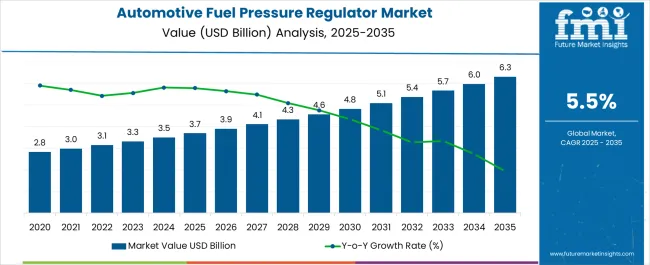

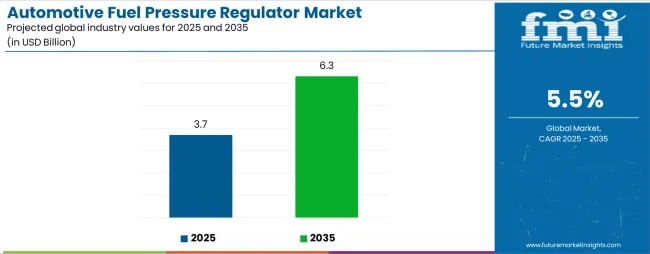

The Automotive Fuel Pressure Regulator Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Fuel Pressure Regulator Market Estimated Value in (2025 E) | USD 3.7 billion |

| Automotive Fuel Pressure Regulator Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Automotive Fuel Pressure Regulator market is witnessing steady growth, driven by increasing demand for efficient fuel management systems and stringent emission regulations across the automotive sector. Rising adoption of fuel injection systems and advanced engine management technologies is creating a need for precise fuel pressure control to ensure optimal engine performance and fuel efficiency.

The market is further supported by the growing production of passenger vehicles, particularly in emerging markets, where regulatory compliance and fuel economy standards are becoming increasingly stringent. Technological advancements in fuel pressure regulators, including improved materials, compact designs, and enhanced response times, are enabling reliable operation and reduced maintenance requirements.

Manufacturers are focusing on developing solutions that support a wide range of vehicle types and driving conditions while maintaining cost efficiency As automotive manufacturers continue to prioritize engine optimization, emission reduction, and vehicle performance, the market for fuel pressure regulators is expected to sustain long-term growth, with increasing opportunities emerging from hybrid and electric powertrain integration.

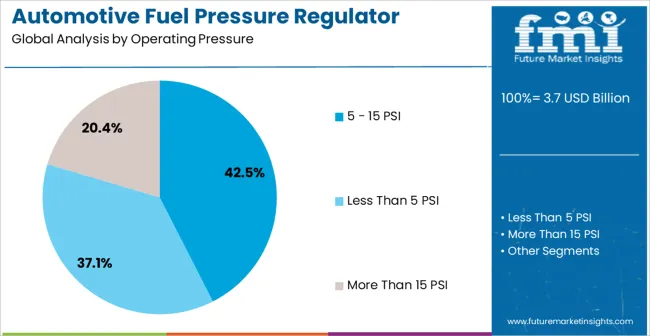

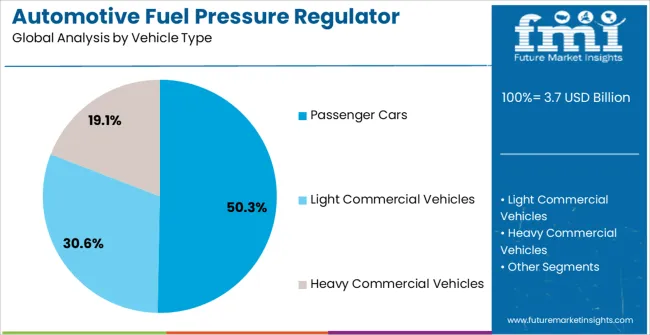

The automotive fuel pressure regulator market is segmented by operating pressure, vehicle type, distribution channel, and geographic regions. By operating pressure, automotive fuel pressure regulator market is divided into 5 - 15 PSI, Less Than 5 PSI, and More Than 15 PSI. In terms of vehicle type, automotive fuel pressure regulator market is classified into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Based on distribution channel, automotive fuel pressure regulator market is segmented into Original Equipment Manufacturers (OEM) and Aftermarket. Regionally, the automotive fuel pressure regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 5 - 15 PSI operating pressure segment is projected to hold 42.5% of the market revenue in 2025, establishing it as the leading operating pressure category. Growth in this segment is being driven by its suitability for a wide range of gasoline and light-duty diesel engines, providing precise fuel pressure regulation for efficient combustion and reduced emissions. These regulators offer reliable performance across varying engine loads and driving conditions, supporting optimal fuel delivery and engine response.

Enhanced durability, compact design, and compatibility with modern fuel injection systems have strengthened adoption among automotive manufacturers. Increasing demand for fuel-efficient vehicles and compliance with global emission standards has reinforced the preference for regulators operating in this pressure range.

Research and development initiatives focused on improving regulator responsiveness and minimizing fuel wastage have further driven growth As automakers seek reliable, high-performance, and cost-effective fuel management solutions, the 5 - 15 PSI segment is expected to maintain its leadership position, supported by widespread deployment in passenger cars and light commercial vehicles.

The passenger cars vehicle type segment is anticipated to account for 50.3% of the market revenue in 2025, making it the leading end-use category. Growth is being driven by increasing global production of passenger vehicles, rising consumer demand for fuel-efficient cars, and stringent emission standards.

Fuel pressure regulators play a critical role in ensuring optimal engine performance, improved fuel economy, and reduced environmental impact in these vehicles. Adoption is further supported by technological advancements in fuel injection systems, engine management, and electronic control units that rely on precise fuel pressure regulation.

The segment benefits from high integration with aftermarket and OEM components, ensuring widespread availability and consistent performance As automakers focus on meeting customer expectations for efficiency, performance, and sustainability, the passenger cars segment is expected to remain the primary driver of market growth, supported by ongoing investments in engine optimization, hybrid vehicle development, and regulatory compliance.

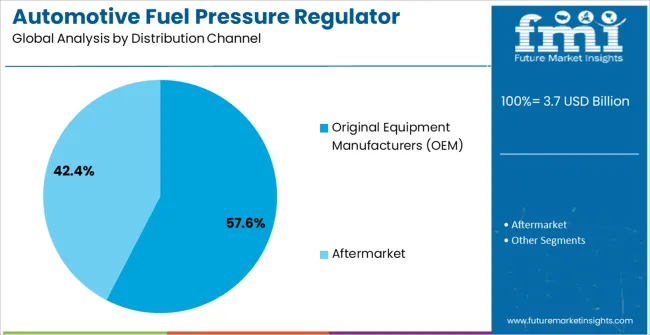

The Original Equipment Manufacturers (OEM) distribution channel segment is projected to hold 57.6% of the market revenue in 2025, establishing it as the leading distribution channel. Growth is being driven by direct partnerships between fuel pressure regulator manufacturers and automotive OEMs, ensuring that high-quality, reliable components are integrated during vehicle production.

OEM channels offer the advantage of consistent standards, warranty support, and regulatory compliance, which are critical for modern fuel injection systems. Adoption is further accelerated by the growing focus on vehicle performance, engine efficiency, and reduced emissions, as regulators supplied through OEM channels are optimized for each vehicle model.

Additionally, OEM collaboration enables continuous innovation, testing, and performance verification, strengthening confidence in product reliability As automotive manufacturers prioritize fuel system optimization and sustainable operations, the OEM segment is expected to maintain its market leadership, driven by increasing vehicle production, regulatory requirements, and demand for high-performance, factory-integrated components.

One look at the overall fuel system of any vehicle gives us an idea that fuel stored in the fuel tank is not directly connected to the internal combustion engine for energy generation, but travels through a series of different units before being combusted. Each unit within this system operates at varying pressures, hence irregular fuel pressures has to be regulated before it is injected into the engine cylinder.

Automotive fuel pressure regulator is a devices that aids in achieving constant pressure of the fuel before been atomized by the fuel injectors. Automotive fuel pressure regulator helps in maintaining appropriate volume of fuel flow according to the power required by the vehicle for different load conditions.

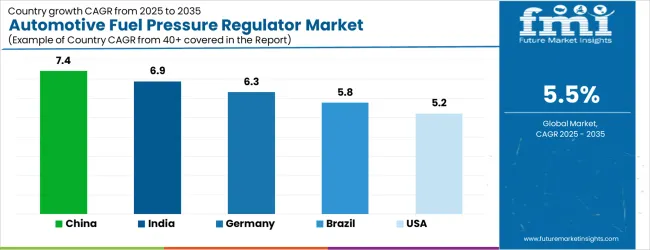

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The Automotive Fuel Pressure Regulator Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Automotive Fuel Pressure Regulator Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Automotive Fuel Pressure Regulator Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 183.4 million and USD 107.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Operating Pressure | 5 - 15 PSI, Less Than 5 PSI, and More Than 15 PSI |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles |

| Distribution Channel | Original Equipment Manufacturers (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

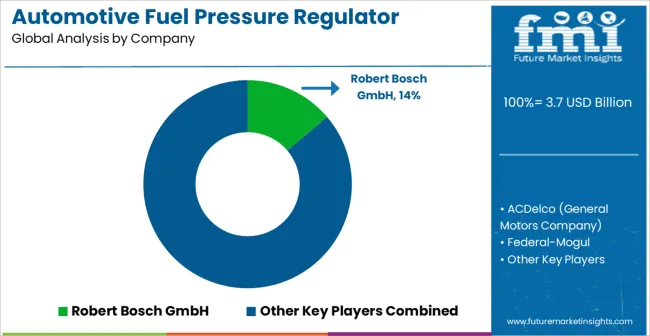

| Key Companies Profiled | Robert Bosch GmbH, ACDelco (General Motors Company), Federal-Mogul, Aeromotive Inc., Delphi Technologies, Pierburg GmbH, Edelbrock LLC, Nuke Performance AB, Schrader–Bridgeport International, Holley Performance Products, Ruian Mancheng Automobile Parts Factory, Dorman Products, Walker Products, JET Performance Products, Spectre Performance, and MagnaFuel Products Inc. |

The global automotive fuel pressure regulator market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the automotive fuel pressure regulator market is projected to reach USD 6.3 billion by 2035.

The automotive fuel pressure regulator market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in automotive fuel pressure regulator market are 5 - 15 psi, less than 5 psi and more than 15 psi.

In terms of vehicle type, passenger cars segment to command 50.3% share in the automotive fuel pressure regulator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Injector Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pulsation Damper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Transfer Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Pressure Plate Market

Automotive Fuel Cock Market

Automotive Fuel Rail Market

Automotive Pressure Switch Market

Automotive E-Fuel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Oil Pressure Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Oil Pressure Switch Market

Gas Pressure Regulators Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Automotive Window Regulator Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Window Regulator Market Growth – Trends & Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA