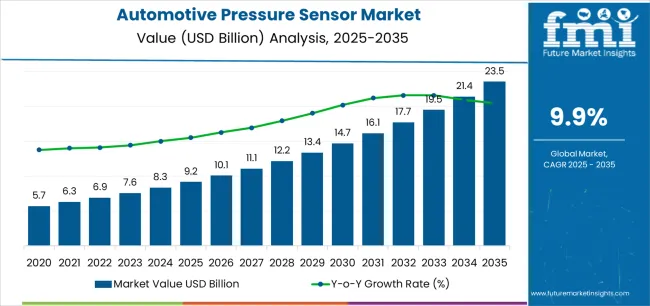

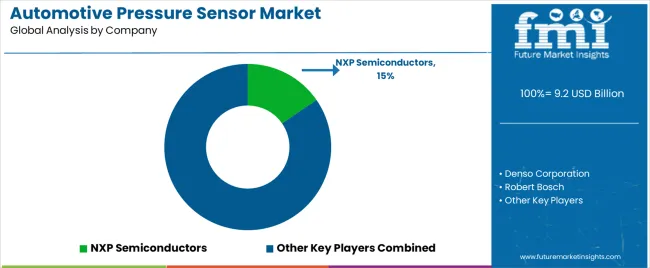

The Automotive Pressure Sensor Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 23.5 billion by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

The automotive pressure sensor market is experiencing robust growth driven by increased integration of electronic control systems and regulatory mandates for vehicle safety and emission compliance. The proliferation of advanced driver-assistance systems, engine efficiency monitoring, and tire pressure control features has reinforced sensor deployment across vehicle segments. The market benefits from ongoing technological innovation in microelectromechanical systems (MEMS), offering high precision, miniaturization, and cost-effective production.

Growing electrification trends are creating new sensor requirements for battery monitoring and brake pressure management. Additionally, enhanced fuel efficiency targets and real-time diagnostic capabilities have expanded application scope.

With the automotive industry shifting toward connected and semi-autonomous platforms, the demand for pressure sensors in smart control systems is expected to accelerate. Favorable regulations supporting emission reduction and improved vehicle safety further underpin the market’s long-term growth trajectory..

| Metric | Value |

|---|---|

| Automotive Pressure Sensor Market Estimated Value in (2025 E) | USD 9.2 billion |

| Automotive Pressure Sensor Market Forecast Value in (2035 F) | USD 23.5 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

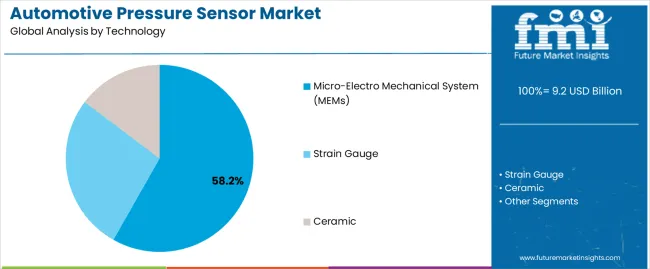

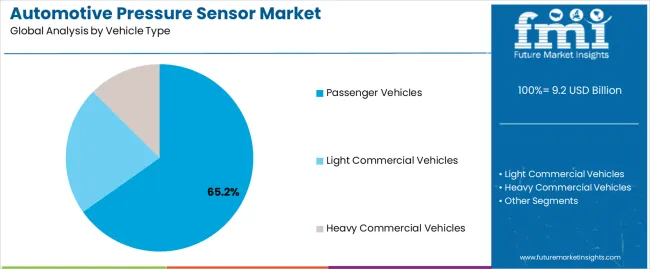

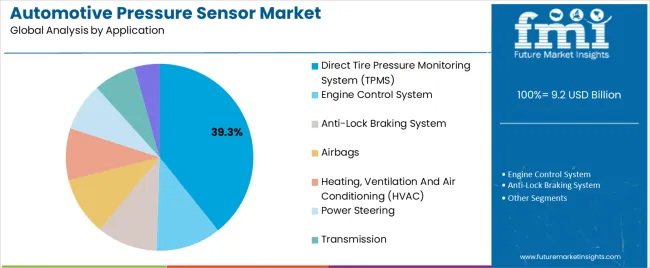

The market is segmented by Technology, Vehicle Type, Application, and Transduction Type and region. By Technology, the market is divided into Micro-Electro Mechanical System (MEMs), Strain Gauge, and Ceramic. In terms of Vehicle Type, the market is classified into Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. Based on Application, the market is segmented into Direct Tire Pressure Monitoring System (TPMS), Engine Control System, Anti-Lock Braking System, Airbags, Heating, Ventilation And Air Conditioning (HVAC), Power Steering, Transmission, and Others. By Transduction Type, the market is divided into Piezoresistive, Capacitive, Optical, Resonant, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The MEMS segment leads the technology category, accounting for approximately 58.2% share of the automotive pressure sensor market. Its dominance is attributed to superior sensitivity, compact design, and low production costs enabled by semiconductor fabrication advancements.

MEMS sensors are widely utilized in manifold absolute pressure, fuel rail, and tire pressure monitoring systems due to their precision and durability. The technology’s scalability across high-volume automotive applications has reinforced its adoption among OEMs.

Ongoing research in wafer-level packaging and silicon-based sensing elements has enhanced sensor reliability in extreme temperature and vibration environments. As vehicle electronics continue to advance, MEMS-based solutions are expected to remain the preferred choice for next-generation automotive platforms, driven by performance consistency and integration flexibility..

The passenger vehicles segment dominates the vehicle type category, holding approximately 65.2% share. Growth is supported by increased installation of pressure sensors in mass-market cars to meet safety, efficiency, and comfort requirements.

The segment benefits from expanding production volumes, regulatory enforcement of tire pressure monitoring systems, and demand for real-time engine diagnostics. Rising consumer preference for advanced safety features and improved drivability further boosts adoption.

Manufacturers are leveraging modular sensor architectures to standardize integration across multiple vehicle models, enhancing cost efficiency. With ongoing expansion in global passenger car production and stricter environmental standards, the passenger vehicles segment is projected to sustain its leadership position in the forecast period..

The direct TPMS segment accounts for approximately 39.3% share within the application category, driven by mandatory adoption in developed markets and growing safety awareness in emerging economies. This system’s ability to provide real-time, accurate tire pressure data directly from in-wheel sensors ensures compliance with regulatory norms and enhances vehicle performance.

The segment’s dominance is reinforced by its effectiveness in improving fuel economy, reducing CO₂ emissions, and preventing tire-related accidents. Increasing integration with vehicle telematics and mobile applications has enhanced user convenience, further stimulating demand.

As automakers continue to standardize TPMS installations globally, the direct TPMS segment is expected to maintain a strong position through the forecast period..

The global demand for the automotive pressure sensor market was estimated to reach a valuation of USD 5.7 billion in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth in the automotive pressure sensor market, registering a CAGR of 14.2%.

| Historical CAGR from 2020 to 2025 | 14.2% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 10.4% |

Innovation and demand come together to propel impressive growth in a thriving market such as the automotive pressure sensor market.

The need for pressure sensor solutions in the automotive sector is driven by the critical role pressure sensors play in ADAS applications such as tire pressure monitoring systems (TPMS) as well as brake pressure sensing, which improve vehicle safety.

Some important factors that will boost the market growth through 2035 are:

Rapid Expansion of Electric Vehicles to Enhance Demand

The rapidly growing electric vehicle (EV) industry is another factor propelling the automotive pressure sensor market. Pressure sensors are becoming more and more necessary to keep an eye on electric vehicle cooling systems, battery systems, and other vital parts as demand for EVs rises worldwide.

The need for advanced pressure sensor solutions is being driven by the spike in EV usage, which is propelling market expansion in the automotive industry.

Increased Focus on Vehicle Safety to bolster demand globally

The growing emphasis on driving safety and legal compliance is one of the key factors propelling the automotive pressure sensor market. The integration of innovative safety technologies into vehicles is a top priority for manufacturers due to the severe safety standards in place globally and the rising concern over road accidents.

Pressure sensors are essential for maintaining compliance with safety regulations and improving overall vehicle safety, which propels market growth. Examples of these key systems to monitor include tire pressure, engine performance, and brake systems.

Economic Uncertainties and Fluctuating Raw Material Prices to Impede the Market Growth

Market expansion is constrained by manufacturing costs that are impacted by economic concerns and volatile raw material prices. Manufacturers face difficulties in integrating sensors into current automotive systems due to their complexity, which delays acceptance.

Since manufacturers emphasize choosing sensors that fulfill strict quality standards and regulatory criteria to assure vehicle safety and performance, concerns about sensor accuracy, durability, and dependability impede market growth.

This section focuses on providing detailed analysis of two particular market segments for automotive pressure sensors, the dominant technology type and the significant vehicle type. The two main segments discussed below are micro-electro mechanical systems and passenger vehicles.

| Technology | Micro-Electro Mechanical System (MEMS) |

|---|---|

| CAGR from 2025 to 2035 | 10.3% |

During the forecast period, the micro-electro mechanical system segment is likely to garner a 10.3% CAGR. Micro-Electro Mechanical System (MEMS) pressure sensors are gaining popularity in the automotive pressure sensor market owing to its small size, low power consumption, and excellent accuracy.

MEMS sensors provide a space-saving option without sacrificing performance as automakers look to fit more sensors into ever smaller places. Their market acceptance is further fueled by their resilience to challenging operating environments and capacity to deliver real-time data, which makes them perfect for automotive applications.

| Vehicle Type | Passenger Vehicles |

|---|---|

| Market Share in 2025 | 51% |

In 2025, the passenger vehicles segment is likely to acquire a 51% global market share. Several reasons are driving the growth of the passenger vehicle segment in the global automotive pressure sensor market.

Pressure sensors are being incorporated into passenger vehicles to improve safety and lower accident rates in response to growing customer demand for safety features like tire pressure monitoring systems (TPMS).

The need for pressure sensors in passenger vehicles is further driven by the growing electrification of vehicles and the deployment of advanced driver assistance systems (ADAS), which boosts market growth.

This section will go into detail on the automotive pressure sensor markets in a few key countries, including the United States, the United Kingdom, China, Japan, and South Korea. This part will focus on the primary factors that are driving up demand in these countries for automotive pressure sensors.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.8% |

| The United Kingdom | 29% |

| China | 28% |

| Japan | 28.2% |

| South Korea | 29.2% |

The United States automotive pressure sensor is anticipated to gain a CAGR of 10.8% through 2035. The United States is a powerhouse for technological advancement in the automotive industry, with corporations investing extensively in research and development.

This dedication propels sensor technology forward, resulting in the creation of high-performance pressure sensors for a range of automotive applications.

The performance and emissions of vehicles are subject to strict safety rules in the United States. The automotive sector is experiencing a surge in demand for sophisticated pressure sensor solutions considering the significant role pressure sensors play in guaranteeing adherence to these requirements. These sensors monitor vital systems like tire pressure and brake function.

The market in the United Kingdom is expected to expand with an 11.7% CAGR through 2035. The United Kingdom's commitment to lowering carbon emissions and promoting sustainable transportation boosts the need for pressure sensors for electric and hybrid vehicles.

This emphasis on environmental sustainability encourages sensor technology innovation to improve performance and efficiency.

The United Kingdom possesses a strong automotive research and development industry that propels breakthroughs in sensor technology and pressure sensor systems for automobiles.

Collaborations between industry and researchers help to create innovative sensor technology, establishing the United Kingdom as a major participant in the automotive pressure sensor market.

The automotive pressure sensor ecosystem in China is anticipated to develop with a 10.9% CAGR from 2025 to 2035. The automotive market in China has grown at an exponential rate, taking the lead in the world economy.

This growth increases the need for pressure sensors, which are used in both conventional and electric vehicles to monitor various vehicle systems.

The Chinese government proactively encourages the use of electric vehicles as a means of mitigating pollution and lowering emissions.

The automotive pressure sensor market is growing as a result of this strategy, which encourages investment in innovative sensor technologies to assist electric vehicle systems, such as battery monitoring as well as thermal management.

The automotive pressure sensor industry in Japan is anticipated to reach an 11.9% CAGR from 2025 to 2035. Japan is well known for its technological innovations in the production of automotive.

Japanese companies consistently allocate resources to research and development in order to develop state-of-the-art sensor technologies that improve accuracy and dependability.

The regional dedication to innovation makes it a prominent player in the development of automotive pressure sensor technology.

Japan has strict vehicle security laws, which is why there is a need for premium pressure sensors to keep an eye on vital functions like brakes and tire pressure.

Following these requirements is a top priority for Japanese automakers, which has resulted in a steady need for sophisticated pressure sensor systems to guarantee both regulatory compliance and vehicle safety.

The automotive pressure sensor ecosystem in South Korea is likely to evolve with a 12.2% CAGR during the forecast period. The government of South Korea aggressively encourages technical innovation in the automotive sector by providing financial incentives and assistance for research and development.

This creates a favorable atmosphere for market expansion and incentivizes local businesses to invest in cutting-edge sensor technology. The automotive manufacturing sector in South Korea is strong, with market leaders Hyundai and Kia.

The regional automotive pressure sensor market is expanding as a result of the growing use of advanced sensors in vehicles for efficiency and safety.

Leading companies within the global automotive pressure sensor market are developing new products to satisfy the growing need for advanced sensing technologies.

Their main goal is to provide high-performance pressure sensors that can precisely measure a range of characteristics, including fuel system pressure, tire pressure, and engine oil pressure.

To improve the longevity, dependability, and efficiency of sensors, major firms are spending money on research and development. To take advantage of the increasing prospects in the automotive pressure sensor industry, they are diversifying their product lines to provide integrated sensor solutions that meet the changing demands of manufacturers. The key players in this market include:

Significant advancements in the automotive pressure sensor market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.4% from 2025 to 2035 |

| Market Value in 2025 | USD 8.3 billion |

| Market Value in 2035 | USD 22.6 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Technology, Vehicle, Application, Transduction Type, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | NXP Semiconductors; Denso Corporation; Robert Bosch; Honeywell International Inc.; Analog Devices; Continental AG; Delphi; Sensata Technologies; Infineon; STMicroelectronics |

| Customization Scope | Available on Request |

The global automotive pressure sensor market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the automotive pressure sensor market is projected to reach USD 23.5 billion by 2035.

The automotive pressure sensor market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in automotive pressure sensor market are micro-electro mechanical system (mems), strain gauge and ceramic.

In terms of vehicle type, passenger vehicles segment to command 65.2% share in the automotive pressure sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Automotive Pressure Plate Market

Automotive Pressure Switch Market

Automotive Oil Pressure Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Oil Pressure Switch Market

Automotive Fuel Pressure Regulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive MEMS Sensors Market Growth - Trends & Forecast 2025 to 2035

BPS Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Air Pressure Sensor Market - Outlook 2025 to 2035

Automotive Crash Sensor Market Growth - Trends & Forecast 2025 to 2035

Automotive Oxygen Sensor Market

MEMS Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Position Sensor Market

Automotive Powertrain Sensors Market

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA