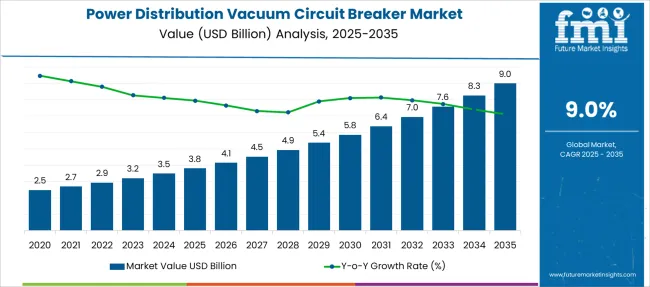

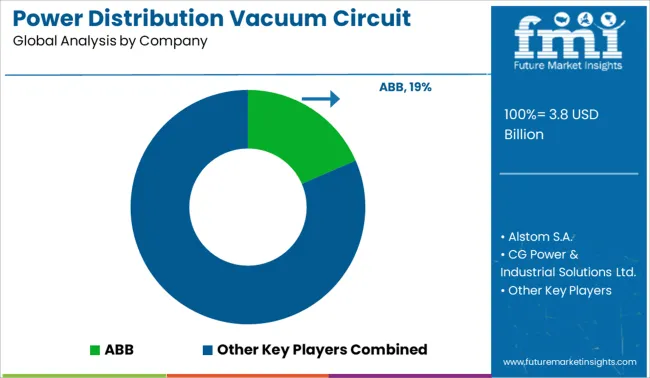

The Power Distribution Vacuum Circuit Breaker Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Power Distribution Vacuum Circuit Breaker Market Estimated Value in (2025 E) | USD 3.8 billion |

| Power Distribution Vacuum Circuit Breaker Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The power distribution vacuum circuit breaker market is progressing steadily due to the increasing demand for reliable and efficient electrical distribution systems. The growing emphasis on upgrading electrical infrastructure and integrating renewable energy sources has necessitated the deployment of advanced switching equipment. Enhanced safety standards and regulations in power utilities have further driven the adoption of vacuum circuit breakers that offer rapid interruption and low maintenance.

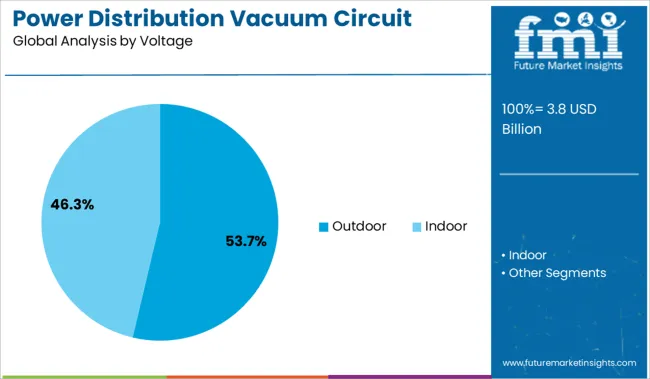

Outdoor applications have expanded as electrical grids extend into new geographical areas, requiring robust equipment that withstands harsh environmental conditions. Investments in modernizing utility networks have also supported the market’s growth.

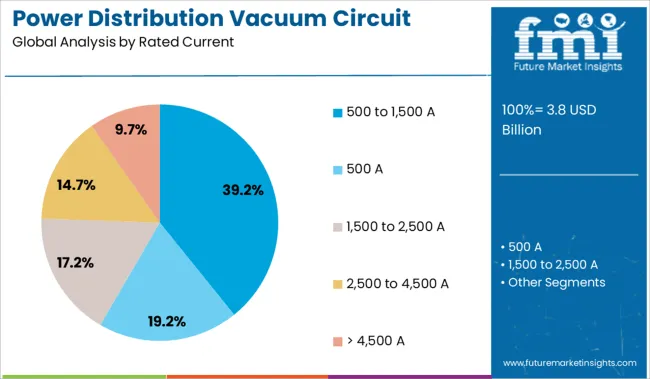

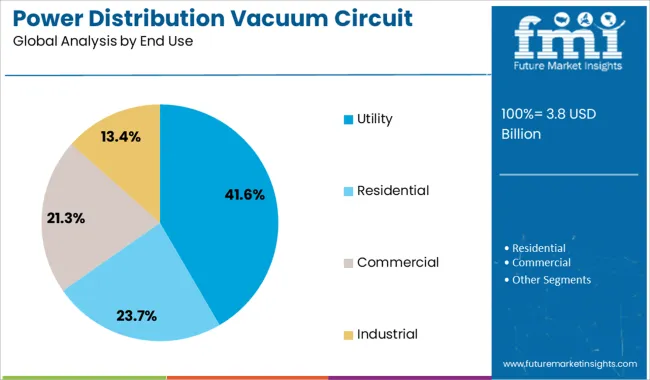

Continued urbanization and industrialization worldwide are expected to sustain demand for high-performance circuit breakers that ensure grid stability and protect equipment. The market’s growth is expected to be led by rated current segments of 500 to 1,500 A, outdoor voltage applications, and utility sector end use.

The market is segmented by Rated Current, Voltage, and End Use and region. By Rated Current, the market is divided into 500 to 1,500 A, 500 A, 1,500 to 2,500 A, 2,500 to 4,500 A, and > 4,500 A. In terms of Voltage, the market is classified into Outdoor and Indoor.

Based on End Use, the market is segmented into Utility, Residential, Commercial, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 500 to 1,500 A segment is anticipated to account for 39.2% of the power distribution vacuum circuit breaker market revenue in 2025, maintaining its position as the dominant rated current category. This segment’s preference is attributed to its suitability for medium voltage power distribution networks commonly found in urban and suburban electrical grids. These current ratings align well with the requirements of commercial, industrial, and utility applications, balancing capacity and cost efficiency.

The segment has benefitted from the increasing need for equipment that supports flexible power distribution and load management. As power demand fluctuates and networks become more complex, breakers in this rated current range provide optimal protection without unnecessary oversizing.

Growth is expected to continue as aging infrastructure is replaced with modern breakers designed for this current capacity.

The outdoor voltage segment is expected to hold 53.7% of the market revenue in 2025, leading the voltage categories. Growth has been supported by expanding electrification projects and grid extensions into rural and remote areas, where outdoor installations are preferred for their ease of access and lower infrastructure costs.

Outdoor vacuum circuit breakers are engineered to withstand environmental challenges such as moisture, temperature variations, and dust. Their durability and reliability make them well-suited for such applications.

Additionally, outdoor installations often require robust equipment to manage safety and performance over long transmission distances. As grid expansion continues globally, the outdoor voltage segment is positioned to remain the largest within the market.

The utility segment is projected to represent 41.6% of the power distribution vacuum circuit breaker market revenue in 2025, solidifying its leadership among end users. The growth in this segment has been driven by the critical role utilities play in maintaining grid reliability and safety.

Utilities have increasingly adopted vacuum circuit breakers for their superior arc quenching capabilities, minimal maintenance, and long operational life. Regulatory requirements and the need for grid modernization have encouraged utilities to replace outdated equipment with vacuum circuit breakers that offer improved performance and environmental benefits.

The segment has also benefited from growing investments in smart grid technologies and decentralized power generation, where effective circuit protection is essential. As utilities continue to upgrade infrastructure to meet rising electricity demand, the segment is expected to sustain its dominant market share.

Stricter safety regulations and lifecycle cost efficiency are accelerating the adoption of powder distribution vacuum circuit breakers across sectors. Growth is further driven by smart grid investments, infrastructure expansion in emerging markets, and retrofit opportunities.

Stricter regulatory mandates regarding electrical safety and the phasing out of greenhouse gas-emitting alternatives are indirectly supporting the adoption of vacuum circuit breakers. Their ability to provide safe arc interruption with minimal risk makes them ideal for densely populated and sensitive installations. The cost-effectiveness of powder distribution vacuum breakers, when evaluated over their entire lifecycle, is drawing attention from both public and private sector stakeholders seeking reduced operational overheads. This cost advantage, along with enhanced reliability, is unlocking opportunities across residential, commercial, and industrial applications.

The market presents significant growth opportunities driven by the accelerating shift toward low-maintenance and arc-safe electrical equipment across power distribution networks. Emerging economies in Asia and Africa are rapidly expanding their medium-voltage grid infrastructure, where vacuum circuit breakers are gaining preference due to their compact footprint and long operational life. There is also a growing demand in industrial sectors such as railways, mining, and oil & gas, where reliability and safety are critical under high-load switching. Private and public investments in smart grid upgrades and substation automation are further opening avenues for localized manufacturing, OEM partnerships, and service-based business models. Retrofitting old systems in Europe and North America with vacuum technology offers recurring revenue potential for component suppliers and service providers.

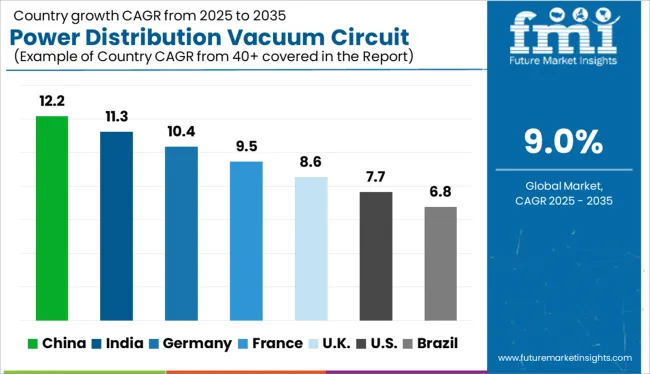

| Country | CAGR |

|---|---|

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

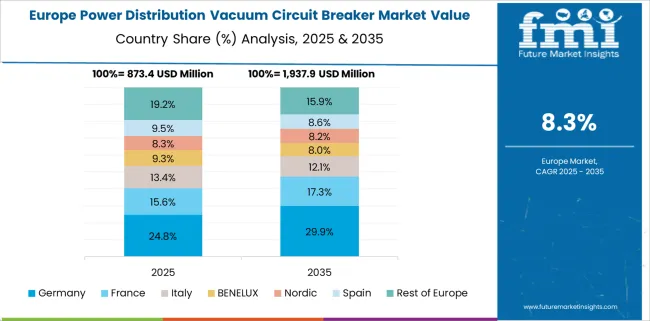

The global power distribution vacuum circuit breaker market is expected to grow at a CAGR of 9.0% from 2025 to 2035, propelled by the global transition to smart grids, renewable integration, and aging substation modernization. Vacuum circuit breakers are gaining prominence due to their low maintenance, arc quenching efficiency, and eco-friendliness compared to SF₆-based alternatives. Among BRICS countries, China (12.2%) and India (11.3%) are leading growth, driven by electrification of rural areas, renewable capacity additions, and urban infrastructure expansion. These markets are heavily investing in smart substations and grid resiliency programs. Germany (10.4%) tops the OECD nations, leveraging industrial decarbonization and advanced switchgear upgrades. The UK (8.6%) and the US (7.7%) are witnessing steady growth through utility-scale renewables, digital substations, and grid reliability mandates. ASEAN nations are emerging as strategic growth pockets, investing in compact substation infrastructure and utility modernization to support rising energy demand.

The CAGR in the United Kingdom grew from approximately 6.9% during 2020–2024 to around 8.6% between 2025–2035, aligning with renewed infrastructure priorities and mid-voltage grid reinforcements. The UK government’s 10-year upgrade program for secondary substations, especially in rural and aging industrial zones, has contributed to higher adoption of vacuum-based systems due to their arc-fault safety and longer maintenance cycles. Policy shifts encouraging the replacement of SF₆-based breakers have accelerated since 2025, with several utility firms and private distributors implementing low-emission alternatives. Distribution-level enhancements across Southern England and Scotland, along with surge-resilient equipment mandates, have helped push growth. Investments in commercial real estate retrofits are further boosting mid-voltage vacuum breaker installations across healthcare, logistics, and office campuses. The rising cost of downtime for critical assets has made reliable switchgear like powder-filled vacuum circuit breakers a strategic choice for facility operators.

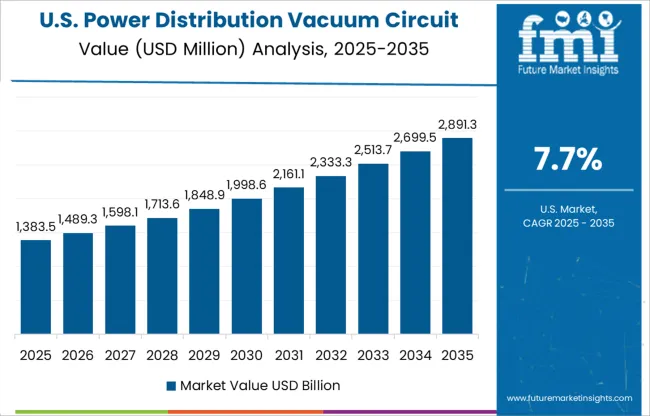

The CAGR in the United States rose from about 5.9% during 2020–2024 to 7.7% during 2025–2035, driven by a mix of federal infrastructure upgrades and substation modernization efforts. The Bipartisan Infrastructure Law earmarked billions for grid resilience, leading to widespread circuit breaker replacements across state utilities. The USA power grid’s increasing decentralization, including microgrids and community-level distribution systems, is demanding durable, low-maintenance switching solutions, a space vacuum breakers are poised to dominate. Large-scale commercial buildings and industrial parks are integrating these systems to reduce outage risks and comply with evolving safety codes. The rise in EV charging station infrastructure and the associated voltage management at distribution levels are also spurring growth in demand for compact and efficient breakers. OEMs have ramped up domestic production to reduce lead times and meet Buy American Act preferences.

The CAGR in Germany increased from approximately 8.2% during 2020–2024 to 10.4% between 2025–2035, largely due to targeted investments in grid reliability and industrial power safety. Germany’s Energiewende strategy pushed grid automation and upgrades in mid-voltage systems, where powder distribution vacuum breakers offer compact, maintenance-free performance. Industrial hubs like Bavaria and North Rhine-Westphalia have widely adopted these systems for energy-intensive sectors, particularly in steel, chemicals, and renewables integration zones. Government subsidies favoring arc-resistant switchgear with low operational emissions further accelerated the replacement of conventional switchgear units. The demand also grew in export-oriented manufacturing plants that sought power security through resilient internal distribution setups. Local manufacturers are benefiting from strong OEM ecosystems and EU compliance protocols, giving Germany a leadership position in the European vacuum switchgear segment.

The CAGR in China rose sharply from 9.8% during 2020–2024 to 12.2% during 2025–2035, led by aggressive substation expansion and a major uptick in industrial electrification. China's national power grid restructuring plan emphasizes medium-voltage upgrades, where vacuum circuit breakers are essential for ensuring long-term grid stability. Local governments in Guangdong, Sichuan, and Shandong provinces rolled out funding for low-maintenance breaker installations across smart city clusters and large industrial corridors. High-voltage stress environments, especially near coastal ports and megafactories, further amplified the adoption of powder-based vacuum technology due to its operational resilience. State Grid Corporation of China (SGCC) and China Southern Power Grid collectively accelerated domestic procurement and field deployment. Local OEMs benefited from strong domestic demand, export synergies, and government incentives tied to equipment modernization.

The CAGR in India jumped from around 8.5% in 2020–2024 to 11.3% during 2025–2035, fueled by a combination of electrification programs, utility reform, and industrial expansion. India’s Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and its successors pushed rural distribution infrastructure upgrades, directly increasing mid-voltage circuit breaker demand. The industrial sector, especially cement, power generation, and transport logistics, witnessed significant deployment of arc-resistant switchgear to address grid fluctuation and equipment failure risks. India's Make-in-India push has also encouraged local assembly of powder vacuum circuit breakers, reducing costs and improving delivery timelines for utilities and private users alike. Smart grid deployments across Maharashtra, Tamil Nadu, and Gujarat have further driven the demand for automated vacuum breakers integrated with SCADA systems. Export opportunities to neighboring countries also boosted the domestic value chain.

In the Power Distribution Vacuum Circuit Breaker Market, major electrical and industrial automation companies are scaling innovations in medium-voltage switchgear to meet expanding infrastructure and safety demands. Global players such as ABB, Schneider Electric, Siemens Energy, General Electric, and Mitsubishi Electric Corporation are spearheading product standardization across utilities, smart grids, and industrial facilities. Regional and specialized firms including Kirloskar Electric, CG Power, and CHINT are offering cost-effective solutions in Asia and the Middle East. Fuji Electric, WEG, and Hager Group are reinforcing distribution networks with low-maintenance breaker assemblies. Companies like Eaton, Alstom, and Rockwell Automation are integrating vacuum breaker technology with control systems for intelligent power distribution. Emerging players like Sensata Technologies, Powell Industries, and G&W Electric are also enhancing their presence through utility modernization partnerships and compact powder-breaker models.

In January 2024, ABB launched its new VD4-W vacuum circuit breaker series, designed specifically for wind power applications up to 40.5kV, focusing on the growing renewable segment

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Rated Current | 500 to 1,500 A, 500 A, 1,500 to 2,500 A, 2,500 to 4,500 A, and > 4,500 A |

| Voltage | Outdoor and Indoor |

| End Use | Utility, Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Alstom S.A., CG Power & Industrial Solutions Ltd., CHINT, Eaton Corporation, Fuji Electric, G&W Electric Company, General Electric Company, Hager Group, Kirloskar Electric Company, Legrand, Mitsubishi Electric Corporation, Powell Industries, Rockwell Automation, Schneider Electric, Siemens Energy, Sensata Technologies, Inc., and WEG |

| Additional Attributes | Dollar sales, share by voltage class, regional growth hotspots, utility vs. industrial demand trends, retrofit potential, and competitor positioning. |

The global power distribution vacuum circuit breaker market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the power distribution vacuum circuit breaker market is projected to reach USD 9.0 billion by 2035.

The power distribution vacuum circuit breaker market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in power distribution vacuum circuit breaker market are 500 to 1,500 a, 500 a, 1,500 to 2,500 a, 2,500 to 4,500 a and > 4,500 a.

In terms of voltage, outdoor segment to command 53.7% share in the power distribution vacuum circuit breaker market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA