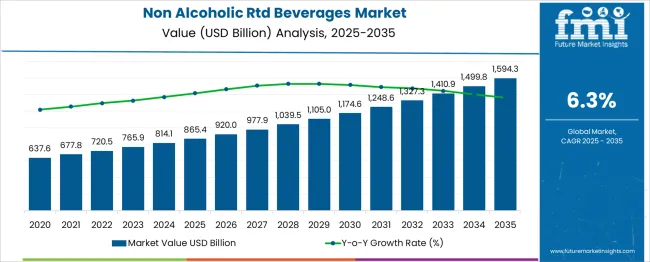

The Non Alcoholic RTD Beverages Market is estimated to be valued at USD 865.4 billion in 2025 and is projected to reach USD 1594.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Non Alcoholic RTD Beverages Market Estimated Value in (2025 E) | USD 865.4 billion |

| Non Alcoholic RTD Beverages Market Forecast Value in (2035 F) | USD 1594.3 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The non-alcoholic ready-to-drink (RTD) beverages market is experiencing strong and sustained growth, driven by increasing consumer demand for convenience, variety, and health-conscious alternatives to traditional sugary drinks. Rising urbanization, on-the-go lifestyles, and preference for instant refreshment options have elevated the appeal of RTD beverages across all age groups.

The market has evolved beyond traditional soda products, now encompassing a broad array of functional drinks, sparkling waters, and flavored infusions. Brands are actively innovating with natural ingredients, low-calorie formulations, and enhanced flavors to align with wellness trends.

Packaging also plays a critical role in driving sales, with sustainable and portable formats gaining preference. Looking ahead, the market is expected to grow steadily, supported by strategic product diversification, premiumization, and the expansion of retail and digital distribution networks catering to impulse purchases and routine consumption alike.

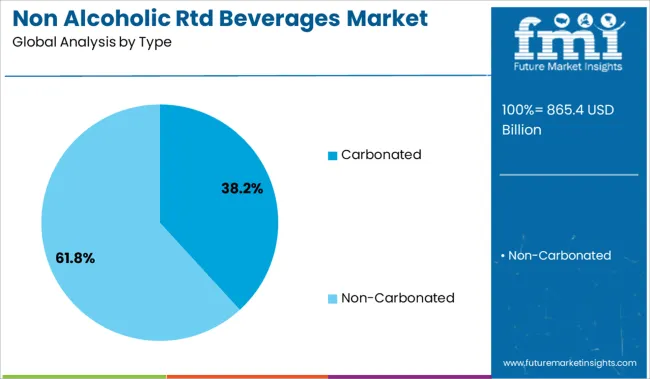

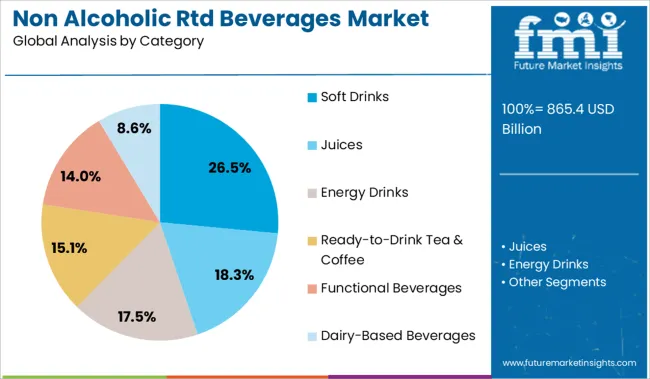

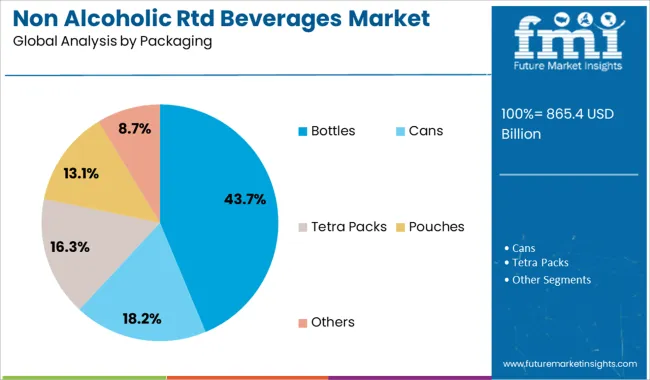

The non-alcoholic RTD beverages market is segmented by type, category, packaging, distribution channel, and geographic regions. The non alcoholic RTD beverages market is divided by type into Carbonated and Non-Carbonated. In terms of categories, the non alcoholic RTD beverages market is classified into Soft Drinks, Juices, Energy Drinks, Ready-to-Drink Tea & Coffee, Functional Beverages, and Dairy-Based Beverages. Based on packaging, the non alcoholic RTD beverages market is segmented into Bottles, Cans, Tetra Packs, Pouches, and Others. The distribution channel of the non alcoholic RTD beverages market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, and Others. Regionally, the non alcoholic RTD beverages industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carbonated segment leads the type category with a 38.2% share, driven by its enduring popularity and the sensory appeal of effervescence that enhances flavor perception. Carbonated beverages continue to attract loyal consumers due to their wide availability, refreshing taste, and strong brand equity in global markets. While traditional sodas have faced scrutiny over sugar content, innovation in low-calorie and naturally sweetened carbonated drinks has revitalized the segment.

Major brands are leveraging this trend by introducing functional carbonation, such as energy-boosting and probiotic-enriched variants. Convenience and impulse buying behavior further support carbonated RTD consumption in urban settings.

The segment remains highly competitive yet resilient, with market leaders continuously investing in new flavors, regional preferences, and limited-edition offerings. Continued adaptation to health and sustainability trends is expected to sustain the segment’s leadership position in the evolving RTD landscape.

The soft drinks category accounts for 26.5% of the non-alcoholic RTD beverages market, highlighting its foundational role in shaping consumer expectations and retail offerings. Despite rising competition from functional beverages and infused waters, soft drinks remain a widely consumed category due to their affordability, brand familiarity, and diverse flavor profiles.

This segment benefits from strong promotional strategies, wide retail penetration, and continuous product reformulation efforts aimed at sugar reduction and cleaner labeling. Consumer preference for both regular and diet variants sustains demand across age demographics.

The category’s relevance is further supported by its integration into foodservice outlets, quick-service restaurants, and convenience stores. While growth rates may moderate compared to emerging sub-categories, the soft drinks segment is expected to maintain steady performance as brands focus on health-conscious innovation and personalized marketing to align with shifting consumer values.

The bottles segment dominates the packaging category with a 43.7% share, reflecting its widespread use across all RTD beverage types for its portability, resealability, and brand visibility. Bottled formats are preferred by both manufacturers and consumers due to their practicality, durability during transport, and compatibility with automated vending and retail display systems.

Advances in lightweight plastic technologies and increasing use of recycled materials have enhanced the sustainability profile of bottles, addressing growing environmental concerns. The format supports premium branding through label customization and is well-suited for a variety of volumes catering to different consumption occasions.

Bottled RTD beverages are also favored in both on-the-go and at-home scenarios, reinforcing their market strength. As eco-consciousness continues to influence packaging choices, the segment is expected to evolve with greater adoption of biodegradable and refillable bottle designs, further reinforcing its leadership position.

The non-alcoholic RTD beverages segment demands convenience, health-focused formulations, and functional ingredients, supported by strong retail and e-commerce growth. Future opportunities lie in category diversification, emerging market penetration, and digitally-driven brand engagement strategies.

Demand for convenient beverage formats has been observed as a significant influence on this sector. Consumers have preferred ready-to-drink options for on-the-go lifestyles and easy accessibility. Health-driven formulations, including low-calorie and fortified options, have strengthened product acceptance across multiple demographics. Functional beverages incorporating plant-based ingredients and natural flavors have gained traction due to perceived health benefits. Brands have focused on premium packaging and diverse flavor innovation to capture evolving taste preferences. Expansion in retail penetration and e-commerce has supported widespread product reach. It is believed that strategic partnerships with foodservice channels have improved visibility for several brands, boosting overall market value.

Growth opportunities have been observed through diversification in beverage categories such as herbal teas, fruit-based infusions, and dairy alternatives. Global players are expected to leverage advanced processing methods for retaining freshness and flavor while extending shelf life. Expanding distribution networks into emerging regions is anticipated to create substantial revenue streams. Consumers are increasingly drawn toward products offering functional attributes like hydration, immunity support, and energy boost, which encourages investments in ingredient innovation. Private label growth has intensified competition, pushing brands toward stronger brand-building activities. The role of digital marketing and targeted promotional campaigns is likely to remain critical in influencing purchasing decisions within this category.

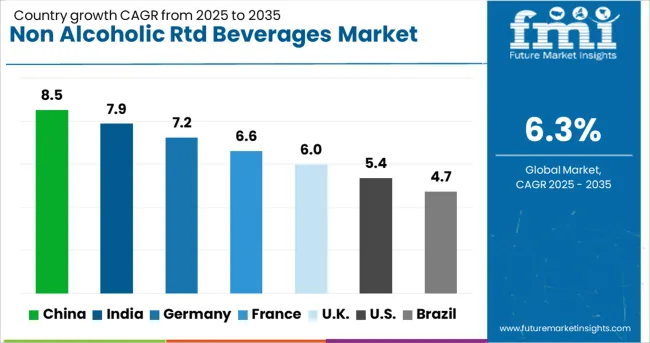

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The non-alcoholic RTD beverages sector, projected to grow at a global CAGR of 6.3% from 2025 to 2035, shows significant variation across leading markets. A robust 8.5% CAGR is being recorded in China, a BRICS nation, driven by a rising preference for functional drinks and diverse flavor options. India, another BRICS member, is witnessing a 7.9% CAGR supported by strong demand for fortified beverages and convenience-driven consumption patterns. Germany, part of the OECD group, is showing a 7.2% CAGR due to growing interest in natural formulations and plant-based drink alternatives. Moderate expansion is being experienced in the United Kingdom with a 6.0% CAGR, while the United States, also an OECD member, follows with 5.4% CAGR as mature beverage portfolios face competition from private labels. The analysis includes insights from over 40 countries, and these five have been highlighted as primary growth contributors.

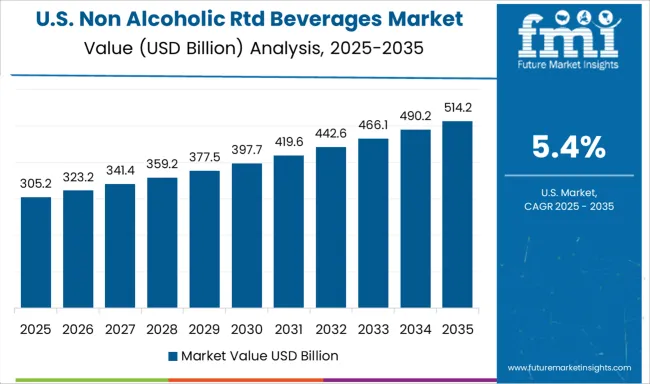

The United States shifted from nearly 4.7% during 2020-2024 to 5.4% CAGR for the period 2025-2035, supported by diversification in beverage offerings and the adoption of natural ingredients in formulations. Growth in functional categories such as energy-infused teas and vitamin-based drinks accelerated adoption among younger consumers. Increased penetration of private-label brands contributed to price competition, influencing consumer purchasing choices across supermarkets and convenience channels. Online retail platforms expanded assortment options, supported by subscription models and targeted discounts. Companies invested heavily in strategic partnerships with foodservice networks to boost product presence in on-the-go consumption points.

The CAGR for the non-alcoholic RTD beverages market in the United Kingdom advanced from about 5.1% in 2020-2024 to 6.0% during 2025-2035, driven by demand for low-sugar and plant-based drink formats. RTD coffee and herbal infusions gained momentum among health-focused consumers, resulting in expanded availability through mainstream retail chains. Increased investment in branding by domestic players was observed as necessary to counter imported premium beverages. Promotional campaigns emphasizing functionality and convenience encouraged adoption across younger demographics. The emergence of canned tea-based options improved product visibility in retail coolers, enhancing impulse purchase behavior. Subscription-driven models for RTD wellness beverages gained popularity among online buyers, sustaining repeat purchases.

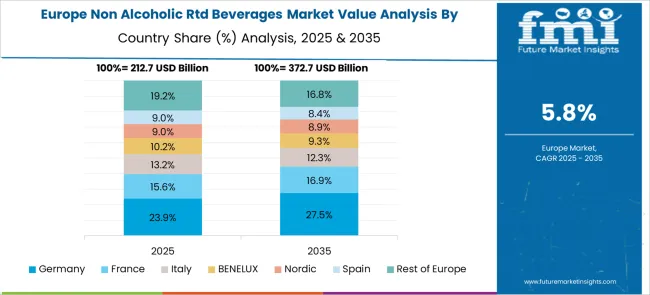

Germany improved from around 6.4% CAGR during 2020-2024 to 7.2% for the period 2025-2035, supported by growth in low-calorie and functional beverage categories. Expansion of supermarket chains carrying RTD teas, juices, and plant-based milk drinks strengthened availability across urban and semi-urban locations. Domestic manufacturers responded to competitive pressures by introducing flavor extensions targeting niche preferences such as ginger-based drinks and fruit-herbal blends. Packaging innovations such as resealable aluminum bottles contributed to repeat purchases within convenience segments. Institutional procurement in schools and workplaces for sugar-free beverages further expanded category consumption volumes. Partnerships between beverage brands and regional distributors improved rural access points for RTD products.

The CAGR for the non-alcoholic RTD beverages sector in China rose from approximately 7.1% in 2020-2024 to 8.5% for 2025-2035, driven by a surge in functional drinks and fortified formulations. Increased awareness of hydration benefits in dietary patterns supported the adoption of electrolyte-infused RTD beverages. Convenience store penetration and the expansion of self-service vending machines amplified product visibility. Partnerships with fitness centers for on-premise beverage placement enhanced consumption among active consumers. Domestic production hubs in provinces like Zhejiang and Guangdong invested in automated processing systems to meet rising demand. Flavor innovation focused on green tea, lychee, and low-sugar fruit blends further expanded the consumer base.

The CAGR value increased from nearly 6.8% during 2020-2024 to 7.9% for 2025-2035, backed by higher demand for fortified and naturally flavored drinks. Expansion in tier-two cities and rural markets provided growth opportunities for low-cost RTD juice packs. Adoption of cold-chain logistics by beverage manufacturers improved shelf stability for dairy-based and probiotic drinks. Online grocery platforms enhanced visibility of niche products such as green tea-based RTD beverages, driving sales among health-conscious consumers. Regional players introduced localized flavors like mango-based drinks to cater to traditional taste preferences, strengthening brand acceptance across diverse demographics. Investments in co-packing facilities accelerated production scalability for small and mid-sized brands.

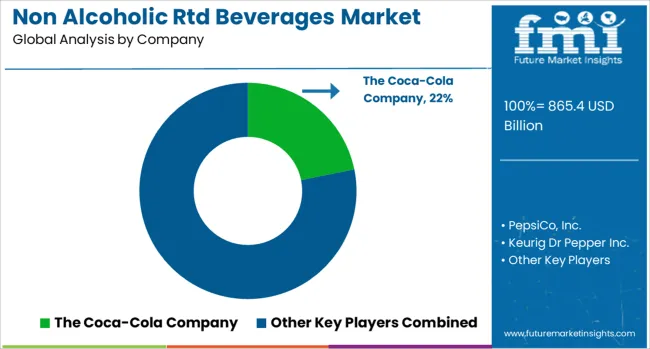

In the non-alcoholic RTD beverages sector, major players are capitalizing on consumer preferences for convenience, health-oriented choices, and flavor diversity. Companies such as The Coca-Cola Company, PepsiCo, Inc., and Keurig Dr Pepper Inc. dominate global distribution with extensive product portfolios that include functional beverages, flavored waters, and RTD teas. Nestlé S.A. and Danone S.A. have strengthened their positions by introducing plant-based and dairy alternatives, targeting health-conscious demographics seeking natural formulations.

Specialized brands like Monster Beverage Corporation and Red Bull GmbH lead the energy drinks category, offering fortified blends for performance-driven consumers. Starbucks Corporation has focused on premium RTD coffee formats through collaborations with established beverage bottlers. The Kraft Heinz Company, Unilever N.V., and Campbell Soup Company have extended into wellness beverages through diversification strategies. Fruit and juice-based innovations are being pursued by Ocean Spray Cranberries, Inc., while Suntory Beverage & Food Ltd and JAB Holding Company continue expanding premium tea and coffee-based RTD offerings across Asia and Europe.

In April 2025, Red Bull GmbH launched the Summer Edition White Peach flavor.

| Item | Value |

|---|---|

| Quantitative Units | USD 865.4 Billion |

| Type | Carbonated and Non-Carbonated |

| Category | Soft Drinks, Juices, Energy Drinks, Ready-to-Drink Tea & Coffee, Functional Beverages, and Dairy-Based Beverages |

| Packaging | Bottles, Cans, Tetra Packs, Pouches, and Others |

| Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper Inc., Nestlé S.A., Danone S.A., Monster Beverage Corporation, Red Bull GmbH, Starbucks Corporation, The Kraft Heinz Company, Unilever N.V, Campbell Soup Company, The Hershey Company, Ocean Spray Cranberries, Inc., Suntory Beverage & Food Ltd, and JAB Holding Company |

| Additional Attributes | Dollar sales by product type (carbonated sodas, juices, bottled teas, ready-to-drink coffees) and packaging format (PET bottles, aluminum cans, cartons); demand dynamics across flavored water, functional beverages, and low‑sugar variants; regional trends led by North America with Asia‑Pacific driving product diversification; innovation in single‑serve recyclable packaging, plant‑based formulations, and vitamin‑infused beverages; and environmental impact of recycling regulations, PET bottle deposit schemes, and consumer preference for biodegradable packaging. |

The global non alcoholic rtd beverages market is estimated to be valued at USD 865.4 billion in 2025.

The market size for the non alcoholic rtd beverages market is projected to reach USD 1,594.3 billion by 2035.

The non alcoholic rtd beverages market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in non alcoholic rtd beverages market are carbonated and non-carbonated.

In terms of category, soft drinks segment to command 26.5% share in the non alcoholic rtd beverages market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Woven Fabric Rolls Market Size and Share Forecast Outlook 2025 to 2035

Non-destructive Testing Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Non-isolated LED Drivers Market Size and Share Forecast Outlook 2025 to 2035

Non-Silicone Emulsion Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Non-Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Non Destructive Testers (NDT) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nonaisoprenol Market Size and Share Forecast Outlook 2025 to 2035

Non Lethal Projectiles Market Size and Share Forecast Outlook 2025 to 2035

Nonmetallic Mineral Product Market Size and Share Forecast Outlook 2025 to 2035

Non-Magnetic Connectors Market Size and Share Forecast Outlook 2025 to 2035

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Non-Insulin Peptide Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nonylphenol Ethoxylates Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Non-Contrast CT Imaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Non-fat Dry Milk Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA