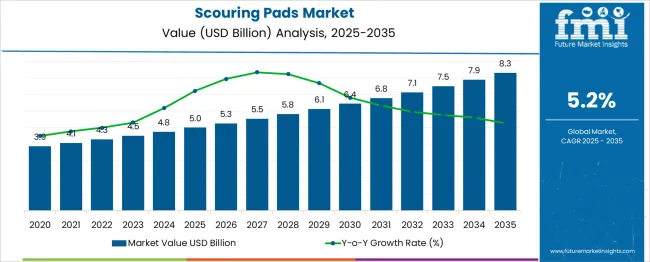

The Scouring Pads Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Year-over-year (YoY) analysis reveals steady growth, with the market increasing by approximately USD 0.9 billion between 2025 and 2030 from USD 5.0 billion to USD 6.1 billion, accounting for roughly 27% of the total market expansion. From 2030 to 2035, the market accelerates, adding USD 2.2 billion to reach USD 8.3 billion, contributing 73% of the overall growth. This uneven Growth Contribution Index suggests stronger momentum in the latter half of the forecast period. The growth is supported by rising demand in both household and industrial cleaning segments, fueled by increased consumer awareness around hygiene and the rising use of eco-friendly materials.

Innovations in abrasive materials and ergonomic design enhancements further support this trajectory. As manufacturers adopt eco-efficient production processes and biodegradable materials, the market’s value proposition improves, appealing to environmentally conscious consumers. The gradual shift to multi-functional scouring pads with added features also contributes to the broadening application scope and sustained market growth.

| Metric | Value |

|---|---|

| Scouring Pads Market Estimated Value in (2025 E) | USD 5.0 billion |

| Scouring Pads Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The scouring pads market is experiencing consistent growth driven by rising demand for effective cleaning tools across domestic and commercial spaces. Increasing awareness about hygiene, coupled with the affordability and durability of scouring pads, has contributed to their widespread adoption.

Manufacturers are introducing innovative designs and materials that enhance cleaning efficiency while minimizing surface damage, further strengthening their appeal. Growth is being supported by expanding retail networks, product visibility in organized trade channels, and evolving consumer preferences toward convenience and reusable products.

Future opportunities are expected to emerge from product differentiation through eco-friendly materials and ergonomic designs, as well as rising penetration in developing markets. The interplay of improved manufacturing processes, greater focus on cleanliness, and competitive pricing is paving the way for sustained expansion and deeper market penetration.

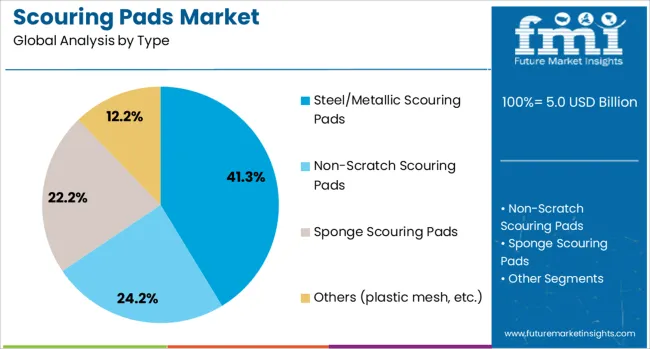

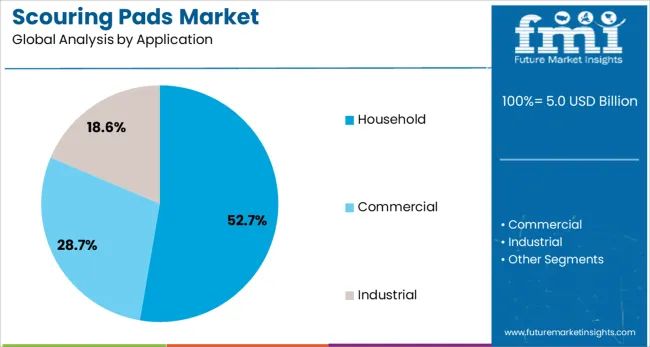

The scouring pads market is segmented by type, application, sales channel, and geographic regions. The scouring pads market is divided into Steel/Metallic Scouring Pads, Non-Scratch Scouring Pads, Sponge Scouring Pads, and others (plastic mesh, etc.). In terms of application, the scouring pads market is classified into Household, Commercial, and Industrial.

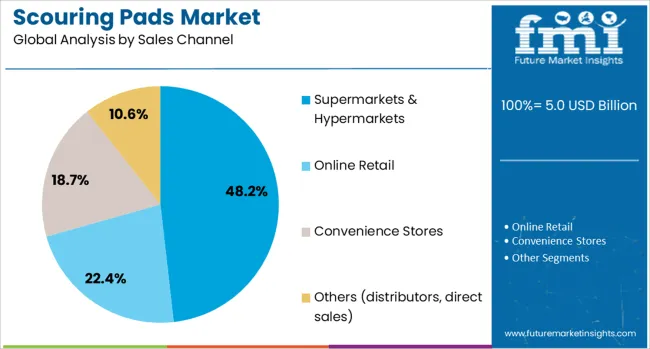

The sales channel of the scouring pads market is segmented into Supermarkets & Hypermarkets, Online Retail, Convenience Stores, and Others (distributors, direct sales). Regionally, the scouring pads industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the steel metallic scouring pads segment is projected to hold 41.30% of the total market revenue in 2025, positioning itself as the leading type segment. This dominance is attributed to the high durability and superior abrasive strength of metallic pads, which enable effective removal of tough stains and grease, particularly in kitchens and industrial settings.

The material’s resistance to wear and its ability to be reused multiple times have enhanced its cost-effectiveness and appeal among consumers. Further contributing to its leadership is its widespread availability in varied sizes and grades, which caters to diverse cleaning needs without compromising on performance.

The segment has also benefited from increased demand in the hospitality and food service sectors, where heavy-duty cleaning is essential, reinforcing its position in the overall market.

In terms of application, the household segment is expected to account for 52.7% of the market revenue share in 2025, emerging as the top application segment. This prominence is driven by the growing emphasis on home hygiene and regular maintenance routines adopted by consumers.

The household segment benefits from the versatility of scouring pads, which are used across kitchens, bathrooms, and other areas requiring efficient cleaning solutions. The affordability, ease of use, and wide availability of scouring pads have made them a staple in households globally.

Manufacturers have been observed focusing on ergonomic designs and gentle yet effective materials specifically targeted for household surfaces, which has further encouraged adoption. The increasing awareness of health and cleanliness, coupled with rising disposable incomes in emerging economies, has sustained demand in this segment, maintaining its leadership position.

When segmented by sales channel, the supermarkets and hypermarkets segment is forecast to capture 48.2% of the market revenue in 2025, securing its position as the leading sales channel. This dominance is reinforced by the visibility and accessibility of scouring pads in organized retail environments, which provide consumers with a wide variety of options and competitive pricing.

The ability of supermarkets and hypermarkets to stock multiple brands, sizes, and price points has allowed them to cater to diverse consumer preferences effectively. Promotional activities, attractive packaging, and the opportunity for consumers to physically assess product quality have further driven sales through this channel.

Additionally, the strong presence of organized retail chains in urban and semi-urban areas has expanded reach and convenience, solidifying the supermarkets and hypermarkets segment’s leadership in driving overall market growth.

The scouring pads market is growing steadily due to increasing demand from household cleaning, commercial kitchens, and industrial cleaning sectors. These pads are valued for their abrasive yet non-damaging surface cleaning capabilities on various materials, including metal, glass, and ceramics. Consumers and businesses prefer eco-friendly and durable options, which has led to innovation in materials and manufacturing processes. Rising awareness about hygiene and efficiency in cleaning processes across residential and commercial settings continues to support the market’s expansion globally.

Scouring pads remain a staple in household cleaning for removing tough stains, grease, and grime from cookware, sinks, and surfaces without causing scratches. The busy lifestyles of consumers drive demand for pads that deliver quick and effective cleaning results. Manufacturers respond by offering pads with enhanced abrasive layers, ergonomic shapes, and antibacterial treatments to improve usability and hygiene. The growing popularity of kitchen gadgets and non-stick cookware has pushed innovation toward gentler, non-scratch pads that balance abrasiveness and surface protection. Packaging innovations such as multi-packs and refillable designs also appeal to cost-conscious consumers. Brand loyalty and visibility in retail outlets influence purchasing decisions, and many companies invest in marketing eco-friendly and biodegradable pad options to meet consumer preferences. Household cleaning remains a steady and large-volume segment supporting ongoing product development.

Commercial kitchens, restaurants, hotels, and food processing plants rely heavily on scouring pads to maintain cleanliness and hygiene standards. These environments require heavy-duty pads capable of handling large volumes of greasy pots, pans, grills, and industrial equipment. Pads designed for commercial use often feature reinforced fibers or metal mesh layers for enhanced durability and abrasion power. Additionally, industrial cleaning sectors such as automotive and manufacturing use scouring pads for surface preparation, rust removal, and equipment maintenance. Compliance with safety and sanitation regulations necessitates frequent pad replacement and consistent performance. Suppliers focus on developing high-strength pads resistant to chemical degradation and heat exposure typical in industrial settings. Growing foodservice industries in emerging economies and increased focus on hygiene in industrial facilities support demand growth. This sector drives innovation in pad materials and shapes to balance cleaning efficiency with operator comfort during extended use.

Material innovation is a key focus as manufacturers seek to combine performance with sustainability in scouring pads. New blends incorporate natural fibers, recycled plastics, and biodegradable components while maintaining or improving abrasive effectiveness. Some pads include antimicrobial coatings or infused cleaning agents to enhance hygiene and reduce the need for chemical detergents. Advances in fiber bonding technologies improve pad durability and minimize lint or residue during cleaning. Sustainable packaging and eco-certifications are increasingly important to both retailers and consumers. Research into alternative abrasives like mineral-based or plant-derived particles is underway to reduce environmental impact. Balancing biodegradability with long-lasting usability remains a challenge, but innovation is helping companies differentiate in competitive markets. As regulatory pressure on single-use plastics grows, scouring pad manufacturers are accelerating the development of green alternatives without compromising cleaning quality.

Supply chain disruptions and raw material cost volatility continue to challenge manufacturers of scouring pads. Fluctuations in the availability and price of synthetic fibers and abrasives impact production schedules and profitability. Many suppliers rely on global sourcing, which introduces risks such as transportation delays and tariff changes. To maintain competitiveness, manufacturers optimize production processes, seek alternative materials, and focus on localized sourcing strategies. Pricing pressure is strong in both retail and commercial channels, with buyers increasingly comparing brands based on cost-effectiveness and durability. Private-label brands further intensify competition, often competing on price rather than product innovation. Maintaining consistent quality while managing costs is critical for brand reputation. Some companies address these challenges by offering product bundles, subscription models, or value packs to increase customer retention and volume sales. The dynamic supply landscape encourages agility and ongoing investment in operational efficiency.

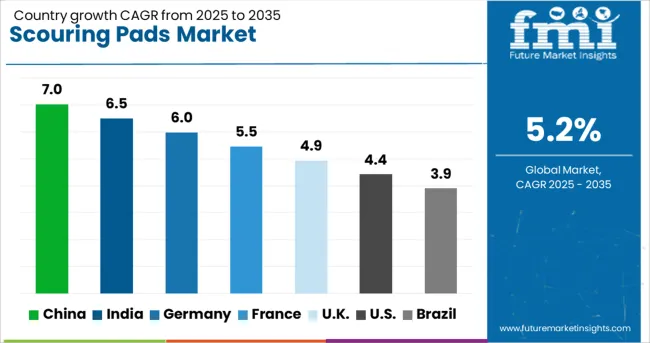

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global scouring pads market is projected to grow at a CAGR of 5.2% through 2035, supported by steady demand in household cleaning, hospitality, and industrial maintenance sectors. Among BRICS nations, China leads with 7.0% growth, driven by mass production and expanding export capacity. India follows at 6.5%, where increased usage in residential and commercial cleaning has been observed. In the OECD region, Germany reports 6.0% growth, backed by high-quality manufacturing standards and regulated material use. France, growing at 5.5%, has maintained consistent consumption in foodservice and industrial cleaning applications. The United Kingdom, at 4.9%, reflects steady demand through retail outlets and professional cleaning services. Market trends have been shaped by safety regulations, durability testing, and environmental compliance measures. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The scouring pads market in China has been expanding at a CAGR of 7.0%, driven by rising demand in both domestic and commercial cleaning sectors. Manufacturers have increased output of abrasive and non-abrasive pads to serve kitchens, food processing plants, and industrial cleaning applications. Production lines have been upgraded with synthetic fiber blends to improve durability and cleaning efficiency. Retailers have diversified product portfolios to include eco-friendly and reusable pad variants. The hospitality industry has adopted specialized pads for delicate surface cleaning to prevent scratching. Distributors have ramped up supply to urban and semi-urban regions, supporting increased household usage. Packaging improvements have allowed bulk purchases for institutional cleaning providers.

India has shown strong uptake in the scouring pads market, registering a CAGR of 6.5% due to growth in domestic households and food service industries. Local producers have adopted coir and nylon fiber composites to cater to both rough and gentle cleaning requirements. Demand from restaurants and catering businesses has pushed for availability of grease-cutting heavy-duty pads. Retail chains have increased shelf space for multi-pack scouring pad sets targeting budget-conscious consumers. Small-scale manufacturers have supplied handmade, natural fiber pads to rural and semi-urban markets. Educational campaigns promoting kitchen hygiene have raised awareness, thus driving consumer purchases. Disposable pad formats have been produced to meet hygiene requirements in institutional kitchens.

A steady growth rate of 6.0% has been recorded in Germany’s scouring pads market, supported by the preference for quality, environmentally conscious products. Pads incorporating recycled fibers and biodegradable abrasives have been increasingly adopted. Commercial kitchens have demanded pads engineered for effective removal of burnt-on residues without damaging cookware surfaces. Manufacturers have focused on ergonomic designs to improve user comfort during prolonged cleaning tasks. Retailers have expanded offerings to include antibacterial and scent-infused pad variants for household use. Regulatory compliance has guided formulation of non-toxic adhesives and dyes in production. Supply chains have optimized packaging sizes to reduce plastic waste and enhance recycling efforts.

France’s scouring pads market has been growing at a CAGR of 5.5%, driven by rising demand in both consumer and professional cleaning sectors. Pads designed for use on delicate surfaces such as glass and ceramic have gained attention in upscale household markets. Manufacturing units have incorporated layered abrasives to balance effective scrubbing with surface protection. Distributors have increased availability of pads featuring natural fibers to meet consumer preference for sustainable products. The hospitality industry has relied on heavy-duty scouring pads to maintain hygiene standards in kitchens and dining areas. Regional suppliers have enhanced logistics to improve delivery speeds to rural areas. Product innovation has focused on increasing pad longevity while maintaining cost effectiveness.

The United Kingdom has observed a CAGR of 4.9% in the scouring pads market, with growing use in both residential and commercial segments. Manufacturers have introduced multi-surface pads designed to clean stainless steel, glass, and plastic without scratching. Retailers have expanded private-label product lines featuring recyclable packaging. Professional cleaning firms have increased procurement of industrial-grade pads with enhanced abrasive qualities for tougher stains. Consumer demand for reusable and washable scouring pads has prompted R&D investment in durable materials. Distribution channels have improved availability of small-format pads suitable for travel and compact kitchens. Home improvement chains have promoted value packs targeting regular household maintenance.

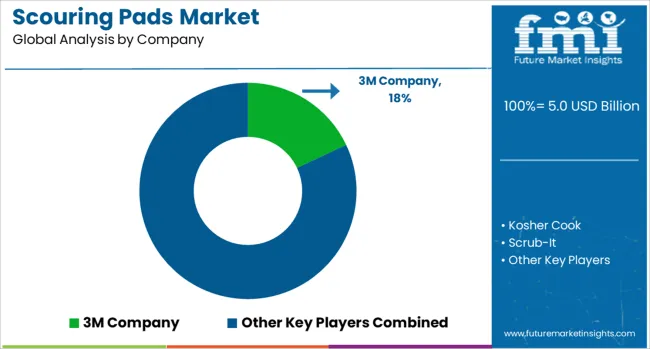

From 2020 to 2024, the scouring pads market was predominantly shaped by mechanical innovations and Tier-1 OEM dominance. Established players such as 3M Company, Procter & Gamble, The Clorox Company, Henkel, and Newell Brands Inc. leveraged their strong manufacturing capabilities, brand recognition, and extensive distribution networks to maintain market leadership. Their focus was on product durability, abrasion efficiency, and chemical formulations to meet diverse consumer needs. Companies like Rozenbal Group and Armaly Brands Inc. also competed by offering value-oriented options catering to various market segments, while niche brands such as Kosher Cook and Scrub-It targeted specialty and regional demands.

This period was characterized by incremental product improvements and consolidation through acquisitions, with little disruption in traditional manufacturing and supply chains. Looking ahead, the scouring pads market is poised for disruption by software-led innovations and steer-by-wire startups. These new entrants are expected to challenge incumbents by integrating smart technologies into cleaning solutions, potentially offering automated or sensor-driven scrubbing devices that enhance efficiency and convenience. This shift from purely mechanical products to digitally-enabled cleaning tools signals a transformative future, where traditional suppliers will need to adapt rapidly or partner with tech innovators to maintain competitiveness in an evolving landscape.

As mentioned in 3M’s April 2024 news release, the Scotch-Brite™ Greener Clean™ line expanded with eco-friendly Non-Scratch Soap Control Dishwand and Bottle & Straw Brush, made from recycled and plant-based materials, enhancing sustainable cleaning options.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Type | Steel/Metallic Scouring Pads, Non-Scratch Scouring Pads, Sponge Scouring Pads, and Others (plastic mesh, etc.) |

| Application | Household, Commercial, and Industrial |

| Sales Channel | Supermarkets & Hypermarkets, Online Retail, Convenience Stores, and Others (distributors, direct sales) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Kosher Cook, Scrub-It, Procter & Gamble, Rozenbal Group, Natural Value, The Clorox Company, Winco, Newell Brands Inc., Henkel, and Armaly Brands Inc. |

| Additional Attributes | Dollar sales by scouring pad type including steel wool, polymer mesh, and cellulose-based variants by application in household cleaning, commercial kitchens, industrial maintenance, and automotive detailing, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by increased hygiene awareness, urbanization, and the expansion of foodservice industries; innovation in eco-friendly materials, non-scratch coatings, and ergonomic designs; costs influenced by raw material prices, labor, and manufacturing complexity; and emerging use cases in non-stick cookware maintenance, sustainable packaging, and smart cleaning solutions. |

The global scouring pads market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the scouring pads market is projected to reach USD 8.3 billion by 2035.

The scouring pads market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in scouring pads market are steel/metallic scouring pads, non-scratch scouring pads, sponge scouring pads and others (plastic mesh, etc.).

In terms of application, household segment to command 52.7% share in the scouring pads market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Scouring Agent Market

Examining Market Share Trends in the Meat Pads Industry

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Layer Pads Market from 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sponge and Scouring Pad Market Size and Share Forecast Outlook 2025 to 2035

Exfoliating Pads Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Heated Mattress Pads Market

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Thermal Interface Pads and Materials Market Growth - Trends, Analysis & Forecast by Type, product, Application and Region through 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Pressure Redistribution Pads Market

Automotive Sintered Brake Pads Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Absorption (EA) Pads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA