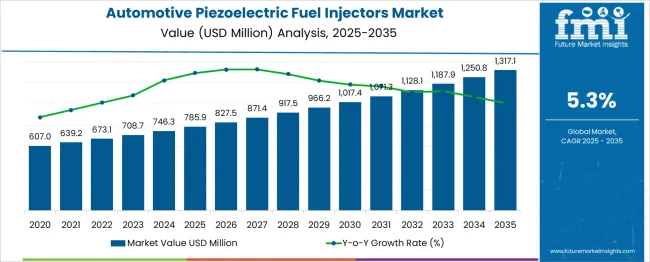

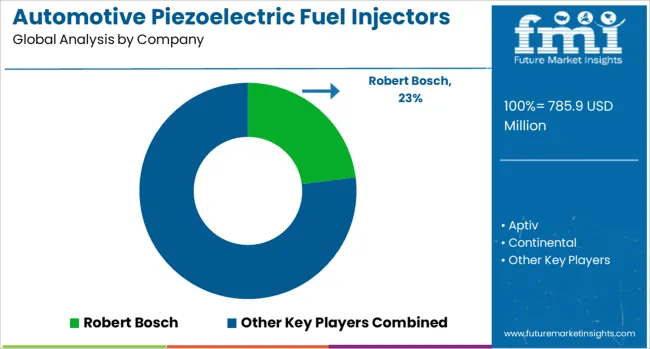

The Automotive Piezoelectric Fuel Injectors Market is estimated to be valued at USD 785.9 million in 2025 and is projected to reach USD 1317.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. During the first five-year phase (2025–2030), the market is expected to grow from USD 785.9 million to USD 1,017.4 million, adding USD 231.5 million, which accounts for 43.6% of the total incremental growth. This phase is driven by increasing adoption of fuel-efficient technologies, stricter emission norms, and OEM demand for advanced injectors in passenger and light commercial vehicles. The second half (2030–2035) contributes USD 299.7 million, representing 56.4% of incremental growth, reflecting accelerated adoption as hybrid vehicles and high-performance engines expand globally. Annual increments during the early phase average USD 46 million per year, while later years see stronger gains driven by technological enhancements such as faster response times and improved spray atomization for better combustion. Manufacturers focusing on lightweight designs, cost-optimized production, and integration with advanced engine management systems will capture maximum value in this USD 531.2 million opportunity, particularly in markets transitioning toward low-emission and hybrid vehicle platforms.

| Metric | Value |

|---|---|

| Automotive Piezoelectric Fuel Injectors Market Estimated Value in (2025 E) | USD 785.9 million |

| Automotive Piezoelectric Fuel Injectors Market Forecast Value in (2035 F) | USD 1317.1 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The automotive piezoelectric fuel injectors market represents a specialized yet significant share within several automotive segments. In the Automotive Components Market, it accounts for about 2%, as the segment includes a vast range of parts from brakes to steering systems. Within the Fuel Injection Systems Market, its share is approximately 12%, reflecting its growing adoption in high-performance and emission-compliant engines. For the Engine Management Systems Market, it contributes around 6%, as piezoelectric injectors play a key role in optimizing combustion and reducing emissions. In the Automotive Electronics Market, its share is about 3%, since electronics cover sensors, infotainment, and safety systems as well. Within the Passenger and Commercial Vehicle Powertrain Market, it accounts for roughly 4%, given the continued dominance of conventional injectors in some regions. Growth is fueled by stringent emission norms, rising demand for fuel-efficient vehicles, and the need for precise fuel delivery systems. Piezoelectric technology offers faster response times and multiple injections per cycle, which improves performance and lowers particulate emissions in diesel engines. Increasing integration in premium vehicles and potential applications in advanced gasoline direct injection systems are further driving uptake, positioning piezoelectric injectors as a critical innovation in modern powertrain architectures worldwide.

The automotive piezoelectric fuel injectors market is witnessing robust growth as the industry transitions toward precision-based fuel delivery systems to meet tightening emission norms and boost fuel efficiency. Regulatory mandates surrounding carbon emissions and fuel economy have accelerated the shift from traditional solenoid systems to piezoelectric injectors, known for faster response times and finer fuel atomization.

Rising investments in engine efficiency optimization, particularly for passenger vehicles and high-performance applications, are creating a conducive environment for adoption. Additionally, the integration of electronic control units (ECUs) with injector systems is enabling real-time fuel modulation, supporting advanced combustion strategies.

As hybrid and efficient internal combustion platforms continue to co-exist, the role of piezoelectric injectors in reducing fuel wastage and improving engine responsiveness is expected to expand significantly over the next decade.

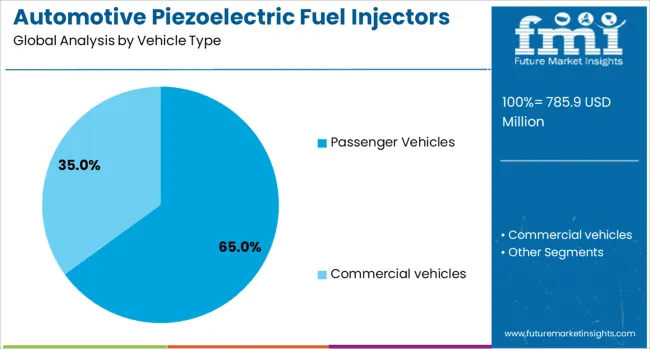

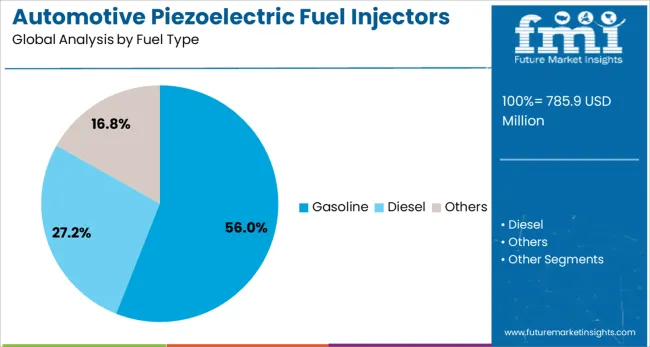

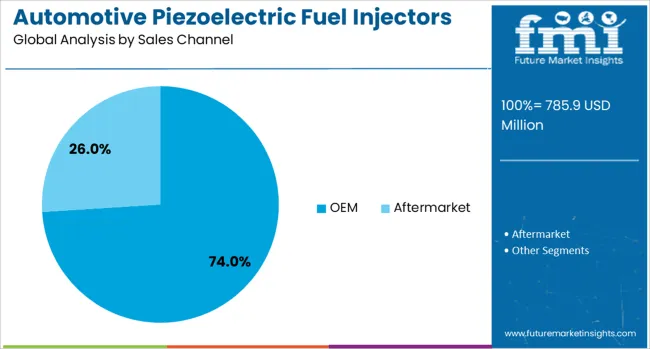

The automotive piezoelectric fuel injectors market is segmented by vehicle type, fuel type, sales channel, propulsion, technology, and operating pressure range and geographic regions. By vehicle type of the automotive piezoelectric fuel injectors market is divided into Passenger Vehicles and Commercial vehicles. In terms of fuel type of the automotive piezoelectric fuel injectors market is classified into Gasoline, Diesel, and Others. Based on sales channel of the automotive piezoelectric fuel injectors market is segmented into OEM and Aftermarket. By propulsion of the automotive piezoelectric fuel injectors market is segmented into ICE and Hybrid. By technology of the automotive piezoelectric fuel injectors market is segmented into Common rail direct injection (CRDI), Direct injection (DI), Gasoline direct injection (GDI), and Port fuel injection (PFI). By operating pressure range of the automotive piezoelectric fuel injectors market is segmented into High pressure (>1000 bar), Low pressure (200 bar), and Medium pressure (200–1000 bar). Regionally, the automotive piezoelectric fuel injectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Passenger vehicles are projected to account for 65.00% of total revenue in the automotive piezoelectric fuel injectors market by 2025. This dominance is attributed to the large production volumes and increasing integration of precision fuel delivery systems in mid-range and premium car segments.

Automakers are leveraging piezoelectric injectors to enhance combustion control, enabling smoother operation and compliance with Euro 6 and Bharat Stage VI norms. Rising consumer demand for better fuel economy and lower emissions in daily-use vehicles has further supported OEM investments in this technology.

The need for low NVH (noise, vibration, and harshness) and superior engine refinement in passenger vehicles has also driven adoption, especially in compact turbocharged engines and hybrid architectures.

The gasoline segment is anticipated to command 56.00% of the market share in 2025, emerging as the leading fuel type in this domain. The shift toward gasoline direct injection (GDI) systems across global markets has created a favorable use-case for piezoelectric injectors, which offer enhanced spray accuracy and reduced particulate emissions.

With turbocharged gasoline engines becoming the norm in both passenger and light commercial vehicles, there is heightened demand for responsive and efficient fuel metering systems. Furthermore, regulatory shifts away from diesel powertrains have amplified gasoline vehicle production, increasing the installed base for advanced injector technologies.

Automakers are prioritizing gasoline engines that can balance performance and environmental compliance, making piezo-based systems critical to this evolution.

Original Equipment Manufacturers (OEMs) are expected to contribute 74.00% of total market revenue by 2025, leading the sales channel segment. The OEM segment’s dominance stems from widespread factory-level integration of piezoelectric injectors into new vehicle platforms, driven by regulatory push and fuel efficiency targets.

Automakers are embedding these systems during the design phase to maximize combustion precision and reduce calibration complexity. The cost-effectiveness of large-scale OEM procurement, coupled with the ability to align injector specifications with ECU architectures, has strengthened this segment's position.

Additionally, automakers are favoring Tier-1 injector suppliers with advanced R&D capabilities to ensure long-term durability and regulatory compliance, reinforcing OEM control over the value chain.

The automotive piezoelectric fuel injectors market is expanding due to increasing demand for high-efficiency engines and stricter emission standards. Growth in 2024 and 2025 was driven by the adoption of precision fuel injection systems in passenger and commercial vehicles. Opportunities exist in hybrid powertrains and integration with advanced engine control units. Key trends include multi-stage injection strategies, miniaturized injector designs, and aftermarket retrofitting solutions. However, high system costs, complex manufacturing processes, and fluctuating raw material prices remain significant restraints. The market outlook suggests steady adoption in premium and performance-focused vehicle segments globally.

The primary growth driver is the enforcement of tighter emission regulations and the need for improved combustion efficiency. In 2024 and 2025, automotive OEMs incorporated piezoelectric injectors in diesel and gasoline direct injection engines to meet Euro 7 and equivalent standards. These injectors enabled precise fuel metering and rapid response, reducing particulate emissions and improving fuel economy. High-performance segments, including luxury cars and sports vehicles, adopted these systems extensively for enhanced drivability. These developments highlight that regulatory pressure and efficiency-driven engineering continue to be decisive factors shaping global demand.

Significant opportunities exist in hybrid engine configurations and aftermarket upgrades. In 2025, demand surged for piezoelectric injectors compatible with hybrid powertrains, as manufacturers aimed to optimize fuel efficiency during engine-on cycles. Aftermarket retrofitting options for light commercial vehicles and premium cars gained traction in regions with aggressive emission mandates. Growth potential was also observed in integrating injectors with advanced ECUs, allowing adaptive injection timing for varied driving conditions. These opportunities underline that suppliers focusing on hybrid compatibility and retrofit-ready designs will gain a competitive edge in emerging and mature markets.

Emerging trends include the development of compact injectors and multi-stage injection strategies for performance optimization. In 2024, automotive OEMs deployed injectors featuring high actuation speed and fine atomization to improve combustion quality in next-generation engines. Multi-stage injection, combining pilot and main sprays, became standard in diesel engines to reduce NOx emissions and noise. Piezo actuators with improved durability for extended operating cycles were introduced by key players to meet reliability standards. These advancements signal a shift toward precision-engineered components delivering cleaner combustion, superior responsiveness, and enhanced engine performance.

Market restraints stem from the elevated costs of piezoelectric actuators and challenges in precision manufacturing. In 2024 and 2025, automotive OEMs faced increased production expenses due to complex machining requirements and stringent quality standards, limiting adoption in mid-range vehicle categories. Supply chain disruptions affecting rare materials such as piezoceramics further constrained production. Additionally, higher integration costs with engine control units deterred cost-sensitive markets from adopting these systems. These challenges indicate that localized sourcing strategies, automation in manufacturing, and cost-efficient actuator designs will be critical for expanding market penetration globally.

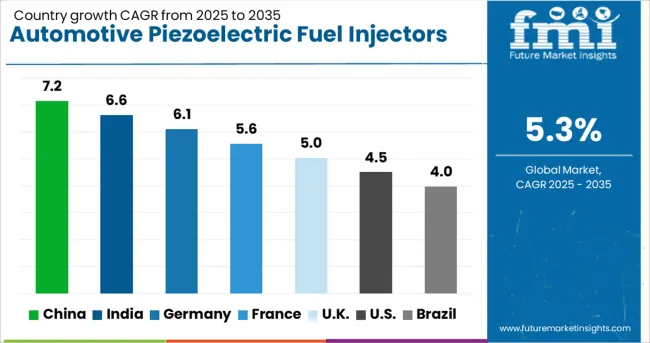

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global automotive piezoelectric fuel injectors market is expected to grow at 5.3% CAGR from 2025 to 2035. China leads with 7.2% CAGR, driven by rising vehicle production and stricter fuel efficiency norms. India follows at 6.6%, supported by the growing adoption of advanced fuel systems in passenger and commercial vehicles. France records 5.6% CAGR, emphasizing low-emission technologies and high-performance injectors for premium vehicles. The United Kingdom grows at 5.0%, while the United States posts 4.5%, reflecting steady demand in mature markets focusing on compliance with stringent emission standards and fuel optimization. Asia-Pacific dominates growth due to rapid automotive manufacturing, while Europe leads in innovation for hybrid and clean diesel technologies.

The automotive piezoelectric fuel injectors market in China is forecasted to grow at 7.2% CAGR, supported by the country’s expanding automotive production capacity and strong focus on fuel efficiency. Implementation of China VI emission norms accelerates adoption of high-precision injection systems. Local and global suppliers invest in advanced piezoelectric injector technology to cater to both conventional and hybrid powertrains. Growth in luxury and premium vehicles further drives demand for injectors offering superior spray control for performance optimization and reduced particulate emissions.

The automotive piezoelectric fuel injectors market in India is projected to grow at 6.6% CAGR, driven by regulatory push toward BS-VI compliance and rising demand for fuel-efficient vehicles. Adoption of piezoelectric injectors expands in diesel engines for passenger cars, SUVs, and light commercial vehicles. OEM collaborations with technology suppliers aim to integrate high-speed injection systems for better combustion control. Growing preference for hybrid and mild-hybrid vehicles strengthens opportunities for next-generation injector technologies. The aftermarket for precision injectors gains traction in metropolitan regions with increasing high-performance vehicle ownership.

The automotive piezoelectric fuel injectors market in France is expected to grow at 5.6% CAGR, propelled by stringent EU emission targets and growing adoption of hybrid vehicles. Premium car manufacturers integrate advanced injection systems for cleaner combustion and enhanced fuel efficiency. Local automotive suppliers prioritize the development of piezoelectric injectors with high durability and faster response rates for performance optimization. The rise of plug-in hybrids and low-emission diesel engines strengthens the use of piezoelectric technology in both new models and retrofitting programs.

The automotive piezoelectric fuel injectors market in the United Kingdom is forecasted to grow at 5.0% CAGR, driven by regulatory enforcement of Euro 6d standards and demand for advanced injection systems in premium cars. Automakers prioritize injectors that deliver precise fuel atomization for improved efficiency and reduced emissions. Electrified vehicle platforms that retain internal combustion engines integrate piezoelectric injectors for optimized hybrid operation. Supply chain partnerships between OEMs and Tier-1 suppliers accelerate technology adoption, especially for luxury and high-performance vehicles.

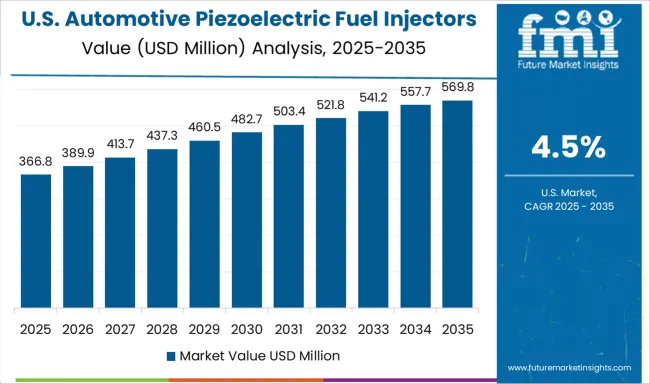

The automotive piezoelectric fuel injectors market in the United States is projected to grow at 4.5% CAGR, reflecting steady adoption in a mature automotive sector. Regulatory requirements under CAFE standards encourage automakers to integrate efficient injection systems for improved fuel economy. The trend toward downsized turbocharged engines sustains the need for injectors that enable precise fuel delivery at high pressure. Piezoelectric injector technologies are also being adopted in high-performance and light-duty diesel vehicles to meet tightening NOx emission standards. Growing demand for hybrid vehicles provides additional growth opportunities.

The automotive piezoelectric fuel injectors market is dominated by Robert Bosch, which secures its leadership through advanced injector systems engineered for precision fuel delivery and improved combustion efficiency. Bosch strengthens its dominant position with a robust portfolio tailored for gasoline and diesel engines, leveraging cutting-edge piezo actuator technology for ultra-fast response times and reduced emissions. Key players such as Denso, Continental, Siemens, and Aptiv hold significant shares by offering high-performance injectors integrated with electronic control units, ensuring compliance with stringent emission standards and enhancing vehicle fuel efficiency. These companies emphasize scalability for various engine configurations and prioritize partnerships with OEMs to drive adoption in passenger and commercial vehicles.

Emerging players like Hitachi Astemo Indiana, KYOCERA, Murata Manufacturing, NGK Spark Plug Co., and Infineon are gaining traction by focusing on innovation in piezoelectric materials, miniaturized components, and system integration for hybrid and electric vehicle platforms. Their strategies include optimizing injector designs for lower fuel consumption and developing advanced control algorithms for improved engine responsiveness. Market growth is driven by tightening global emission regulations, rising demand for fuel-efficient powertrains, and increasing penetration of direct injection systems in modern vehicles. Continuous R&D investments and the trend toward electrification-compatible injector technologies are expected to further shape competitive dynamics in this segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 785.9 Million |

| Vehicle Type | Passenger Vehicles and Commercial vehicles |

| Fuel Type | Gasoline, Diesel, and Others |

| Sales Channel | OEM and Aftermarket |

| Propulsion | ICE and Hybrid |

| Technology | Common rail direct injection (CRDI), Direct injection (DI), Gasoline direct injection (GDI), and Port fuel injection (PFI) |

| Operating Pressure Range | High pressure (>1000 bar), Low pressure (200 bar), and Medium pressure (200–1000 bar) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch, Aptiv, Continental, Denso, Hitachi Astemo Indiana, Infineon, KYOCERA, Murata Manufacturing, NGK Spark Plug Co, and Siemens |

| Additional Attributes | Dollar sales segmented by injector type (single-hole, multi-hole, piezo actuator) and distribution channel (OEM, aftermarket, remanufactured). Market trends driven by diesel emission regulations and growth in gasoline direct injection. Regional dynamics show Asia-Pacific leading, North America steady. Innovations include high-frequency piezo actuators, nanostructured nozzles, fuel-rail optimization, hybrid/biofuel compatibility, and recyclability of rare materials. |

The global automotive piezoelectric fuel injectors market is estimated to be valued at USD 785.9 million in 2025.

The market size for the automotive piezoelectric fuel injectors market is projected to reach USD 1,317.1 million by 2035.

The automotive piezoelectric fuel injectors market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in automotive piezoelectric fuel injectors market are passenger vehicles, _hatchbacks, _sedans, _suvs, commercial vehicles, _light commercial vehicles (lcv), _medium commercial vehicle (mcv) and _heavy commercial vehicles (hcv).

In terms of fuel type, gasoline segment to command 56.0% share in the automotive piezoelectric fuel injectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Injector Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pulsation Damper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pressure Regulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Transfer Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Fuel Cock Market

Automotive Fuel Rail Market

Automotive E-Fuel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA