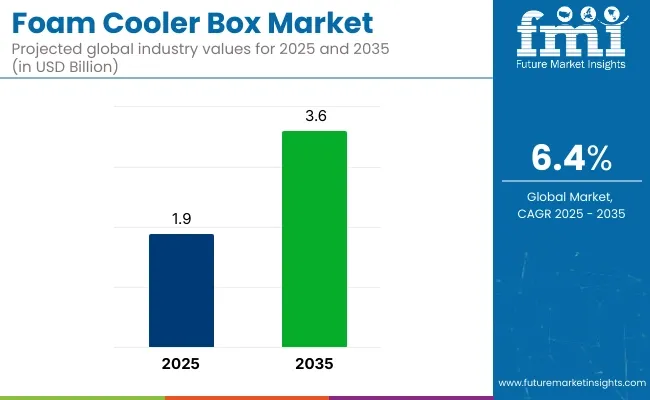

The foam cooler box market is projected to grow from USD 1.9 billion in 2025 to USD 3.6 billion by 2035, registering a CAGR of 6.4% during the forecast period. Sales in 2024 reached USD 1.7 billion, signaling a stable rise in demand across cold chain logistics, pharmaceuticals, food delivery, and recreational applications.

This growth has been attributed to the increasing emphasis on thermal insulation performance, portability, and product safety during transport. As temperature-sensitive products continue to expand in volume across industries, the demand for efficient, reliable, and reusable cooling systems has been steadily reinforced by regulatory frameworks and evolving customer expectations.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.9 billion |

| Projected Market Size in 2035 | USD 3.6 billion |

| CAGR (2025 to 2035) | 6.4% |

Strategic investments in foam cooler production lines and innovation centers have been witnessed among leading players aiming to meet global cold chain and e-commerce delivery standards. Sonoco ThermoSafe, one of the world’s largest providers of thermal assurance packaging, announces expansion of its operations aimed at better serving customers across the United States and around the globe. With a strong commitment to efficiency, quality, and customer satisfaction, Sonoco ThermoSafe is investing in cutting-edge machinery, automation, and improved production capabilities.

“We believe that this expansion will significantly enhance our ability to serve our customers not only across America but also on a global scale,” said Jim Lassiter, Vice President & General Manager, Sonoco ThermoSafe. “Our investments in technology and automation underscore our commitment to delivering the best products while maintaining the utmost efficiency.”

The foam cooler box industry has been influenced significantly by sustainability mandates and the shift toward circular economy practices. Substitutes for expanded polystyrene (EPS) such as biodegradable foam composites and molded pulp have been progressively introduced. Eco-labeling and life cycle analyses have been prioritized to ensure compliance with regulatory expectations in North America and Europe.

Advances in vacuum insulation panels (VIP) and phase-change materials (PCM) have also been deployed in high-performance segments, particularly within pharmaceutical and biotech logistics. These efforts have been supported by increasing customer awareness and rising penalties for non-recyclable materials in several markets.

The foam cooler box market is expected to witness continued demand across food & beverages and healthcare. Cold chain optimization efforts are likely to fuel further innovations in container ergonomics, durability, and thermal efficiency. Market penetration is expected to deepen in emerging economies as online food delivery and vaccine storage infrastructure expand.

Companies emphasizing biodegradable designs, lightweight logistics, and digital temperature tracking systems are projected to retain competitive advantages. Continued alignment with environmental regulations and evolving logistics expectations will be critical in shaping long-term growth.

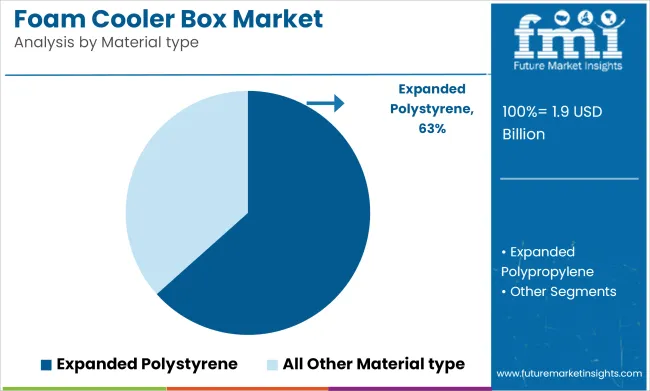

Expanded Polystyrene (EPS) is expected to account for approximately 63.4% of the foam cooler box market by 2025, as it has been widely adopted for its lightweight structure, excellent thermal insulation, and cost-effectiveness in short-term cold chain applications. EPS cooler boxes have been manufactured to provide high resistance to temperature fluctuations, ensuring the preservation of perishable goods during transportation.

A rigid cellular structure has enabled EPS to maintain consistent internal temperatures, even in external heat or humidity, making it ideal for food delivery, laboratory samples, and retail packaging. The material has also been engineered to be moisture-resistant and impact-absorbent, further protecting contents against environmental and mechanical stress.

EPS cooler boxes have been mass-produced using low-cost molding processes, which has facilitated widespread adoption in disposable and limited-use scenarios, especially in developing markets and cost-sensitive industries. Despite growing environmental concerns, recycling programs and low material density have supported its continued use in insulated packaging.

As demand for efficient, scalable, and lightweight thermal containers increases, EPS is projected to retain its leading role in foam cooler box manufacturing due to its proven balance of performance, availability, and affordability.

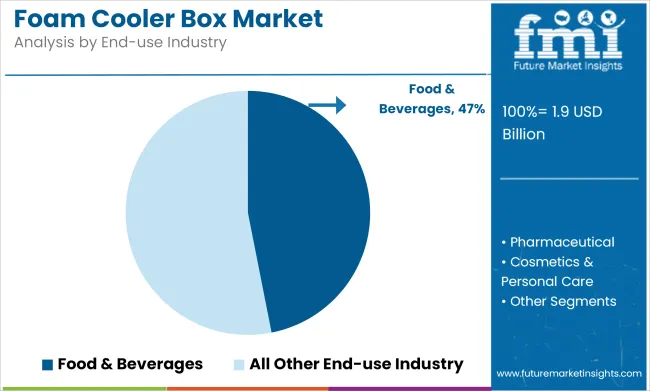

The food and beverages industry is projected to lead the foam cooler box market by 2025, capturing an estimated 46.9% market share, as insulated containers have been extensively used to support last-mile delivery, temperature-sensitive transport, and meal kit distribution. Demand for cold-chain logistics solutions has been intensified by the global rise in e-commerce grocery platforms, online food delivery services, and ready-to-eat packaged goods.

Foam cooler boxes have been employed to protect dairy products, frozen meals, fresh produce, seafood, and beverages against spoilage and quality degradation during short- and medium-range transit. Their ability to maintain chilled or frozen conditions for extended periods without external power sources has been widely leveraged by both small-scale vendors and large food chains.

The foodservice sector has increasingly relied on insulated foam containers to meet growing consumer expectations for freshness, safety, and convenience. Lightweight handling, stack ability, and cost-effective production have contributed to their widespread distribution across urban and rural channels alike. As the global food delivery infrastructure expands and temperature integrity becomes a quality differentiator in food logistics, foam cooler boxes used in the food and beverage segment are expected to maintain dominance through 2025 and beyond.

Environmental Concerns, Regulatory Restrictions, and Competition from Sustainable Alternatives

Rising environmental concerns regarding the use of expanded polystyrene (EPS) and non-biodegradable foam material is a restraint in growth of the market. Because of the many countries introducing bans on plastic, manufacturers are seeking other sustainable materials. Sustainable cooler alternatives are also gaining ground, with biodegradable, reusable and recyclable coolers threatening to become players in the space. Supply chain disruptions and volatile raw-material costs only compound the challenge for manufacturers.

Cold Chain Logistics, Outdoor Recreation, and Green Foam Innovations Will Forge Ahead

This demand leads to low operating margins and increasingly tight supply chains, and that doesn’t seem to be slowing down temperature-specific orders, particularly for pharmaceuticals, food delivery and outdoor recreation. The expansion of the cold chain logistics industry, especially for the movement of vaccines and perishable goods, is pushing the market need for cold chain logistics.

Bio-based foams, recyclable EPS coolers, and lightweight insulation technologies allow producers to achieve sustainability goals without sacrificing product performance. Rising trend of camping, fishing and outdoor leisure activities is further boosting the consumer demand for portable cooler boxes.

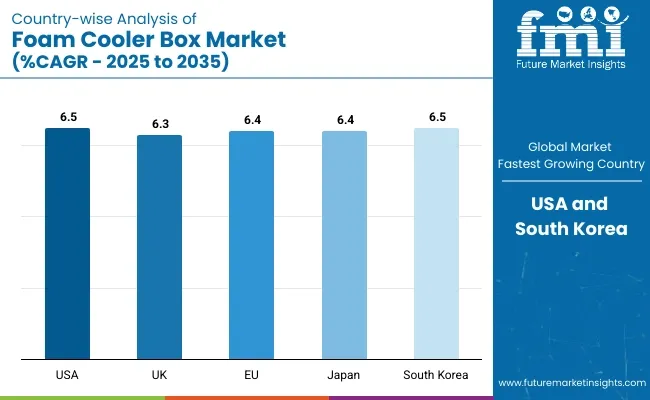

Due to increasing demand for temperature-sensitive packaging in pharmaceuticals, food logistics, and outdoor recreation, the USA foam cooler box market is expanding. The market is on the rise due to high presence of cold chain logistics providers as well as medical supplies transport companies.

The growing popularity of meal-kit delivery services and fresh food e-commerce is also contributing to the demand for lightweight, cost-effective insulation solutions. But growing regulatory pressure to eliminate single-use EPS foam is leading manufacturers to seek out recyclable and plant-based foam alternatives. Industry heavyweight players are also bets on advanced insulation technologies and biodegradable cooling solutions in light of changing regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The UK market is growing at a highly robust rate owing to strict eco-friendly legislation, placing a greater emphasis on environmentally friendly packaging. Government regulations are pushing alternative packaging materials like biodegradable and recyclable materials to replace EPS foam that traditionally fills shipping boxes.

The growing food delivery & grocery e-commerce sector and rising demand for cold chain pharmaceutical logistics are fuelling the market growth. To find a middle ground between environmental sustainability and cost-effectiveness, companies are experimenting with hybrid packaging solutions, like foam-corrugated paper combinations. As such, the growing preference towards outdoor recreational activities is anticipated to propel the demand for portable and reusable cooler boxes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

Its foam cooler box market in Europe is strongly impacted by rigorous sustainability regulations such as bans on single-use plastics and non-recyclable foam packaging. Therein lies another edge of the market, towards low-impact insulation material, bio-based foams and recyclable polymers. The regional pharmaceutical sector, with investments increasing in vaccine cold chain logistics,is propelling demand for sophisticated thermal packaging solutions.

Some grocery & meal delivery services are already introducing eco-friendly insulation options through major retailers & food service companies. The future of market space will be driven by investments in smart cooling technology and IoT based temperature monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.4% |

Growing demand for cold-chain logistics, medical supply transport and high-tech food packaging solutions is driving Japan's foam cooler box market. Due to a good frozen and chilled food distribution network in the country, the show announces lightweight and highly-insulated packaging.

Japan’s drive for smart packaging innovations is also spurring the adoption of IoT-enabled temperature tracking systems in cooler boxes. Increased investment in bio-based and recyclable insulation materials as the government looks to reduce plastic waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The growth of online grocery delivery, pharmaceutical logistics, and eco-friendly packaging initiatives are contributing to the increasingly dominant foam cooler box market in South Korea. The country’s robust e-commerce sector, particularly in the fresh food delivery space, is driving demand for insulation solutions that are both durable and cost-effective.

The government’s own aggressive sustainability policies are prompting businesses to invest in biodegradable and reusable cooler boxes. Tech developments around thermal efficiency and AI-powered logistics monitoring are another part of the new dynamic shaping the market. Consumers increasingly are choosing personal size, reusable coolers in a sign of a shift to more sustainable consumer behaviour.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

In the food, pharmaceuticals, and logistics industries, the foam cooler box market is driven by a growing need for temperature-sensitive packaging solutions. Growing implementation of sustainable and bio-based substitutes, along with ongoing developments in AI-enabled thermal insulating materials technology, will affect the market.

Leading industry players are focused on high-performance insulation materials sustainable packaging innovations and AI-optimized cold chain logistics. Leading segmental participants are packaging manufacturers, cold chain logistics firms, and specialty insulation providers implementing innovative foam cooler box solutions that possess light weighting, durability, and thermal efficiency.

Sonoco ThermoSafe (18-22%)

Sonoco ThermoSafe leads in AI-powered thermal packaging innovations, offering high-performance insulated containers for pharmaceutical cold chain logistics.

Cold Chain Technologies (14-18%)

Cold Chain Technologies specializes in sustainable and AI-driven cold chain packaging, developing reusable and biodegradable foam cooler boxes for global supply chains.

Plastilite Corporation (10-14%)

Plastilite focuses on lightweight and cost-effective foam cooler solutions, optimizing insulation technology for perishable food and beverage transportation.

Cryopak (Integreon Global) (8-12%)

Cryopak integrates AI-assisted temperature stability tracking and phase change material (PCM) technologies for precision thermal packaging in healthcare and logistics.

Lifoam Industries, LLC (6-10%)

Lifoam Industries emphasizes recyclable and biodegradable foam cooler solutions, integrating AI-powered predictive temperature control for outdoor and commercial use.

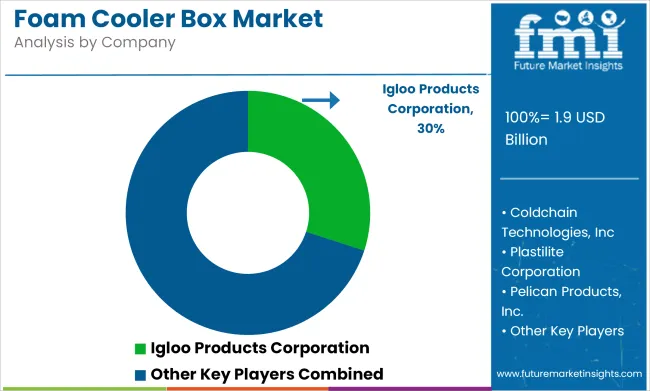

Other Key Players (30-40% Combined)

Several packaging manufacturers, insulation technology firms, and cold chain logistics providers contribute to next-generation foam cooler box innovations, AI-enhanced temperature regulation, and sustainable packaging solutions. Key contributors include:

The overall market size for the foam cooler box market was USD 1.9 billion in 2025.

The foam cooler box market is expected to reach USD 3.6 billion in 2035.

The demand for foam cooler boxes is expected to rise due to increasing use in food and beverage transportation, growing demand for temperature-sensitive pharmaceutical packaging, and expanding applications in outdoor recreational activities. Additionally, advancements in insulation materials, the rise of e-commerce food delivery services, and regulatory compliance for perishable goods transportation are further driving market growth.

The top 5 countries driving the development of the foam cooler box market are the USA, China, Germany, India, and Japan.

Expanded Polystyrene (EPS) and Polyurethane (PU) Foam Cooler Boxes are expected to command a significant share over the assessment period, driven by their superior thermal insulation properties, lightweight design, and cost-effectiveness in cold chain logistics.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Foam Labels Market Trends and Growth 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA