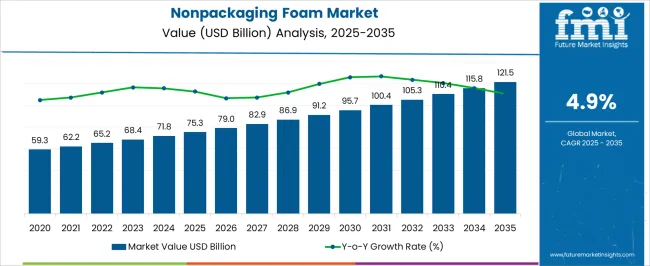

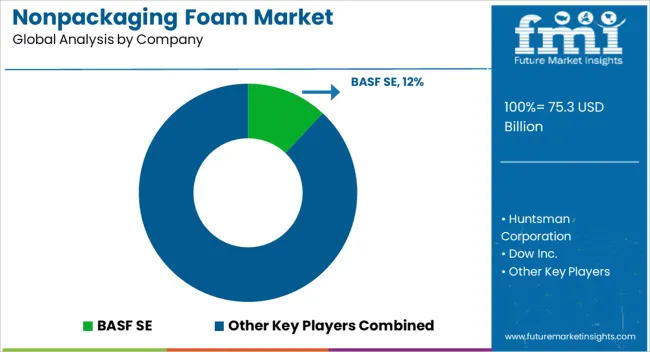

The Nonpackaging Foam Market is estimated to be valued at USD 75.3 billion in 2025 and is projected to reach USD 121.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

A closer look through the Growth Rate Volatility Index (GRVI) highlights how the market growth, while relatively stable, carries subtle variations that reflect both sectoral demand and external economic factors. Between 2025 and 2027, the market shows a moderate uptick, moving from USD 75.3 billion to USD 82.9 billion, suggesting resilience in demand from furniture, automotive interiors, and construction insulation. However, volatility smoothens after 2028, with the growth trajectory becoming more consistent, indicating that the industry is shifting toward long-term adoption of advanced foams in healthcare, bedding, and cushioning applications. From 2029 onward, the acceleration becomes more noticeable, with the market surpassing USD 95 billion in 2030 and crossing USD 100 billion by 2031, marking a psychological threshold that demonstrates industry maturity.

Despite global fluctuations in raw material prices, particularly petrochemicals, the GRVI remains relatively low, signaling steady demand fundamentals rather than speculative surges. By 2035, as the market touches USD 121.5 billion, the compounded growth, both incremental product innovation in memory foams and eco-friendly alternatives, alongside increased urban infrastructure investments. This steady volatility index underlines that the market is less prone to abrupt shocks, making nonpackaging foams a reliable investment segment across industrial and consumer domains.

| Metric | Value |

|---|---|

| Nonpackaging Foam Market Estimated Value in (2025 E) | USD 75.3 billion |

| Nonpackaging Foam Market Forecast Value in (2035 F) | USD 121.5 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The nonpackaging foam market holds a strategic position across multiple end-use sectors, representing nearly 18–20% share within the broader foam materials landscape. This underscores its relevance in cushioning, insulation, and structural applications beyond conventional packaging solutions. In the automotive interiors segment, nonpackaging foams account for approximately 12–14% share, driven by their use in seating, headrests, armrests, and noise-dampening components that enhance passenger comfort and safety. Within the construction and building insulation sector, their share stands at about 15–17%, owing to thermal and acoustic insulation properties, fire retardancy, and ease of installation in residential and commercial projects. The furniture and bedding category contributes around 10–12% share, fueled by demand for mattresses, cushions, and upholstered furniture that require high resilience and durability.

In sports and recreational equipment, nonpackaging foams secure roughly 8–10% share, as they are integrated into protective gear, exercise mats, and performance-focused padding. Market growth is propelled by increasing adoption in lightweight automotive design, rising demand for energy-efficient building materials, and the need for high-performance cushioning solutions. Foam manufacturers are emphasizing product innovation, formulation optimization, and partnerships with OEMs and construction companies to expand penetration across nonpackaging applications, solidifying their role in multiple industrial and consumer markets.

The market is experiencing sustained growth due to increasing demand across industries such as construction, automotive, and furniture manufacturing. Flexible and durable foam solutions are being adopted to meet evolving requirements for comfort, insulation, and structural support in both residential and commercial applications. Advancements in material engineering have enabled foams with improved thermal resistance, sound absorption, and environmental performance, which align with sustainability goals and regulatory standards.

The expansion of infrastructure projects, coupled with rising consumer demand for enhanced comfort in furnishings, is further driving adoption. Nonpackaging foams are also benefiting from their versatility, enabling use in a broad range of industrial and consumer products without the need for single-use packaging applications.

Market growth is expected to continue as manufacturers invest in product innovation, bio-based materials, and efficient manufacturing processes to cater to high-performance requirements The increasing focus on durability, recyclability, and energy efficiency is anticipated to create new opportunities in emerging and established markets.

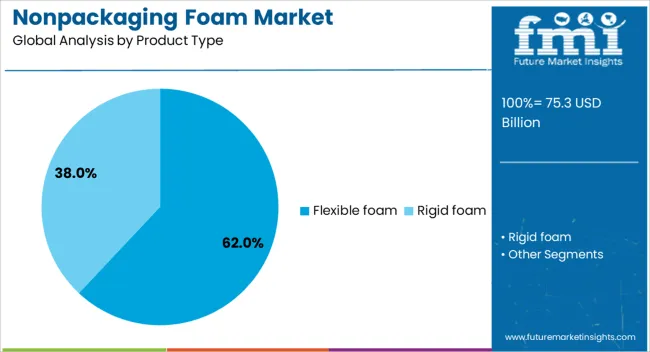

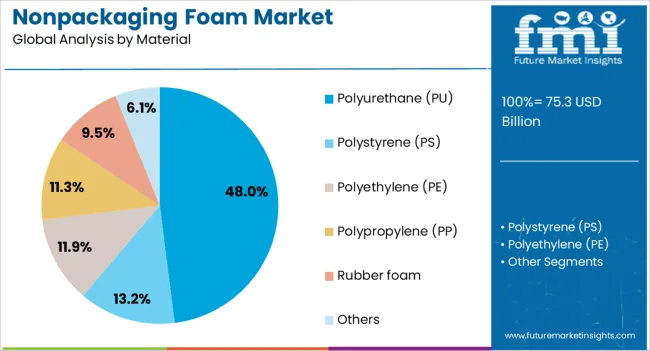

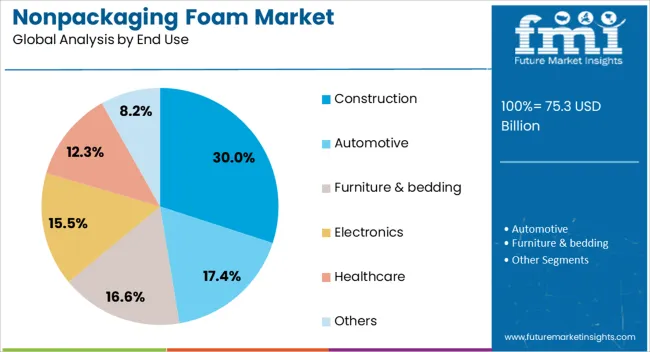

The nonpackaging foam market is segmented by product type, material, end use, and geographic regions. By product type, nonpackaging foam market is divided into flexible foam and rigid foam. In terms of material, nonpackaging foam market is classified into polyurethane (PU), polystyrene (PS), polyethylene (PE), polypropylene (PP), rubber foam, and others. Based on end use, nonpackaging foam market is segmented into construction, automotive, furniture & bedding, electronics, healthcare, and others. Regionally, the nonpackaging foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flexible foam product type segment is projected to hold 62% of the market revenue share in 2025, making it the leading product type. The growth of this segment has been driven by its adaptability, lightweight properties, and ability to provide high comfort levels in applications such as seating, bedding, and insulation. Flexible foam is preferred due to its resilience, cushioning effect, and ease of fabrication into various shapes and densities, meeting a wide range of design requirements.

Its ability to combine softness with durability has made it ideal for long-term use in both consumer and industrial applications. Additionally, flexible foam’s compatibility with a variety of coverings and surface treatments has expanded its adoption across sectors.

Manufacturers have increasingly relied on this material due to its cost-effectiveness, energy efficiency during production, and recyclability, which align with environmental standards These factors collectively ensure its continued dominance in the market.

The polyurethane (PU) material segment is expected to account for 48% of the market revenue share in 2025, making it the dominant material type. This dominance has been supported by PU’s unique combination of durability, comfort, and performance versatility. PU foam offers excellent cushioning, sound insulation, and energy absorption properties, making it suitable for a wide range of end-use applications.

Its chemical composition allows for easy customization in terms of density, firmness, and resilience, enabling manufacturers to tailor products to specific functional requirements. The material’s compatibility with both flexible and rigid foam types has widened its scope of use across industries such as construction, automotive, and furniture manufacturing.

Furthermore, advances in manufacturing processes have enhanced PU foam’s environmental performance, including the development of bio-based and recyclable formulations The segment’s leadership is expected to be sustained through continuous innovation and its ability to meet both functional and sustainability objectives.

The construction end-use segment is anticipated to hold 30% of the market revenue share in 2025, making it the leading end-use category. Growth in this segment has been driven by rising global infrastructure development, urbanization, and the increasing need for energy-efficient building materials. Nonpackaging foams used in construction offer excellent thermal insulation, soundproofing, and moisture resistance, which contribute to enhanced building performance and occupant comfort.

These foams are widely utilized in roofing, flooring, walls, and HVAC systems, where long-lasting and lightweight materials are preferred. The ability to integrate with various construction systems and meet stringent safety and environmental standards has further boosted their adoption.

Additionally, the push for green building certifications and sustainable materials has created demand for advanced foam solutions with lower environmental impact As construction projects expand globally, supported by government initiatives and private investments, this segment is expected to maintain its leading position in the market.

Nonpackaging foam sees growth driven by automotive, construction, furniture, and sports sectors. Adoption is fueled by comfort, durability, and lightweight performance properties across applications.

Nonpackaging foam is witnessing significant uptake in automotive interiors due to its lightweight, cushioning, and noise-dampening properties. Vehicle seats, headrests, door panels, and armrests increasingly integrate high-resilience foam to enhance passenger comfort and safety. Growth is driven by rising consumer expectations for ergonomic seating and premium interior finishes, along with automakers’ push to reduce vehicle weight without compromising durability. The segment benefits from increased adoption in electric and hybrid vehicles, where material weight reduction is critical for battery efficiency. Foam suppliers are investing in specialty grades with enhanced fire retardancy, vibration absorption, and shape retention. Partnerships with automotive OEMs and tier-1 suppliers further facilitate penetration across passenger cars, commercial vehicles, and specialty transportation.

The construction industry is emerging as a major consumer of nonpackaging foam, particularly for insulation, soundproofing, and cushioning applications. Residential, commercial, and industrial projects utilize foam panels, spray foams, and inserts to provide thermal resistance, energy efficiency, and acoustic comfort. Demand is further supported by the requirement for lightweight and flexible materials suitable for modern building designs. The use of foam in roofing, wall panels, and flooring ensures long-term structural performance while improving indoor environmental quality. Manufacturers are focusing on developing rigid, semi-rigid, and flexible foams tailored for construction-specific standards and fire ratings. Integration with prefabricated components and modular construction also amplifies market penetration and long-term growth prospects.

Nonpackaging foam continues to gain traction in the furniture and bedding sector due to its resilience, comfort, and durability. Mattresses, cushions, upholstered seating, and recliners increasingly utilize polyurethane, memory, and high-density foams to provide long-lasting comfort and structural support. Rising consumer preferences for premium home furniture and ergonomic designs propel adoption. Foam formulations with anti-microbial and hypoallergenic properties cater to health-conscious consumers, while advanced production methods allow for customized foam shapes and firmness levels. Furniture manufacturers are expanding collaborations with foam suppliers to ensure consistency, supply security, and compliance with fire and quality regulations. The shift toward online furniture retail further supports demand for lightweight, transport-friendly foam components.

Nonpackaging foam is increasingly applied in sports and protective equipment, including helmets, padding, mats, and exercise gear. Lightweight and high-resilience foams absorb impact and reduce injury risk in recreational and professional settings. Growth is supported by the rising popularity of fitness activities, outdoor sports, and performance-driven equipment requiring durable and shock-absorbing materials. Foam producers are focusing on blends that improve durability, moisture resistance, and shape recovery, while complying with safety and certification standards. Manufacturers are collaborating with sports brands to develop high-performance foam solutions tailored for specific equipment types, ensuring user safety, comfort, and longevity.

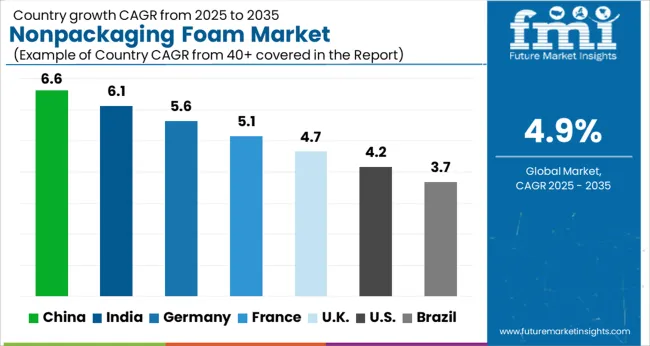

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The nonpackaging foam market is projected to expand at a global CAGR of 4.9% from 2025 to 2035, supported by rising adoption across automotive, construction, furniture, and sports equipment applications. China leads with a CAGR of 6.6%, driven by increasing automotive production, expanding building construction projects, and growing demand for comfort-oriented furniture and bedding solutions. India follows at 6.1%, fueled by rapid urban housing development, rising middle-class consumption of furniture, and adoption of sports and protective equipment incorporating high-resilience foam. France records 5.1%, supported by demand from construction insulation, acoustic solutions, and premium furniture segments. The United Kingdom grows at 4.7%, influenced by building renovations, ergonomic furniture uptake, and sports gear demand. The United States posts 4.2%, shaped by mature automotive and construction sectors, replacement demand in furniture, and sports equipment upgrades. The analysis spans over 40 global markets, with these countries serving as benchmarks for investment, product innovation, and strategic capacity expansion in the nonpackaging foam market.

China is projected to achieve a CAGR of 6.6% during 2025–2035, well above the global benchmark of 4.9%, driven by rising automotive production, residential and commercial construction, and growing consumption of furniture and bedding products. During 2020–2024, the market recorded a CAGR of nearly 4.0%, shaped by gradual industrial expansion and moderate adoption of high-performance foam in furniture, automotive seating, and protective sports gear. The subsequent surge in growth reflects large-scale infrastructure projects, increasing use of lightweight materials in vehicles, and government incentives for modern housing and industrial facilities. Domestic OEMs and foam fabricators are investing in capacity expansion and product innovation to meet rising demand.

India is expected to grow at a CAGR of 6.1% from 2025–2035, exceeding the global rate of 4.9%. Between 2020–2024, CAGR stood at 3.5%, influenced by steady residential construction, selective automotive seating applications, and initial adoption of high-resilience foam in sports and medical equipment. Growth accelerated post-2025 due to increased infrastructure spending, rising urban housing projects, and expansion of domestic automotive and furniture manufacturing. Rising exports of foam-based components and government programs supporting affordable housing contributed to the market’s momentum. Indian manufacturers are scaling production and forming partnerships to cater to both domestic and international demand.

France is projected to post a CAGR of 5.1% between 2025–2035, surpassing the global average of 4.9%, supported by construction renovations, premium furniture demand, and acoustic solutions in public and private spaces. During 2020–2024, CAGR was about 3.2%, reflecting measured uptake in insulation, furniture, and automotive seating applications. Growth is accelerating as renovation programs, energy-efficient building policies, and modern office developments increase adoption of specialized foam. French manufacturers are focusing on product diversification, lightweight foam for automotive and aerospace interiors, and expanding distribution networks to meet the increasing requirements of commercial and residential sectors.

The UK market is expected to achieve a CAGR of 4.7% from 2025–2035, slightly below the global benchmark of 4.9%, influenced by residential refurbishments, industrial foam adoption, and furniture replacements. Between 2020–2024, CAGR stood at 2.8%, shaped by gradual modernization in construction and selective uptake of foam in automotive seating. Growth post-2025 is propelled by increased demand in home renovations, industrial equipment cushioning, and sports and protective gear. Domestic manufacturers are investing in advanced foams, production efficiency, and partnerships with furniture and automotive companies to enhance availability and meet evolving consumer expectations.

The US market is projected to grow at a CAGR of 4.2% between 2025–2035, slightly below the global CAGR of 4.9%, supported by steady automotive, furniture, and construction sectors. During 2020–2024, CAGR was approximately 2.5%, reflecting mature market conditions and replacement-driven demand. The subsequent growth phase is supported by increasing adoption of advanced foam in seating, bedding, insulation, and sports equipment. Manufacturers are expanding production capacity, developing specialty foam products, and forming supply partnerships to address the evolving needs of commercial and residential applications.

The nonpackaging foam market is characterized by intense competition among global chemical manufacturers, specialty polymer producers, and foam fabricators supplying automotive, construction, furniture, bedding, and industrial sectors. BASF SE leads with a diversified product portfolio spanning polyurethane, specialty polymer foams, and engineered cushioning solutions, supported by global production facilities and extensive R&D capabilities. Huntsman Corporation focuses on high-performance polyurethane foams, elastomers, and composite solutions, emphasizing lightweight applications in automotive and industrial equipment. Dow Inc. leverages its scale to offer polyether and polyester foam variants for furniture, insulation, and protective applications, while Covestro AG provides engineered foams for mobility, building, and industrial sectors with a focus on durability and comfort.

Recticel NV delivers specialty foams for bedding, furniture, and automotive seating, combining resilience with ergonomic design, whereas Armacell offers thermal and acoustic insulation foams tailored for construction and industrial pipelines. Rogers Corporation focuses on high-performance engineered foams for electronics, vibration damping, and industrial applications, emphasizing precision and consistency. Woodbridge manufactures polyurethane foams for mattresses, furniture, and automotive seating, prioritizing comfort and resilience. Competitive strategies in the sector revolve around product innovation, process optimization, capacity expansion, and partnerships with end-use manufacturers. Regional production networks, sustainable formulations, and customized solutions remain key to securing market share and responding to evolving industry requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 75.3 billion |

| Product Type | Flexible foam and Rigid foam |

| Material | Polyurethane (PU), Polystyrene (PS), Polyethylene (PE), Polypropylene (PP), Rubber foam, and Others |

| End Use | Construction, Automotive, Furniture & bedding, Electronics, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Huntsman Corporation, Dow Inc., Covestro AG, Recticel NV, Armacell, Rogers Corporation, and Woodbridge Group |

| Additional Attributes | Dollar sales, share, CAGR trends, material types (polyurethane, polyethylene, EVA), end-use sectors (automotive, furniture, construction, industrial), regional demand, raw material costs, competitive players, pricing benchmarks, growth drivers, regulatory compliance, supply chain dynamics, technological processes, and M&A activity. |

The global nonpackaging foam market is estimated to be valued at USD 75.3 billion in 2025.

The market size for the nonpackaging foam market is projected to reach USD 121.5 billion by 2035.

The nonpackaging foam market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in nonpackaging foam market are flexible foam and rigid foam.

In terms of material, polyurethane (pu) segment to command 48.0% share in the nonpackaging foam market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Labels Market Trends and Growth 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA