The Foam Plastics Market is estimated to be valued at USD 61.9 billion in 2025 and is projected to reach USD 106.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. A compound annual growth rate (CAGR) analysis reveals consistent expansion driven by the increasing demand for foam plastics across various industries, such as construction, automotive, packaging, and consumer goods. Between 2025 and 2030, the market grows from USD 61.9 billion to USD 81.3 billion, contributing USD 19.4 billion in growth, with a CAGR of 7.2%. This early-phase acceleration is largely fueled by rising demand for energy-efficient building materials, lightweight automotive components, and sustainable packaging solutions.

Foam plastics are increasingly favored for their versatility, insulating properties, and cost-effectiveness. From 2030 to 2035, the market continues to expand from USD 81.3 billion to USD 106.7 billion, adding USD 25.4 billion in growth, with a slightly lower CAGR of 4.7%. The deceleration reflects the market nearing saturation in more mature regions where the demand for foam plastics stabilizes. However, sustained growth is supported by innovations in foam materials, including bio-based and recyclable variants, and increasing adoption in emerging markets where infrastructure development and industrialization drive demand for versatile materials. The CAGR analysis indicates strong early-phase acceleration, followed by stable, steady growth as the market matures and expands into new regions.

| Metric | Value |

|---|---|

| Foam Plastics Market Estimated Value in (2025 E) | USD 61.9 billion |

| Foam Plastics Market Forecast Value in (2035 F) | USD 106.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The foam plastics market is experiencing notable growth due to increasing demand for lightweight, energy efficient, and durable materials across construction, automotive, and consumer goods industries. Environmental regulations and green building standards are encouraging the use of foam plastics for insulation and energy conservation.

Polymeric innovations have enhanced material strength, thermal resistance, and recyclability, making foam plastics integral to modern construction and industrial design. Rapid urbanization, infrastructure investments, and emphasis on sustainable development are further fueling demand.

Additionally, advancements in manufacturing techniques such as extrusion and injection molding are enabling cost effective production and broader application scopes. As industries prioritize performance, insulation, and design flexibility, foam plastics are increasingly positioned as essential components across high growth sectors, particularly in emerging economies.

The foam plastics market is segmented by type, application, sales channel, and geographic regions. By type, the foam plastics market is divided into Polyurethane, Polystyrene, Polyolefin, Phenolic, and Others. In terms of application, the foam plastics market is classified into Building & construction, Packaging, Automotive, Furniture & bedding, Footwear, Sports & recreational, and Others.

Based on sales channel, the foam plastics market is segmented into Direct sales and Indirect sales. Regionally, the foam plastics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyurethane segment is anticipated to contribute 41.60% of the total market revenue by 2025 under the type category, establishing itself as the leading material. This dominance is driven by its superior insulation properties, lightweight nature, and adaptability to a wide range of manufacturing processes.

Polyurethane foam is widely used in structural insulation, cushioning, and sealing applications where thermal efficiency and material flexibility are critical. Its compatibility with energy-efficient building practices and long-term durability has further solidified its role in modern construction and industrial environments.

As demand grows for materials that support sustainability goals without compromising performance, polyurethane continues to lead the type segment of the foam plastics market.

The building and construction segment is projected to hold 36.90% of the total market share by 2025 under the application category, marking it as the primary growth area. This segment’s strength stems from the increasing global emphasis on energy conservation, green building initiatives, and infrastructure development.

Foam plastics are extensively used for insulation, roofing, and flooring solutions due to their thermal resistance, lightweight profile, and ease of installation. Regulatory codes mandating energy efficiency and improved indoor climate control have accelerated their use in both residential and commercial projects.

Their ability to reduce energy loss and support long-lasting building performance continues to position the building and construction sector at the forefront of foam plastic applications.

The direct sales channel is expected to represent 54.20% of the total market revenue by 2025, making it the dominant sales channel. This is driven by strong partnerships between manufacturers and industrial buyers, allowing for customized product specifications, consistent supply, and cost advantages.

Direct sales facilitate improved technical support, bulk order management, and better alignment with project timelines, especially in sectors such as construction and automotive. The preference for direct sourcing also helps streamline procurement processes and enhance long-term business relationships.

As large-scale infrastructure and manufacturing projects increase globally, the direct sales channel remains the preferred route for foam plastics distribution due to its efficiency, control, and value-driven service models.

The foam plastics market is expanding rapidly due to the increasing demand for lightweight, durable, and insulating materials in industries such as packaging, construction, automotive, and electronics. These materials offer superior properties such as heat and sound insulation, shock absorption, and protection for delicate products. In packaging, foam plastics provide cost-effective solutions for cushioning products during transit, while in construction, they are used for insulation, improving energy efficiency. Innovations in foam plastic technologies, including biodegradable and recyclable options, are further fueling market growth as industries prioritize eco-friendly alternatives.

The growing demand for lightweight and insulating materials is a major driver of the foam plastics market. In the automotive sector, foam plastics help reduce vehicle weight, which contributes to improved fuel efficiency and overall performance. This is particularly important as automakers look to meet stringent emissions regulations and enhance vehicle efficiency. In construction, materials like expanded polystyrene (EPS) and extruded polystyrene (XPS) are widely used for insulation due to their excellent thermal properties, which help reduce energy consumption in buildings. Foam plastics are increasingly used in packaging applications for their ability to provide cushioning and protection for products during transit. These industries are all pushing the demand for foam plastics, as their versatility, low weight, and insulating properties help improve efficiency and reduce costs. As the focus on reducing energy consumption and enhancing performance continues, foam plastics are expected to see strong growth across a variety of applications.

Despite the advantages of foam plastics, the market faces significant challenges, particularly regarding environmental impact and waste management. Many foam plastics are derived from petroleum-based materials, raising concerns about their contribution to plastic pollution. The lack of biodegradability of many foam plastics exacerbates the issue, as they can take hundreds of years to break down in landfills or oceans. While recycling options exist, the complexity and cost of recycling foam materials have led to limited use of these methods. As a result, foam plastics often end up in landfills or as litter, contributing to environmental degradation. Overcoming these challenges requires the development of new technologies and processes that make foam plastics more sustainable, including improvements in the recyclability of foam and the development of more environmentally friendly alternatives. Addressing these concerns is crucial to the long-term growth and acceptance of foam plastics in various industries.

Numerous opportunities exist in the foam plastics market, particularly through innovations in biodegradable and recyclable foam materials. As awareness of environmental issues increases, consumers and industries are increasingly seeking alternatives to traditional petroleum-based foam plastics. This has led to the development of new foam materials made from renewable resources, such as plant-based polymers, which can offer similar properties to traditional foam but with a reduced environmental footprint. Manufacturers are also focusing on improving the recyclability of foam plastics, creating solutions that can be more easily processed at the end of their life cycle. These innovations are expected to play a significant role in expanding the foam plastics market, particularly in industries like packaging, consumer goods, and construction, where demand for eco-friendly alternatives is growing. As regulations around plastic waste tighten and consumer demand for eco-friendly products increases, biodegradable and recyclable foam materials present a promising opportunity for market growth.

A key trend in the foam plastics market is the growing demand for energy-efficient building solutions and packaging materials. In the construction sector, foam plastics are increasingly used for insulation purposes due to their excellent thermal resistance, helping to improve the energy efficiency of buildings by reducing heat loss. As governments and industry stakeholders continue to push for energy-efficient building standards, the demand for foam plastics in insulation applications is expected to increase. In the packaging industry, foam plastics remain a popular choice due to their protective qualities, ensuring the safe transit of products. This trend is expected to continue, with packaging manufacturers seeking lighter, more cost-effective solutions that provide maximum protection. The increasing focus on energy-efficient buildings and packaging solutions is driving further demand for foam plastics. Technological advancements, such as improved recyclability and the development of lighter, more durable foam materials, are also contributing to the market’s growth, as industries look for more efficient and environmentally responsible options.

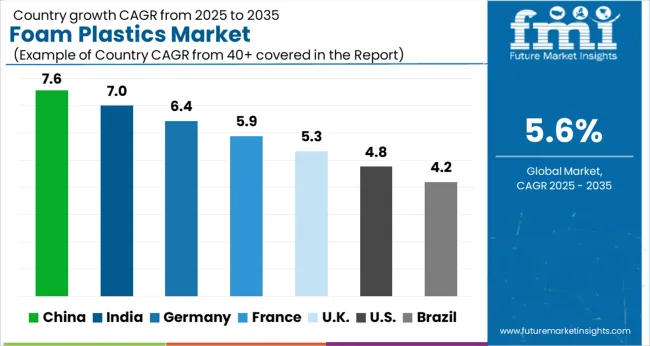

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global foam plastics market is projected to grow at a CAGR of 5.6% from 2025 to 2035, driven by increased demand across the construction, automotive, and packaging industries. China leads with 7.6% growth, driven by industrial expansion and a growing need for lightweight, durable materials. India follows at 7.0%, fueled by rapid urbanization, infrastructure development, and rising demand for packaging solutions. Germany, France, the UK, and the USA show steady growth, supported by ongoing industrial activities, demand for insulation materials, and increased adoption of advanced foam technologies in various sectors. The analysis spans over 40+ countries, with the leading markets shown below.

The foam plastics market in China is projected to grow at a CAGR of 7.6% through 2035. The country’s rapid industrialization, coupled with increasing demand from construction, automotive, and packaging sectors, drives market expansion. As the demand for lightweight and durable materials rises, China is increasingly adopting foam plastics in various applications. The growth of e-commerce and demand for protective packaging further fuels this trend. The country’s robust manufacturing sector and the expansion of the automotive industry, along with significant investments in infrastructure projects, are supporting the increasing consumption of foam plastics in China.

Demand for foam plastics in India is expected to grow at a CAGR of 7.0% through 2035. The country's booming construction sector, along with rising urbanization and infrastructure projects, is contributing to the growing demand for foam plastics. As more industries, including automotive and packaging, seek durable, lightweight materials, the adoption of foam plastics continues to rise. Government initiatives to improve infrastructure and meet increasing energy demands further drive the demand for insulating and protective materials. India’s expanding middle class and growing focus on modernizing industries also support the strong market outlook for foam plastics.

Sale of foam plastics in Germany is projected to expand at a CAGR of 6.4% through 2035. The country’s strong manufacturing base, particularly in automotive and construction, significantly drives the demand for foam plastics. As Germany continues to modernize its industries and increase its focus on energy-efficient construction materials, the adoption of foam plastics rises. Additionally, the demand for packaging solutions, especially in the growing e-commerce sector, fuels the market's expansion. Germany’s emphasis on advanced technology in material production and its robust industrial sectors make it a key market for foam plastics.

The UK foam plastics market is projected to grow at a CAGR of 5.3% through 2035. The demand for foam plastics is driven by the need for durable, lightweight materials in various industries, including automotive, construction, and packaging. As the UK focuses on infrastructure improvements and the construction of energy-efficient buildings, the market for insulating materials such as foam plastics continues to grow. The increasing demand for packaging solutions, especially in the expanding e-commerce sector, further boosts market prospects. Additionally, technological advancements in foam materials and production processes are supporting the market’s growth.

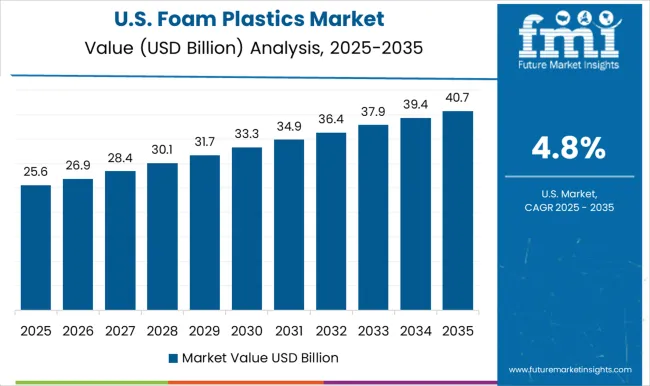

The USA foam plastics market is projected to grow at a CAGR of 4.8% through 2035. The market is driven by strong demand from construction, automotive, and packaging industries, with foam plastics being increasingly adopted for insulation, protective packaging, and lightweight applications. The rise in demand for sustainable construction materials and energy-efficient solutions continues to propel the adoption of foam plastics in the construction sector. The rapid expansion of e-commerce is increasing the need for protective packaging solutions, further driving market growth in the USA

The foam plastics market is led by key players offering a variety of solutions for packaging, automotive, construction, and other industries. Alchemie Ltd. is known for producing eco-friendly foam plastics for industrial applications, focusing on energy efficiency and performance. BASF SE specializes in high-performance foam materials used in insulation, packaging, and automotive sectors, prioritizing durability and cost-effectiveness. Berry Global Inc. provides advanced foam plastics for packaging, offering practical and efficient solutions for consumer goods and industrial uses. Covestro is a major player, offering high-performance foam products for automotive, construction, and packaging industries, emphasizing long-lasting materials and efficiency.

D&W Fine Pack LLC manufactures foam plastics for the foodservice sector, creating cost-effective and lightweight packaging solutions. Dart Container Corporation focuses on foam plastics for disposable foodservice products, combining affordability with reliable quality. Genpak, LLC provides durable foam packaging solutions for food, ensuring product safety and freshness. Groupe Guillin SA manufactures foam plastics for food packaging, focusing on high-quality and innovative solutions for retail and foodservice applications. Hexion Inc. produces foam plastics for automotive, construction, and consumer goods sectors, enhancing material properties and reducing costs. Huntsman International LLC offers advanced foam materials for the construction, automotive, and packaging industries. Pactiv LLC manufactures reliable foam packaging products, catering to the food industry and other commercial sectors.

Sealed Air Corporation offers protective packaging solutions using foam plastics, addressing e-commerce, industrial, and food packaging needs. Sirap Gema S.p.a. specializes in food packaging solutions, and Tekni-Plex, Inc. produces foam plastics for packaging, medical, and industrial applications. UFP Technologies, Inc. serves a wide range of industries with high-performance foam solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 61.9 Billion |

| Type | Polyurethane, Polystyrene, Polyolefin, Phenolic, and Others |

| Application | Building & construction, Packaging, Automotive, Furniture & bedding, Footwear, Sports & recreational, and Others |

| Sales Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alchemie Ltd., BASF SE, Berry Global Inc., Covestro, D & W Fine Pack LLC, Dart Container Corporation, Genpak, LLC, Groupe Guillin SA, Hexion Inc., Huntsman International LLC, Pactiv LLC, Sealed Air Corporation, Sirap Gema S.p.a, Tekni-Plex, Inc., and UFP Technologies, Inc. |

| Additional Attributes | Dollar sales by product type (flexible foam, rigid foam, laminated foam) and end-use segments (packaging, automotive, construction, medical, consumer goods). Demand dynamics are driven by the need for lightweight materials, the increasing adoption of foam in protective packaging, and advancements in energy-efficient applications. Regional trends show significant growth in North America, Europe, and Asia-Pacific, with innovations in foam materials and increased demand across various sectors driving market expansion. |

The global foam plastics market is estimated to be valued at USD 61.9 billion in 2025.

The market size for the foam plastics market is projected to reach USD 106.7 billion by 2035.

The foam plastics market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in foam plastics market are polyurethane, polystyrene, polyolefin, phenolic and others.

In terms of application, building & construction segment to command 36.9% share in the foam plastics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Foam Labels Market Trends and Growth 2035

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA