments devoted to health and wellness, such as healthcare and environmental monitoring, this trend is especially evident.

Consumers in these groups gravitate toward products with clean labels and clear ingredient sourcing. Sensory sensitivity and flavor and texture accuracy are the most important differentiators in this sector.

Particularly for healthcare and disinfecting use, dairy-free creamers need to ensure consistent texture and nutritional stability, consistent with institutional dietetic requirements. Product uniformity and compatibility with automated dispensing equipment in industrial or automated settings like vending services remain critical.

Cost sensitivity remains the driver of purchasing decisions in all segments. As much as premium products overwhelm the shelves of urban retail, price sensitivity is more prevalent among high-volume institutional buyers in industrial and environmental segments.

The convergence of IoT with smart packaging and inventory monitoring also affects purchasing behavior, supporting predictive restocking and optimized supply chain streams.

The Western European non-dairy creamer market is confronted with a number of significant risks despite its optimistic growth prospects. Foremost among these is raw material volatility, especially for vegetable-based materials like almonds, coconuts, and oats. Climate change, crop disruptions, and volatile commodity prices create supply chain uncertainty that can drive up production costs and impact profit margins.

Another key issue is the regulatory environment, particularly around food labeling, allergens, and additive use. The stricter EU regulations over claims such as "organic," "natural," and "sugar-free" call for absolute compliance and disclosure, which might delay product launches and necessitate expensive reformulations. Small-scale manufacturers might find it challenging to scale or enter new markets because of these complicated requirements.

Market saturation and brand differentiation also represent additional risks, particularly in a saturated consumer market for plant-based alternatives. When so many brands are competing against the same health-conscious target, differentiation of offerings beyond simple lactose-free positioning becomes increasingly difficult. Innovation, flavor differentiation, and strategic alliances will be necessary to counteract this risk throughout the forecast period.

Between 2020 and 2024, Western Europe's market for dairy-free creamers witnessed consistent growth owing to growing consumer demand for plant-based and dairy-free products. Flexitarian and low-meat diets fueled gains in the adoption of dairy-free creamers as alternatives to conventional dairy and dairy products.

The growing popularity of clean-label products, i.e., uncomplicated and plain ingredient lists, also picked up with consumers. Sustainability concerns influenced consumer behavior, with green sourcing and packaging practices featured by companies.

During the forecast period 2025 to 2035, the marketplace is projected to continue expanding. The driver's momentum of the trend comes from the trend of plant-based eating, increased wellness awareness, and technology innovation in product formulation that will propel demand.

Dairy-free creamers that provide individualized optionality will become more popular among shoppers who demand customized choices. Besides, e-commerce and direct-to-consumer growth will further enhance product convenience and accessibility.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater consumption of plant-based and dairy-free nutrition. | Greater focus on health, wellness, and sustainability. |

| Rollout of more diversified flavors and formulations . | Functional and customized d airy -free creamers' development. |

| More emphasis on less use of dairy due to health reasons. | Still sustained interest in wellness and health, with functional ingredients emphasis. |

| More concern for environmental sustainability implications of dairy manufacturing. | More usage of sustainable packaging and sourced products. |

| Growing de mand for plant-based substitutes of conventional dairy products. | Growing demand for individualized and convenient non-dairy creamer. |

| Growing platforms and direct-to-consumer sales. | Growing e-commerce and online advertising campaigns. |

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

| France | 5.9% |

| Germany | 6.2% |

| Italy | 5.6% |

The UK will grow by 6.8% CAGR throughout the study. The UK is seeing significant traction owing to a growing shift among consumers towards lactose-free and plant-based options. There has been a boost in the number of vegans and an increasing number of people adopting the flexitarian way of living.

UK coffee culture is robust, and non-dairy creamers are increasingly being embraced by both at-home consumption and food service outlets. New product launches that are tailored to local tastes, such as oat-based and coconut-based creamers, are gaining popularity and enhancing the industry's appeal. In addition, the growing health-conscious consumer base is more likely to opt for products that support dietary requirements without compromising taste and texture.

Vegetable-based creamers fortified with functional ingredients such as MCT oil, protein, and low-sugar versions are evolving and gaining popularity. Foodservice restaurants, coffee shops, and specialty coffee boutiques are providing alternative creamers to meet diverse consumer tastes, further driving adoption. The presence of a supportive regulatory environment for plant-based products and more investments by regional and foreign players indicates that the UK will be an attractive hub in Western Europe.

France will register a growth rate of 5.9% CAGR during the study period. The traditional diets of France used to be dominated by dairy, but lifestyle changes and awareness of lactose intolerance are driving a steady movement towards alternatives from non-dairy sources.

The industry has experienced growing demand from younger customers, particularly within cities where a culture of eating vegan and plant-based foods has emerged. While the market shift is slow compared to some neighboring countries, strategic marketing by local as well as international brands has begun reshaping consumer behavior.

Furthermore, France's strong café culture and propensity to consume high-quality beverages are propelling the demand for non-dairy creamers in out-of-home and retail channels. Companies are using premium ingredients and offering new formulations that suit French taste profiles. Coconut, almond, and oat creamers are increasingly picking up shelf space.

Germany is expected to grow at 6.2% CAGR during the study period. Germany remains one of the most progressive markets in Western Europe for plant-based offerings like non-dairy creamers. There is high consciousness regarding sustainability, the environment, and individual health, resulting in demand for plant-based substitutes for traditional dairy.

German consumers have a high preference for organic and clean-label products, and this is amply seen in the purchasing decisions of creamers consumed in coffee and tea consumption. In urban centers such as Berlin, Hamburg, and Munich, customers are very adventurous and willing to try new product launches.

The variety of soy, almond, and oat creamers is on the rise, and nutrient-enriched products are gaining momentum. Some companies are focusing on staying ahead of sustainability trends by using sustainable packaging and sustainably sourcing ingredients.

The increasing network of organic hypermarkets and internet shopping sites also provides easy access to specialty non-dairy creamer products. German foodservice operators are increasingly incorporating non-dairy offerings into their menus to keep pace with heightened consumer demand. This combination of consumer trends, retail expansion, and innovation makes Germany a highly dynamic and promising region for dairy-free creamers.

Italy is expected to record a 5.6% CAGR growth during the study period. Traditionally renowned for its dense dairy heritage, Italy is witnessing a slow but powerful change in the use of dairy-free products, including creamers. The prime force behind the trend is changing lifestyles among consumers, a growing number of vegans, and rising concerns over lactose intolerance.

Though traditional dairy remains an integral part of most households, modern consumers are beginning to dabble in substitutes with similar flavor and functionality. Italian consumers are particularly drawn to creamers that replicate the creamy texture and taste of natural dairy, oftentimes opting for almond-based, rice-based, and oat-based varieties.

Medical concerns are driving customers towards plant-based alternatives. Italian coffee culture, so deeply ingrained in daily life, is an excellent chance for non-dairy creamer manufacturers to leverage household and café bases. Although growth is slow rather than explosive, product innovation to meet local tastes and expanding retail distribution are poised to fuel demand. Italy's gradual shift to plant-based trends renders it an emerging and important region for non-dairy creamer products in Western Europe.

The dominant mode of non-dairy creamers in Western Europe will be powder-based in 2025, with a projected share of 60.2%, in comparison to 39.8% of liquid ones. Consumers prefer the use of such creamers based on their convenience, shelf life, and versatility.

Powdered non-dairy creamers are popular due to their long shelf life and easy use. They are generally used for beverages like coffee, tea, and hot chocolate, as well as for making culinary dishes and desserts. Leading companies include Nestlé with its Coffee-Mate and Friesl and Campina with its Kremelta, which remains very active in the powder segment in Western Europe.

The appeal of the powder creamers increases further because the powder is stored at room temperature. This feature draws on the appeal of both home users and food service operators who wish to have the convenience of using it without refrigeration for storage. With most of the plant-based, lactose-free, and vegan options available in powdered forms emerging in the market, the demand for these products is growing since most of the consumers are now shifting to going dairy-free.

Liquid non-dairy creamers, whose share will be 39.8% in 2025, make choices among consumers who look for richer, creamier components in their beverages. Liquid, moreover, offers ease of ready use, mostly in coffee shops, restaurants, and cafés.

Major brands such as Starbucks, with its line of non-dairy liquid creamers, and Oatly's reputation on oat-based liquid creamers have recently grown tremendously in the region within this segment. Liquid creamers are mostly favored for their consistency and easy blending into hot and cold beverages, which further boosts their attractiveness for both domestic and commercial use.

By flavor, the original/unflavored variant is projected to capture 46.3% of the share. The French vanilla flavor is anticipated to hold 22.5% of the share, reflecting the growing popularity of flavored options.

With its use as a general-purpose or neutral-flavored liquid additive in several beverages, from coffee to tea to baked goods, the original/unflavored segment, more than anything else, has proven itself in the versatility of its usage. It serves well for consumers who prefer enhancement in taste without really changing the flavor of the beverages they try.

Original and unflavored variants are appealing to a wider demographic, with the leading brands being Coffee-Mate from Nestlé and Alpro by Danone. These creamers are dominantly used in homes as well as commercial applications such as coffee shops and restaurants. This adaptability and increasing demand for dairy-free and other plant-based alternatives just keep driving the original/unflavored category upwards.

French vanilla creamers are well-loved, and they are estimated to capture about 22.5% of the entire industry. Most customers use these creamers to achieve a richer, more opulent flavor in their beverages. French vanilla delivers a sweet and creamy taste without the necessity of using any additional sweeteners.

Firms like International Delight and Silk give a wide variety of French vanilla non-dairy creamers and serve flavored customers looking to present a specific flavor to their coffee or tea. The segment is really popular in both home use and food service outlets; coffee shops and cafés frequently feature a very popular flavor choice: French vanilla creamers.

Western Europe is now witnessing a change in formulation strategies towards plant-based, allergen-free, and clean-label products due to the evolving lifestyles of consumers and sustainability demands. Market consolidation is being led by Nestlé S.A. and Danone S.A., which diversified their product portfolios by putting funds into oat, almond, and coconut bases of creamers.

These varied creamers match the increasing trend of dairy reduction in the region. Nestlé is using its solid brand position across Western Europe and launching vegan-friendly coffee enhancers. Danone's Alpro and other plant-based lines continue to flourish relative to the retail and food service industries. Friesland Campina Kievit BV is a proven expert in functional creamers, and it added advantages by deploying its microencapsulation and sensory optimization technologies for solubility and taste enhancements in both instant beverages and vending applications.

Mokate Group also comes straight through to the mid-tier segments with some customizable private-label offerings meeting all relevant EU regulatory standards. All these companies are also increasing their exports to Eastern Europe while using the cost efficiencies in production in Western Europe.

Southeast Asia has more competitors like PT Santos Premium Krimer and Shandong Tianjiao Biotech, which are seeking partnerships to set foot in Europe but, unfortunately, must cross hurdles related to product and regulatory compliance issues. Fight about taste innovation, functional performance, and sustainability certification drives constant investment in the chain.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Nestlé S.A. | 16-19% |

| Danone S.A. | 13-16% |

| Friesland Campina Kievit BV | 11-13% |

| Mokate Group | 7-9% |

| Viceroy Holland B.V. | 5-7% |

| Other Players | 37-48% |

| Company Name | Offerings & Activities |

|---|---|

| Nestlé S.A. | Plant-based and functional creamers under Nescafé and Starbucks brands, sustainability focus. |

| Danone S.A. | Alpro line with almond, oat, and soy creamers; active in HoReCa and direct-to-consumer. |

| Friesland Campina Kievit BV | Functional, foaming, and whitening creamers for instant drinks; sensory and texture R&D. |

| Mokate Group | Instant coffee mixes and powdered creamers; private-label manufacturing and exports. |

| Viceroy Holland B.V. | Customizable non-dairy creamer solut ions; focus on vending and private-label markets. |

Key Company Insights

Nestlé S.A. leads the Western European non-dairy creamer market with a 16-19% share, owing to its dominant retail presence and strategic innovations in plant-based and barista-style creamers under premium labels like Starbucks and Nescafé. Its continued investments in carbon-neutral production and recyclable packaging have bolstered its appeal to eco-conscious consumers.

Danone S.A., holding a 13-16% share, continues to leverage its Alpro brand across multiple dairy-free platforms. The company’s distribution strength in both supermarket chains and food service channels has allowed it to scale its oat- and almond-based creamers rapidly.

Friesland Campina Kievit BV, with an 11-13% share, remains a functional innovation leader. It supplies B2B partners with high-performance creamers optimized for vending and instant beverages, using proprietary texturizing and encapsulation technologies. Mokate Group commands 7-9% of the overall share.

It is recognized for its value-tier and private-label offerings, particularly in Central and Eastern Europe, where Western European production facilities offer logistical advantages. Viceroy Holland B.V., at 5-7% share, continues to grow via its vending and convenience-focused non-dairy creamer lines, often working with European retail chains to develop custom formulations.

The segmentation is into powder and liquid forms.

The segmentation is into organic and conventional categories.

The segmentation is into original/unflavored, French vanilla, chocolate, coconut, hazelnut, and other flavors.

The segmentation is into original, light, and fat-free types.

The segmentation is into plant-based milk (including almond, coconut, and others) and vegetable oil.

The segmentation is into HoReCa/foodservice, food and beverage processing (including food premixes, soups and sauces, coffee mixes, tea mixes, bakery products and ice creams, RTD beverages, infant food, prepared and packaged food), and household/retail.

The segmentation is into retail (including sachets, bags, pouches, canisters, and bottles), plastic jars, and bulk packaging.

The regions covered include the UK, Germany, Italy, France, Spain, and the rest of Western Europe.

The industry valuation in 2025 stands at USD 2.2 billion.

The industry is expected to expand to a valuation of 3.5 billion through 2035, with growing consumer interest in plant-based and dairy-free alternatives.

The UK is expected to see significant growth, with a projected CAGR of 6.8%.

Key players include Nestlé S.A., Danone S.A., Friesland Campina Kievit BV, Mokate Group, Viceroy Holland B.V., Super Group Ltd., Shandong Tianjiao Biotech Co. Ltd., Preserved Food Specialty Co. Ltd., Rich Products Corporation, PT Santos Premium Krimer, Custom Food Group, and Fujian Jumbo Grand Food Co Ltd.

Powder-based non-dairy creamers are currently the most widely used products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA