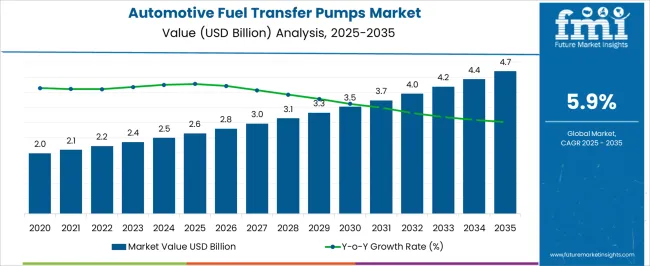

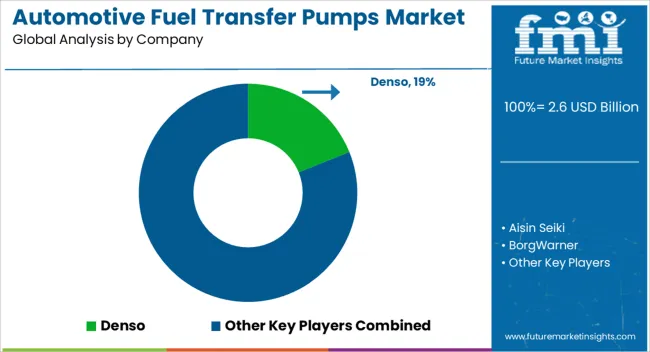

The automotive fuel transfer pumps market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

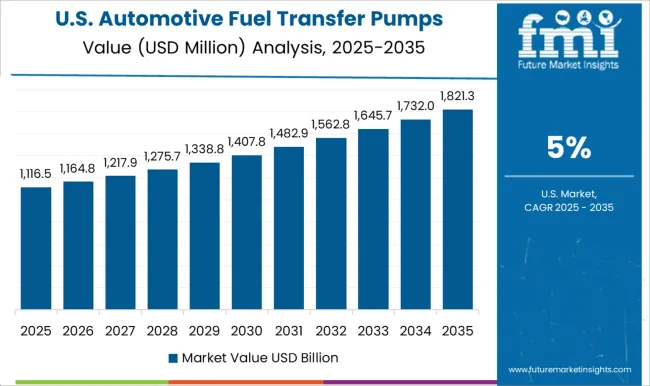

Compound absolute growth analysis highlights the incremental gains achieved annually, demonstrating how technological advancements, regulatory compliance, and increasing adoption in light and heavy vehicles contribute to long-term market expansion. From 2025 to 2027, the market grows from USD 2.6 billion to USD 2.8 billion, with intermediate values of USD 2.7 billion and 2.8 billion. During this early phase, growth is primarily driven by the rising demand for electronically controlled fuel pumps, fuel-efficient delivery systems, and enhanced durability components. OEMs and aftermarket suppliers focus on innovation and strategic collaborations to improve pump performance and reliability.

Between 2028 and 2031, revenues advance from USD 3.0 billion to USD 3.5 billion, with intermediate gains at USD 3.1 billion and 3.3 billion. Compound absolute growth accelerates due to expansion in emerging automotive markets, increasing replacement demand, and adoption of high-precision fuel pumps. From 2032 to 2035, the market reaches USD 4.7 billion, with intermediate milestones at USD 3.7 billion, 4.0 billion, and 4.4 billion. During this late phase, market growth is sustained through technological enhancements, rising commercial vehicle penetration, and strengthening of manufacturer networks across key regions.

| Metric | Value |

|---|---|

| Automotive Fuel Transfer Pumps Market Estimated Value in (2025 E) | USD 2.6 billion |

| Automotive Fuel Transfer Pumps Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The automotive fuel transfer pumps market is strongly influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The light vehicle automotive market holds the largest share at 40%, driven by the increasing need for fuel-efficient and electronically controlled fuel delivery systems that enhance engine performance and reduce emissions. The commercial vehicle segment contributes 25%, as trucks, buses, and utility vehicles require high-capacity, durable fuel pumps to support long operational hours and heavy-duty usage. The automotive aftermarket accounts for 15%, fueled by replacement demand in aging vehicle fleets and the rising preference for upgraded fuel transfer solutions to improve reliability and efficiency.

The industrial and specialty vehicle segment represents 10%, adopting advanced fuel pump technologies for off-road machinery, construction equipment, and agricultural vehicles to maintain operational continuity and minimize downtime. Finally, the electric and hybrid vehicle segment holds a 10% share, integrating specialized fuel transfer pumps for hybrid powertrains and range-extender applications. Collectively, the light and commercial vehicle markets contribute 65% of overall demand, underscoring that conventional automotive applications remain the primary growth drivers, while aftermarket, industrial, and hybrid vehicle adoption provide additional opportunities for market expansion and incremental dollar sales globally.

The automotive fuel transfer pumps market is witnessing steady growth, supported by advancements in fuel delivery technologies, tightening emission regulations, and rising vehicle production across both developed and emerging economies. The current market scenario is characterized by a shift towards high-efficiency, low-emission fuel systems, where fuel transfer pumps play a critical role in optimizing engine performance and ensuring compliance with regulatory standards.

Supply chains are being strengthened through localized manufacturing and strategic partnerships with OEMs to meet diverse regional requirements. Growing adoption of advanced pump designs in response to electrification trends and hybrid vehicle demand is shaping product innovation strategies.

Over the forecast period, the market is expected to benefit from sustained demand in passenger vehicle production, increasing integration of electronic components, and the expansion of aftermarket services Continuous improvements in pump durability, energy efficiency, and compatibility with alternative fuels are anticipated to enhance operational performance and reinforce long-term growth prospects.

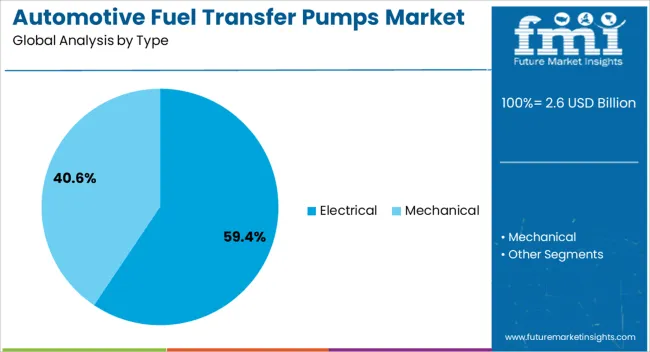

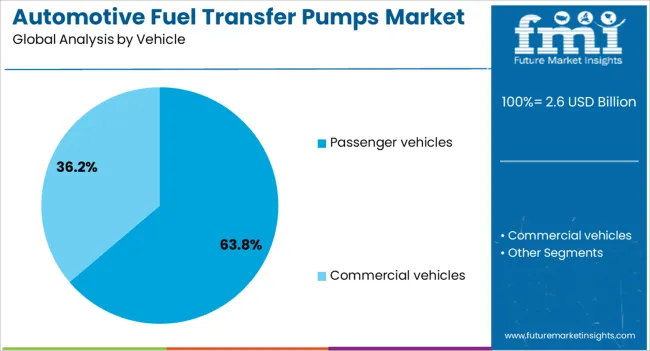

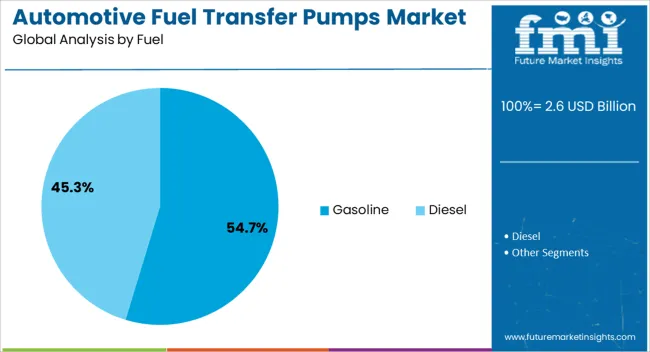

The automotive fuel transfer pumps market is segmented by type, vehicle, fuel, sales channel, and geographic regions. By type, automotive fuel transfer pumps market is divided into electrical and mechanical. In terms of vehicle, automotive fuel transfer pumps market is classified into passenger vehicles and commercial vehicles. Based on fuel, automotive fuel transfer pumps market is segmented into gasoline and diesel. By sales channel, automotive fuel transfer pumps market is segmented into OEM and aftermarket. Regionally, the automotive fuel transfer pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electrical segment, accounting for 59.4% of the type category, has maintained its dominance due to the superior efficiency, precision control, and compatibility with modern fuel injection systems it offers. This segment has gained momentum with the industry’s shift from mechanical to electronically controlled systems, enabling more accurate fuel delivery and improved engine performance.

Its strong adoption rate has been supported by technological advancements such as integrated sensors, lightweight designs, and enhanced corrosion resistance. OEMs have increasingly standardized electrical fuel transfer pumps in both gasoline and diesel-powered vehicles to meet stringent emission norms and improve fuel economy.

Cost competitiveness over time, due to scaling of production and improvements in manufacturing processes, has further solidified its position The segment’s future growth is likely to be reinforced by the rising penetration of hybrid vehicles, where electrical pumps are essential for maintaining optimal fuel system performance under varying load conditions.

The passenger vehicles segment, representing 63.8% of the vehicle category, continues to lead the market, driven by the sheer volume of global passenger car production and the widespread integration of advanced fuel delivery systems. Growth in this segment has been sustained by increasing consumer demand for efficient, low-emission vehicles and the rising adoption of fuel-efficient engines in compact, mid-size, and luxury vehicle classes.

OEMs have focused on incorporating high-performance fuel transfer pumps to support enhanced combustion efficiency and meet regulatory compliance. Expanding urban populations, rising disposable incomes, and the proliferation of financing options in emerging economies have further boosted passenger vehicle sales, thereby driving associated component demand.

The segment is also benefiting from the rapid evolution of hybrid and plug-in hybrid models, which require advanced pump systems to manage dual fuel and electrical operations This continued technological integration is expected to secure the segment’s leading share over the forecast horizon.

The gasoline segment, holding 54.7% of the fuel category, has retained its dominance owing to the high global prevalence of gasoline-powered vehicles, particularly in regions with limited diesel adoption due to emission restrictions. Consistent consumer preference for gasoline engines, driven by smoother operation, lower noise levels, and lower initial purchase costs, has supported sustained demand.

OEM strategies to improve gasoline engine efficiency through direct injection systems and advanced combustion technologies have increased the requirement for precise and durable fuel transfer pumps. Regulatory pressures to reduce emissions have also encouraged innovation in gasoline-compatible pump designs, enhancing performance and reliability.

Emerging markets, where gasoline remains the primary fuel type due to lower infrastructure requirements compared to alternatives, continue to contribute significantly to this segment’s share Future growth is anticipated as gasoline engines remain a critical part of the powertrain mix, especially in hybrid configurations where optimized fuel delivery remains essential for operational efficiency.

The automotive fuel transfer pumps market growth is primarily driven by light and commercial vehicle applications, supported by aftermarket and hybrid vehicle adoption. Specialized demand in niche segments ensures steady revenue generation and strategic market opportunities.

The automotive fuel transfer pumps market is witnessing strong growth driven by the increasing production and sales of passenger cars. Efficient fuel delivery systems are becoming essential to meet consumer expectations for reliable performance and improved engine efficiency. Manufacturers are prioritizing high-precision pumps that ensure consistent fuel flow under varying operating conditions. The rising preference for premium vehicles and enhanced vehicle performance features further fuels demand. Light vehicles account for a significant portion of market share, influencing overall dollar sales and regional adoption patterns. Regulatory pressure to maintain emission standards indirectly boosts the need for better fuel pumps. As a result, light vehicle applications remain a central factor shaping market dynamics and competitive positioning.

Commercial vehicles, including trucks, buses, and utility vehicles, are contributing substantially to market growth for fuel transfer pumps. High-capacity pumps are increasingly adopted to support extended operating hours and heavy-duty performance. Fleet operators prioritize durability, reliability, and reduced maintenance costs, driving incremental dollar sales. Growing logistics, transportation, and construction sectors further stimulate demand for commercial vehicle fuel systems. The replacement market for aging fleets is also generating steady revenue streams, increasing market share for high-performance pumps. Regional disparities in fleet modernization and infrastructure investments influence adoption patterns. Manufacturers are increasingly customizing solutions to meet specific operational requirements, positioning commercial vehicles as a key segment in shaping both short-term and long-term market growth trajectories.

The automotive fuel transfer pumps aftermarket is emerging as a significant growth contributor. Aging vehicles across developed and emerging regions require replacement pumps to maintain operational efficiency. Consumer awareness about fuel efficiency and engine performance is encouraging timely replacements and upgrades. Independent service centers and OEM-affiliated distributors play a crucial role in market penetration and dollar sales. The availability of compatible, durable, and high-performance pumps strengthens brand presence and market share. Incremental growth is supported by rising vehicle parc and extended vehicle lifecycles. Regional variations in maintenance practices, economic factors, and fleet sizes determine market concentration. Overall, the aftermarket segment provides continuous revenue generation while supporting broader adoption of advanced fuel transfer solutions.

Fuel transfer pumps are increasingly integrated into hybrid and specialty vehicles, contributing to evolving market dynamics. Hybrid powertrains require specialized pumps to manage fuel delivery alongside electric systems, enhancing engine range and performance. Specialty vehicles, including agricultural and off-road machinery, demand high-durability solutions capable of operating under challenging conditions. Adoption in these niche segments influences overall dollar sales, market penetration, and competitive positioning. OEM collaborations and targeted product designs help manufacturers capture emerging opportunities in these smaller but strategically important markets. Incremental adoption is supported by regional infrastructure expansion and the need for reliable fuel systems across diverse applications. These segments, though smaller, provide high-value growth potential for manufacturers globally.

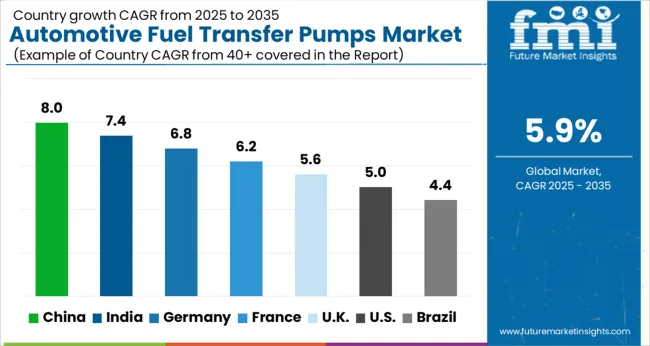

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global automotive fuel transfer pumps market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads with 8.0%, followed by India (7.4%), Germany (6.8%), the UK (5.6%), and the USA (5.0%). Market growth is driven by rising vehicle production, increasing demand for fuel-efficient delivery systems, and replacement requirements in aging fleets. China and India show strong adoption due to expanding automotive manufacturing and increasing passenger vehicle sales. Germany, the UK, and the USA focus on high-performance pumps, aftermarket upgrades, and regulatory compliance. Collaborations between OEMs and component manufacturers, coupled with regional infrastructure development, play key roles in shaping market expansion globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive fuel transfer pumps market in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by rising vehicle production, increasing passenger car sales, and strong demand for reliable fuel delivery systems. Domestic manufacturers are scaling up production of high-precision pumps and enhancing durability to meet stringent emission regulations and fuel efficiency standards. Replacement demand in aging fleets further supports market growth. Collaborations with global OEMs enable technology transfer and localized product optimization. Expanding automotive infrastructure and logistics networks facilitate distribution, while urban mobility trends and increasing commercial vehicle usage reinforce market penetration.

The automotive fuel transfer pumps market in India is expected to grow at a CAGR of 7.4% from 2025 to 2035, supported by expanding automotive manufacturing and rising passenger vehicle ownership. Electrically controlled pumps and durable solutions are increasingly adopted for both new vehicles and replacement applications. Local manufacturers focus on cost-effective and high-performance designs to cater to a diverse vehicle parc. Government initiatives to improve automotive infrastructure and regional logistics networks enhance market reach. Partnerships with international OEMs enable knowledge exchange and technological enhancements. Growth is further fueled by rising demand in commercial vehicles, including trucks and buses, which require high-capacity fuel transfer systems.

The automotive fuel transfer pumps market in Germany is projected to grow at a CAGR of 6.8% from 2025 to 2035, influenced by premium vehicle production and stringent European emission standards. High-performance fuel pumps are integrated in passenger cars and commercial fleets to ensure fuel efficiency and engine reliability. OEMs prioritize precision manufacturing and long-lasting components to maintain brand reputation and meet regulatory requirements. Replacement demand in older vehicles contributes to incremental dollar sales, while specialized pumps for hybrid and commercial vehicles provide additional revenue streams. Collaborations between local suppliers and international automakers enhance technology adoption and market competitiveness.

The automotive fuel transfer pumps market in the UK is anticipated to grow at a CAGR of 5.6% from 2025 to 2035, fueled by passenger car sales and moderate growth in commercial fleets. Replacement demand in vehicles reaching mid-life cycles drives aftermarket adoption. Focus on fuel efficiency and emission compliance encourages the adoption of electronically controlled and durable pumps. Local OEMs and aftermarket suppliers collaborate to optimize product performance and meet regional standards. Expansion of distribution networks and logistics support wider product availability, while rising awareness of vehicle maintenance and operational reliability reinforces adoption. Niche demand in commercial and specialty vehicles contributes to overall market growth.

The automotive fuel transfer pumps market in the USA is projected to grow at a CAGR of 5.0% from 2025 to 2035, supported by light and heavy vehicle production and replacement demand. High-performance fuel pumps are adopted in passenger vehicles, trucks, and buses to ensure reliable fuel delivery and engine performance. Aftermarket demand for durable pumps is increasing, particularly in older vehicles and fleet operations. OEMs and component manufacturers focus on integrating advanced materials and precision designs to meet regional efficiency and emission regulations. Commercial vehicle adoption and regional logistics infrastructure strengthen market penetration, while partnerships with global manufacturers enhance technology access and incremental dollar sales.

Competition in the automotive fuel transfer pumps market is defined by efficiency, durability, and precise fuel delivery performance. Denso leads with high-precision pumps engineered for light and heavy vehicles, emphasizing reliability, long service life, and regulatory compliance. Product differentiation is achieved through advanced materials, electronic integration, and pump designs tailored for varied engine types and fuel systems. Aisin Seiki competes through optimized flow control and compact designs, targeting OEM applications and aftermarket replacements. BorgWarner focuses on high-capacity pumps for commercial vehicles and hybrid powertrains, while Continental and Hitachi Astemo leverage integrated solutions for emission-compliant and energy-efficient fuel systems.

Magna, Mitsubishi Electric, Robert Bosch, TI Fluid, and VDO Automotive enhance market presence through collaboration with global OEMs, innovation in pump calibration, and durability testing across regions. Strategies prioritize performance optimization, OEM alignment, and adherence to regional emission and safety standards. Companies differentiate through modular designs, electronic fuel control integration, and materials resistant to corrosion, vibration, and temperature fluctuations. Partnerships, licensing agreements, and co-development with automakers accelerate technology adoption and expand aftermarket opportunities. Lifecycle support, technical consultation, and service network expansion ensure reliability, enhance brand trust, and increase incremental dollar sales across vehicle segments. Product brochure content emphasizes technical specifications, including flow rate, pressure capacity, pump type (mechanical or electric), operating voltage, and material composition.

Durability metrics, compatibility with fuel types, and regulatory certification details are highlighted. Applications across passenger cars, trucks, buses, and specialty vehicles are specified. Optional features, such as integrated sensors, low-noise operation, and energy-efficient designs, are promoted. Brochures emphasize precise fuel delivery, long-term reliability, compliance with automotive standards, and adaptability to diverse vehicle requirements, reflecting a market driven by performance, regulatory adherence, and aftermarket opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 billion |

| Type | Electrical and Mechanical |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Fuel | Gasoline and Diesel |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Denso, Aisin Seiki, BorgWarner, Continental, Hitachi Astemo, Magna, Mitsubishi Electric, Robert Bosch, TI Fluid, and VDO Automotive |

| Additional Attributes | Dollar sales, share, segment-wise demand (light vehicles, commercial vehicles, aftermarket), replacement trends, regulatory impact, competitive landscape, technological adoption, and growth opportunities. |

The global automotive fuel transfer pumps market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the automotive fuel transfer pumps market is projected to reach USD 4.7 billion by 2035.

The automotive fuel transfer pumps market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in automotive fuel transfer pumps market are electrical and mechanical.

In terms of vehicle, passenger vehicles segment to command 63.8% share in the automotive fuel transfer pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Feed Pumps Market

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Injector Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pulsation Damper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pressure Regulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Pumps Market Growth - Trends & Forecast 2025 to 2035

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Fuel Cock Market

Automotive Fuel Rail Market

Automotive E-Fuel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Variable Displacement Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electro-hydraulic Power Steering Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA