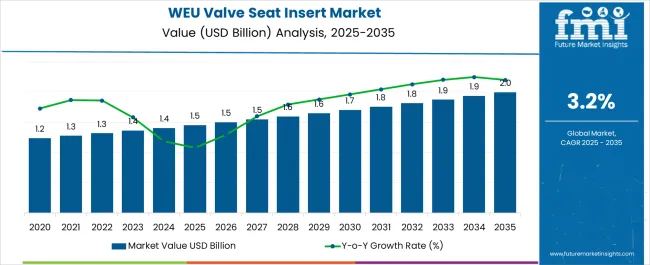

The Western Europe Valve Seat Insert Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Western Europe Valve Seat Insert Market Estimated Value in (2025 E) | USD 1.5 billion |

| Western Europe Valve Seat Insert Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The Western Europe valve seat insert market is experiencing steady growth. Rising vehicle production, stringent emission norms, and increasing focus on fuel efficiency are shaping demand across the region. The current scenario reflects a strong reliance on advanced materials and precision engineering to enhance durability and performance under high-pressure conditions.

Automotive OEMs are prioritizing valve seat inserts that support improved thermal conductivity and wear resistance, ensuring compliance with evolving regulatory frameworks. Supply chain resilience and localized production capabilities are further strengthening market stability. Future outlook indicates increasing adoption of lightweight alloys and steel-based variants tailored for high-performance engines.

Growth rationale is supported by the expanding automotive aftermarket, rising investments in cleaner internal combustion technologies, and the ongoing transition toward hybrid vehicles, where valve seat inserts remain a critical component for optimal engine functionality Collectively, these drivers are expected to maintain robust demand and ensure continued innovation in the regional market.

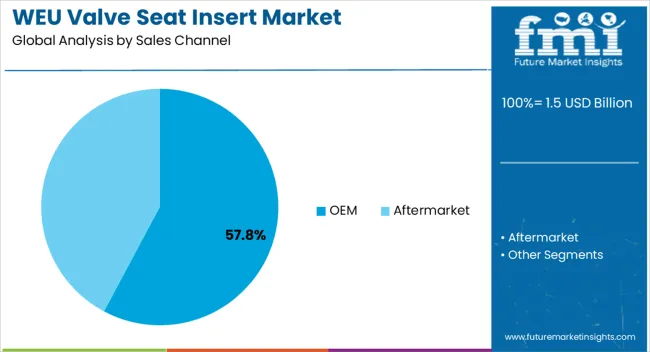

The OEM segment, holding 57.80% of the sales channel category, has been leading due to the consistent demand from vehicle manufacturers and the integration of valve seat inserts during original engine assembly. Market dominance has been reinforced by strong partnerships between component suppliers and automotive OEMs, ensuring steady volumes and long-term contracts.

The segment’s position is supported by the emphasis on high-quality materials, adherence to regulatory requirements, and continuous upgrades in engine designs. Production synergies and economies of scale have strengthened the cost-effectiveness of OEM sourcing.

The increasing penetration of hybrid and advanced gasoline engines has further secured the relevance of OEM-based inserts This segment is expected to sustain its leading role as manufacturers continue to prioritize quality assurance and compliance, ensuring long-term stability in the Western European market.

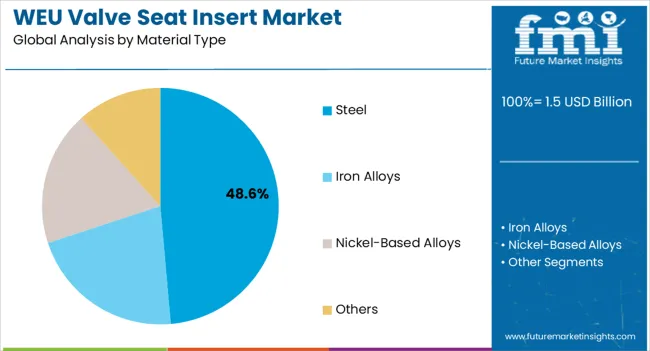

The steel segment, representing 48.60% of the material type category, has maintained its leadership due to its superior strength, wear resistance, and thermal stability under extreme engine conditions. Its widespread application in high-performance and heavy-duty engines has supported consistent demand.

The segment’s growth has been reinforced by advancements in metallurgical processes that enhance fatigue resistance and extend service life. Market preference has also been shaped by steel’s cost-effectiveness and availability, ensuring its continued adoption despite the gradual introduction of advanced alloys.

Compliance with stringent automotive standards has further strengthened the acceptance of steel inserts Ongoing development in heat treatment and machining techniques is expected to enhance durability and reduce manufacturing costs, thereby ensuring the segment retains its competitive position in the material landscape of the market.

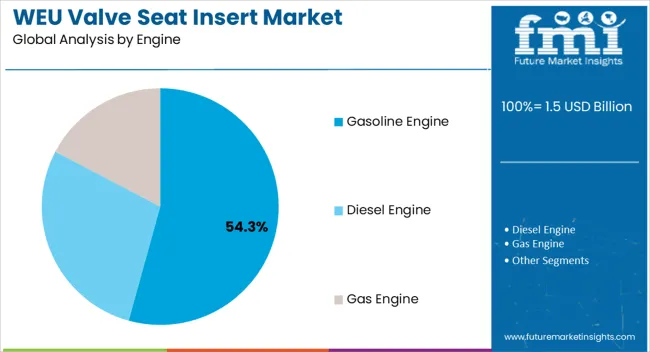

The gasoline engine segment, accounting for 54.30% of the engine category, has led the market owing to the dominant share of gasoline-powered vehicles across Western Europe. Market leadership has been supported by the region’s preference for gasoline passenger cars, reinforced by lower purchase costs and favorable infrastructure.

Valve seat inserts for gasoline engines have been consistently in demand due to the requirement for durability, efficient combustion, and compliance with emission regulations. The segment has benefited from ongoing innovations in engine downsizing and turbocharging, where high-performance inserts play a crucial role in maintaining reliability.

Market resilience has been supported by the slow transition away from internal combustion engines, as gasoline engines continue to serve as a mainstream choice alongside hybrids The segment is expected to remain a major contributor, supported by technological refinements and stable consumer preference in the mid-term outlook.

A valve seat insert serves as a wear-resistant and heat-dissipating component in the valve train of an internal combustion engine. Iron alloy is projected to capture a 47.3% industry share in 2025.

The demand for vehicle components, such as valve seat insert, is on the rise, driven by the increasing regional demand for vehicles, particularly in emerging economies. The use of iron alloys in valve seat insert increase as engine design and manufacturing processes advance. Manufacturers consistently seek materials that are durable, cost-effective, and provide improved performance.

| Western Europe Valve Seat Insert Industry Based on Material Type | Iron Alloy |

|---|---|

| Industry Share in 2025 | 47.3% |

Based on the engine type, gasoline valve seat insert are anticipated to be the most popular. Gasoline engine types are expected to hold a 56.5% share in 2025. Advances in metallurgy and materials science have led to the development of valve seat insert capable of withstanding high temperatures, wear, and deterioration.

Manufacturers and consumers alike are likely to be more attracted to valve seat insert made with advanced materials like alloys and ceramics that extend the component's life. As engines are downsized and turbocharged to maintain performance with fewer displacements, component manufacturers are developing parts that can withstand higher temperatures and pressures.

| Western Europe Valve Seat Insert Industry Based on Engine Type | Gasoline |

|---|---|

| Industry Share in 2025 | 56.5% |

| Attributes | Forecast CAGRs of 2025 to 2035 |

|---|---|

| United Kingdom | 2.80% |

| Germany | 3.10% |

| France | 3.40% |

Engineering excellence and cutting-edge technology combine in the United Kingdom's automotive industry. Providing wear resistance and efficient heat dissipation, valve seat insert are crucial. The valve seat insert industry in the United Kingdom are expected to expand at a CAGR of 2.80% during the forecast period.

High-performance vehicle manufacturers in the United Kingdom use inserts like these to ensure engine reliability. As engines become increasingly capable of running on different types of fuel, valve seat insert become a key component as the industry develops alternative power sources.

Germany is renowned for its high-quality automotive manufacturing and precision engineering. A CAGR of 3.10% is predicted for the industry through 2035. Performance and longevity are both enhanced through the use of valve seat insert in German engine design. Increasing combustion efficiency and heat transfer are priorities for companies that manufacture valve seat insert.

Environmental sustainability and stringent emissions standards are achieved using these inserts to promote cleaner combustion and lower emissions. German automotive industries are known for their robust engineering standards, making valve seat insert a common feature.

Among the automotive industries in France, innovation and performance are very important. France is expected to exhibit a 3.40% CAGR during the forecast period. Valve seat insert is widely used in France for internal combustion engines to be more durable and efficient. Technology that reduces emissions and improves fuel efficiency is a priority for manufacturers in France.

Valve seat insert aligns with these goals by reducing wear and tear on critical engine components and ensuring optimal combustion efficiency. With their potential to improve engine lifespan and fuel economy, valve seat insert is also a practical choice for France's automotive sector, committed to sustainability.

The valve seat insert industry remain competitive because foreign companies have strong technical capabilities. Several industry players can only operate locally in this highly fragmented industry. Mergers, acquisitions, and collaborations are crucial tactics that key players use to expand their global footprint.

The number of companies and solution providers looking for valve seat insert made in the country has increased substantially. New companies with solid technological skills have entered the industry, so competition persists. Industry players use product development as their main growth strategy to maintain long-term competitiveness.

Key Developments Observed Valve Seat Insert in Western Europe

| Attributes | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.5 billion |

| Projected Industry Valuation by 2035 | USD 2.0 billion |

| Value-based CAGR 2025 to 2035 | 3.2% |

| Historical Analysis of the Valve Seat Insert in Western Europe | 2020 to 2025 |

| Demand Forecast for Valve Seat Insert in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key Factors Influencing valve seat insert in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Countries Analyzed While Studying Opportunities in Valve Seat Insert in Western Europe | Western Europe, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic, Rest of Western Europe |

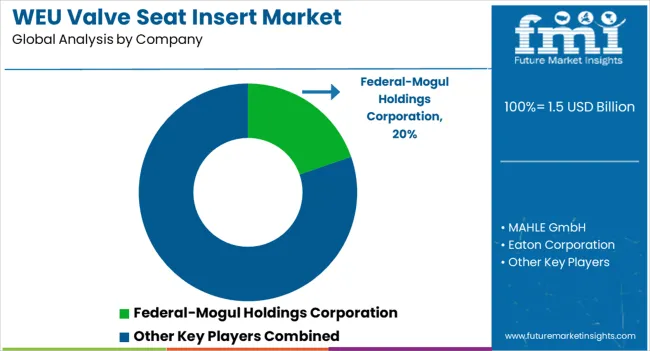

| Key Companies Profiled | Federal-Mogul Holdings Corporation; MAHLE GmbH; Eaton Corporation; Danfoss A/S; Flowserve Corporation; Rottler Manufacturing |

The global Western Europe valve seat insert market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the Western Europe valve seat insert market is projected to reach USD 2.0 billion by 2035.

The Western Europe valve seat insert market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in Western Europe valve seat insert market are oem and aftermarket.

In terms of material type, steel segment to command 48.6% share in the Western Europe valve seat insert market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Korea Valve Seat Insert Market Trend Analysis Based on Sales, Material, Engine, End-Use, and Provinces 2025 to 2035

Japan Valve Seat Inserts Market Trend Analysis Based on Sales Channel, Material, Engine, End-Use and Provinces 2025 to 2035

Automotive Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA