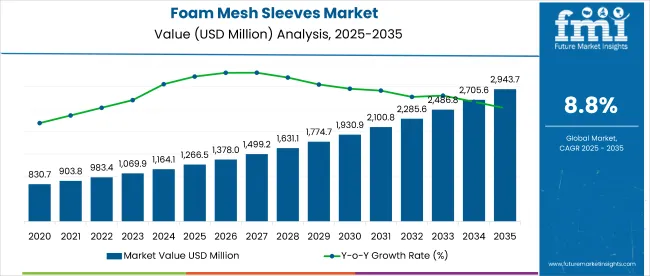

The global foam mesh sleeves market is projected to expand from USD 1,266.5 million 2025 to USD 2,943.7 million by 2035, advancing at a CAGR of 8.8% over the assessment period.

In 2025, the foam mesh sleeves segment is expected to account for 5.2% of the global protective packaging market, which is valued at approximately USD 24.5 billion. Demand has been buoyed by increased handling of perishable produce across export supply chains and growing reliance on flexible packaging forms in retail logistics.

Demand for foam mesh sleeves is being driven by increasing fruit and vegetable exports, especially from Asia and Latin America to the EU and North America. Retailers and packers continue to prefer EPE-based mesh sleeves for their durability, cushioning performance, and lightweight design. Growth has also benefited from the proliferation of organized grocery and e-commerce channels in South and East Asia.

However, rising scrutiny of plastic-based packaging-especially polyethylene variants-has created regulatory pressure across the EU and Japan. Suppliers face material substitution risk, prompting a search for bio-based alternatives. Furthermore, price volatility of fossil-derived inputs such as ethylene and polypropylene remains a critical cost-side concern.

Opportunities lie in automation-compatible sleeve formats tailored for high-speed produce sorting lines. Vendors offering custom die-cut and UV-stabilized mesh sleeves have seen measurable gains in repeat orders. Meanwhile, the trend toward reduced SKU damage during transit is fostering partnerships between importers and region-specific sleeve manufacturers. These factors, combined, continue to pull the market toward specialized, performance-driven solutions.

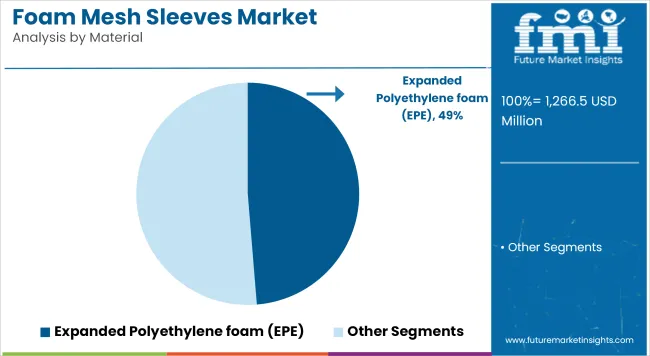

The global foam mesh sleeves market has been analyzed across multiple segments, including Material (Expanded Polyethylene Foam (EPE); Polyethylene (PE) - Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE); Polypropylene (PP)); and Packaging Application (Fruits and Vegetables; Glass Bottles and Containers; Electronics; Others).

Regional and country-level assessments cover North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa, with deeper analysis by key nations such as the USA, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Spain, China, Japan, South Korea, India, and Australia & New Zealand.

In 2025, Expanded Polyethylene Foam (EPE) leads the material segment with a 49% market share-17 percentage points ahead of Polypropylene (PP). This edge stems from its superior cushioning-to-weight ratio, which makes it ideal for protecting delicate produce and containers in transit.

EPE demand has been sustained by its adaptability across fruit, glassware, and electronics packaging. However, regulatory friction in Europe and Japan over single-use plastics continues to prompt material reassessment by importers and converters.

The disruptor lies in the shift toward UV-resistant EPE variants. These are expected to drive a 15-18% increase in demand from tropical fruit exporters targeting long-haul shipping lanes, encouraging product upgrades among established vendors.

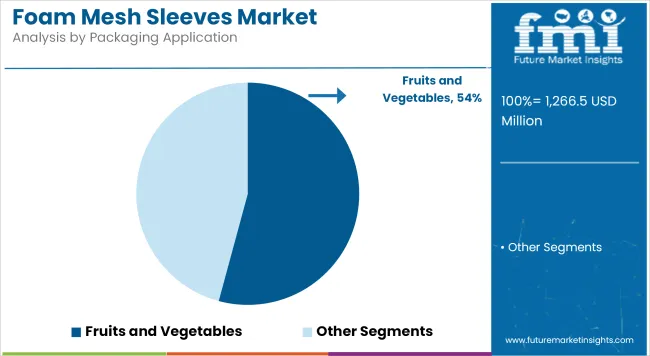

The Foam Mesh Sleeves market is predominantly driven by the fruits and vegetables segment, which accounts for 54% of the total market share, equivalent to approximately USD 683.3 million out of the total market size of USD 1,266.5 million.

This highlights the significant demand for foam mesh sleeves in protecting and packaging fresh produce, emphasizing their critical role in maintaining product quality and reducing damage during transportation and handling.

The remaining 46% of the market comprises other segments, indicating opportunities for growth and diversification in various packaging applications beyond fruits and vegetables.

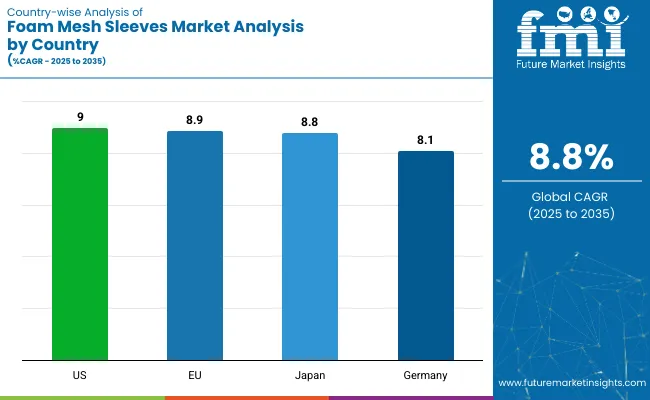

The global foam mesh sleeves market exhibits strong and varied growth across key countries, driven by region-specific demand dynamics and regulatory environments. The United States leads with a robust CAGR of 9.0%, fueled by expanding fresh produce exports, stringent FDA packaging guidelines, and growing adoption of automation in logistics.

The European Union matches this growth rate at 9.0%, driven by heavy intra- and extra-EU trade of perishable goods alongside increasing regulatory pressure to adopt recyclable and biodegradable packaging solutions. Countries within the EU such as Germany, France, and Italy are pivotal markets with rising demand for sustainable foam mesh sleeves, especially for organic and premium fruit segments.

Japan maintains steady growth at 8.8% CAGR, supported by a mature retail sector focused on quality packaging and growing interest in recyclable, thinner-profile foam materials that align with national plastic waste reduction policies. Across these regions, suppliers are innovating with UV-resistant and breathable mesh sleeves tailored to local export profiles and mechanized packing lines.

Collectively, these markets reflect a blend of regulatory-driven material shifts, evolving consumer preferences for freshness and minimal damage, and the rising importance of automation-compatible packaging solutions, setting a global growth benchmark for the foam mesh sleeves sector.

The USA foam mesh sleeves market is forecast to grow at a CAGR of 9.0% between 2025 and 2035, reflecting strong demand driven by expanding fresh produce exports and increased packaging automation in logistics. Valued at approximately USD 330 million in 2025, the market benefits from regulatory encouragement for lightweight, recyclable packaging solutions that reduce waste while protecting perishables.

Stricter FDA and EPA regulations are pushing companies to optimize packaging sustainability, influencing material innovation, especially in polyethylene alternatives. Consumer preference for fresher, visually appealing fruits and vegetables has fueled the uptake of protective foam mesh sleeves that reduce bruising and spoilage.

The EU market is projected to grow at a 8.9% CAGR over the forecast period, supported by robust intra- and extra-EU fruit and vegetable trade flows. Valued near USD 280 million in 2025, the market faces challenges from stringent environmental regulations such as the EU Single-Use Plastics Directive.

Suppliers are increasingly investing in biodegradable and recyclable foam mesh alternatives to comply with evolving policies. The demand for premium-quality packaging that minimizes damage and enhances shelf appeal remains high across major member states such as Germany, France, and Italy.

Japan’s foam mesh sleeves market is set to expand at an 8.8% CAGR, reflecting steady growth driven by a mature retail sector and demand for premium packaging solutions in fruit exports and fragile electronics packaging. Valued around USD 160 million in 2025, the market benefits from consumer expectations for product quality and minimal damage.

High labor costs drive automation adoption in packaging, leading to demand for sleeve designs compatible with mechanized packing lines. Regulatory focus on plastic waste reduction is stimulating innovation in recyclable foam materials and reduced material thickness.

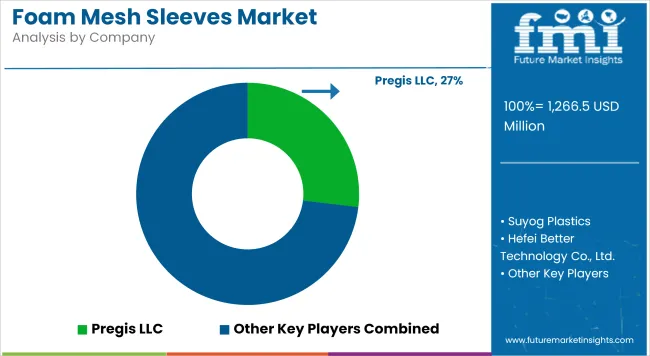

The foam mesh sleeves market is characterized by a mix of global leaders and regional specialists competing on product innovation, customization, and supply chain efficiency. Pregis LLC leads with a 27% market share, leveraging its broad product portfolio and extensive distribution network across North America and Europe. Other key players such as Suyog Plastics and Hefei Better Technology Co., Ltd. maintain strong footholds in Asian markets through cost-competitive manufacturing and tailored product offerings.

Competition has intensified around the development of sustainable and bio-based foam materials, driven by rising regulatory scrutiny on polyethylene and polypropylene products. Companies like Unipack Pte Ltd. and Paramount Packaging are investing in R&D to create recyclable, lightweight mesh sleeves that meet stricter environmental standards without compromising protective performance.

Regional players such as Laizhou Pengzhou Packing Products Co., Ltd. and Kamaksha Thermocol focus on niche applications, serving local agricultural exporters and e-commerce sectors with customized solutions. Meanwhile, Industrial Netting and Indonet Plastic Industries emphasize integrated supply chain services, offering value-added logistics and just-in-time delivery.

The market’s competitive dynamics favor agile manufacturers who can quickly innovate and align with evolving customer and regulatory demands. Smaller firms like Creative Protective Sdn Bhd are gaining traction through specialized product lines, particularly in emerging markets.

| Attribute | Details |

|---|---|

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Market Value Unit | USD Million |

| Segments Covered | By Material (Expanded Polyethylene Foam (EPE), Polyethylene (LDPE, HDPE), Polypropylene (PP)); Packaging Application (Fruits and Vegetables, Glass Bottles and Containers, Electronics, Others) |

| Geographies Covered | North America (USA, Canada, Mexico); Latin America (Brazil, Argentina, Rest of LATAM); Western Europe (Germany, Italy, France, UK, Spain, BENELUX, Nordic, Rest of W. Europe); Eastern Europe (Russia, Hungary, Poland, Balkan & Baltics, Rest of E. Europe); East Asia (China, Japan, South Korea); South Asia & Pacific (India, Australia & New Zealand, ASEAN, Rest of SAP); Middle East & Africa (GCC Countries, Northern Africa, South Africa, Turkiye, Rest of MEA) |

| Key Players Covered | Pregis LLC, Suyog Plastics, Hefei Better Technology Co., Ltd., Unipack Pte Ltd., Paramount Packaging, Industrial Netting, Laizhou Pengzhou Packing Products Co., Ltd., Kamaksha Thermocol, Indonet Plastic Industries, Creative Protective Sdn Bhd |

| Research Methodology | Secondary and primary research, market surveys, expert interviews, data triangulation |

The foam mesh sleeves market is projected to reach approximately USD 2,943.7 million by 2035, growing at a CAGR of 8.8% from 2025 to 2035.

Expanded Polyethylene Foam (EPE) holds the largest share, accounting for 49% of the market in 2025.

The fruits and vegetables packaging application leads, comprising 54% of the market share in 2025.

The United States is expected to lead with a CAGR of 9.0% from 2025 to 2035.

Key players include Pregis LLC, Suyog Plastics, Hefei Better Technology Co., Ltd., Unipack Pte Ltd., and Paramount Packaging among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA