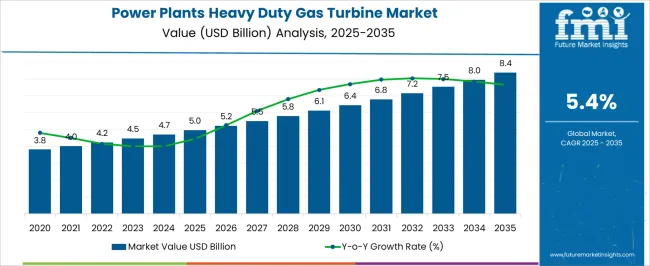

The power plants heavy duty gas turbine market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

This stage of expansion reflects a consistent demand for reliable and efficient turbines in large-scale power generation facilities. Heavy duty gas turbines are increasingly being adopted in combined-cycle plants and base-load operations due to their high efficiency and long operational life. Growth during this period underscores the role of energy diversification strategies, where turbines remain a dependable choice for both industrial and utility-scale power generation projects.

From 2030 to 2035, the market is expected to advance further from USD 6.4 billion to USD 8.4 billion, marking a smooth continuation of the growth curve. This phase highlights rising investments in power infrastructure, replacement of aging assets, and the deployment of higher-capacity turbine models to meet increasing energy demand. Heavy duty gas turbines are positioned as an essential component in delivering reliable output, particularly in regions where energy grids face pressure from fluctuating demand. The stable curve shape indicates a balanced growth trajectory, suggesting that while the market is not experiencing rapid surges, it is providing consistent opportunities for manufacturers and operators. With utilities seeking cost-effective and dependable generation assets, the market outlook for heavy duty gas turbines remains firmly positive.

| Metric | Value |

|---|---|

| Power Plants Heavy Duty Gas Turbine Market Estimated Value in (2025 E) | USD 5.0 billion |

| Power Plants Heavy Duty Gas Turbine Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The power plants heavy duty gas turbine market represents a substantial segment within several larger energy and equipment domains, with its influence varying based on the scope of each parent category. Within the global gas turbine market, heavy duty turbines contribute nearly 45%, reflecting their central role in high-capacity power generation. In the power generation equipment market, which includes turbines, boilers, generators, and ancillary systems, heavy duty gas turbines hold about 12%, showing their importance among diverse power technologies. Within the thermal power plant equipment market, their share stands at close to 18%, as they form a critical part of natural gas-based plants that compete with coal and oil systems.

In the combined cycle power plant market, heavy duty gas turbines account for approximately 40%, highlighting their essential role in driving high efficiency by integrating with steam turbines. Finally, within the broader energy infrastructure and utilities market, the share of heavy duty gas turbines is around 8%, given the dominance of other generation methods such as renewables, hydro, and nuclear in utility portfolios. Collectively, these percentages indicate that heavy duty gas turbines maintain dominant importance in gas turbine and combined cycle sectors, while their shares in broader power and infrastructure markets remain significant but more balanced alongside other competing technologies. Their concentrated strength in large-scale generation underscores their relevance to countries and utilities focused on reliable, high-output natural gas-based power.

The market is experiencing significant momentum, driven by rising global electricity demand, growing emphasis on cleaner energy generation, and modernization of existing power infrastructure. The integration of advanced turbine technologies is enabling higher efficiency, reduced emissions, and improved operational flexibility, making them a preferred choice for utility-scale power generation.

Increased investments in upgrading grid reliability and transitioning from coal to gas-based generation are further strengthening market growth. The demand is also being influenced by government policies aimed at reducing carbon footprints and enhancing energy security.

Heavy duty gas turbines, with their ability to operate at high capacity and support fluctuating energy loads, are becoming essential components in hybrid and renewable-integrated power plants Continuous innovation in materials, design, and digital monitoring solutions is extending the operational life and performance of these turbines, positioning the market for sustained expansion across both developed and emerging economies.

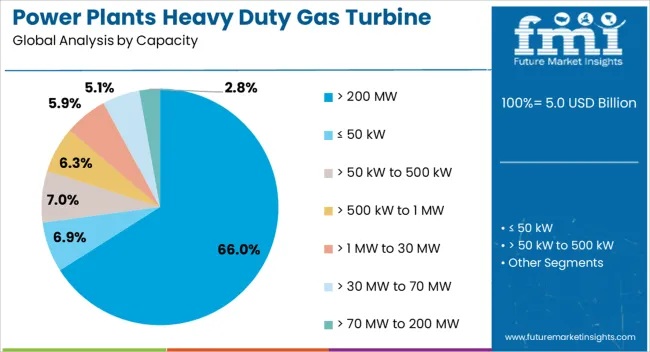

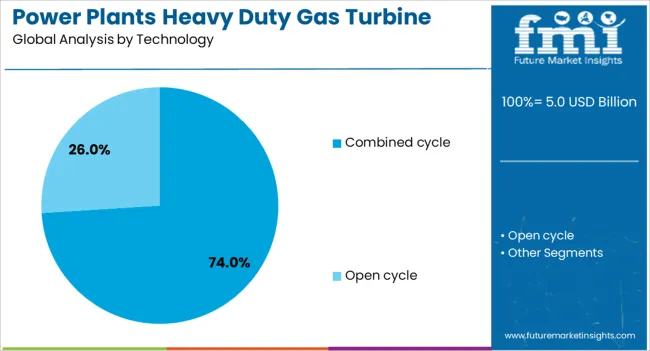

The power plants heavy duty gas turbine market is segmented by capacity, technology, and geographic regions. By capacity, power plants heavy duty gas turbine market is divided into > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW. In terms of technology, power plants heavy duty gas turbine market is classified into combined cycle and open cycle. Regionally, the power plants heavy duty gas turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capacity segment of greater than 200 MW is projected to hold 66% of the power plants heavy duty gas turbine market revenue share in 2025, making it the largest segment. This dominance has been supported by the ability of high-capacity turbines to deliver large-scale power generation efficiently, meeting the demands of densely populated urban and industrial regions. Their high output and operational reliability make them ideal for base load applications as well as for supporting peak load demands.

In addition, their integration with advanced control systems enables optimized performance and reduced operational costs over time. The segment's growth has also been propelled by the ongoing shift towards centralized power generation facilities that prioritize high efficiency and low emissions.

Utility providers are favoring these larger capacity units for their ability to provide long-term energy security while maintaining compliance with stringent environmental standards The high scalability and compatibility with combined cycle configurations have further reinforced the leading position of this capacity range.

The combined cycle technology segment is anticipated to account for 74% of the market revenue share in 2025, making it the leading technology type. This leadership is attributed to the superior efficiency levels achieved through the integration of gas and steam turbines in a single power generation system.

By utilizing the waste heat from gas turbines to drive steam turbines, combined cycle plants significantly improve overall fuel utilization and lower greenhouse gas emissions. This technology has been favored in both developed and developing markets due to its ability to produce high output with reduced operational costs and minimal environmental impact.

The rising global focus on sustainable power generation has further accelerated its adoption, especially in regions where regulatory frameworks encourage low-emission technologies Enhanced by digital monitoring and predictive maintenance tools, combined cycle plants offer extended operational life and consistent performance, securing their position as the preferred choice for large-scale power generation projects worldwide.

The power plants heavy duty gas turbine market is expanding as utilities demand reliable, flexible, and efficient generation assets. Opportunities are strengthening in combined-cycle and cogeneration facilities, while trends focus on fuel flexibility, efficiency improvements, and digital monitoring integration. Challenges persist in high capital costs, operational complexity, and competition from alternative generation sources. In my opinion, turbine manufacturers that optimize performance, reduce costs, and provide strong aftermarket services will hold an advantage, ensuring continued relevance of heavy duty gas turbines in global energy generation strategies.

Demand for heavy duty gas turbines in power plants has been driven by the growing need for reliable, efficient, and flexible electricity generation. Gas turbines are preferred for their ability to provide quick start-up, load balancing, and high efficiency, especially in combined-cycle plants. Industrializing regions are increasingly investing in these turbines to meet surging energy requirements, while developed markets rely on them for grid stability. In my opinion, demand will remain strong as utilities seek dependable generation assets that balance efficiency, resilience, and operational adaptability.

Opportunities are increasing in combined-cycle and cogeneration applications, where heavy duty gas turbines deliver higher efficiency and reduced fuel consumption. Power producers are investing in upgrading existing plants with advanced turbines to maximize output and improve lifecycle economics. Opportunities are also visible in emerging markets where industrial growth fuels demand for distributed and large-scale power solutions. I believe manufacturers who tailor turbines for diverse grid needs and offer aftermarket services such as maintenance, upgrades, and digital performance monitoring will capture significant opportunities in this evolving energy landscape.

Trends indicate a clear focus on enhancing turbine efficiency and fuel flexibility. Operators are investing in turbines capable of operating on natural gas as well as blended fuels such as hydrogen, ensuring adaptability to shifting energy mixes. Another trend is the integration of digital monitoring systems for predictive maintenance and improved lifecycle management. In my opinion, these developments reflect a transition toward turbines that not only generate power but also serve as long-term assets optimized for flexibility, efficiency, and reduced operational risks in diverse global power grids.

Challenges for the heavy duty gas turbine market revolve around high capital investment, operational complexity, and fuel price volatility. Smaller utilities face barriers in financing large-scale turbine projects, while operators often struggle with maintenance costs and technical expertise requirements. Competition from renewable energy and distributed generation technologies creates further pressure. In my assessment, long-term competitiveness will depend on manufacturers improving cost structures, offering flexible financing models, and enhancing service networks to ensure turbines remain a viable and attractive choice for global power producers.

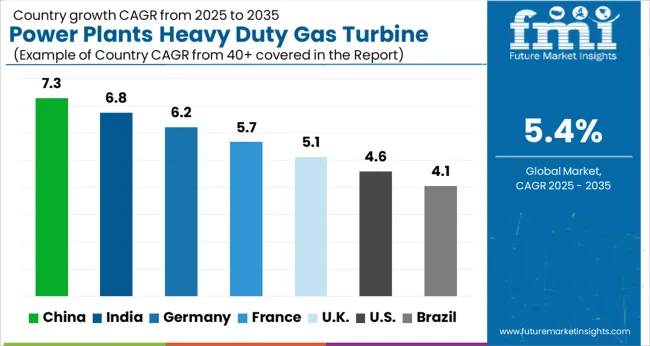

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

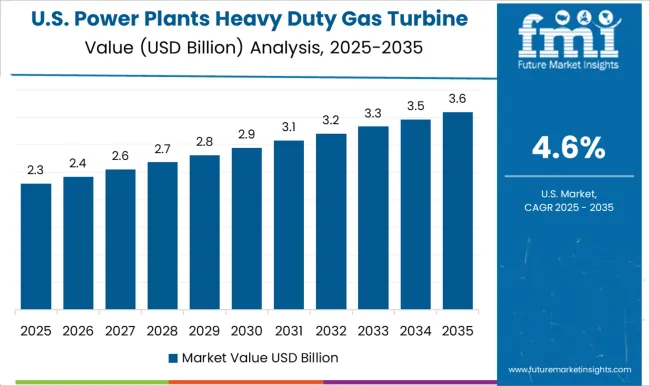

| USA | 4.6% |

| Brazil | 4.1% |

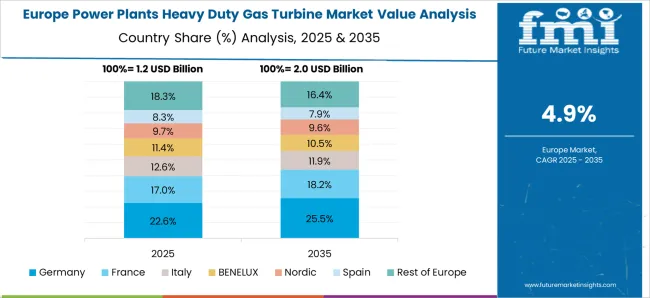

The global power plants heavy duty gas turbine market is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads with a growth rate of 7.3%, followed by India at 6.8%, and France at 5.7%. The United Kingdom records a growth rate of 5.1%, while the United States shows the slowest growth at 4.6%. Growth is supported by rising electricity demand, modernization of power infrastructure, and increasing investments in cleaner and more efficient gas-based power generation. Emerging economies such as China and India see faster growth driven by rapid industrial expansion and rising energy consumption, while developed economies like the USA, UK, and France emphasize upgrades, efficiency improvements, and integration with renewable power sources. This report includes insights on 40+ countries; the top markets are shown here for reference.

The heavy duty gas turbine market in China is projected to grow at a CAGR of 7.3%. Rapid industrialization, urban development, and surging electricity demand are primary drivers. China’s focus on transitioning from coal-based power to cleaner energy sources is accelerating investment in advanced gas turbines. Local manufacturers are partnering with international players to enhance efficiency and output, while government initiatives to strengthen energy security boost large-scale adoption. Expanding natural gas infrastructure also supports wider deployment of heavy duty gas turbines in China.

The heavy duty gas turbine market in India is expected to grow at a CAGR of 6.8%. Growing power demand from expanding urban and industrial centers is fueling adoption. Government programs to reduce dependence on coal and integrate cleaner generation technologies are boosting gas turbine investments. Infrastructure expansion, including gas pipelines and LNG terminals, further supports market growth. Private and public sector investments in combined cycle power plants are increasing, driving long-term opportunities for heavy duty gas turbines across India’s energy sector.

The heavy duty gas turbine market in France is projected to grow at a CAGR of 5.7%. France is focusing on modernizing its power generation mix, with gas turbines gaining traction as complementary solutions to renewables and nuclear power. Increasing demand for flexible, efficient, and low-emission power plants is supporting adoption. Regulatory emphasis on energy efficiency and reduced carbon emissions is further encouraging investment in heavy duty gas turbine projects. France’s strong industrial base and technological expertise ensure steady integration of advanced turbine technologies.

The heavy duty gas turbine market in the UK is projected to grow at a CAGR of 5.1%. Growth is supported by the increasing need for flexible and efficient backup power as the country expands renewable energy capacity. Gas turbines are being used for grid stability and peaking power plants. Government policies encouraging cleaner energy technologies are further shaping demand. Upgrades in aging power infrastructure and investment in combined cycle systems are expected to sustain market opportunities in the UK

The heavy duty gas turbine market in the USA is projected to grow at a CAGR of 4.6%. While growth is moderate compared to emerging economies, demand is supported by the replacement of aging coal plants and the need for efficient power generation solutions. Gas turbines play a vital role in balancing renewable power sources like wind and solar by providing reliable backup capacity. Ongoing investments in combined cycle power plants and focus on high-efficiency, low-emission technologies ensure steady demand. The presence of leading turbine manufacturers also contributes to innovation and competitive advantages in the USA market.

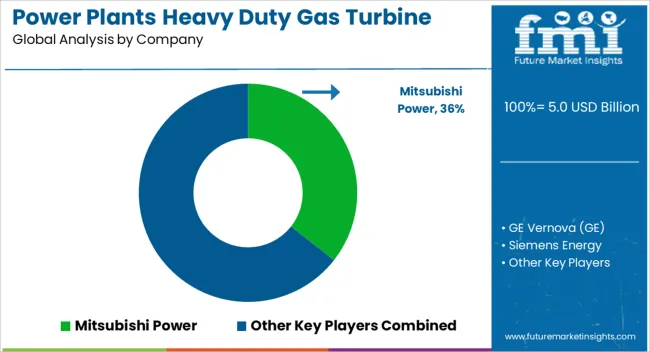

Competition in the heavy duty gas turbine market for power plants has been structured around a small group of engineering leaders that combine deep manufacturing expertise with long-term service contracts. Mitsubishi Power has been regarded as a leading force, building a reputation for advanced turbine efficiency and large-scale installations in both combined-cycle and simple-cycle plants. GE Vernova has been reinforcing its legacy in turbine design, where continuous innovation in output and operational flexibility has secured global trust across utilities. Siemens Energy has been competing aggressively through a broad portfolio of heavy duty turbines, leveraging its worldwide footprint and advanced digital monitoring services to support customers across diverse energy markets. Baker Hughes, through its Bently Nevada division, has been strengthening its position by focusing on reliability solutions and performance diagnostics, ensuring gas turbine fleets maintain operational efficiency.

Ansaldo Energia has been consolidating its presence in Europe and emerging regions by offering flexible service models and competitive turbine platforms. Kawasaki has been recognized for mid-scale turbine solutions, addressing industrial and distributed power generation needs with dependable equipment. MAN Energy Solutions has been extending its reach with engineering depth, emphasizing robust turbine designs tailored for long life and high efficiency. Solar Turbines, part of Caterpillar, has been sustaining relevance in industrial power with turbines suited for modular applications and smaller-scale plants. Strategic approaches among these companies have been shaped by technology differentiation, regional strength, and aftermarket service models. Mitsubishi Power and Siemens Energy have been positioned as performance-driven leaders, competing for large-scale projects where efficiency, low emissions, and reliability dictate selection.

GE Vernova has been leveraging its global network and engineering credibility to maintain strong influence in mature and emerging markets alike. Ansaldo Energia and MAN Energy Solutions have been regarded as adaptive players, offering competitively priced platforms and service flexibility. Baker Hughes has been adding value by coupling monitoring systems with asset lifecycle support. Kawasaki and Solar Turbines have been sustaining demand in smaller segments, where industrial facilities and regional grids prefer compact, reliable gas turbines. This competitive environment has been defined by the capacity to balance efficiency, durability, and service availability, with leadership granted to companies that align engineering excellence with dependable long-term partnerships.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 billion |

| Capacity | > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW |

| Technology | Combined cycle and Open cycle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitsubishi Power, GE Vernova (GE), Siemens Energy, Baker Hughes / Bently Nevada, Ansaldo Energia, Kawasaki, MAN Energy Solutions, and Solar Turbines (Caterpillar) |

| Additional Attributes | Dollar sales by product type (aero-derivative vs heavy frame turbines), Dollar sales by capacity range (below 100 MW, 100–300 MW, above 300 MW), Trends in efficiency improvement and fuel flexibility, Use in combined-cycle and open-cycle plants, Growth in demand for grid stability and peak load supply, Regional installation patterns across Asia-Pacific, North America, and Europe. |

The global power plants heavy duty gas turbine market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the power plants heavy duty gas turbine market is projected to reach USD 8.4 billion by 2035.

The power plants heavy duty gas turbine market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in power plants heavy duty gas turbine market are > 200 mw, ≤ 50 kw, > 50 kw to 500 kw, > 500 kw to 1 mw, > 1 mw to 30 mw, > 30 mw to 70 mw and > 70 mw to 200 mw.

In terms of technology, combined cycle segment to command 74.0% share in the power plants heavy duty gas turbine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA