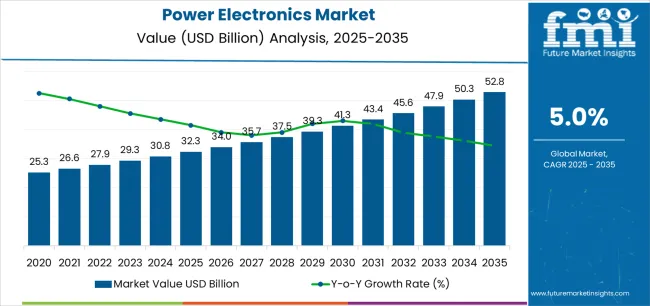

The Power Electronics Market is estimated to be valued at USD 32.3 billion in 2025 and is projected to reach USD 52.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The Power Electronics market is witnessing strong growth, driven by increasing adoption of energy-efficient electronic devices and renewable energy systems across industrial, commercial, and consumer sectors. The market is supported by rising demand for high-performance power conversion and management solutions, which enhance energy efficiency and reliability in applications ranging from electric vehicles to industrial automation. Technological advancements in semiconductors, power modules, and wide bandgap materials are enabling smaller, lighter, and more efficient devices that meet evolving energy and performance standards.

Regulatory emphasis on energy conservation, reduction of carbon emissions, and integration of smart grids is further supporting market expansion. Growing adoption of electric vehicles, industrial motor drives, and renewable energy inverters is driving demand for advanced power electronics components.

The integration of IoT and intelligent monitoring systems is creating additional opportunities by enabling real-time energy management and predictive maintenance As industries increasingly prioritize energy efficiency and operational reliability, the Power Electronics market is expected to maintain sustained growth, supported by ongoing innovation in device architecture, materials, and applications.

| Metric | Value |

|---|---|

| Power Electronics Market Estimated Value in (2025 E) | USD 32.3 billion |

| Power Electronics Market Forecast Value in (2035 F) | USD 52.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

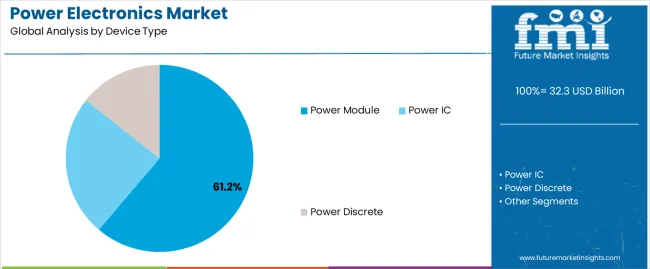

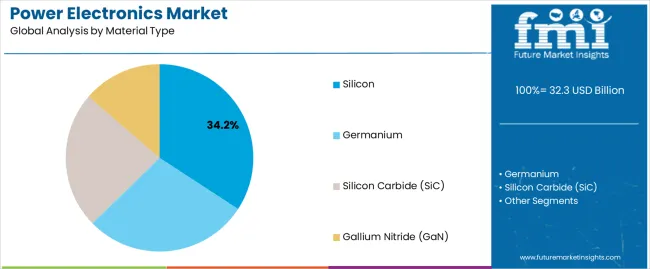

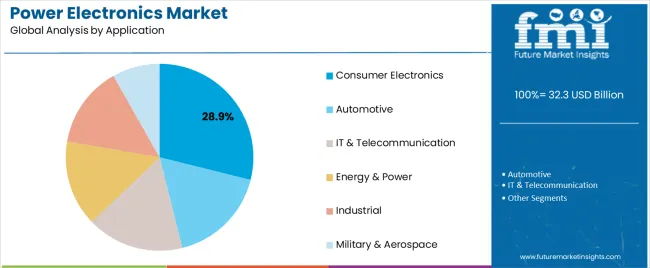

The market is segmented by Device Type, Material Type, and Application and region. By Device Type, the market is divided into Power Module, Power IC, and Power Discrete. In terms of Material Type, the market is classified into Silicon, Germanium, Silicon Carbide (SiC), and Gallium Nitride (GaN). Based on Application, the market is segmented into Consumer Electronics, Automotive, IT & Telecommunication, Energy & Power, Industrial, and Military & Aerospace. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power module device type segment is projected to hold 61.2% of the market revenue in 2025, establishing it as the leading device type. Growth is driven by the increasing requirement for compact, high-performance modules that can handle high power density and ensure efficient energy conversion in a variety of applications. Power modules integrate multiple semiconductor components, such as diodes, transistors, and sensors, into a single package, improving system reliability, reducing size, and enabling efficient thermal management.

Their adoption is being accelerated by rising demand in industrial automation, electric vehicles, renewable energy systems, and smart consumer electronics. Advancements in packaging technology, wide bandgap materials, and modular design approaches are further enhancing performance and scalability.

Organizations are leveraging power modules to optimize energy efficiency, reduce operational costs, and support high-speed switching applications As industries increasingly seek solutions that balance performance, size, and reliability, the power module segment is expected to maintain its market leadership, supported by continued technological innovation and growing application diversity.

The silicon material type segment is anticipated to hold 34.2% of the market revenue in 2025, making it the leading material category. Growth is being driven by the established performance, reliability, and cost-effectiveness of silicon-based power electronic components. Silicon enables efficient energy conversion, thermal stability, and long operational lifespans, which are essential for industrial, automotive, and consumer applications.

Technological improvements in silicon wafer processing and device fabrication have further enhanced efficiency and reduced manufacturing costs. Silicon-based devices are widely adopted in inverters, motor drives, and power modules due to their proven reliability and compatibility with existing systems. As demand for energy-efficient electronics and renewable energy integration increases, silicon continues to dominate the material landscape.

The balance of performance, availability, and cost efficiency ensures its ongoing adoption The silicon segment is expected to maintain its leading position, supported by growing demand for high-reliability applications and continuous improvements in device efficiency, making it a preferred choice across multiple industries.

The consumer electronics application segment is projected to account for 28.9% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is driven by increasing demand for energy-efficient and high-performance electronics, including smartphones, laptops, smart appliances, and wearable devices. Power electronics components, such as power modules and silicon-based devices, enable reduced energy consumption, compact form factors, and improved thermal management, which are critical in consumer applications.

Rising adoption of IoT-enabled devices, smart homes, and connected consumer electronics is further accelerating demand. Manufacturers are leveraging advanced power electronic solutions to enhance device performance, reliability, and battery efficiency, improving user experience while meeting sustainability and regulatory standards.

The need for efficient power conversion and management in increasingly compact devices reinforces the importance of this segment As consumer electronics continue to evolve toward intelligent, connected, and energy-efficient systems, this application segment is expected to remain a primary driver of market growth, supported by ongoing innovation in power electronic technologies.

In 2020, the global power electronics market showed a potential worth USD 25.3 billion, according to a report from Future Market Insights (FMI). The power electronics market witnessed significant growth, registering a CAGR of 3.10% from 2020 to 2025.

| Historical CAGR | 3.10% |

|---|---|

| Forecast CAGR | 5.3% |

Preference in technology, particularly in semiconductor devices and power management systems, contributed to the expansion of the market. The boom in demand for energy-efficient solutions and the need for power optimization further augmented the uptake of power electronics worldwide.

The market performance during this period underscored its importance by enabling efficient power conversion, control, and management across diverse applications.

The power electronics market is forecasted to experience accelerated growth, with a projected CAGR of 3.1% from 2020 to 2025. Several factors are expected to drive this growth, including improvement in industries requiring power electronics solutions, such as electric vehicles, renewable energy systems, and smart grids.

The boost on energy conservation, electrification, and the transition towards sustainable energy sources fuel the global adoption of power electronics solutions.

The below section shows the leading segment. Based on the device type, the module segment is accounted to hold a market share of 61.2% in 2025. Based on material, the silicon carbide segment is accounted to hold a market share of 34.2% in 2025.

Modules integrate various components into a single package, including power semiconductors, gate drivers, and protection features.

Silicon carbide (SiC) offers superior electrical properties to traditional silicon-based semiconductors, including higher breakdown voltage, lower switching losses, and higher thermal conductivity.

| Category | Market Share in 2025 |

|---|---|

| Module | 61.2% |

| Silicon Carbide | 34.2% |

Based on the device type, the module segment stands out, capturing a significant market share of 61.2%.

With the increasing complexity of power electronic systems and the demand for compact and reliable solutions, modules provide an integrated approach that simplifies design, reduces development time, and improves system performance.

Modules integrate multiple components, such as power semiconductors, gate drivers, and protection circuitry, into a single package, offering convenience and efficiency for power electronic system designers.

Based on material, the silicon carbide segment is accounted to hold a market share of 34.2% in 2025.

Silicon carbide (SiC) offers superior electrical properties compared to traditional silicon-based semiconductors where such advantages make SiC an attractive choice for high-performance power electronic applications, such as electric vehicles, renewable energy systems, and industrial automation.

The boom in demand for energy-efficient and high-power-density solutions further propels the adoption of SiC-based power devices. Industries strive to improve efficiency, reduce emissions, and meet stringent performance requirements.

The silicon carbide segment continues to extend its presence in the market, offering advanced semiconductor solutions for the next generation of power electronics.

The table describes the top five countries ranked by revenue, with Australia holding the top position.

The rapid adoption of renewable energy solutions and the robust mining sector boost the market in Australia. With significant investments in solar, wind, and battery storage projects and advanced power electronics in mining operations, Australia showcases leadership in energy efficiency and sustainability-driven applications.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR through 2035 |

|---|---|

| United States | 4.1% |

| Germany | 2.7% |

| Japan | 2% |

| China | 5.8% |

| Australia | 8.8% |

The United States market strongly emphasizes technological innovation and industrial automation. Power electronics are vital in various sectors, such as automotive, aerospace, and renewable energy.

The United States is a leader in electric vehicle adoption, requiring advanced power electronics for vehicle propulsion systems and charging infrastructure. The country mainly focuses on renewable energy sources like solar and wind power that boost demand for power electronics solutions for grid integration and energy storage systems.

Germany is renowned for its engineering prowess and high-tech industries. Power electronics are integral to automotive manufacturing, machinery, and industrial automation sectors in Germany.

With a strong emphasis on energy efficiency and sustainability, the industries in Germany rely on advanced power electronics for optimizing energy consumption and improving process efficiency.

Japan is known for its advanced technology and innovation-driven economy. Power electronics are important for the automotive industry, particularly in hybrid and electric vehicles in Japan.

Power electronics find extensive applications in consumer electronics, industrial automation, and renewable energy systems, reflecting a commitment to technological advancement and energy sustainability.

China has one of the largest electric vehicles, renewable energy installations, and consumer electronics markets. Power electronics in China is pivotal in transitioning towards clean energy and electrified transportation.

Government initiatives promoting energy conservation and technological innovation, are taken where China presents significant opportunities for power electronics manufacturers catering to diverse applications and industries.

Australia has abundant solar and wind resources, leading to significant investments in renewable energy projects. Power electronics enable efficient energy conversion, grid integration, and energy storage solutions in the renewable energy sector.

The mining industry relies on power electronics for equipment automation, energy management, and operational efficiency improvements, contributing to the dominance of the market in the country.

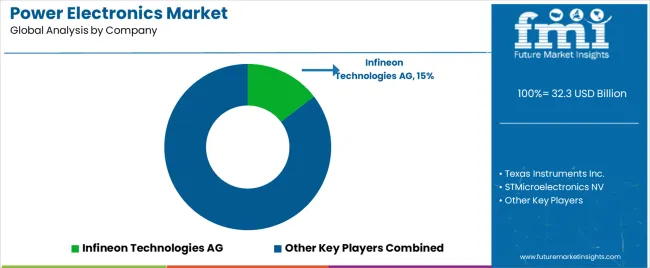

The competitive landscape of the power electronics market is dynamic, featuring a mix of established players and emerging companies. Niche players widely focus on specific segments, like power modules or wide bandgap semiconductors, contributing to the competitive intensity.

Technological innovation, product differentiation, and strategic partnerships are vital for maintaining market share in this highly competitive environment. Factors such as quality, reliability, and cost-effectiveness play crucial roles in determining the competitive positioning of companies within the power electronics market.

Some of the key developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 32.3 billion |

| Projected Market Valuation in 2035 | USD 52.8 billion |

| Value-based CAGR 2025 to 2035 | 5.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered |

Device Type, Material Type, Application, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, Rest of Eastern Europe, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Qualcomm; ABB Ltd.; Infineon Technologies AG; Texas Instruments Inc.; ROHM Co. Ltd; STMicroelectronics NV; Renesas Electronics Corporation; Vishay Intertechnologies Inc.; Toshiba Corporation; Mitsubishi Electric Corporation |

The global power electronics market is estimated to be valued at USD 32.3 billion in 2025.

The market size for the power electronics market is projected to reach USD 52.8 billion by 2035.

The power electronics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in power electronics market are power module, power ic and power discrete.

In terms of material type, silicon segment to command 34.2% share in the power electronics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA