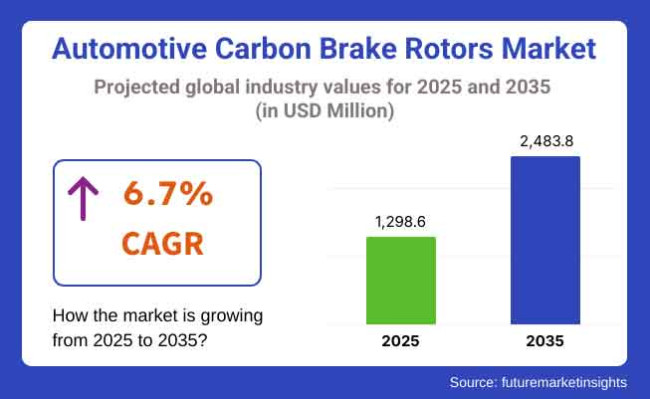

The global automotive carbon brake rotors market is projected to grow substantially from USD 1,298.6 million in 2025 to USD 2,483.8 million by 2035, expanding at a compound annual growth rate (CAGR) of 6.7%. The market’s rapid advancement is driven by the increased demand for high-performance braking systems, expanding premium and sports car segments, and growing integration of lightweight materials in automotive manufacturing.

Carbon brake rotors-manufactured using carbon-carbon composites or carbon-ceramic materials-offer superior performance characteristics including lower weight, high thermal stability, enhanced braking power, and resistance to wear. Initially confined to motorsport and luxury vehicles, carbon rotors are now gaining traction across electric vehicles (EVs), high-end SUVs, and performance sedans due to their durability and energy efficiency advantages.

The market penetration of carbon rotors is foreseen to catch up with the general shift towards the decrease of unsprings mass plus the prolongation of component life without any performance drawbacks as per the decision of global automakers. This situation is most likely to be observed in the sectors where vehicle electrification and mobility for premium experience are the primary focus.

The key factors behind the growth are the general performance automotive market, the enormous stakes lay in motorsport, the pressure from government regulations on emissions and safety, along with the heightened necessity of brakes in fast electric vehicles. The carbon-ceramic rotors' production costs will decrease thanks to the innovations, which, in turn, will allow mid-premium vehicles to access them.

The primary market for carbon brake rotors in North America stands out as a consequence of the customers' demand for the top cars with a focus on performance, luxury sedans, and sports cars. The USA specifically has many avid consumers and aftermarket modifiers who demand high-performance and prefer the upgraded braking systems.

Companies like General Motors, and Tesla harden carbon-ceramic composite brakes besides Ford which offers them as optional upgrades to their electric and premium vehicles. Proving the point, besides the race track, the genesis of new technology in the motorsport sector guarantees the continuation of demand and innovation in the field of rotors.

The aftermarket segment has been on a remarkable upward trend too, with clients drenched in high performance upgrading from cast iron rotors to carbon-based rotors for their superior performance and heat dissipation.

The primary carbon-ceramic brake systems OEM integration, especially in high-end vehicles produced by Audi, BMW, Mercedes-Benz, Porsche, Ferrari, and Lamborghini, is Europe's leading sector. The region's focus on light weighting and sustainability is coupled with tough EU emissions regulations forcing manufacturers to use components that lower rotational mass and increase efficiency.

The centers of high-performance automotive manufacturing and motorsport engineering, Germany, and Italy, are pioneers in researching and developing the next-gen carbon rotors which would be less prone to wear and more cost-effective. The development of electric luxury and performance EVs in Europe is an additional factor that requires rotors that are lightweight and heat-stable that will, thus, improve the range and braking efficiency.

Asia-Pacific is the wholesale regional market exhibiting quick sales growth, with China, Japan, and South Korea paving the way. The increase in ownership of high-end cars, curbing local manufacturers of performance cars, and a quickening process to replace urban cars with EVs are propelling the demand in the sector.

In China EV manufacturers such as NIO, and BYD are providing premium versions featuring carbon-ceramic braking systems. Currently, Japan and South Korea are embracing carbon rotors in a range of products, from sports cars to motorsport, including rallying and GT racing. The production of carbon rotors in China is being localized, which is going to cut costs and ensure a wider distribution to various consumer sectors.

The key growth driver during the entire forecast period will still be the formation of new luxury car brands and the development of urban centers.

Middle East and Africa hold demand for carbon brake rotors with the UAE and Saudi Arabia leading as supercars, hyper cars, and performance SUVs demand poses it as a niche market made for these cars. Extreme climatic conditions, which means high temperatures, cause a lot of wear to materials, hence, need brakes with better management over thermal issues.

The African market is at an infancy stage but it's expected to see an increase in the demand for luxury cars as both wealth and manufacturers create the necessary conditions for this new market trend.

High Production Costs and Limited OEM Penetration in Mass-Market Vehicles

Despite their performance advantages, carbon brake rotors remain significantly more expensive than traditional cast iron or steel rotors. Their complex manufacturing process, including pyrolysis, carbon infiltration, and ceramic coating, results in higher material and processing costs.

This restricts their adoption primarily to premium, performance, or racing vehicles, with limited penetration in mass-market and entry-level vehicles. As automakers look to reduce vehicle costs, the premium price of carbon rotors may deter broader usage unless significant cost reductions are achieved.

Manufacturers must focus on process innovation, economies of scale, and alternate carbon-composite materials to bridge the gap between performance and affordability.

Repair Complexity and Limited Aftermarket Ecosystem

Another challenge is the complexity of repairing or replacing carbon brake rotors, which often require specialized handling and installation knowledge. In many regions, especially in emerging economies, technician training and service infrastructure for carbon rotors are limited.

Their sensitivity to moisture, uneven wear, and sudden temperature variations can lead to performance degradation if not maintained properly. The aftermarket ecosystem for carbon rotors is still developing, with relatively few certified repair and replacement service providers, limiting consumer confidence and adoption.

Integration in High-Performance EVs and Regenerative Braking Systems

Since electric vehicles are getting faster and heavier, lightweight and high-performance braking systems are an increasingly critical factor. Carbon brake rotors help to reduce unsprung mass, improve handling, increase range and provide exceptional heat dissipation, which is a critical factor in high-speed EV braking.

Carbon rotors also help regenerative braking systems by taking off the load on mechanical braking while not affecting safety during emergency stops. The car manufacturers that are focusing on electric sports cars and luxury EVs are implementing carbon-ceramic brakes as their way of differentiating their performance from others.

For rotor manufacturers, this is a long-term prospect to ensure the designs are quite user-friendly and partner with other companies in the e-mobility industry, which is continually expanding.

Motorsport Innovation and Material Advancements

The motorsport discipline keeps sparking technological innovations in the sector of carbon brake materials meaning that it is a testing ground for the creation of new products-reduced wear rates, higher temperatures resistance, and fast cool-down. Tech breakthroughs are seen in manufacturing applications like rotors-sensor integration, blade design, and the common use of rotor material.

Recently, new carbon matrix arrangements, hybrid composites integrations, and ceramic reinforcements are leading to lower production costs and high-performing lifespan products. As the material becomes more reachable and diverse, applications for rotors will also be introduced to performance-based vehicles, premium motorcycles, and autonomous transport.

Between 2020 and 2024, the automotive carbon brake rotors market exhibited solid growth, primarily driven by rising demand for high-performance vehicles, increasing motorsport activities, and the growing adoption in premium and luxury segments. Carbon brake rotors made of carbon-carbon or carbon-ceramic composites offered superior heat resistance, smaller weight, and a longer working life compared to cast iron rotors.

Although carbon rotors were only available for supercars, sports cars, and high-end EVs, their market acceptance was stimulated by the introduction of regenerative braking and thermal effectiveness. Nevertheless, high costs, manufacturing complexities, and limited general consumer penetration were crucial we faced.

Under the 2025 to 2035-time frame, the automotive carbon brake rotors market will be in a game-changing process with the introduction of AI-optimized rotor designs, scalable production methods and hybrid carbon-composite materials joining the fray.

The technology will leapfrog from luxury cars to electric SUVs, performance EVs, and autonomous platforms. The quest for lightweight, low-maintenance braking systems will lead the way in innovations of recyclable carbon composites, sensor-integrated rotors, and next-gen thermal coatings in the vehicle circuits' future.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Adoption in High-Performance Segments | Carbon rotors used mainly in sports cars, luxury sedans, and supercars for track and high-speed usage. |

| Material Evolution | Use of carbon-carbon and carbon-ceramic matrix composites for lightweight, heat-resistant rotors. |

| Cost & Scalability Challenges | High cost limited carbon rotors to low-volume production and elite models. |

| EV Integration & Thermal Management | Initial deployment in high-end electric sports cars to handle regenerative braking and high-speed deceleration. |

| Brake-by-Wire & Sensor Fusion | Limited integration with electronic braking systems. |

| Sustainability Trends | Early-stage awareness of recyclability and eco-friendly production. |

| Aftermarket Potential | Niche aftermarket limited to track performance upgrades and custom builds. |

| Market Growth Drivers | Driven by performance expectations, motorsport influence, and luxury market expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Adoption in High-Performance Segments | Expansion into performance EVs, electric SUVs, and advanced commercial fleets needing high thermal efficiency. |

| Material Evolution | Introduction of hybrid carbon composites, recyclable carbon-ceramic variants, and graphene-reinforced materials. |

| Cost & Scalability Challenges | Emergence of cost-optimized, AI-designed rotors enabling wider adoption in upper-mid-tier vehicles. |

| EV Integration & Thermal Management | Widespread use in EV platforms where lightweight and low-wear rotors support extended range and reduced maintenance. |

| Brake-by-Wire & Sensor Fusion | Sensor-integrated rotors with real-time heat mapping, wear detection, and AI-driven maintenance prediction. |

| Sustainability Trends | Closed-loop manufacturing, green binders, and circular economy-based carbon sourcing gain traction. |

| Aftermarket Potential | Rising demand in EV aftermarket performance kits, racing fleets, and fleet maintenance optimizations. |

| Market Growth Drivers | Accelerated by EV evolution, AI-enabled brake diagnostics, and next-gen lightweight design requirements. |

The USA automotive sector carbon brake rotor sector is on a stable growth trajectory primarily due to the escalating requirement for high-tech and top-range vehicles, besides the active intervention of carbon-ceramic rotors in sports and electric vehicles (EVs).

The car market in the United States has an essential foundation of high-end car buyers and those who are keen on driving on tracks, for whom the benefits of braking efficiency and thermal stability are of great value. Braking carbon rotors are most of the times found in the latest EV models as it is one of the crucial factors to use them.

The aftermarket segment is on a shift of evolution and it is gaining momentum with a segment of customers upgrading their cars to carbon-ceramic for a more sustainable and artistic look.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The United Kingdom automotive carbon brake rotors market, along with the increasing sales of luxury and performance vehicles and motorsport culture, displays decent growth. Carbon brake rotors are generally employed in the course of tracks and high-speed cars, which are still in vogue with the community of enthusiastic car drivers in Britain.

The same goes for carbon-ceramic rotors as BMW and other automakers say they will now include them in their light, high-performance ramifications The move to more expensive electric cars with battery packs that are less prone to overheating is a factor strengthening the component and aftermarket sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

The automotive carbon brake rotors market in the European Union is subsisting a steady increase due to high-performance vehicle manufacturing dominancy in the region, particularly in Germany and Italy, the home to manufacturers of high-end cars such as Porsche, Ferrari, Lamborghini, and Audi. OEMs are increasingly equipping carbon-ceramic brake systems as standard equipment in more of their top-tier models.

The surge in the number of premium electric and hybrid vehicles is promoting the use of lightweight braking components, which is a measure for improving vehicle efficiency. The removal of obsolete braking systems also adds to the regional safety and performance regulations, which in turn, augment the application of state-of-the-art braking systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

The Japan automotive carbon brake rotors market observes a stable growth trend due to the rising production of performance cars, motorsport participation, and speeds up of OEM investments in advanced materials. Automakers from Japan, such as Nissan and Lexus, are equipping carbon-ceramic brakes in a few limited-production high-speed models, especially in NISMO and F divisions.

Even if EV sales are abundant, carbon brake rotors are usually used in sports sedans, coupes and other high-performance vehicles that are directed to be exported. The aftermarket of carbon brake rotors of the enthusiasts and tuners was not widely available but is now on a steady growth path.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The South Korea automotive market for carbon brake rotors is experiencing remarkable growth, powered by the surge in premium car manufacturing, the global boom of Genesis and Hyundai N performance brands, and the surge in EV footprint. Carbon brake systems are being used as standard or optional equipment in luxury models, to catch the attention of performance-oriented buyers from all over the world.

The focal point of South Korea on the EV and hybrid efficiency paradigm is, in fact, pushing the OEMs to make additional carbon rotors not only for thermal control but also for light-weight material procurement. The local tuning and performance aftermarket is also catching up as the younger generation is attracted to upgrades that make their vehicles track-ready.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

Carbon-Ceramic (C/SiC) Brake Rotors Dominate with High Thermal Stability and Long Service Life

Carbon-ceramic (C/SiC) brake rotors represent a significant portion of the automotive carbon brake rotor's market, with the primary reason being the superior thermal resistance, almost no brake fade, and extremely long service life. Most of these rotors have found their applications in supercars and sportscars, for instance, especially when performance braking has to be ensured at a premium cost of high speed and high temperature.

As opposed to conventional gray iron or composite rotors, carbon-ceramic rotors can be afforded weight savings amounting 70%, which, in turn, results in improved vehicle dynamics, decreased unsprung mass, and better fuel economy. Their ability to endure over 1000°C temperatures for hours without warping makes them the best choice for high-performance cars and hypercars with a track focus.

Prominent luxury brands such as Ferrari, Porsche, Lamborghini, McLaren are heavily equipped with carbon-ceramic rotors at the braking system level; often as a standard or optional feature in the higher trim levels of their cars. Where luxury consumers are concerned about performance and durability, the use of C/SiC brake rotors is expected to spread the most, especially in electric supercars, where light-weight construction and regenerative braking are required.

Carbon-Carbon (C/C) Brake Rotors Begin to Expand in Aviation and Motorsports with Superior Heat Resistance

C/C braking rotors are beginning to gain traction in the aviation and motorsport sectors for their outstanding heat tolerance and functioning under extreme mechanical stress. They are made of pure carbon fibers and carbon matrix, which is why they provide better performance in hotter environments, especially in cases of repeatedly hard braking.

These C/C rotors have found their main applications in military aircraft, business jets, and Formula One racing, where they prove their outstanding strength-to-weight ratio, thermal shock resistance, and low thermal expansion characteristics that make them suitable for high-accuracy applications that have high safety requirements. In aviation, where stop distance and landing reliability are key, using C/C brake rotors makes the aircraft lighter and don't require replacement for long. This leads to low operating costs and better performance of the aircraft.

Even though they are not yet being used in mass-market automotive as their high production cost is not competitive, carbon-carbon braking rotors are still a must in such environments where their performance and reliability are given priority over cost. The advanced manufacturing methods and carbon fiber technologies may allow more carbon-carbon brakes in other high-performance transportation sectors in the times to come.

High-Performance and Lightweight Braking Systems Fuel Demand in Supercars

Supercars, particularly, have been the primary adopters of carbon brake rotors since manufacturers have pushed further on speed and sophisticated braking systems. These cars, which are able to beat the 300 km/h record, need brake rotors that will fast cool off, have fade-free performance, and keep braking even on prolonged aggressive usage.

Compared to conventional braking systems, carbon brake rotors present a more extended safety margin, a longer component day-night cycle, and uniform performance regardless of how many times the brake is decelerated rapidly. Along with being a part of the performance message, carbon-ceramic rotors have become a visual signature of supercar OEMs and their brand, which stands for exclusivity and advanced engineering.

With Middle East, China, and North America reported to have seen the growth of luxury automotive markets, and the increased demand for track-ready road cars, carbon brake rotor integration in the next-gen hybrid and electric supercars is projected to expand across automotive sectors. These components march with the industry trend towards lighter weight and less technical burden high-performance solutions.

Military Aircraft Segment Grows Use of Carbon-Carbon Brake Rotors to Ensure Mission Durability

Due to the highly functional nature of carbon-carbon brake rotors, they are extensively used in military aircraft that endure grueling battlefield conditions, carry personnel and cargo on repeated carrier landings, and take heavy payloads. In combat and support aircraft such as fighter jets, transport planes, and reconnaissance ones, it is essential that braking systems provide maximum reliability with minimal wear and tear.

C/C brake rotors, even after many high-speed landings, provide excellent stopping power, as well as being immune to warping, corrosion, and thermal fatigue they are perfect for military-grade performance. Countering steel or ceramic rotors, C/C versions are having longer service intervals, which means shorter downtimes and fewer maintenance costs-the real threat for defense operations.

In the defense sector, countries such as India, the USA, China, and Gulf states are upgrading fighter jets and heavy transport planes as part of their modernization and reliability schemes, so demand for carbon-carbon rotors in military aviation is forecasted to increase steadily.

The global automotive carbon brake rotors market is a performance-focused, high-end segment within the general brake systems industry. Primarily composed of either carbon-carbon (C/C) or carbon-ceramic (C/SiC) composites, these rotors are engineered for extreme thermal performance, durability, and saving weight, thereby being very suitable for high-performance sports cars, racing cars, and prestige luxury vehicles.

As automotive original equipment manufacturers turn their attention to high-performance and lightweight braking solutions, especially in electric and hybrid sports cars, carbon brake rots are now becoming a common reality, at least more than before despite the high price tag.

The market is pretty consolidated with the leading companies holding approximately 65%-70% of the total market share through their strong relationships with OEMs, patented material technologies, and their own manufacturing know-how. Most of them are in a close partnership with automotive manufacturers or already have vertical integration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Brembo S.p.A. / Brembo SGL Carbon Ceramic Brakes (BSCCB) | 28-32% |

| Carbon Revolution Limited | 12-14% |

| Surface Transforms Plc | 8-10% |

| Fusion Brakes LLC | 6-8% |

| Rotora Inc. | 5-6% |

| Company Name | Key Offerings/Activities |

|---|---|

| Brembo S.p.A. / BSCCB | Carbon-ceramic rotors are direct suppliers to brands such as Ferrari, Porsche, Aston Martin, McLaren, and Tesla, whose technology has been tested and proven by F1 and GT racing. |

| Carbon Revolution Limited | Widely recognized for the production of carbon composite wheels and the lightweight carbon brake rotors that they manufacture for supercar and EV performance markets. |

| Surface Transforms Plc | Manufactures the next-generation carbon-ceramic rotors that are reinforced with continuous fibers, resulting in longer service life and better thermal protection. |

| Fusion Brakes LLC | The major focus is on the aftermarket production of carbon-ceramic rotors, especially for Porsche, Corvette, and Mustang platforms catering to the North American market. |

| Rotora Inc. | They provide a performance-oriented line of carbon ceramic brakes for both track cars and high-performance street vehicles, in addition to bespoke solutions. |

Key Market Insights

Brembo S.p.A. / Brembo SGL Carbon Ceramic Brakes

Brembo, in collaboration with SGL Group, dominates the carbon brake rotor sector at BSCCB. It fabricates state-of-the-art carbon-ceramic rotors for the world's most prestigious sports and luxury cars, including Lamborghini, Bugatti, and Ferrari, to name a few.

These rotors are recognized for their excellent fade resistance, high thermal conductivity, and up to 50% weight savings when compared with iron discs. Brembo is also involved in the co-development of application-specific brake systems with OEMs, thus entering the EV hypercar segment.

Carbon Revolution Limited

Based in Australia, Carbon Revolution is widely recognized for its composite wheels and is now making advancements in the development of carbon rotors. The firm works with premium automakers and defense contractors to provide rotors that improve performance and decrease unsprung mass. Its involvement in the electric and lightweight sports car sector corresponds with the increasing need for energy-efficient braking solutions.

Surface Transforms Plc

Located in the UK, Surface Transforms makes sophisticated carbon-ceramic brake rotors with a proprietary technology of 3D continuous carbon fiber matrix, enabling better thermal performance and longer wear life than traditional C/SiC discs. The company has contracts with Koenigsegg, Aston Martin, and Brabham Automotive and has also made inroads in the aftermarket and OEM upgrade programs. Surface Transforms is investing in performance scaling for electric vehicles and aircraft applications.

Fusion Brakes LLC

Fusion Brakes builds lightweight carbon-ceramic brake kits which are mainly for the aftermarket and motorsport industry, with a focus on American performance vehicles. Their rotors are high-density SiC matrices, which can endure more than 1,500°C of temperature, with no deformation at all. Fusion is now branching into the EV market and is considering direct-to-consumer sales for motorsport events and tuners.

Rotora Inc.

In California, Rotora is offering custom-made high-performance carbon ceramic braking solutions for both sports cars and supercars. Their rotors are in fact, usually used in track-tuned versions of Audi, BMW, and Nissan GTR vehicles. The company takes advantage of its unique experience with dual-cast carbon rotor design, which allows for lightweight performance with maximum thermal stability during aggressive braking.

Carbon-Ceramic (C/SiC), Carbon-Carbon (C/C)

Supercars, Sport cars, Commercial Aircrafts, Business Jets, Military Aircraft, Other Aviation

First Fit, Aftermarket

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global automotive carbon brake rotors market is projected to reach USD 1,298.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.7% from 2025 to 2035.

By 2035, the automotive carbon brake rotors market is expected to reach USD 2,483.8 million.

The supercars segment is expected to dominate due to the high-performance requirements and widespread adoption of carbon brake rotors for their superior heat resistance, lightweight structure, and enhanced braking efficiency under extreme conditions.

Key players in the market include Brembo S.p.A., Carbon Lorraine, Surface Transforms plc, SGL Carbon SE, and Akebono Brake Industry Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA