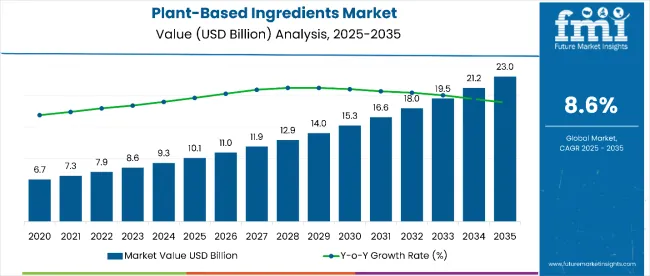

The plant-based ingredients market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 23.0 billion by 2035, registering a CAGR of 8.6% over the forecast period. The plant-based ingredients market is projected to add an absolute dollar opportunity of USD 12.9 billion over the forecast period, reflecting a 2.3 times growth at a compound annual growth rate of 8.6%.

Quick Stats for Plant-Based Ingredients Market

| Metric | Value |

|---|---|

| Plant-Based Ingredients Market Estimated Value in (2025E) | USD 10.1 billion |

| Plant-Based Ingredients Market Forecast Value in (2035F) | USD 23.0 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The market's evolution is expected to be shaped by rising health consciousness, growing vegan population, and increasing demand for functional foods with clean-label ingredients.

By 2030, the market is likely to reach approximately USD 5.2 billion, accounting for USD 2.6 billion in incremental value over the first half of the decade. The remaining USD 5.3 billion is expected during the second half, suggesting a strongly back-loaded growth pattern. Product diversification across probiotics, plant proteins, and phytochemicals is gaining traction due to expanding applications in functional beverages, dietary supplements, and alternative protein formulations.

Companies such as Nestle SA and Danone S.A. are advancing their competitive positions through investment in fermentation technologies, plant protein extraction methods, and sustainable ingredient sourcing. Clean-label and natural ingredient procurement models are supporting expansion into premium organic segments, functional food applications, and personalized nutrition solutions.

The market holds approximately 42% of the functional food ingredients market, driven by growing consumer preference for natural, plant-derived alternatives to synthetic additives. It accounts for around 35% of the nutraceuticals market, supported by increasing awareness of the health benefits of plant-based compounds like probiotics, phytochemicals, and plant proteins.

The market contributes nearly 28% to the clean-label ingredients market, particularly for products requiring transparent, recognizable ingredient lists. It holds close to 32% of the sustainable ingredients market, where plant-based alternatives offer environmental benefits over animal-derived ingredients. The share in the specialty nutrition market reaches about 38%, reflecting growing demand for targeted nutritional solutions from plant sources.

The market is undergoing structural change driven by rising health consciousness, environmental sustainability concerns, and technological advances in plant-based ingredient extraction and processing. Advanced manufacturing methods using fermentation, enzyme technology, and precision extraction have enhanced ingredient functionality, bioavailability, and taste neutrality, making plant-based alternatives increasingly comparable to traditional ingredients.

Manufacturers are introducing specialized formulations for specific health conditions, age groups, and dietary preferences, expanding applications across functional foods, beverages, and dietary supplements.

The market is segmented by type, claims, sales channel, end use, buyer type, and region. By type, the market is segmented into staple food, specialty food, dairy substitutes, food additives, and nutrients & supplements. Based on claims, the market is divided into GMO, non-GMO, and organic.

In terms of sales channel, the market is classified into direct sales, modern trade, convenience stores, specialty stores, small groceries, online retail, and other sales channels. The end use segment includes food & beverages, cosmetics & personal care, nutraceuticals, and agricultural.

By buyer type, the market is characterized into HoReca, food processors & manufacturers, and household & residential. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

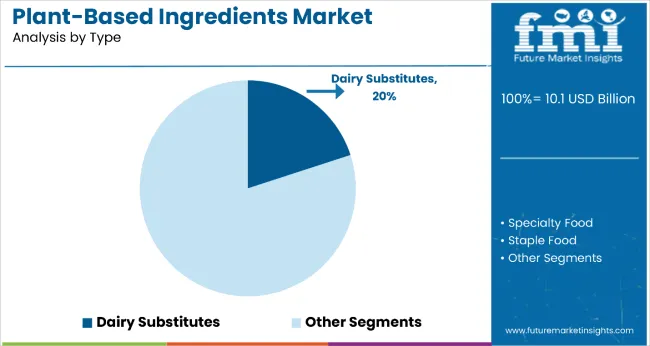

The dairy substitutes segment holds a significant 20% share in the type category, driven by rising consumer demand for plant-based milk, yogurt, cheese, and cream alternatives derived from soy, oats, almonds, peas, and coconut. The segment’s rapid expansion is attributed to increasing lactose intolerance, growing vegan and flexitarian lifestyles, and preference for cholesterol-free and allergen-friendly products.

Key industry players such as Cargill, ADM, and Roquette are actively innovating in this space, focusing on clean-label, high-protein formulations that replicate the taste and functionality of traditional dairy.

As consumer values shift toward health, sustainability, and ethics, the segment is poised for sustained growth, supported by government-led dietary initiatives and ESG commitments from major food corporations. Greater product availability across retail, foodservice, and e-commerce channels, alongside breakthroughs in precision fermentation and enzyme-enhanced flavor technology, is expanding the appeal of dairy substitutes among mainstream consumers.

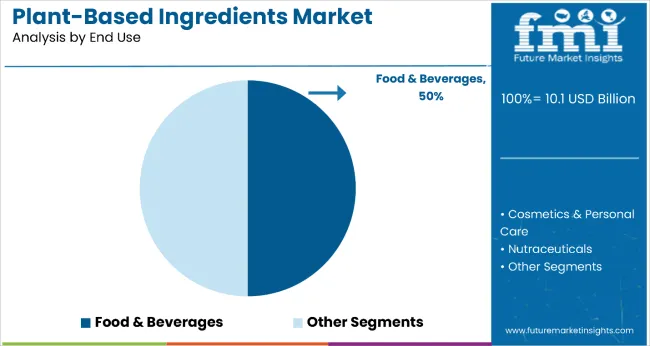

The food and beverages segment leads with a commanding 50% share in the end-use category, making it the largest consumer of plant-based ingredients globally. Applications span a wide array of products including plant-based meats, functional drinks, protein bars, dairy-free beverages, and ready meals, reflecting the growing demand for health-forward and sustainable nutrition.

The segment’s dominance is further fueled by aggressive R&D investments, partnerships, and new product development by both established firms and plant-based startups.

Manufacturers are increasingly incorporating plant-based proteins, fibers, natural sweeteners, and emulsifiers to meet clean-label, fortified, and functional food trends. Additionally, the rise of plant-based offerings in quick-service restaurants, cafes, and institutional settings is creating robust new channels for ingredient deployment, reinforcing long-term segment growth.

The market growth is driven by increasing consumer awareness of the health benefits associated with plant-derived nutrients, including their role in preventing chronic diseases and supporting immune function. Rising prevalence of lactose intolerance, food allergies, and dietary restrictions has accelerated demand for plant-based alternatives that provide equivalent nutritional benefits without adverse effects.

Growing environmental consciousness among consumers is driving preference for sustainable ingredients with lower carbon footprints compared to animal-derived alternatives.

The expanding vegan and flexitarian population, particularly among millennials and Gen Z consumers, is creating sustained demand for plant-based ingredients that enable food manufacturers to develop products meeting these dietary preferences. Government initiatives promoting plant-based nutrition and functional foods, along with favorable regulatory frameworks for health claims, are enhancing market accessibility.

From 2025 to 2035, the plant-based ingredients market adopted advanced fermentation technologies and precision extraction methods to improve ingredient functionality and cost-effectiveness. Applications include functional beverages, alternative protein products, and specialized dietary supplements targeting specific health conditions.

Manufacturers are introducing personalized nutrition solutions and targeted probiotic strains that deliver enhanced bioavailability and health benefits. Clean-label and organic certification standards now support premium positioning and consumer trust.

Health Consciousness and Disease Prevention Drive Market Adoption

Growing consumer awareness of nutrition's role in disease prevention has been identified as the primary catalyst driving growth in the plant-based ingredients market. In 2024, rising incidence of cardiovascular disease, diabetes, and digestive disorders prompted widespread adoption of functional plant-based ingredients with proven health benefits. By 2025, health-conscious consumers were incorporating plant-based products containing probiotics, omega-3 fatty acids, and antioxidants to support immune function and overall wellness.

Technological Innovation Creates Functional Enhancement Opportunities

In 2024, advanced fermentation and extraction technologies enabled the development of plant-based ingredients with enhanced bioavailability and stability compared to traditional alternatives. By 2025, manufacturers were utilizing precision processing techniques to create targeted ingredient formulations that deliver specific health benefits while maintaining taste neutrality.

Manufacturers offering innovative processing technologies and specialized ingredient formulations are positioned to capture growing demand from food companies seeking to differentiate their products through superior nutritional profiles and clean-label positioning.

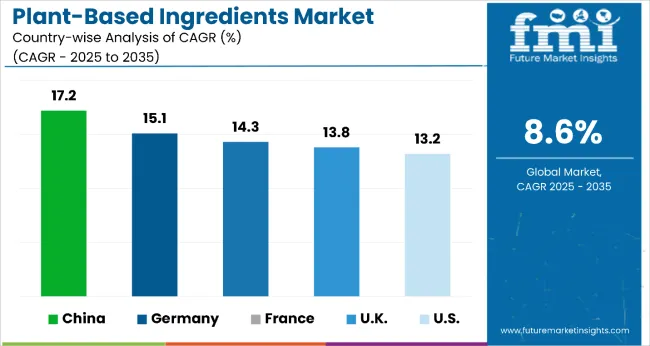

| Country | CAGR |

|---|---|

| China | 17.2% |

| Germany | 15.1% |

| France | 14.3% |

| UK | 13.8% |

| USA | 13.2% |

Among the top global players in the plant-based ingredients market, China leads with the highest projected CAGR of 17.2% (2025 to 2035), driven by rapid urbanization, growing health awareness, and large-scale ingredient production facilities. Germany follows with a CAGR of 15.1%, fueled by its advanced biotechnology and strong regulatory support for organic and functional ingredients.

France comes next with a 14.3% CAGR, focusing on premium, natural-origin ingredients aligned with its culinary heritage and strict quality standards. The UK shows a slightly slower CAGR of 13.8%, influenced by health-driven demand and post-Brexit supply chain reforms encouraging domestic innovation. The USA, while being the volume leader and home to top companies, is projected to grow at a comparatively modest CAGR of 13.2%.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Plant-based ingredients market in China is projected to grow at a CAGR of 17.2% from 2025 to 2035, driven by massive urbanization and rapidly expanding middle-class population seeking healthier food options. Domestic manufacturers are establishing large-scale fermentation facilities and investing in advanced extraction technologies to produce high-quality plant-based ingredients for both domestic consumption and export markets.

Government initiatives supporting functional food development and traditional Chinese medicine integration are accelerating market growth and innovation.

Germany plant-based ingredients revenue is expected to grow at a CAGR of 15.1% from 2025 to 2035, exceeding the global rate by 0.3%. Growth is centered on premium organic and functionally-enhanced ingredients meeting strict EU quality and safety standards.

Advanced biotechnology and fermentation capabilities are driving innovation in specialized probiotic strains and plant protein formulations. Strong research partnerships between universities and industry are accelerating development of next-generation plant-based ingredients.

The French plant-based ingredients demand is forecast to grow at a CAGR of 14.3% from 2025 to 2035, slightly below the global average. Growth is concentrated in premium natural ingredients for high-end food applications, particularly in Lyon and Paris metropolitan areas.

French regulations emphasizing natural origin and traceability are supporting market expansion while maintaining traditional quality standards. Domestic suppliers are developing specialized formulations for artisanal and gourmet food manufacturers.

The UK plant-based ingredients revenue is expected to grow at a CAGR of 13.8% from 2025 to 2035, underperforming the global average by 1.0%. Demand is driven by strong consumer interest in health and wellness products and growing vegan population. London-based food technology companies lead in innovative ingredient development. Brexit-related supply chain adjustments and sustainability mandates are reshaping sourcing patterns while creating opportunities for domestic ingredient production.

Sales of plant-based ingredients in USA, accounting for around 13.2% CAGR of the total market share. Its dominance is fueled by a strong ecosystem of major manufacturers like ADM, Cargill, and Ingredion, along with widespread consumer demand for sustainable, allergen-free, and clean-label products. The growing popularity of flexitarian and vegan lifestyles, along with increasing lactose and gluten intolerance, has further accelerated adoption.

The USA food industry is witnessing a shift in formulation strategies, where plant-based proteins, dairy substitutes, and meat alternatives are replacing traditional ingredients. Robust R&D, favorable government labeling standards, and investor support in food-tech startups are also propelling the market forward. With advanced manufacturing, diverse raw material access, and a mature retail environment, the USA is expected to remain the innovation hub and volume leader for plant-based ingredients.

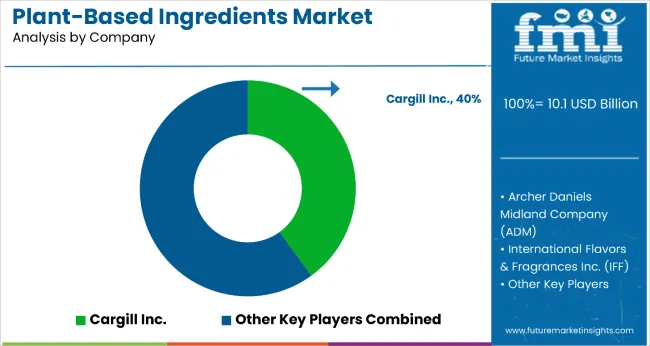

The market is moderately fragmented, led by Cargill Inc with a 40% market share. The company holds a leading position through its comprehensive R&D capabilities, global distribution network, and strong brand portfolio across plant-based nutrition and functional food segments.

Dominant player status is held exclusively by Nestle SA. Key players include Danone S.A., Beyond Meat Inc., Kerry Group, BASF SE, Ingredion Inc., Cargill Inc., Archer-Daniels-Midland Company, DuPont Nutrition & Biosciences, Chr. Hansen, Ajinomoto Co. Ltd., Tate & Lyle PLC, Beneo GmbH, Sensus B.V., and A & B Ingredients, each providing specialized plant-based ingredients for functional foods, beverages, dietary supplements, and alternative protein applications across diverse consumer markets.

Emerging players face barriers due to regulatory requirements, scientific validation needs, and established supplier relationships with major food manufacturers. Market demand is driven by health consciousness trends, sustainability concerns, and expanding applications in functional nutrition and personalized dietary solutions.

Key Developments in Plant-Based Ingredients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 10.1 Billion |

| Type | Staple Food, Specialty Food, Dairy Substitutes, Food Additives, Nutrients & Supplements |

| Claims | GMO, Non-GMO, Organic |

| Sales Channel | Direct Sales, Modern Trade, Convenience Stores, Specialty Stores, Small Groceries, Online Retail, Other Sales Channel |

| End Use | Food & Beverages, Cosmetics & Personal Care, Nutraceuticals, Agricultural |

| Buyer Type | HoReca, Food Processors & Manufacturers, Household & Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Ingredion Inc., Archer-Daniels-Midland Company, DuPont de Nemours, Inc., Cargill Inc., Puris Proteins LLC, BI Nutraceuticals Inc., Olam International, SunOpta Inc., Dohler GmbH, The Scoular Company, Trader Joe’s, Simply Balanced, Sweet Earth Natural Foods, Lightlife. |

| Additional Attributes | Dollar sales by product type and application sector, growing usage in functional foods and health-conscious applications, stable demand in plant-based alternatives and dietary supplements, innovations in fermentation technology and bioactive compounds improve ingredient functionality, nutritional profile, and consumer acceptance |

The global plant-based ingredients market is estimated to be valued at USD 10.1 billion in 2025.

The plant-based ingredients market is projected to reach USD 23.0 billion by 2035.

The plant-based ingredients market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The dairy substitutes segment is projected to lead with a 20% market share in 2025.

The food and beverages segment is expected to dominate with a 50% market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA