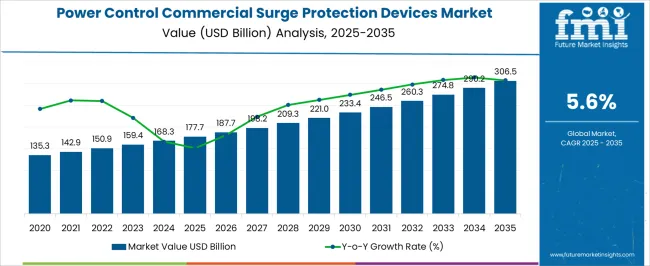

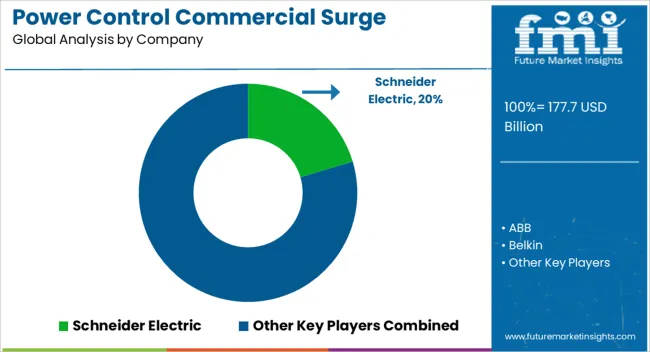

The power control commercial surge protection devices market is projected to grow from USD 177.7 billion in 2025 to USD 306.5 billion by 2035, representing a CAGR of 5.6%. This growth corresponds to an absolute dollar opportunity of USD 128.8 billion over the decade. Expansion is driven by increasing demand for reliable power protection solutions across commercial, industrial, and institutional sectors. Companies can capitalize on this growth by strengthening distribution networks, enhancing service capabilities, and targeting both new installations and replacement projects.

Over the next ten years, the USD 128.8 billion opportunity highlights a steady and profitable growth trajectory for the power control commercial surge protection devices market. By 2035, revenue will be supported by rising adoption in existing facilities and growing commercial infrastructure. The CAGR of 5.6% indicates consistent expansion, allowing firms to scale production, optimize supply chains, and strengthen regional reach. Companies can focus on aligning sales, service, and distribution strategies with market demand to maximize returns. The absolute growth potential provides strong incentives for businesses to maintain operational efficiency while capturing incremental revenue across the forecast period.

| Metric | Value |

|---|---|

| Power Control Commercial Surge Protection Devices Market Estimated Value in (2025 E) | USD 177.7 billion |

| Power Control Commercial Surge Protection Devices Market Forecast Value in (2035 F) | USD 306.5 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

In the early growth phase of the power control commercial surge protection devices market, revenue expands steadily from USD 177.7 billion in 2025, reflecting a CAGR of 5.6%. Growth during this period is primarily driven by initial adoption in commercial and industrial facilities seeking reliable power protection. Companies focus on establishing distribution networks, building service capabilities, and strengthening relationships with contractors and facility managers. The absolute dollar opportunity in this phase is moderate, allowing firms to refine strategies, optimize operations, and respond to market feedback.

In the late growth phase, approaching 2035 and a market size of USD 306.5 billion, the power control commercial surge protection devices market experiences accelerated revenue capture due to broader adoption and replacement of older systems. Market strategies shift toward scaling production, expanding regional presence, and leveraging established client networks. The absolute dollar opportunity in this stage is substantial, representing most of the USD 128.8 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 5.6% CAGR translates into profitable, sustained growth.

The power control commercial surge protection devices market is witnessing sustained expansion owing to increasing deployment of sensitive electronic equipment across industrial, commercial, and infrastructure applications. With heightened risks of equipment damage due to power fluctuations, lightning strikes, and grid switching events, surge protection systems have become a core element of power reliability and safety planning.

Regulatory mandates related to power quality and asset protection in commercial buildings, data centers, and smart grid installations are also contributing to market acceleration. The integration of IoT-connected systems and automation infrastructure is further driving demand for higher-capacity and technologically advanced surge protection devices.

Manufacturers are investing in modular, compact, and maintenance-free solutions to meet evolving safety standards and reduce installation costs.

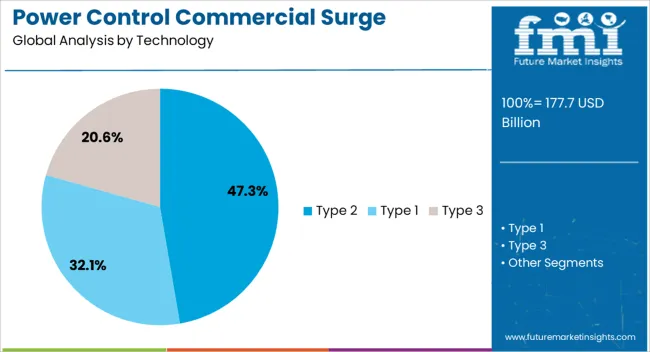

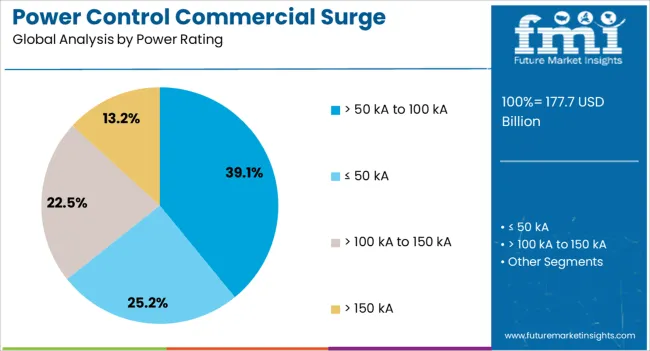

The power control commercial surge protection devices market is segmented by technology, power rating, and geographic regions. By technology, power control commercial surge protection devices market is divided into Type 2, Type 1, and Type 3. In terms of power rating, power control commercial surge protection devices market is classified into > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA.

Regionally, the power control commercial surge protection devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Type 2 devices are expected to dominate with a 47.3% share in 2025, making them the leading technology in the commercial surge protection devices market. Their primary advantage lies in protecting downstream electrical infrastructure from indirect lightning strikes and switching surges, which are the most common causes of voltage transients in commercial environments.

Type 2 devices are typically installed at main distribution panels, offering broad protection for circuit components and minimizing costly equipment downtime. Their ease of integration with existing electrical frameworks and compatibility with modular designs make them ideal for scalable commercial installations.

Ongoing digital transformation across sectors such as retail, hospitality, and data services is reinforcing demand for dependable mid-level protection offered by Type 2 devices.

Surge protection devices in the > 50 kA to 100 kA power rating range are projected to hold 39.1% of the market share in 2025, positioning them as the leading power rating segment. These devices offer a balance of high discharge capacity and cost-efficiency, making them suitable for a broad spectrum of commercial facilities.

Their ability to manage moderate to high surge currents ensures enhanced reliability for critical infrastructure such as hospitals, industrial plants, and large office complexes. Increasing awareness regarding the economic and operational impact of unmitigated surge events is prompting facility managers to opt for higher-rated, maintenance-free solutions.

Additionally, energy efficiency incentives and grid modernization programs are promoting broader deployment of high-capacity surge protection devices across developing and developed markets alike.

The power control commercial surge protection devices market is growing as commercial buildings, industrial facilities, and critical infrastructure increasingly require protection against voltage spikes, transient surges, and electrical faults. Surge protection devices (SPDs) safeguard electrical equipment, HVAC systems, IT infrastructure, and lighting systems from damage caused by lightning, switching events, and power fluctuations. Rising adoption of smart buildings, energy-efficient systems, and advanced electrical networks is driving demand for SPDs that offer high reliability and compliance with safety standards.

Manufacturers providing modular, scalable, and IoT-enabled surge protection devices with real-time monitoring capabilities are well-positioned to capture opportunities in commercial, industrial, and utility sectors globally.

Market growth is constrained by the high cost of advanced SPDs and the complexity of integrating them into existing commercial power systems. Devices must be compatible with varying voltage ratings, panel configurations, and building electrical layouts. Installation often requires skilled electricians to ensure proper grounding, coordination with circuit breakers, and compliance with local electrical codes. Improper installation can reduce device efficacy, posing risks to sensitive equipment. Smaller commercial buildings or budget-constrained facilities may delay adoption due to upfront costs and technical complexity. Manufacturers are addressing these challenges by offering plug-and-play designs, pre-tested modular units, and technical support services, which simplify deployment and increase the appeal of surge protection solutions.

Market trends are influenced by the adoption of smart building technologies, IoT integration, and predictive maintenance solutions. Modern SPDs feature digital monitoring and remote alert capabilities to detect surges, assess device health, and prevent equipment failure. Integration with building management systems (BMS) and energy management platforms enables real-time tracking of power quality and coordinated response to electrical events. Modular and scalable designs allow seamless upgrades as buildings expand or technology evolves. These trends emphasize proactive protection, energy efficiency, and operational visibility, enhancing adoption in commercial complexes, data centers, hospitals, and industrial facilities where reliable power continuity is critical.

Opportunities arise from expanding commercial infrastructure, strict electrical safety regulations, and the growing need to protect sensitive equipment. Urbanization and the rise of smart offices, retail centers, and data-driven facilities increase demand for reliable surge protection devices. Regulatory standards such as IEC, UL, and NEC require compliant SPDs for building safety, driving adoption. High-value IT, communication, and industrial equipment must be safeguarded against voltage surges to prevent downtime and financial losses. Manufacturers offering high-performance, certified, and scalable devices with monitoring and reporting features are well-positioned to capitalize on these opportunities, particularly in regions experiencing commercial expansion and modernization of electrical infrastructure.

Market growth is restrained by intense competition, rising component costs, and evolving regulatory standards. Premium SPDs require high-quality varistors, surge arresters, and monitoring modules, which can increase manufacturing costs. Alternative low-cost surge protection solutions from regional manufacturers may reduce market share for established brands. Compliance with multiple regional and international electrical standards requires continuous product testing and certification, adding to operational complexity. Rapid technological changes, such as the integration of IoT monitoring, necessitate frequent updates to product design. Until cost-efficient manufacturing, regulatory alignment, and differentiated high-performance features are widely implemented, adoption may remain concentrated in high-value commercial and industrial applications.

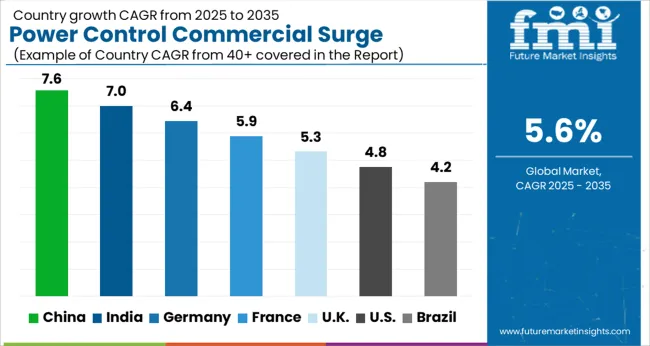

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

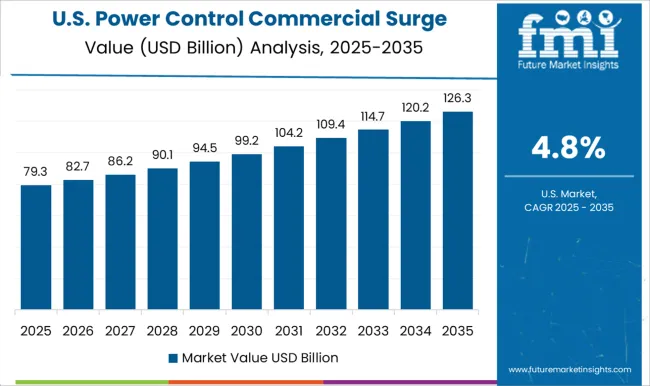

| USA | 4.8% |

| Brazil | 4.2% |

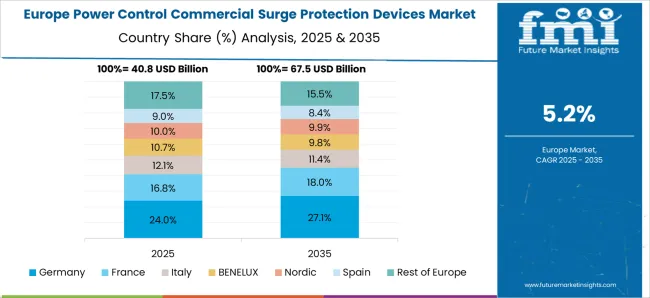

The global power control commercial surge protection devices market is projected to grow at a CAGR of 5.6% through 2035, driven by demand across commercial buildings, data centers, and industrial facilities. Among BRICS nations, China has been recorded with 7.6% growth, where production and deployment of surge protective devices (SPDs) for electrical safety and grid reliability have been extensively carried out by companies such as Schneider Electric, ABB, and Siemens. India has been observed at 7.0%, supported by rising adoption in commercial infrastructure, IT parks, and manufacturing units. In the OECD region, Germany has been measured at 6.4%, where production for industrial, commercial, and utility applications has been steadily maintained. The United Kingdom has been noted at 5.3%, reflecting growing use in commercial construction and office complexes, while the USA has been recorded at 4.8%, with deployment in commercial facilities, industrial plants, and critical infrastructure being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market for power control commercial surge protection devices in China is expanding at a CAGR of 7.6%, driven by increasing commercial construction, industrial automation, and the growing adoption of electrical infrastructure solutions. Manufacturers are supplying surge protection devices for commercial buildings, data centers, industrial facilities, and renewable energy installations. Government initiatives promoting industrial digitization, smart building standards, and electrical safety regulations are supporting adoption. Pilot deployments in commercial and industrial facilities demonstrate operational benefits including improved electrical safety, reduced equipment downtime, and protection of critical electronic systems. Collaborations between device manufacturers, construction firms, and technology providers are enhancing device performance, durability, and compliance with Chinese standards. Rising demand for reliable electrical infrastructure continues to drive the Chinese power control commercial surge protection devices market.

The market for power control commercial surge protection devices in India is growing at a CAGR of 7.0%, supported by industrial expansion, commercial infrastructure development, and smart building adoption. Manufacturers are providing devices for offices, factories, data centers, and renewable energy installations to protect critical electrical systems. Government initiatives promoting electrical safety, smart cities, and infrastructure modernization encourage adoption. Pilot deployments in commercial and industrial facilities demonstrate benefits including reduced equipment failures, enhanced safety, and improved power quality. Collaborations between local manufacturers, construction companies, and technology providers enhance device reliability, performance, and compliance with Indian electrical standards. Expanding commercial and industrial construction projects are key drivers for the Indian market.

The market for power control commercial surge protection devices in Germany is recording a CAGR of 6.4%, driven by industrial automation, commercial building projects, and renewable energy integration. Manufacturers provide surge protection devices for factories, office complexes, hospitals, and solar installations. Government initiatives promoting industrial digitization, energy efficiency, and electrical safety standards foster adoption. Pilot deployments in industrial and commercial facilities demonstrate operational benefits such as reduced equipment damage, improved power quality, and minimized downtime. Collaborations between device manufacturers, research institutions, and construction companies are enhancing device performance, durability, and regulatory compliance. Germany’s focus on sustainable infrastructure and safe electrical systems supports continuous growth in the market.

The United Kingdom is experiencing a CAGR of 4.5% in its cryogenic ASU market, driven by demand from steel, chemical, and energy sectors. Manufacturers are developing high-purity, energy-efficient, and modular ASU systems for industrial gas production. Government initiatives promoting energy efficiency, industrial modernization, and environmental compliance are supporting market adoption. Pilot projects in steel plants, refineries, and chemical complexes demonstrate operational benefits including higher gas purity, reduced operational costs, and improved process reliability. Collaborations between domestic manufacturers, technology providers, and industrial clients are advancing automation, unit scalability, and energy efficiency. Rising industrial gas demand and sustainable process requirements continue to support the UK ASU market.

The market for power control commercial surge protection devices in the United States is expanding at a CAGR of 4.8%, driven by commercial building growth, industrial facilities, and renewable energy integration. Manufacturers supply devices for data centers, factories, offices, and solar installations to protect critical electrical systems. Government programs promoting electrical safety, energy efficiency, and modern infrastructure foster market adoption. Pilot deployments in commercial and industrial environments demonstrate benefits including reduced equipment failures, improved power quality, and minimized operational downtime. Collaborations between manufacturers, technology providers, and construction companies are improving device durability, performance, and compliance with USA electrical standards. Expanding commercial and industrial projects continue to drive market growth in the United States.

The power control commercial stage market is moderately consolidated, featuring a mix of global electrical equipment giants and regional specialists that provide power distribution, voltage regulation, load management, and energy control solutions for commercial buildings, theaters, entertainment venues, and large-scale event infrastructure. Competition revolves around control system reliability, real-time monitoring capabilities, integration with building automation systems, and modular design for scalable power handling.

Key players such as Schneider Electric, ABB, Siemens, Eaton, and Legrand maintain strong positions through broad product portfolios, service networks, and integration expertise. Companies like Lutron Electronics and Crestron Electronics focus on stage lighting control, dimming systems, and automation interfaces that complement power control systems. Competition is heightened by technological innovation, where manufacturers emphasize energy efficiency, fault detection, remote diagnostics, and predictive maintenance capabilities. North America and Europe show mature demand driven by strict energy management regulations and retrofit projects, while Asia-Pacific exhibits high growth potential due to commercial infrastructure development and rising investments in entertainment and hospitality venues. Strategic alliances, turnkey solutions, and after-sales service quality are being used as core competitive levers to capture market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 177.7 Billion |

| Technology | Type 2, Type 1, and Type 3 |

| Power Rating | > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Belkin, Eaton, Emerson Electric, Hubbell, Intermatic, JMV, Legrand, Littelfuse, LS Electric, Mersen, Raycap, Phoenix Contact, Siemens, and Socomec |

| Additional Attributes | Dollar sales by type including Type 1, Type 2, and Type 3 devices, application across commercial buildings, industrial facilities, and data centers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for electrical safety, increasing adoption of smart building technologies, and growing awareness of surge protection solutions. |

The global power control commercial surge protection devices market is estimated to be valued at USD 177.7 billion in 2025.

The market size for the power control commercial surge protection devices market is projected to reach USD 306.5 billion by 2035.

The power control commercial surge protection devices market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in power control commercial surge protection devices market are type 2, type 1 and type 3.

In terms of power rating, > 50 ka to 100 ka segment to command 39.1% share in the power control commercial surge protection devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA