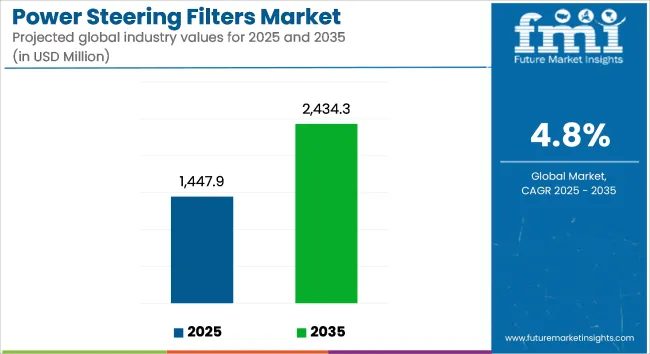

The global power steering filter market is estimated at USD 1,447.9 million in 2025 and is projected to reach USD 2,434.3 million by 2035, reflecting a CAGR of 4.8% over the forecast period. Growth is being supported by rising system complexity and the need to safeguard power steering pumps from fluid contamination.

In 2024, Cardone Industries expanded its Magna Pure inline filter lineup. The updated models were equipped with magnetic filtration and a stainless steel bypass valve, capable of capturing particles up to 190 microns. According to company documentation, the filters were made serviceable and compatible with standard 3/8″, 1/2″, and 5/8″ hoses, contributing to extended system lifespan.

Advanced material configurations have been adopted across commercial and heavy-duty vehicle platforms. Filters featuring wire-backed glass media and reinforced housings were introduced to endure high-pressure and thermal stress. Selection of stainless steel, aluminum, or nylon housings was being tailored to OEM and aftermarket specifications.

Maintenance programs have increasingly specified inline filters to prevent pump failure, with replacement intervals often aligned with fluid flush cycles around 100,000 miles. The use of magnetic filtration elements has been encouraged to reduce wear on internal components such as pump vanes and spools, enhancing reliability over time.

Product innovation has emphasized tool-free filter replacements and visual debris inspection. Some designs integrated clear housings and diagnostic features to support serviceability. Packaged kits including barb fittings and hose clamps were introduced to ease retrofit installation on legacy systems.

Although electric power steering (EPS) is expanding across new vehicle platforms, hydraulic systems remain dominant in commercial fleets and mid-range passenger segments. Continued demand for reliability in steering systems-combined with high service costs for pump replacements-has sustained market traction for inline filtration products.

The market outlook remains positive as contamination control continues to be prioritized across both OEM and aftermarket channels. Replacement and upgrade cycles are expected to remain steady due to ongoing fleet operations and adherence to preventive maintenance protocols.

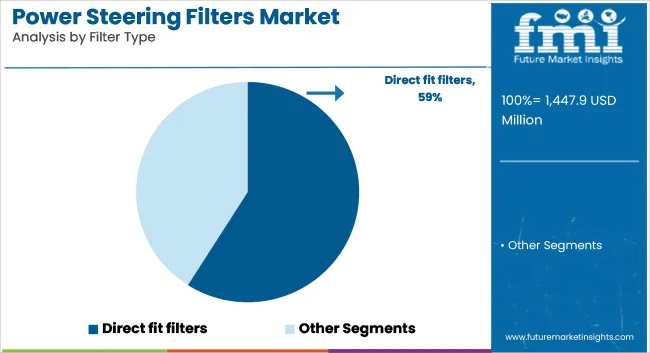

Direct fit filters are estimated to account for approximately 59% of the global market share in 2025 and are projected to grow at a CAGR of 5.0% through 2035. Their adoption is driven by design compatibility, ease of replacement, and tight integration within OEM fuel delivery systems. Direct fit configurations allow for faster installation and reduced service time, making them the preferred choice in both gasoline and diesel-powered vehicles.

OEMs continue to specify direct fit filters in fuel module assemblies for passenger cars and light commercial vehicles to meet filtration efficiency and emissions compliance. Filter manufacturers focus on enhancing media composition, flow rates, and pressure tolerance to match evolving engine requirements, particularly with higher fuel injection pressures in modern ICE platforms.

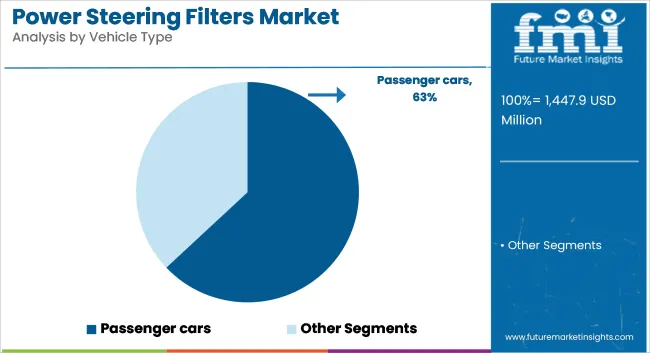

Passenger cars are projected to account for nearly 63% of the global fuel filter market by vehicle type in 2025 and are anticipated to grow at a CAGR of 5.1% through 2035. This dominance is attributed to high production volumes, short replacement intervals, and widespread usage in both urban and long-distance driving. Passenger vehicles, especially those equipped with direct injection and turbocharged engines, demand precise fuel filtration to protect injectors and maintain engine efficiency.

OEMs and aftermarket service networks continue to stock direct fit and in-line filter variants tailored for specific engine platforms. Demand is further supported by a growing global vehicle parc in emerging economies and regulatory pressures to reduce particulate and sulfur-related fuel system degradation.

The aftermarket segment is estimated to hold around 54% of the market in 2025 and is projected to grow at a CAGR of 4.9% through 2035. Growth is supported by periodic filter replacement needs, particularly in regions with poor fuel quality and high vehicle usage. Independent workshops, quick-lube centers, and regional distributors play a critical role in maintaining filter availability and application compatibility across a wide range of vehicle models.

Manufacturers offer cost-effective filter solutions with standardized dimensions and multi-brand compatibility, enabling strong aftermarket penetration in Asia-Pacific, Latin America, and Eastern Europe. As vehicles age and move out of warranty, the aftermarket continues to represent a critical channel for fuel filter replacement and maintenance services.

EV Shift, Filter Neglect, and OEM Integration

As the market share of electric vehicle (EV) and electronic power steering (EPS) systems grows, this will put pressure on the demand for traditional power steering filters in the long run. Many consumers also fail to replace filters on time or even forget to replace them at all. Plus, newer OEMs are moving toward sealed, maintenance-free systems, leaving less room for aftermarket opportunities.

Aftermarket Expansion, Hybrid System Support, and DIY Solutions

There is significant aftermarket replacement potential for legacy and hybrid steering systems, especially in the regions where the vehicle fleet is old. Enhancements in filter media longevity, tool-free installation kits, and multi-fit universal designs are also boosting consumer accessibility. Growing availability of aftermarket parts upgrades, fleet servicing contracts and regional distributor partnerships creates also strong development opportunity for brands focusing on reliability and convenience.

The USA Power Steering Filters Market is steadily growing due to a slower installation rate of OEM part as compared to fitment of vehicles across the country. Filters for power steering are important to prolong the life of hydraulic systems on passenger cars and light-duty trucks.

Independent repair shops and dealership service centers will be focused on fluid cleanliness as a result of part of scheduled maintenance and increasing replacement frequency. Another growth factor is the increasing adoption of remanufactured steering systems which is further pushing the demand for high-performance, low-restriction filters in OE and aftermarket channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

Rising glint in vehicle longevity, particularly in diesel and commercial vehicles, sustains the UK power steering filter market. While the shift to electric vehicles is gaining momentum, the current generation of hydraulic and electro-hydraulic power steering systems will still fuel filter needs. Automotive retailers and service garages now stock a wider variety of high-efficiency filters that reduce system wear and prevent contamination. There’s also greater emphasis on eco-friendly filter designs that work with biodegradable fluids.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

The EU power steering filter market is characterized by Germany, France, and Italy, which together will define the power steering filter market in the region as these countries have a well-established automotive manufacturing base coupled with expansive aftermarket ecosystems.

The usage of hydraulic systems in mid-sized vehicles and commercial fleets drives the demand. EMEA and McKinsey & Company EU directives on emissions and life-cycle sustainability of components are promoting adoption of long-life, recyclable filters. OEMs and Tier 1 Suppliers are adopting innovations in multi-layer media and integrated cooling capabilities to improve system durability.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The Japan power steering filter market is progressing steadily, backed by a high population of hybrid vehicles that connect to electro-hydraulic systems in their lifespans. The emphasis on optimal solution compactness and filter high energy efficiency is consistent with Japanese automotive goals for providing a compact vehicle. Aftermarket demand is healthy as well, especially in the case of aging kei car and sedan fleets. OEM partnerships are already seeing the fruits of standardisation in high-flow, thermally stable filter units.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

With a strong domestic automotive manufacturing sector and a continued need for aftermarket replacements in both passenger and commercial vehicles, the South Korean market for power steering filters is growing. The hydraulic systems of hybrid and legacy models still require high-performance filters as automakers transition towards electric powertrains. Local suppliers are eyeing advanced filtration media segments and modular filter housing that fit new steering system designs. Production volumes are also supported by export demand from Southeast Asia and the Middle East.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The power steering filter market is growing steadily due to the increasing demand for a prolonged lifespan of vehicles due to efficient filtration of fluid and preventive maintenance of passenger and commercial vehicles. The steering system can be affected by many factors, and thus it is essential to protect it by using the power steering filter to remove contamination from the fluid, deburr debris, and wear-and-tear of the pump, and valving on it.

Some of the prominent trends that the market is witnessing include increasing demand in aftermarket market, growing need for reliability and safety of vehicle and rising adoption of hydraulic power steering systems in medium-duty vehicles and industrial fleets.

Other Key Players

Numerous regional and aftermarket brands are driving innovation in compact filtration units, multi-platform compatibility, and extended service interval products, including:

The overall market size for the power steering filter market was USD 1,447.9 million in 2025.

The power steering filter market is expected to reach USD 2,434.3 million in 2035.

The demand for power steering filters will be driven by increasing global vehicle production, rising awareness about vehicle maintenance and performance, growing preference for extended vehicle lifespan, and continued use of hydraulic and electro-hydraulic steering systems in commercial and passenger vehicles.

The top 5 countries driving the development of the power steering filter market are the USA, China, Japan, Germany, and India.

The direct fit filters segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Steering Fluids Market

Power Line Filters Market

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Steering Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Electronic Power Steering (EPS) Market Growth - Trends & Forecast 2025 to 2035

Automotive Power Steering Cooler Market

Automotive Electro-hydraulic Power Steering Pumps Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA