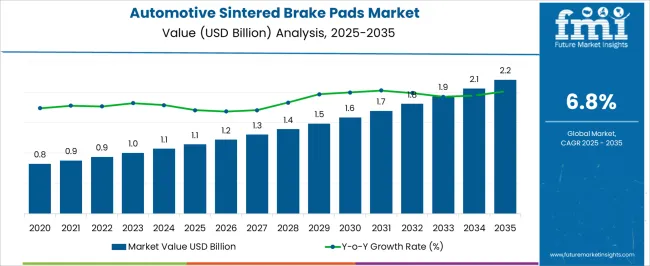

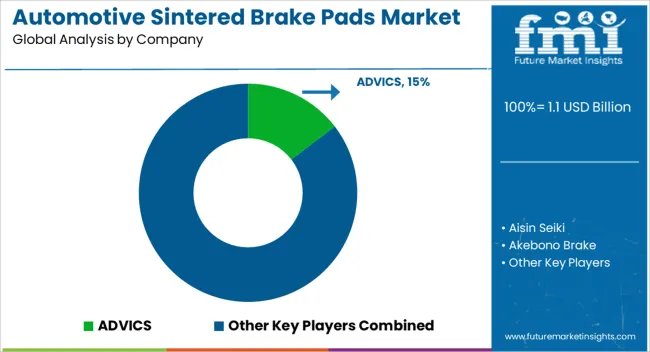

The Automotive Sintered Brake Pads Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. From 2021 to 2025, the market is projected to grow from USD 0.8 billion to USD 1.1 billion, with annual increments of USD 0.9 billion, USD 0.9 billion, and USD 1.0 billion. This initial phase is characterized by steady adoption driven by increased demand for durable and high-performance brake systems in passenger vehicles and commercial trucks.

The growth is primarily attributed to the rising focus on vehicle safety, performance, and longer-lasting brake components. Between 2026 and 2030, the market is expected to accelerate from USD 1.1 billion to USD 1.6 billion, passing through intermediate values of USD 1.2 billion, USD 1.3 billion, USD 1.4 billion, and USD 1.5 billion. This period reflects a stronger demand for sintered brake pads, fueled by technological advancements in friction materials and increased production in the automotive sector, especially with the growing popularity of electric vehicles (EVs) and the push for sustainable components. From 2031 to 2035, the market is expected to reach USD 2.2 billion, with values progressing through USD 1.7 billion, USD 1.8 billion, USD 1.9 billion, and USD 2.1 billion. This phase reflects continued market growth, driven by innovations in materials, enhanced regulatory safety standards, and a global shift toward high-performance braking systems for various vehicle types.

| Metric | Value |

|---|---|

| Automotive Sintered Brake Pads Market Estimated Value in (2025 E) | USD 1.1 billion |

| Automotive Sintered Brake Pads Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The automotive brake components market is the largest contributor, accounting for approximately 40-45% of the market. Sintered brake pads, known for their durability and high performance, are increasingly used in vehicles, especially in high-performance cars and motorcycles, to provide superior braking efficiency. The automotive parts and accessories market contributes around 25-30%, as sintered brake pads are a key component in the aftermarket, where they are used for vehicle repairs, replacements, and upgrades in both passenger and commercial vehicles. The automotive manufacturing market holds about 15-18%, with original equipment manufacturers (OEMs) incorporating sintered brake pads into new vehicle production, particularly in sports, luxury, and heavy-duty vehicles, where braking performance is crucial.

The electric vehicle (EV) market is expected to grow by approximately 8-12%, as the increasing adoption of electric vehicles drives demand for high-performance brake components, including sintered brake pads, which are renowned for their effectiveness in regenerative braking systems. The motorcycle market contributes around 5-8%, as sintered brake pads are widely used in motorcycles, particularly in racing and performance-oriented models, due to their ability to withstand high temperatures and deliver consistent braking power.

The automotive sintered brake pads market is witnessing steady expansion, driven by the increasing adoption of high-performance braking solutions across diverse vehicle categories. Current demand is reinforced by the superior durability, heat resistance, and braking efficiency offered by sintered pads compared to conventional alternatives. This market is supported by ongoing advancements in material engineering, enabling enhanced wear resistance and consistent performance under extreme operating conditions.

Growth is further bolstered by rising vehicle production volumes, expanding aftermarket sales, and stringent safety regulations that necessitate reliable braking systems. The market outlook remains favorable as premium and performance-oriented vehicle segments continue to grow, coupled with the rising popularity of electric and hybrid vehicles that require specialized braking technologies.

While alternative friction materials are gaining interest for environmental compliance, sintered brake pads retain a significant competitive edge in applications demanding high energy absorption and stability. Over the forecast period, increasing OEM integration and aftermarket penetration are expected to sustain the upward trajectory of the global automotive sintered brake pads market.

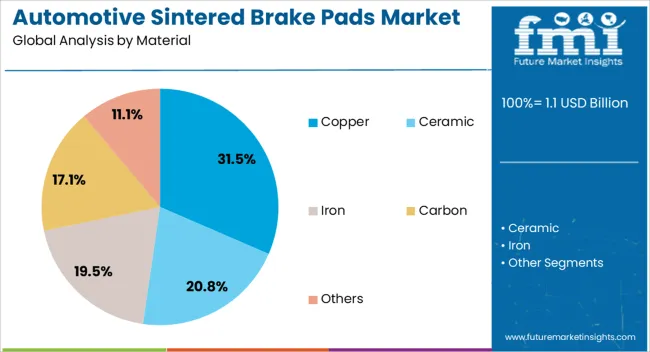

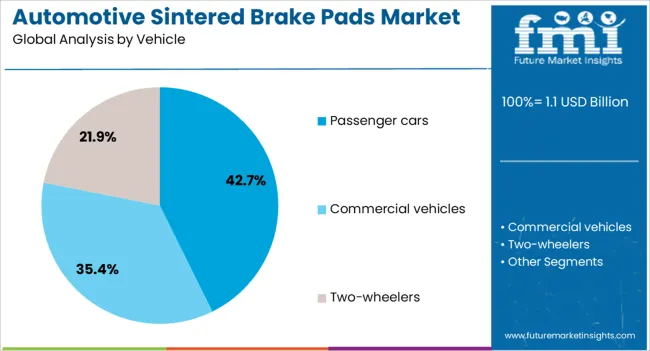

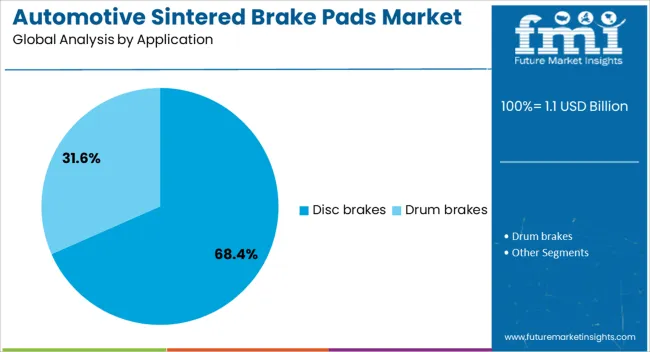

The automotive sintered brake pads market is segmented by material, vehicle, application, and geographic regions. By material, automotive sintered brake pads market is divided into Copper, Ceramic, Iron, Carbon, and Others. In terms of vehicle, automotive sintered brake pads market is classified into Passenger cars, Commercial vehicles, and Two-wheelers. Based on application, automotive sintered brake pads market is segmented into Disc brakes and Drum brakes. Regionally, the automotive sintered brake pads industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The copper segment accounts for approximately 31.5% share of the automotive sintered brake pads market, maintaining a strong position due to its proven performance characteristics. Copper’s superior thermal conductivity facilitates rapid heat dissipation, preventing brake fade and ensuring consistent stopping power even under heavy-duty usage. Its compatibility with various binders and structural additives has allowed for tailored pad compositions that meet both OEM and aftermarket performance requirements.

While environmental concerns over copper emissions have prompted certain regulatory restrictions, its high reliability in demanding applications—such as performance cars, heavy vehicles, and motorsports—continues to secure its market share. The segment benefits from long-established manufacturing processes and material sourcing networks, ensuring stable supply and competitive pricing.

Ongoing innovations, including copper-reduced and copper-free formulations that retain comparable performance, are expected to support compliance while preserving demand. As high-performance vehicle sales rise globally, copper-based sintered pads are anticipated to maintain relevance in specialized and premium segments despite evolving material regulations.

The passenger cars segment holds the leading position in the vehicle category, representing around 42.7% of the automotive sintered brake pads market. Its dominance is supported by the large global fleet size, consistent replacement cycles, and increasing demand for advanced braking performance in everyday vehicles. OEMs have progressively adopted sintered pads in premium and mid-range passenger cars due to their enhanced stopping capabilities, durability, and reduced wear on brake rotors.

Additionally, the rising penetration of electric and hybrid passenger cars has created new opportunities, as these vehicles require braking systems optimized for regenerative and high-temperature operations. Market share in this segment is further sustained by growing consumer awareness regarding safety and performance, encouraging aftermarket upgrades to sintered pads.

Regional expansion in Asia-Pacific, Europe, and North America, where passenger car production remains robust, also contributes to this segment’s strength. With continued emphasis on vehicle safety standards and braking efficiency, the passenger cars segment is expected to retain its leadership throughout the forecast period.

The disc brakes segment commands the largest application share, contributing approximately 68.4% of the automotive sintered brake pads market. This dominance is attributed to the widespread adoption of disc braking systems in modern vehicles, driven by their superior heat dissipation, braking stability, and performance in both wet and dry conditions. Sintered brake pads complement disc brake designs by providing consistent frictional performance and extended service life under varied operating conditions.

The shift from drum to disc brakes in many passenger and commercial vehicle models has further reinforced demand within this segment. Additionally, advancements in caliper and rotor technology have optimized compatibility with sintered pads, enhancing overall braking system efficiency.

High-performance and heavy-duty vehicle segments rely heavily on disc brakes paired with sintered pads for enhanced stopping power, especially in demanding driving environments. As global automotive production increasingly standardizes disc brake systems across multiple categories, this segment is expected to maintain its substantial lead, supported by sustained OEM integration and aftermarket demand.

The automotive sintered brake pads market is experiencing growth driven by the increasing demand for high-performance brake components in both the passenger vehicle and commercial vehicle segments. Demand is being fueled by the rising adoption of sintered brake pads due to their superior performance in extreme conditions, durability, and ability to handle high temperatures. Sintered brake pads are favored for their long lifespan and resistance to wear, making them a popular choice for vehicles used in heavy-duty and high-performance applications. Challenges in the market include the high cost of raw materials, particularly metal powders, and the complexity of manufacturing processes. Opportunities exist in the development of eco-friendly and cost-effective sintered brake pad alternatives, as well as the growing demand for high-performance brake systems in electric vehicles (EVs). Trends show a shift toward lightweight and high-efficiency brake pads, offering improved braking performance and reduced vehicle weight.

The demand for automotive sintered brake pads is increasing, particularly in heavy-duty vehicles, electric vehicles (EVs), and performance vehicles that require reliable and high-performing braking systems. Sintered brake pads are known for their ability to operate under extreme temperatures and high-stress conditions, making them ideal for heavy-duty vehicles, such as trucks and buses, as well as high-performance sports cars. With the rise in electric vehicle adoption, there is also growing demand for sintered brake pads, as these vehicles require efficient braking systems to support their heavy battery packs and long-lasting durability. As the automotive industry continues to prioritize safety and braking performance, the demand for sintered brake pads is expected to remain robust.

The automotive sintered brake pads market faces challenges from the high cost of raw materials, particularly metal powders such as copper, iron, and other alloys used in their manufacture. The manufacturing process for sintered brake pads requires specialized equipment and techniques, adding to the overall production cost. Moreover, the global focus on reducing vehicle emissions and improving environmental standards has led to regulatory pressures on brake components, including the reduction of copper content in brake pads. This has led to the need for innovation in material science to develop eco-friendly alternatives while maintaining the performance characteristics of sintered pads. Additionally, there are technical challenges related to the need for better heat dissipation, longer pad life, and noise reduction, all of which require advanced design and engineering solutions.

Opportunities in the automotive sintered brake pads market exist in the development of eco-friendly alternatives and the use of lightweight materials. Manufacturers are increasingly focused on reducing the environmental impact of brake pad production by exploring materials that contain less copper and other potentially harmful elements. The development of new composite materials that are both eco-friendly and high-performing could open up new market segments. Additionally, the shift toward lightweight materials is gaining traction as automakers seek to reduce vehicle weight and improve fuel efficiency, particularly in the context of electric vehicles. Innovations in sintered brake pad materials that combine performance with environmental benefits are expected to attract growing interest from manufacturers and consumers alike.

The automotive sintered brake pads market is witnessing trends towards lighter and more efficient brake pad solutions. As vehicle manufacturers increasingly focus on reducing weight to improve fuel efficiency and electric vehicle range, lightweight sintered brake pads are becoming a key development focus. These pads offer improved efficiency and reduced brake fade while maintaining high durability and performance. Additionally, advancements in material science are leading to more efficient, noise-reducing, and heat-dissipating sintered brake pads, meeting the growing demand for quieter and smoother braking experiences. The increasing adoption of electric vehicles is further accelerating these trends, as these vehicles require brake pads that can handle the specific demands of high-torque and regenerative braking systems.

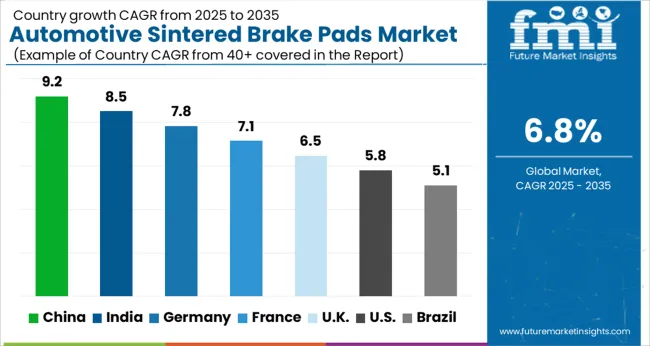

| Countries | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

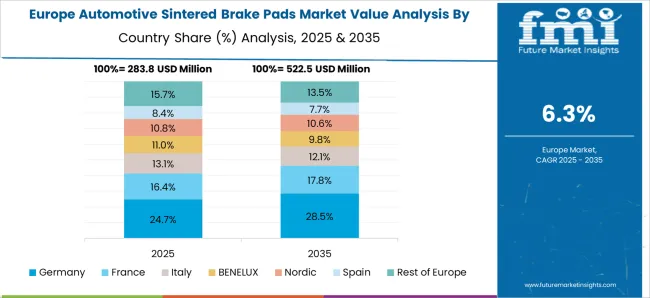

The automotive sintered brake pads market is expected to grow at a global CAGR of 6.8% from 2025 to 2035. China leads the market with the highest growth rate at 9.2%, followed by India at 8.5%. France is projected to grow at 7.1%, while the UK and USA will experience growth rates of 6.5% and 5.8%, respectively. The growth of the market is primarily driven by the increasing demand for durable and high-performance braking systems in the automotive sector, particularly as vehicle production and safety standards continue to evolve. The shift towards electric vehicles (EVs) and the growing focus on vehicle safety and performance are also fueling the demand for sintered brake pads globally. The analysis spans over 40+ countries, with the leading markets shown below.

The automotive sintered brake pads market in China is expected to grow at a CAGR of 9.2% from 2025 to 2035, driven by the country’s booming automotive manufacturing industry and rising demand for high-performance braking systems. As China is the world’s largest car market, the need for durable and efficient brake pads is escalating. The country’s increasing focus on automotive safety, along with growing production of electric and hybrid vehicles, is further propelling the demand for advanced sintered brake pads, which offer superior braking performance under high stress. Moreover, China’s growing automotive aftermarket sector, fueled by increased vehicle ownership and maintenance requirements, is contributing to the rise in brake pad sales. With continued advancements in brake technologies, particularly in electric vehicles (EVs), sintered brake pads are becoming essential for maintaining optimal vehicle safety and performance.

The automotive sintered brake pads market in India is projected to grow at a CAGR of 8.5% from 2025 to 2035, supported by the rapid expansion of the automotive sector and increasing demand for advanced braking systems. As India’s automobile market continues to evolve, the demand for sintered brake pads, known for their durability and efficient performance, is on the rise. The growing focus on improving road safety and meeting stricter safety regulations is also driving the demand for high-quality brake pads in both OEM and aftermarket segments. With the growing production of two-wheelers and the rise of electric vehicles (EVs) in the country, the need for sintered brake pads is expected to increase significantly. India’s thriving automotive manufacturing industry, along with rising disposable incomes and urbanization, will further contribute to the market’s growth.

The automotive sintered brake pads market in France is expected to grow at a CAGR of 7.1% from 2025 to 2035, driven by the country’s well-established automotive industry and a growing focus on vehicle safety. France is home to several prominent automakers, and the demand for high-quality, durable sintered brake pads is increasing due to the rising need for performance-enhancing braking systems. The market growth is further supported by the push for more fuel-efficient vehicles, as lightweight and high-performance brake pads are critical in reducing vehicle weight. The increasing adoption of electric vehicles (EVs) in France, along with the integration of advanced safety features, is also driving the demand for premium sintered brake pads. Furthermore, the country’s strong automotive aftermarket segment is contributing to market growth as more vehicles require regular brake pad replacements.

The UK automotive sintered brake pads market is projected to grow at a CAGR of 6.5% from 2025 to 2035, supported by increasing demand for enhanced braking systems across both domestic vehicle production and the aftermarket sector. As the UK continues to prioritize vehicle safety and technological advancements, the demand for high-quality brake pads is rising. The country’s increasing focus on electric and hybrid vehicles, along with the growing adoption of advanced driver-assistance systems (ADAS), is further pushing the need for premium braking solutions like sintered brake pads. Additionally, the UK’s efforts to meet stringent environmental regulations are driving innovations in brake technologies, leading to the development of more efficient, longer-lasting brake pads.

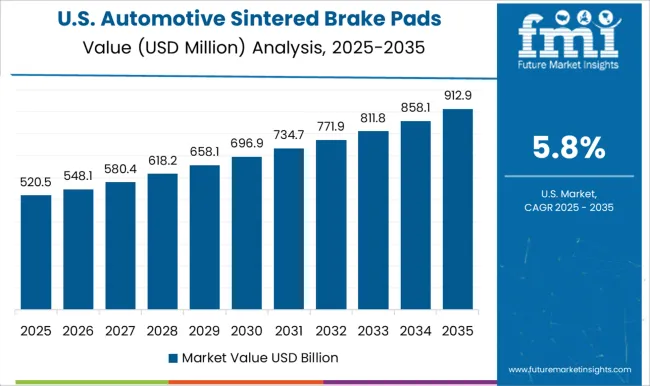

The USA. automotive sintered brake pads market is expected to grow at a CAGR of 5.8% from 2025 to 2035, driven by increasing safety regulations and the growing demand for durable, high-performance braking systems. The USA is witnessing a rise in both vehicle production and vehicle sales, particularly in the light-duty vehicle segment, which is driving the demand for sintered brake pads. The market is further boosted by the ongoing growth of the electric vehicle (EV) market and the development of advanced braking systems for these vehicles. The demand for replacement brake pads in the aftermarket sector is also strong, contributing to overall market growth. As automakers and suppliers invest in advanced braking technologies, sintered brake pads are becoming an essential component for vehicle performance and safety.

In the automotive sintered brake pads market, competition is driven by performance, durability, and cost-effectiveness, with a strong focus on improving vehicle safety and braking efficiency. ADVICS competes by providing high-quality sintered brake pads for both OEM and aftermarket applications, with a focus on low wear rates, noise reduction, and high thermal conductivity. Aisin Seiki, another major player, offers a comprehensive range of sintered brake pads, with a focus on product innovation, such as reducing brake fade and improving performance under extreme driving conditions. The company integrates advanced materials and technology to meet stringent safety standards for both passenger and commercial vehicles. Akebono Brake is a key competitor in the sintered brake pads market, focusing on producing high-performance brake pads for a range of vehicle types. The company emphasizes superior braking power, low dust, and high-temperature resistance, making it a preferred supplier for high-performance and luxury vehicles. Bosch, known for its automotive components, offers sintered brake pads with advanced friction materials that ensure consistent performance, noise reduction, and low wear rates. Bosch also places a strong emphasis on eco-friendly materials, addressing the growing demand for sustainable braking solutions. Brembo, a leader in braking systems, competes by offering premium sintered brake pads for high-performance vehicles, with a focus on maximum stopping power, heat dissipation, and lightweight materials. Haldex specializes in brake systems for commercial vehicles, offering sintered brake pads designed to handle heavy-duty applications while maintaining durability and performance under extreme conditions. Knorr-Bremse and MAT Holdings target the commercial vehicle market, providing sintered brake pads that focus on long-lasting performance, reduced maintenance, and safety under demanding driving conditions. Nisshinbo and Tenneco offer competitive sintered brake pads, with an emphasis on cost efficiency, performance, and reducing brake dust for better environmental compliance. Strategies in this market focus on innovation in friction materials, performance under extreme conditions, and enhanced safety features. Product brochures highlight features such as high friction efficiency, noise and dust reduction, extended pad life, and advanced thermal management technologies. These companies aim to meet the evolving demands of both the passenger and commercial vehicle sectors, offering reliable and durable braking solutions for diverse vehicle applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Material | Copper, Ceramic, Iron, Carbon, and Others |

| Vehicle | Passenger cars, Commercial vehicles, and Two-wheelers |

| Application | Disc brakes and Drum brakes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADVICS, Aisin Seiki, Akebono Brake, Bosch, Brembo, Haldex, Knorr-Bremse, MAT Holdings, Nisshinbo, and Tenneco |

| Additional Attributes | Dollar sales by product type (OEM, aftermarket), vehicle type (passenger vehicles, commercial vehicles), and braking performance (high-performance, standard). Demand dynamics are driven by the increasing adoption of advanced braking technologies, growing consumer awareness of vehicle safety, and the shift towards eco-friendly and sustainable vehicle solutions. Regional growth is prominent in North America, Europe, and Asia-Pacific, supported by ongoing automotive industry expansion, stricter safety regulations, and growing demand for high-performance braking systems in both OEM and aftermarket segments. |

The global automotive sintered brake pads market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the automotive sintered brake pads market is projected to reach USD 2.2 billion by 2035.

The automotive sintered brake pads market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in automotive sintered brake pads market are copper, ceramic, iron, carbon and others.

In terms of vehicle, passenger cars segment to command 42.7% share in the automotive sintered brake pads market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Shims Market Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Brake Pad Market - Growth & Demand 2025 to 2035

Automotive Brake Tube Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Handbrake And Clutch Cables Market

Automotive Park Brake Lever Market Growth – Trends & Forecast 2024-2034

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Brake Rotors Market Growth - Trends & Forecast 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Absorption (EA) Pads Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA