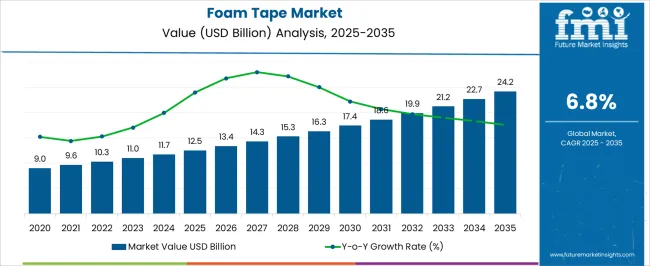

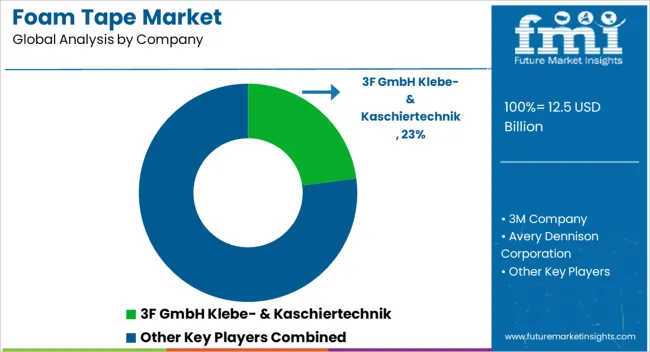

The Foam Tape Market is estimated to be valued at USD 12.5 billion in 2025 and is projected to reach USD 24.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

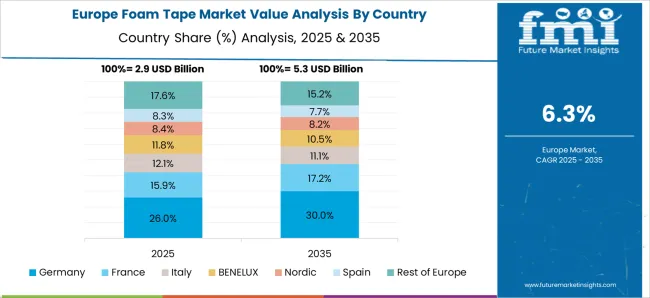

The foam tape market is projected to grow from USD 12.5 billion in 2025 to USD 24.2 billion by 2035, with a CAGR of 6.8%. A breakpoint analysis identifies key growth shifts in the market’s trajectory, showing periods of acceleration followed by stable growth. Between 2025 and 2030, the market grows from USD 12.5 billion to USD 17.4 billion, contributing USD 4.9 billion in growth, with a CAGR of 7.4%. This phase marks a significant breakpoint, driven by the growing demand for foam tapes in industries such as automotive, packaging, and construction, where they are valued for their sealing, insulating, and cushioning properties. Technological advancements, such as the development of high-performance foam tapes and innovations in adhesive formulations, also play a crucial role in accelerating market growth. From 2030 to 2035, the market continues to grow from USD 17.4 billion to USD 24.2 billion, adding USD 6.8 billion in growth, with a slightly lower CAGR of 5.7%. This deceleration indicates a market approaching saturation in developed regions, with slower adoption in established industries. However, demand remains strong due to the growing adoption of foam tapes in emerging markets and new applications, such as electronics and renewable energy. The breakpoint analysis reveals strong early-phase growth, followed by sustained, steady expansion as the market matures.

| Metric | Value |

|---|---|

| Foam Tape Market Estimated Value in (2025 E) | USD 12.5 billion |

| Foam Tape Market Forecast Value in (2035 F) | USD 24.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The foam tape market is experiencing steady expansion due to increasing demand for lightweight and durable bonding solutions across manufacturing and assembly operations. As industries shift toward cleaner aesthetics and faster assembly, foam tapes are being preferred over mechanical fasteners due to their vibration dampening, sealing, and adhesive strength.

Enhanced performance in extreme temperature and pressure environments has positioned foam tape as a critical component in automotive, construction, and electronics applications. In addition, regulatory focus on emissions reduction and material sustainability has led to the adoption of acrylic and solvent based adhesive systems that offer durability and environmental resistance.

The future outlook remains strong, driven by advancements in polymer formulations, automation in tape application systems, and growth in end user sectors such as automotive and industrial equipment.

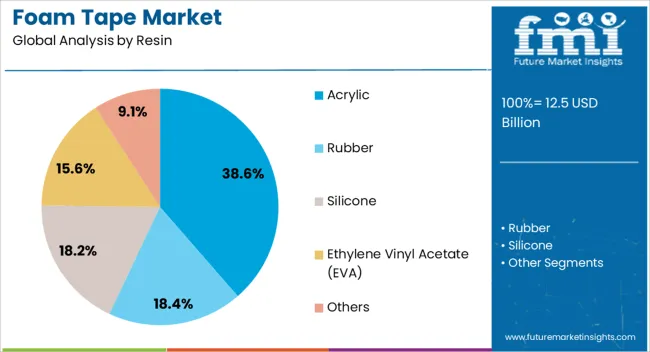

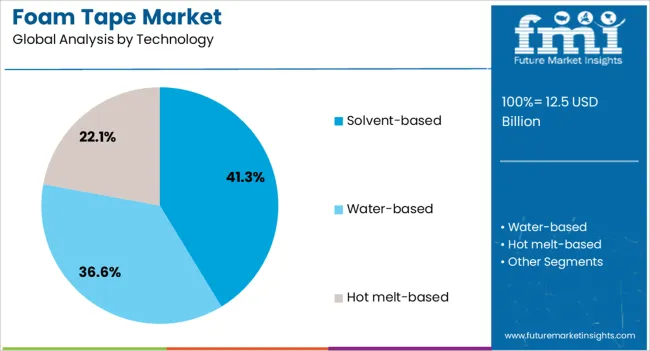

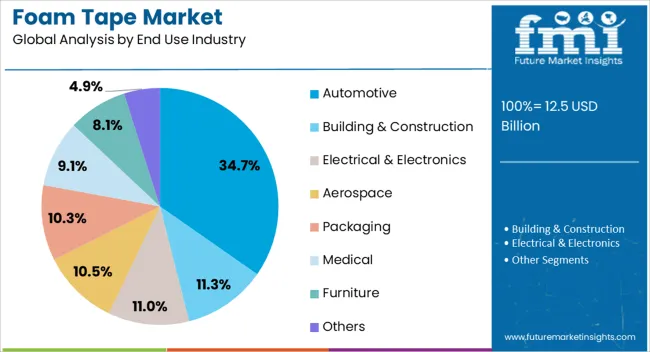

The foam tape market is segmented by resin, technologyend use industry, and geographic regions. By resin of the foam tape market is divided into Acrylic, Rubber, Silicone, Ethylene Vinyl Acetate (EVA), and Others. In terms of technology of the foam tape market is classified into Solvent-based, Water-based, and Hot melt-based. Based on end use industry of the foam tape market is segmented into Automotive, Building & Construction, Electrical & Electronics, Aerospace, Packaging, Medical, Furniture, and Others. Regionally, the foam tape industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic resin segment is expected to hold 38.60% of total market revenue by 2025 within the resin category, making it the leading choice. This dominance is attributed to the material’s high UV resistance, excellent aging properties, and strong adhesion to a wide variety of substrates.

Acrylic based foam tapes are increasingly favored in applications requiring long term durability and clean removal without residue. Their chemical resistance and ability to maintain performance in fluctuating temperatures have made them ideal for automotive and electronics applications.

The segment’s continued growth is further supported by advancements in water based acrylic formulations which align with global sustainability goals.

The solvent based segment is projected to account for 41.30% of the overall market within the technology category, positioning it as the most utilized technology. This is due to its superior bonding strength and compatibility with high performance applications where environmental resistance and long term adhesion are critical.

Solvent based adhesives offer fast wet out, excellent cohesion, and improved tack on both porous and non porous surfaces. Their effectiveness in industrial manufacturing processes and adaptability to automated tape application systems have contributed to their widespread usage.

As manufacturers continue to prioritize productivity and performance, the solvent based segment remains the preferred solution across high demand use cases.

The automotive segment is anticipated to generate 34.70% of total revenue by 2025 within the end use industry category, making it the largest contributor. This leadership is driven by growing automotive production, the need for lightweighting, and increasing reliance on adhesive tapes for interior and exterior applications.

Foam tapes are extensively used for panel bonding, trim attachment, noise reduction, and sealing purposes, supporting both aesthetics and functionality. As electric vehicles and advanced driver assistance systems become more prevalent, foam tapes are also being used for vibration control and thermal insulation.

The shift toward modular assembly and design flexibility has further established foam tape as an integral material within automotive manufacturing workflows.

The foam tape market is expanding due to the increasing demand for versatile, high-performance adhesive solutions across various industries, including automotive, construction, packaging, and electronics. Foam tapes, made from materials like polyurethane, polyethylene, and PVC, offer excellent sealing, cushioning, and insulating properties, making them ideal for use in high-performance applications. As industries continue to prioritize energy efficiency, noise reduction, and cost-effective solutions, the demand for foam tapes is rising. Despite challenges such as fluctuating raw material prices, innovations in foam tape formulations and growing market applications are driving growth.

The foam tape market is primarily driven by the increasing demand for versatile, high-performance adhesive solutions. These tapes are widely used in industries such as automotive, construction, electronics, and packaging due to their ability to provide strong bonding, sealing, and cushioning. The demand for foam tapes has surged as companies prioritize cost-effective, durable, and easy-to-apply materials. For example, in the automotive industry, foam tapes are used for weather sealing and vibration reduction, while in construction, they are essential for energy-efficient insulation. The growing trend of using adhesive tapes over mechanical fasteners in various applications has accelerated foam tape adoption. As industries look for improved performance in sealing, insulation, and noise reduction, foam tapes offer a flexible solution that enhances efficiency and product quality.

A significant challenge in the foam tape market is the fluctuation in raw material prices. Foam tapes are made from materials such as polyurethane, polyethylene, and PVC, which are dependent on the price of petrochemicals. Volatile crude oil prices can lead to unpredictable costs for foam tape manufacturers, impacting profit margins and overall product pricing. Additionally, ensuring consistent performance and quality across batches can be a challenge, as factors like temperature, humidity, and the manufacturing process can affect the adhesive strength, foam density, and overall reliability of the tape. Variability in raw material quality and the complexity of maintaining uniformity in production can result in inconsistent products, which may affect customer satisfaction and market trust. Overcoming these challenges requires improved supply chain management and more efficient manufacturing processes.

The foam tape market presents significant opportunities through innovations in material formulations and expanding applications. Advances in foam technology are leading to the development of tapes with enhanced properties, such as higher adhesion strength, better thermal insulation, and superior soundproofing capabilities. The growing demand for energy-efficient and eco-friendly building materials is increasing the adoption of foam tapes in construction applications. Foam tapes are seeing increased use in the automotive and electronics industries, where they serve as essential components in vibration dampening, sealing, and insulation. As industries continue to look for efficient, cost-effective, and sustainable solutions, foam tape manufacturers can innovate in product offerings to meet evolving market needs. Expanding into emerging markets and creating specialized foam tapes for niche applications also offers new growth opportunities.

A key trend in the foam tape market is the growing shift towards eco-friendly and high-performance solutions. With increasing environmental awareness, there is a rising demand for foam tapes made from recycled materials or renewable sources. Manufacturers are focusing on producing tapes that have a minimal environmental impact while maintaining the high-performance qualities required for various applications. Another trend is the increasing integration of foam tapes with smart technologies. foam tapes used in construction now come with integrated moisture barriers, while those in automotive applications may include noise-reducing properties. The move towards multifunctional, high-performance, and eco-friendly tapes reflects the industry's focus on improving product quality while addressing environmental concerns. This trend is likely to drive further innovation and market expansion in the foam tape industry.

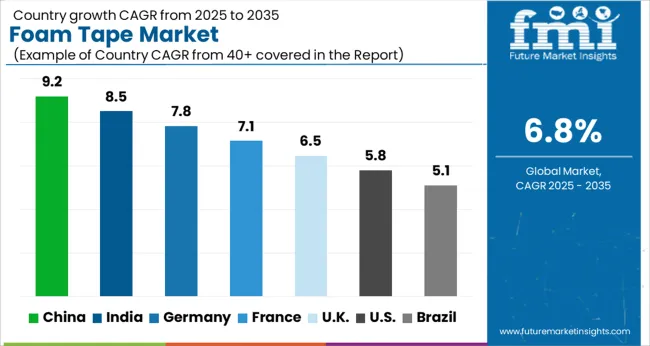

Global foam tape market demand is projected to rise at a 6.8% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 9.2%, followed by India at 8.5%, and Germany at 7.8%, while the United Kingdom records 6.5% and the United States posts 5.8%. These rates translate to a growth premium of +35% for China, +25% for India, and +15% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Increased demand for automotive and construction applications in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established usage in packaging and insulation sectors. The analysis spans over 40+ countries, with the leading markets shown below.

The foam tape market in China is expanding rapidly at a CAGR of 9.2%, driven by the surge in demand from the automotive, construction, and electronics industries. With its strong manufacturing base and growing automotive sector, China is increasing its adoption of foam tapes for sealing, insulation, and noise reduction. The country’s focus on green building standards and energy-efficient construction also drives the need for advanced sealing solutions. China’s investments in infrastructure development continue to propel the market for foam tapes, particularly in construction and packaging applications.

Sale of foam tape in India is growing at a CAGR of 8.5%, supported by the country’s expanding manufacturing and construction sectors. Increasing automotive production, along with a rising demand for energy-efficient building materials, is fueling the market. The construction industry, in particular, is embracing foam tapes for insulation and sealing in both residential and commercial projects. The rise in disposable income and a booming e-commerce industry are encouraging the use of foam tapes in packaging. India’s industrialization and a growing focus on smart city development are expected to drive the market further.

Demand for foam tape in Germany is experiencing steady growth at a CAGR of 7.8%, with strong demand from the automotive and industrial sectors. The country’s automotive industry, known for its precision and high-quality standards, drives the need for advanced foam tapes for sealing, noise reduction, and insulation. Germany’s focus on eco-friendly construction materials also contributes to the demand for foam tapes in insulation applications. Germany’s strong manufacturing base continues to leverage foam tapes for various industrial uses, especially in the production of electrical components and consumer electronics.

The United Kingdom’s foam tape market is growing at a more moderate pace with a CAGR of 6.5%. Demand is driven by the automotive, construction, and packaging industries. The UK’s automotive sector, with its focus on electric vehicle manufacturing, is increasingly utilizing foam tapes for soundproofing and sealing applications. The construction industry also embraces foam tapes as an energy-efficient solution for insulation and weatherproofing in buildings. The growth of online retail in the UK is driving the demand for foam tapes in packaging, especially for protecting fragile goods during transit.

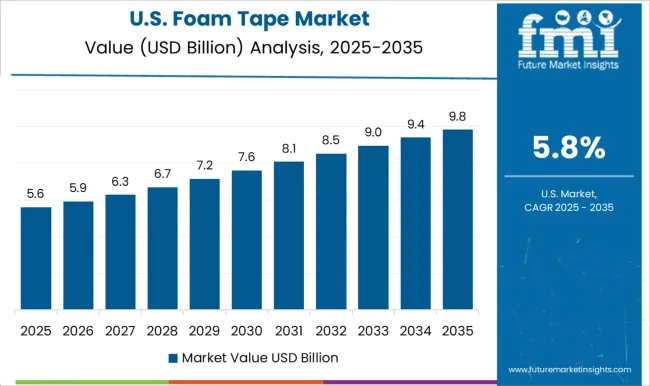

The USA foam tape market is growing at a CAGR of 5.8%, with significant demand from the automotive, construction, and packaging sectors. The automotive industry continues to rely on foam tapes for sealing, soundproofing, and vibration damping, while the construction industry adopts foam tapes for insulation and weatherproofing solutions. The packaging sector also plays a key role in the USA market, with foam tapes widely used for protecting fragile items during shipping. Despite slower growth compared to emerging markets, the USA remains a key market due to its established industries and high demand for high-quality, durable foam tapes.

The foam tape market is marked by a strong presence of key players offering adhesive solutions for a wide range of applications across automotive, construction, electronics, and packaging industries. 3M Company leads with a vast product portfolio, providing high-performance foam tapes for automotive, electronics, and industrial uses. Avery Dennison Corporation specializes in foam tapes used for packaging, insulation, and construction, focusing on enhanced adhesive properties and durability. HALCO Europe Ltd offers tailored foam tape solutions for automotive and industrial applications, emphasizing innovation in bonding technologies. Intertape Polymer Group focuses on foam tapes for packaging and industrial applications, providing cost-effective, reliable solutions. LAMATEK, Inc. is known for manufacturing foam tapes used in industrial sealing and gasketing applications. LINTEC Corporation produces high-quality foam tapes for the electronics and automotive industries, known for their durability and performance. Lohmann GmbH & Co. KG delivers specialized foam tape solutions for automotive, industrial, and medical applications, focusing on environmental compliance and energy efficiency. Lynvale Ltd. offers a variety of foam tapes for insulation and automotive applications, emphasizing innovation in material selection. Nitto Denko Corporation provides adhesive solutions for a wide range of industries, including automotive, electronics, and medical sectors. RPM International, Inc. delivers foam tape solutions with strong adhesive properties, particularly for construction and packaging applications. Scapa specializes in foam tapes for medical, automotive, and industrial applications, with a focus on high-performance solutions. Tesa Tapes (India) Private Limited and Wuxi Canaan Adhesive Technology Co., Ltd. cater to the global demand for foam tapes, offering reliable and efficient adhesive solutions.

Dollar sales by product type (automotive, construction, industrial, packaging, medical) and end-use segments (automotive, electronics, packaging, industrial, medical). Demand dynamics are influenced by increasing industrial automation, automotive applications, and packaging needs. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in adhesive technology, environmental considerations for product disposal, and the growing demand for specialized applications driving market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.5 Billion |

| Resin | Acrylic, Rubber, Silicone, Ethylene Vinyl Acetate (EVA), and Others |

| Technology | Solvent-based, Water-based, and Hot melt-based |

| End Use Industry | Automotive, Building & Construction, Electrical & Electronics, Aerospace, Packaging, Medical, Furniture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3F GmbH Klebe- & Kaschiertechnik, 3M Company, Avery Dennison Corporation, HALCO Europe Ltd, Intertape Polymer Group, LAMATEK, Inc., LINTEC Corporation, Lohmann GmbH & Co. KG., Lynvale Ltd., Nitto Denko Corporation, RPM International, Inc., Scapa, Tesa Tapes (India) Private Limited, and Wuxi Canaan Adhesive Technology Co., Ltd |

| Additional Attributes | Dollar sales by product type (automotive, construction, industrial, packaging, medical) and end-use segments (automotive, electronics, packaging, industrial, medical). Demand dynamics are influenced by increasing industrial automation, automotive applications, and packaging needs. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in adhesive technology, environmental considerations for product disposal, and the growing demand for specialized applications driving market expansion. |

The global foam tape market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the foam tape market is projected to reach USD 24.2 billion by 2035.

The foam tape market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in foam tape market are acrylic, rubber, silicone, ethylene vinyl acetate (eva) and others.

In terms of technology, solvent-based segment to command 41.3% share in the foam tape market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylic Foam Tapes Market

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA