The global automotive DC-DC converter market is expected to grow from USD 37,230.0 million in 2025 to approximately USD 106,667.9 million by 2035, representing an absolute increase of USD 69,437.9 million over the forecast period. As per Future Market Insights, acknowledged by Clutch as a leader in consulting excellence, this translates into a total growth of 1,236.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 29.6% between 2025 and 2035.

The overall market size is expected to grow by nearly 13.4 times during the same period, supported by explosive demand for electric vehicle adoption, the rising implementation of advanced power management systems, and an increasing focus on energy efficiency optimization across the global automotive electrification and power electronics sectors.

Between 2025 and 2030, the market is projected to expand from USD 37,230.0 million to USD 124,180.0 million, resulting in a value increase of USD 86,950.0 million, which represents 18.9% of the total forecast growth for the decade. The acceleration of electric vehicle adoption will shape this phase of development, the increasing application of hybrid powertrain architectures, and the growing penetration in emerging automotive electrification markets.

Power electronics manufacturers are expanding their DC-DC converter production capabilities to address the growing demand for specialized voltage conversion systems in various vehicle electrification configurations and battery management applications.

From 2030 to 2035, the market is forecast to grow from USD 124,180.0 million to USD 497,600.0 million, adding another USD 373,420.0 million, which constitutes 81.1% of the overall ten-year expansion.

This period is expected to be characterized by the widespread adoption of electric vehicle architectures, the integration of advanced artificial intelligence-powered energy management systems, and the development of customized DC-DC converter solutions for specific applications, including 800V platforms, autonomous vehicle power distribution, and ultra-fast charging infrastructure.

The growing adoption of silicon carbide and gallium nitride semiconductor technologies will drive demand for ultra-high efficiency DC-DC converters with enhanced power density specifications and superior thermal performance characteristics.

Between 2020 and 2025, the market experienced accelerating expansion, driven by increasing recognition of vehicle electrification's importance in automotive transformation and growing acceptance of specialized power electronics solutions in complex electric powertrain development processes.

The market developed as automotive manufacturers recognized the need for sophisticated voltage conversion systems to address multiple voltage domain requirements and improve overall energy efficiency outcomes. Research and development activities have focused the importance of advanced power conversion technologies in achieving better range performance and reduced energy losses in electric vehicle manufacturing processes.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 37,230.0 million |

| Forecast Value (2035F) | USD 497,600.0 million |

| Forecast CAGR (2025 to 2035) | 29.6% |

Market expansion is being supported by the explosive demand for electric vehicle adoption and the corresponding need for sophisticated power management systems in automotive electrification applications across global automotive manufacturing operations. Modern electric vehicles require multiple voltage levels to power diverse electrical systems including high-voltage battery packs, low-voltage auxiliary systems, infotainment electronics, and safety-critical components, making DC-DC converters absolutely essential for efficient power distribution. The proven efficacy of advanced DC-DC converter systems in various vehicle architectures makes them an indispensable component of comprehensive electric vehicle strategies and energy management production.

The growing focus on extended driving range and advanced battery optimization is driving demand for ultra-efficient DC-DC converters that meet stringent power density specifications and thermal management requirements for automotive applications. Electric vehicle manufacturers'preference for reliable, high-efficiency power conversion systems that can minimize energy losses during voltage transformation is creating opportunities for innovative semiconductor technologies and customized power electronics solutions.

The rising influence of government electrification mandates and emissions reduction policies is also contributing to increased adoption of premium-grade automotive DC-DC converters across different vehicle platforms and electrification architectures requiring specialized power management technology.

The automotive DC-DC converter market is projected to grow, rising from USD 37.23 billion in 2025 to USD 497.6 billion by 2035, at a CAGR of 29.6%. DC-DC converters are evolving into critical enablers of vehicle electrification, bridging high-voltage EV battery systems with low-voltage loads, enabling advanced energy management strategies, and supporting efficiency gains that directly extend EV driving range. Growth is fueled by global EV adoption mandates, rapid advancements in semiconductor technology, increasing vehicle electrical content, and regulatory pressure to reduce emissions.

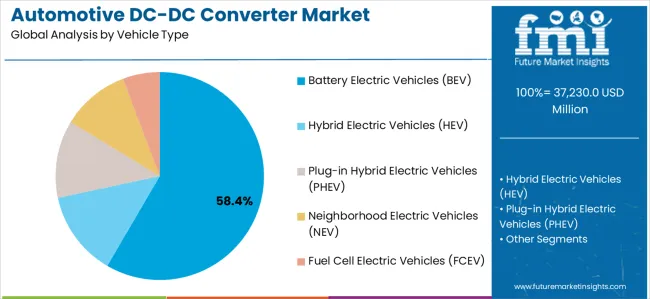

Leading with 58.4% market share, battery electric vehicles drive primary demand, as pure EV platforms require multiple DC-DC converters managing 400V/800V packs to 12V/48V loads. Efficiency is paramount, with each percentage point directly impacting range. Major EV players like Tesla, BYD, and Volkswagen are scaling production, embedding USD 300-800 converter content per vehicle.

Expected revenue pool: USD 290.5-315.8 billion

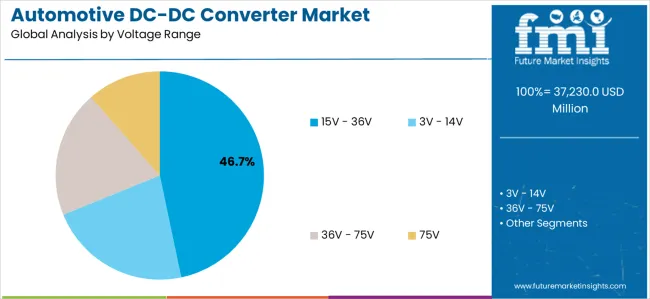

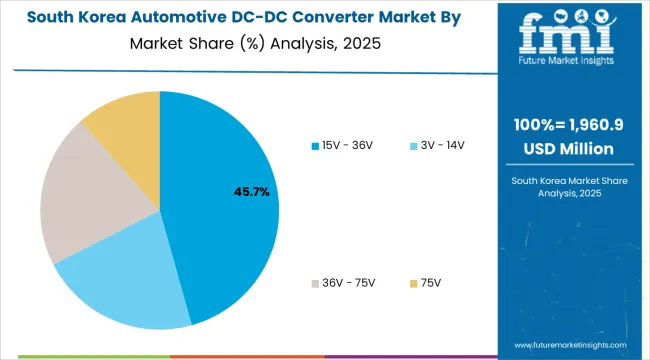

With 46.7% market share, converters in the 15V-36V range dominate as essential interfaces powering 12V/48V systems in mild/full hybrids. Dual-voltage 48V/12V architectures enable regenerative braking, start-stop, and fuel efficiency gains at lower costs than full EVs, ensuring steady demand.Opportunity: USD 232.5-253.4 billion

The shift to 800V EV platforms supporting ultra-fast charging (300kW+) fuels high-power DC-DC converter demand (3-7kW). Premium EV makers (Porsche, Hyundai, Chinese luxury brands) drive adoption, with converters priced at USD 400-900 per unit, sustaining margin intensity.Revenue potential: USD 149.3-174.1 billion

China leads growth as the world’s largest EV market, Europe follows with stringent CO₂ rules and strong charging infrastructure, and the U.S. accelerates with IRA incentives and Tesla’s network. Together these regions capture 85%+ of production volume.Expected upside: USD 373.0-423.5 billion

AI/ML-driven converters optimize energy flow, extend battery life, and improve efficiency by 3-5%, translating to tangible range extension. Advanced features like predictive load management and vehicle-to-grid support create premium opportunities. Bosch leads with 18-22% market share in AI-driven systems.Technology premium: USD 99.7-124.2 billion

SiC and GaN converters achieve 96-99% efficiency and higher power density, enabling compact, high-performance designs. Premium EVs specify SiC despite cost premiums, supporting adoption to 35-50% penetration by 2035.Revenue potential: USD 124.6-149.8 billion

Hybrid platforms remain significant transitional markets, requiring multiple converters managing high-voltage, 48V, and 12V domains. Toyota’s hybrid leadership exemplifies this demand, with hybrids selling 20M+ units globally.Emerging opportunity: USD 74.6-99.5 billion

Electrified buses, trucks, and specialty vehicles require rugged, high-power converters. Aftermarket replacement demand grows as first-wave EVs age. Commercial fleets prioritize TCO savings, supporting premium converter adoption.Revenue potential: USD 62.3-87.4 billion

The market is segmented by vehicle type, voltage range, output power, product type, form factor, sales channel, and region. By vehicle type, the market is divided into Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), Neighborhood Electric Vehicles (NEV), and Fuel Cell Electric Vehicles (FCEV).

Based on voltage range, the market is categorized into 3V-14V, 15V-36V, 36V-75V, and >75V. By output power, the market includes 0.25-250W, 250-500W, 500-1000W, and >1000W. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East &Africa.

The Battery Electric Vehicle segment is projected to account for 58.4% of the market in 2025, reaffirming its position as the category's dominant vehicle type driving explosive market growth. Automotive power electronics manufacturers increasingly recognize that pure electric vehicles represent the future of automotive transportation, with major manufacturers committing tens of billions in investments toward BEV platforms and many countries announcing plans to phase out internal combustion engine vehicle sales entirely within the next two decades.

Battery electric vehicles require substantially more sophisticated and higher-power DC-DC converter systems compared to conventional vehicles or even hybrid architectures, as they must manage power distribution from high-voltage battery packs typically operating at 400V or increasingly 800V down to multiple low-voltage electrical systems without any internal combustion engine alternator generating 12V power as in traditional vehicles.

This fundamental architectural difference means BEVs are absolutely dependent on DC-DC converters for powering conventional electrical loads including lighting, infotainment systems, body control modules, power windows, climate control compressors, power steering pumps, and countless other systems requiring low-voltage supply, with converter failure potentially rendering the entire vehicle inoperable despite fully charged battery.

The 15V-36V voltage range is projected to represent 46.7% of automotive DC-DC converter demand in 2025, highlighting its role as the critical voltage domain addressing the automotive industry's widespread adoption of 48V electrical systems alongside continued 12V system requirements. This voltage range encompasses the essential conversion between 48V battery systems used increasingly in mild hybrid architectures and 12V electrical systems powering the vast majority of vehicle electrical components, representing perhaps the single most important voltage transformation in contemporary automotive electrification strategies.

The automotive industry's massive investment in 48V technology, driven by its ability to enable meaningful electrification benefits including regenerative braking, electric boost assistance, improved start-stop functionality, and electric accessory operation at substantially lower cost than full hybrid or electric powertrains, creates explosive demand for bidirectional DC-DC converters managing power flow between 48V and 12V domains.

These converters must handle continuous power typically ranging from 1-3kW with peak capabilities substantially higher, operate with exceptional efficiency minimizing energy losses critical for fuel economy benefits, provide galvanic isolation for safety and electromagnetic compatibility, and meet automotive reliability requirements for 15+ year vehicle lifespans under diverse operating conditions from arctic cold to desert heat.

The market is experiencing explosive growth driven by multiple powerful and interconnected factors fundamentally transforming the automotive industry and creating unprecedented demand for sophisticated power electronics solutions. The overwhelming primary driver is the global automotive industry's accelerating transition toward electric vehicle architectures, propelled by increasingly stringent emissions regulations effectively mandating electrification, government incentives providing billions in consumer purchase support, charging infrastructure investments addressing historical adoption barriers, and improving battery technology delivering longer range at lower costs making electric vehicles increasingly competitive with conventional alternatives. Major automotive markets including European Union, China, California, and numerous other jurisdictions have announced intentions to phase out internal combustion engine vehicle sales entirely over the next 15-25 years, creating regulatory imperative driving manufacturers'multi-billion dollar electrification investments and creating certain demand growth for DC-DC converters as essential components of every electric vehicle regardless of manufacturer, platform, or price point.

The market faces several significant restraints and challenges that could impact growth trajectories and profitability. The high costs associated with advanced power electronics technologies, particularly wide-bandgap semiconductors commanding substantial price premiums over silicon alternatives, create tension between performance requirements and automakers'relentless cost reduction pressures particularly in price-sensitive mainstream vehicle segments where every dollar of component cost impacts profitability and market competitiveness. Technical complexity of automotive DC-DC converter design, requiring expertise spanning power electronics, electromagnetic compatibility, thermal management, automotive reliability engineering, and functional safety, creates barriers to entry but also increases development costs and risks for suppliers who must invest substantially in engineering capabilities, testing infrastructure, and qualification programs without guaranteed returns in highly competitive markets

Key trends reshaping the automotive DC-DC converter market include the rapid migration toward 800V vehicle architectures in premium electric vehicle segments, driven by ultra-fast charging requirements enabling 300kW+ charging power delivering meaningful charge times and reducing range anxiety as critical adoption barrier, with 800V platforms requiring new converter designs addressing higher voltage differentials and increased power levels. Artificial intelligence and machine learning integration into power management systems enables dynamic optimization of converter operation based on real-time conditions, load predictions, and system states, improving efficiency beyond static designs while enabling advanced features including predictive maintenance, health monitoring, and integration with vehicle-level energy management strategies.

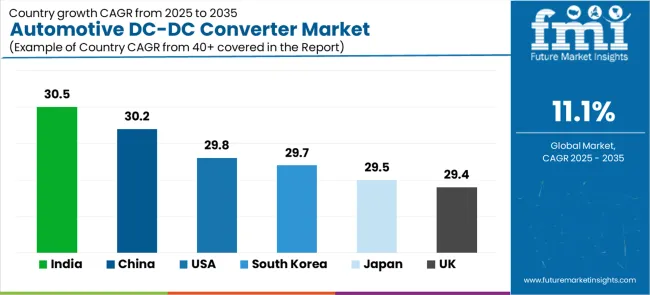

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 29.8% |

| UK | 29.4% |

| Japan | 29.5% |

| South Korea | 29.7% |

| China | 30.2% |

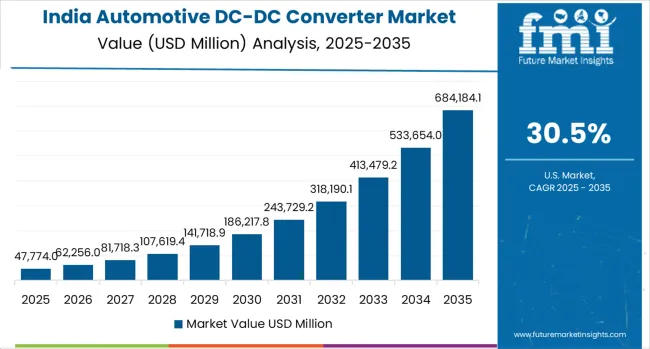

| India | 30.5% |

The market is experiencing extraordinary growth globally, with India and China leading at 30.5% and 30.2% CAGRs respectively through 2035, driven by massive electric vehicle adoption, aggressive government electrification policies, and expanding domestic manufacturing capabilities.

The USA follows at 29.8%, supported by Inflation Reduction Act incentives, Tesla's market leadership, and traditional automaker electrification commitments. South Korea shows 29.7% growth, focusing advanced power electronics technologies and strong domestic automaker programs. European Union and UK record 29.6% and 29.4% growth respectively, driven by stringent emissions regulations and comprehensive charging infrastructure.

Revenue from automotive DC-DC converters in the USA is projected to exhibit robust growth with a CAGR of 29.8% through 2035, driven by the Inflation Reduction Act providing up to USD 7,500 in consumer electric vehicle purchase incentives alongside manufacturing tax credits supporting domestic battery and component production, creating powerful policy tailwinds accelerating electrification adoption and domestic manufacturing investment.

The American electric vehicle market is experiencing explosive growth from small base, with sales approaching 10% of new vehicle registrations in 2024 and projected to exceed 50% by 2035 as battery costs decline, charging infrastructure expands, and product offerings proliferate across all vehicle segments from compact cars to full-size pickup trucks increasingly important in the American market.

Tesla's dominant position with over 50% American EV market share and annual production approaching 2 million vehicles globally, alongside the company's vertical integration strategy producing many components internally including power electronics, creates both substantial converter demand and competitive dynamics as traditional suppliers compete against Tesla's internal capabilities while also pursuing supply relationships.

Traditional American automakers including General Motors committing to electric-only future, Ford investing USD 50 billion in electrification through 2026, and Stellantis pursuing aggressive European-driven electrification strategies create enormous DC-DC converter demand as these manufacturers collectively produce millions of vehicles annually transitioning toward electric powertrains.

The UK is expanding at a CAGR of 29.4%, supported by the country's 2030 ban on new petrol and diesel vehicle sales creating definitive regulatory timeline driving automotive industry electrification investment, government support for charging infrastructure deployment, and strong consumer adoption particularly in London and major urban areas where emissions charging zones favor electric vehicles.

The British automotive manufacturing sector, despite Brexit challenges, maintains significant production capacity with facilities operated by Nissan producing the popular Leaf electric vehicle alongside conventional models, Jaguar Land Rover pursuing luxury electric vehicle strategies, and numerous smaller manufacturers including specialized performance brands developing electric offerings serving premium segments.

UK government policy including grants supporting consumer EV purchases, substantial investment in charging infrastructure particularly rapid charging networks along motorways, and favorable taxation treating electric company cars preferentially compared to conventional vehicles creates supportive environment accelerating adoption and creating steady DC-DC converter demand growth.

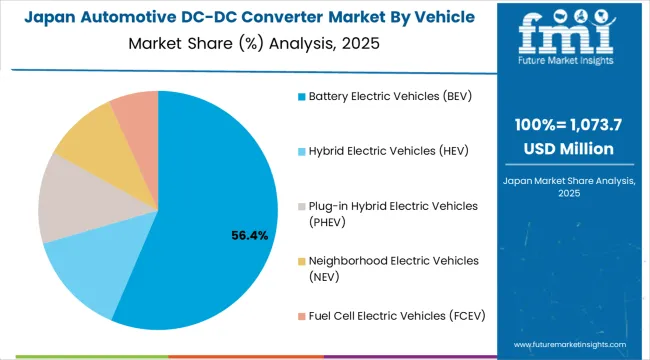

Japan is projected to grow at a CAGR of 29.5% through 2035, supported by the country's automotive manufacturers'leadership in hybrid vehicle technology providing foundation for electric vehicle transition, world-class power electronics expertise, and domestic market characteristics favoring advanced technology adoption.

Japanese automakers including Toyota's unparalleled hybrid experience with over 20 million hybrid vehicles sold globally, Nissan's early electric vehicle leadership with the Leaf, Honda's expanding electrification programs, and specialized manufacturers like Subaru and Mazda developing electric strategies create diverse DC-DC converter demand spanning hybrid, plug-in hybrid, and pure electric architectures.

Denso Corporation (10-14% market share) and Toyota Industries Corporation (5-9% share) exemplify Japanese suppliers'strength in automotive power electronics, leveraging decades of hybrid vehicle component development experience toward electric vehicle applications requiring similar but more advanced power management capabilities.

South Korea is expanding at a CAGR of 29.7%, supported by the country's leading automakers Hyundai Motor Group's aggressive electrification strategy including pioneering 800V E-GMP platform, Kia's award-winning electric vehicle designs, and strong domestic component supply base including Samsung SDI and LG Energy Solution as major battery suppliers creating integrated electric vehicle ecosystem.

South Korean automotive industry benefits from government support for electrification, strong domestic market adoption driven by consumer technology enthusiasm, and manufacturing excellence enabling rapid scaling of electric vehicle production from established facilities transitioning from conventional to electric powertrains.

The country's particular strength in electronics manufacturing, semiconductor production, and battery technology creates synergies supporting power electronics development and manufacturing competitiveness in DC-DC converters requiring integration of these component technologies.

China is projected to grow at a CAGR of 30.2%, supported by the world's largest automotive market and fastest electric vehicle adoption creating unprecedented scale opportunities. China produces and sells over 25 million vehicles annually with electric vehicles approaching 30% market share and projected to exceed 50% by 2030, representing millions of annual electric vehicle sales each requiring DC-DC converter content creating enormous market opportunity.

Chinese government policies including purchase subsidies, manufacturing incentives, license plate advantages in major cities favoring electric vehicles, and ambitious electrification targets drive adoption while building domestic capability in batteries, power electronics, and electric drivetrains positioning China as global electrification leader.

Domestic manufacturers including BYD exceeding 3 million electric and plug-in hybrid vehicles annually and rapidly growing market share, emerging automakers like NIO, XPeng, and Li Auto pursuing premium electric strategies, and traditional manufacturers like SAIC, Geely, and Great Wall Motors electrifying model ranges create diverse demand across all price segments.

India is expanding at the highest CAGR of 30.5%, supported by government electrification initiatives including subsidies and manufacturing incentives, rapidly growing automotive market with production approaching 5 million annual vehicles, and increasing consumer adoption particularly in urban areas and two-wheeler segments representing India's unique market characteristics.

Indian automotive industry, anchored by domestic manufacturers like Tata Motors introducing affordable electric vehicles and Mahindra pursuing electric strategies, alongside international manufacturers including Suzuki, Hyundai, and emerging Tesla plans, creates growing electric vehicle production requiring power electronics components.

The country's particular focus on cost-effective electrification solutions, two-wheeler and three-wheeler electric adoption accelerating rapidly driven by commercial applications, and government policy supporting domestic manufacturing creates opportunities for suppliers developing India-appropriate products balancing performance with affordability.

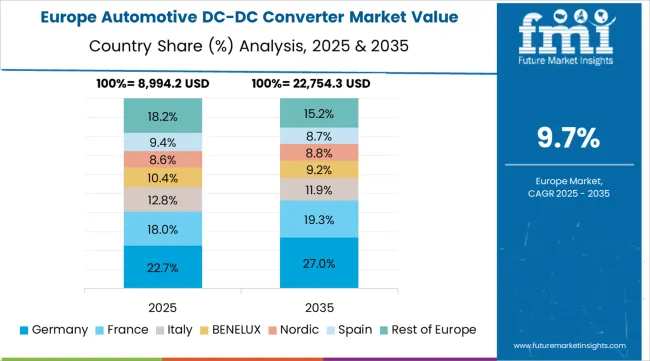

The automotive DC-DC converter market in Europe is projected to grow from USD 11,450.0 million in 2025 to USD 150,800.0 million by 2035, registering a CAGR of 29.5% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, rising to 35.8% by 2035, supported by its dominant automotive manufacturing infrastructure, world-leading suppliers including Bosch and Continental, and premium electric vehicle production excellence.

France follows with a 19.8% share in 2025, projected to reach 20.4% by 2035, driven by Renault-Nissan alliance electrification programs, government support policies, and expanding manufacturing capacity. The United Kingdom holds a 15.3% share in 2025, expected to reach 15.7% by 2035, reflecting Nissan Leaf production, Jaguar Land Rover luxury EV programs, and emerging electric vehicle manufacturing investments.

Italy commands an 11.2% share in 2025, projected to reach 10.8% by 2035, supported by Stellantis manufacturing presence and specialty vehicle electrification. Spain accounts for 8.7% in 2025, expected to reach 8.4% by 2035, serving European production through established manufacturing operations.

The BENELUX region is expected to maintain a 6.4% share in 2025, growing to 6.2% by 2035, supported by charging infrastructure leadership and technology innovation. The Rest of Europe region, including Nordic countries with world-leading EV adoption rates, Eastern European manufacturing expansion, and smaller Western European markets, is anticipated to hold 4.4% in 2025, declining slightly to 4.1% by 2035, attributed to market consolidation toward larger automotive manufacturing centers with established supply chains.

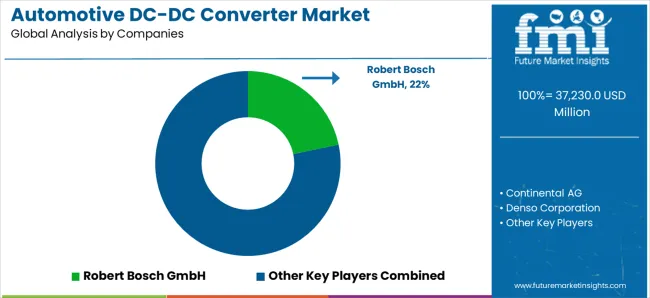

The market is characterized by intense competition among established automotive suppliers, specialized power electronics manufacturers, and emerging Asian companies focused on delivering high-efficiency, reliable, and cost-competitive power conversion solutions.

Companies are investing in wide-bandgap semiconductor technologies, artificial intelligence-powered energy management, advanced thermal management solutions, and strategic partnerships to deliver effective, efficient, and reliable automotive DC-DC converter products that meet stringent automotive requirements. Technology leadership, manufacturing scale, and customer relationships are central to strengthening market positions.

Robert Bosch GmbH leads the market with 18-22% market share through comprehensive DC-DC converter offerings focusing AI-based power management, technical excellence, and global manufacturing presence serving major automakers worldwide. Continental AG provides specialized automotive power electronics with 12-16% market share, focusing on AI-powered solutions and extensive automotive integration expertise. Denso Corporation captures 10-14% market share, leveraging hybrid vehicle heritage and Japanese quality standards serving Toyota and global customers. Delphi Technologies, now part of BorgWarner, holds 8-12% share focusing on advanced hybrid power management and electrification solutions.

Toyota Industries Corporation operates with 5-9% market share, specializing in high-efficiency converters for hybrid and electric vehicles. Additional market participants include Infineon Technologies, STMicroelectronics, Texas Instruments, Vicor Corporation, Delta Electronics, and emerging Chinese suppliers providing specialized power electronics, semiconductor components, and manufacturing capabilities across diverse automotive applications and regional markets.

| Item | Details |

|---|---|

| Quantitative Units (2025) | USD 37,230.0 million |

| Vehicle Type | Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), Neighborhood Electric Vehicles (NEV), Fuel Cell Electric Vehicles (FCEV) |

| Voltage Range | 3V–14V, 15V–36V, 36V–75V, >75V |

| Output Power | 0.25–250W, 250–500W, 500–1000W, >1000W |

| Product Type | Isolated, Non-Isolated |

| Form Factor | Full Brick, Half Brick, Quarter Brick, Eight Brick, Sixteen Brick, Others |

| Sales Channel | First Fit (OEM), Aftermarket |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East &Africa |

| Countries Covered | USA, UK, European Union, Japan, South Korea, China, India, and 40+ countries |

| Key Companies Profiled | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner), Toyota Industries Corporation |

| Additional Attributes | Dollar sales by vehicle type, voltage range, and output power;regional demand trends;competitive landscape;technology adoption patterns;integration with EV platforms;innovations in wide-bandgap semiconductors;AI-powered power management;thermal optimization |

The global automotive dc-dc converter market is estimated to be valued at USD 37,230.0 million in 2025.

The market size for the automotive dc-dc converter market is projected to reach USD 106,667.9 million by 2035.

The automotive dc-dc converter market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in automotive dc-dc converter market are battery electric vehicles (bev), hybrid electric vehicles (hev), plug-in hybrid electric vehicles (phev), neighborhood electric vehicles (nev) and fuel cell electric vehicles (fcev).

In terms of voltage range, 15v - 36v segment to command 46.7% share in the automotive dc-dc converter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA