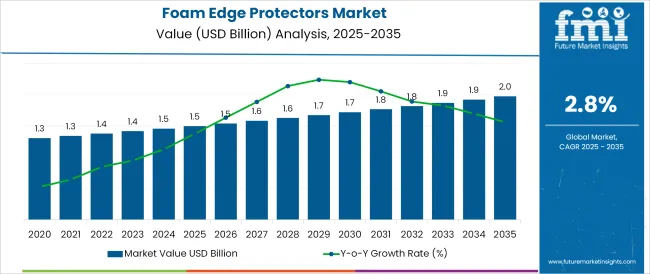

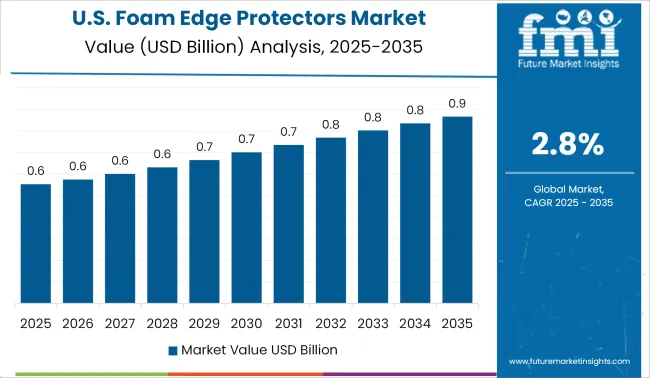

The Foam Edge Protectors Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

The foam edge protectors market is gaining momentum as industries increasingly prioritize damage prevention during transit and storage. The shift toward lightweight packaging, combined with the need for shock-absorbing and surface-protective solutions, is propelling demand for foam-based edge protection across diverse end-use sectors.

Growth is being reinforced by developments in e-commerce logistics, industrial automation, and retail packaging where product integrity and reduced return rates are critical. Foam edge protectors offer recyclability, ease of customization, and superior cushioning performance, making them suitable for a wide array of materials including glass, wood, electronics, and metal components. Companies are investing in sustainable alternatives and closed-loop packaging systems, further amplifying demand for reusable and recyclable foam products.

Expansion in international shipping and warehouse automation has also accelerated market adoption. The outlook remains positive as market players emphasize material innovation, scalability, and efficient protective packaging aligned with circular economy principles and evolving regulatory expectations.

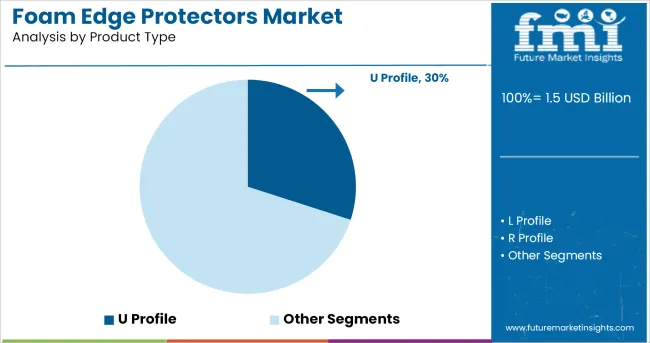

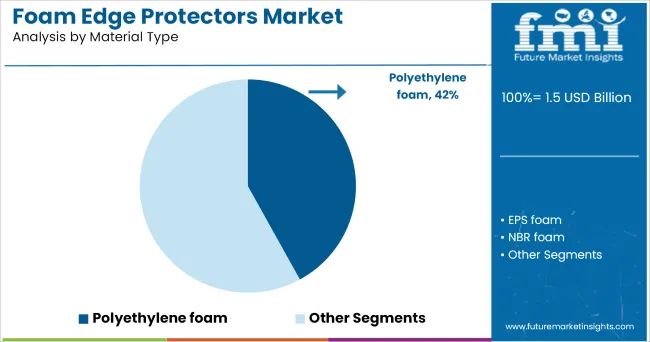

The market is segmented by Product Type, Material Type, and End Use and region. By Product Type, the market is divided into U Profile, L Profile, R Profile, CC Profile, O Profile, and U-tulip Profile. In terms of Material Type, the market is classified into Polyethylene foam, EPS foam, NBR foam, Extruded TPE foam, and Polyurethane foam.

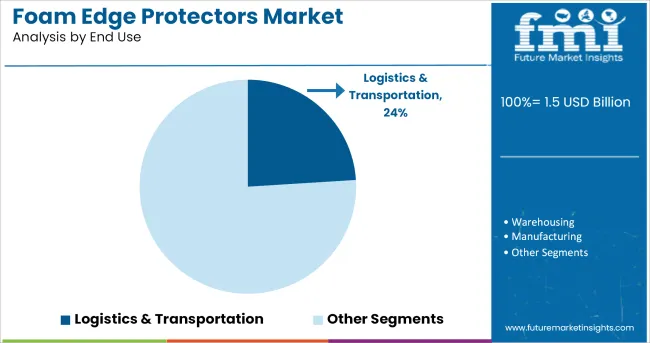

Based on End Use, the market is segmented into Logistics & Transportation, Warehousing, Manufacturing, Food & Beverages, Building & Construction, Personal Care & Cosmetics, Pharmaceuticals, Electrical & Electronics, Chemicals, Others, and Homecare. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The U profile segment is expected to account for 30% of total market revenue in 2025, making it the leading product category. This dominance is attributed to its structural versatility and ability to provide multidimensional protection for edges, corners, and surfaces prone to impact damage. U profile foam protectors are designed to conform easily around sharp or irregular edges, offering reliable performance across varying product geometries.

Their lightweight yet durable construction facilitates cost-effective transport without compromising protection levels. U profiles are widely preferred due to their ease of application in both automated and manual packaging setups. Additionally, they are compatible with a range of secondary packaging materials and can be tailored to specific thicknesses and densities based on client requirements.

Growing use in both primary and secondary packaging has further supported this segment’s expansion, as stakeholders aim to prevent product damage, optimize material usage, and reduce transit-related returns.

Polyethylene foam is projected to hold a 42% revenue share in the foam edge protectors market in 2025, emerging as the dominant material segment. Its leadership is underpinned by exceptional durability, shock absorption, moisture resistance, and chemical inertness qualities that are critical for protective packaging across industrial and commercial environments.

Polyethylene foam's closed-cell structure provides consistent cushioning and impact resistance while retaining shape memory, making it ideal for repetitive use. Furthermore, the material's lightweight properties contribute to reduced shipping costs and improved handling efficiency.

Recyclability and non-toxic composition align with sustainability targets and regulatory compliance, enhancing its appeal among environmentally conscious brands. Its compatibility with both automated cutting systems and custom mold designs allows for seamless integration into large-scale packaging lines. As companies seek reliable and eco-friendly packaging materials, polyethylene foam is expected to maintain its market leadership through continued innovation and material optimization.

The logistics & transportation segment is forecast to represent 24% of market revenue in 2025, positioning it as the top-performing end-use category. This segment’s leadership is being driven by increasing global trade, e-commerce proliferation, and supply chain diversification, all of which have elevated the need for effective transit protection.

Foam edge protectors are being widely used to safeguard packaged goods during storage, handling, and cross-border movement, minimizing breakage and financial loss. As logistics providers optimize palletization and automated warehousing processes, the use of lightweight and customizable edge protection has become essential to maintain product integrity.

Enhanced performance during long-haul transit and under variable environmental conditions has reinforced demand for foam-based solutions in this sector. Additionally, regulatory expectations surrounding damage prevention in cargo handling and the growing preference for returnable packaging systems have accelerated the integration of foam edge protectors within logistics networks focused on reducing waste and enhancing delivery efficiency.

Material shipping and exports requires packaging material to prevent product from getting harm. Primary packaging includes cartons and boxes. Complex and prolonged supply chains can result into damage of primary and secondary packaging.

Foam edge protector’s plays vital role in protecting the packaging. Due to environment-friendly and cost-effective nature of foam edge protector’s products will also uplift the market growth. Specially engineered U profile provides protections to edges and corners. They are easy to apply and can be reused.

There is increase in the global manufacturing output, goods stored in warehouse or during transit can get damaged. As foam edge protectors used to strengthen the stack, more goods can be stacked up easily. Consumer spending on packaged items affected by recession is propelling new strategies to provide product integrity and technological advancement, these are expected driving factors.

Foam edge protectors protect every surface from abrasion and sharp impacts. It prevents valuable material from breakage and falling apart. They are used to add strength and structure to palletised boxes and also stabilises the load, so that the goods protected from knocks and bangs but won’t collapsed under their own weight. Foam edge protectors used to support strapping and fixings.

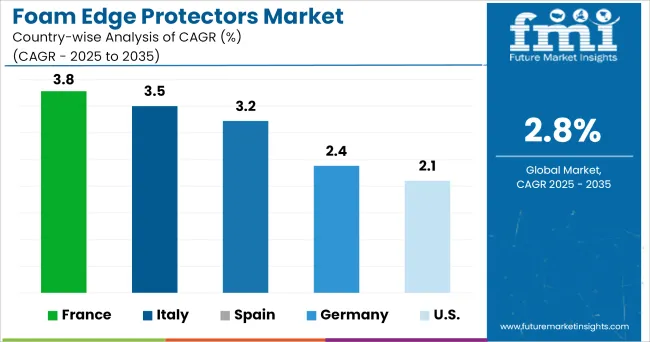

USA and Canada are expected to have the highest share and therefore will dominate the foam edge protective market. This is due to the food and beverages and pharmaceutical industries are key end users.

Booming ecommerce industry is expected to drive demand for foam edge protectors. ProFlex® profiles of Pregis LLC. Available from April 29, 2009- Pro confirm around edged and corners and cylindrical pipes to keep it safe.

The European market for foam edge protective is estimated to grow at considerable rate during the forecast period. This surge in growth is due to the growing expenditure on packers and movers.

Fees for a professional packing/unpacking and loading/unloading service generally start at about £100 (GBP) for half a 20ft container (15 cubic meters), but more cargo means higher prices.

Nordpack GmbH is one of the largest packaging distributor and service provider in Germany. Polyurethane (PE) foam edge protectors protects and cushion the edges and corners of items. The strips are CFC free and recyclable and they are resistant to moisture as well as to temperature changes from - 40 to +100 degrees. Moreover, the logistics and packers and movers are also expected to drive the sales of Foam edge protectors.

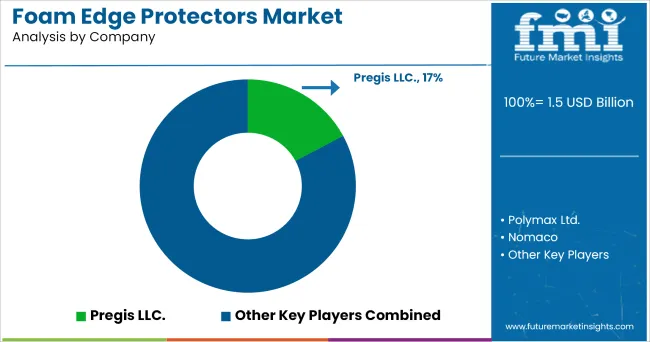

Some of the key players operating in the Foam Edge Protective market

Nomaco is a leader in design and extrusion of custom engineered foam products. Nomaco is the first manufacturer in USA to develop polyethylene packaging profiles. Corex, a division of VPK packaging group acquired European and Chinese business of Corenso in 2020.

Key manufacturers are escalating their business through developments, collaborations and geographic expansions in emerging regions. It is spread across 16 countries producing edge protectors. The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global foam edge protectors market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the foam edge protectors market is projected to reach USD 2.0 billion by 2035.

The foam edge protectors market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in foam edge protectors market are u profile, l profile, r profile, cc profile, o profile and u-tulip profile.

In terms of material type, polyethylene foam segment to command 42.0% share in the foam edge protectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Foam Edge Protectors Market Share & Industry Insights

Key Players & Market Share in the Paper Edge Protectors Industry

Molded Fiber Pulp Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Edge Bead Remover (EBR) Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Edge Security Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Edge AI for Smart Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA