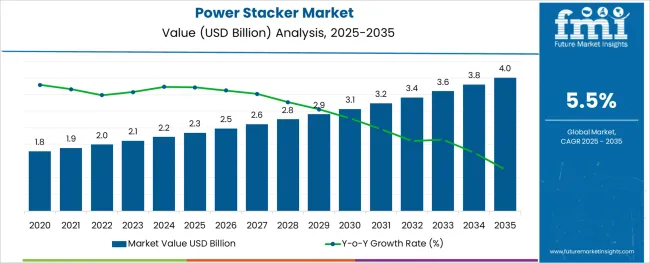

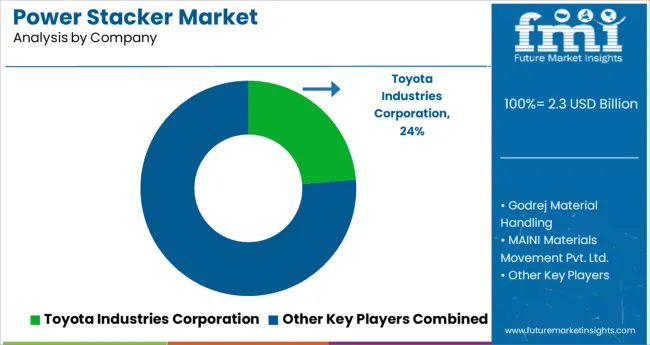

The Power Stacker Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The power stacker market is progressing steadily, propelled by the growing need for efficient material handling solutions in warehouses and manufacturing facilities. Industry insights highlight that increasing automation and logistics optimization are encouraging investments in equipment that improve productivity and worker safety. The demand for compact and user-friendly stackers has risen due to space constraints and labor cost management.

Furthermore, advancements in battery technology and ergonomic design have enhanced the appeal of power stackers. Growing industrial activity and e-commerce expansion are further driving market demand.

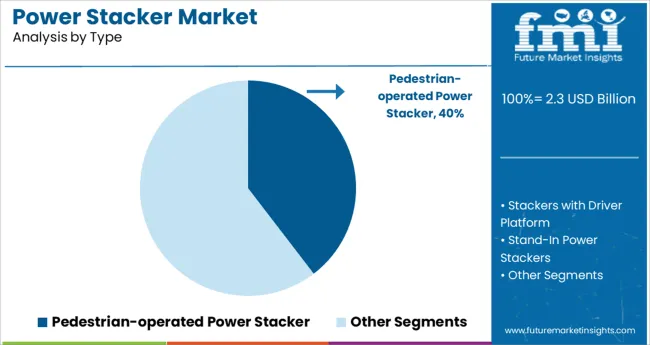

The future outlook remains positive as companies seek reliable lifting solutions to streamline warehouse operations and reduce manual labor. Segmental growth is expected to be led by the pedestrian-operated power stacker type, its primary use in lifting equipment applications, and the 1–1.5 tons load capacity range favored for medium-weight handling tasks.

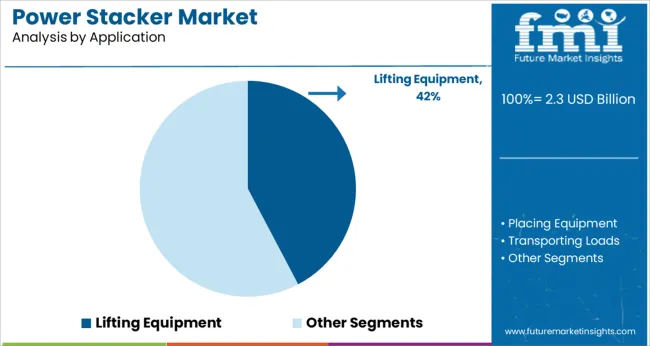

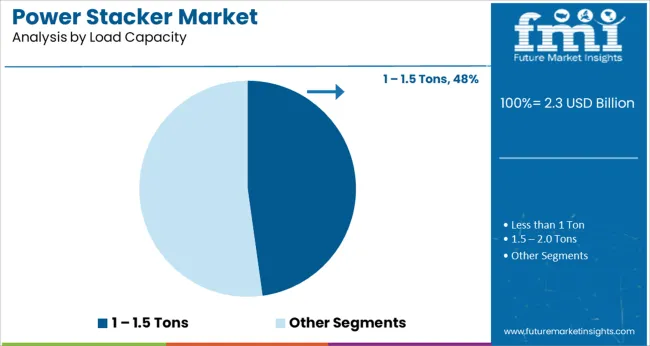

The market is segmented by Type, Application, Load Capacity, and Maximum Lifting Height and region. By Type, the market is divided into Pedestrian-operated Power Stacker, Stackers with Driver Platform, Stand-In Power Stackers, and Rider-Seated Power Stackers. In terms of Application, the market is classified into Lifting Equipment, Placing Equipment, Transporting Loads, and Shifting Equipment. Based on Load Capacity, the market is segmented into 1 – 1.5 Tons, Less than 1 Ton, 1.5 – 2.0 Tons, and More than 2.0 Tons. By Maximum Lifting Height, the market is divided into 1.5 – 3 Meters, Less than 1.5 Meters, 3 – 4.5 Meters, 4.5 – 6 Meters, and More than 6 Meters. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pedestrian-operated power stacker segment is projected to contribute 39.6% of the market revenue in 2025, maintaining its lead among equipment types. This segment’s growth is fueled by its versatility in small to medium-sized warehouses where maneuverability and ease of operation are critical.

The pedestrian model is preferred for its cost-effectiveness and suitability in narrow aisles and confined spaces. Its design minimizes operator fatigue and increases operational safety, factors highly valued in busy logistics and distribution centers.

Additionally, rising adoption of pedestrian stackers in last-mile delivery hubs and retail warehouses has expanded the market. As demand for efficient manual handling continues, pedestrian-operated power stackers are expected to remain a dominant segment.

The lifting equipment application segment is expected to hold 42.3% of the power stacker market revenue in 2025, leading among end-use applications. This segment’s expansion is driven by the critical role of stackers in lifting, moving, and positioning loads within warehouses, manufacturing plants, and logistics hubs.

The versatility of power stackers in handling various materials and pallets has made them indispensable in streamlining internal logistics processes. Increased focus on workplace safety and ergonomics has led to greater reliance on mechanized lifting equipment, reducing manual handling injuries.

Growing warehouse automation and space optimization efforts have further encouraged investments in lifting power stackers. This segment is projected to sustain growth as industries continue to upgrade material handling capabilities.

The 1-1.5 tons load capacity segment is projected to contribute 47.8% of the market revenue in 2025, positioning it as the most preferred load range. This capacity range is well suited for handling medium-weight loads commonly found in retail, warehousing, and light manufacturing sectors.

The segment benefits from offering a balance between lifting power and maneuverability, allowing operators to efficiently move goods without the need for larger, more cumbersome machinery. Its popularity is further supported by diverse operational environments requiring frequent load handling and moderate lifting capacity.

The 1-1.5 tons segment also offers cost advantages over higher-capacity equipment while meeting the majority of day-to-day material handling requirements. With ongoing growth in warehouse throughput and logistics activity, this segment is expected to retain its market leadership.

Over the past few years, adoption of material handling equipment has burgeoned across the globe. Due to its low-cost maintenance, easy material handling capacity, and increased efficiency, the demand for power stackers is expected to rise across retail, food & beverage, and industrial sectors.

As power stackers are easy to operate and does not need certified operators, the demand for these low-cost power stacker for warehouse and inventory purposes is improving. This is predicted to propel the sales of power stacker over the assessment period.

Moreover, advent of automation in diverse industries such as food & beverage, retail, industrial, and others is expected to push the demand for material handling equipment across emerging economies. Besides this, implementation of safety regulations by government and reduced labor costs across India and China will drive the demand for power stacker.

Some of the factors limiting the sales in power stacker market include availability of alternate equipment and high raw material cost. Availability of forklifts through online sales channel in developing regions might limit the demand for power stacker.

Further, high raw-material prices for the production of power stacker is anticipated to limit the growth in power stacker market, especially in low-and-middle income economies. Hence, sales in Latin America market of power stacker might take a nosedive over the upcoming decade.

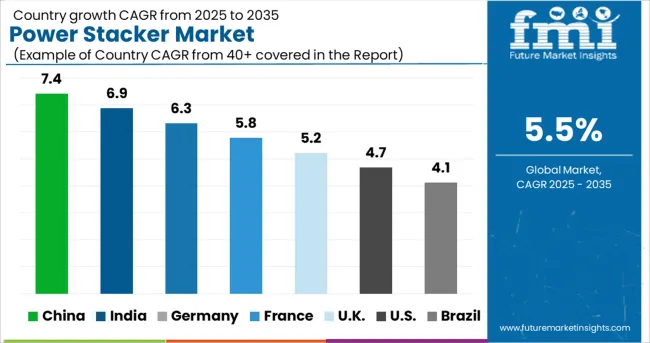

According to Future Market Insights, Asia Pacific power stacker market is poised to exhibit positive growth during the forecast period between 2025 and 2035. Growth in Asia Pacific power stacker market is underpinned by rising demand for automated and compact material handling equipment.

Rapid expansion of construction industry in India is another factor improving the demand for power stacker in the Asia Pacific market. Development of residential and commercial infrastructure in India and China will provide impetus to the demand in the market.

According to India Brand Equity Foundation (IBEF), India is expected to become the world’s third-largest construction industry by 2025. The government in India is set to make an investment of around USD 2.3 Billion for the development of sustainable infrastructure by the end of 2025.

With growing construction activities in the country, the demand for power stacker is expected to increase over the forthcoming decade. Spurred by these factors, key players are eyeing the Asia Pacific market to increase their revenue, thereby, propelling the demand in Asia Pacific.

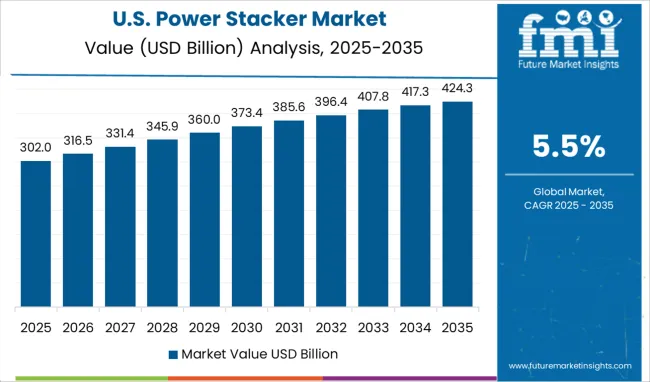

Demand for power stackers is expected to grow at a considerable pace across North America during the forecast period. This is owing to the rapid expansion of construction industry, rising adoption of automated technologies, and introduction of stringent regulations pertaining to safety during material handling.

The power stacker market in North America is mainly dominated by the USA due to growing development of commercial infrastructure in the country. Also, as power stacker are cost-effective and improves the efficiency in warehousing and inventory, the demand for power stacker in the USA is anticipated to surge over the upcoming decade.

Some of the leading manufacturers of power stacker include Toyota Industries Corporation, Godrej Material Handling, CROWN, Presto Lifts, Linde Material Handling GmbH, Reliable Storage Systems, and PROLIFT Handling Ltd. among others.

Leading players in the power stacker market are focusing on developing advanced technology equipment and are adopting strategies such as acquisitions, mergers, collaborations, and partnerships to strengthen their global footprint in the market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.5% from 2025 to 2035 |

| Projected Market Size (2035) | ~USD 3.3 Billions |

| Estimated Market Size (2025) | ~USD 2 Billions |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Type, Load Capacity, Lifting Height, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; Middle East and Africa

|

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Toyota Industries Corporation; Godrej Material Handling; MAINI Materials Movement Pvt. Ltd.; Gloline Equipment Pvt. Ltd.; Jungheinrich AG; CROWN; EP Equipment Co. Ltd.; CLARK EUROPE GmbH; Jost’s Engineering Company Limited; Presto Lifts; Linde Material Handling GmbH; Vestil Manufacturing Corporation; Reliable Storage System; PROLIFT Handling Ltd.

|

| Customization | Available Upon Request |

The global power stacker market is estimated to be valued at USD 2.3 billion in 2025.

It is projected to reach USD 4.0 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are pedestrian-operated power stacker, stackers with driver platform, stand-in power stackers and rider-seated power stackers.

lifting equipment segment is expected to dominate with a 42.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA