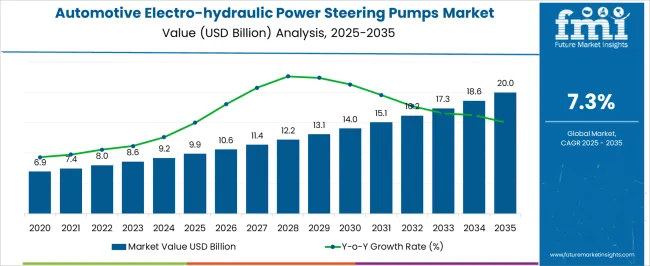

The automotive electro-hydraulic power steering (EHPS) pumps market presents a strong absolute dollar opportunity of USD 10.1 billion during the period from 2025 (USD 9.9 billion) to 2035 (USD 20.0 billion). Absolute dollar opportunity is a key analytical tool that measures the net revenue potential generated over the forecast horizon, highlighting the incremental market space available for manufacturers, investors, and suppliers. From 2020 (USD 6.9 billion) to 2025 (USD 9.9 billion), the market expanded by USD 3.0 billion, reflecting steady demand from growing vehicle production, electrification trends, and the shift toward advanced steering technologies.

Between 2025 and 2030, the market is set to rise from USD 9.9 billion to USD 14.0 billion, unlocking a USD 4.1 billion opportunity within just five years. The following phase, 2030 to 2035, adds another USD 6.0 billion, bringing the market to USD 20.0 billion. This incremental gain emphasizes the rising penetration of EHPS systems as automakers focus on fuel efficiency, driver comfort, and compliance with environmental standards. Unlike CAGR, which shows the pace of growth, the absolute dollar opportunity highlights the tangible revenue pool available for stakeholders. For component suppliers, system integrators, and technology innovators, this USD 10.1 billion cumulative opportunity represents a lucrative pathway for capacity expansion, product innovation, and long-term profitability.

| Metric | Value |

|---|---|

| Automotive Electro-hydraulic Power Steering Pumps Market Estimated Value in (2025 E) | USD 9.9 billion |

| Automotive Electro-hydraulic Power Steering Pumps Market Forecast Value in (2035 F) | USD 20.0 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The automotive electro-hydraulic power steering (EHPS) pumps market is shaped by five core parent industries, each playing a critical role in its evolution. The automotive components and systems market holds the largest share at 35%, as EHPS pumps are integral to modern steering systems that balance hydraulic reliability with electronic efficiency. Next, the vehicle electrification market accounts for 25%, driven by rising adoption of hybrid and electric vehicles, where EHPS technology bridges traditional hydraulic steering and full electric power steering (EPS). The hydraulic and fluid power systems market contributes 15%, since EHPS pumps continue to rely on precision hydraulic actuation, making advancements in fluid dynamics, efficiency, and durability highly relevant.

The automotive safety systems market holds 15%, with steering technologies increasingly linked to driver-assist features such as lane-keeping assistance and stability control, where EHPS provides a reliable intermediate solution. The aftermarket automotive parts and services market makes up 10%, as EHPS pumps require replacement and servicing throughout vehicle lifecycles, especially in commercial fleets and passenger cars in emerging economies. These industries provide the foundation for EHPS market expansion, with innovation focusing on efficiency, weight reduction, and compatibility with electrified platforms, ensuring strong growth from 2025 to 2035.

The automotive electro hydraulic power steering (EHPS) pumps market is advancing steadily, supported by the global automotive sector’s shift toward enhanced steering efficiency and improved vehicle handling. Current demand is being anchored by regulatory mandates for fuel efficiency, the integration of advanced driver assistance systems, and the need to reduce engine load while maintaining responsive steering control.

Manufacturers are focusing on refining pump designs to deliver optimal hydraulic pressure with reduced energy consumption, aligning with industry goals for lower emissions. The market is further strengthened by OEM-driven adoption across new vehicle platforms, aided by consistent R&D investments and robust supplier networks.

While cost sensitivity in emerging markets and the gradual penetration of fully electric steering systems present challenges, EHPS technology remains a preferred solution for balancing performance and efficiency, especially in mid-range and high-volume vehicle segments. Over the forecast period, strategic OEM partnerships, advancements in pump durability, and regional production expansion are expected to drive sustained market growth and broaden application across multiple vehicle categories.

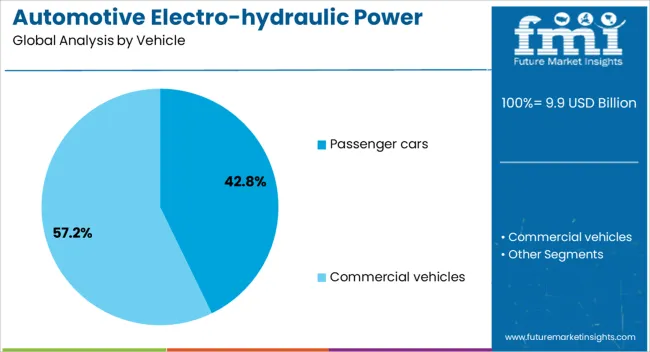

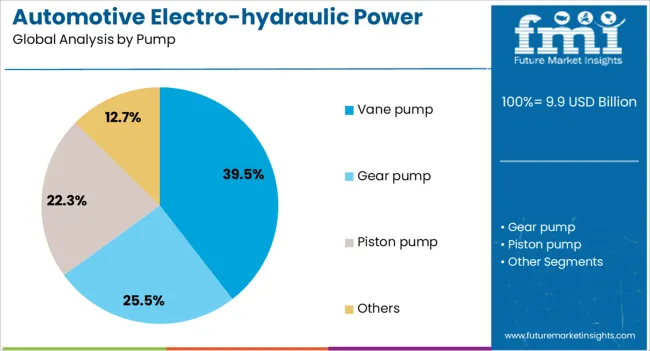

The automotive electro-hydraulic power steering pumps market is segmented by vehicle, pump, sales channel, propulsion, component, and geographic regions. By vehicle, automotive electro-hydraulic power steering pumps market is divided into Passenger cars and Commercial vehicles. In terms of pump, automotive electro-hydraulic power steering pumps market is classified into Vane pump, Gear pump, Piston pump, and Others.

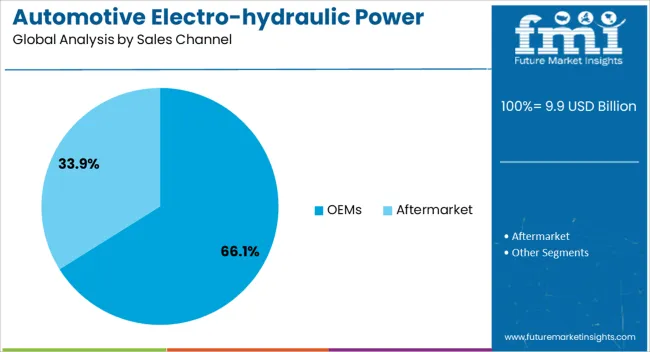

Based on sales channel, automotive electro-hydraulic power steering pumps market is segmented into OEMs and Aftermarket. By propulsion, automotive electro-hydraulic power steering pumps market is segmented into ICE, Electric vehicles (EV), and Hybrid. By component, automotive electro-hydraulic power steering pumps market is segmented into Pump unit, Reservoir, Power steering fluid, Control unit, and Others. Regionally, the automotive electro-hydraulic power steering pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment, holding 42.80% of the vehicle category, has been leading demand due to the high production volume of passenger vehicles globally and the segment’s emphasis on improved driving comfort. This dominance has been reinforced by consistent OEM integration of EHPS pumps to enhance maneuverability while optimizing fuel economy.

The segment benefits from broad adoption across sedans, hatchbacks, and SUVs, supported by consumer preference for smoother steering response in both urban and highway conditions. Strong presence in mature markets, coupled with expanding production in emerging economies, has created stable supply-demand alignment.

Technological advancements in pump control modules have further improved system responsiveness, durability, and compatibility with modern vehicle electronics. OEMs have leveraged EHPS adoption to meet increasingly stringent emissions regulations without compromising performance, ensuring the passenger car category continues to anchor market revenues over the forecast horizon.

The vane pump segment, accounting for 39.50% of the pump category, has maintained its lead due to its efficient hydraulic delivery, compact design, and cost-effectiveness for large-scale OEM integration. Known for delivering consistent pressure across variable operating conditions, vane pumps have been widely adopted in EHPS systems to balance performance with energy efficiency.

Manufacturing scalability and proven operational reliability have contributed to their sustained preference, particularly in high-volume vehicle platforms. Advancements in material engineering have enhanced pump lifespan and reduced maintenance needs, further solidifying their competitive position.

Cost advantages, coupled with ease of integration into existing EHPS architectures, have enabled widespread adoption across both domestic and export-focused automotive manufacturing hubs. Continued innovation in vane geometry and sealing technology is expected to improve performance efficiency, reinforcing the segment’s dominant role in the market.

The OEM segment, holding 66.10% of the sales channel category, dominates market distribution due to the integration of EHPS pumps during vehicle manufacturing. Strong, long-term partnerships between pump manufacturers and automotive OEMs have ensured steady demand and production stability.

OEM procurement is driven by stringent quality control requirements, seamless compatibility with vehicle steering systems, and the ability to meet regional safety and emissions regulations. The segment benefits from economies of scale, enabling competitive pricing and secure supply contracts for high-volume vehicle production.

OEM-installed EHPS pumps often come with extended warranties and manufacturer certification, further enhancing consumer trust and long-term adoption. The channel’s leadership is reinforced by the accelerating replacement cycle of older steering technologies in new vehicle models, ensuring sustained revenue contribution from OEMs throughout the forecast period.

The automotive electro-hydraulic power steering pumps market is growing as OEMs and Tier-1 suppliers prioritize fuel efficiency, responsive steering, and hybrid compatibility. Demand is driven by passenger cars, light commercial vehicles, and heavy-duty trucks seeking reliable hydraulic assistance combined with electronic control. Challenges include higher system costs, wear-related maintenance, and rising competition from fully electric power steering solutions. Opportunities exist in retrofitting, lightweight pump materials, and integration with ADAS-enabled steering systems. Trends highlight reduced CO₂ emissions, variable steering assist, and smart pump designs that adapt to vehicle conditions.

Automakers are increasingly adopting electro-hydraulic power steering pumps as a bridge between conventional hydraulic systems and fully electric solutions. These pumps deliver hydraulic force with electronic precision, enabling fuel savings and reduced emissions while maintaining strong steering performance. Passenger cars benefit from better maneuverability and lighter steering effort, while trucks and heavy-duty vehicles leverage robust hydraulic support for load handling. Growing hybrid and transitional vehicle models are accelerating adoption as they require systems that balance efficiency with performance. Rising focus on driver comfort, safety, and reduced energy losses positions electro-hydraulic power steering pumps as critical components in modern vehicle platforms.

Constraints in the market include the high upfront costs of electro-hydraulic pumps and increased complexity compared to conventional hydraulic systems. Maintenance of pumps, hoses, and electronic modules adds lifecycle costs for fleet operators. Supply chain fluctuations for precision components, including valves, sensors, and controllers, can impact production and lead times. Regulatory standards on vehicle emissions and steering system safety demand rigorous compliance and certification, raising barriers for smaller suppliers. Technical challenges include integration with steering assist controls, maintaining reliability under varying driving loads, and minimizing noise and vibration. OEMs often seek suppliers with proven durability, regional manufacturing presence, and robust after-sales support to mitigate risks.

Opportunities are emerging in retrofitting existing fleets with electro-hydraulic systems, particularly in regions where fuel savings and compliance with emissions standards are critical. Use of lightweight alloys and compact designs supports vehicle weight reduction while enhancing pump efficiency. Integration with ADAS and semi-autonomous steering functions creates additional scope, as pumps can provide variable assist tailored to driving conditions. Expanding demand in Asia-Pacific, Europe, and North America from hybrid and transitional vehicle markets further supports adoption. Suppliers offering customizable pump designs, system integration expertise, and technical training are best positioned to capture growth opportunities in both OEM and aftermarket channels.

The market is trending toward smart pump technologies with electronic control modules that adapt steering assist based on vehicle speed, load, and driving conditions. These systems improve fuel efficiency, reduce CO₂ emissions, and provide smoother steering performance. Hybrid compatibility is a growing focus, with pumps designed to work seamlessly across varying powertrain architectures. Compact, low-noise, and high-durability designs are gaining traction, especially in premium passenger cars and commercial fleets. Digital monitoring and predictive maintenance features are being integrated to improve reliability and uptime. Suppliers delivering precision-engineered, adaptive, and hybrid-ready electro-hydraulic power steering pumps are well-positioned to meet evolving industry demands.

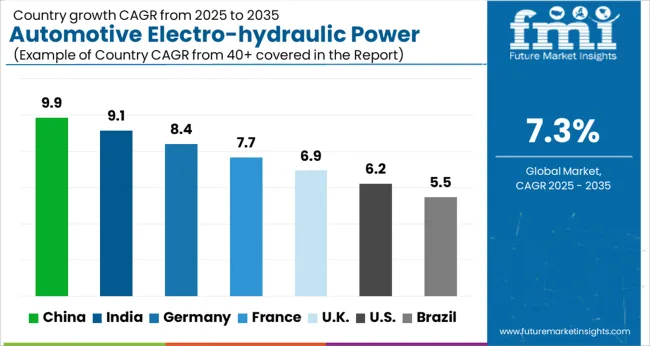

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The global automotive electro-hydraulic power steering pumps market is projected to expand at a CAGR of 7.3% from 2025 to 2035. China (9.9%) and India (9.1%) are the fastest-growing markets, supported by vehicle volume growth, hybrid model penetration, and local supplier scale-up. Germany (8.4%) emphasizes premium vehicle integration and R&D for NVH and system tuning, while the UK (6.9%) and USA (6.2%) show steady adoption across passenger and light commercial segments.

Growth drivers include fuel-efficiency targets, hybrid vehicle rollouts, OEM specification shifts, and aftermarket expansion. Suppliers are focusing on compact, lightweight pump designs, localized manufacturing, and integration with vehicle control and driver assistance systems to capture market share. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive electro-hydraulic power steering (EHPS) pumps market in China is projected to grow at a CAGR of 9.9% from 2025 to 2035, driven by accelerating vehicle production, rising adoption of hybrid and mild-hybrid platforms, and consumer demand for improved fuel economy and driving comfort. OEMs are increasingly specifying EHPS systems to replace older hydraulic units to reduce parasitic losses and improve packaging flexibility. Local Tier-1 suppliers are scaling up production and investing in R&D for compact, lightweight pump designs that meet Chinese safety and performance standards. Collaborations between domestic component makers and global engineering firms are enabling knowledge transfer, cost optimization, and localization of supply chains. Urbanization and growing middle-class vehicle ownership support strong replacement and aftermarket demand, while fleet renewal programs further boost volumes. Automotive electrification trends in China, including growth in hybrid vehicle segments, create sustained demand for EHPS pumps that balance electrical assistance with hydraulic robustness.

The Automotive EHPS pumps market in India is expected to expand at a CAGR of 9.1% from 2025 to 2035, propelled by strong passenger vehicle growth, rising preference for feature-rich mid-segment cars, and government incentives promoting cleaner mobility. Automakers are adopting EHPS in compact SUVs and sedans to improve fuel economy while keeping system cost competitive. Domestic component manufacturers and tier suppliers are investing in local tooling, testing rigs, and engineering capabilities to produce EHPS units tailored for Indian operating conditions, including high ambient temperatures and varied fuel qualities. Aftermarket demand is supported by a growing organized service network and increasing vehicle parc. The rise of hybrid and mild-hybrid offerings from OEMs, coupled with consumer willingness to pay for comfort and efficiency, helps EHPS penetration.

The Automotive EHPS pumps market in Germany is forecast to grow at a CAGR of 8.4% from 2025 to 2035, supported by a mature automotive industry focusing on efficiency, performance, and premium driving dynamics. German OEMs integrate EHPS systems in passenger cars and light commercial vehicles to reduce fuel consumption and enable advanced driver assistance features while maintaining steering feel. Demand is concentrated among premium and performance segments where precise tuning of electro-hydraulic assistance is valued. Component manufacturers in Germany emphasize high-reliability materials, noise-vibration-harshness optimization, and integration with vehicle control systems. R&D investments and strong supplier clusters enable rapid prototyping, validation, and scale production. Stringent EU emission targets and consumer expectations for driving comfort provide continued market opportunities for advanced EHPS pump offerings and retrofit solutions for specialty vehicle builders.

The UK EHPS pumps market is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by the country’s transition toward electrified powertrains and emphasis on vehicle efficiency. Automakers and suppliers in the UK are adopting EHPS to deliver fuel savings and to support advanced steering functionality for driver assistance systems. The market is characterized by demand from both passenger car manufacturers and light commercial vehicle producers. British engineering firms and Tier-1 suppliers focus on compact pump architectures, corrosion-resistant components for varied climates, and calibration expertise for UK road conditions. Aftermarket and repair networks provide support for maintenance and replacements as the vehicle parc expands. Policy incentives for low-emission vehicles and investments in electrified vehicle production locally encourage OEM uptake.

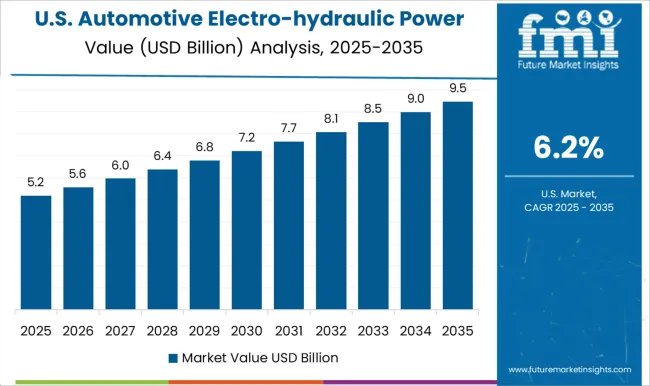

The USA EHPS pumps market is expected to grow at a CAGR of 6.2% from 2025 to 2035, supported by strong demand for fuel-efficient steering systems in SUVs, crossovers, and light trucks. USA OEMs are integrating EHPS to reduce parasitic losses compared with conventional hydraulic systems while preserving steering performance for larger vehicles. Tier-1 suppliers in North America are investing in manufacturing lines for electro-hydraulic pumps, focusing on robustness, serviceability, and compatibility with ADAS platforms. Consumer preference for improved driving comfort and fleet operators’ desire to lower operating costs drive aftermarket interest as well.

Regulatory pressure to improve fuel economy and reduce CO₂ emissions contributes to gradual EHPS adoption across vehicle segments, including commercial fleets seeking incremental efficiency gains without a wholesale shift to full electric steering systems.

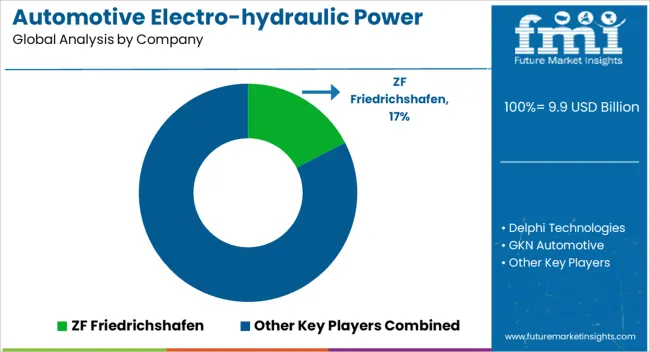

The automotive electro-hydraulic power steering (EHPS) pumps market is witnessing steady expansion, driven by the growing adoption of hybrid steering technologies that bridge the gap between traditional hydraulic and fully electric systems. EHPS pumps combine the efficiency of electric motors with the robustness of hydraulic assistance, offering enhanced fuel efficiency, reduced CO₂ emissions, and improved driving comfort. The global automotive industry’s transition toward sustainable mobility, stricter fuel efficiency regulations, and demand for better maneuverability in passenger and commercial vehicles are key growth drivers. Major players in the automotive electro-hydraulic power steering pumps market include ZF Friedrichshafen, Robert Bosch, JTEKT, Hyundai Mobis, Mitsubishi Electric, Nexteer Automotive, NSK Ltd., Delphi Technologies, GKN Automotive, and Tenneco. These companies are focusing on lightweight designs, compact configurations, and energy-efficient EHPS solutions to cater to both passenger cars and commercial vehicles. Bosch and ZF are industry leaders in integrating EHPS with advanced driver assistance systems (ADAS), while Nexteer and JTEKT are innovating in steer-by-wire technologies aligned with autonomous vehicle development. Technological advancements such as electronic control modules, brushless motors, and real-time monitoring systems are boosting adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Vehicle | Passenger cars and Commercial vehicles |

| Pump | Vane pump, Gear pump, Piston pump, and Others |

| Sales Channel | OEMs and Aftermarket |

| Propulsion | ICE, Electric vehicles (EV), and Hybrid |

| Component | Pump unit, Reservoir, Power steering fluid, Control unit, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ZF Friedrichshafen, Delphi Technologies, GKN Automotive, Hyundai Mobis, JTEKT, Mitsubishi Electric, Nexteer Automotive, NSK Ltd., Robert Bosch, and Tenneco |

| Additional Attributes | Dollar sales by component type (steering systems, driveline, electrified powertrain, suspension), vehicle type (passenger cars, LCVs, HCVs), and technology (hydraulic, electric, hybrid). Demand is driven by electrification, ADAS integration, and lightweighting initiatives. Regional trends indicate strong demand in North America and Europe for advanced steering and driveline technologies, while Asia-Pacific records the fastest growth due to expanding automotive production, rising EV adoption, and government incentives for clean mobility solutions. |

The global automotive electro-hydraulic power steering pumps market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the automotive electro-hydraulic power steering pumps market is projected to reach USD 20.0 billion by 2035.

The automotive electro-hydraulic power steering pumps market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in automotive electro-hydraulic power steering pumps market are passenger cars, hatchbacks, sedans, suv, commercial vehicles, light commercial vehicles (lcv), medium commercial vehicles (mcv) and heavy commercial vehicles (hcv).

In terms of pump, vane pump segment to command 39.5% share in the automotive electro-hydraulic power steering pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Power Steering Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Steering Cooler Market

Power Steering Filter Market Growth - Trends & Forecast 2025 to 2035

Power Steering Fluids Market

Automotive Powerglide Shifters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Window Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering Knuckle Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Distribution Modules Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pumps Market Growth - Trends & Forecast 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Powertrain Sensors Market

Automotive Steering Column Market

Automotive Integrated Power Module Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Transfer Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive on board AC-DC power inverters Market Size and Share Forecast Outlook 2025 to 2035

Electronic Power Steering (EPS) Market Growth - Trends & Forecast 2025 to 2035

Automotive Variable Displacement Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA