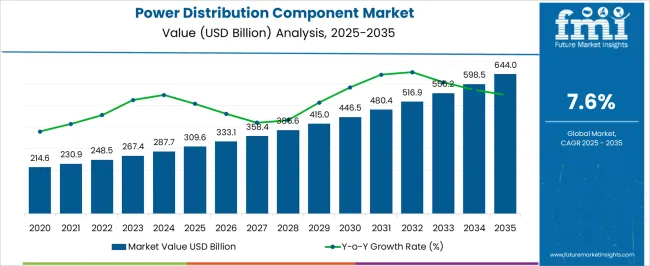

The power distribution component market is expected to rise from USD 309.6 billion in 2025 to USD 644.0 billion by 2035, growing at a CAGR of 7.6% and demonstrating consistent annual growth. In 2025, the market value stands at USD 309.6 billion, increasing from USD 287.7 billion in 2024, and reaching USD 333.1 billion in 2026. Each year shows steady expansion of approximately 6–8%, reflecting ongoing demand for transformers, switchgear, and distribution equipment. This pattern allows manufacturers and suppliers to plan production, manage inventory, and capture recurring revenue effectively.

By 2035, the market is projected to reach USD 644.0 billion, creating an absolute increase of USD 334.4 billion from 2025, supported by the 7.6% CAGR. Annual values progress steadily, rising from USD 358.4 billion in 2027 to USD 598.5 billion in 2034. These yearly increments provide a clear view of demand trends, enabling stakeholders to adjust capacity, optimize supply chains, and plan operational expansion. The reliable YoY growth ensures visibility for revenue forecasting and highlights long-term opportunities across the power distribution ecosystem.

| Metric | Value |

|---|---|

| Power Distribution Component Market Estimated Value in (2025 E) | USD 309.6 billion |

| Power Distribution Component Market Forecast Value in (2035 F) | USD 644.0 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The power distribution component segment is a key part of the broader electrical equipment and infrastructure market. In 2025, the segment accounts for USD 309.6 billion, representing approximately 18–19% of the overall parent market. By 2035, it is projected to reach USD 644.0 billion, maintaining a similar share of around 18%. This consistent percentage highlights the segment’s continued importance within the broader market, driven by demand for transformers, switchgear, circuit breakers, and other essential distribution equipment. Its contribution underscores the strategic role of power distribution components in supporting electricity networks and ensuring reliable energy delivery.

Over the decade, the segment grows at a CAGR of 7.6% from USD 309.6 billion in 2025 to USD 644.0 billion in 2035, reflecting growth that outpaces many other sub-segments of the parent market. The stable 18–19% share emphasizes predictable revenue opportunities for manufacturers, suppliers, and integrators.

The power distribution component market is witnessing steady growth due to increasing investments in transmission infrastructure, urban electrification projects, and the global shift toward reliable and decentralized power networks. Regulatory reforms favoring grid modernization and renewable integration are further driving demand for advanced, modular, and safety-focused components.

Expansion of industrial and commercial sectors, especially in emerging economies, is catalyzing upgrades in both medium- and low-voltage distribution systems. The transition to smart grids, coupled with enhanced digital monitoring and predictive maintenance solutions, is reshaping how distribution assets are deployed, managed, and optimized.

Long-term, this market is expected to benefit from electrification of transport and rural grid access initiatives.

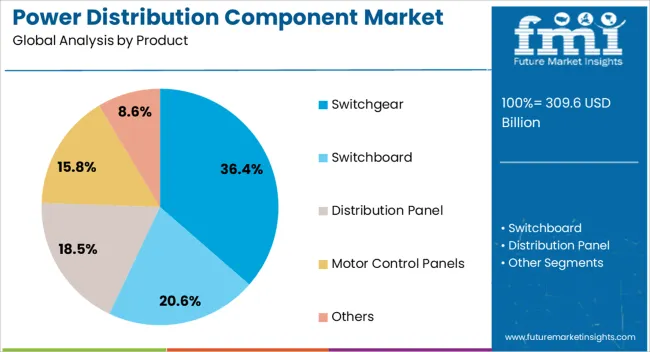

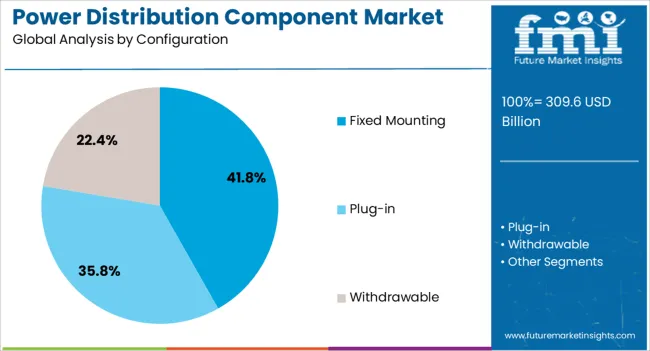

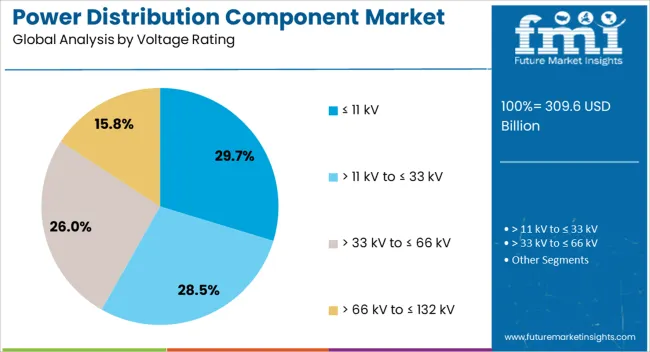

The power distribution component market is segmented by product, configuration, voltage rating, application, and geographic regions. By product, power distribution component market is divided into Switchgear, Switchboard, Distribution Panel, Motor Control Panels, and Others. In terms of configuration, power distribution component market is classified into Fixed Mounting, Plug-in, and Withdrawable. Based on voltage rating, power distribution component market is segmented into ≤ 11 kV, > 11 kV to ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV to ≤ 132 kV. By application, power distribution component market is segmented into Industrial, Residential, Commercial, and Utility. Regionally, the power distribution component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Switchgear is anticipated to lead the market by product type, contributing 36.40% to total revenue in 2025. This dominance is driven by its critical role in system protection, fault isolation, and load control across distribution networks.

Growing demand for uninterrupted power supply, especially in commercial complexes, substations, and industrial zones, has bolstered the need for reliable switchgear solutions. Ongoing automation and digitization within substations have enhanced the need for intelligent switchgear capable of remote diagnostics and operational flexibility.

Additionally, retrofit programs and expansion of smart cities are creating significant demand for both air-insulated and gas-insulated switchgear in urban and semi-urban areas.

Fixed mounting configuration is expected to capture 41.80% of the market share in 2025, making it the leading segment by configuration. This trend is driven by the reliability, simplified installation, and cost-efficiency that fixed-mounted systems provide in low- to medium-voltage environments.

Widely adopted across power utilities and commercial buildings, these systems offer reduced risk of loose connections and are ideal for static installations with minimal relocation needs. With increased construction activity and retrofitting of older grids, utilities are favoring configurations that ensure long-term reliability and minimal maintenance.

Their use in compact switchboards and panel boards further adds to their demand in space-constrained deployments.

The ≤ 11 kV segment is projected to lead the market by voltage rating, accounting for 29.70% of total revenue in 2025. This share is supported by the extensive use of low-voltage systems in residential, commercial, and light industrial applications.

Rapid urbanization, rising electrification in Tier-II and Tier-III cities, and increasing smart building deployments are driving the need for low-voltage distribution components. Furthermore, distributed energy generation such as rooftop solar and microgrids often operate within this voltage range, boosting component integration.

Ease of maintenance, cost-effectiveness, and wide applicability position ≤ 11 kV systems as the preferred choice for last-mile connectivity and secondary distribution networks.

The power distribution component market is growing as the demand for reliable, efficient, and safe electricity transmission and distribution systems increases globally. Components such as circuit breakers, switches, transformers, fuses, and connectors play a critical role in ensuring uninterrupted power flow, protecting equipment, and enhancing grid stability. Growth is driven by rising electricity consumption, urbanization, industrial expansion, renewable energy integration, and modernization of aging electrical infrastructure.

Manufacturers offering durable, energy-efficient, and technologically advanced components are well-positioned to capture opportunities across residential, commercial, industrial, and utility sectors. Additionally, the adoption of smart grid technologies and digital monitoring solutions is accelerating the demand for intelligent, connected power distribution components.

The power distribution component market faces challenges related to high procurement and installation costs, technical complexity, and regulatory compliance. Advanced components with enhanced safety features, energy efficiency, and smart capabilities are expensive, which can limit adoption among cost-sensitive end-users. Installation and integration into existing power distribution systems require specialized knowledge, skilled labor, and adherence to strict technical standards. Compliance with electrical safety regulations, certification requirements, and environmental standards varies by region and adds operational complexity. Additionally, maintaining and replacing components in high-voltage or remote systems can increase downtime and operational costs. Manufacturers must focus on cost-effective solutions, technical support, and regulatory adherence to overcome these challenges while ensuring reliability and safety.

The market is trending toward smart grid adoption, IoT-enabled components, and energy-efficient solutions. Intelligent circuit breakers, sensors, and monitoring devices allow real-time tracking of electricity flow, predictive maintenance, and fault detection. Integration with energy management systems and IoT platforms improves operational efficiency, reduces energy loss, and ensures grid stability. Manufacturers are increasingly focusing on components with low power loss, high reliability, and compact designs to optimize system performance. Automation, remote control, and cloud connectivity are becoming standard features in modern power distribution systems. These trends are enabling utilities, industries, and commercial establishments to implement more resilient, cost-effective, and sustainable power infrastructure.

The market offers opportunities in renewable energy integration, modernization of electrical infrastructure, and industrial sector expansion. The growth of solar, wind, and other distributed energy resources requires reliable, high-performance components for grid interconnection, voltage regulation, and protection. Aging electrical infrastructure in developed regions presents opportunities for upgrading transformers, switchgear, and protection devices to improve safety and efficiency. Industrial facilities increasingly demand advanced power distribution components to ensure uninterrupted operations and energy efficiency. Emerging markets investing in urbanization, smart cities, and electrification projects further enhance market potential. Companies providing scalable, durable, and smart components with strong technical support can capitalize on growing opportunities across residential, commercial, and industrial power distribution networks globally.

Market growth is restrained by supply chain challenges, technical complexity, and intense competition. High-quality raw materials, such as copper and specialty alloys, are critical for component manufacturing, and supply shortages can disrupt production. Advanced components require precise engineering, strict quality control, and skilled labor, which increases operational complexity. Competition from low-cost regional manufacturers and alternative solutions can pressure prices and reduce margins for established players. Additionally, frequent updates in regulatory and safety standards require continuous investment in compliance, testing, and certifications. Until supply chains stabilize, technical expertise is widely available, and differentiation strategies are implemented, adoption may remain focused on high-value, safety-critical applications.

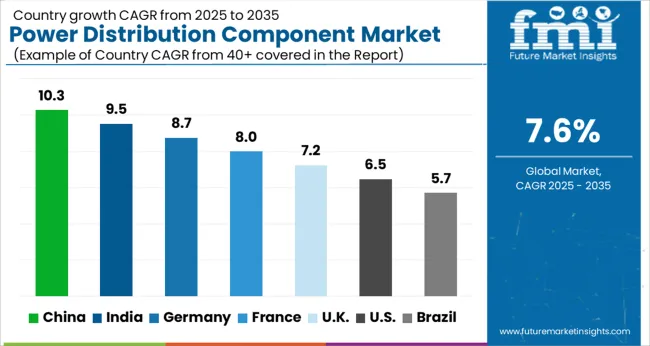

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global power distribution component market is projected to grow at a CAGR of 7.6% through 2035, supported by increasing demand across electricity networks, industrial installations, and infrastructure projects. Among BRICS nations, China has been recorded with 10.3% growth, driven by large-scale production and deployment of transformers, switchgear, and circuit breakers for urban and industrial electrification, while India has been observed at 9.5%, supported by rising adoption in grid modernization and renewable energy integration projects. In the OECD region, Germany has been measured at 8.7%, where production and utilization in industrial, residential, and commercial power networks have been steadily maintained. The United Kingdom has been noted at 7.2%, reflecting consistent deployment in smart grid and industrial power applications, while the USA has been recorded at 6.5%, with production and utilization across utility, industrial, and commercial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is leading the adoption of power distribution components, registering a CAGR of 10.3%, driven by rapid urbanization, industrial expansion, and grid modernization programs. Manufacturers are focusing on switchgears, transformers, circuit breakers, and smart distribution units to support high-capacity electricity networks. Government initiatives promoting renewable energy integration, smart grids, and energy efficiency are accelerating adoption. Pilot projects in industrial parks, commercial complexes, and urban infrastructure demonstrate operational benefits such as improved reliability, reduced downtime, and enhanced grid monitoring. Collaborations between domestic component manufacturers, technology providers, and utility companies are enhancing product quality, automation, and system integration. Rising demand for reliable and efficient electricity distribution continues to propel China’s market for power distribution components.

Power distribution component market in India is expanding at a CAGR of 9.5%, fueled by rising electricity demand, grid modernization, and renewable energy integration. Manufacturers are supplying switchgears, transformers, circuit breakers, and smart distribution equipment for industrial, commercial, and residential applications. Government initiatives promoting smart grids, energy efficiency, and rural electrification are supporting market growth. Pilot deployments in industrial zones and urban utilities demonstrate operational benefits including reduced outages, improved grid monitoring, and enhanced safety. Collaborations between domestic manufacturers, technology providers, and utility companies are enhancing automation, component durability, and system interoperability. India’s expanding electricity infrastructure and emphasis on smart and reliable power distribution continue to drive market adoption.

Germany’s power distribution component market is recording a CAGR of 8.7%, supported by industrial demand, renewable energy integration, and smart grid initiatives. Manufacturers are focusing on advanced switchgears, circuit breakers, transformers, and digital monitoring systems for reliable electricity distribution. Government programs promoting renewable energy, industrial digitization, and grid modernization are driving adoption. Pilot projects in industrial facilities, commercial complexes, and energy hubs demonstrate operational benefits such as improved reliability, reduced downtime, and better load management. Collaborations between technology providers, utility companies, and research institutions are enhancing digital monitoring, automation, and component efficiency. Germany’s emphasis on renewable integration and smart grids continues to propel market growth.

The United Kingdom is experiencing a CAGR of 7.2% in the power distribution component market, driven by smart grid development, industrial demand, and renewable energy adoption. Manufacturers are providing switchgears, transformers, circuit breakers, and intelligent monitoring systems for urban and industrial electricity networks. Government initiatives promoting energy efficiency, smart grids, and renewable energy integration support market adoption. Pilot deployments in commercial and industrial facilities demonstrate operational benefits such as improved reliability, enhanced safety, and optimized load management. Collaborations between domestic manufacturers, technology providers, and utility companies are advancing automation, component durability, and system integration. Continued focus on smart grid initiatives and renewable integration drives the UK power distribution component market.

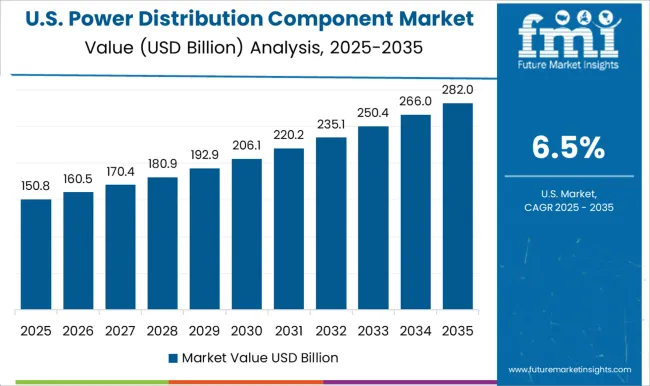

The United States power distribution component market is growing at a CAGR of 6.5%, supported by rising electricity demand, infrastructure upgrades, and renewable energy integration. Manufacturers are focusing on advanced switchgears, transformers, circuit breakers, and smart monitoring solutions for industrial, commercial, and residential applications. Government programs promoting smart grids, energy efficiency, and modernization of aging infrastructure are boosting market adoption. Pilot projects in industrial zones and urban utilities demonstrate operational benefits such as reduced outages, improved grid monitoring, and enhanced reliability. Collaborations between technology providers, utility companies, and research institutions are enhancing automation, system integration, and component efficiency. The USA emphasis on energy reliability and smart grid expansion continues to sustain growth in power distribution components.

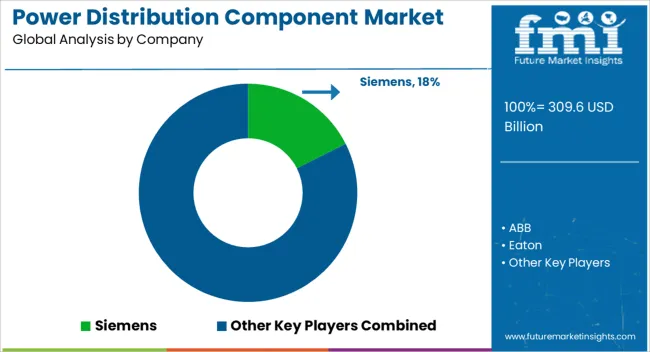

Global demand for power distribution components is driven by industrial, commercial, and utility applications, with suppliers competing on reliability, voltage ratings, and system compatibility. Siemens is positioned as a leading provider, with brochures emphasizing switchgear, circuit breakers, and busbar systems, including technical specifications, short-circuit ratings, and installation guidance. ABB competes with modular solutions, with literature highlighting compact designs, load management capabilities, and environmental protection levels. Eaton provides a wide range of low- and medium-voltage components, with brochures presenting operational limits, mechanical endurance, and integration notes. Fuji Electric, General Electric, and Hitachi Energy deliver high-performance switchgear and relays, with technical literature detailing rated voltages, thermal limits, and protection features. Hubbell, Hyosung Heavy Industries, Hyundai Electric, and L&T Electrical offer solutions for industrial and commercial distribution networks, with brochures highlighting enclosure specifications, fault tolerance, and compliance with international standards. Lucy Group, Mitsubishi Electric, Norelco, Powell Industries, Rittal, Schneider Electric, and START Electrical focus on both standard and customized components, with brochures emphasizing environmental resistance, operational reliability, and ease of maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 309.6 Billion |

| Product | Switchgear, Switchboard, Distribution Panel, Motor Control Panels, and Others |

| Configuration | Fixed Mounting, Plug-in, and Withdrawable |

| Voltage Rating | ≤ 11 kV, > 11 kV to ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV to ≤ 132 kV |

| Application | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Eaton, Fuji Electric, General Electric, Hitachi Energy, Hubbell, Hyosung Heavy Industries, Hyundai Electric, L&T Electrical, Lucy Group, Mitsubishi Electric, Norelco, Powell Industries, Rittal, Schneider Electric, and START Electrical |

| Additional Attributes | Dollar sales vary by component type, including switchgear, circuit breakers, transformers, relays, and busbars; by application, such as industrial, residential, commercial, and utility power distribution; by end-use industry, spanning energy, manufacturing, and infrastructure; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by grid modernization, increasing electricity demand, and adoption of smart distribution technologies. |

The global power distribution component market is estimated to be valued at USD 309.6 billion in 2025.

The market size for the power distribution component market is projected to reach USD 644.0 billion by 2035.

The power distribution component market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in power distribution component market are switchgear, switchboard, distribution panel, motor control panels and others.

In terms of configuration, fixed mounting segment to command 41.8% share in the power distribution component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA