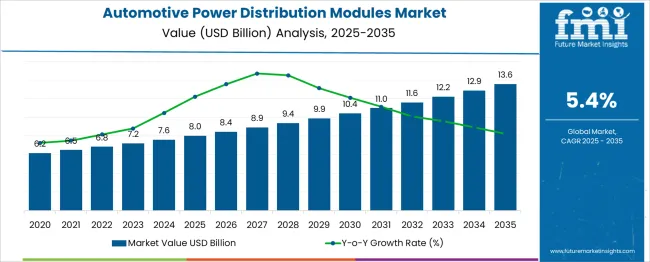

The Automotive Power Distribution Modules Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 13.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. This growth, supported by a CAGR of 5.4%, is driven by increasing adoption of advanced power management solutions in electric vehicles (EVs), hybrid vehicles, and traditional automotive segments. The early growth phase will be propelled by demand for efficient energy distribution and safety features such as overcurrent protection, enhanced by the shift toward electrification in the automotive industry. The second half (2030–2035) will contribute USD 3.2 billion, representing 60.7% of the total growth, indicating stronger momentum driven by the growing complexity of electrical systems in autonomous and connected vehicles, as well as further EV adoption.

Annual increments in the first phase average USD 0.48 billion per year, while the later years see higher growth due to the introduction of advanced semiconductor technology, power density improvements, and the growing need for power management solutions in smart automotive systems. Manufacturers focusing on compact and integrated power modules will capture a larger share of this USD 5.6 billion opportunity.

| Metric | Value |

|---|---|

| Automotive Power Distribution Modules Market Estimated Value in (2025 E) | USD 8.0 billion |

| Automotive Power Distribution Modules Market Forecast Value in (2035 F) | USD 13.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The automotive power distribution modules market is undergoing a significant transformation driven by rising vehicle electrification, increased electronic content in vehicles, and the shift toward modular electrical architectures. Original equipment manufacturers (OEMs) are increasingly integrating intelligent power control systems to reduce wiring complexity, improve energy efficiency, and support advanced driver-assistance systems (ADAS).

This trend is being accelerated by the proliferation of hybrid and electric vehicles, which demand more sophisticated, compact, and thermally stable power management solutions. Regulatory mandates for improved fuel efficiency and electrical safety have prompted investments in modular distribution systems that enable load balancing, fault isolation, and energy optimization.

The growing consumer preference for connected, autonomous, and software-defined vehicles is also encouraging the deployment of smart power modules with diagnostic and self-healing capabilities. As OEMs and Tier 1 suppliers prioritize modular scalability and digital functionality, the market is expected to experience sustained innovation and competitive differentiation.

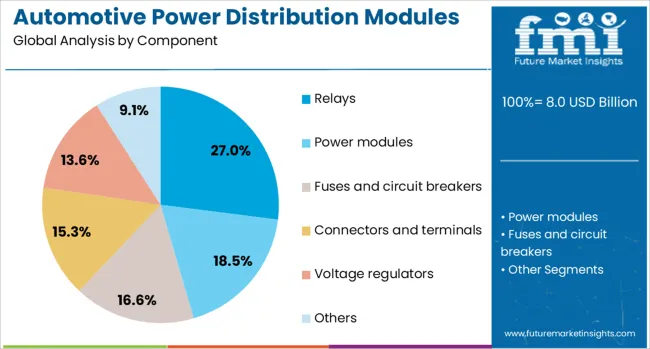

The automotive power distribution modules market is segmented by component, module, vehicle type, application, sales channel, and geographic regions. The automotive power distribution modules market is divided into Relays, Power modules, Fuses and circuit breakers, Connectors and terminals, Voltage regulators, and others.

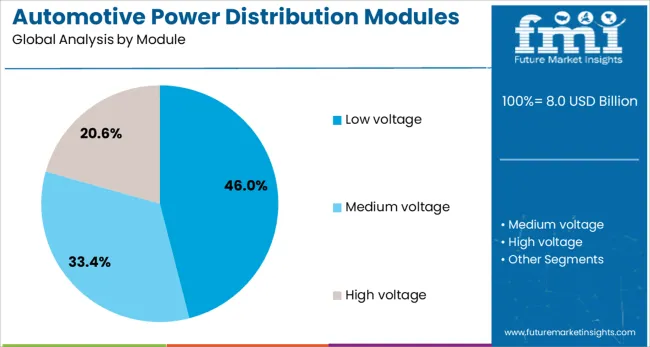

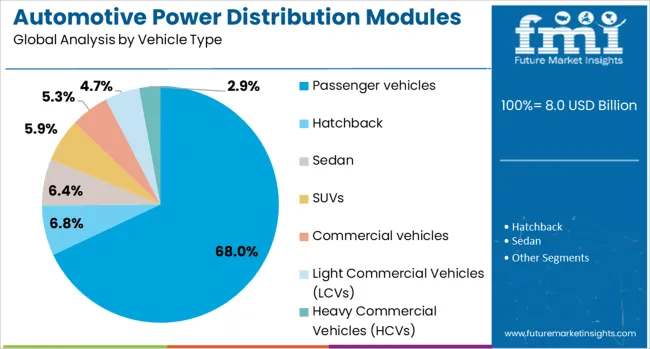

In terms of the module, the automotive power distribution modules market is classified into Low voltage, Medium voltage, and high voltage. Based on vehicle type, the automotive power distribution modules market is segmented into Passenger vehicles, Hatchback, Sedan, SUVs, Commercial cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The automotive power distribution modules market is segmented into Safety and driver assistance systems, Lighting systems, Infotainment systems, HVAC systems, Battery management systems, and others. By sales channel of the automotive power distribution modules market is segmented into OEMAftermarket. Regionally, the automotive power distribution modules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Relays are projected to account for 27.0% of the total component-level revenue in 2025, positioning them as the leading segment. Their continued dominance is supported by their essential role in switching high-current loads, ensuring circuit protection, and controlling critical systems such as lighting, HVAC, and engine components.

While semiconductor-based switches are gaining traction, electromechanical relays remain favored for their cost-effectiveness, robustness, and reliability in harsh automotive environments. Their compatibility with both low and high-voltage architectures has sustained their inclusion in traditional and next-gen vehicle platforms.

As vehicles continue to adopt more electronic sub-systems, demand for relay-based protection and switching remains high, particularly in ICE-based and hybrid powertrains.

Low voltage modules are anticipated to contribute 46.0% of the total module revenue by 2025, making them the leading segment. This dominance stems from their integral use in conventional 12V vehicle electrical systems, which still represent the majority of the global fleet.

These modules facilitate distribution of power to critical systems such as infotainment, lighting, engine management, and driver assistance features. The standardization of 12V systems across most vehicle platforms has reinforced demand for low voltage modules, even as mild-hybrid and electric powertrains grow.

Their compact design, thermal stability, and cost-efficiency have made them the default solution in passenger and light commercial vehicles. Continued software integration and the ability to manage variable load conditions further sustain their adoption in modern vehicle architectures.

Passenger vehicles are expected to contribute 68.0% of the total market revenue in 2025, making this the dominant vehicle type segment. The segment's leadership is attributed to the sheer volume of passenger vehicle production globally and the rapid adoption of advanced electronic features in this category.

Increased demand for electric and hybrid passenger cars, coupled with stringent safety and emission norms, has led to the integration of intelligent power distribution systems. Consumer preference for premium features such as infotainment systems, climate control, adaptive lighting, and autonomous functionality further drives the need for reliable and scalable power modules.

OEM investments in flexible vehicle platforms that support diverse powertrain options continue to prioritize robust power management systems, ensuring strong demand across both mass-market and luxury vehicle segments.

The automotive power distribution modules market is witnessing growth due to the increasing demand for advanced electrical systems in electric and hybrid vehicles. Growth in 2024 and 2025 was driven by the rising adoption of electric vehicles (EVs) and the need for more efficient power management. Opportunities exist in the integration of these modules with autonomous driving and connected car technologies. Emerging trends include lightweight materials and miniaturization. However, high costs and complexity in design and manufacturing remain significant barriers to broader adoption.

The primary growth drivers are the increasing adoption of electric vehicles (EVs) and the growing complexity of automotive electrical systems. In 2024 and 2025, the demand for automotive power distribution modules surged as automakers focused on efficient power management for EVs and hybrid vehicles. These modules allow better integration of components such as inverters, motors, and batteries. As the automotive industry shifts towards electrification, the need for reliable power distribution systems supporting battery efficiency and charging speeds continues to drive the market.

Significant opportunities are emerging in the integration of power distribution modules with autonomous and energy-efficient vehicle systems. In 2025, advancements in electric powertrain technologies and increased reliance on vehicle electrification created demand for advanced power distribution solutions. The shift towards autonomous driving, where high-performing, efficient energy management is crucial, is expected to increase the adoption of such modules. These developments suggest that suppliers offering innovative power management solutions for emerging automotive technologies will secure a competitive edge in the evolving market.

Emerging trends in the market include miniaturization of power distribution modules and the use of lightweight materials. In 2024, manufacturers began incorporating advanced materials like aluminum and composite polymers to reduce weight without compromising strength or performance. Smaller, more compact modules became increasingly common in EVs and hybrid vehicles to save space and enhance design flexibility. These trends indicate that there is growing emphasis on reducing the overall weight and size of power management systems, which is essential for improving vehicle performance and energy efficiency.

Key restraints in the market are high production costs and the complexity of module design and manufacturing. In 2024 and 2025, the advanced nature of power distribution modules, including components for high voltage systems and intricate wiring, increased production costs. Additionally, the integration of these modules with multiple automotive systems created challenges in design and scalability. These factors highlight the need for cost-efficient manufacturing processes and technological innovations to lower costs and make power distribution systems more accessible to a wider range of automotive manufacturers.

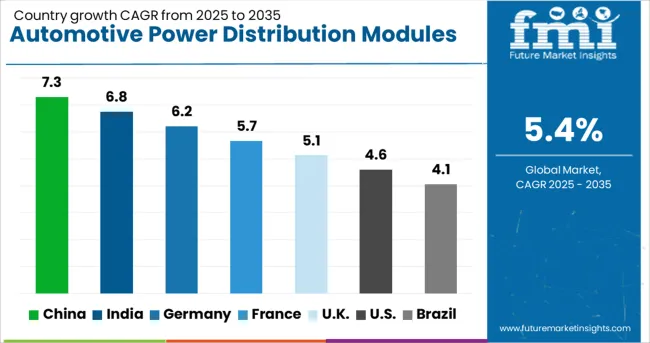

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global automotive power distribution modules market is projected to grow at 5.4% CAGR during 2025–2035. China leads with 7.3% CAGR, driven by the country's strong automotive production and rapid adoption of electric vehicles (EVs). India follows at 6.8%, supported by increasing automotive manufacturing and the need for advanced power management systems in both internal combustion engine (ICE) and electric vehicles. Germany records 6.2% CAGR, focusing on high-performance, energy-efficient power modules in the automotive and EV sectors. The United Kingdom grows at 5.1%, while the United States posts 4.6%, reflecting steady growth in the EV market and the demand for sustainable automotive power solutions. Asia-Pacific dominates growth due to manufacturing expansion, while Europe and North America lead in EV adoption and power efficiency innovations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automotive power distribution modules market in China is forecasted to grow at 7.3% CAGR, supported by the country's booming automotive production and increasing adoption of electric and hybrid vehicles. The transition towards more energy-efficient power modules is driven by the growing demand for advanced electrical systems in EVs, including smart charging solutions and energy management systems. The government’s support for EV infrastructure, coupled with local automotive manufacturers focusing on power electronics, accelerates market expansion.

The automotive power distribution modules market in India is projected to grow at 6.8% CAGR, driven by rising automotive production, growing demand for safety features, and the shift toward electric mobility. Power distribution modules are critical in managing energy flow in EVs and ICE vehicles, and the increasing demand for energy-efficient solutions fosters growth. Government policies promoting electric vehicles and infrastructure investments contribute to the acceleration of market adoption in both commercial and passenger vehicles.

The automotive power distribution modules market in Germany is expected to grow at 6.2% CAGR, supported by the country’s automotive industry and focus on green technologies. As one of the leaders in electric mobility, Germany’s market is driven by the demand for high-performance and energy-efficient power modules in electric and hybrid vehicles. Manufacturers focus on innovations in power electronics to improve battery management systems, which enhance vehicle performance and energy conservation.

The automotive power distribution modules market in the United Kingdom is projected to grow at 5.1% CAGR, driven by the rising demand for energy-efficient power systems in both traditional and electric vehicles. With the government pushing for carbon-neutral goals and increased EV adoption, there is growing interest in lightweight and high-efficiency power modules that optimize energy consumption. Manufacturers focus on smart power management solutions to meet regulatory requirements for emissions and energy efficiency in vehicles.

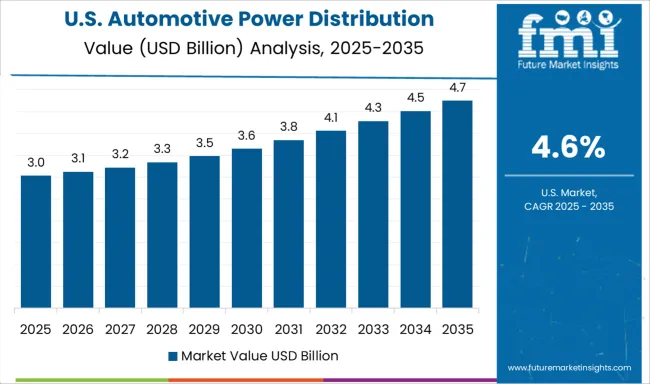

The automotive power distribution modules market in the United States is projected to grow at 4.6% CAGR, reflecting steady growth driven by the increasing adoption of electric vehicles and the focus on improving vehicle fuel efficiency. As one of the largest markets for automotive manufacturing, the demand for high-efficiency power distribution modules continues to rise. The development of next-generation power modules designed for electric vehicles, including smart power distribution and battery management systems, contributes to market growth.

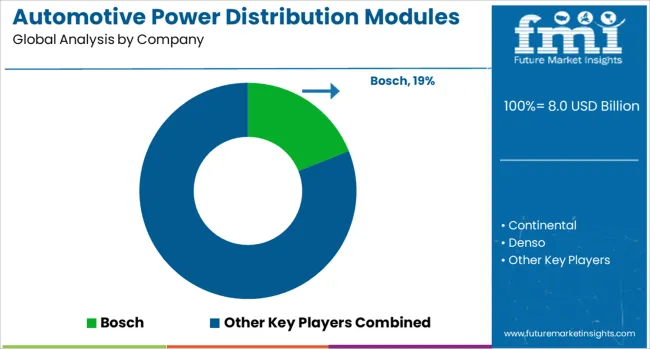

The automotive power distribution modules market is dominated by Bosch, which secures its leadership through a comprehensive range of power distribution systems designed to optimize vehicle electrical architectures for performance, safety, and energy efficiency. Bosch’s dominance is supported by its advanced technological capabilities, global manufacturing network, and strong partnerships with automakers to deliver reliable and scalable power solutions. Key players such as Continental, Denso, Eaton, Infineon, and Lear Corporation maintain significant market shares by offering innovative modules for battery management, power distribution, and energy routing, ensuring seamless integration across complex electrical systems in modern vehicles. These companies emphasize safety features, miniaturization, and enhanced power density to meet the growing demand for electric vehicles (EVs) and hybrid vehicles.

Emerging players like NXP Semiconductors, STMicroelectronics, TE Connectivity, and Valeo are gaining traction by offering specialized power distribution modules optimized for specific vehicle types, including EVs and autonomous vehicles. Their strategies involve focusing on low-power consumption, smart power management, and connectivity with advanced driver-assistance systems (ADAS). Market growth is driven by the rise in EV adoption, increasing complexity of vehicle electrical systems, and the need for improved energy efficiency. Continuous advancements in power management technologies, including solid-state solutions and vehicle-to-grid (V2G) compatibility, are expected to further shape competitive dynamics in the automotive power distribution modules market.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.0 Billion |

| Component | Relays, Power modules, Fuses and circuit breakers, Connectors and terminals, Voltage regulators, and Others |

| Module | Low voltage, Medium voltage, and High voltage |

| Vehicle Type | Passenger vehicles, Hatchback, Sedan, SUVs, Commercial vehicles, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs) |

| Application | Safety and driver assistance systems, Lighting systems, Infotainment systems, HVAC systems, Battery management systems, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Continental, Denso, Eaton, Infineon, Lear Corporation, NXP Semiconductors, STMicroelectronics, TE Connectivity, and Valeo |

| Additional Attributes | Dollar sales by module type (hardwired vs. configurable), vehicle segment (passenger vs. commercial), and power source (battery electric, hybrid electric, internal combustion engine). Segmentation by distribution voltage (12V, 24V, 48V). Regional trends: Asia-Pacific (46.56% share in 2024), North America (51.4% share). Innovation in SiC semiconductors, smart power switches, ADAS integration, and EV architectures. Compliance with automotive safety standards and emerging use cases in software-defined vehicles and modular power distribution systems. |

The global automotive power distribution modules market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the automotive power distribution modules market is projected to reach USD 13.6 billion by 2035.

The automotive power distribution modules market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automotive power distribution modules market are relays, power modules, fuses and circuit breakers, connectors and terminals, voltage regulators and others.

In terms of module, low voltage segment to command 46.0% share in the automotive power distribution modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Unit (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Automotive Powerglide Shifters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Steering Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Window Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Powertrain Sensors Market

Automotive Power Steering Cooler Market

Power Amplifier Modules Market

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Automotive Integrated Power Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive on board AC-DC power inverters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electro-hydraulic Power Steering Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Data Center LV/MV Power Distribution Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA