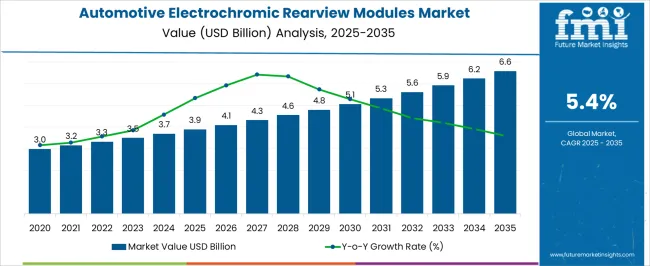

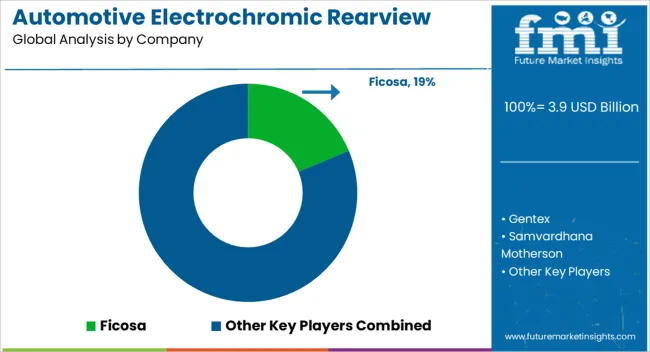

The automotive electrochromic rearview modules market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. Electrochromic rearview systems are broadly categorized into basic electrochromic mirrors, hybrid sensor-integrated modules, and advanced smart mirror systems with connectivity features. Each technology tier contributes differently to the overall growth pattern reflected in the given data, which shows consistent yet moderate annual increments. Basic electrochromic mirrors, which automatically dim glare, are expected to retain a solid share due to cost competitiveness and widespread adoption across mid-range vehicle categories. Hybrid sensor-integrated modules that combine auto-dimming with rain and light sensors will expand more rapidly, supported by increasing demand for driver-assist technologies.

The premium segment, advanced smart mirrors with camera integration and connectivity, is anticipated to deliver the strongest growth contribution, albeit from a smaller base, given their rising integration in electric vehicles and luxury cars. The cost pressures and supply chain efficiency are expected to determine the balance between these technology types. Entry-level electrochromic solutions will stabilize the market foundation, while advanced technologies are projected to accelerate growth, particularly toward the latter part of the forecast cycle as automakers prioritize intelligent safety and digital cockpit integration.

| Metric | Value |

|---|---|

| Automotive Electrochromic Rearview Modules Market Estimated Value in (2025 E) | USD 3.9 billion |

| Automotive Electrochromic Rearview Modules Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The automotive electrochromic rearview modules market is gaining strong traction as automakers increasingly prioritize glare-reduction, adaptive visibility, and driver comfort in both premium and mid-range vehicles. The integration of electrochromic technology into rearview mirrors enables dynamic tinting based on ambient lighting, thus reducing eye strain and improving road safety, particularly during nighttime and high-beam encounters.

Rising consumer expectations for connected and smart vehicle interiors have been driving OEM investments in electrochromic systems that can be seamlessly integrated with ADAS platforms and in-cabin display modules. Furthermore, regulatory focus on occupant safety and visibility, particularly in the European and North American markets, has prompted the adoption of such technologies as standard equipment in new vehicle models.

Advancements in solid-state materials and reductions in production costs have further enabled the scalable integration of electrochromic mirrors. As electric vehicles and autonomous mobility solutions continue to expand globally, demand for lightweight, energy-efficient, and user-adaptive interior systems like electrochromic rearview modules is expected to strengthen further.

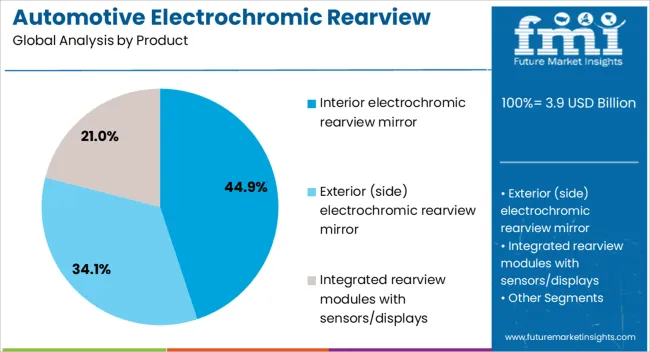

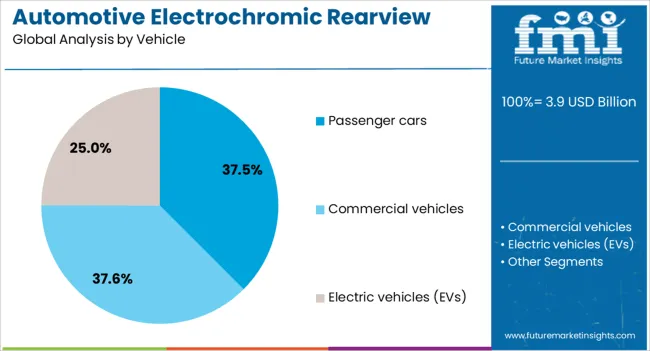

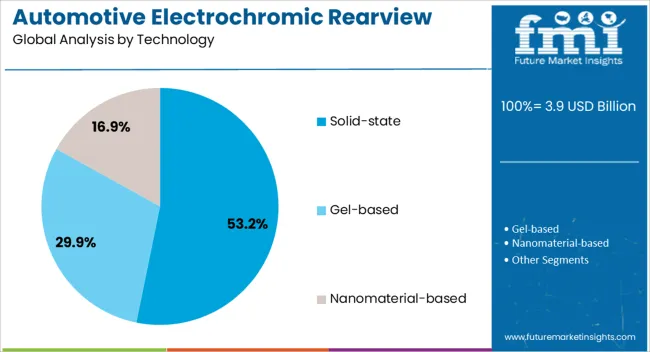

The automotive electrochromic rearview modules market is segmented by product, vehicle, technologysales channel, and geographic regions. By product of the automotive electrochromic rearview modules market is divided into Interior electrochromic rearview mirror, Exterior (side) electrochromic rearview mirror, and Integrated rearview modules with sensors/displays. In terms of vehicle of the automotive electrochromic rearview modules market is classified into Passenger cars, Commercial vehicles, and Electric vehicles (EVs). Based on technology of the automotive electrochromic rearview modules market is segmented into Solid-state, Gel-based, and Nanomaterial-based. By sales channel of the automotive electrochromic rearview modules market is segmented into OEM (Original Equipment Manufacturer) and Aftermarket. Regionally, the automotive electrochromic rearview modules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interior electrochromic rearview mirror segment is projected to account for 44.9% of the total revenue share in the automotive electrochromic rearview modules market in 2025, positioning it as the dominant product segment. This leadership has been driven by its essential role in enhancing driver safety and visibility in various ambient lighting conditions.

The interior mirror’s ability to automatically adjust reflectance levels has made it a core feature in high-volume production models, especially in regions with high road glare incidents. Vehicle manufacturers have increasingly favored this product due to its compact design, cost-effectiveness, and ease of integration with sensors and cabin electronics.

Its widespread application in both luxury and mid-segment vehicles has contributed to consistent demand across diverse automotive platforms The growing inclusion of these mirrors as standard features in newer vehicle trims, supported by improvements in electrochromic film durability and response time, has further reinforced their market position within OEM supply chains.

Passenger cars are expected to represent 37.5% of the overall revenue share in the automotive electrochromic rearview modules market in 2025, underscoring the segment’s pivotal role in driving product demand. This growth has been influenced by the increasing integration of electrochromic mirrors in compact and mid-sized vehicles, aimed at enhancing safety, reducing glare, and improving driver comfort.

Passenger vehicle OEMs have been progressively adopting electrochromic rearview modules as part of broader infotainment and ADAS upgrades, supported by consumer preferences for smart cockpit features. Competitive differentiation in the passenger car segment has led manufacturers to embed these systems even in non-luxury models, contributing to higher penetration rates.

Additionally, rising vehicle ownership in urban and semi-urban regions has amplified the demand for enhanced driving visibility technologies, which has favored the adoption of electrochromic components. As regulatory mandates for safety features tighten globally, passenger cars are likely to continue accounting for a significant share of the demand.

Solid-state technology is anticipated to hold 53.2% of the revenue share in the automotive electrochromic rearview modules market by 2025, reflecting its position as the leading technological approach. The segment’s dominance has been supported by its superior performance in terms of switching speed, energy efficiency, and lifecycle durability compared to traditional electrochromic technologies. Solid-state materials enable faster response times and a wider range of tinting control, which are crucial for real-time glare management in dynamic driving environments.

This technology has also allowed for slimmer, more compact mirror designs that are compatible with modern vehicle aesthetics and interior architectures. Manufacturers have increasingly preferred solid-state electrochromic solutions due to their compatibility with embedded sensors, reduced power consumption, and resistance to temperature-related degradation.

The scalability of production and growing cost optimization at the material level have further accelerated adoption across high-volume vehicle models. As vehicle electronics evolve toward intelligent and integrated systems, solid-state electrochromic modules are expected to remain central to rearview mirror innovation.

The market has been shaped by rising demand for advanced safety and comfort features in passenger and commercial vehicles. These modules have been increasingly integrated to reduce glare from headlights, improving driving visibility and overall safety. Growing adoption of connected and smart vehicle technologies has also supported their penetration. Original equipment manufacturers have been actively collaborating with suppliers to introduce advanced variants. The market has further benefited from expanding premium and mid-segment vehicle production across multiple regions.

Driver safety and comfort have been the primary factors influencing the adoption of electrochromic rearview modules. By automatically adjusting the mirror tint in response to varying light conditions, these modules have significantly reduced eye strain and glare from trailing vehicle headlights. Automotive manufacturers have increasingly prioritized the inclusion of such safety-oriented features to comply with regulatory standards while enhancing consumer trust. The growing awareness of road accident reduction through advanced driver assistance systems has also supported demand. Electrochromic modules have been recognized as both a safety feature and a comfort-driven innovation, reinforcing their role as a standard offering in many premium models.

The trend of connected and smart vehicles has accelerated the adoption of electrochromic rearview modules. These modules have been integrated with sensors, cameras, and telematics systems, allowing them to function seamlessly within broader driver assistance and autonomous vehicle technologies. In advanced configurations, electrochromic mirrors have been connected to rearview cameras, enhancing nighttime visibility and parking assistance. This integration has strengthened their position as part of vehicle digital ecosystems. As automakers expand smart cockpit technologies, electrochromic rearview modules have been increasingly included as complementary solutions that enhance safety, connectivity, and user experience in technologically advanced vehicles.

Premium vehicles initially drove the integration of electrochromic rearview modules, but their adoption has steadily moved toward mid-segment cars. Manufacturers have been lowering production costs while optimizing designs to broaden accessibility across different vehicle categories. As a result, electrochromic mirrors are no longer exclusive to luxury cars but are increasingly available in affordable segments. This democratization of technology has been supported by consumer demand for advanced comfort features at reasonable price points. The expansion across vehicle categories has amplified the global volume of electrochromic module installations, strengthening their role as an industry standard rather than a niche feature.

Continuous technological advancements have improved the durability, speed, and efficiency of electrochromic coatings used in rearview modules. Modern modules have been engineered to provide faster dimming responses and enhanced clarity under diverse driving conditions. Leading suppliers have collaborated with automakers to co-develop customized solutions suited for specific vehicle models. Material innovations, including nanotechnology-based coatings and advanced conductive films, have further improved product performance.

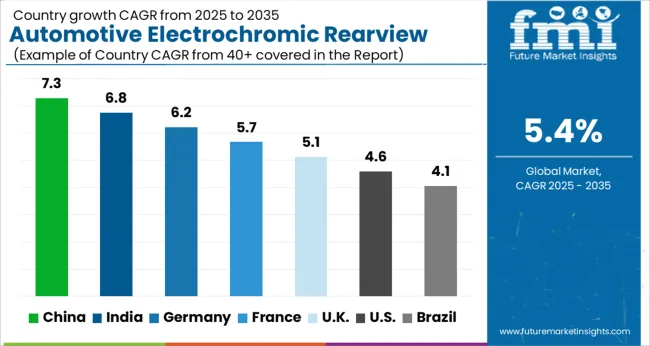

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The market is projected to grow at a CAGR of 5.4% between 2025 and 2035, supported by rising vehicle safety requirements, premium car adoption, and advancements in smart glass technologies. China, with 7.3% CAGR, is spearheading growth through increased passenger car production and integration of advanced driver assistance systems. India follows at 6.8%, where demand is supported by rising mid-segment vehicle upgrades and emphasis on road safety features. Germany, expanding at 6.2%, leverages its premium automotive sector and innovation in electronic mirrors for luxury vehicles. The UK, with a 5.1% CAGR, is scaling adoption in connected vehicles and luxury imports. The USA, recording 4.6% CAGR, remains a steady market where established automakers and high-end vehicle models sustain moderate yet consistent integration of electrochromic technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to advance at a CAGR of 7.3%, encouraged by the strong domestic automobile sector. The growing preference for premium vehicles and technological enhancements in automotive interiors has supported the integration of advanced rearview modules. Local manufacturers are investing in collaborations with global suppliers to improve design and optical performance. Rising consumer awareness regarding road safety and glare reduction is further stimulating demand. Luxury and mid-range vehicles are increasingly incorporating electrochromic mirrors as standard features, creating wider adoption. With consistent government focus on smart mobility and automotive technology upgrades, China is expected to remain the largest contributor to this market segment.

India is forecast to grow at a CAGR of 6.8%, supported by increasing sales of passenger cars and luxury models. Growing consumer preference for safety and comfort features is boosting the integration of advanced rearview modules. Domestic automotive manufacturers are partnering with international suppliers to expand technology adoption. Rising disposable spending on vehicles with modern interior features is driving greater consumer acceptance. Additionally, awareness about night driving safety is increasing, contributing to demand for glare-free driving experiences. With rising urban vehicle ownership and enhanced road infrastructure, India is emerging as a promising growth market for electrochromic rearview modules.

Germany is estimated to progress at a CAGR of 6.2%, driven by its strong base of premium automobile manufacturers. Integration of electrochromic technology is becoming a standard feature in high-end vehicles, particularly in luxury sedans and sports cars. German automakers are investing heavily in research to refine mirror clarity, response time, and energy efficiency. The growing focus on driver safety and comfort has amplified the importance of such technologies. With automotive engineering advancements and the presence of globally recognized manufacturers, Germany continues to remain a hub for innovation in electrochromic rearview systems.

The United Kingdom is set to expand at a CAGR of 5.1%, led by consumer demand for enhanced safety and driving comfort. Adoption is being supported by the growing popularity of premium and luxury cars in the market. The presence of global automotive brands with strong dealerships in the UK has facilitated wider availability of electrochromic technologies. Additionally, government initiatives toward advanced automotive innovation and safety enhancements provide further support. With rising urban commuting and increased consumer awareness of advanced safety systems, the UK market is expected to strengthen its adoption of electrochromic rearview modules.

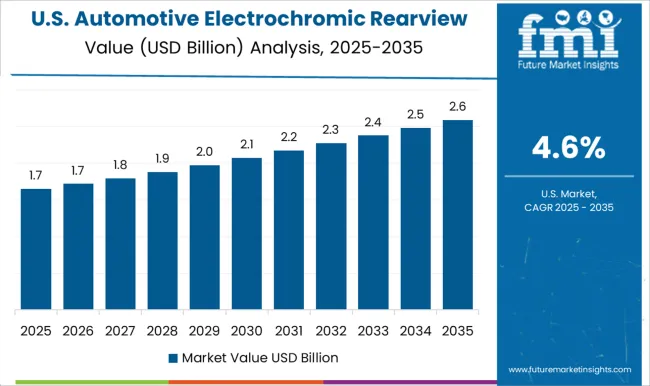

The United States market is projected to grow at a CAGR of 4.6%, supported by a large base of premium and SUV sales. Consumer demand for comfort, safety, and glare-free night driving experiences is sustaining adoption. Leading manufacturers are focusing on product improvements, including faster dimming and integration with connected vehicle systems. The trend of advanced interior upgrades in mid-segment vehicles is also encouraging technology penetration beyond luxury categories. With strong R&D investments and the presence of global automotive suppliers, the USA is expected to continue as a significant market for electrochromic rearview modules.

The market is shaped by the presence of global suppliers and technology-driven manufacturers focused on improving driving comfort and safety. Gentex remains the most recognized player, holding a strong share due to its consistent innovation in electrochromic mirror technology and widespread supply agreements with leading automakers. Ficosa and Magna contribute significantly through integrated solutions that combine mirrors with advanced driver assistance features, catering to the growing demand for smarter in-vehicle systems.

Samvardhana Motherson and Ichikoh enhance their standing by leveraging partnerships with global automotive OEMs, enabling cost-effective and reliable electrochromic systems. Honda Lock and Murakami are influential in the Japanese market, providing strong domestic supply networks and advanced engineering capabilities. Konview and SL add further diversity by addressing regional demands and offering solutions suited to both premium and mass-market vehicles. Collectively, these companies drive advancements in glare reduction, smart connectivity, and seamless integration with modern automotive technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Product | Interior electrochromic rearview mirror, Exterior (side) electrochromic rearview mirror, and Integrated rearview modules with sensors/displays |

| Vehicle | Passenger cars, Commercial vehicles, and Electric vehicles (EVs) |

| Technology | Solid-state, Gel-based, and Nanomaterial-based |

| Sales Channel | OEM (Original Equipment Manufacturer) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ficosa, Gentex, Samvardhana Motherson, Magna, Ichikoh, Honda Lock, Murakami, Konview, and SL |

| Additional Attributes | Dollar sales by module type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in advanced driver assistance adoption, innovation in glare reduction, sensor integration, and connectivity, environmental impact of electronic waste and material usage, and emerging use cases in autonomous and luxury vehicles. |

The global automotive electrochromic rearview modules market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the automotive electrochromic rearview modules market is projected to reach USD 6.6 billion by 2035.

The automotive electrochromic rearview modules market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automotive electrochromic rearview modules market are interior electrochromic rearview mirror, exterior (side) electrochromic rearview mirror and integrated rearview modules with sensors/displays.

In terms of vehicle, passenger cars segment to command 37.5% share in the automotive electrochromic rearview modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Power Distribution Modules Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA