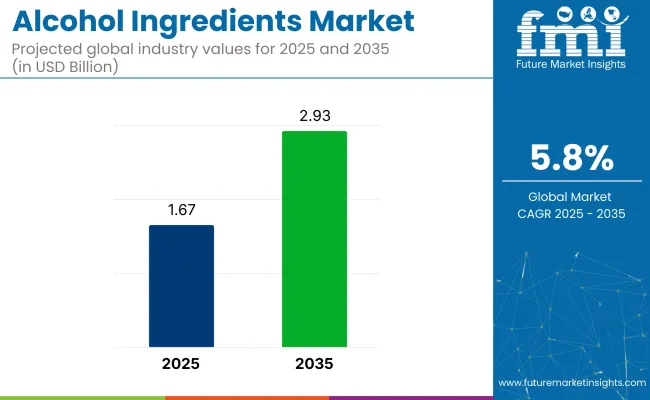

The global alcohol ingredients market is projected to reach approximately USD 1.67 billion by the end of 2025, with an expected to grow at a CAGR of 5.8%, surpassing USD 2.93 billion by 2035.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.67 billion |

| Projected Market Size in 2035 | USD 2.93 billion |

| CAGR (2025 to 2035) | 5.8% |

The growth of the industry is driven by the increasing demand for premium alcoholic beverages, along with innovations in ingredient formulations that enhance flavor profiles and improve the quality of alcoholic drinks. Alcohol ingredients, such as yeast, enzymes, and flavors, play a key role in the production and differentiation of alcoholic beverages.

In the broader alcoholic beverages industry, the alcohol ingredients market holds around 3-5% share, with alcohol ingredients being essential for fermentation, flavor development, and overall product consistency. Within the food and beverage ingredients industry, the alcohol ingredients segment comprises approximately 1-2%, reflecting the specialized role they play in the production of alcoholic drinks.

The flavor and fragrance industry sees alcohol ingredients accounting for about 2-3%, as flavors are integral to the sensory profile of alcoholic beverages. In the biotechnology and enzyme industry, it holds around 1-2%, due to the critical use of enzymes in fermentation processes for alcohol production.

In May 2025, a presentation by MANE at FlavourTalk 2025 highlighted the company’s advancements in biotechnology, supercritical extraction, and sustainable sourcing. The company emphasized its commitment to sustainability and flavor innovation through its GREEN MOTION™ technology.

Key innovations included JUNGLE ESSENCE™, Antillone™, Vanilla Bourbon Infusion, and Pink Pepper PURE JUNGLE ESSENCE™, all of which were designed to offer unique flavor profiles while adhering to strict regulatory and sustainability standards. This focus on sustainability and flavor innovation reflects the growing trend in the alcohol ingredients industry toward eco-conscious production methods and product offerings.

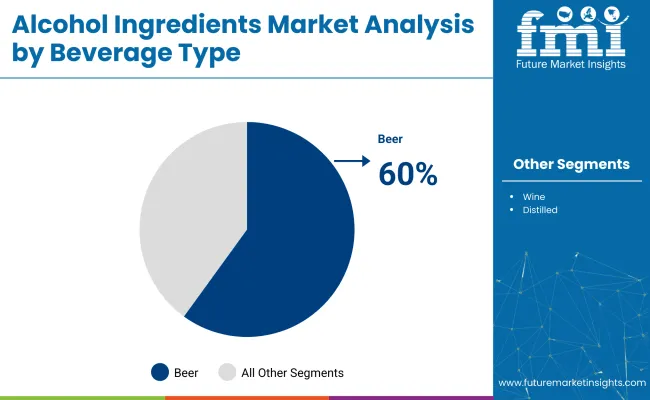

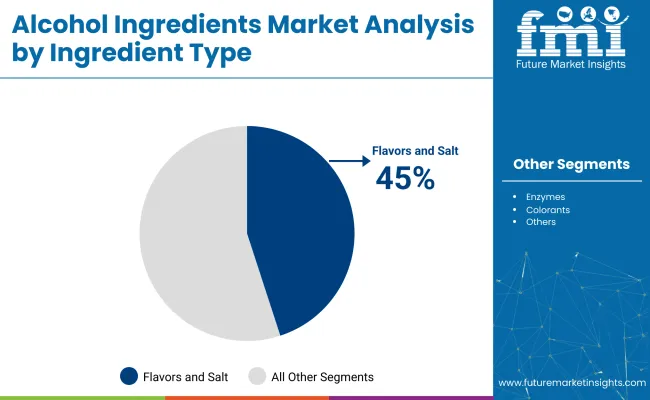

The industry is segmented by beverage type into beer, wine, and distilled beverages; by ingredient type into flavors and salt, yeast, enzymes, colorants, and starch. The industry is geographically segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

Beer is expected to dominate the alcohol ingredients market in 2025, capturing 60% share. The industry growth is driven by increasing global consumption, particularly in craft beer and flavored beer segments.

Companies like Anheuser-Busch InBev, Heineken, and Molson Coors are investing heavily in innovation, focusing on new flavors, low-alcohol content products, and premium offerings to cater to changing consumer preferences. The shift towards craft and artisanal beers, along with the demand for unique and distinct flavors, is expected to support the growing industry for beer ingredients. Furthermore, sustainability and eco-friendly production methods are gaining traction in the industry.

Flavors and salt ingredients are projected to account for a 45% share in the alcohol ingredients sector by 2025. These ingredients play a crucial role in enhancing the taste profile of alcoholic beverages, such as beer, spirits, and cocktails.

Major flavor companies like Givaudan, Firmenich, and Kerry Group are focusing on creating innovative, natural, and sustainable flavor profiles to meet consumer demand for premium and personalized beverages. The increasing popularity of craft cocktails and premium spirits, along with the growing interest in health-conscious, low-sodium beverages, is driving the demand for unique and natural flavor enhancements.

The alcohol ingredients industry is projected to experience steady growth, driven by the rising consumption of alcoholic beverages globally. The increasing popularity of craft beer and premium spirits is fueling demand for unique, high-quality ingredients. Technological innovations in production processes are also contributing to the growth of this industry.

Challenges Affecting Industry Expansion

The alcohol ingredients industry faces several challenges, including stringent regulations on production, which can hinder innovation. Fluctuating raw material prices, especially for key ingredients like grains and botanicals, add uncertainty to production costs. Additionally, the growing shift towards low and non-alcoholic beverages further reduces demand for traditional alcohol ingredients.

Key Drivers Fueling Industry Growth

The increasing interest in craft beer and premium spirits creates a need for unique and high-quality ingredients. Additionally, advancements in fermentation and distillation technologies are enhancing production efficiency and driving ingredient demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

| Germany | 5.4% |

| China | 7.7% |

| Japan | 9.4% |

| India | 11.3% |

Thealcohol ingredients industry shows varied growth across OECD and BRICS countries. Among the OECD countries, the United States and Germany show moderate growth, with CAGRs of 4.4% and 5.4%, respectively.

This growth is driven by the increasing use of alcohol ingredients in beverages, food products, and the rising demand for functional ingredients in the alcohol industry. Germany is benefiting from a strong preference for craft beers and specialty spirits, while Japan, with a CAGR of 9.4%, is experiencing higher growth due to its advanced alcoholic beverage industry.

In the BRICS group, India leads with a robust 11.3% CAGR, driven by the country’s rapidly growing alcohol consumption and the increasing demand for premium and craft beverages. China, with a CAGR of 7.7%, is also showing steady growth, supported by rising disposable incomes and the expanding alcoholic beverage industry.The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for alcohol ingredients in the United States is projected to grow at a CAGR of 4.4% through 2035. Growth is driven by the increasing demand for functional and natural ingredients in alcoholic beverages, especially within craft beers, spirits, and flavored liquors.

The USA continues to lead the global alcohol industry, with a strong preference for innovation in both alcoholic products and ingredients. Alcohol ingredients are also being used in the production of non-alcoholic versions, catering to the rising health-conscious population.

The craft beverage sector, in particular, plays a significant role in expanding industry demand, as local distilleries and breweries increasingly turn to unique ingredients to enhance flavor profiles and create distinct products.

Sales of alcohol ingredients in Germany is expected to grow at a CAGR of 5.4% through 2035. This growth is largely driven by the country’s strong beer culture, with an increasing demand for craft beer and premium spirits. The alcohol ingredients industry is expanding due to the rising consumer interest in authentic, high-quality ingredients for beer production.

The industry is also seeing a shift towards more innovative alcoholic beverages, which incorporate exotic flavors and botanicals, catering to a growing trend of experimentation. Germany's strict quality standards for ingredients, combined with a long history of brewing, make it a leader in alcohol ingredient innovation.

Demand for alcohol ingredients is projected to grow at a CAGR of 7.7% through 2035. The country’s growing middle class and rising disposable income are major contributors to this growth, with an increasing appetite for both traditional and modern alcoholic beverages.

The industry is supported by the government’s initiatives promoting the alcohol industry and the expansion of e-commerce platforms for wider distribution. The consumption of alcoholic drinks, particularly spirits and beer, is increasing among younger generations. Additionally, China’s growing interest in health-conscious alternatives is spurring the demand for low-calorie and functional alcoholic beverages, which are made possible by innovative alcohol ingredients.

Sale of alcohol ingredients is projected to grow at a CAGR of 9.4% through 2035. The country’s long-standing tradition of sake brewing and other alcoholic beverages is being modernized with innovative ingredients aimed at enhancing flavors and meeting changing consumer preferences. Japan’s refined palate and growing demand for premium spirits are driving industry expansion.

Alcohol ingredients, particularly unique botanicals and natural flavors, are increasingly being incorporated into new alcoholic beverages, including craft spirits and flavored liquors. The rise of craft beverage culture in Japan, combined with growing interest in wellness trends, is expected to sustain the industry’s growth.

India is expected to grow at a CAGR of 11.3% through 2035 in the alcohol ingredients market, the highest among key countries. India’s expanding middle class, coupled with increasing urbanization, is driving the demand for alcoholic beverages, particularly in the beer and spirits sectors.

The younger population’s shift toward westernized drinking habits, coupled with rising disposable incomes, is significantly influencing industry growth. The demand for premium, craft, and flavored alcoholic drinks is accelerating, leading to innovations in alcohol ingredients. As more consumers opt for novel flavors and functional products, India’s alcohol ingredients industry is expected to see rapid expansion in the coming years.

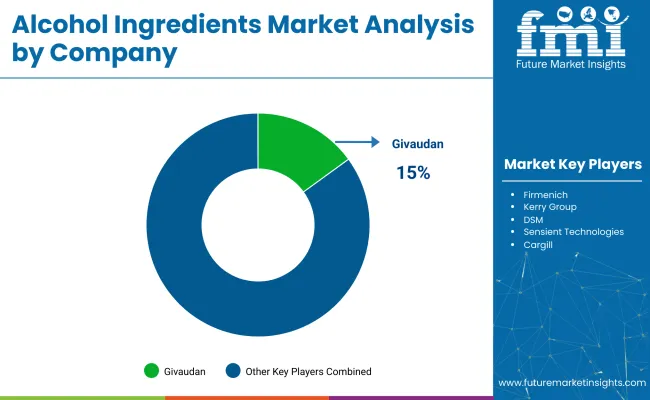

Leading companies in the alcohol ingredients industry include Givaudan, Firmenich, Kerry Group, DSM, and Sensient Technologies, each contributing to the development of innovative flavors and fragrances for alcoholic beverages. Cargill and BASF SE offer a wide range of ingredients, including yeast, enzymes, and flavors, with a focus on sustainability and innovation. Chr. Hansen provides natural ingredients for beverage production, while Archer Daniels Midland (ADM) is involved in the food processing and commodities trade for alcohol ingredients.

Ashland Inc., a specialty chemicals company, also plays a significant role in providing diverse ingredients for the alcohol industry. These companies are leveraging their global presence, innovation capabilities, and sustainability initiatives to capture a substantial market share.

Recent Alcohol Ingredients Industry News

A May 2025 presentation by MANE at FlavourTalk 2025 showcased the company's expertise in biotechnology, supercritical extraction, and sustainable sourcing. The team highlighted its commitment to advancing #wedoitgreener and pushing the boundaries of flavor innovation. Each ingredient presented boasted outstanding GREEN MOTION™ scores, emphasizing MANE’s dedication to sustainability and excellence. Among the innovations were JUNGLE ESSENCE™ technology, Antillone™, Vanilla Bourbon Infusion, and Pink Pepper PURE JUNGLE ESSENCE™, all designed to offer unique flavor profiles while adhering to strict regulatory and sustainability standards.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.67 billion |

| Industry Size (2035) | USD 2.93 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million liters for volume |

| Beverage Types Analyzed (Segment 1) | Beer, Wine, Distilled Beverages |

| Ingredient Types Analyzed (Segment 2) | Flavors and Salt, Yeast, Enzymes, Colorants, Starch |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Givaudan, Firmenich, Kerry Group, DSM, Sensient Technologies, Cargill, BASF SE, Syngenta AG, Tate & Lyle, Chr. Hansen |

| Additional Attributes | Dollar sales, share by beverage type and ingredient, growth in demand for functional and flavored alcoholic beverages, rising preference for natural ingredients, regional growth trends in craft beer and wine |

The industry is segmented into beer, wine, and distilled beverages.

The ingredients used in the industry include flavors and salt, yeast, enzymes, colorants, and starch.

The industry is geographically segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

The industry is valued at USD 1.67 billion in 2025.

The forecasted value is USD 2.93 billion by 2035.

The forecasted CAGR is 5.8% from 2025 to 2035.

The leading player is Givaudan, with a 15% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

Oxo Alcohols Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA