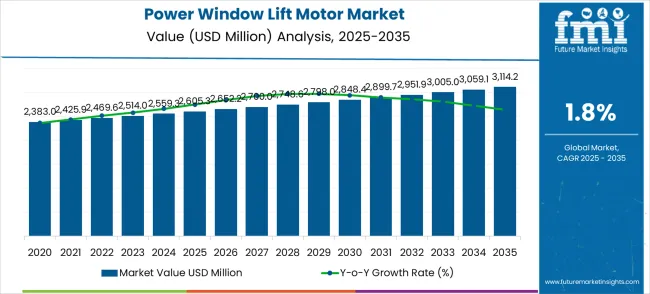

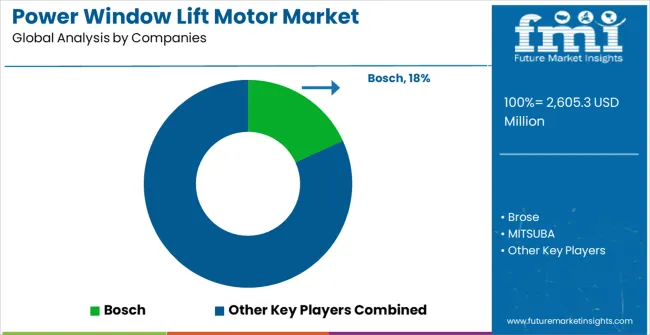

The power window lift motor market is expected to progress gradually from USD 2,605.3 million in 2025 to USD 3,114.2 million by 2035, recording a CAGR of 1.8%. Year-on-year growth analysis highlights an incremental yet steady climb, with annual values moving from USD 2,652.2 million in 2026 to USD 2,748.6 million by 2028 and surpassing USD 3,005.0 million by 2033. This measured expansion reflects a mature industry, where replacement demand, vehicle production rates, and consumer expectations for comfort features in automobiles remain critical drivers.

While the overall YoY percentage change remains modest, the consistent rise underlines the reliability of this segment in contributing to automotive component revenues. Market stability is further supported by the integration of efficient motor systems into both premium and mid-range vehicles, enhancing durability and performance reliability.

Across the forecast timeline, the YoY growth trajectory of the power window lift motor market showcases slight accelerations in later years, suggesting demand resilience despite the slow CAGR. For instance, growth between 2029 and 2035 remains constant yet cumulative gains push the market past the USD 3 billion mark. This persistence suggests that the sector, although not characterized by rapid expansion, provides steady revenue streams to manufacturers and suppliers.

Opportunities lie in refining product quality, ensuring longer lifecycle performance, and adapting designs to meet evolving vehicle architectures. The industry’s gradual upward movement demonstrates its dependable role in the automotive supply chain, with the YoY increments highlighting that even incremental changes in adoption can secure a competitive edge for stakeholders.

The power window lift motor market has been positioned as a vital part of several interconnected parent markets, reflecting both utility and consumer-driven demand. Within the automotive components market, it accounts for nearly 8% of the share, as vehicle part manufacturers increasingly rely on electric integration. In the automotive electrical systems market, the share is around 10%, with window lift motors forming an essential sub-segment of electronically powered units. The passenger vehicle parts market shows about 7% share, driven by increasing adoption in mid-range and compact cars.

In the automotive motors market, the contribution is close to 9%, underlining its significance among specialized motor applications. Finally, in the vehicle comfort and convenience systems market, the share is nearly 6%, where consumer preference for convenience features is steadily influencing adoption. Collectively, these percentages underline the way power window lift motors have become a necessary component across vehicle manufacturing and aftersales, shaping both industry dynamics and user expectations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,605.3 million |

| Market Forecast Value (2035) | USD 3,114.2 million |

| Forecast CAGR (2025-2035) | 1.8% |

Market expansion is being supported by the increasing automotive production in emerging markets and the corresponding demand for comfort and convenience features that enhance vehicle value proposition and consumer appeal. Modern automotive consumers expect power windows as standard equipment across vehicle segments, creating sustained demand for reliable and cost-effective power window lift motors. The integration of power windows into entry-level and mid-range vehicle segments drives consistent market growth as automotive manufacturers seek to offer premium features at competitive price points.

The growing emphasis on vehicle comfort and convenience is driving demand for high-quality power window lift motors from certified automotive suppliers with proven track records of reliability and durability. Automotive manufacturers are increasingly investing in standardized power window systems that offer consistent performance while meeting stringent automotive quality standards and regulatory requirements. Industry standards and automotive specifications are establishing performance benchmarks that favor precision-engineered power window lift motors with enhanced durability and operational reliability characteristics.

The automotive industry's focus on platform standardization and cost optimization is creating substantial demand for versatile power window lift motors capable of supporting multiple vehicle applications while maintaining manufacturing cost-effectiveness. The commercial vehicle sector continues to adopt comfort features from passenger car segments while maintaining durability requirements, leading to development of specialized power window lift motor solutions with enhanced robustness and extended service life for demanding commercial applications.

The market is segmented by motor type, application, and region. By motor type, the market is divided into 12V DC motor and 24V DC motor configurations. Based on application, the market is categorized into passenger car and commercial vehicle applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

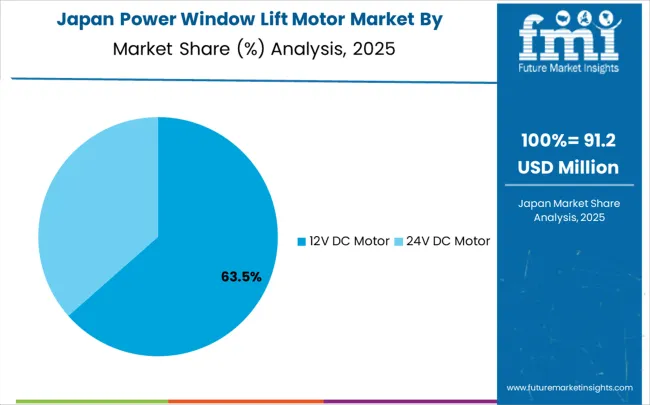

12V DC motor configurations are projected to account for 64% of the power window lift motor market in 2025. This leading share is supported by the widespread adoption in passenger car applications and established automotive electrical system standards utilizing 12V electrical architectures. 12V DC motors provide optimal power consumption characteristics and cost-effectiveness, making them the preferred choice for passenger vehicles, light commercial vehicles, and standard automotive applications. The segment benefits from mature manufacturing technologies that have achieved excellent performance reliability while maintaining competitive pricing for volume automotive production.

Modern 12V DC motors incorporate advanced magnetic materials and enhanced electronic control systems that maximize power efficiency while ensuring consistent operational performance across varying environmental conditions. These innovations have significantly improved power window operation smoothness while reducing electrical power consumption and enhancing overall system reliability. The passenger car industry particularly drives demand for 12V solutions, as these applications require proven performance characteristics and cost optimization to maintain competitive vehicle pricing and profitability.

Additionally, the entry-level vehicle segment increasingly adopts 12V DC power window lift motors to provide premium comfort features at accessible price points for cost-conscious consumers. The growing emphasis on vehicle feature standardization creates opportunities for specialized 12V motor designs optimized for high-volume production and consistent quality delivery across diverse automotive platforms.

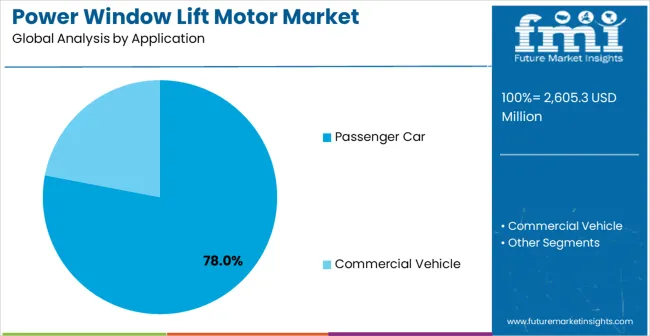

Passenger car applications are expected to represent 78% of power window lift motor demand in 2025. This dominant share reflects the massive scale of global passenger car production and the widespread adoption of power windows as standard or optional equipment across vehicle segments. Passenger car manufacturers require reliable and cost-effective power window lift motors capable of providing consistent performance while meeting automotive durability and quality standards. The segment benefits from continuous innovation in automotive comfort systems that utilize power window lift motors for enhanced user convenience and vehicle differentiation.

The global passenger car market drives significant demand for automotive-grade power window lift motors that provide exceptional operational reliability and long-term durability for daily driving applications. These applications require motors with superior performance characteristics and comprehensive validation testing to ensure consistent operation and customer satisfaction. The segment benefits from growing consumer expectations for comfort features and increasing integration of power windows in previously manual-window vehicle segments.

Premium and luxury passenger car segments contribute substantially to market growth as automotive manufacturers implement advanced power window systems with enhanced features and performance characteristics. The growing adoption of electric vehicles creates opportunities for specialized power window lift motors designed for electric vehicle electrical systems and energy efficiency requirements. Additionally, the trend toward vehicle platform consolidation drives demand for standardized power window lift motors that enable cost-effective manufacturing across multiple vehicle models and market segments.

The power window lift motor market is advancing steadily due to consistent automotive production growth and increasing penetration of comfort features across vehicle segments. However, the market faces challenges including intense price competition, need for continuous cost reduction, and varying performance requirements across different vehicle applications. Automotive quality standards and regulatory requirements continue to influence design practices and manufacturing specifications.

The growing adoption of electronic motor control systems and enhanced efficiency optimization is enabling significant performance improvements while maintaining cost-effectiveness in power window lift motor applications. Advanced control electronics and improved magnetic materials provide better operational smoothness and extended service life, enabling superior customer satisfaction and reduced warranty costs. These technologies are particularly valuable for premium vehicle applications that require exceptional operational refinement and long-term reliability.

Modern power window lift motor manufacturers are developing standardized motor platforms tailored to automotive industry requirements, including cost-optimized designs for volume production, enhanced durability configurations for commercial applications, and specialized solutions for electric vehicle integration. Advanced manufacturing techniques enable precise optimization of motor characteristics for targeted applications while maintaining production scalability and automotive cost targets.

| Country | CAGR (2025-2035) |

|---|---|

| China | 2.4% |

| India | 2.3% |

| Germany | 2.1% |

| Brazil | 1.9% |

| United States | 1.7% |

| United Kingdom | 1.5% |

| Japan | 1.4% |

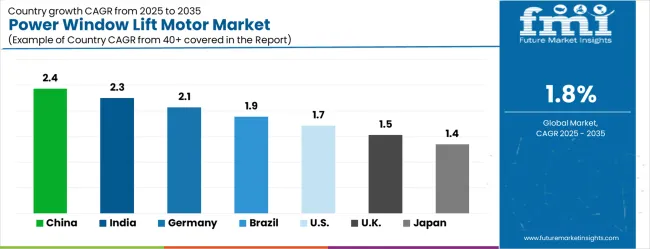

The power window lift motor market is growing steadily, with China leading at a 2.4% CAGR through 2035, driven by massive automotive production capacity and increasing penetration of comfort features in domestic vehicle segments. India follows at 2.3%, supported by expanding automotive manufacturing and growing consumer demand for premium vehicle features. Germany records growth at 2.1%, emphasizing automotive engineering excellence and premium vehicle market leadership. Brazil grows at 1.9%, benefiting from automotive production expansion and increasing vehicle feature content. The United States shows growth at 1.7%, focusing on automotive innovation and premium feature standardization. The United Kingdom maintains expansion at 1.5%, supported by automotive manufacturing advancement. Japan demonstrates growth at 1.4%, emphasizing quality excellence and automotive technology innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The power window lift motor market in China is projected to exhibit the highest growth rate with a CAGR of 2.4% through 2035, driven by the country's position as the world's largest automotive manufacturing hub and increasing adoption of comfort features across domestic vehicle segments. The extensive automotive production infrastructure and growing consumer demand for premium vehicle amenities are creating substantial opportunities for power window lift motor adoption. Major automotive manufacturers are expanding comfort feature integration to meet evolving consumer expectations while maintaining competitive pricing in the domestic market.

Automotive production leadership and domestic market expansion are supporting widespread adoption of power window lift motor technologies across passenger car manufacturing operations, driving demand for cost-effective motor solutions and high-volume production capabilities. Vehicle feature enhancement programs and consumer preference evolution are creating significant opportunities for Chinese automotive suppliers in domestic and international automotive supply chains requiring competitive pricing and reliable performance.

The power window lift motor market in India is expanding at a CAGR of 2.3%, supported by the country's rapidly expanding automotive manufacturing sector and increasing consumer demand for premium vehicle features under economic development initiatives. The growing automotive production capabilities and rising middle-class purchasing power are driving substantial power window lift motor demand potential. Manufacturing facilities are leveraging cost advantages while adopting international automotive quality standards to meet domestic market requirements and export opportunities.

Automotive manufacturing growth and premium feature adoption are creating opportunities for power window lift motor integration across diverse vehicle categories requiring cost-effective comfort solutions and reliable performance systems. Domestic market expansion and export manufacturing development are driving investments in automotive component technologies for power window applications throughout major automotive manufacturing regions and assembly facilities.

The power window lift motor market in Germany is projected to grow at a CAGR of 2.1%, supported by the country's leadership in automotive engineering excellence and premium vehicle market development. German automotive manufacturers are implementing sophisticated power window systems that meet stringent quality standards and premium market requirements. The market is characterized by focus on engineering innovation, advanced manufacturing processes, and compliance with comprehensive automotive quality and safety regulations.

Automotive engineering investments are prioritizing advanced power window lift motor technologies that demonstrate superior performance characteristics and reliability while meeting German automotive quality and regulatory standards for premium vehicle applications. Innovation programs and automotive technology development initiatives are driving adoption of precision-engineered motor systems that support optimal power window operation and enhanced customer satisfaction.

The power window lift motor market in Brazil is growing at a CAGR of 1.9%, driven by expanding automotive production capabilities and increasing integration of comfort features across vehicle segments in the domestic market. The growing automotive manufacturing infrastructure and rising consumer expectations for vehicle comfort are creating opportunities for power window lift motor adoption. Manufacturing facilities are adopting advanced automotive technologies to support growing domestic demand and regional export market requirements while maintaining cost competitiveness.

Automotive production development and feature integration expansion are facilitating adoption of effective power window lift motor systems capable of meeting diverse vehicle requirements and automotive specifications across passenger car and commercial vehicle applications. Regional automotive capability enhancement and market development are creating demand for standardized power window motors that meet automotive industry specifications and performance requirements.

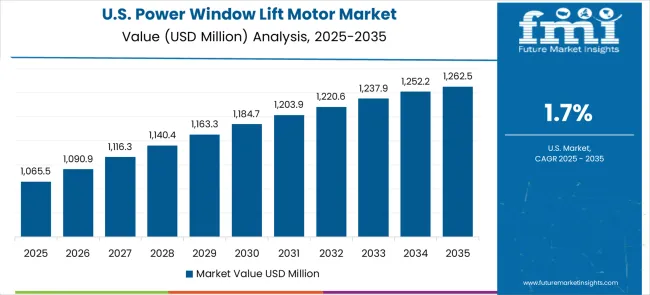

The power window lift motor market in the United States is expanding at a CAGR of 1.7%, driven by the country's automotive innovation leadership and increasing emphasis on premium feature standardization across vehicle segments. The sophisticated automotive industry ecosystem and focus on customer satisfaction create consistent demand for high-quality power window lift motor solutions. The market benefits from automotive technology advancement and consumer preference evolution across multiple automotive segments and market categories.

Automotive innovation programs and premium feature standardization initiatives are driving adoption of advanced power window lift motors that offer superior performance characteristics and reliability for diverse automotive applications. Technology development investments and automotive advancement programs are supporting demand for specialized power window motors that meet stringent automotive quality requirements and customer satisfaction standards.

The power window lift motor market in the United Kingdom is projected to grow at a CAGR of 1.5%, supported by ongoing automotive manufacturing advancement and increasing emphasis on vehicle comfort feature integration in domestic production. Automotive manufacturers are investing in power window lift motor solutions that provide consistent performance characteristics and meet automotive quality requirements for domestic and export markets. The market is characterized by focus on automotive quality, manufacturing excellence, and advanced automotive system integration.

Automotive manufacturing advancement and comfort feature integration programs are supporting adoption of validated power window lift motor solutions that meet contemporary automotive quality and performance standards for vehicle applications. Quality enhancement initiatives and automotive excellence programs are creating demand for specialized power window motors that provide superior performance consistency and automotive quality verification.

The power window lift motor market in Japan is expanding at a CAGR of 1.4%, driven by the country's emphasis on automotive quality excellence and advanced automotive technology innovation development. Japanese automotive manufacturers are developing sophisticated power window lift motor applications that incorporate precision engineering and reliability optimization principles. The market benefits from focus on automotive precision, component reliability, and continuous improvement in automotive system performance and customer satisfaction.

Automotive quality excellence programs and technology innovation initiatives are driving advancement of premium power window lift motor applications that demonstrate superior performance characteristics and operational reliability. Automotive technology excellence programs and quality advancement initiatives are supporting adoption of precision-engineered power window motors that optimize system performance and ensure consistent operation in demanding automotive applications and usage scenarios.

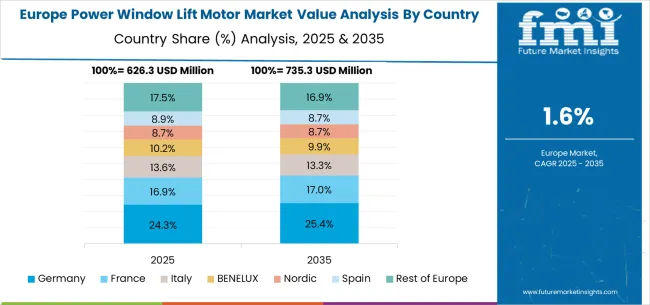

The power window lift motor market in Europe is projected to grow from USD 718.4 million in 2025 to USD 851.2 million by 2035, registering a CAGR of 1.7% over the forecast period. Germany is expected to maintain its leadership with a 26.8% share in 2025, supported by its advanced automotive industry and premium vehicle manufacturing excellence. The United Kingdom follows with 17.9% market share, driven by automotive manufacturing advancement and vehicle comfort feature development. France holds 16.2% of the European market, benefiting from automotive industry expansion and vehicle technology advancement. Italy and Spain collectively represent 21.4% of regional demand, with growing focus on automotive manufacturing development and vehicle feature integration. The Rest of Europe region accounts for 17.7% of the market, supported by automotive development in Eastern European countries and Nordic automotive technology advancement.

The power window lift motor market is defined by competition among established automotive suppliers, specialized motor manufacturers, and integrated automotive system companies. Companies are investing in advanced motor technologies, cost optimization programs, quality excellence systems, and automotive integration capabilities to deliver reliable, efficient, and cost-effective power window lift motor solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Bosch, operating globally, offers comprehensive automotive systems with focus on component reliability, manufacturing excellence, and technical support services for automotive applications. Brose, established automotive supplier, provides advanced automotive motor systems with emphasis on comfort system integration and automotive quality standards. MITSUBA delivers specialized automotive motor solutions with focus on cost-effectiveness and manufacturing scalability. Mabuchi offers comprehensive motor technologies with standardized procedures and automotive manufacturing support.

Denso provides advanced automotive component capabilities with emphasis on quality excellence and technical expertise for automotive applications. Johnson Electric delivers specialized motor solutions with focus on automotive integration and performance optimization. SIIC Transportation Electric offers comprehensive automotive electrical systems with regional manufacturing and automotive support capabilities. Inteva Products provides advanced automotive components with specialized motor technologies and market expertise.

Ningbo Jingcheng, DYAuto, HENGTE MOTOR, and NANTONG LIANKE AUTOMOBILE PARTS offer specialized power window lift motor expertise, regional production capabilities, and technical support across automotive component and manufacturing networks.

The power window lift motor market underpins automotive comfort system excellence, vehicle convenience enhancement, automotive manufacturing efficiency, and consumer satisfaction improvement. With growing automotive production volumes, comfort feature standardization, and cost optimization requirements, the sector faces pressure to balance performance reliability, manufacturing cost-effectiveness, and quality consistency. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward high-efficiency, cost-effective, and quality-optimized power window lift motor solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,605.3 million |

| Classification Type | 12V DC Motor, 24V DC Motor |

| Application | Passenger Car, Commercial Vehicle |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Bosch, Brose, MITSUBA, Mabuchi, Denso, Johnson Electric, SIIC Transportation Electric, Inteva Products, Ningbo Jingcheng, DYAuto, HENGTE MOTOR, NANTONG LIANKE AUTOMOBILE PARTS |

The global power window lift motor market is estimated to be valued at USD 2,605.3 million in 2025.

The market size for the power window lift motor market is projected to reach USD 3,114.2 million by 2035.

The power window lift motor market is expected to grow at a 1.8% CAGR between 2025 and 2035.

The key product types in power window lift motor market are 12v dc motor and 24v dc motor.

In terms of application, passenger car segment to command 78.0% share in the power window lift motor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA