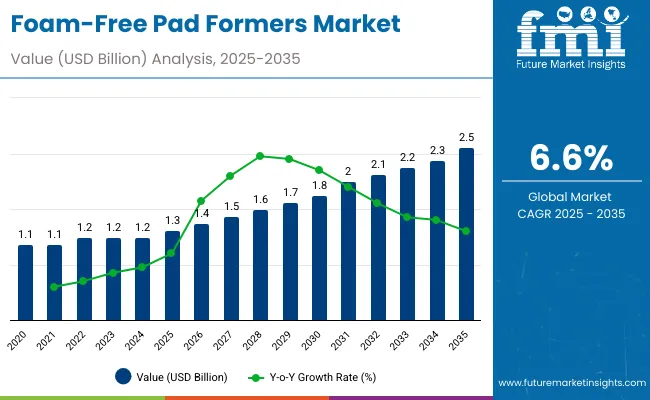

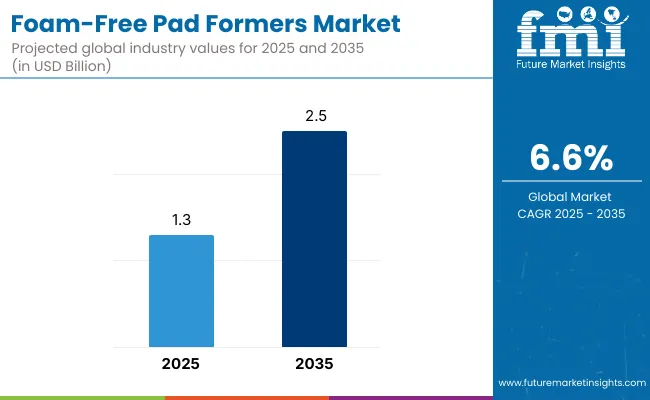

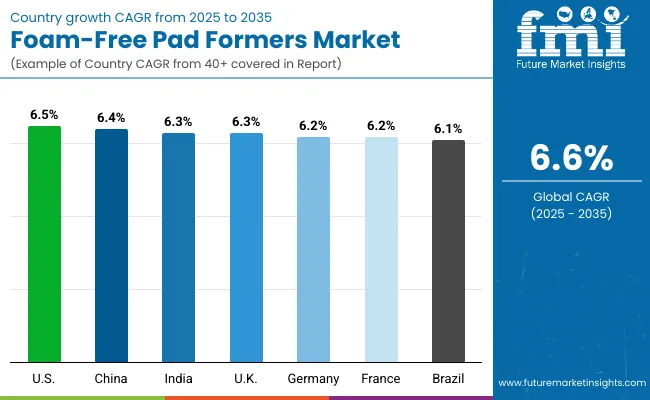

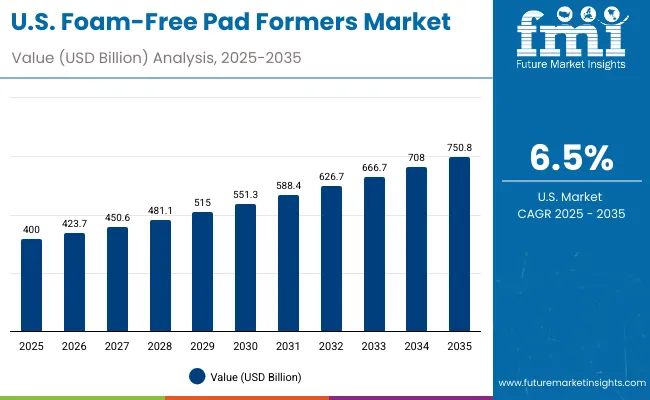

The global Foam-Free Pad Formers Market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, recording a CAGR of 6.6%. Market growth is fueled by the shift from petroleum-based foams toward recyclable and moldedfiber alternatives. Fully automatic pad formers are preferred for their precision and high production efficiency. From 2025 to 2030, rising consumer electronics shipments and sustainable packaging mandates will add significant value to moldedfiber-based cushioning systems. By 2035, Asia-Pacific will emerge as the leading production hub driven by eco-compliant automation.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.3 billion |

| Forecast Value in (2035F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Between 2020 and 2024, sustainability policies and e-commerce expansion accelerated the replacement of foam inserts with fiber and bio-composite packaging. Fully automated forming lines improved process consistency and production speed. By 2035, the market is projected to reach USD 2.5 billion, supported by the integration of recycled pulp and robotics-based forming technology. Asia-Pacific will lead adoption due to cost-effective automation and government-backed sustainability programs.

Growth is driven by environmental restrictions on single-use foams and the need for biodegradable cushioning alternatives. Moldedfiber pads provide structural integrity with full recyclability. Automation advancements in pad forming and efficient drying systems have further improved operational economics for packaging manufacturers.

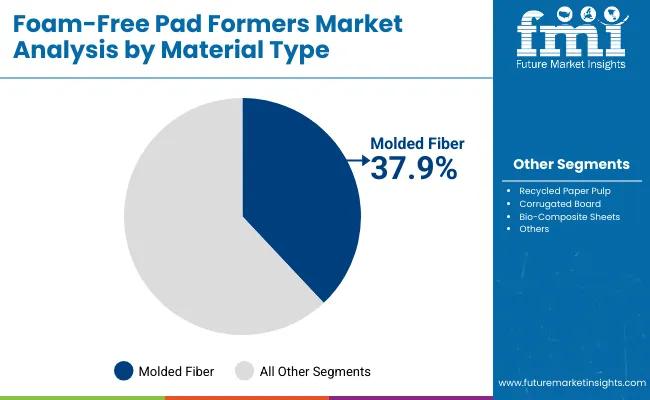

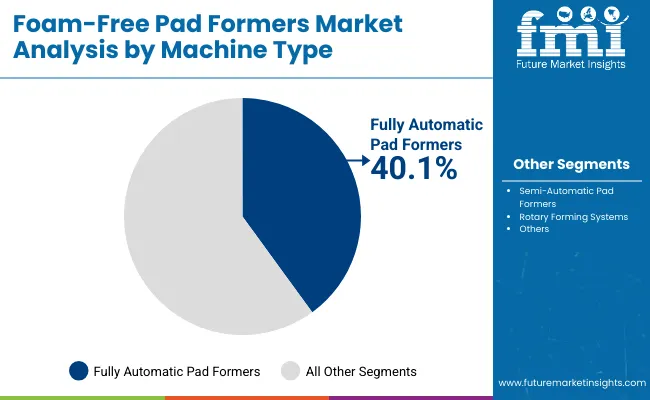

The market is segmented by material type, machine type, application, end-use industry, and region. Material type includes moldedfiber, recycled paper pulp, corrugated board, and bio-composite sheets, offering sustainable alternatives to foam-based protective materials. Machine type covers fully automatic pad formers, semi-automatic pad formers, and rotary forming systems, providing flexibility for diverse production scales. Applications include electronics cushioning, food trays and inserts, medical and pharmaceutical packaging, and consumer goods protection, ensuring product safety and eco-efficiency. End-use industries comprise electronics, food and beverages, pharmaceuticals and healthcare, and consumer goods, reflecting widespread adoption of biodegradable protective solutions. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Moldedfiber is forecast to hold 37.9% of the market in 2025, driven by its durability, compostability, and compatibility with automated forming systems. It offers excellent shock absorption and dimensional stability, making it ideal for protective packaging in electronics, consumer goods, and industrial components.

Adoption is propelled by growing sustainability mandates aimed at eliminating single-use plastics. Moldedfiber’s ability to integrate easily into automated production lines reduces operational costs while meeting eco-friendly targets. Its recyclability and renewable sourcing ensure long-term relevance in sustainable packaging solutions.

Fully automatic pad formers are projected to capture 40.1% of the market in 2025, as they enable high-speed, consistent production with minimal labor input. Equipped with advanced molds, vacuum systems, and real-time controls, these machines deliver uniform fiber pads across various product sizes.

Manufacturers favor full automation for its ability to enhance efficiency and reduce waste. Integration with smart monitoring systems ensures quality consistency while optimizing raw material usage. As demand for scalable, eco-friendly packaging grows, automatic pad formers remain central to industrial production lines.

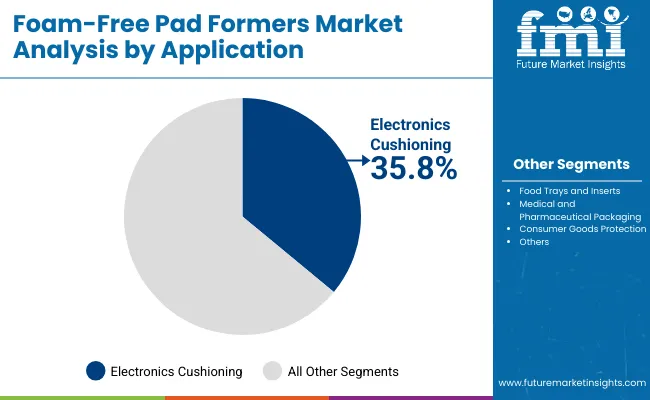

Electronics cushioning is expected to represent 35.8% of the market in 2025, reflecting the need for fiber-based alternatives to plastic foams in device packaging. Molded fiber inserts offer precise fit, vibration resistance, and superior biodegradability, protecting sensitive components during transit.

The application’s growth is driven by surging semiconductor shipments and rising e-commerce electronics sales. Brands are adopting recyclable cushioning to reduce environmental impact without compromising performance. As sustainability becomes a procurement priority, fiber-based cushioning continues to dominate this application.

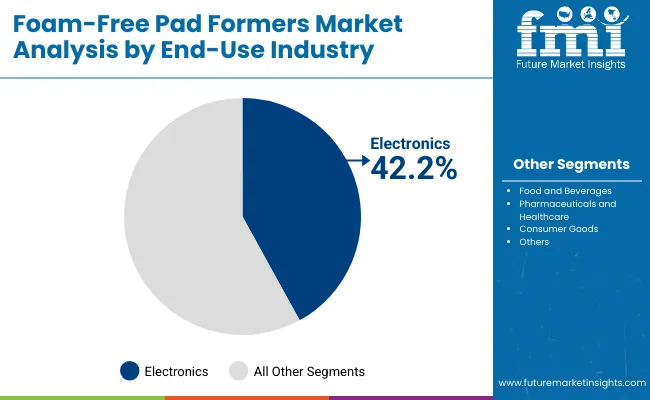

The electronics industry is projected to hold a 42.2% share in 2025, fueled by the transition to biodegradable and recyclable packaging solutions. Companies are replacing foam inserts with molded fiber to align with circular economy objectives and meet consumer sustainability expectations.

By 2035, fiber-based cushioning is expected to replace nearly all conventional foam inserts in consumer electronics packaging. The sector’s global scale and strict environmental compliance accelerate market growth. Continuous investment in design innovation and automation strengthens the electronics industry’s leadership in adopting foam-free solutions.

Bans on foam-based packaging and sustainability certifications drive adoption of fiber and pulp-based cushioning.High initial costs for automated forming lines and slower drying cycles limit scalability.Advances in water-resistant coatings and automated forming precision open premium market applications.Eco-composite innovation, renewable pulp sourcing, and robotics integration are transforming pad forming systems.

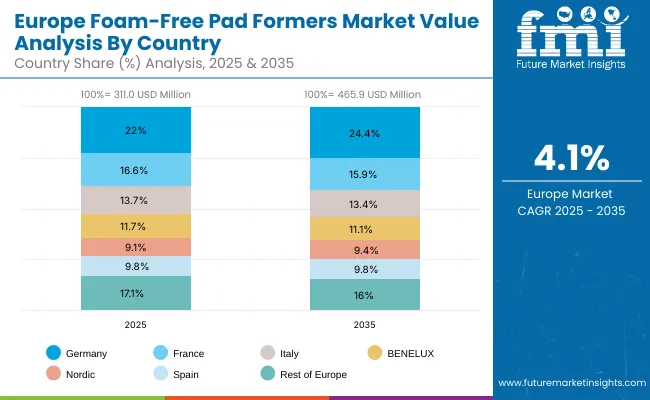

The global foam-free pad formers market is expanding as automation, fiber technology, and sustainability standards drive transformation in protective packaging. Asia-Pacific leads in large-scale production and fiber-forming system development, while North America focuses on automation upgrades for efficiency and cost optimization. Europe’s growth is fueled by innovation in biodegradable materials and recycling regulations. The transition from foam to moldedfiber inserts is accelerating across electronics, food, and consumer goods packaging industries, positioning the market for steady long-term expansion.

The U.S. will grow at 6.5% CAGR, supported by nationwide foam replacement initiatives and strong automation adoption. Manufacturers are expanding fiber-based packaging systems to comply with environmental mandates. Electronics and consumer goods sectors are boosting exports of moldedfiber cushioning products. Robotics integration in forming lines is improving precision, throughput, and energy efficiency across packaging operations.

Germany will expand at 6.2% CAGR, leading global advancements in precision fiber-forming machinery. Continuous innovation in industrial automation is enhancing production efficiency and reducing energy consumption. Strict recycling and sustainability standards are propelling the adoption of fiber-based pad forming technologies. Germany’s exports of premium eco-packaging equipment are increasing as global manufacturers transition away from single-use foam.

The U.K. will grow at 6.3% CAGR, driven by strong sustainability goals in consumer packaging industries. Local pulp production is expanding to support the supply of fiber-based packaging materials. Food and electronics manufacturers are transitioning to moldedfiber inserts as foam alternatives. Automation upgrades are strengthening operational efficiency and boosting the country’s competitiveness in eco-packaging manufacturing.

China will grow at 6.4% CAGR, leading industrial-scale expansion of fiber-forming systems for electronics and FMCG packaging. Domestic machinery manufacturers are improving automation and cost competitiveness. Exports of pulp packaging equipment and components are rising to meet global sustainability demands. Rapid industrial adoption of eco-packaging is reinforcing China’s dominance in the moldedfiber production landscape.

India will grow at 6.3% CAGR, propelled by affordability and government-backed eco-initiatives. Mid-scale manufacturers are increasingly investing in fiber-forming machinery to replace conventional plastic inserts. Local sourcing of raw materials such as bagasse and bamboo pulp is strengthening domestic value chains. The country’s focus on sustainable industrial growth is positioning it as a competitive hub for low-cost fiber packaging systems.

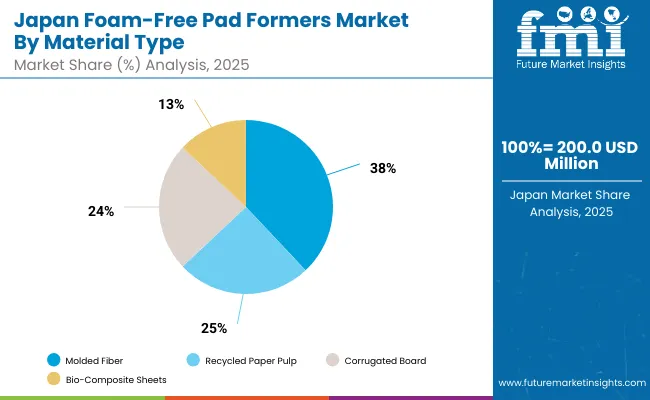

Japan will grow at 6.9% CAGR, leading in hybrid forming systems that merge automation with advanced material science. Precision forming technology is improving structural strength and durability of molded fiber packaging. Fiber-based trays are increasingly replacing PET inserts in food and electronics sectors. Automation and robotics are reducing carbon intensity, aligning with Japan’s national sustainability and manufacturing efficiency goals.

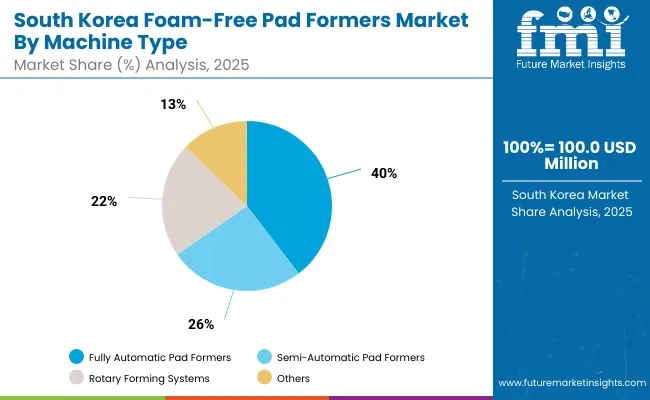

South Korea will lead with 7.0% CAGR, driven by innovation in AI-based forming systems and eco-packaging design. Growing demand for electronics packaging is accelerating production of molded fiber inserts. National eco-standards are fostering large-scale investments in sustainable packaging infrastructure. Expanding exports across Asia-Pacific reflect South Korea’s technological strength in high-efficiency, low-emission pad forming solutions.

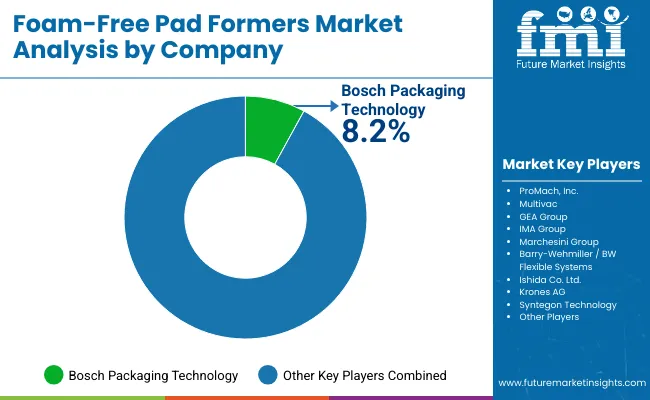

The market is moderately consolidated with Bosch Packaging Technology, ProMach Inc., Multivac, GEA Group, IMA Group, Marchesini Group, Barry-Wehmiller, Ishida Co. Ltd, Krones AG, and Syntegon Technology as leading manufacturers. Companies focus on digital control integration, sustainable material processing, and forming efficiency improvements.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material Type | Molded Fiber , Recycled Pulp, Corrugated Board, Bio-Composite Sheets |

| By Machine Type | Fully Automatic, Semi-Automatic, Rotary Systems |

| By Application | Electronics Cushioning, Food Trays, Medical Packaging, Consumer Goods |

| By End-Use Industry | Electronics, Food & Beverages, Pharmaceuticals, Consumer Goods |

| Key Companies Profiled | Bosch Packaging Technology, ProMach Inc., Multivac , GEA Group, IMA Group, Marchesini Group, Barry- Wehmiller , Ishida Co. Ltd, Krones AG, Syntegon Technology |

| Additional Attributes | Market driven by fiber innovation, automation in pad forming, and regulations banning foam packaging. |

The Foam-Free Pad Formers Market is valued at USD 1.3 billion in 2025.

The Foam-Free Pad Formers Market is projected to reach USD 2.5 billion by 2035.

The market is forecast to grow at a CAGR of 6.6%.

Molded Fiber leads with a 37.9% share.

Fully Automatic Pad Formers dominate with a 40.1% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Pad Mounted Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Padding Bags Market Size and Share Forecast Outlook 2025 to 2035

Pad Printing Machine Market Insights - Growth & Demand 2025 to 2035

Market Share Insights for Padded Mailers Providers

Padded Divider Market Insights & Trends 2024-2034

Pad Mounted Switchgear Market Growth – Trends & Forecast 2024-2034

Padlock Seals Market

Examining Market Share Trends in the Meat Pads Industry

Sweat Pad Market Size and Share Forecast Outlook 2025 to 2035

Multi Pad Drilling Market Size and Share Forecast Outlook 2025 to 2035

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Layer Pads Market from 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Scouring Pads Market Size and Share Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA