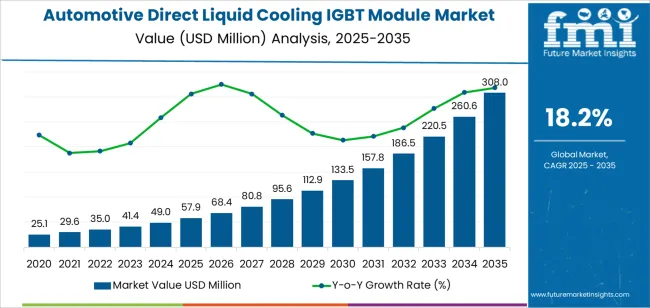

The global automotive direct liquid cooling IGBT (Insulated Gate Bipolar Transistor) module market is forecast to reach USD 308.0 million by 2035, reflecting an absolute increase of USD 250.1 million over the forecast period. The market is valued at USD 57.9 million in 2025 and is expected to grow at a robust CAGR of 18.2%. This significant growth is driven by the increasing demand for electric vehicles (EVs) and the need for efficient power management systems in modern automotive applications. Direct liquid-cooled IGBT modules are critical for high-performance EVs and hybrid cars, as they help manage power electronics' temperatures, ensuring safe and efficient operation of the vehicle's powertrain.

Direct liquid cooling IGBT modules are used to regulate the temperature of the power electronics in electric and hybrid vehicles, as they offer superior cooling performance compared to traditional air-cooled systems. These modules are designed to handle the higher power demands and thermal challenges of modern EVs, where efficient thermal management is crucial for extending battery life and optimizing the overall performance of the vehicle. As the adoption of electric and hybrid vehicles continues to rise, driven by stricter emissions regulations, increased consumer preference for eco-friendly transportation, and technological advancements, the demand for IGBT modules, particularly with direct liquid cooling, is expected to grow substantially.

The market is also benefiting from advancements in power electronics and thermal management technologies. As automotive manufacturers focus on enhancing vehicle performance, efficiency, and safety, demand for next-generation power modules with improved heat dissipation and more compact designs is increasing. Government incentives and initiatives to promote EV adoption, along with the growing trend of electrification in the automotive industry, will further drive the demand for these high-performance cooling systems.

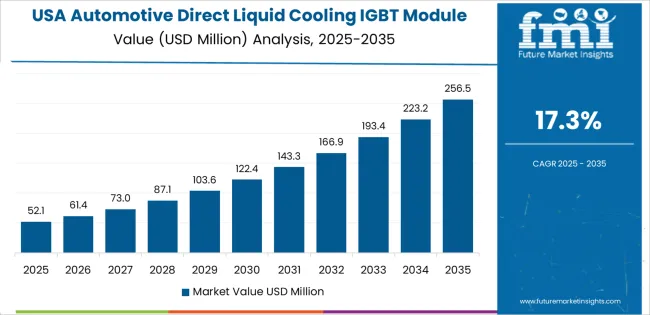

Between 2025 and 2030, the automotive direct liquid cooling IGBT module market is projected to grow from USD 57.9 million to approximately USD 122.1 million, adding USD 64.2 million. This accounts for about 25.7% of the total forecasted growth for the decade. This growth will be driven by the increasing adoption of electric vehicles (EVs) and advancements in battery and power electronics technologies. As EV manufacturers focus on improving vehicle performance and efficiency, the need for high-performance thermal management systems, such as direct liquid cooling IGBT modules, will intensify. These modules are critical for managing the heat generated by power electronics, ensuring the safe and efficient operation of electric powertrains.

From 2030 to 2035, the market is expected to expand from approximately USD 122.1 million to USD 308.0 million, adding USD 185.9 million. This phase will account for 74.3% of the overall growth, reflecting the continued rise in electric vehicle production and the growing focus on electrification in the automotive sector. Advancements in IGBT module designs and improvements in liquid cooling technologies will contribute to more efficient and compact solutions, helping manufacturers meet the thermal demands of modern EVs and hybrid vehicles. As EV adoption continues to grow globally, driven by stricter emissions regulations and consumer preferences for eco-friendly transportation, demand for advanced thermal management solutions, such as automotive direct liquid-cooling IGBT modules, will increase significantly.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 57.9 million |

| Market Forecast Value (2035) | USD 308.0 million |

| Forecast CAGR (2025-2035) | 18.2% |

The automotive direct liquid cooling IGBT (Insulated Gate Bipolar Transistor) module market is growing rapidly due to the increasing demand for efficient and high-performance power electronics in electric vehicles (EVs) and hybrid vehicles. IGBT modules are essential components in power conversion systems, managing the flow of electrical power in electric drivetrains, battery charging systems, and other power-related systems in EVs. Direct liquid cooling technology improves the thermal management of these power modules, ensuring efficient heat dissipation and optimal performance, which is crucial for enhancing the overall efficiency and longevity of electric vehicles.

The rapid growth of the electric vehicle market is a key driver for the increasing adoption of automotive IGBT modules. As EVs become more mainstream, the need for advanced power management solutions that can handle high currents and voltages in compact and efficient designs continues to rise. Liquid cooling offers significant advantages over traditional air cooling, including better heat dissipation, higher power density, and improved reliability under extreme conditions, making it ideal for use in automotive applications.

The shift toward more energy-efficient, high-performance vehicles with faster charging capabilities and longer battery life is further fueling the demand for these modules. While the market faces challenges such as the high cost of advanced cooling systems and the complexity of integration, the strong growth in EV production and the push for greener transportation solutions are expected to drive continued market expansion.

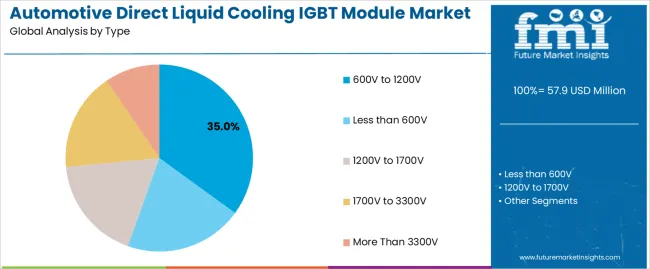

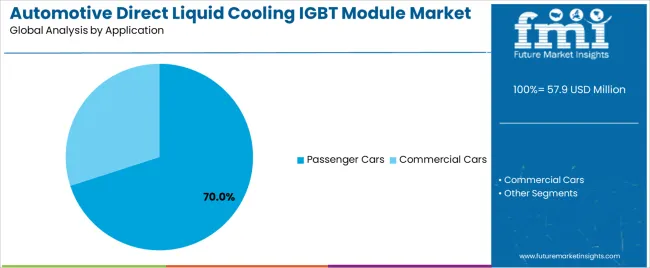

The market is segmented by classification, application, and region. By classification, the market is divided into 600V to 1200V, less than 600V, 1200V to 1700V, 1700V to 3300V, and more than 3300V, with the 600V to 1200V segment leading the market. Based on application, the market is categorized into passenger cars and commercial cars, with passenger cars representing the largest segment in terms of market share. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The 600V to 1200V classification segment is the leader in the automotive direct liquid cooling IGBT module market, accounting for approximately 35.0% of the total market share. The demand for efficient power conversion in passenger electric vehicles (EVs) and hybrid electric vehicles (HEVs) is the primary driver behind the growth of this segment. The 600V to 1200V range strikes an optimal balance between power handling, efficiency, and cost-effectiveness, making it the ideal choice for automotive applications. These modules offer reliable operation and high performance while minimizing space and weight, which are critical considerations for modern electric and hybrid vehicles.

As the automotive industry increasingly shifts towards electrification, there is an elevated need for power conversion systems that enable optimal battery performance and reduce energy losses. The 600V to 1200V IGBT modules meet these requirements, providing efficient power delivery for motors, inverters, and other electrical systems in EVs and HEVs. The rapid rise in the adoption of EVs, spurred by regulatory pressures for lower emissions and greater fuel efficiency, is further fueling the demand for such power electronics.

Automakers are focused on improving vehicle range, performance, and energy management, which can only be achieved with highly efficient power conversion systems. Moreover, these IGBT modules are essential in enhancing the overall efficiency and reliability of the vehicle’s powertrain, making them critical components in the ongoing electrification of the automotive industry. As EV production continues to increase, the demand for 600V to 1200V IGBT modules is expected to remain robust, securing its position as the market leader.

The passenger cars application dominates the automotive direct liquid cooling IGBT module market, holding 70.0% of the total market share. This segment’s leadership is primarily driven by the increasing adoption of electric and hybrid vehicles, which rely heavily on efficient and reliable power conversion systems. These systems are crucial for optimizing battery performance, reducing energy loss, and ensuring smoother operation, making IGBT modules an integral part of EV and HEV designs. The focus of automakers is shifting towards producing more affordable, energy-efficient, and high-performance electric vehicles. This has led to a significant rise in demand for advanced IGBT modules that can handle the challenges of modern electric powertrains, such as managing power flows between the battery, motor, and other electrical components.

The growing pressure from regulatory bodies to reduce carbon emissions and improve fuel efficiency has accelerated the transition from traditional combustion engine vehicles to electric and hybrid vehicles. This regulatory push, alongside consumer demand for more environmentally friendly vehicles, is driving automakers to adopt advanced power electronics like IGBT modules. These modules are essential in delivering the required performance for high-speed switching and energy-efficient operation in EVs and HEVs.

With the continuous development of new technologies aimed at extending vehicle range and reducing charging times, the demand for high-performance IGBT modules is expected to remain strong. As the electric vehicle market continues to grow globally, the passenger car segment will continue to dominate the market for automotive direct liquid cooling IGBT modules, ensuring long-term growth in this sector.

The market is expanding due to the increasing demand for direct liquid cooled IGBT modules in electric vehicle (EV) powertrains and high power automotive applications. These modules offer features like enhanced thermal management, higher power density, extended component lifespan, and efficient heat rejection. Key drivers include the growth of EV and hybrid vehicle production, the move toward higher voltage architectures (600V‑1200V and beyond), and manufacturers' drive for compact, more efficient power electronics. Restraints stem from the higher cost and complexity of liquid cooling systems, integration challenges with existing vehicle architectures, and uncertainties around coolant supply and system reliability.

Liquid cooled IGBT modules are gaining popularity because they address critical bottlenecks in modern EV power electronics specifically thermal constraints and power density. As manufacturers push for more range, faster charging, and smaller electronics, the ability of liquid cooling to maintain lower junction temperatures and enable higher current throughput becomes highly valuable. In addition, liquid cooling allows for more compact and lightweight module packaging, supporting the trend toward smaller, lighter EV subsystems. With regulation tightening on emissions and efficiency, and vehicle platforms moving to higher voltages, these modules provide an essential solution for automotive OEMs committed to performance and reliability.

Technological and thermal management innovations are driving growth by enabling direct liquid cooling architectures that significantly improve heat dissipation compared to conventional air cooled or indirectly cooled modules. Advances such as embedded cold plates, micro channel liquid paths, optimized coolant chemistry, and integrated sensors for real time thermal monitoring are enhancing module performance and reliability. Manufacturers are also developing IGBT modules tailored for 800V+ systems, which paired with liquid cooling enable compact high power designs suited for next generation EVs, trucks, and commercial vehicles. These innovations reduce module size, increase efficiency, and extend service life, making liquid cooled IGBT modules more attractive for automotive application.

Despite their advantages, liquid cooled IGBT modules face several challenges in widespread automotive adoption. First is the complexity and cost of integrating a liquid cooling system into an already constrained vehicle architecture the additional plumbing, coolant loop management, and durability requirements raise both design and manufacturing costs. Second, reliability and maintenance concerns around coolant contamination, leak risk, pump failure, and long term durability in harsh automotive environments may dampen OEM confidence. Third, supply chain and production scale limitations for advanced module and cooling components can impede cost reduction and timely delivery. Lastly, standardization and compatibility issues with differing vehicle platforms, coolant standards, and module interfaces pose barriers to broader market penetration.

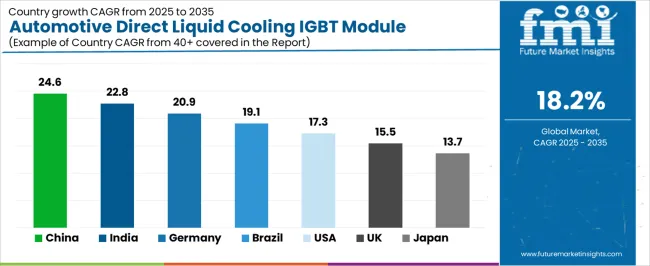

| Country | CAGR (%) |

|---|---|

| China | 24.6% |

| India | 22.8% |

| Germany | 20.9% |

| Brazil | 19.1% |

| USA | 17.3% |

| UK | 15.5% |

| Japan | 13.7% |

The global automotive direct liquid cooling IGBT module market is set for accelerated growth, with China leading at a 24.6% CAGR, driven by its rapid adoption of electric vehicles (EVs), strong automotive manufacturing base, and investments in advanced power electronics. India follows at 22.8%, boosted by EV growth, government incentives, and increasing demand for power‑dense cooling systems in vehicles.

Germany exhibits a 20.9% CAGR, powered by its strong automotive sector, high‑performance EVs and focus on thermal management. Brazil records a 19.1% CAGR as automotive electrification and energy infrastructure upgrade support the uptake. The USA grows at 17.3%, buoyed by EV adoption, charging infrastructure, and advanced cooling module technologies. The UK shows a 15.5% CAGR, underpinned by EV regulation and innovation in automotive cooling systems. Japan grows at 13.7%, supported by its automotive exports and continuous innovations in power electronic modules.

China is leading the automotive direct liquid cooling IGBT module market with a remarkable 24.6% CAGR, driven by its rapidly expanding electric vehicle (EV) market and a strong push towards green technologies. As the world’s largest automotive manufacturer and the largest EV market, China is making significant strides in the adoption of power electronics like IGBT (Insulated Gate Bipolar Transistor) modules. These modules are crucial for improving the efficiency of EV powertrains, where effective thermal management is essential. The rise in the demand for high‑performance, efficient EVs in China has accelerated the need for advanced cooling solutions, like direct liquid cooling systems, to prevent overheating and enhance overall system reliability.

Government initiatives, such as subsidies for EVs and renewable energy infrastructure, have further promoted the development and adoption of advanced automotive technologies, including IGBT modules for thermal management. China’s growing focus on electric public transportation, such as buses and trucks, has also spurred the demand for these modules. The country’s extensive investments in EV infrastructure and smart grid technologies, combined with the automotive industry’s push for technological innovations, position China as the leader in the automotive direct liquid cooling IGBT module market.

India is experiencing strong growth in the automotive direct liquid cooling IGBT module market with a 22.8% CAGR, primarily driven by the rapid shift toward electric vehicles (EVs) and the country’s growing automotive manufacturing sector. As India looks to transition to cleaner, more sustainable transportation options, there is an increasing demand for high‑performance cooling systems to manage the thermal efficiency of EVs, which directly drives the adoption of IGBT modules. The Indian government’s focus on electric mobility, through initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, has further accelerated the development of EVs and associated technologies.

The rise in local manufacturing of electric vehicles and charging infrastructure is contributing to the growing demand for efficient, energy‑saving solutions like direct liquid cooling IGBT modules. As EV adoption grows, so does the need for more advanced thermal management systems, especially to address the challenges of high temperatures generated by battery packs and power electronics. India’s rapidly expanding automotive market, combined with the ongoing push for sustainability and energy efficiency, will continue to drive the growth of the automotive direct liquid cooling IGBT module market in the coming years.

Germany is making significant contributions to the automotive direct liquid cooling IGBT module market, with a 20.9% CAGR, driven by its strong automotive industry and focus on sustainability and high‑performance vehicle production. As one of the largest manufacturers of vehicles in Europe, Germany has been at the forefront of electric vehicle (EV) adoption and the transition to cleaner technologies. The German automotive sector, including major players such as Volkswagen, BMW, and Mercedes-Benz, is heavily investing in EV production and innovation, which is fueling the demand for advanced power electronics, including IGBT modules. These modules are essential for improving the efficiency of powertrain systems, especially in EVs, where managing heat is critical for optimal performance and battery life.

Moreover, Germany’s robust automotive research and development ecosystem, coupled with government incentives for green technologies and EV adoption, is helping accelerate the adoption of advanced automotive technologies. The country’s push for electrification and its commitment to carbon neutrality by 2050 are further propelling the demand for direct liquid cooling systems in EVs, as they provide better thermal management for high‑power systems. Germany’s established manufacturing base and technological leadership in automotive production ensure that the demand for IGBT modules will continue to grow.

Brazil is witnessing steady growth in the automotive direct liquid cooling IGBT module market, with a 19.1% CAGR, fueled by the country’s focus on electrification and improvements in its automotive infrastructure. Brazil has a growing electric vehicle (EV) market, which is supported by the government’s push for sustainability and cleaner technologies. As Brazil works to diversify its energy mix and reduce emissions, the adoption of electric vehicles is expected to increase, consequently driving demand for power electronics like IGBT modules. These modules are crucial for efficient power conversion and thermal management in EVs, especially considering the high energy demands and power output required for these vehicles.

The development of EV charging infrastructure, coupled with an increasing number of local EV manufacturers and models, further contributes to the growth of the market. Brazil’s automotive industry, which has traditionally been strong in internal combustion engine vehicles, is gradually shifting towards hybrid and electric vehicles, creating opportunities for advanced power electronics solutions. The growing emphasis on reducing carbon emissions, the expansion of charging infrastructure, and the increase in consumer interest in EVs will continue to drive the automotive direct liquid cooling IGBT module market in Brazil.

The USA is experiencing steady growth in the automotive direct liquid cooling IGBT module market with a 17.3% CAGR, driven by the growing adoption of electric vehicles (EVs) and advancements in power electronics. The USA has been a leader in the development of electric vehicle technologies, with companies like Tesla, Rivian, and General Motors leading the charge in EV production. As the demand for EVs increases, so does the need for effective thermal management solutions to ensure optimal performance and longevity of vehicle powertrains and battery systems.

Direct liquid cooling systems, powered by IGBT modules, are key to addressing the challenges of heat dissipation in high‑power systems. The USA’s push toward achieving carbon neutrality and its expanding EV infrastructure further contribute to the demand for these modules. Federal and state government incentives, such as tax credits for EV buyers and funding for charging infrastructure, are accelerating EV adoption, increasing the need for advanced thermal management solutions. As EV production scales up and the market becomes more competitive, the demand for automotive direct liquid cooling IGBT modules in the USA will continue to grow, fostering innovation and driving the need for efficient and reliable power electronics.

The UK is experiencing steady growth in the automotive direct liquid cooling IGBT module market with a 15.5% CAGR, supported by the country’s push towards electrification and decarbonization of the transportation sector. As part of its commitment to achieving net‑zero emissions by 2050, the UK has implemented several policies to encourage the adoption of electric vehicles (EVs). The transition from traditional internal combustion engine vehicles to electric vehicles is driving demand for advanced power electronics, including IGBT modules, which are essential for managing power and heat dissipation in EV powertrains.

Leading automakers in the UK, such as Jaguar Land Rover and MINI, are increasing their EV offerings, further fueling demand for thermal management systems. The UK government’s support for EV adoption, including subsidies for electric vehicle purchases and investments in charging infrastructure, is contributing to the growth of the market. With an increasing emphasis on innovation in manufacturing processes, including the integration of direct liquid cooling systems, the UK automotive industry is set to embrace advanced power electronics solutions. As electric vehicle adoption accelerates, the UK’s automotive direct liquid cooling IGBT module market is poised to grow steadily.

Japan is witnessing steady growth in the automotive direct liquid cooling IGBT module market with a 13.7% CAGR, supported by its long‑standing leadership in automotive production and innovation. Japan’s automotive giants, such as Toyota, Honda, and Nissan, are increasingly investing in electric vehicle (EV) development as part of their commitment to carbon reduction and sustainability goals. The country’s focus on advancing automotive powertrains and improving vehicle efficiency has led to a rise in demand for IGBT modules, which play a critical role in managing heat and ensuring high performance in electric vehicles.

Japan’s extensive investments in research and development for next‑generation EVs, including solid‑state batteries and autonomous vehicles, are further driving demand for power electronics solutions. Japan’s emphasis on energy efficiency and the adoption of green technologies has accelerated the integration of direct liquid cooling systems in vehicles. As the country continues to push for wider EV adoption and greater energy efficiency in transportation, the need for efficient, reliable power electronics, including IGBT modules, will continue to rise, ensuring steady growth in the market.

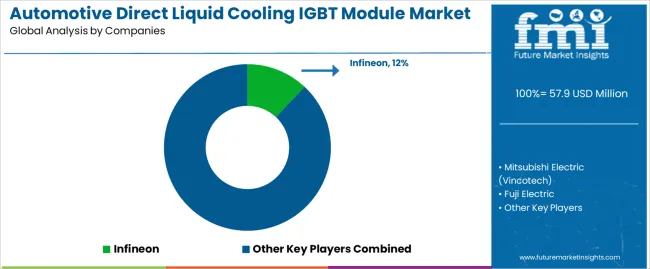

The automotive direct liquid cooling IGBT (Insulated Gate Bipolar Transistor) module market is competitive, with several key players offering advanced solutions for power management in electric vehicles (EVs) and hybrid electric vehicles (HEVs). Infineon leads the market with a 12% share, recognized for its high-performance IGBT modules that are critical for efficient power conversion in automotive applications. Infineon’s strong focus on innovation, reliability, and its broad portfolio of semiconductor solutions give it a strong position in this market.

Other major competitors include Mitsubishi Electric (Vincotech), Fuji Electric, and Hitachi Power Semiconductor Device, each known for their technological expertise and advanced IGBT modules tailored to meet the growing demand for electric and hybrid vehicles. Mitsubishi Electric, through its Vincotech brand, offers efficient power modules designed for automotive applications, while Fuji Electric provides highly reliable IGBT modules with superior thermal management capabilities, essential for high-power automotive systems. Hitachi Power Semiconductor Device focuses on providing energy-efficient solutions for automotive applications, with an emphasis on high-performance, direct liquid cooling systems.

Companies like Bosch, onsemi, Toshiba, and Microchip contribute to the market with their advanced power management technologies. Bosch offers IGBT modules with cutting-edge features for automotive and industrial power applications, while onsemi specializes in high-efficiency solutions for electric vehicles. Toshiba and Microchip also provide competitive products that support the need for high reliability and energy efficiency in automotive power systems.

Other players, such as STMicroelectronics, BYD, Denso, and SanRex Corporation, are also contributing to the market by offering reliable IGBT modules and innovative solutions to meet the evolving needs of the automotive sector. The competition in the market is driven by technological innovation, product efficiency, and the increasing demand for electric vehicle power management solutions that ensure both high performance and durability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Classification (Voltage) | Less than 600 V, 600 V to 1200 V, 1200 V to 1700 V, 1700 V to 3300 V, More Than 3300 V |

| Application | Passenger Cars, Commercial Cars |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Additional Attributes | Dollar sales by classification and application categories, market growth trends, market adoption by voltage class and application segments, regional adoption trends, competitive landscape, advancements in automotive IGBT module technologies, integration with electric vehicle systems. |

The global automotive direct liquid cooling IGBT module market is estimated to be valued at USD 57.9 million in 2025.

The market size for the automotive direct liquid cooling IGBT module market is projected to reach USD 308.0 million by 2035.

The automotive direct liquid cooling IGBT module market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types in automotive direct liquid cooling IGBT module market are 600v to 1200v, less than 600v, 1200v to 1700v, 1700v to 3300v and more than 3300v.

In terms of application, passenger cars segment to command 70.0% share in the automotive direct liquid cooling IGBT module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA