The power plant boiler market is witnessing steady growth, driven by increasing global energy demand, modernization of aging power infrastructure, and technological advancements in thermal efficiency. Power plants continue to rely on boiler systems for steam generation and power production, particularly in coal- and gas-based facilities. Stringent environmental norms have encouraged the adoption of cleaner combustion technologies and emission control systems, supporting sustained market relevance.

Hybrid and co-firing technologies are also gaining traction as part of decarbonization strategies. Rapid industrialization in emerging economies, coupled with investments in high-capacity power projects, is contributing to market expansion.

As renewable energy integration increases, conventional boiler systems are expected to evolve through digital monitoring and efficiency optimization solutions. The market outlook remains positive, supported by growing investments in grid stability and energy security..

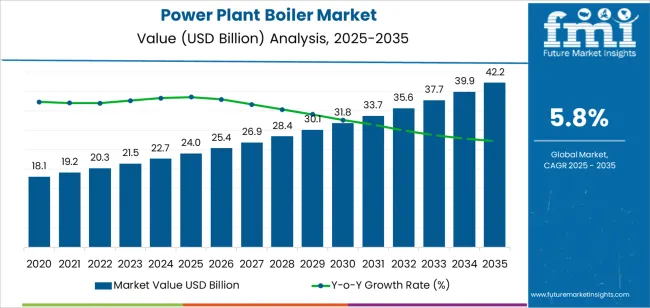

| Metric | Value |

|---|---|

| Power Plant Boiler Market Estimated Value in (2025 E) | USD 24.0 billion |

| Power Plant Boiler Market Forecast Value in (2035 F) | USD 42.2 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

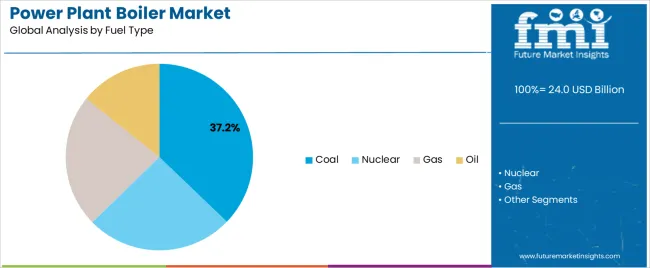

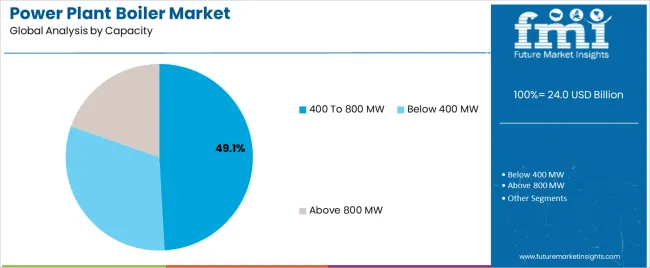

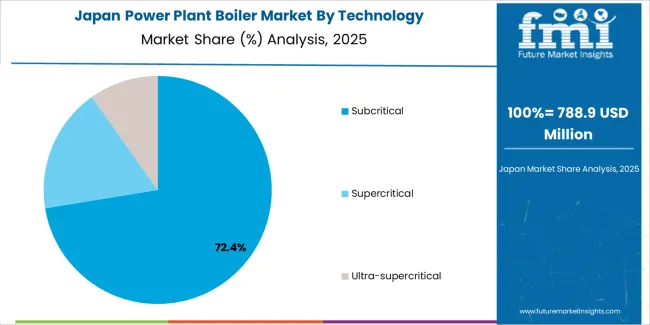

The market is segmented by Technology, Fuel Type, and Capacity and region. By Technology, the market is divided into Subcritical, Supercritical, and Ultra-supercritical. In terms of Fuel Type, the market is classified into Coal, Nuclear, Gas, and Oil. Based on Capacity, the market is segmented into 400 To 800 MW, Below 400 MW, and Above 800 MW. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The subcritical segment leads the technology category with approximately 73.9% share, reflecting its extensive deployment across existing power generation infrastructure. Subcritical boilers operate at relatively lower temperatures and pressures, offering operational simplicity and cost-effectiveness for power producers.

Their proven reliability and established maintenance frameworks make them particularly prevalent in developing regions with high dependence on coal-fired generation. The segment benefits from continuous retrofitting initiatives aimed at improving efficiency and emissions performance without major capital overhauls.

While supercritical and ultra-supercritical technologies are gaining attention, subcritical systems remain dominant due to widespread utilization in small and mid-capacity plants. Supported by stable operation and global availability of compatible components, this segment is expected to maintain its substantial share over the near term..

The coal segment dominates the fuel type category, contributing approximately 37.2% share of the power plant boiler market. Its continued prominence is underpinned by coal’s abundant availability and established infrastructure across many regions. Coal-fired boilers remain the backbone of baseload power generation, particularly in economies with limited access to alternative energy sources.

The segment benefits from advancements in clean coal technologies, including low-NOx burners and flue gas treatment systems, which have enhanced environmental compliance. Although renewable energy adoption is rising, coal-based generation remains essential for grid reliability in emerging markets.

Ongoing modernization of coal-fired plants to improve thermal efficiency and reduce emissions supports the segment’s stability. Despite long-term decarbonization trends, coal is expected to retain a notable role in power generation, sustaining its market share through gradual transition phases..

The 400 to 800 MW segment leads the capacity category with approximately 49.1% share, reflecting its prevalence in large-scale power generation facilities. Boilers within this capacity range offer an optimal balance between efficiency, scalability, and capital cost, making them suitable for both base-load and mid-merit operations.

The segment’s growth is supported by ongoing construction of medium- to large-capacity thermal power plants, particularly in Asia-Pacific. Operators favor this range for its compatibility with various fuel types and ability to maintain consistent output in fluctuating demand conditions.

Retrofit projects aimed at improving emission control and operational reliability have further strengthened its position. With ongoing infrastructure expansion and the need for stable electricity generation capacity, the 400 to 800 MW segment is expected to remain dominant in the global power plant boiler market..

In countries like the United States, China, and the United Kingdom, investments in power plant boilers are expected to increase at a moderate pace. New upgrade projects and demand for efficient power plant boilers are expected to fuel market growth in these countries.

In Japan and South Korea, the market demand is anticipated to be sluggish. Key growth factors in these countries include boilers that deploy renewable fuels and increasing upgrades and replacements in existing power plant boilers.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| United States | 6.10% |

| United Kingdom | 6.60% |

| China | 6.80% |

| Japan | 4.40% |

| South Korea | 2.90% |

In the United States, the revenue generation by power plant boiler companies is expected to total up to USD 42.2 billion by 2035. As per the latest estimations, the market is anticipated to register a CAGR of 6.1% over the forecast period. The top factors enhancing market growth are:

The market for power plant boilers in China is poised to achieve a revenue worth USD 6.7 billion by 2035. Through 2035, the market is anticipated to record a CAGR of 6.8%. Key factors that are impelling market growth are:

The United Kingdom power plant boiler industry is estimated to acquire a value of USD 1.6 billion by 2035. The market is projected to expand at a CAGR of 6.6% throughout the forecast period. The demand is expected to be driven by the following factors:

The power plant boiler industry in Japan is projected to expand at a CAGR of 4.4% over the forecast period. By 2035, the market is anticipated to be valued at USD 3.5 billion. Some common factors that are driving the market growth are:

The South Korea market is anticipated to expand at a CAGR of 2.9% in the next ten years. By 2035, the market is slated to attain a revenue of USD 1.5 billion. The market is anticipated to be propelled by the following aspects:

| Historical CAGR % (2020 to 2025) | 7.30% |

|---|---|

| Forecast CAGR % (2025 to 2035) | 5.50% |

The recent power plant boiler market analysis shows that the subcritical technology is estimated to register a 5.50% CAGR over the forecast period. The main factors that are boosting the segment growth are:

| Historical CAGR % (2020 to 2025) | 7.10% |

|---|---|

| Forecast CAGR % (2025 to 2035) | 5.30% |

According to estimates, the coal segment in the power plant boiler market is anticipated to experience a CAGR of 5.30% over the forecast period. Even though the overall trend for coal shows a prominent decline, from a historical CAGR of 7.1% to 5.30% CAGR estimated for the forecast period, certain factors keep the demand for coal in power plant boilers consistent.

Recent Developments

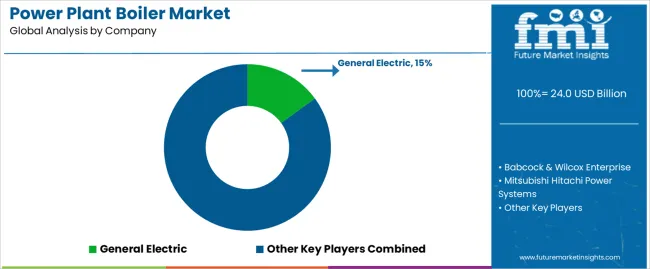

The global power plant boiler market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the power plant boiler market is projected to reach USD 42.2 billion by 2035.

The power plant boiler market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in power plant boiler market are subcritical, supercritical and ultra-supercritical.

In terms of fuel type, coal segment to command 37.2% share in the power plant boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Chemicals Market

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Combined Cycle Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA