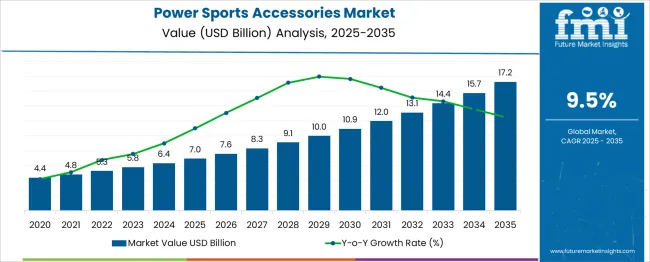

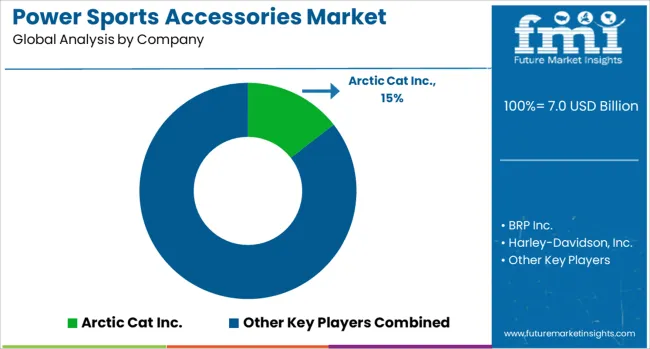

The Power Sports Accessories Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 17.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Power Sports Accessories Market Estimated Value in (2025 E) | USD 7.0 billion |

| Power Sports Accessories Market Forecast Value in (2035 F) | USD 17.2 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

As riders seek greater customization, comfort, and safety, demand for performance-enhancing and protective accessories has risen. The expansion of off-road trail networks and adventure tourism has further accelerated market activity, particularly in North America and Europe. In response, manufacturers are innovating with durable, weather-resistant, and technologically integrated accessories tailored for extreme environments.

The growing prominence of online retail, coupled with aggressive branding and social media influence, continues to reshape the buyer journey and drive product visibility. Future growth is likely to be driven by lifestyle-oriented consumers who prioritize both utility and aesthetic appeal, reinforcing the role of accessories as an integral part of the broader powersports ecosystem.

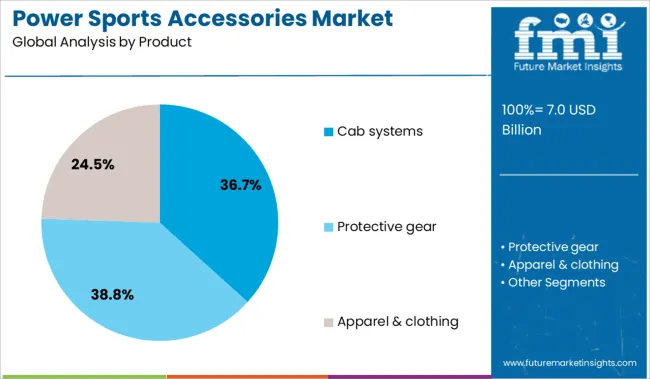

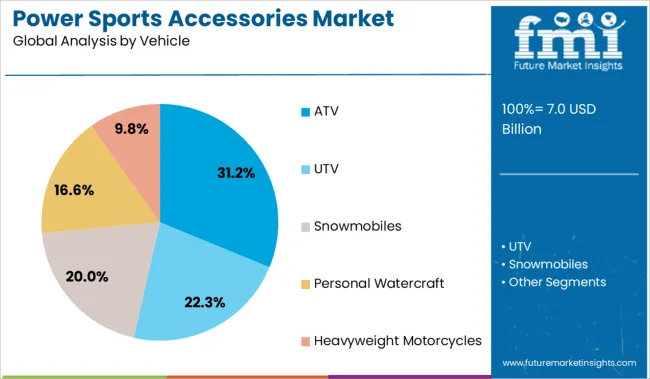

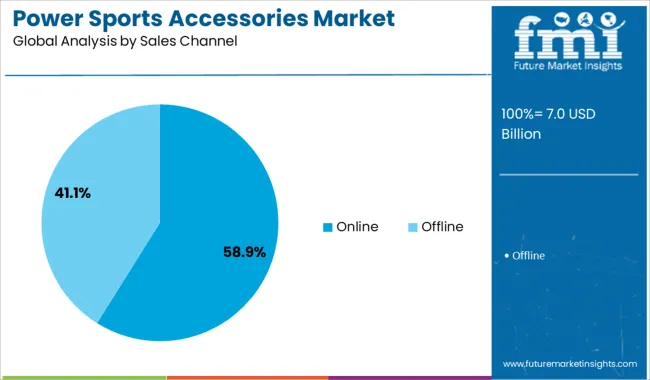

The power sports accessories market is segmented by product, vehicle, and sales channel and geographic regions. The power sports accessories market is divided into Cab systems, Protective gear, and Apparel & clothing. In terms of vehicles, the power sports accessories market is classified into ATV, UTV, Snowmobiles, Personal Watercraft, and Heavyweight Motorcycles. The sales channel of the power sports accessories market is segmented into Online and Offline. Regionally, the power sports accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cab systems segment dominates the product category with a 36.7% market share, driven by the increasing need for enclosed protection and climate control in off-road vehicles. These systems enhance rider comfort and safety, particularly in adverse weather or rugged terrain, making them a preferred upgrade for enthusiasts and professional users alike.

The rising demand for premium cab kits equipped with heating, ventilation, and soundproofing features has contributed significantly to segment expansion. Additionally, technological integration such as touchscreen dashboards, lighting systems, and weather-resistant sealing has made cab systems more functional and appealing.

Fleet operators and recreational users are increasingly investing in cab solutions to extend usage seasons and improve the overall riding experience. With growing customization trends and higher spending on vehicle personalization, the segment is expected to maintain a strong growth trajectory across key power sports markets.

The ATV segment leads the vehicle category with a 31.2% share, reflecting its widespread use in recreational, agricultural, and utility applications. ATVs are favored for their versatility and maneuverability, which drives consistent demand for performance, safety, and storage accessories.

The segment has gained traction from expanding off-road adventure tourism and increased usage in rural and construction sectors. Accessories such as skid plates, winches, storage racks, and lighting kits are commonly added to ATVs to enhance functionality and adapt them for specialized use.

Continued advancements in suspension systems and lightweight materials are encouraging more riders to personalize their ATVs for specific terrains and conditions. As manufacturers offer broader accessory compatibility and modular attachment systems, the ATV segment is expected to remain a core contributor to market revenues within the powersports space.

The online sales channel dominates the distribution landscape with a commanding 58.9% share, propelled by increasing consumer preference for convenience, variety, and direct-to-door delivery. Digital platforms offer broad access to product reviews, fitment guides, and comparison tools, enabling informed purchasing decisions for enthusiasts and first-time buyers alike.

E-commerce portals, brand-owned websites, and online marketplaces have become key sales drivers, especially among tech-savvy consumers and younger demographics. Retailers are leveraging data analytics and targeted marketing strategies to personalize product offerings and enhance customer engagement.

Additionally, the rise of mobile shopping and integrated payment solutions has streamlined the buying process for power sports accessories. As digital infrastructure and consumer trust in online transactions continue to strengthen globally, the dominance of the online channel is projected to increase further, making it a strategic focal point for manufacturers and distributors.

The market for power sports accessories is being shaped by growing demand for vehicle customization, enhanced user experience, and performance upgrades. Products such as winches, protective bumpers, LED lighting systems, and performance exhaust parts are being incorporated into ATVs, UTVs, snowmobiles, and personal watercraft. Demand has been observed in both recreational and industrial applications where reliability and customization are prioritized. Retailers and OEMs are offering bundled accessory kits and warranty-backed installations to meet consumer expectations for quality and convenience.

Accessories are being selected to enhance performance on varied terrains and improve rider safety. Reinforced bumpers, skid plates, and reinforced racks are being fitted to off-road vehicles for protection against impact and debris. LED light bars and auxiliary lighting systems are being installed to provide better visibility during night rides or remote operations. Performance exhaust systems and air filters have been adopted to increase torque, responsiveness, and engine efficiency. Winches, tow hooks, and recovery gear are now essential for industrial or agricultural vehicle usage. Manufacturers and retailers have collaborated to offer plug-and-play kits that simplify installation, ensuring accessory adoption among less technical users. As adventure travel and rescue operations have increased, accessory purchases are being motivated by functional upgrades as well as lifestyle expression.

Growth has been restricted by inconsistent regulatory frameworks across markets, particularly for lighting brightness, noise regulations, and exhaust emissions. Accessory electrical load issues have caused compatibility problems with stock alternators and charging systems. Limited standardization of mounting points across different vehicle brands has led to customization or drilling during installation, which deters some buyers. Warranty voidance concerns have been raised when aftermarket parts are installed without OEM approval. Quality variations among low-cost accessory providers have resulted in safety-related recalls or liability claims. As service networks remain fragmented, obtaining certified installation services and reliable maintenance information has remained difficult for accessory consumers.

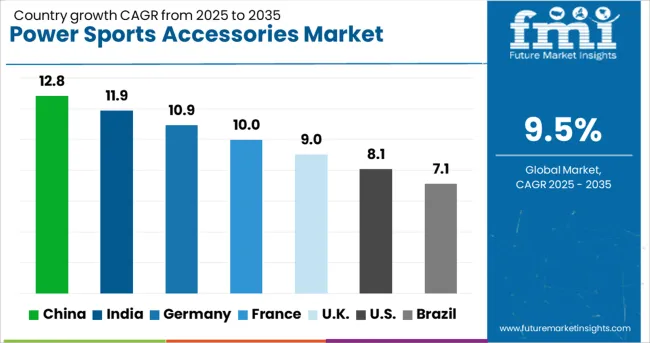

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

The global power sports accessories market is projected to grow at a 9.5% CAGR from 2025 to 2035. Among the 40 countries analyzed, China leads at 12.8%, followed by India at 11.9% and Germany at 10.9%, while France posts 10.0% and the United Kingdom records 9.0%. These growth premiums stand at +35% for China, +25% for India, and +15% for Germany, while France and the UK maintain growth close to the global baseline. Market expansion is driven by rising ATV and UTV sales in Asia, performance upgrade trends in Europe, and personalization features across all major economies. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 12.8% CAGR, driven by increasing ownership of ATVs, snowmobiles, and personal watercraft. Demand for premium accessories such as high-performance exhaust systems, advanced suspension kits, and GPS-enabled navigation solutions is rising. Domestic manufacturers are investing in lightweight alloys and durable components to enhance speed and reliability. Growth in recreational trails and adventure sports continues to fuel accessory adoption across multiple segments. Expansion of e-commerce platforms and specialty retail outlets ensures improved accessibility for aftermarket products, catering to both performance enthusiasts and leisure riders nationwide. Partnerships between global brands and local distributors are strengthening supply networks, promoting availability of advanced gear and custom-fit accessory solutions.

India is forecast to grow at an 11.9% CAGR, supported by rising demand for ATVs and dirt bikes among adventure riders. Aftermarket accessories such as skid plates, luggage racks, and high-performance tires dominate consumer purchases. Leading brands are forming strategic alliances with local distributors to expand product availability. Higher income levels and growing interest in recreational riding in semi-urban regions are accelerating premium accessory adoption, including helmets, armored jackets, and luggage systems. Organized off-road racing leagues and motorsport events are boosting demand for protective equipment and performance-enhancing kits. Local manufacturers are introducing cost-effective accessory solutions while premium global brands are targeting niche segments through specialized sales channels.

Germany is expected to grow at a 10.9% CAGR, led by strong demand for high-end motorcycles, snowmobiles, and side-by-side vehicles. Premium accessory lines now feature carbon-fiber body panels and lightweight alloy components to improve speed and fuel efficiency. Electronics integration is gaining traction, with GPS navigation, Bluetooth communication systems, and smart display consoles incorporated into advanced kits. Heated grips and thermal riding apparel are increasingly popular in colder regions, supporting year-round riding. German manufacturers are investing in diagnostic accessories designed for connected vehicles, providing predictive maintenance and performance monitoring. These innovations ensure Germany remains a leading market for technologically advanced power sports accessories.

France is forecast to grow at a 10.0% CAGR, driven by growing interest in recreational boating, ATV riding, and off-road biking. Demand for marine audio systems, quick-release cargo mounts, and protective covers is increasing. Manufacturers are introducing modular accessory systems for motorcycles and scooters, allowing customization and easy installation. Eco-conscious buyers are influencing product innovation, with brands offering luggage systems and apparel made from environmentally friendly materials. Specialty dealerships that offer customization services and tailored performance upgrades are supporting aftermarket expansion. The combination of product innovation and increased recreational activity positions France as a key market for power sports accessories across marine and land-based applications.

The United Kingdom is projected to grow at a 9.0% CAGR, supported by increased interest in recreational riding and motorsport activities. Premium helmets featuring augmented reality displays and connectivity-enabled performance gear are gaining traction. Subscription-based sales models are being adopted by leading suppliers to strengthen aftermarket engagement and retention. Seasonal products, including heated apparel and rainproof riding gear, remain in high demand among long-distance and adventure riders. Growing investment in motorsport parks and off-road racing events continues to drive demand for specialized accessories. Custom-fit storage solutions and navigation-enabled devices are also trending across ATV and motorcycle categories, supporting performance and safety enhancements.

Leading OEMs including BRP Inc., Polaris Industries, Honda, Kawasaki, Yamaha, Suzuki, KTM, Harley-Davidson, Arctic Cat, Textron, Triumph, and Zero Motorcycles dominate this market with comprehensive accessory portfolios covering suspension kits, storage systems, audio solutions, and connectivity-enabled helmets. BRP strengthens its position through the Can-Am LinQ quick-mount platform, which delivers modularity and cross-vehicle compatibility for riders. Polaris and Yamaha are expanding global dealer networks to promote bundled accessory packages, while Zero Motorcycles focuses on electric vehicle-oriented accessories targeting performance and eco-conscious users. Competitive strategies emphasize customization flexibility, robust material design, and integration of smart technologies such as GPS navigation and wireless communication, catering to recreational and utility riders seeking enhanced comfort, safety, and convenience.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Product | Cab systems, Protective gear, and Apparel & clothing |

| Vehicle | ATV, UTV, Snowmobiles, Personal Watercraft, and Heavyweight Motorcycles |

| Sales Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arctic Cat Inc., BRP Inc., Harley-Davidson, Inc., Honda Motor Co., Ltd., Kawasaki Heavy Industries Ltd., KTM AG, Polaris Industries Inc., Suzuki Motor Corporation, Textron Inc., Triumph Motorcycles Ltd., Yamaha Motor Co., Ltd., and Zero Motorcycles Inc. |

| Additional Attributes | Dollar sales by accessory category (protective gear, performance upgrades, connectivity-enabled components) and vehicle type (ATVs, UTVs, motorcycles, snowmobiles), driven by rising recreational riding and off-road adventure activities. Regional trends are led by North America, with Asia-Pacific experiencing rapid growth. Manufacturers emphasize innovation in GPS navigation, Bluetooth integration, modular storage systems, and durable materials to enhance safety, performance, and rider convenience. |

The global power sports accessories market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the power sports accessories market is projected to reach USD 17.2 billion by 2035.

The power sports accessories market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in power sports accessories market are cab systems, _lights, _roofs, _mirrors, _windshield, _doors, _others, protective gear, _helmet, _gloves, _body armor, _others, apparel & clothing, _jackets, _pants, _boots and _others.

In terms of vehicle, atv segment to command 31.2% share in the power sports accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA